¶ Introduction

The Risk Register is a tool used to identify, assess, and monitor potential risks that could impact the organization’s financial position. One key aspect of this register is accounting for expected credit losses, which are the losses an entity anticipates incurring if certain risks materialize in the future. These risks can include market risk, credit risk, liquidity risk, and operational risk. Tracking and reporting expected credit losses is essential because IFRS 9 requires that financial statements provide a fair and accurate representation of the company’s financial position, reflecting anticipated losses in the present rather than waiting for them to occur.

What is expected credit losses?

- market risk

- credit risk

- liquidity risk and

- operational risk

Why is it necessary to account for expected credit losses?

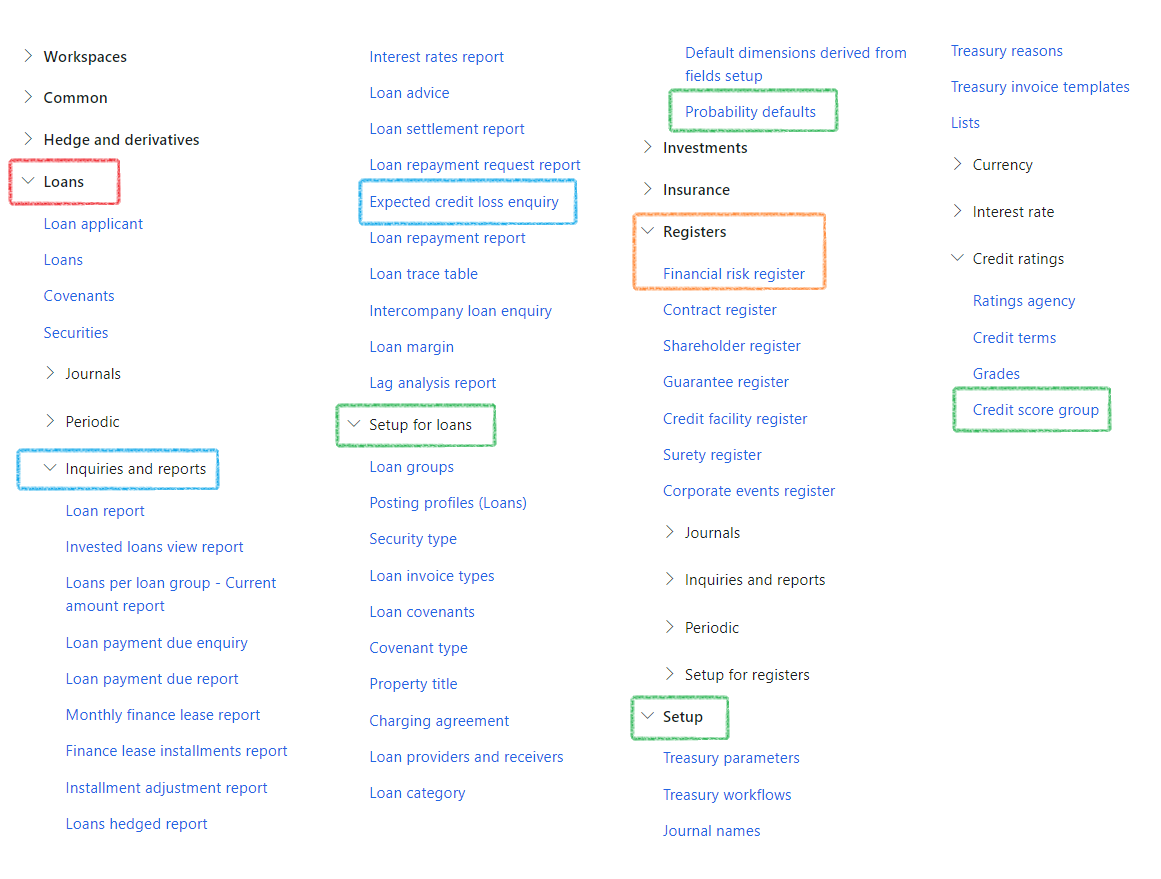

¶ Navigation

¶ Specific setup

The following setups for the Financial risk register will be explained:

- Risk type

- Credit loss epxense Main account

- Expected credit loss journal name

- Probability defaults

- Loan groups

- Loan category

- Credit score group

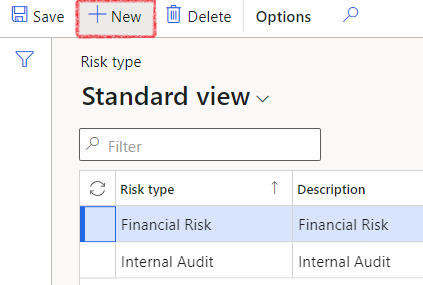

¶ Step 1: Setup Risk type

- Navigate to Governance, Risk and Compliance > Risk > Setup for risks > Risk type

- In the action pane, click on the New button to create a new Risk type

- Fill in the fields:

- Risk type – This is the type of risk, for example market risk or interest rate risk

- Description – Give a description of the Risk type

- In the action pane, click on Save

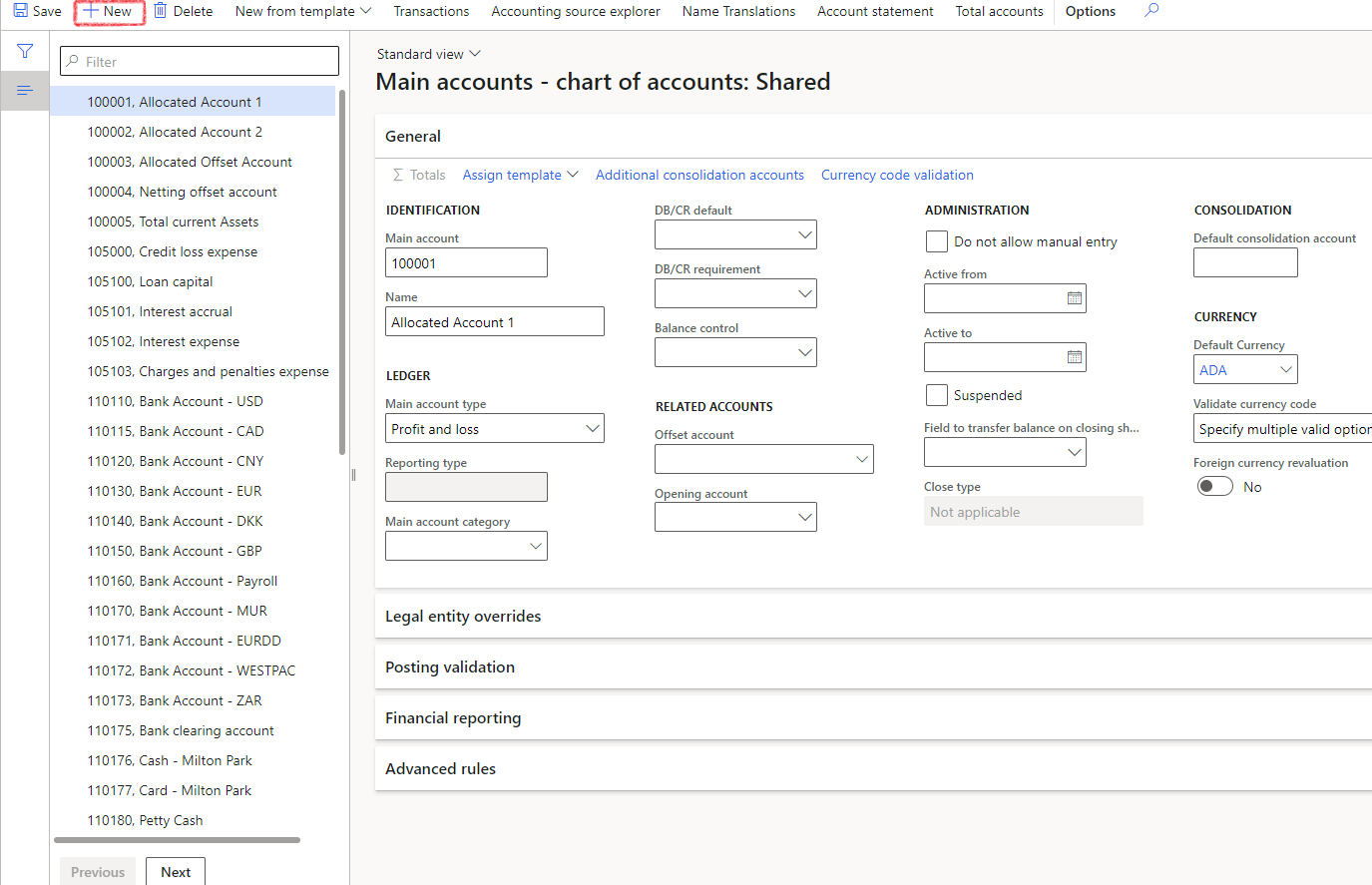

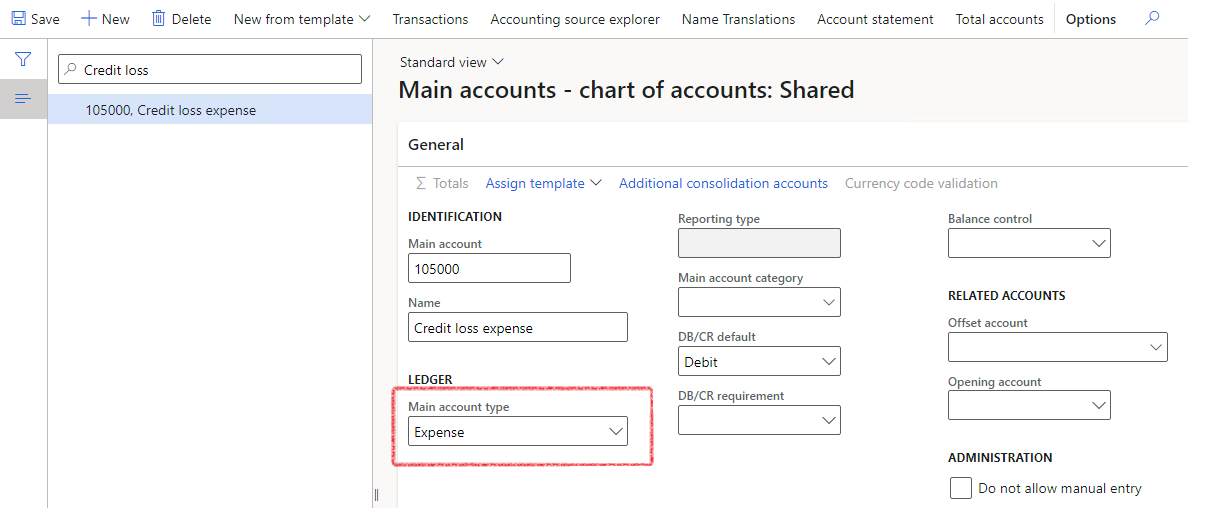

¶ Step 2: Create a Credit loss expense Main account

- Navigate to General ledger > Chart of accounts > Accounts > Main accounts

- Click on the New button in the Action pane to create a new Main account for the credit loss expense

- Enter the details of the Main account:

- Main account (enter a number that falls within the ranges of the Chart of Accounts)

- Enter a Name for the Credit loss journal

- Main account type – select Expense

- This account will be used for the Credit loss expense

¶ Step 3: Setup an Expected credit loss journal name

- Navigate to Treasury > Setup > Journal names

- Set up a journal name for Expected credit losses steps:

- Click on the New button in the action pane

- Enter a Name

- Enter a Description

- For Journal type, select Daily

- Select the Treasury journal type as Expected credit loss

- Select the number sequence that was created for the Expected credit loss in Number series

- Optional is to enter a default Offset account for the Expected credit loss Journal name

