¶ Introduction

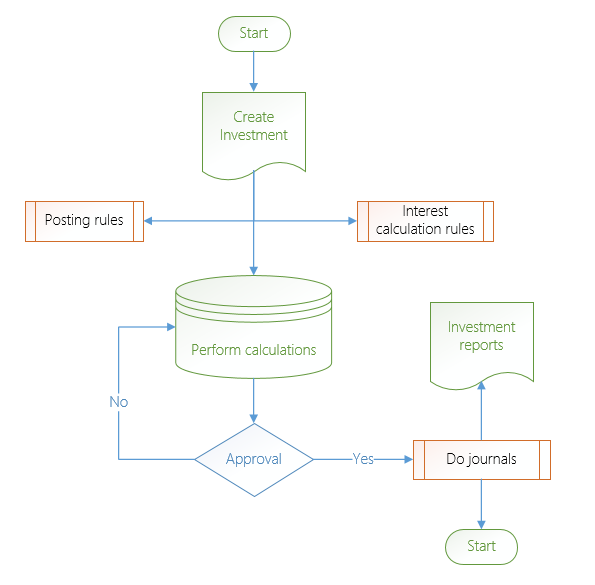

Process Non-Cash Investment

When excess cash is identified, it can be allocated to longer-term investments, referred to as non-cash investments, which are typically not held directly with financial institutions.

These investments are managed by specialized investment fund managers. Additional contributions may be made periodically, and the asset managers oversee day-to-day management of the funds. They provide detailed investment reports showing fund utilization and monthly movements. Users then record these movements in Microsoft Dynamics Finance and Operations (D365 F&O), directly within the Treasury module, which updates the corresponding general ledger accounts.

This module focuses on efficiently managing non-cash investments, interest, and funds.

¶ Navigation

Inside Microsoft Dynamics 365, Axnosis created a storage area for non-cash investments. From the main menu, browse to Treasury.

¶ Specific setup

The following setup will be covered:

- Budget models, codes and parameters

- Treasury parameters for Non-Cash investments

- Exchange

- Journal names for Non-Cash investments

- Asset classes

- Account types

- Asset manager

- Investment types

- Investment movement types

- Fund performance import setup

- Posting profiles

- Equities

- Property types

- Property

¶ Step 1: Set up Budgets

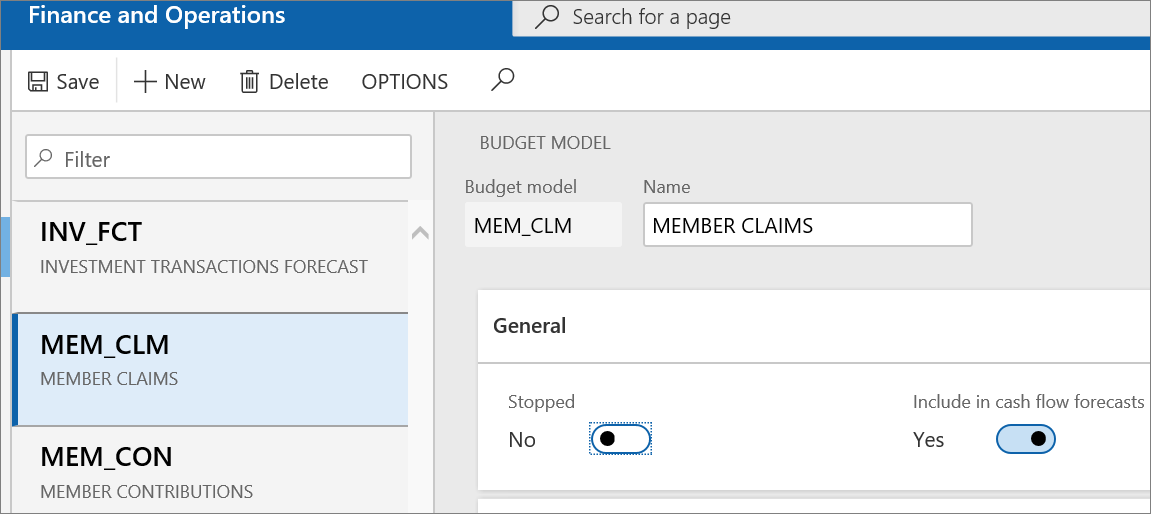

¶ Step 1.1: Set up Budget models

- Go to: Budgeting > Setup > Basic Budgeting > Budget models

- Create Budget Models for Member Contributions, member claims and Investment Transactions

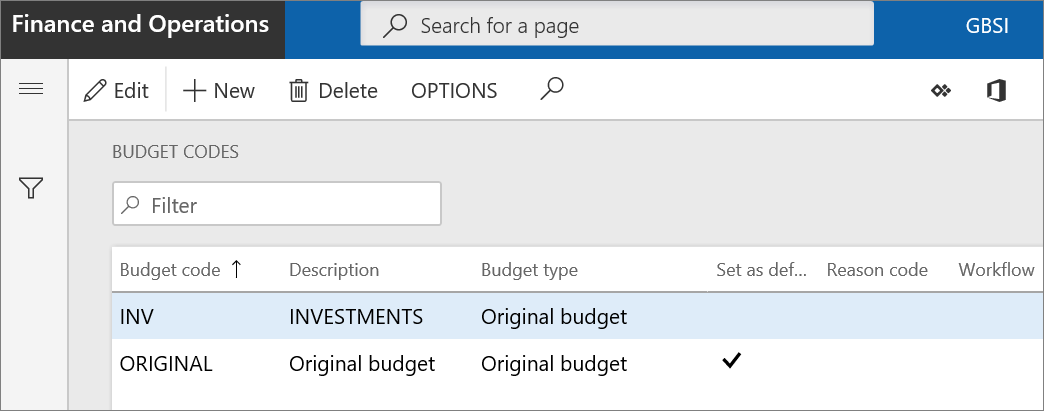

¶ Step 1.2: Set up Budget codes

- Go to: Budgeting > Setup > Basic Budgeting > Budget codes

- Create Budget Code for Investment Module

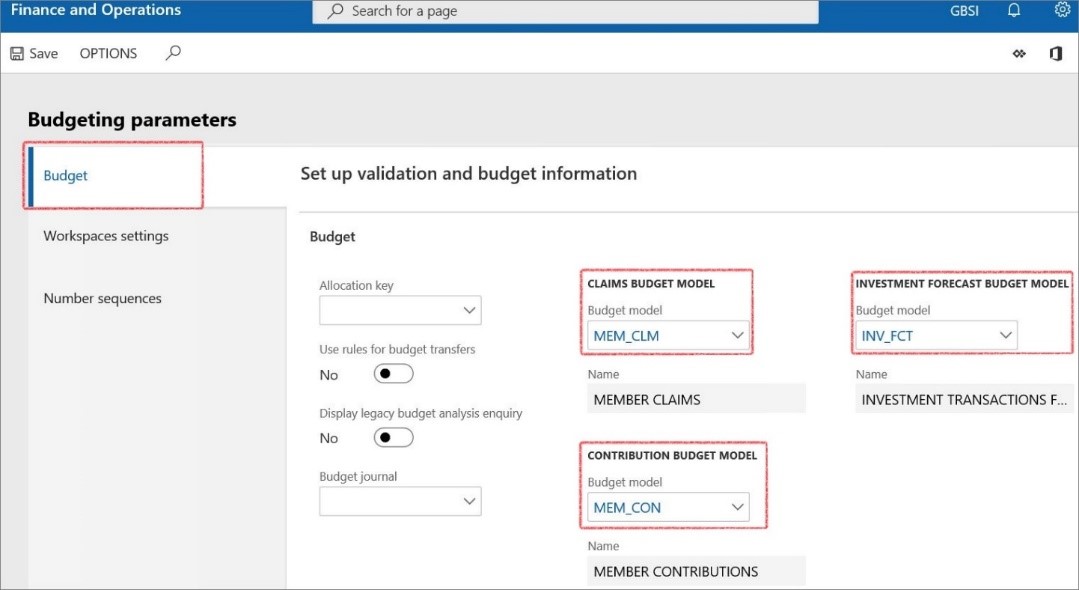

¶ Step 1.3: Set up Budgeting Parameters

- Go to: Budgeting > Setup > Basic Budgeting > Budgeting Parameters

- Link the newly created Budget Models to the model fields under parameters

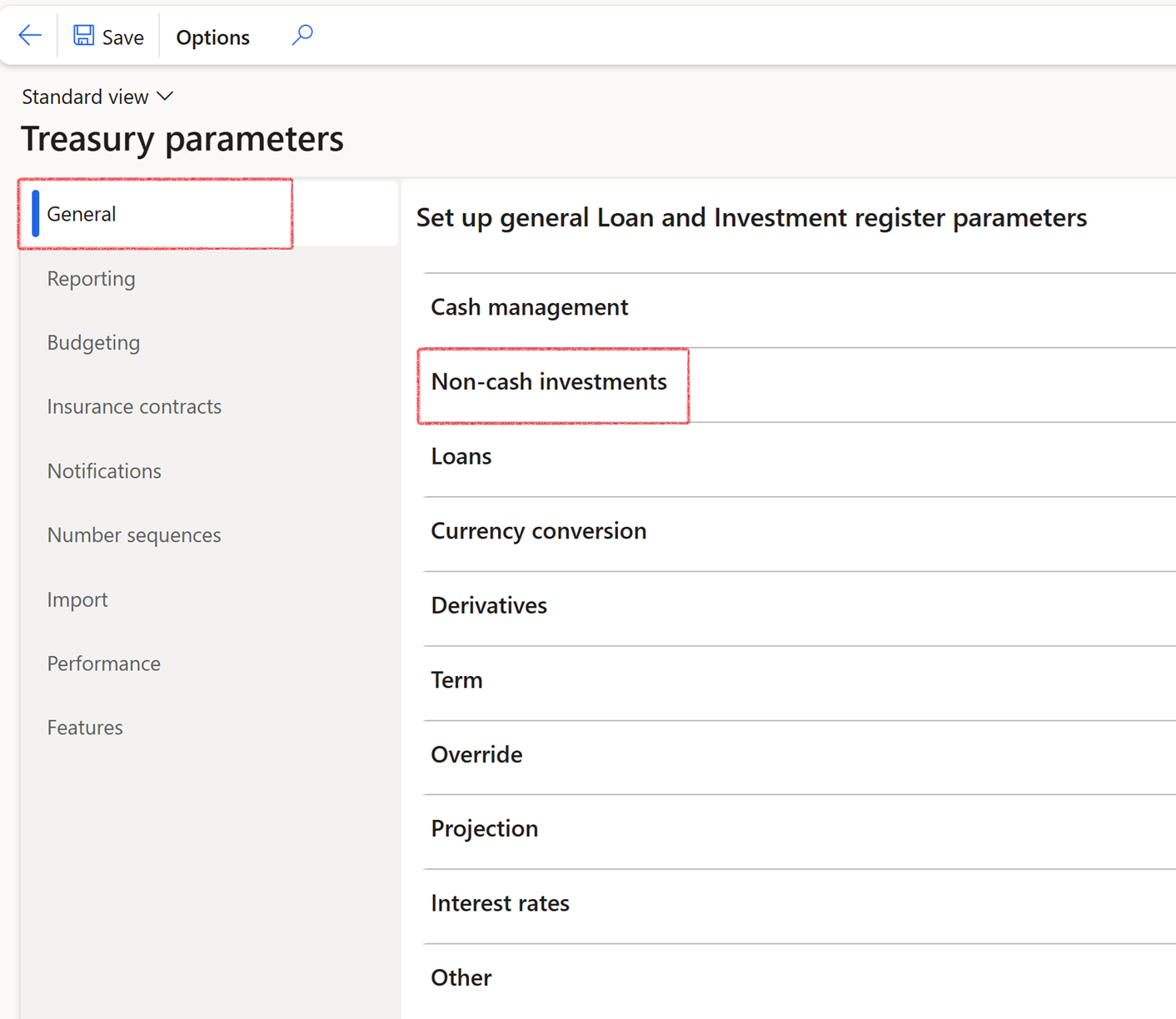

¶ Step 2: Setup Treasury parameters

Treasury parameters is the core setups specifically for the Treasury module and will be relevant to each area in TMS.

- When navigating to Treasury > Setup > Treasury parameters, you will find a page with sections for General, Reporting, Budgeting, Notifications and Number sequences. Each of these sections have a set of FastTabs.