- Enter any other desired fields

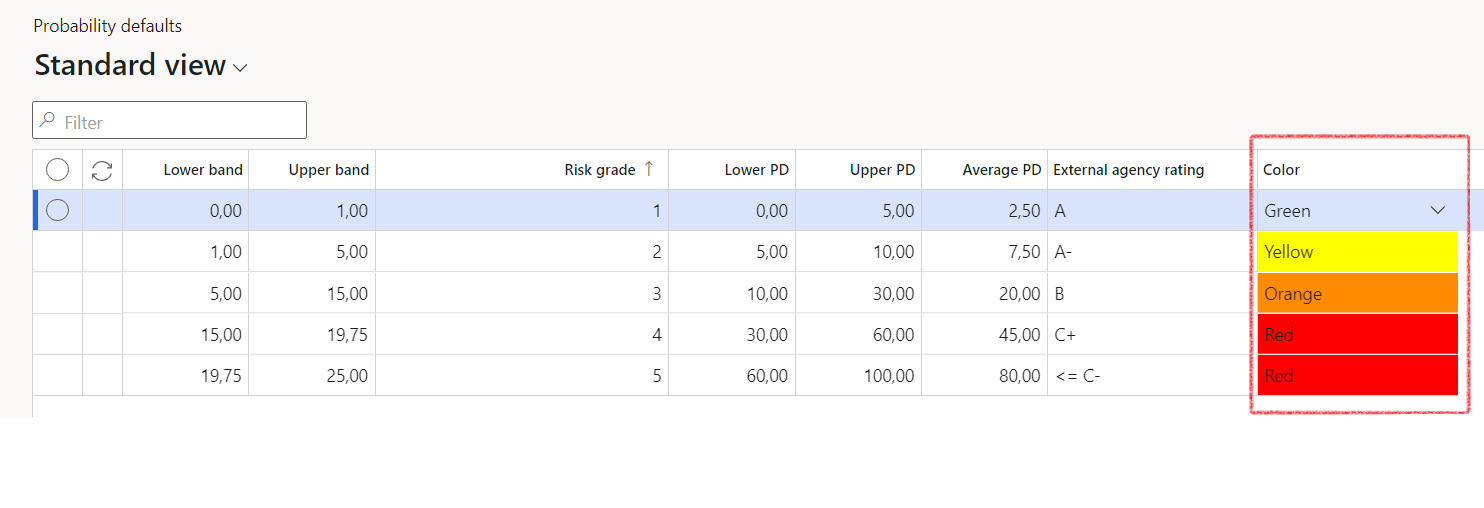

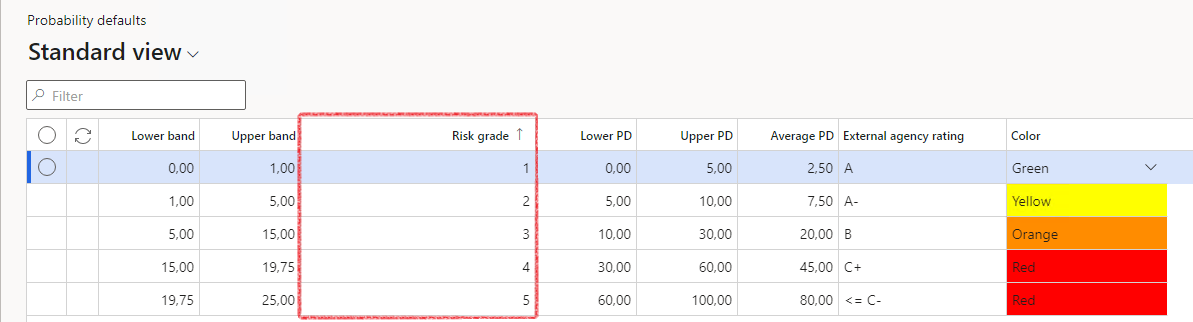

¶ Step 4: Set up Probability defaults

Default probability, or probability of default (PD), is the likelihood that a borrower will fail to pay back a debt. For businesses, probability of default is reflected in credit ratings. PD is typically calculated by running a migration analysis of similarly rated loans, over a prescribed time frame, and measuring the percentage of loans that default. That PD is then assigned to the risk level; each risk level will only have one PD percentage.

- Navigate to Treasury > Loans > Setup for loans > Probability defaults

- Create a Probability defaults line

- In the Probability defaults page, select the New button in the Action pane to create a new line for probability defaults.

- Fill in values for the fields in Probability defaults

- Probability defaults Columns and descriptions:

- Lower band – The probability default lower band is the lowest probability default value for this range

- Upper band - The probability default lower band is the maximum probability default value for this range

- Risk grade – The probability default Risk grade is a numerical value attached to the risk, as risk increases, the Risk grade and Probability default increases e.g., 1 being low and then increasing. The maximum Risk grade is 25.

- Lower PD – The lower Probability default percentage for the line

- Higher PD - The higher Probability default percentage for the line

- Average PD – The average of the Lower PD and Higher PD. This is a calculation that will perform after Lower PD and Higher PD was filled in.

- External agency rating – To set up the External agency rating, Navigate to Treasury > Common > Credit ratings

- Color – This is a color that gives a visual representation of the line. This color will be used in the Financial risk register.

When you enter the Risk grade number (as setup above) to the Financial Risk Register, in the Credit rating field (under Expected Credit loss FastTab), it will populate the related color into the risk line.

¶ Step 5: Update / Setup Loan groups

- Navigate to Treasury > Loans > Setup for Loans > Loan groups

- In the Posting profiles FastTab enter the ECL account type as well as the Expected credit loss which is the Main account that will be used for the Expected credit loss journal.

- ECL account type and Expected credit loss

- After the Credit loss journal proposal, this account per loan group will show up in the Expected credit loss journal.

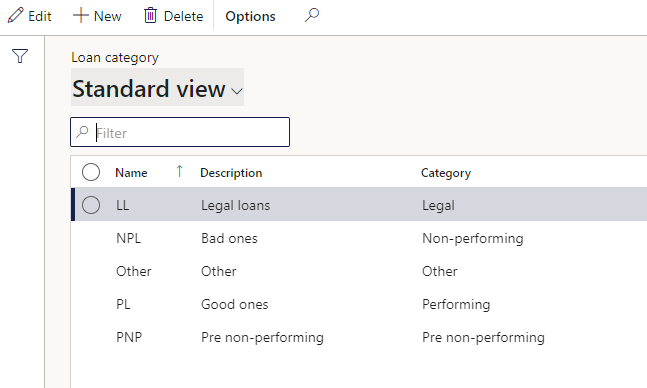

¶ Step 6: Set up Loan category

A Loan category setup contain the Name, Description and Category

- In the navigation pane, go to: Modules > Treasury > Loans > Setup for loans > Loan category

- Click on the New button

- Enter a Name

- Enter a Description

- Select a Category from the drop-down menu and choose between one of the following:

- Legal

- Non-performing

- Other

- Performing

- Pre-non-performing

Loan categories are part of the filters and options that can be selected on the Financial Risk register. It also sets the criteria to bulk add loans

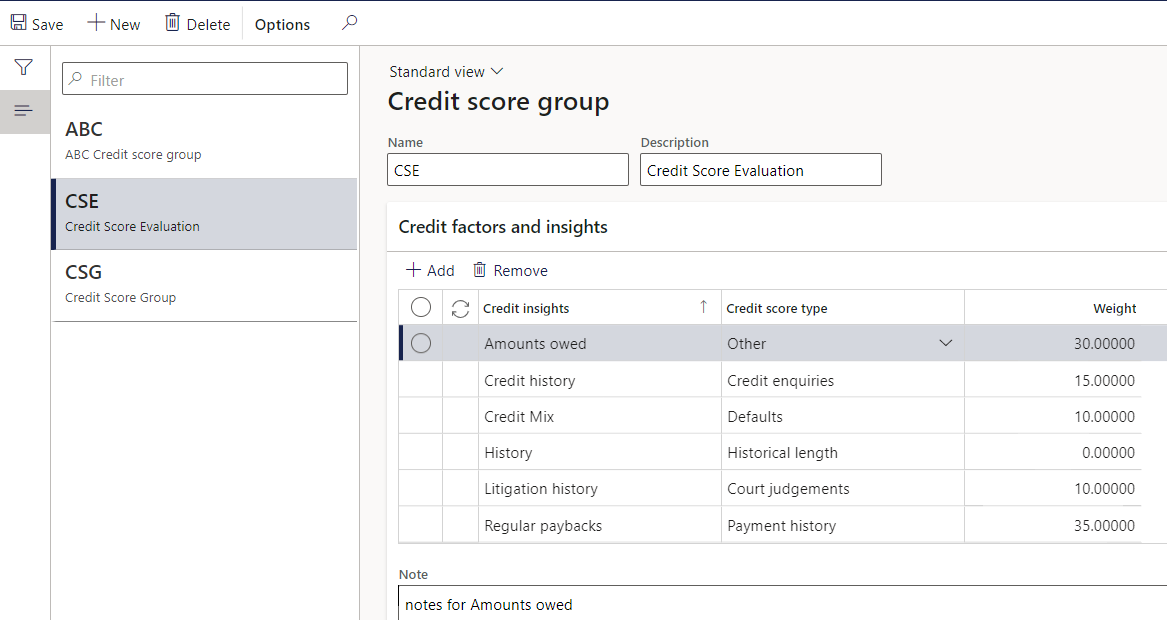

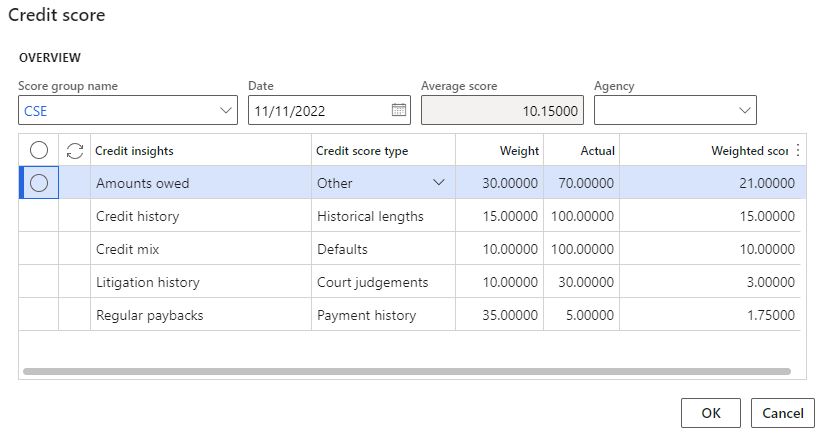

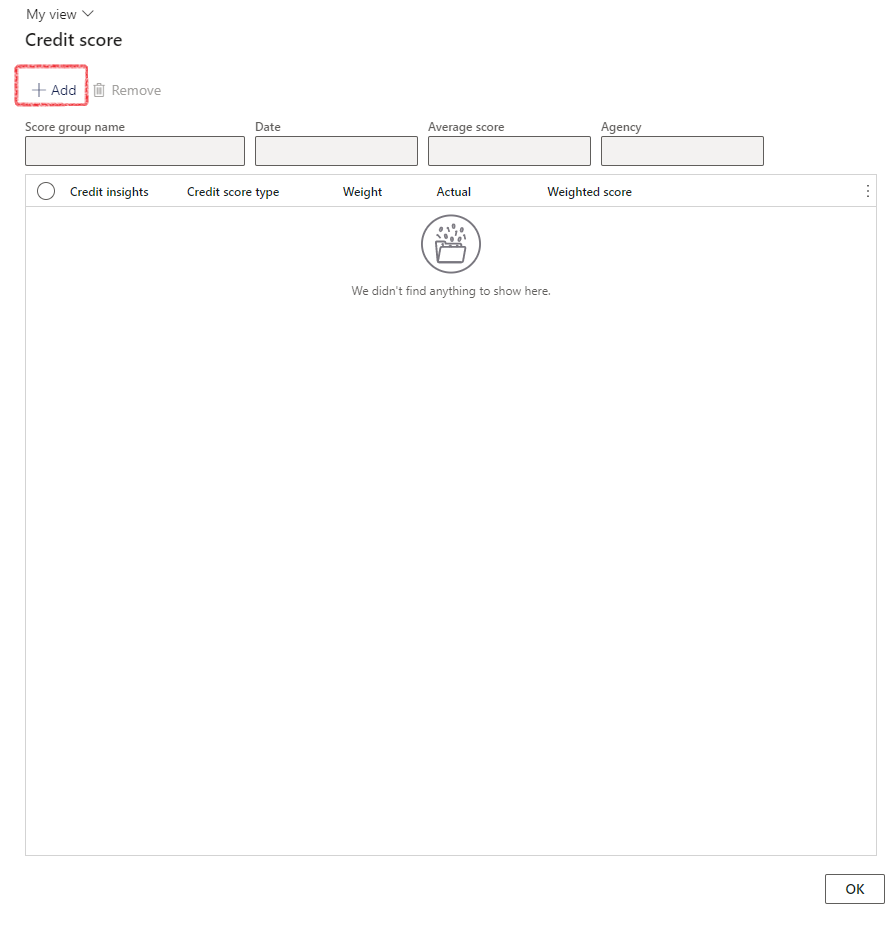

¶ Step 7: Setup Credit score group

This credit score ratings engine will provide more depth for credit ratings that is done in the Treasury module. This setup forms the basis for the Last credit score that can be done on Customers, Vendors, Loan applicants and Loan providers and receivers.