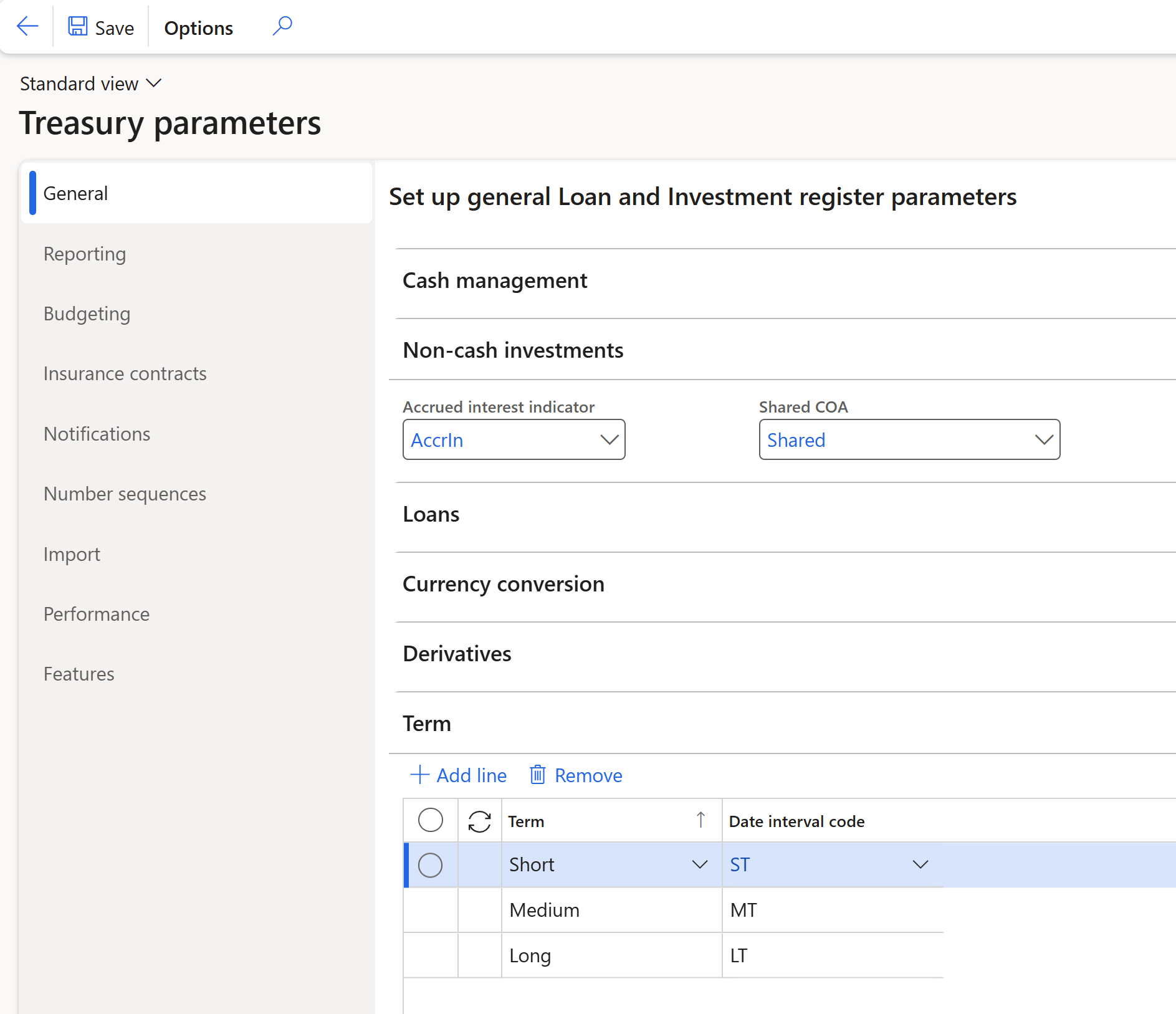

¶ Step 2.1: Treasury parameters General: Accrued Interest indicator

- Go to Treasury > Setup > Treasury parameters

- Expand the General tab

- Select an Accrued interest indicator from a drop-down menu

- Choose a shared Chart of Account if required

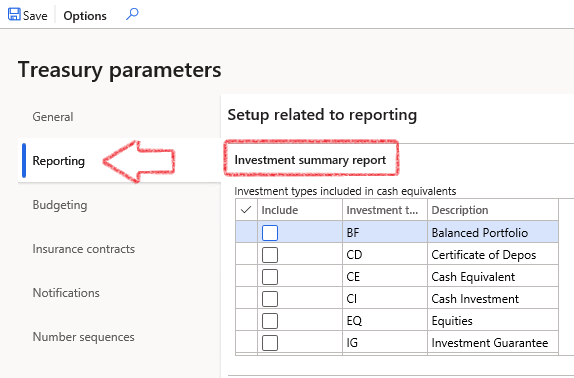

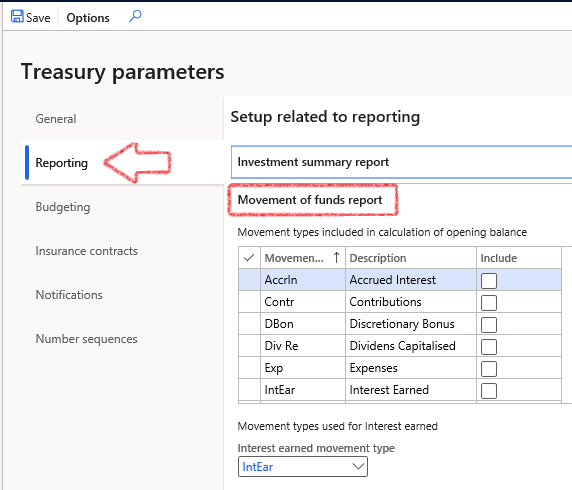

¶ Step 2.2: Treasury parameters - Reporting

- Go to Treasury > Setup > Treasury parameters

- Expand the Reporting tab

- Expand the Investment summary report FastTab

- Select the relevant tick boxes for investment types included in cash equivalent group

- Go to Treasury > Setup > Treasury parameters

- Expand the Reporting tab

- Expand the Movement of funds report FastTab

- Select whether or not to include the movement type when calculating the opening balance on the Movement of funds report

- On the same form, move down to Movement type used for Interest earned

- Select movement types to sum as the interest accrued value

- Click Save on the top left

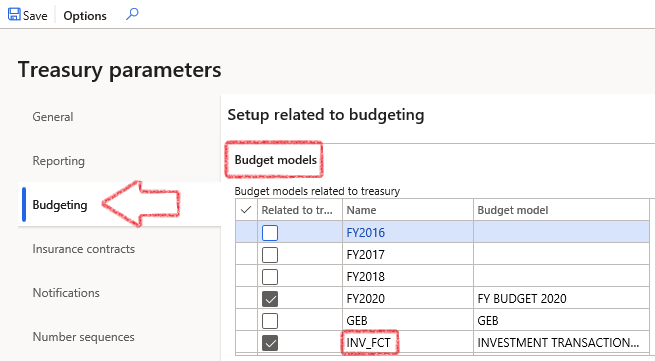

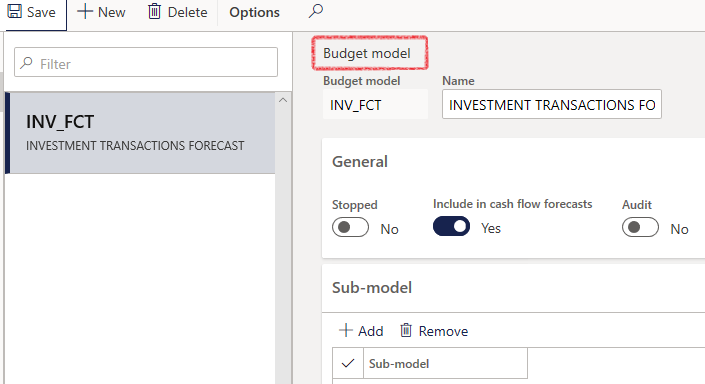

¶ Step 2.3: Treasury parameters view Budget models

Budget models are part of the assumed setups and can be found by navigating to Budgeting > Setup > Basic budgeting > Budget models.

- Go to: Treasury > Setup > Treasury Parameters

- Select the Budgeting tab

- Selecting a tick box indicates if the budget model is part of the treasury module

- If you click on the Name field, the specific setup for that Budget model will open

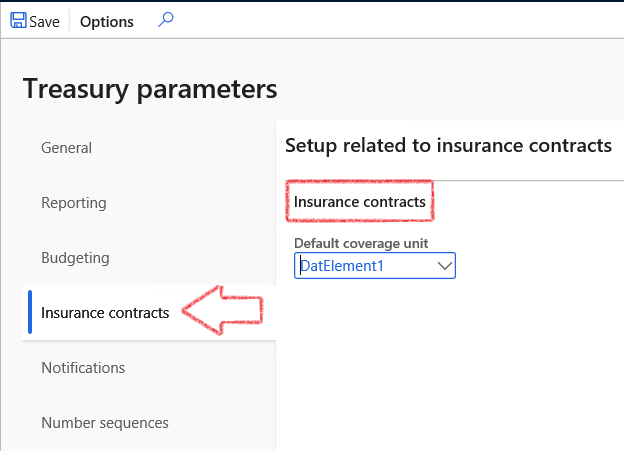

¶ Step 2.4: Set up Insurance contracts

- Go to Treasury > Setup > Treasury parameters

- Open the Insurance contracts FastTab

- Select the relevant Default coverage unit

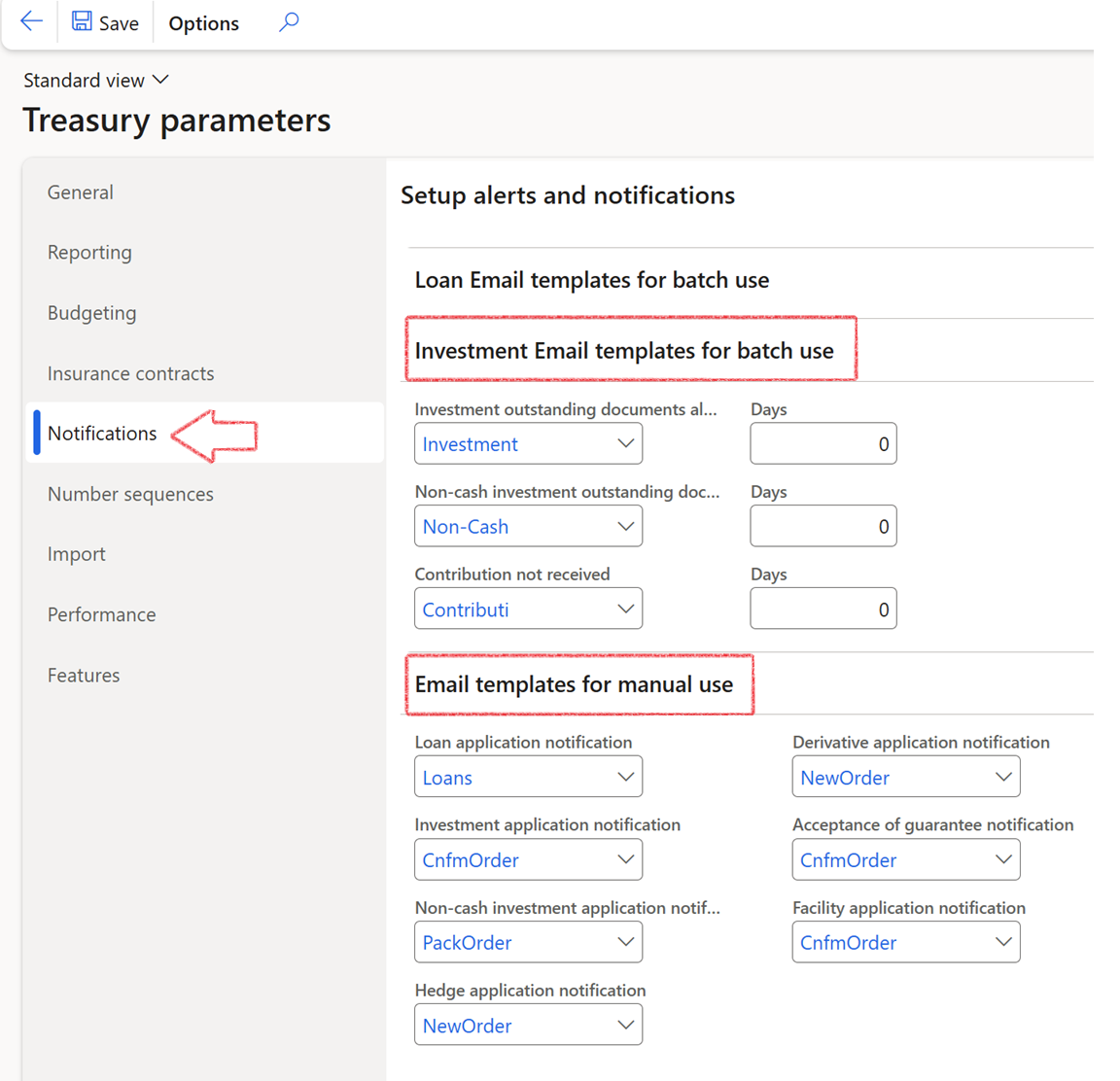

¶ Step 2.5: Set up Notifications

Email templates can be set up by navigating to Organisation administration > Setup > Organisation email templates.

- To select Investment E-mail templates for batch use, go to Treasury > Setup > Treasury parameters

- Open the Notifications FastTab

- Select the relevant e-mail templates for Investment E-mail templates for batch use, and E-mail templates for manual use from the list

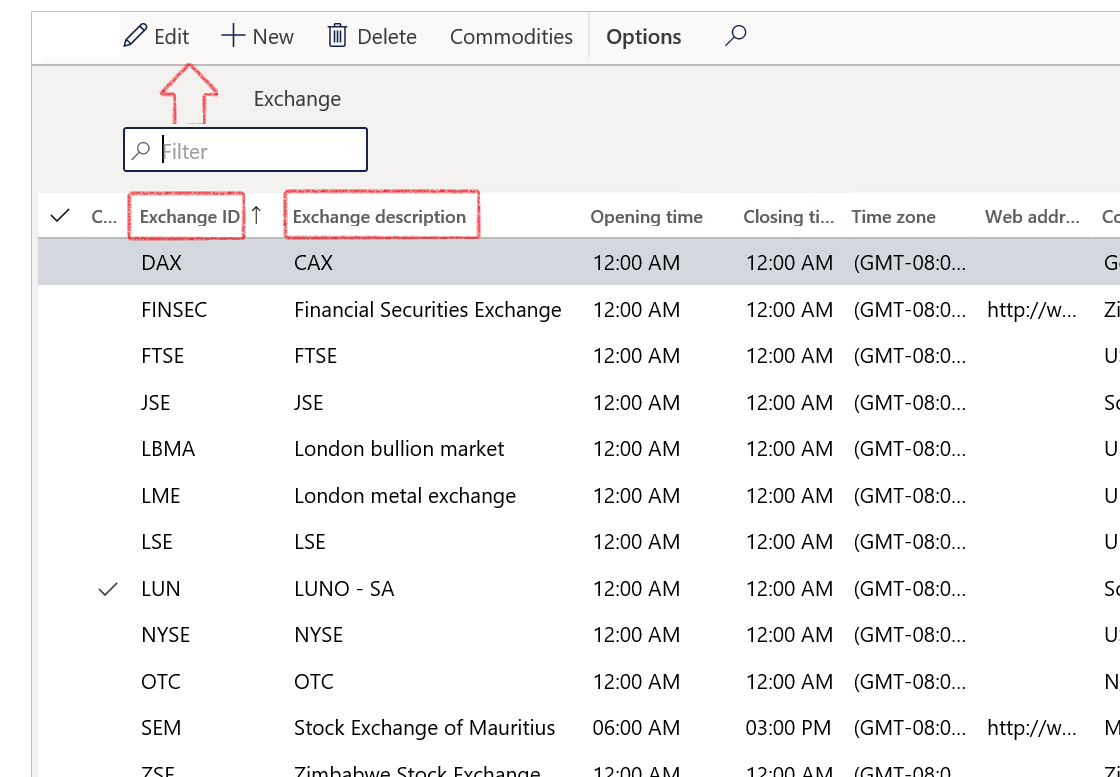

¶ Step 3: Setup Exchange

An exchange is a marketplace where securities, commodities, derivatives and other financial instruments are traded. An interest rate index is an index based on the interest rate of a financial instrument or basket of financial instruments. The Exchange form under the Common sub-module makes provision for both Exchanges and Interest rate indexes. Typical market rate indexes include LIBOR, Bloomberg foreign exchange, and Reuter’s foreign exchange. An index categorizes the various market rates that you track.

- Go to: Treasury > Common > Exchange

- Click the New button

- Enter the Exchange ID and Description

- Also complete the Web address

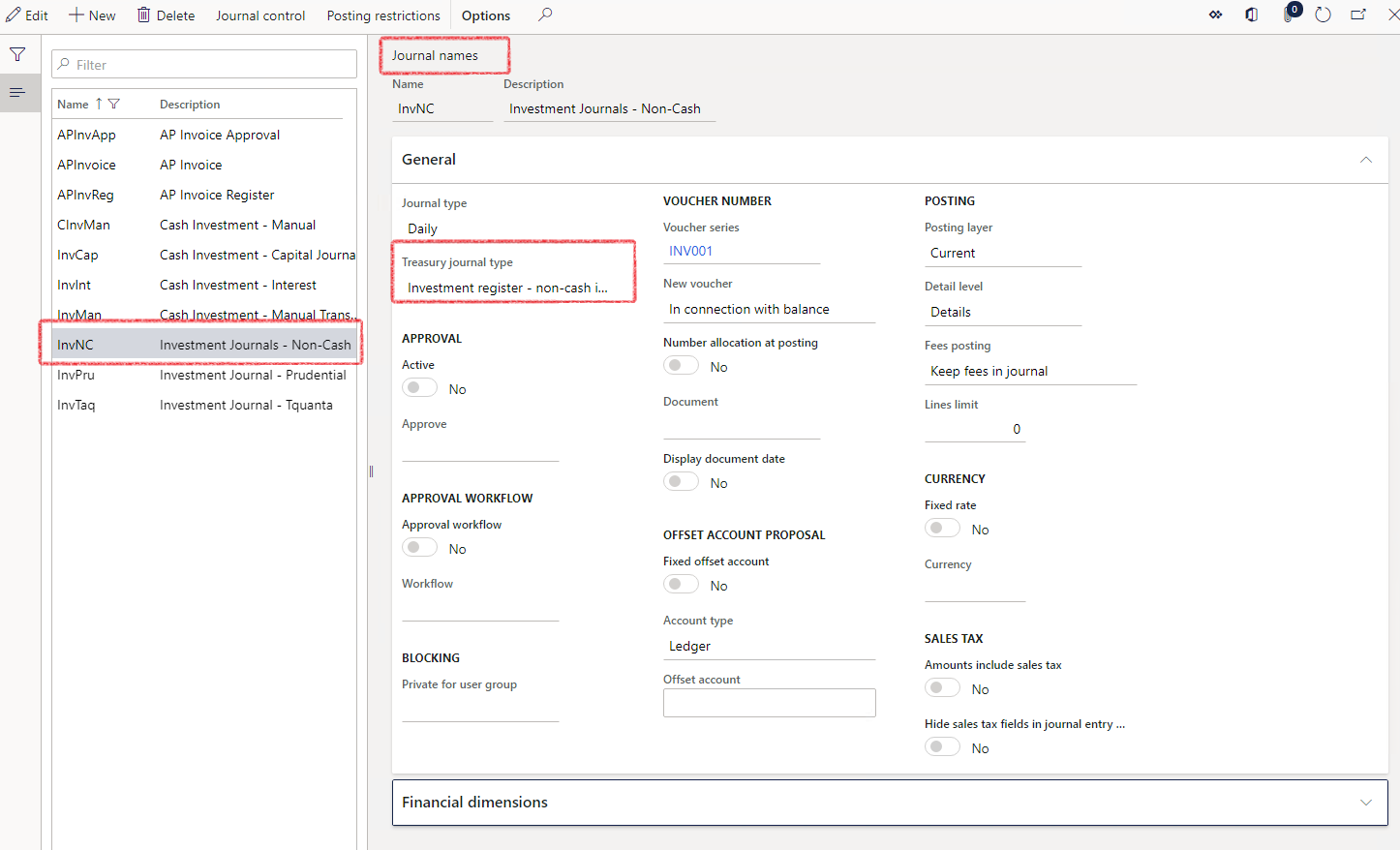

¶ Step 4: Create Journal names

For Non-Cash Investments, choose movement type on non-cash journal, which will give you the posting profile

When creating a journal, the first selection to be done is a journal name. In Treasury, each journal name setup is done by linking the journal name to a Treasury journal type, as well as an Account type.

- Go to: Treasury > Setup > Journal names

- On the Action pane, click on the New button

- In the Name field, enter the name of the journal. This name is used to refer to this journal throughout the system

- Enter a brief Description for the journal

- Under the General FastTab:

- Select the relevant Journal type from the dropdown list

- Select the relevant Treasury journal type from the dropdown list

- Under the Approval field group, the user can select Yes to Activate the manual journal approval system for this journal name

- In the Approve field, select the user group that can approve the journal

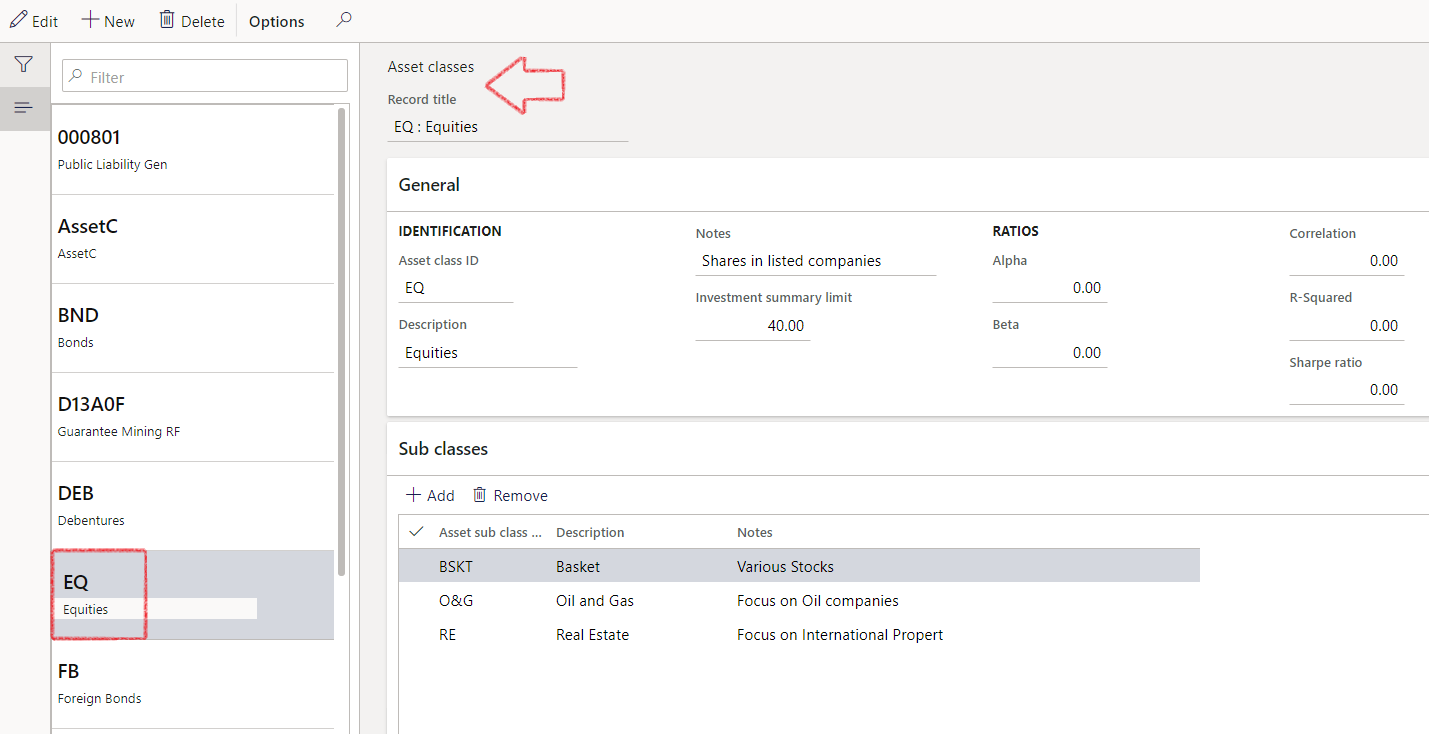

¶ Step 5: Setup Asset classes

In finance, an asset class is a group of financial instruments which have similar financial characteristics and behave similarly in the marketplace. We can often break these instruments into those having to do with real assets and those having to do with financial assets. Historically, the three main asset classes have been equities (stocks), fixed income (bonds) and cash equivalent or money market instruments. Currently, most investment professionals include real estate, commodities, futures, other financial derivatives and even cryptocurrencies to the asset class mix.

The list of asset classes we create are: Debentures, Equities, Foreign bonds, Foreign cash, Investment Bank and Public Funds.

- Go to: Treasury > Investments > Setup for investments > Asset classes

- Click on the New button to create new Asset classes and enter an Asset class ID and Description.