- Navigate to Treasury > Setup > Credit ratings > Credit score group

- Click on the New button

- Enter a Name

- Enter a Description

- Expand the Credit factors and insights FastTab

- Click on Add

- Enter a Credit insights name

- Select a Credit score type. Choose between:

- Payment history

- Defaults

- Court judgements

- Credit enquiries

- Historical length

- Other

- Enter a Weight percentage

- For each Credit insight, a Note can be added

¶ Daily use

Financial risks consist of a Header, Lines and Assessment dates. Financial risks can be linked to various financial elements inside the system, such Loans, Investments, Currencies and more.

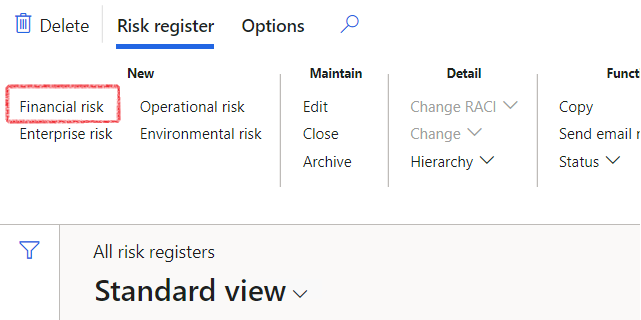

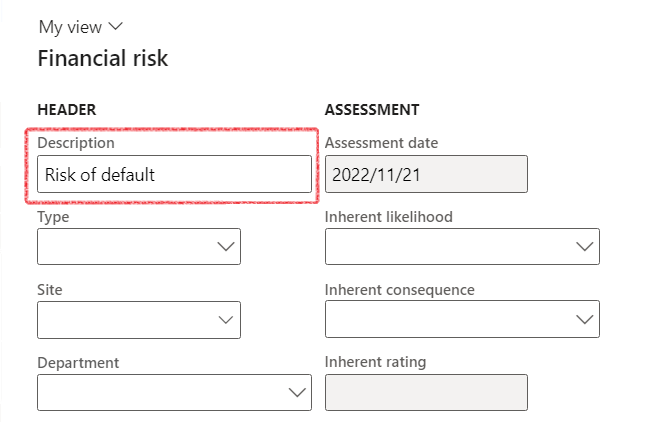

¶ Step 8: Create a Financial risk register

This functionality is applicable to G2T

- Navigate to: Treasury > Registers > Financial risk register

- On the financial risk register page, on the action pane, navigate to the New button and click on Financial risk

- In the Description field enter a general description of the Financial risk.

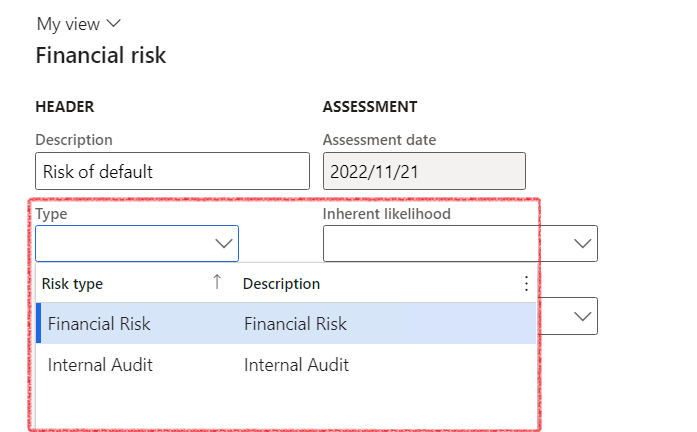

- Select the Type of risk by first clicking on the Type dropdown and then selecting the appropriate Risk type from the drop down.

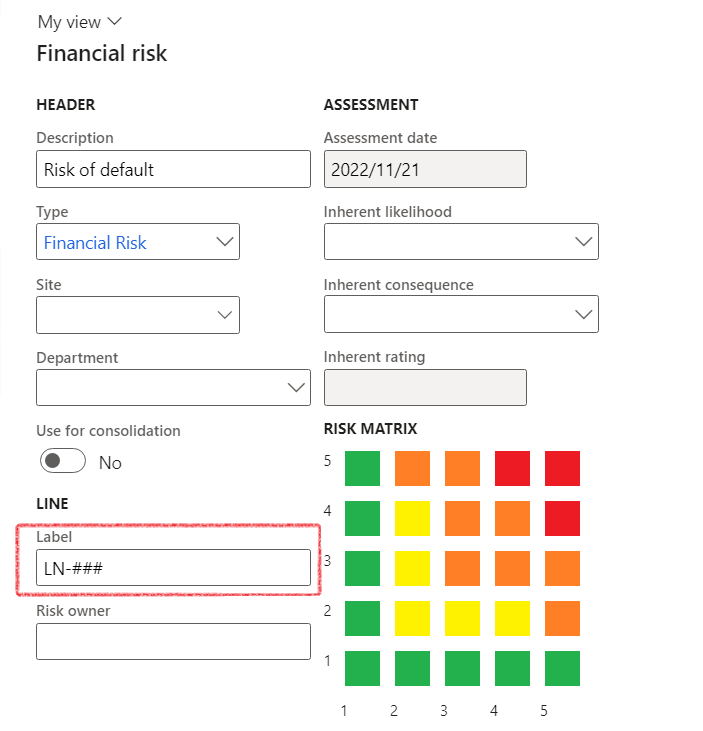

- It is optional to set up the following fields for the financial risk register:

- Description

- Site

- Department

- Risk owner

- Inherent likelihood

- Inherent consequence

- Inherent rating

To see the setup for these non-mandatory fields, see the Test script on Governance, Risk and Compliance

- In the Label field enter a label which is free text (For loan financial risks, the label is usually the loan number)

- Click on the Create button at the bottom of the page

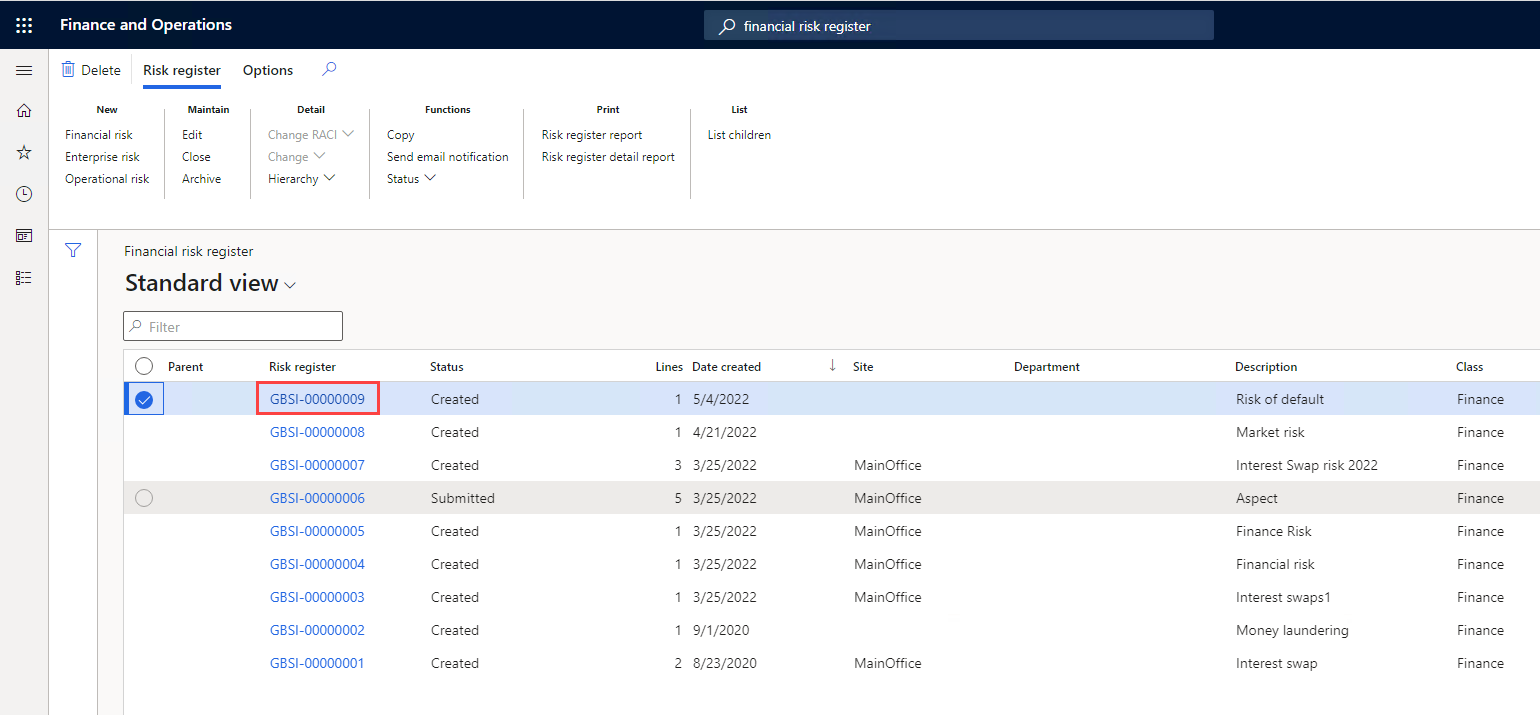

¶ Step 9: Update the Financial Risk register

- Select the Financial risk register that was just created and navigate to the action pane, under the Maintain button group, click on Edit

- or click on the Risk register in the Risk register column:

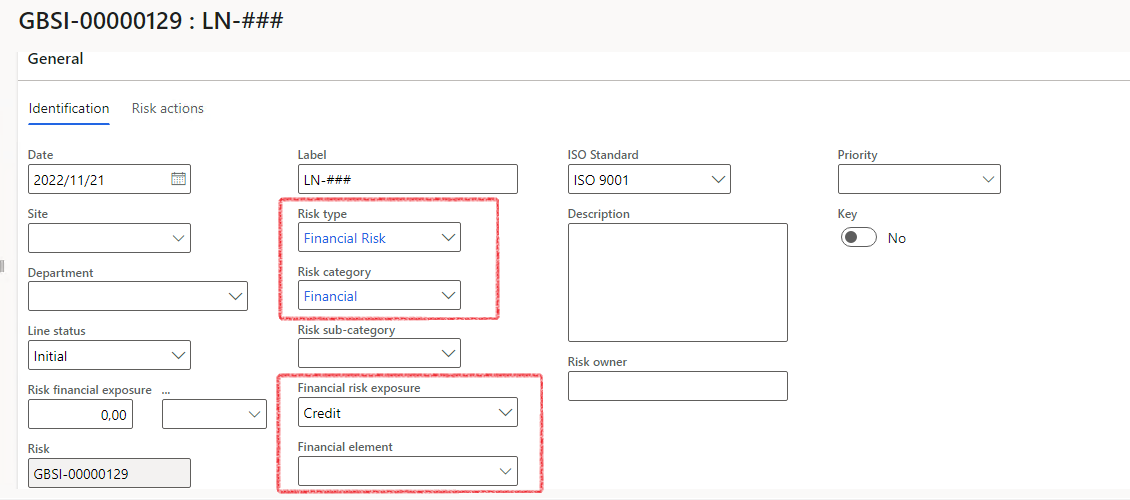

¶ The General FastTab

- The following are important fields, in the General FastTab, to set up for expected credit losses:

- Risk type

- Financial risk exposure

- Financial element

- Risk type

- In the General FastTab, navigate to the Risk type field.