- Insert an Investment summary limit

- Click Add to create Sub-classes if required

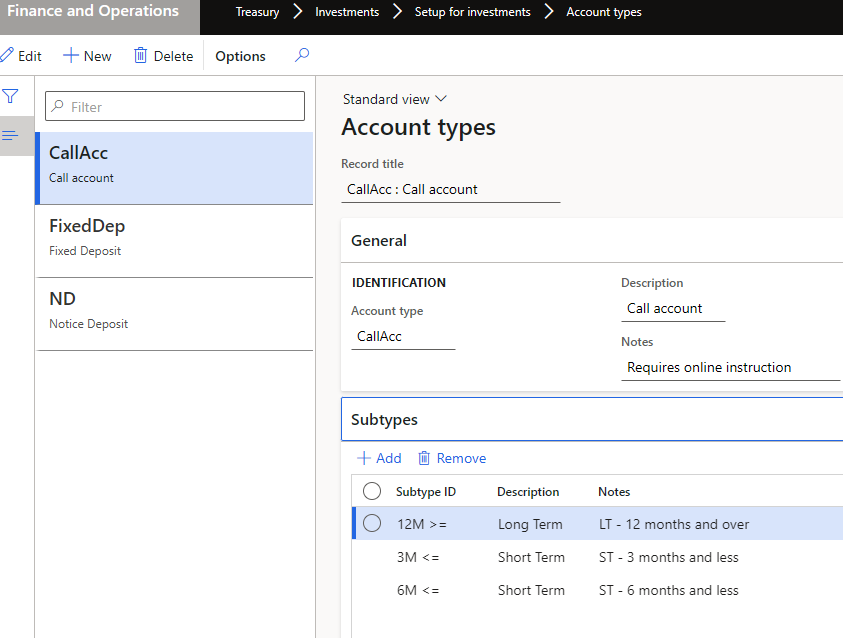

¶ Step 6: Setup Account types

To create a new Account type, navigate to:

- Treasury > Investments > Setup for investments > Account types

- Click on New to add a new account type, or Edit to edit an existing account type

- Expand the General FastTab

- Enter an account type

- Enter a Description

- Add Notes if required

- Expand the Subtypes FastTab

- Click on Add

- Enter a Subtype ID

- Type a Description

- Add Notes

- Click on Save

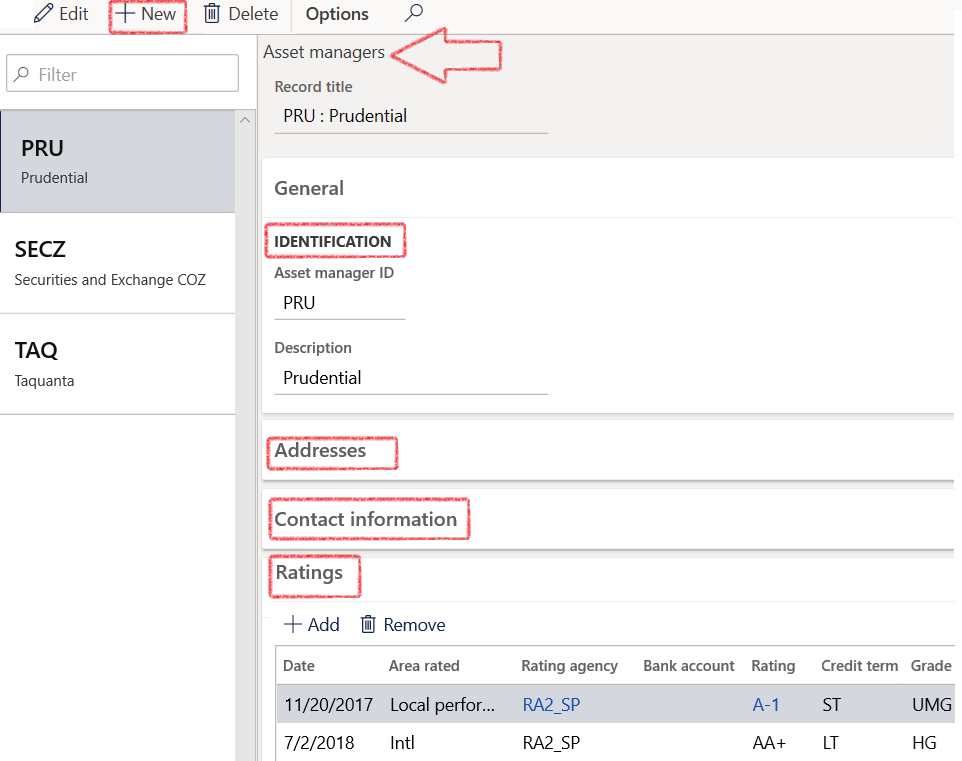

¶ Step 7: Setup Asset Manager

Asset management is part of a financial company which employs experts who manage money and handle the investments of clients. They manage funds for individuals and companies. They make well-timed investment decisions on behalf of their clients to grow their finances and portfolio. Working with a group of several investors, asset management firms are able to diversify their clients' portfolios.