- Risk type is the type of risk that was set up in the page Risk type

- Financial risk exposure

- In the General FastTab, navigate to Financial risk exposure and select Credit as the Financial risk exposure.

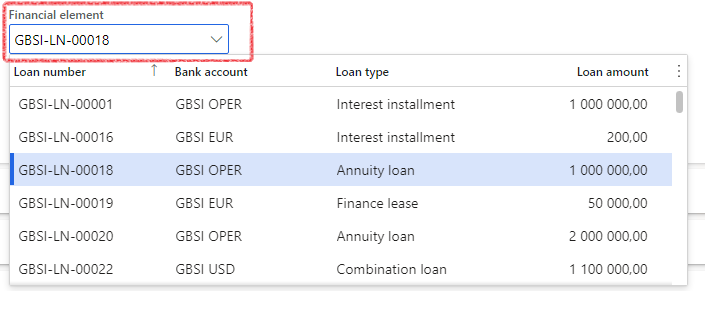

- Financial element

- In the General FastTab, navigate to Financial element.

- The Financial element will have different options to select depending on what was selected in the Financial risk exposure field.

- The Financial element, where the Financial risk exposure is set to Credit, is a dropdown of the Loans of the legal entity.

- The purpose of the Financial element is to attach or link a specific loan to the risk.

- Select a Loan from the Financial element drop down.

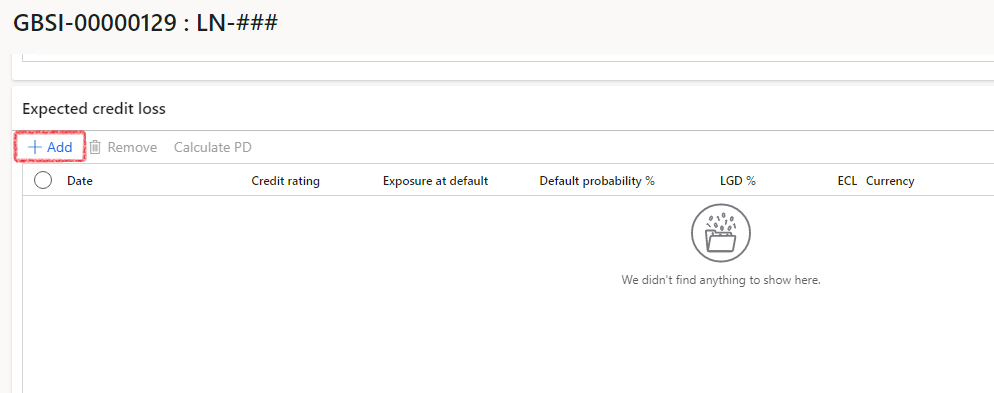

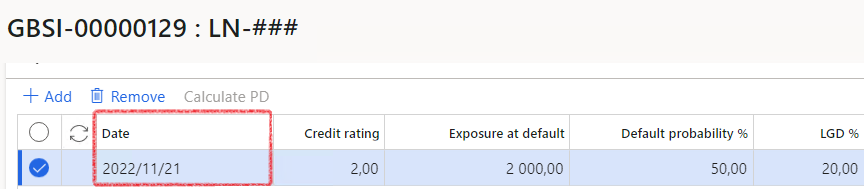

¶ Step 9.1: Expected credit loss

To Add an Expected credit loss line:

- In the same Financial risk register page, scroll down to the Expected credit loss FastTab

- Select Addto create an Expected credit loss line

- Enter the Date of the Expected credit loss risk

- The Date of the Expected credit loss is the Assessment date of the line

¶ Step 9.1.1: Credit rating for the Expected credit loss

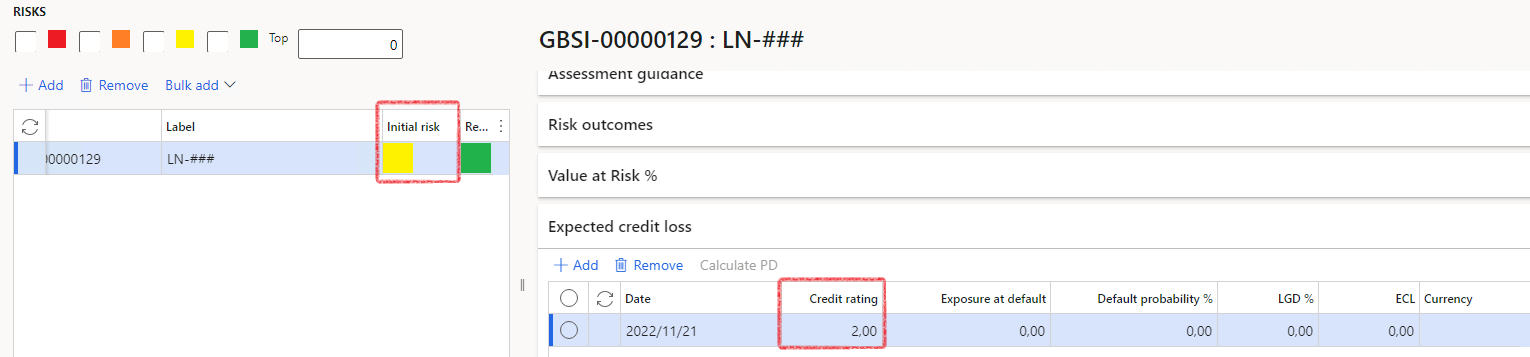

The Credit rating field in the Expected credit loss FastTab is a numeric field

- Enter the credit rating. These credit ratings are set up in the Probability defaults page.

- To see the credit ratings values in the Probability defaults page, navigate to:

- Loans > Setup for loans > Probability defaults and inspect the Risk grade column in the table.

- Using the above image, In the Credit rating column in the Expected credit loss FastTab, if the user enters:

- “1” then the colour Green will display in the Initial risk column in the financial risk register

- “2” then the colour Yellow will display in the Initial risk column in the financial risk register

- “3” then the colour Orange will display in the Initial risk column in the financial risk register

- “4” then the colour Red will display in the Initial risk column in the financial risk register

- “5” then the colour Red will display in the Initial risk column in the financial risk register

- Therefore, when the user enters a Credit rating that matches a Risk grade in the Probability defaults table, the colour in the Colour column of the Probability defaults page will then display in the Financial risk register in the Initial risk column on the left.

- Enter “2” as the Credit rating.

- The colour will be that of Risk grade where the Risk grade is equal to 2 in the Probability defaults page.

¶ Step 9.1.2: Exposure at default on the Expected credit loss

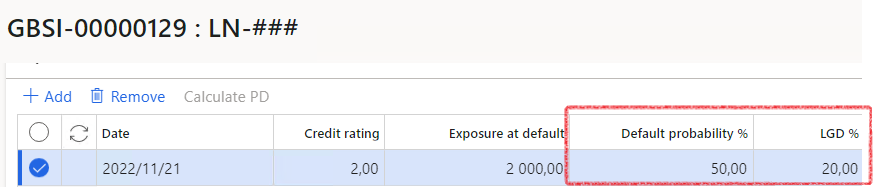

- When creating a new line in the Expected credit loss FastTab, the Exposure at default column will automatically populate the Carrying value of the Loan at the date of creation of that line.

¶ Step 9.1.3: Default probability % on the Expected credit loss FastTab

- LGD and Default probability % columns in Expected credit loss FastTab

- LGD is an abbreviation for Loss Given Default.

- Enter the LGD percentage in the the LGD% column

- Enter a Default probability %

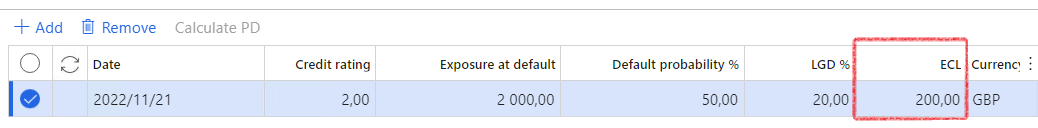

¶ Step 9.1.4: ECL column on the Expected credit loss FastTab

- ECL is the Expected credit loss which is the output of all the inputs.

- The system will calculate the Expected credit loss and plot the amount in the ECL column. The amount is calculated as follows:

- Exposure at default * Default probability% * LGD%

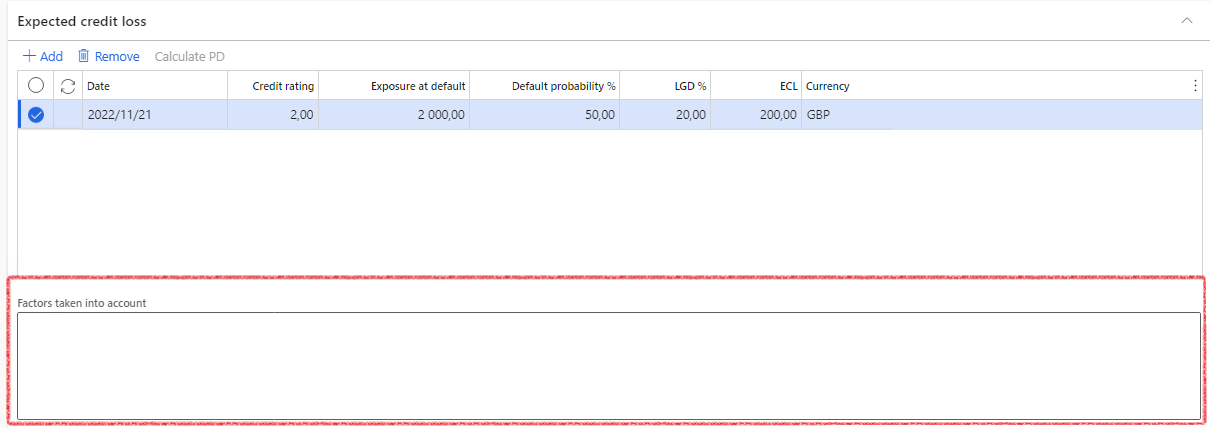

Note that the Currency column is the Transaction currency of the loan.

¶ Step 9.1.5: Factors considered for the Expected credit loss line

- In the Expected credit loss FastTab, there is a free text field namely, Factors considered, for the user to enter the factors taken into account for the expected credit loss calculation.

¶ Step 9.1.6: Additional lines on the Expected credit loss FastTab

- Click on Add in the Expected credit loss FastTab to add another line for the loan at a later date that represents the Expected credit loss at that date.

- The steps are:

- Click on Add to add another expected credit loss line

- Enter the assessment date in Date

- Enter the Credit rating

- The Initial risk colour changes based off the credit rating value

- Enter a default probability %.

- Enter the LGD%

It is important to note that the system will use the Most recent Date in the Expected credit loss FastTab as the Expected credit loss amount. This will be the line at the bottom as the lines are sorted so that the latest Date is displayed at the bottom

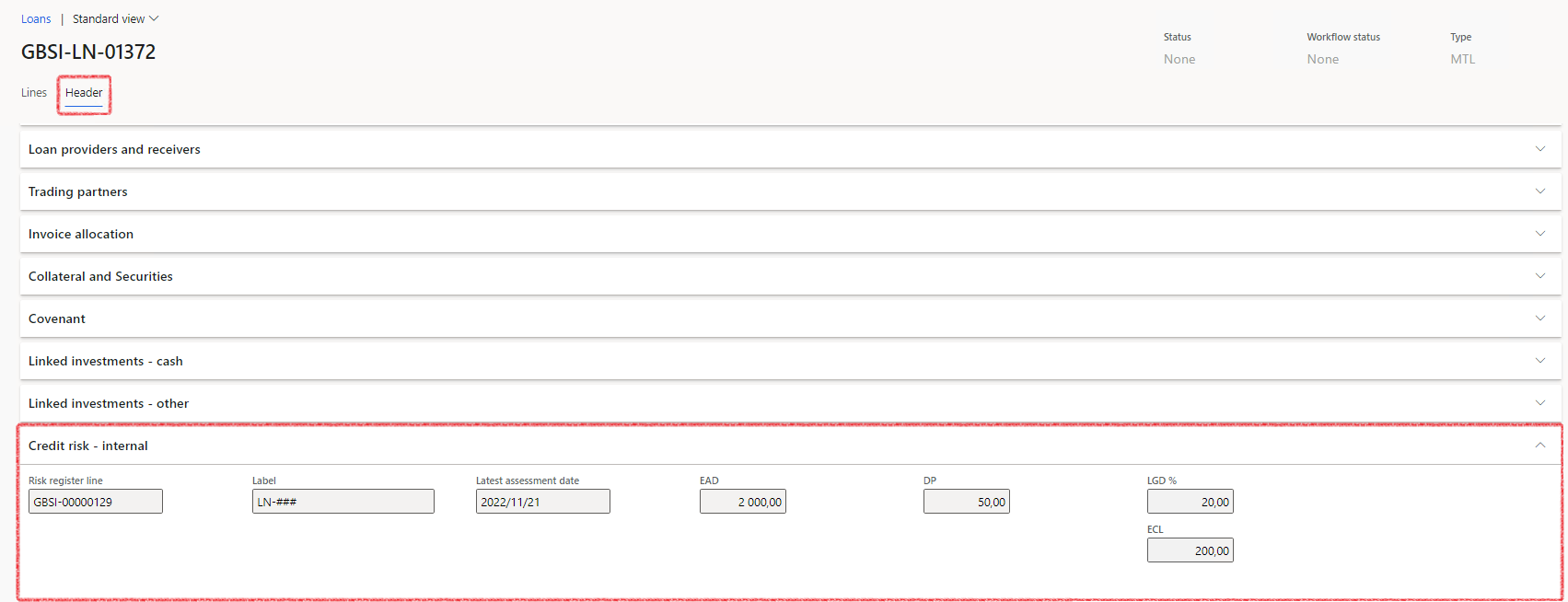

¶ Step 9.2: Credit rating - internal

- The most recent Expected credit loss line per Risk line will be displayed for the specific loan on the loan header.

- Navigate to Treasury > Loans > Loans

- In the Loans page, filter the loans to find your loan

- Search for the specific loan used in the Financial risk register in the filter bar and press Enter

- Click on the Loan number

- Scroll down to the Credit risk – internal FastTab

- How the credit risk – internal FastTab works:

- The values from the risk line for a specific loan as well as from the Expected credit loss FastTab will display here.

- It is important to note that the Credit risk – internal FastTab, contains the values of the latest Date line in the Expected credit loss FastTab (from the Financial risk register)

- Values from the Financial risk register, Expected credit loss FastTab to the Credit rating-internal FastTab in the Loan.

¶ Step 9.3: Add a new risk register line

- In the same Financial risk register, it is possible to add multiple risk lines. Do this by clicking on the Add button on the left below the Risks colour boxes.

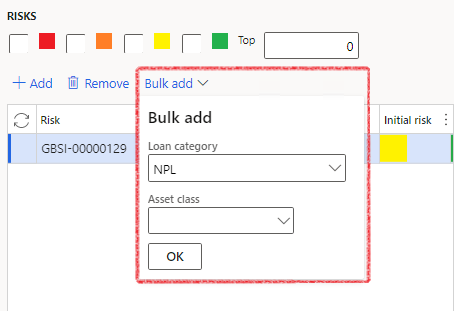

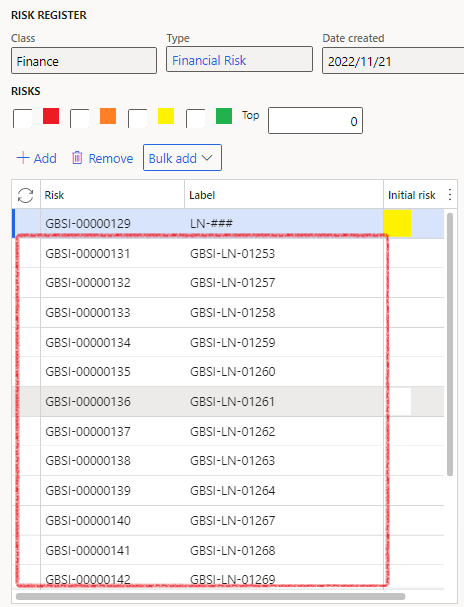

¶ Step 9.3.1: Bulk add risk lines

- In the financial risk register, click on the Bulk add button

- This will then display two drop downs that the user can select to import Loans

- This will then create a risk line for each of the Loans

- Click on the OK button after entering the Loan category and/or Asset class.

- Display of Bulk add below

¶ Step 10: Expected Credit Loss enquiry and Credit Loss Journal

The Expected Credit Loss enquiry and Credit Loss Journal Proposal are on the same page.

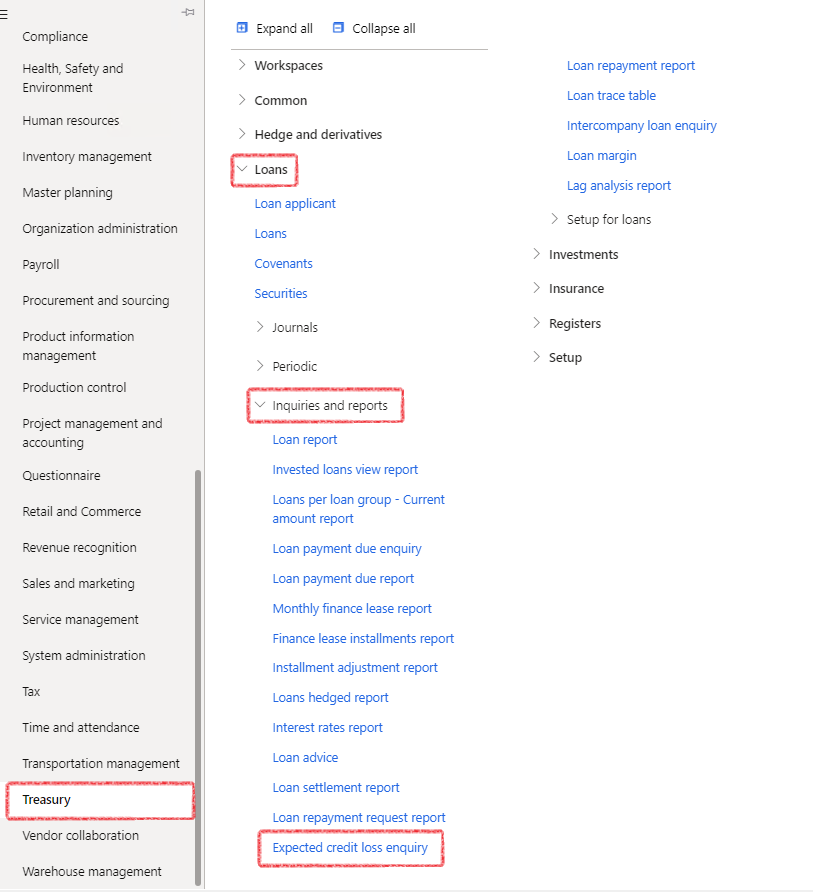

¶ Step 10.1: View Expected Credit Loss enquiry

- Navigate to Treasury > Loans > Inquiries and reports > Expected credit loss enquiry

- The purpose of the Expected credit loss enquiry page is to select a group of specific Expected credit loss risks from the Financial risk register and to Propose journals for these expected credit losses, which can then be approved and posted.

- Expected credit loss enquiry page showing the Risk lines created in the Financial risk register

- Each line displayed in the Expected credit loss enquiry page is a Risk line from the Financial risk registers if that risk line has a unique Loan attached as the Financial element. When there are risk lines that contain the same Loan as the Financial element, then the system will Only display the Risk line with the latest Date in the Expected credit loss FastTab.

¶ Step 10.2: Credit loss journal proposal

- Navigate to Treasury > Loans > Inquiries and reports > Expected credit loss enquiry

- Click on Credit loss journal proposal in the Action pane

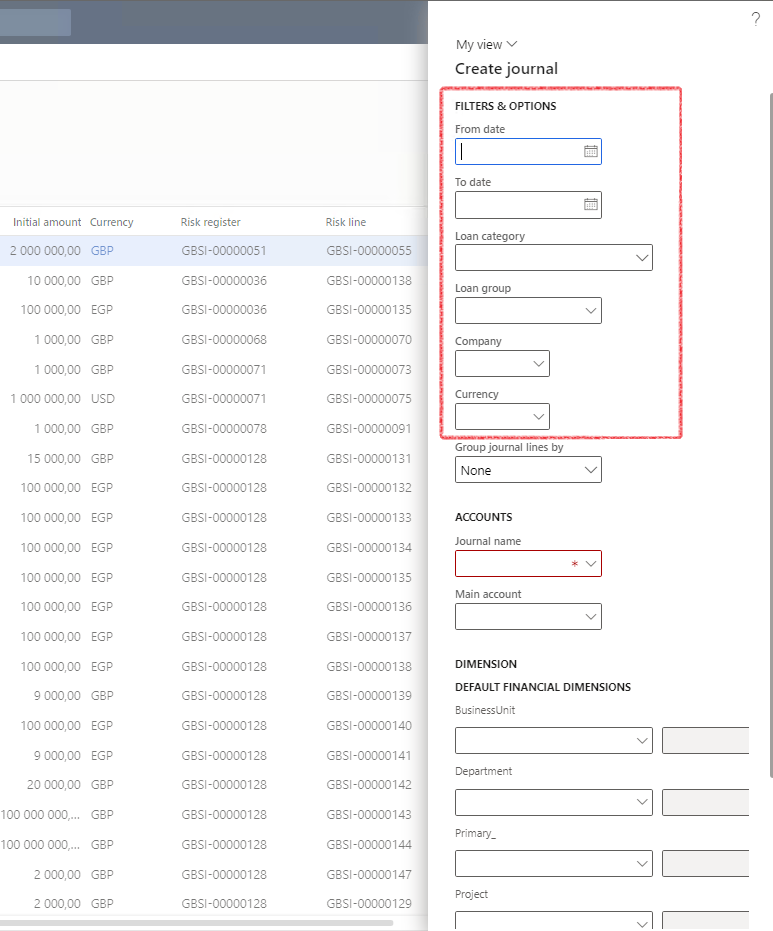

- In the Create journal dialogue page, select and complete the following sections:

- Filters & Options

- Accounts

- Dimensions

- The Filters & Options section on the Create dialogue page includes the following:

- From date - Filter by the From date which filters Expected credit losses with Assessment dates from this date.

The Assessment date is the date in the Expected credit loss FastTab

- To date - Filter by the To date which filters Expected credit losses with Assessment dates up to this date

- Loan category

- Loan group

- Company - select a specific legal entity

- Currency - The transaction currency of the Loan

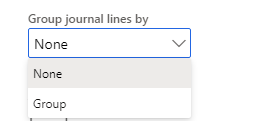

- Group journal lines by (select between None and Group)

If Group by = None, then a voucher number will be assigned per expected credit loss. No grouping will take place.

If Group by = Group, then a single voucher number will be assigned per Loan group. The sum of the amounts in the Credit column will be used as the amount of the journal line

¶ Accounts

- Journal name

- Select the journal name that will be used for the Expected credit loss. Only journal names with Treasury journal type of Expected credit loss will be available for selection here

- Main account

- Select a Main account to be used as the Main account in the journal proposal for Loan groups that do not have an account selected for the Expected credit loss in Loan groups.

- If no financial dimensions were specified in the Loan group, then the user can enter financial dimensions that relates to the Main account.