- Go to: Treasury > Investments > Setup for investments > Asset Manager

- Create New Asset manager

- Expand the General FastTab, to enter an Asset manager ID and Description

- Expand the Addresses and Contact information FastTabs to complete those fields

- Ratings can be inserted by expanding the RatingsFastTab and selecting Add

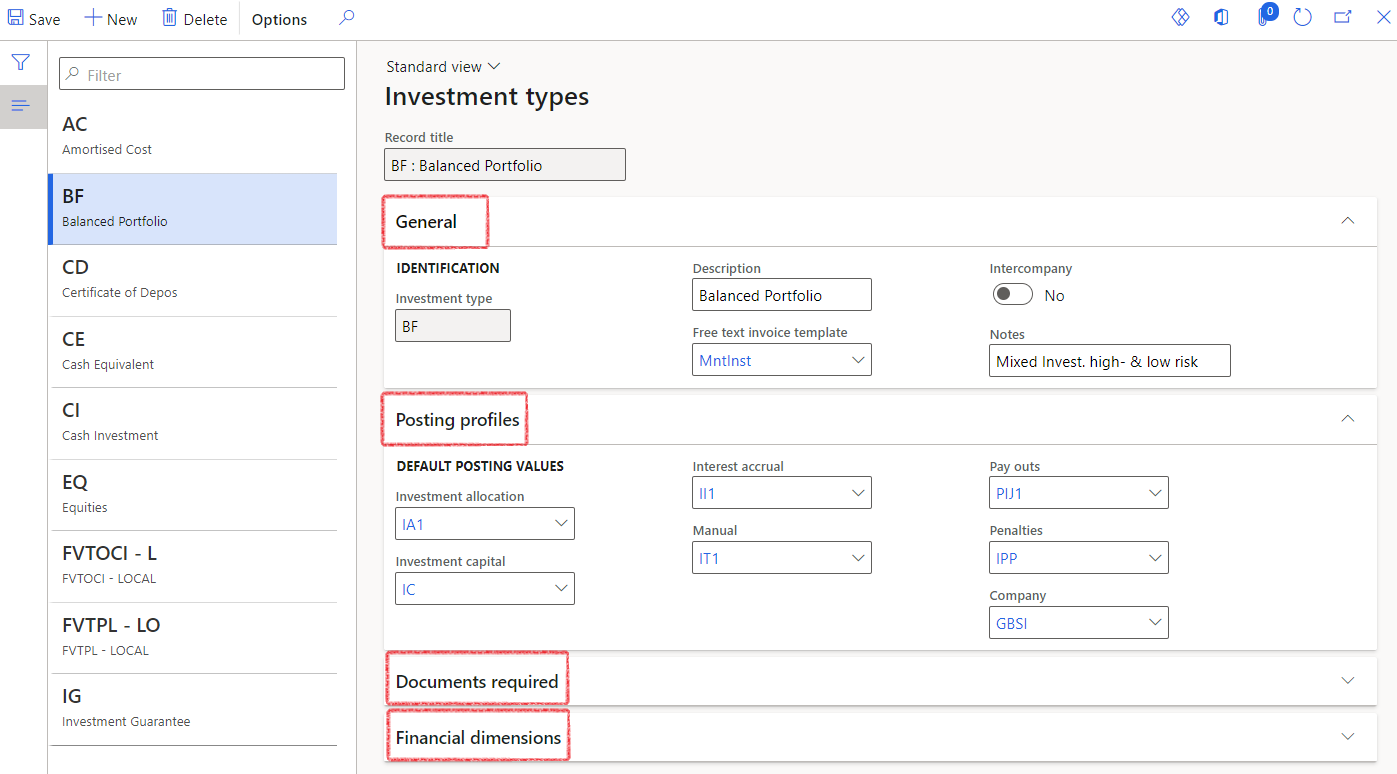

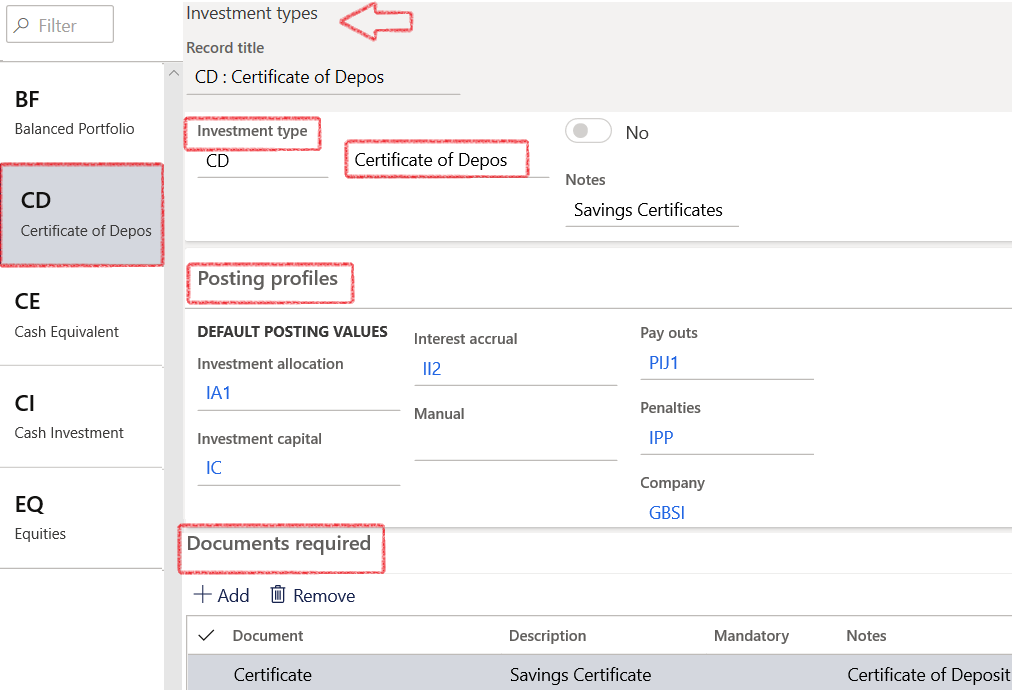

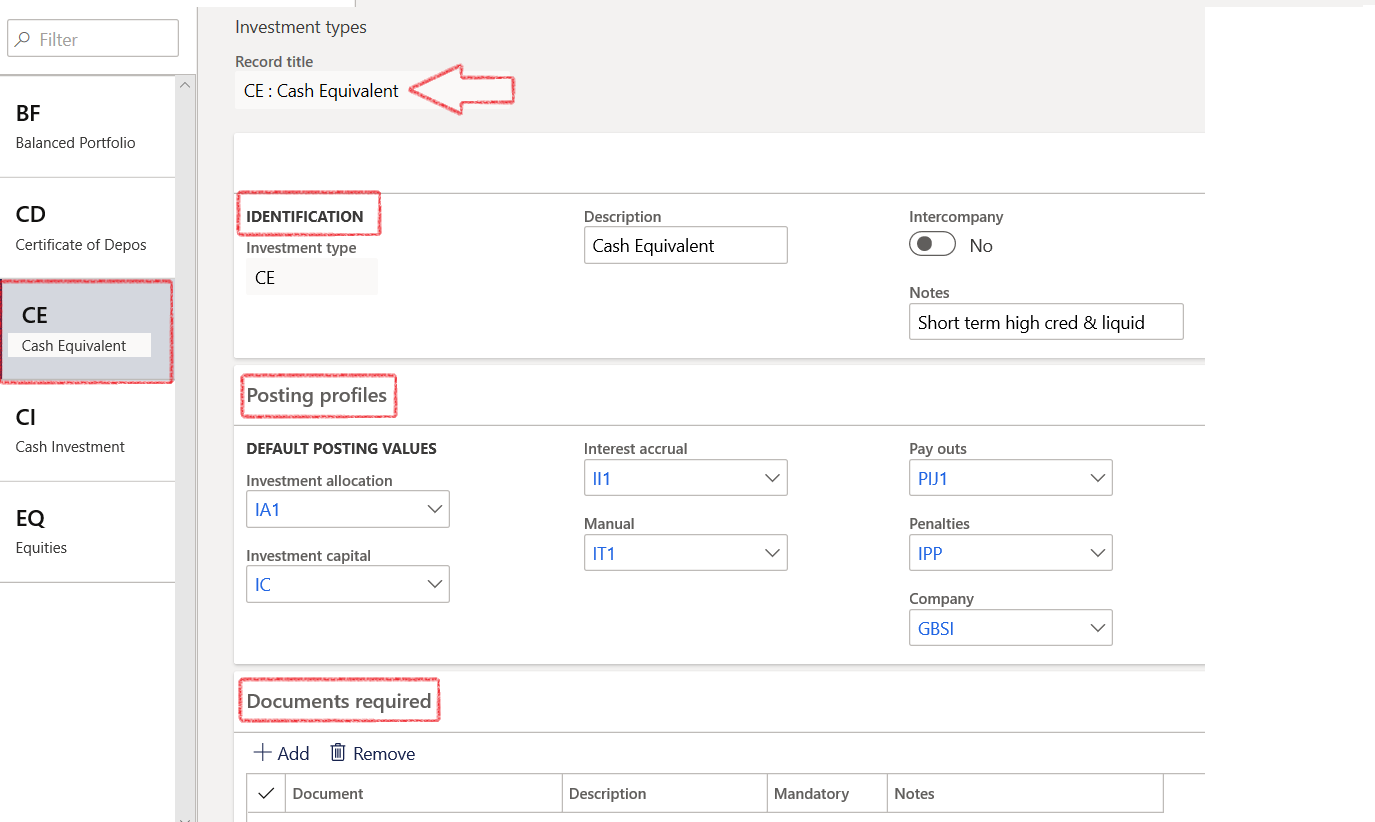

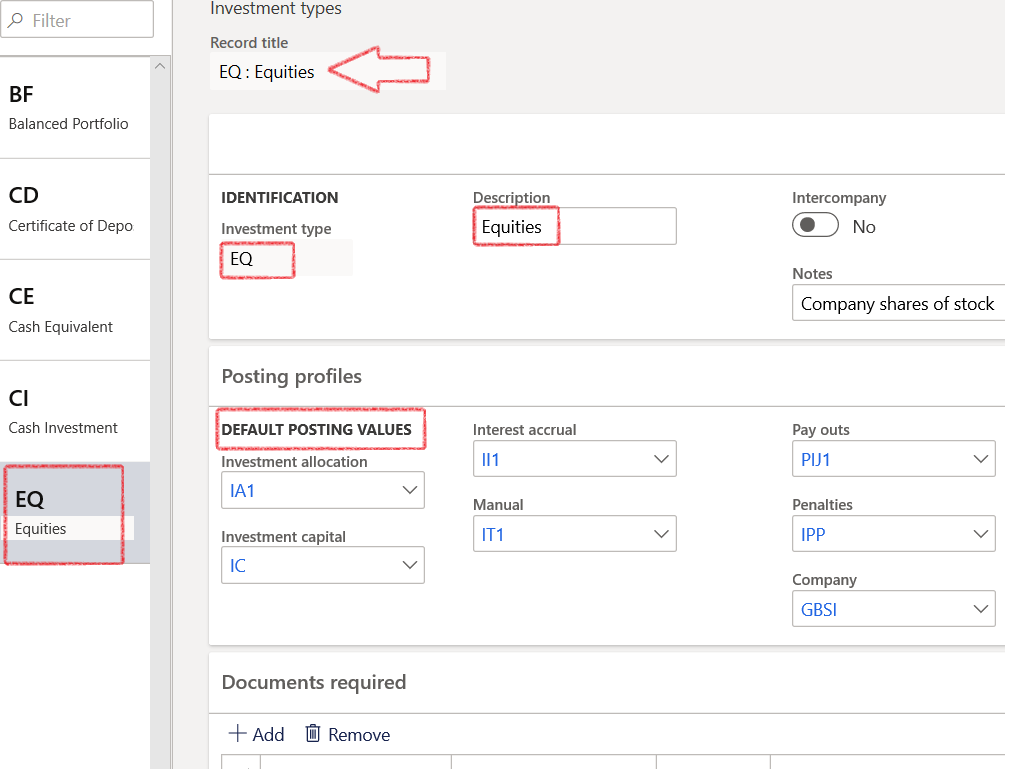

¶ Step 8: Setup Investment types

The main investment types to be set up are Balanced Portfolio, Certificates of deposit, Cash equivalents and Equities.

- Go to: Treasury > Investments > Setup for investments > Investment types

- Create New Investment types

- Complete the Identification tab fields

- Investment type

- Description

- Notes

- Select default posting values for this investment type

- Add documents required for the investment

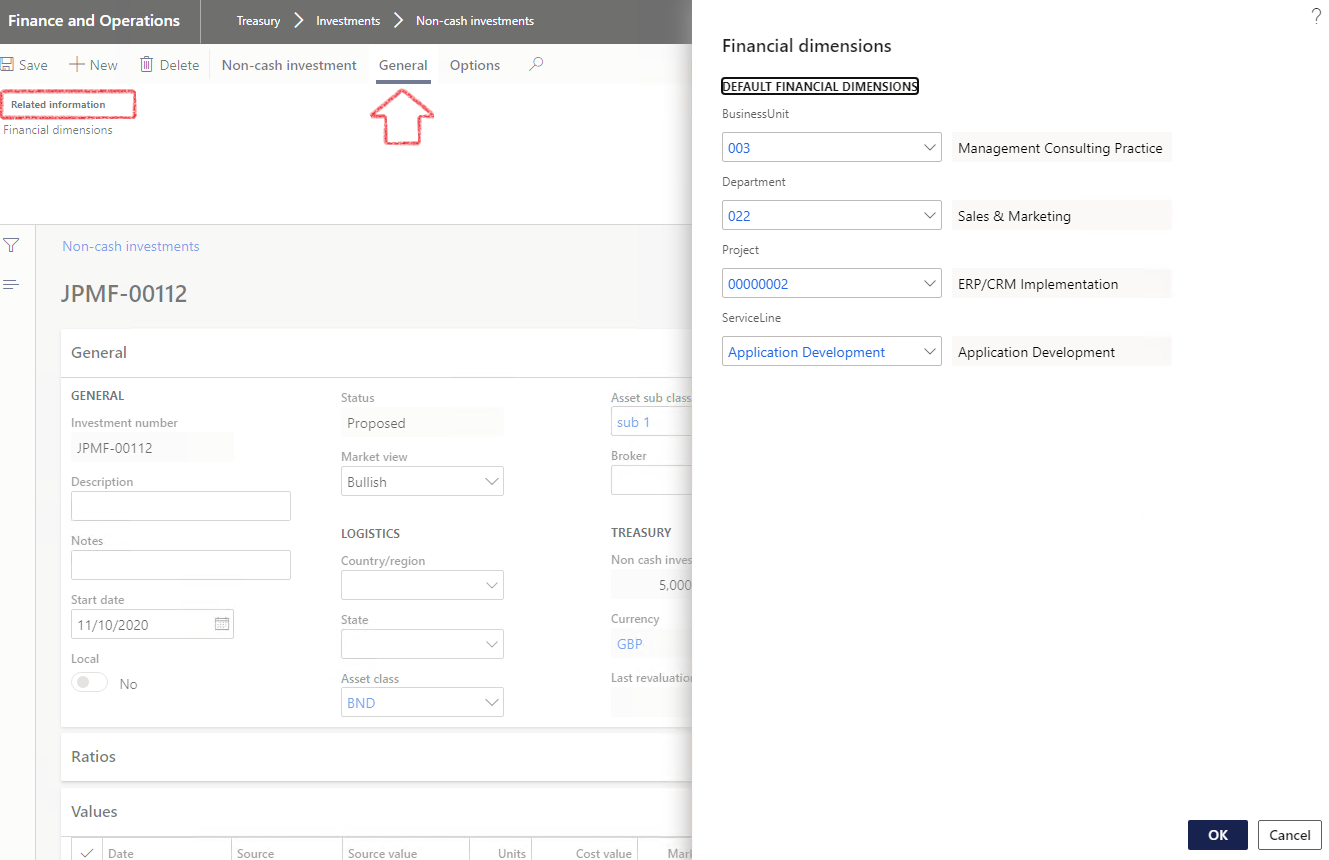

- Add default financial dimensions for each investment type. This financial dimension will default to the individual investments and can be used for journal processing.

- A specific Free text invoice template can be selected for each Investment type. This can be done if the Treasury slider is selected on the Free Text Invoice template form.

Balanced Portfolio is a portfolio with money invested equally or almost equally in high-risk and low-risk securities. It requires less day-to-day management than an aggressive investment strategy, but more than a defensive one.

Certificates of deposit are a secure form of time deposit, where money must stay in the bank for a certain length of time to earn a promised return. A CD, also called a share certificate at credit unions, almost always earns more interest than a regular savings account.

Cash equivalents are investments securities that are meant for short-term investing; they have high credit quality and are highly liquid. Cash equivalents are one of the three main asset classes in financial investing, along with stocks and bonds.

Equities - An equity investment generally refers to the buying and holding of shares of stock on a stock market by individuals and firms in anticipation of income from dividends and capital gains. A calculation can be made to assess whether an equity is over or underpriced, compared with a long-term government bond.

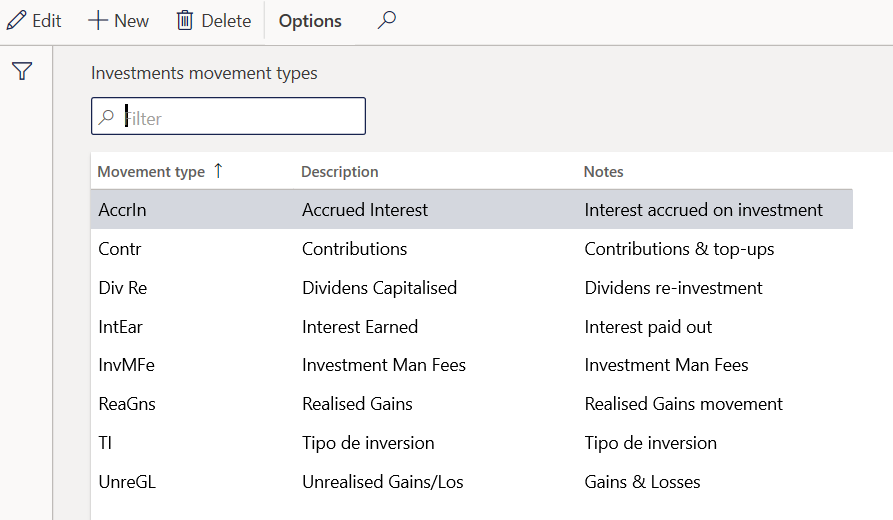

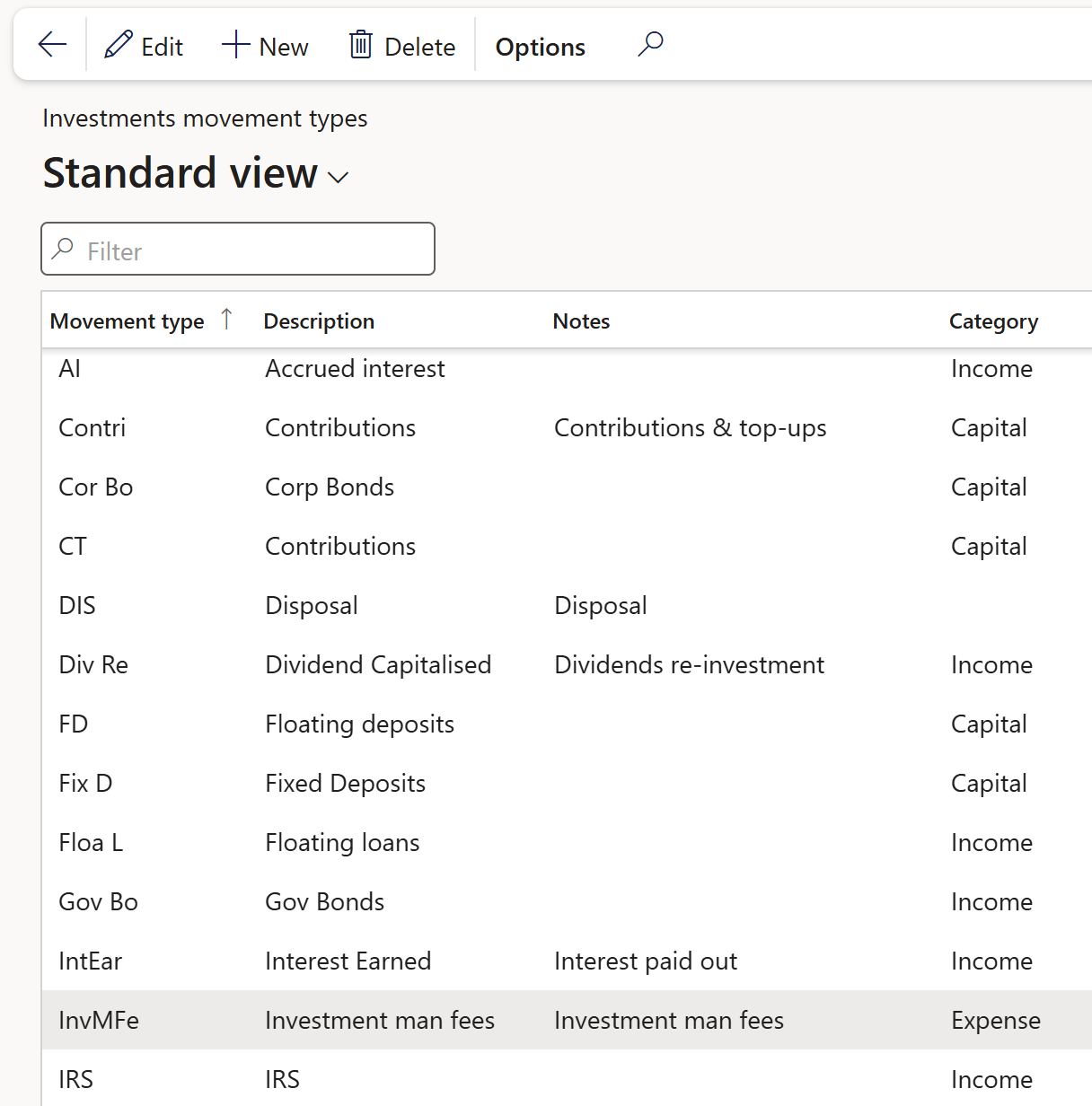

¶ Step 9: Setup Investment movement types

Movement types are used to specify movements in non-cash investments. For instance, interest accrued on an investment, or contributions and top-ups, or realized & unrealized gains or losses.