- If the user entered a Main account in the Expected credit loss and a Main account is set up in Loan groups, then the journal would use the main account that is set up in the Loan groups and not the Main account from the Proposal.

- Dimension – Default Financial dimensions

- Select a Main account that will be used as the offset account (if no account is selected in the Posting profiles (Loans) for Expected credit losses)

Risk lines with identical Financial elements.

For two Risk lines with exactly the same Financial element, only the Risk line with the latest Assessment Date in the given time period as specified in the Credit loss journal proposal will be used for the Loan as it’s expected credit loss value.

If Start date is 4/30/2022 and the End date is 6/1/2022 as selected in the Credit loss journal proposal, then for two risk lines with the same Financial element, the latest assessment date in that time period will be used.

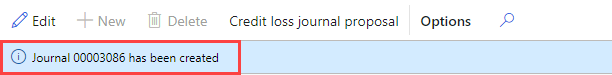

- When all the desired fields are filled in for the Credit loss journal proposal, then click on the OK button at the bottom of the dialogue

- A message will pop up stating that the journal has been created

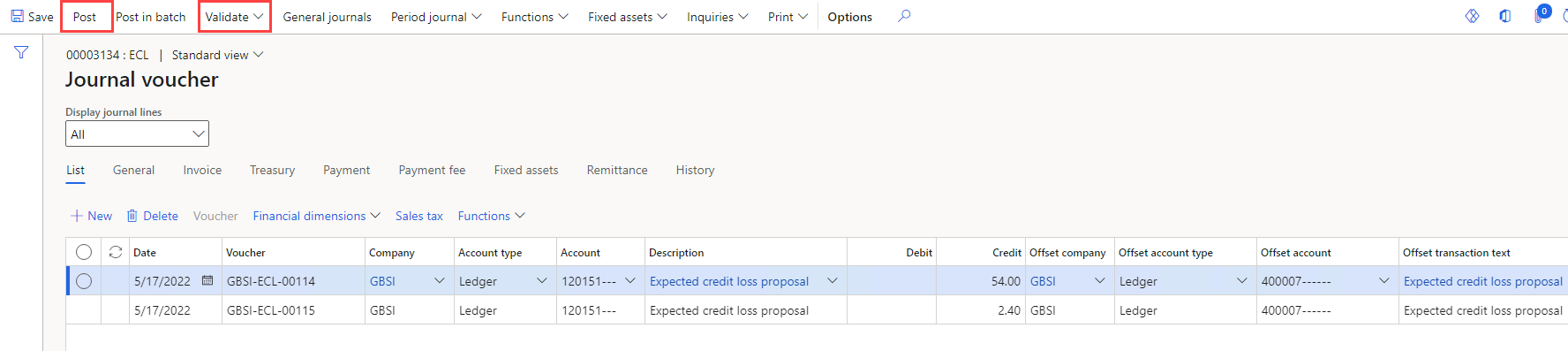

¶ Step 11: View the Credit loss journal.

Navigation currently is through Filtering the general journal. (Work in progress, detailed steps to follow)

- Navigate to General journals

¶ Step 11.1: Validate and Post the journal

- Click on Validate in the action pane and then click on Validate or just Post by clicking on Post in the action pane.

¶ Step 12. Calculate Last Credit score

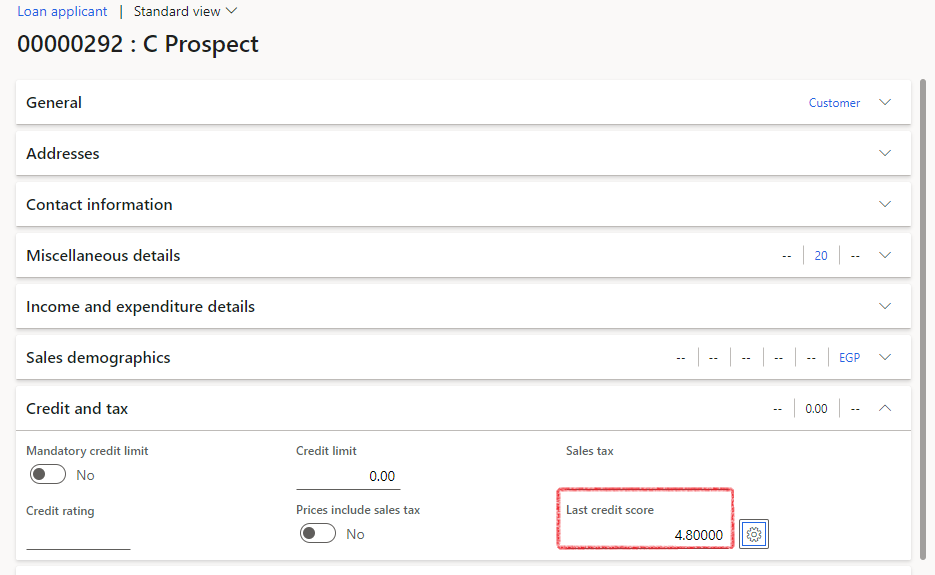

¶ Step 12.1: Calculate Last Credit score for a Loan applicant

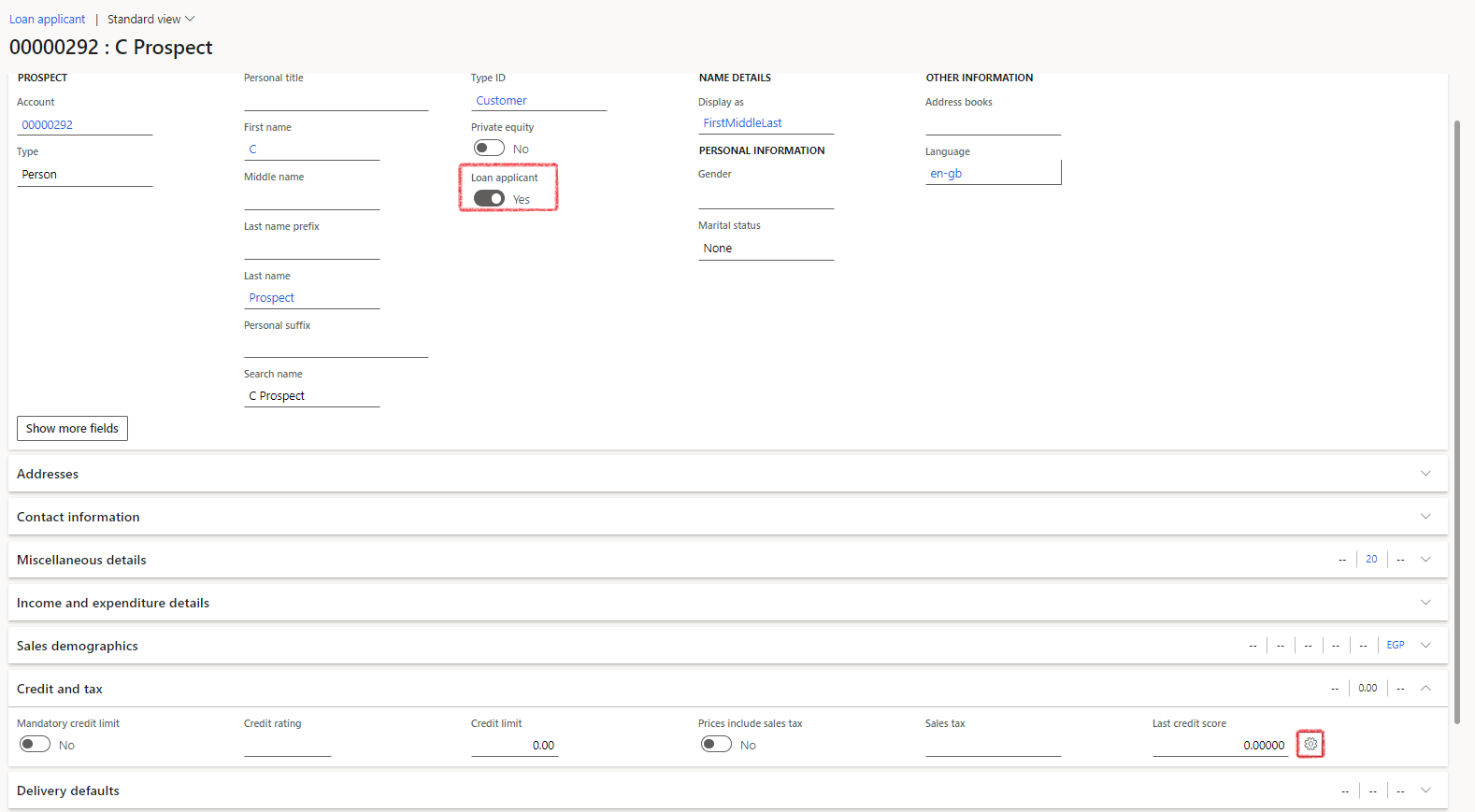

- Navigate to Treasury > Loans > Loan applicant

- Select a loan applicant record

- Note that the slider for Loan applicant should be set to Yes in the General FastTab