- Go to: Treasury > Investments > Setup for investments > Investment movement types

- Create New Movement Type. These will be used to setup Posting profiles and all movements must be processed against a movement type.

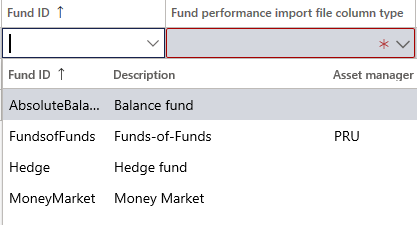

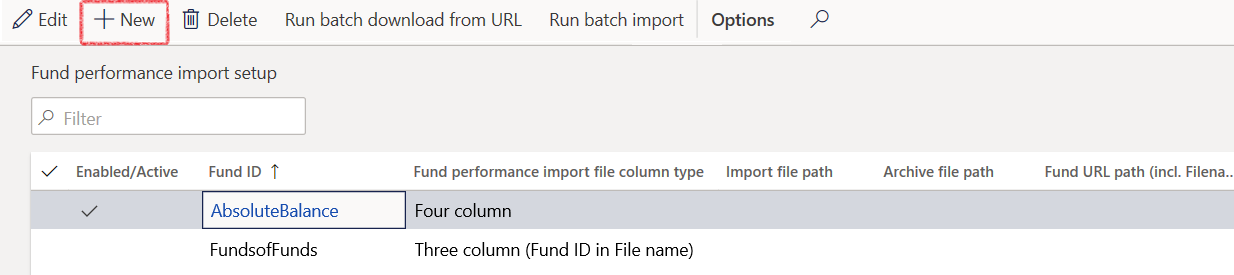

¶ Step 10: Fund performance import setup

- Go to: Treasury > Investment > Setup for investments > Fund performance import setup

- Click on New

- Select a Fund ID from the drop-down list. Choose between Balance fund, Funds-of-Funds, Hedge fund and Money Market

- Select the Fund performance import file column type – choose between Four column and Three column

- Enter the file path for the Import file and Archive file.

- Enter a URL path, including the file name

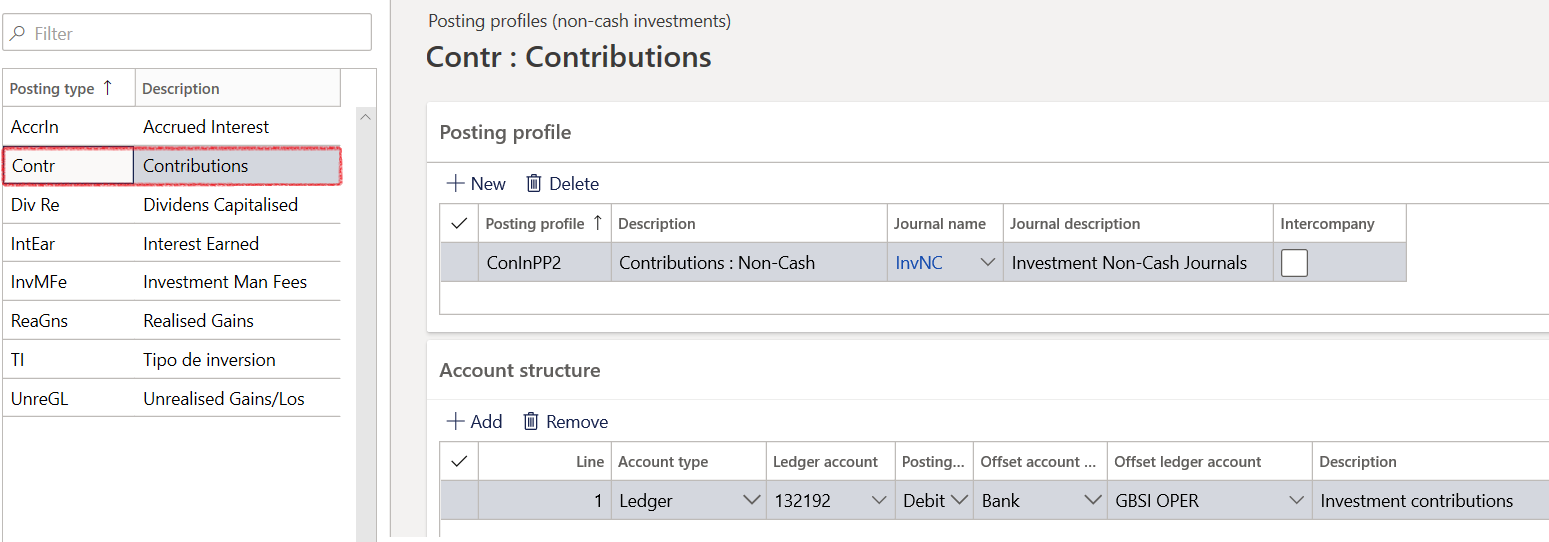

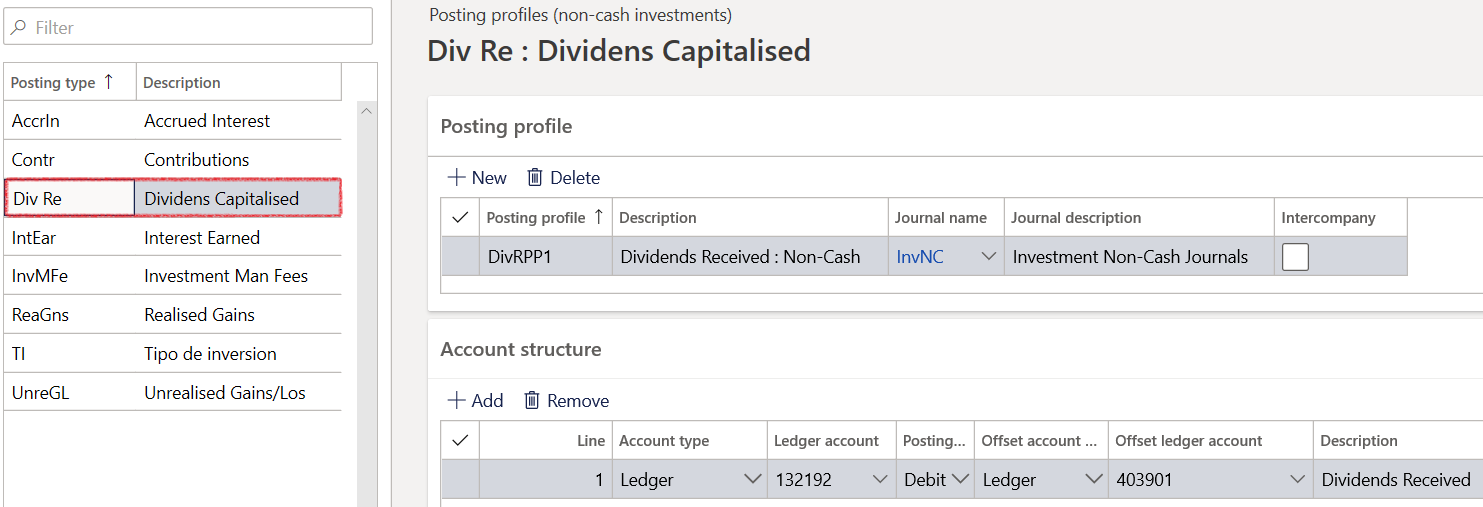

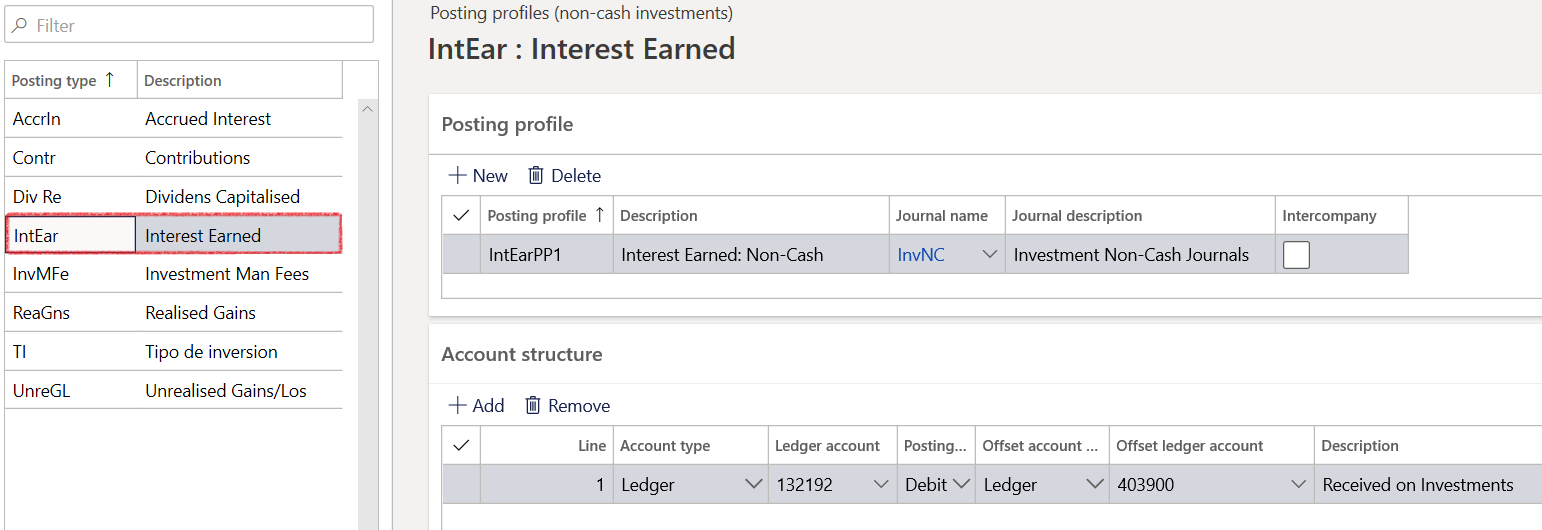

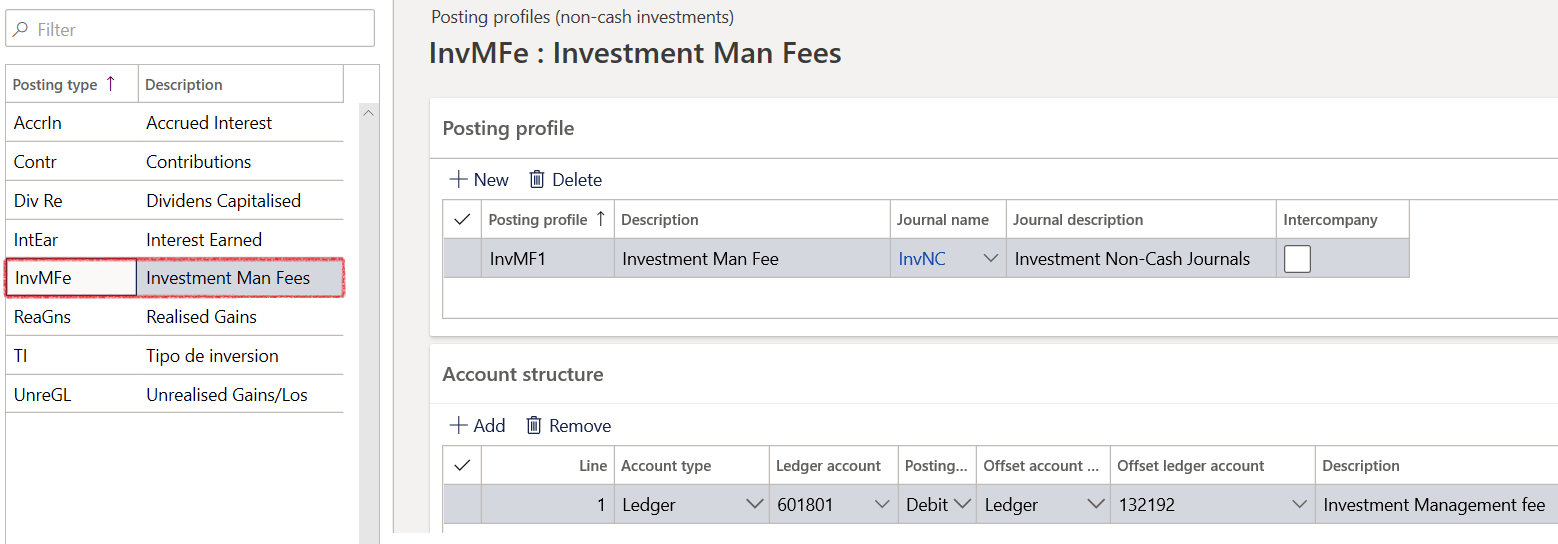

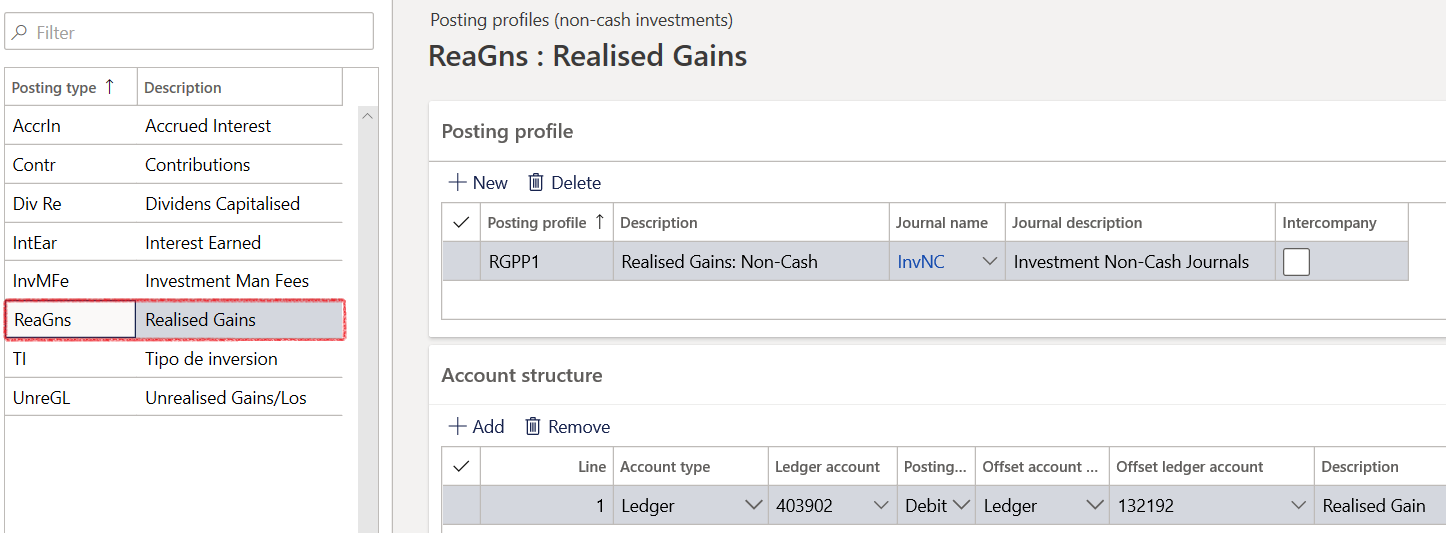

¶ Step 11: Setup Posting profiles (Non-Cash Investments)

Create Non-Cash investment posting profiles for Accrued Interest, Contributions, Dividends Capitalized, Interest Earned, Investment Management fees, Realized Gains and Unrealized Gains/Losses

- Go to: Treasury > Investments > Setup for investments > Posting profiles (Non-cash investments)

- Create New Header and Posting Lines for all movement types

- Create New Posting profile header

- Under Account structure, Add Posting profile accounts

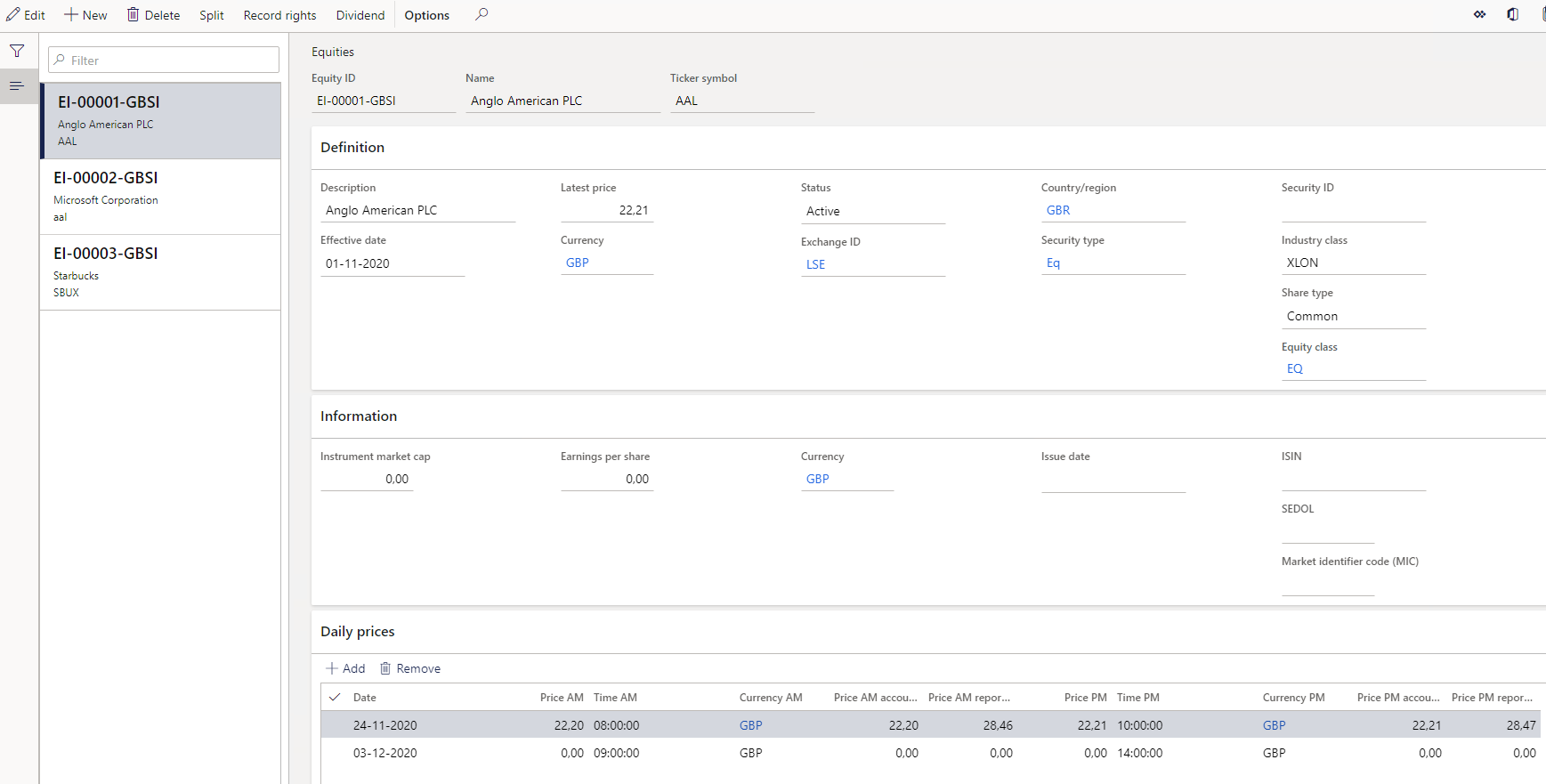

¶ Step 12: Create Equities

Equities for Investments are defined by the effective date, industry class, share type and equity class. It holds information about the Instrument market cap, Earnings per share, Currency and other market identifiers. Daily prices can be entered for each equity.

- Go to Treasury > Investments > Equities

- The equities page consists of three FastTabs:

- Definition

- Information

- Daily prices

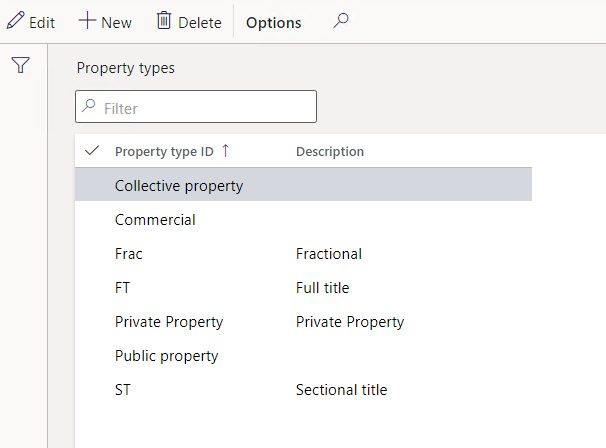

¶ Step 13: Setup Property types

Types of property include real property (the combination of land and any improvements to or on the land), personal property (physical possessions belonging to a person), private property (property owned by legal persons, business entities or individual natural persons), public property (state owned or publicly owned and available possessions) and intellectual property (exclusive rights over artistic creations, inventions, etc.), although the last is not always as widely recognized or enforced.

To set up property types for Non-Cash Investments, go to:

- Treasury > Investments > Setup for investments > Property types

- The Property type ID and description can be added by clicking on the New button on top.

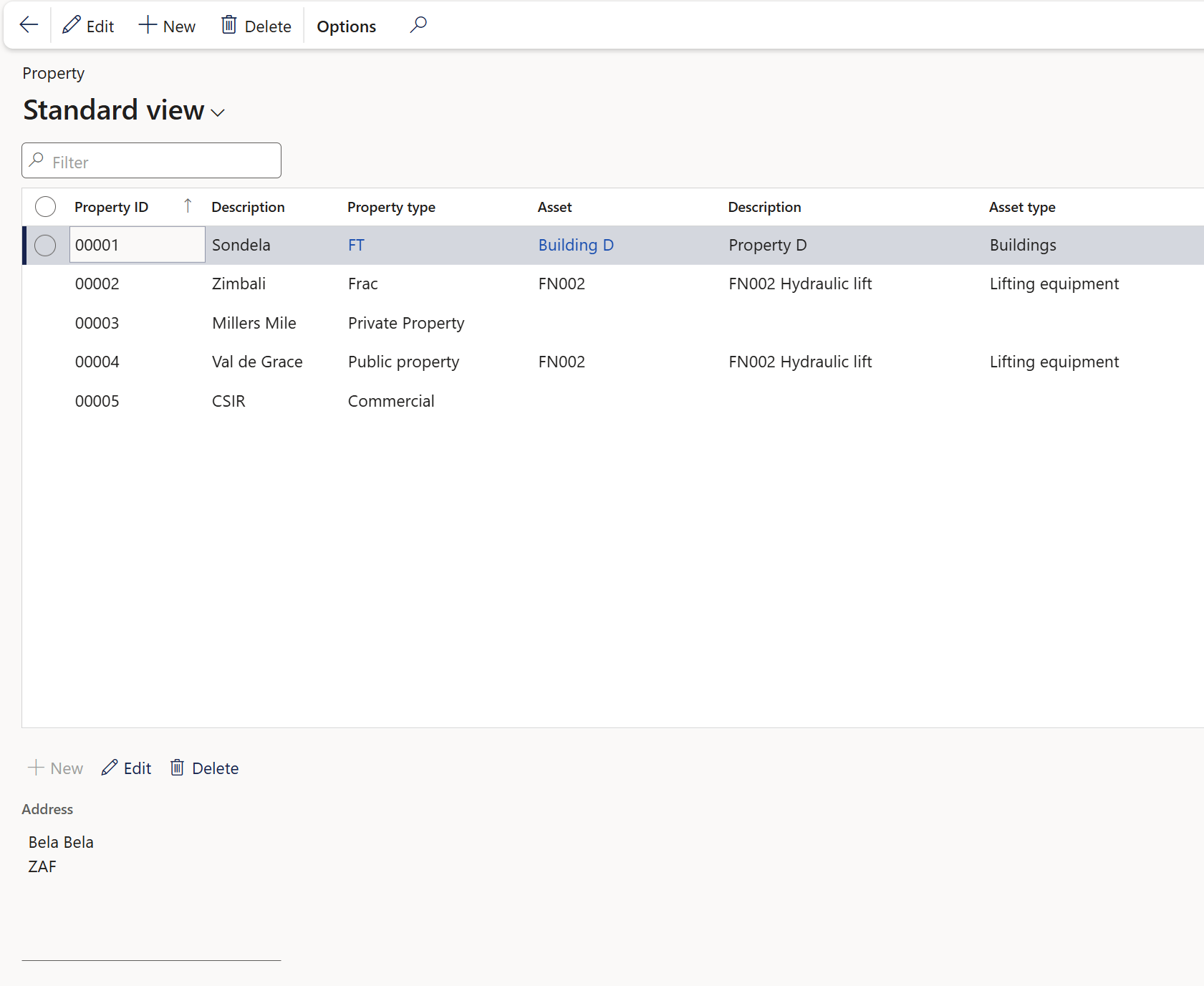

¶ Step 14: Setup Property

Properties with addresses can be setup by navigating to:

- Treasury > Investments > Property

- Click New on top.