- Expand the Credit and VAT FastTab

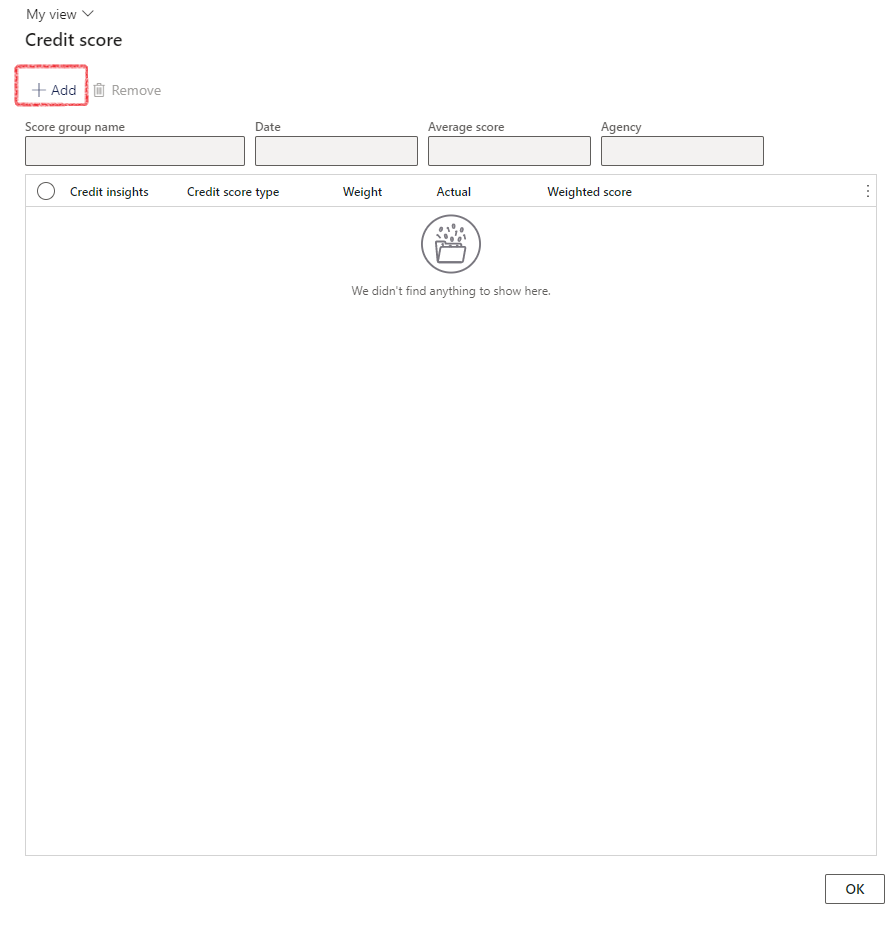

- On the field Last credit score, click on the gear icon

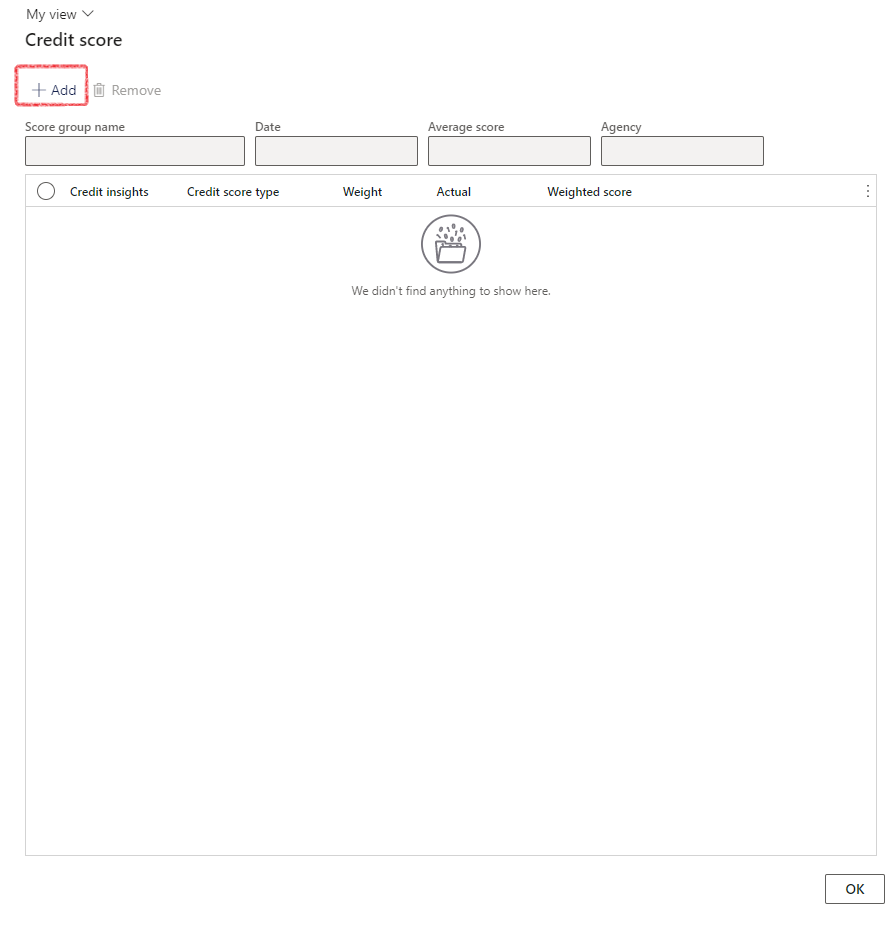

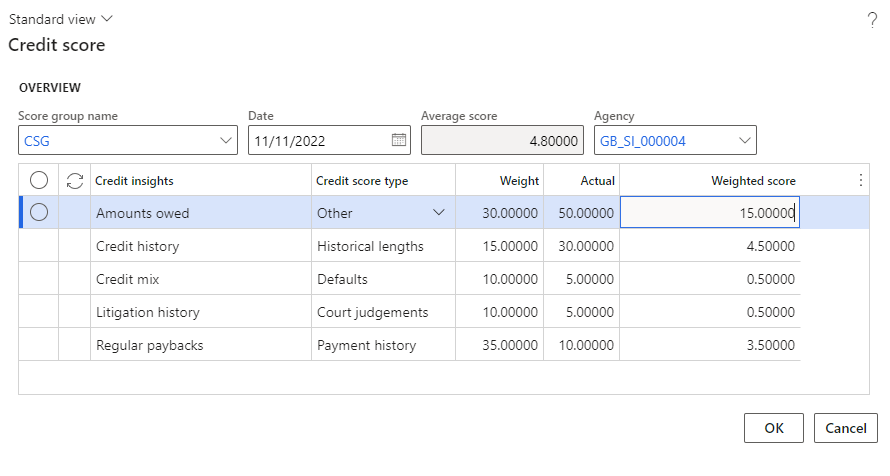

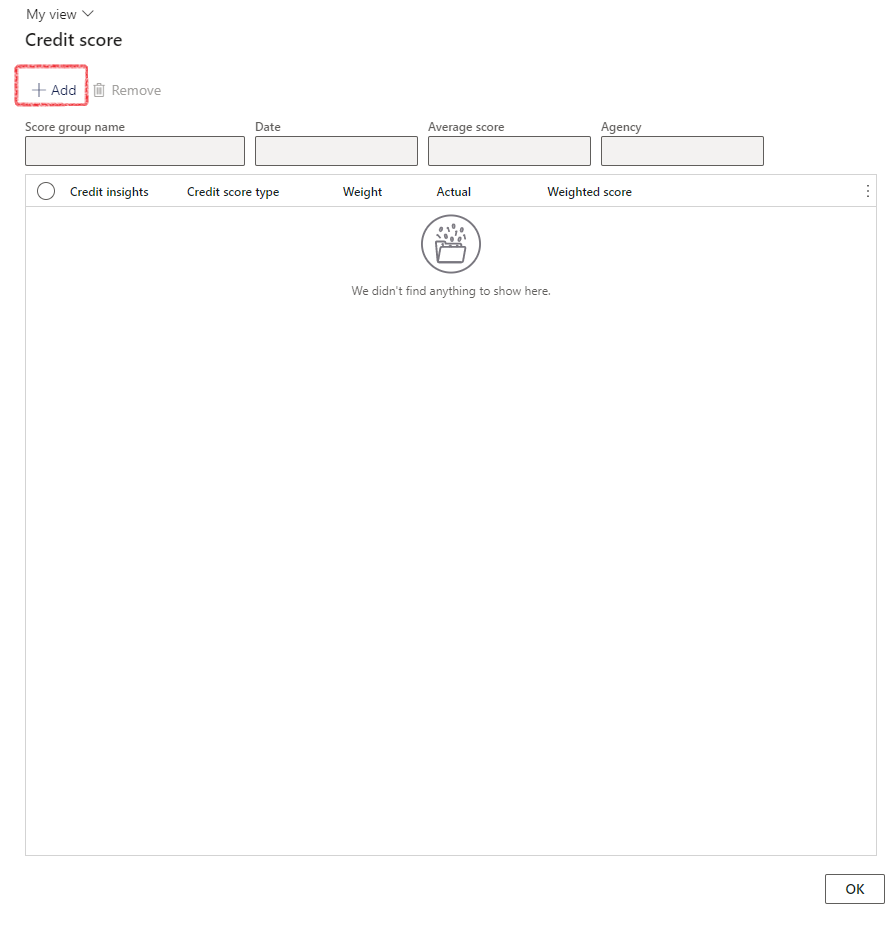

- Click on Add to select a new Score group name or Remove to remove existing credit scores for this Loan applicant

- Select a Score group name from the dropdown list

- Enter a date

- Select an Agency. This is a link to the Vendor lookup table

- Type in the Actual percentages for each line

- You will see that the Weighted score will then be calculated automatically

- Click the OK button

- The Last credit score is calculated as per the setup and the latest values that was entered.

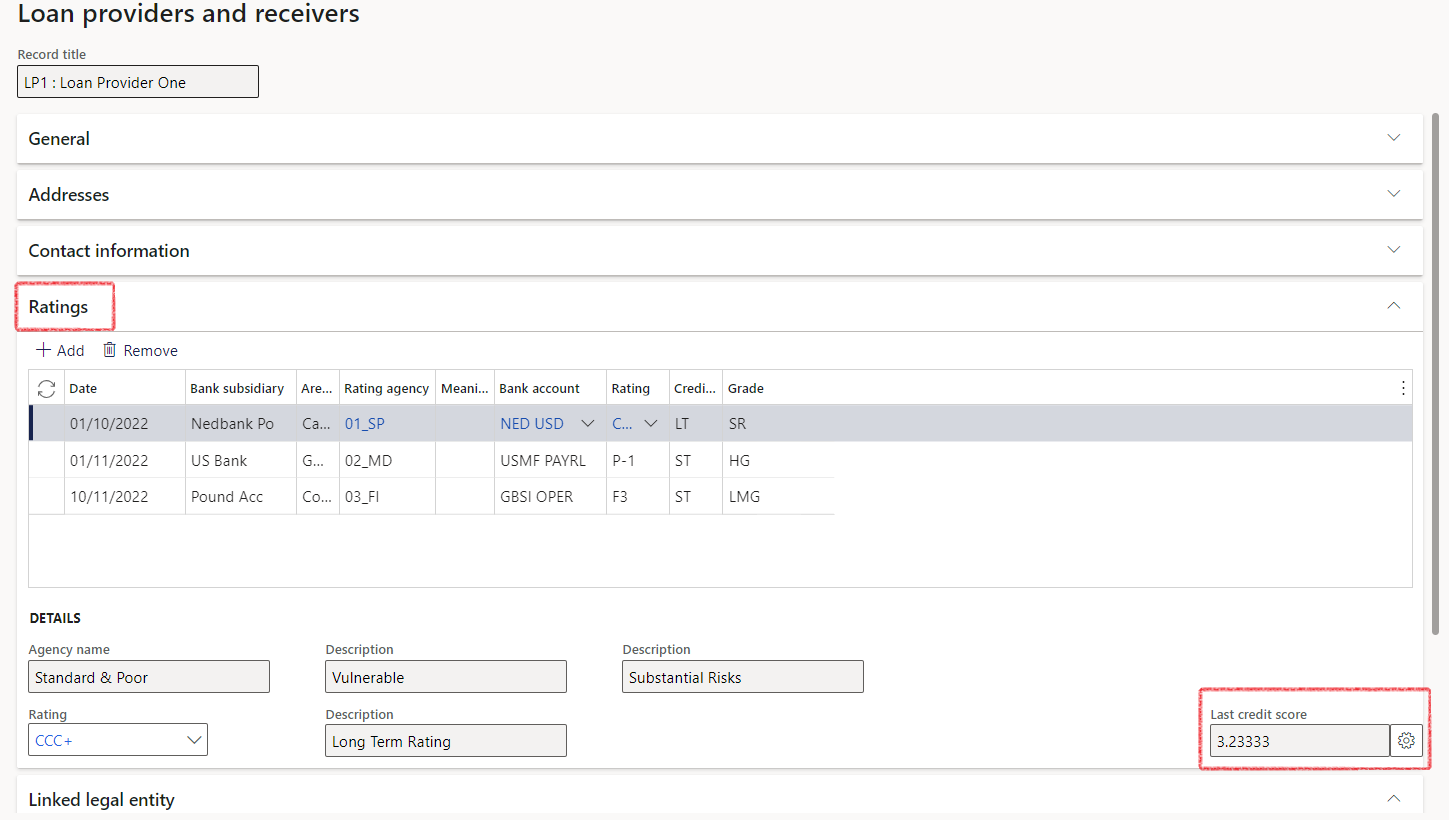

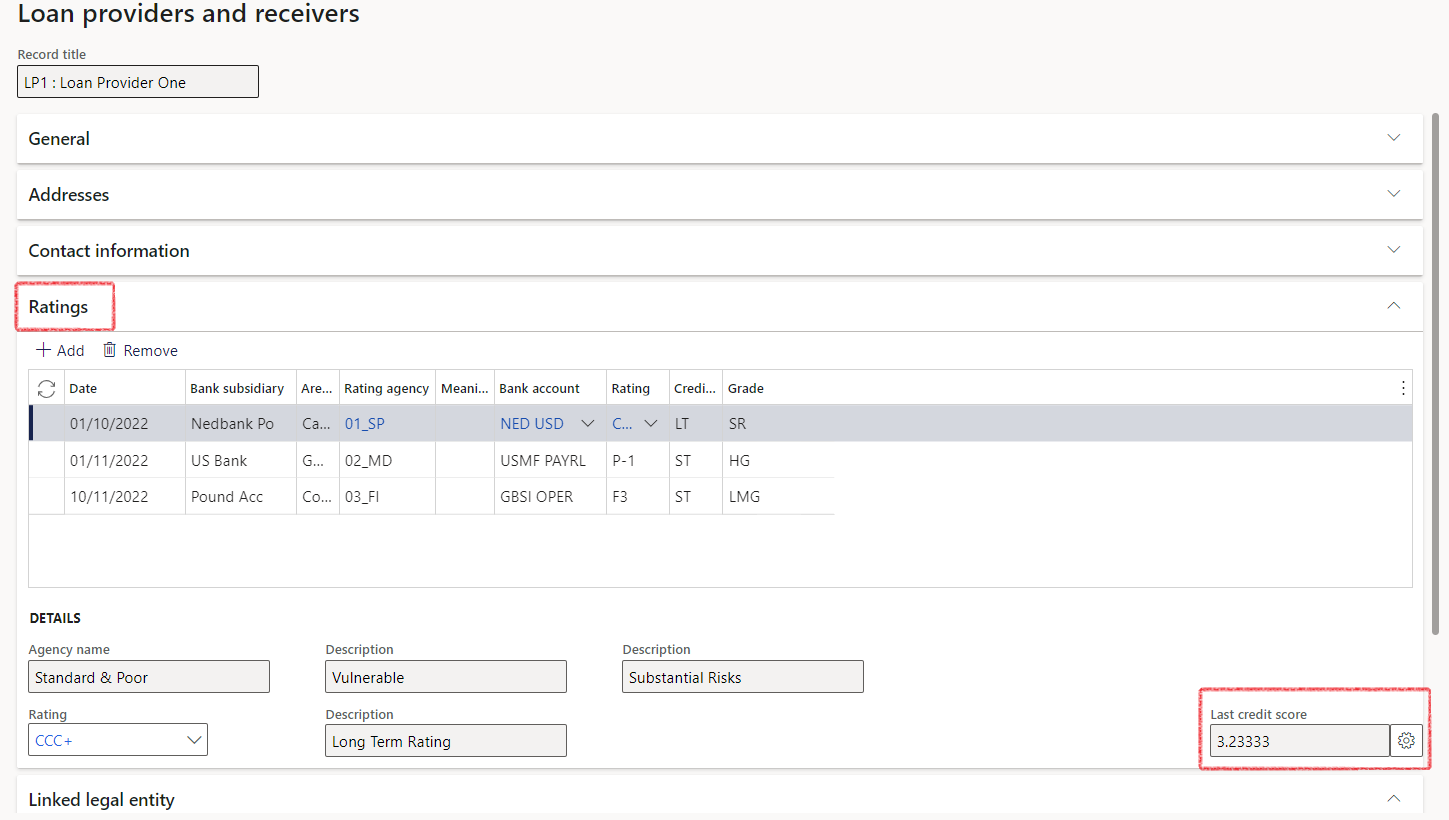

¶ Step 12.2: Calculate Last Credit score for Loan providers and receivers

- Navigate to Treasury > Loans > Setup for Loans > Loan providers and receivers

- Select a Loan providers and receivers record

- Expand the Ratings FastTab

- On the field Last credit score, click on the gear icon

- Click on Add to select a new Score group name orRemove to remove existing credit scores for this Loan provider/Loan receiver

- Select a Score group name from the dropdown list

- Select a Score group name

- Enter a date

- Select an Agency. This is a link to the Vendor lookup table

- Type in the Actual percentages for each line

- You will see that the Weighted score will then be calculated automatically

- Click the OK button

- The Last credit score is calculated as per the setup and the latest values that was entered.

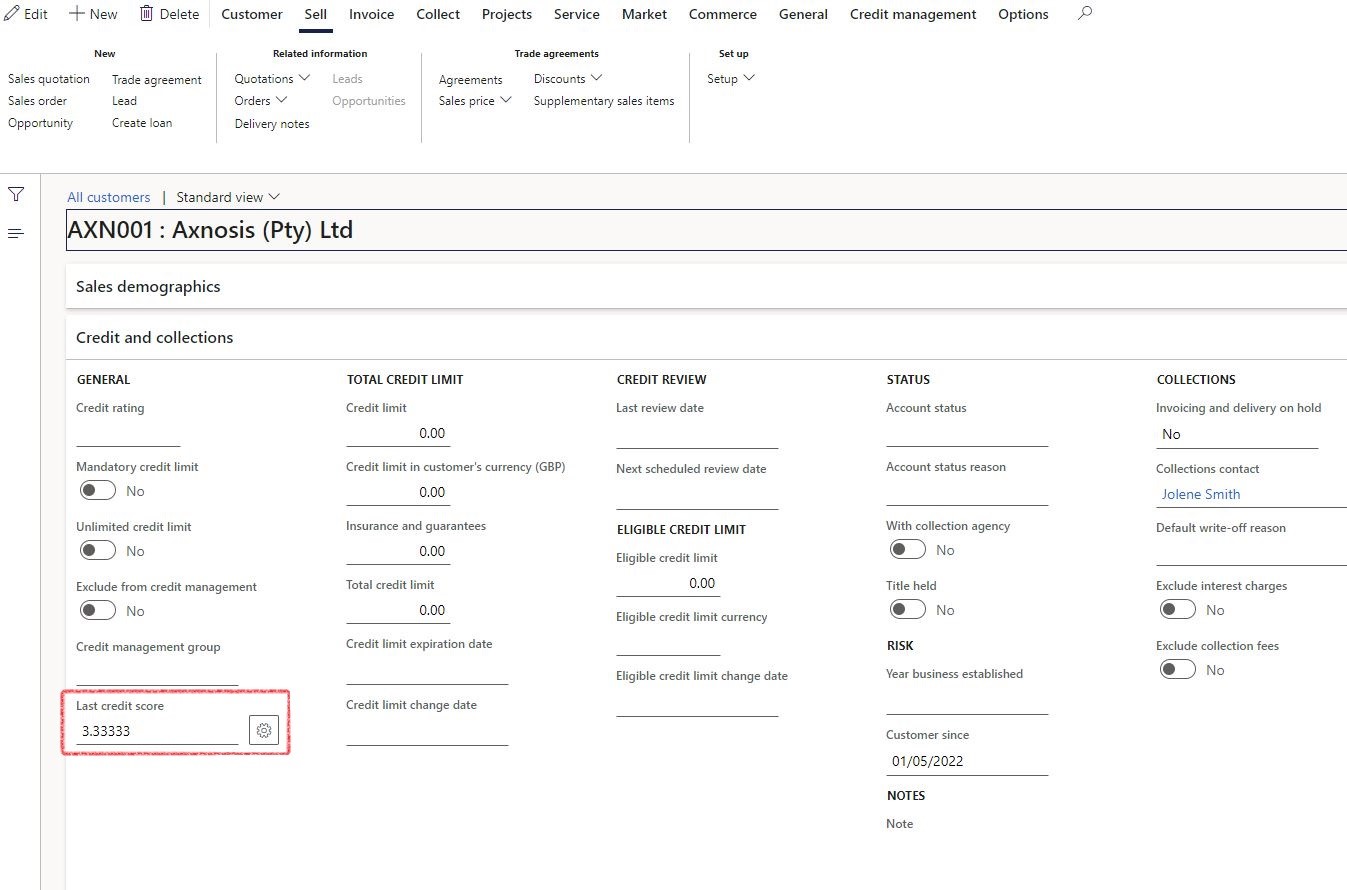

¶ Step 12.3: Calculate Last Credit score for a Customer

- Navigate to Sales Ledger > Customers > All customers

- Select a customer record

- Expand the Credit and Collections FastTab

- On the field Last credit score, click on the gear icon

- Click on Add to select a new Score group name or Remove to remove existing credit scores for this Customer

- Select a Score group name from the dropdown list

- Enter a date

- Select an Agency. This is a link to the Vendor lookup table

- Type in the Actual percentages for each line

- You will see that the Weighted score will then be calculated automatically

- Click the OK button

- The Last credit score field is calculated and updated as per the setup and the latest values that was entered.

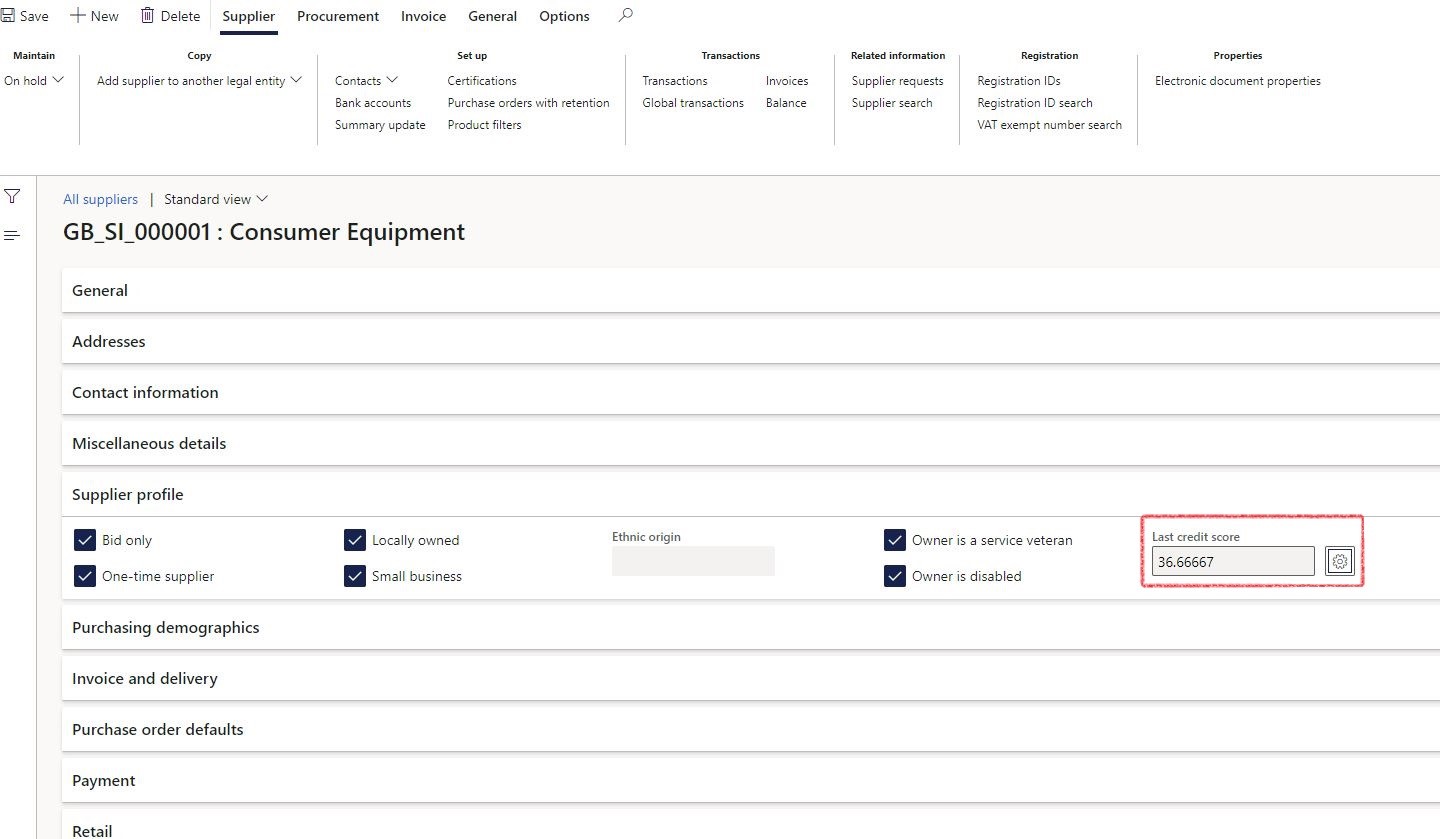

¶ Step 12.4: Calculate Last Credit score for a Vendor

- Navigate to Purchase Ledger > Vendors > All vendors

- Select a Vendor record

- Expand the Supplier/Vendor profile FastTab

- On the field Last credit score, click on the gear icon

- Click on Add to select a new Score group name or Remove to remove existing credit scores for this Vendor.

- Select a Score group name from the dropdown list

- Enter a date

- Select an Agency. This is a link to the Vendor lookup table

- Type in the Actual percentages for each line

- You will see that the Weighted score will then be calculated automatically

- Click the OK button

- The Last credit score field is calculated and updated as per the setup and the latest values that was entered.