- Enter a Property ID and Description

- Select a Property type

- Select an Asset

- Description will be populated automatically, and is a display field

- The Asset type will display when an Asset is selected

- Create an address for the property

- Save the record

¶ Daily use

Processing Non-Cash Investment

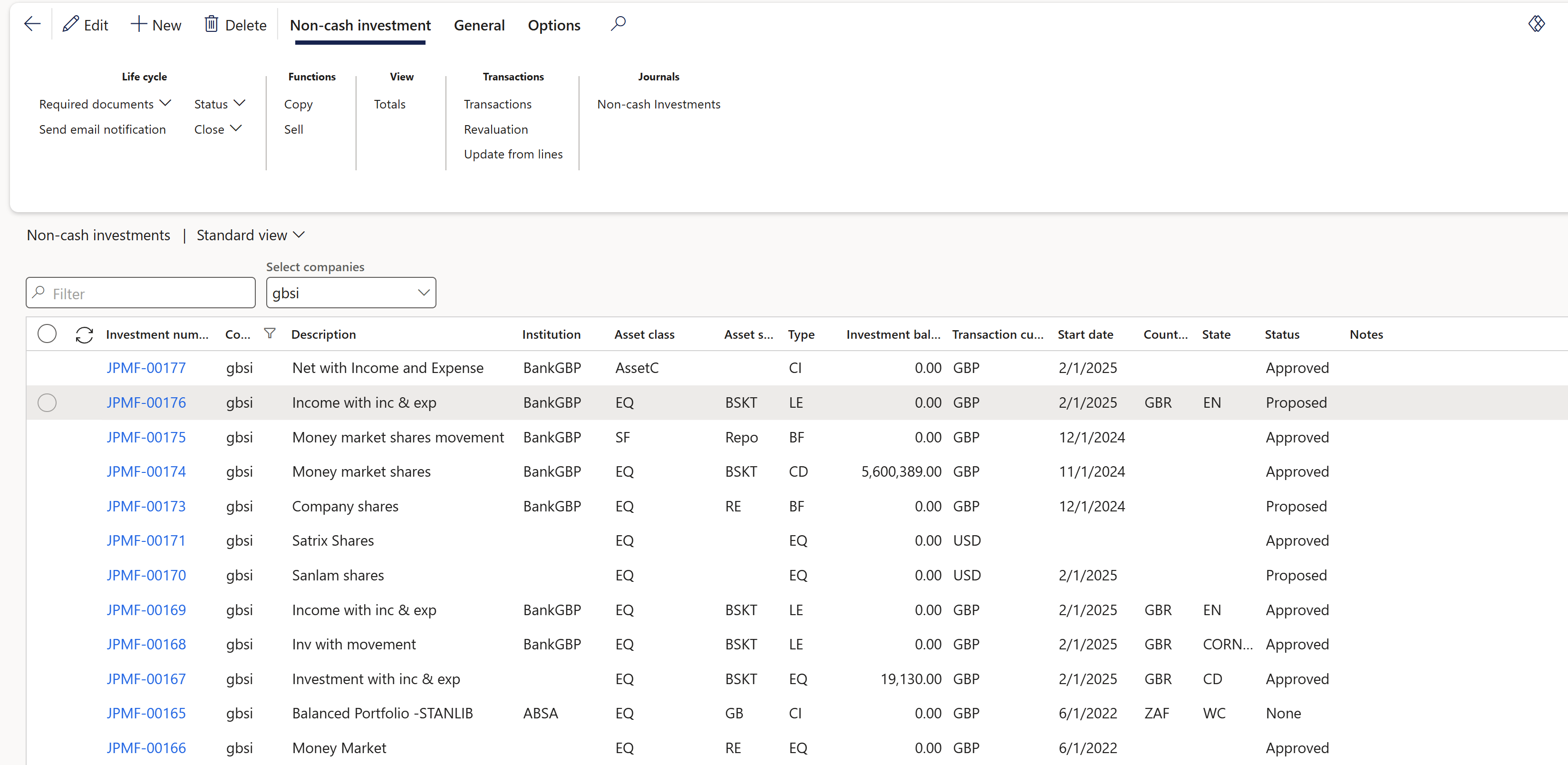

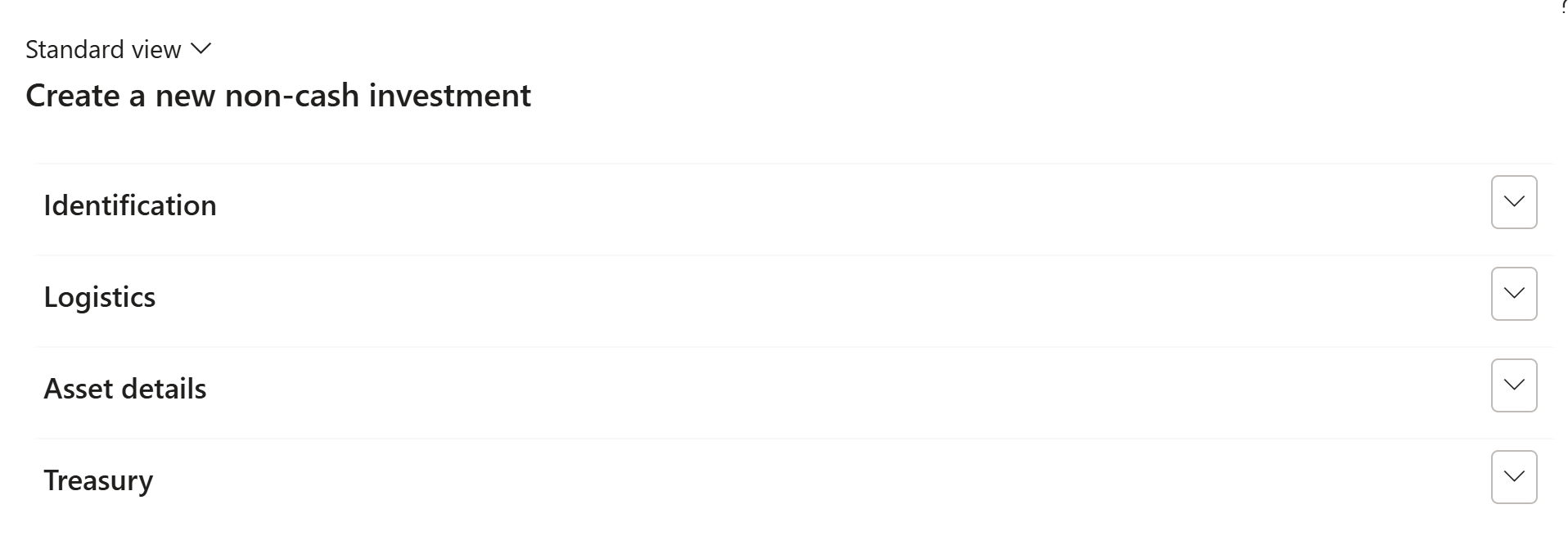

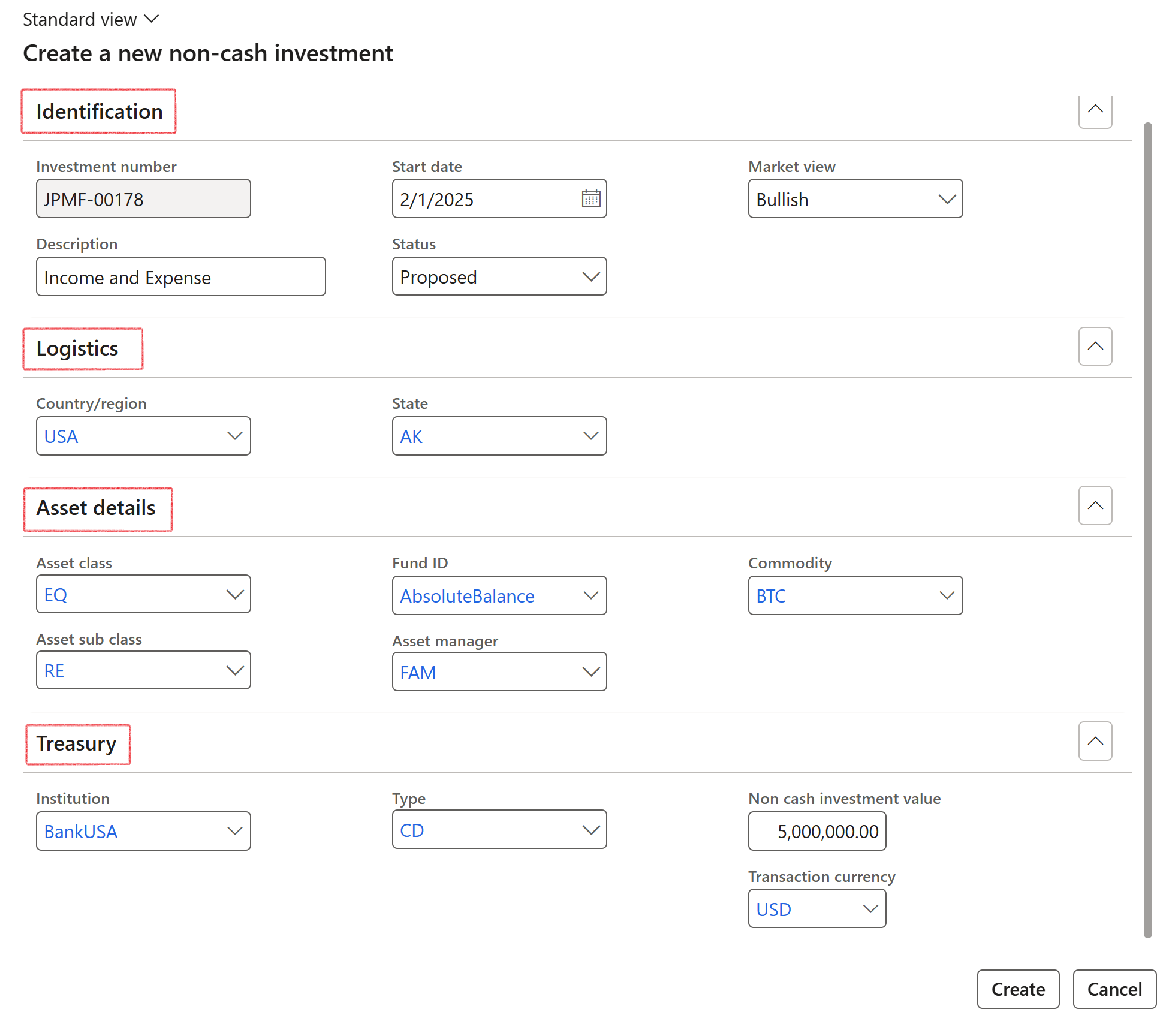

¶ Step 15: Create Non-cash investments

- Go to: Treasury > Investments > Non-cash investments

- Create New Investment

The non-cash investment form is divided into sections for:

- Identification

- Investment number system generated

- Start date

- Market view (drop down selection: Bullish, Flat, etc.)

- Status (approved, proposed, active, cancelled or none)

- Description

- Logistics

- Country/region

- Province

- Asset details

- Asset class

- Asset sub class

- Fund ID

- Commodity

- Asset manager

- Treasury

- Institution (Bank) – only if the investment is placed with a relevant institution, regardless if it is placed directly or by the asset manager

- Type – Balanced Portfolio, Certificate of Depo, Cash Equivalent, Equities)

- Non-cash investment value

- Currency

When a Non-Cash investment is Closed, the user will not be able to transact against that specific investment and will also not be able to select the Investment ID from a drop down list inside journals.

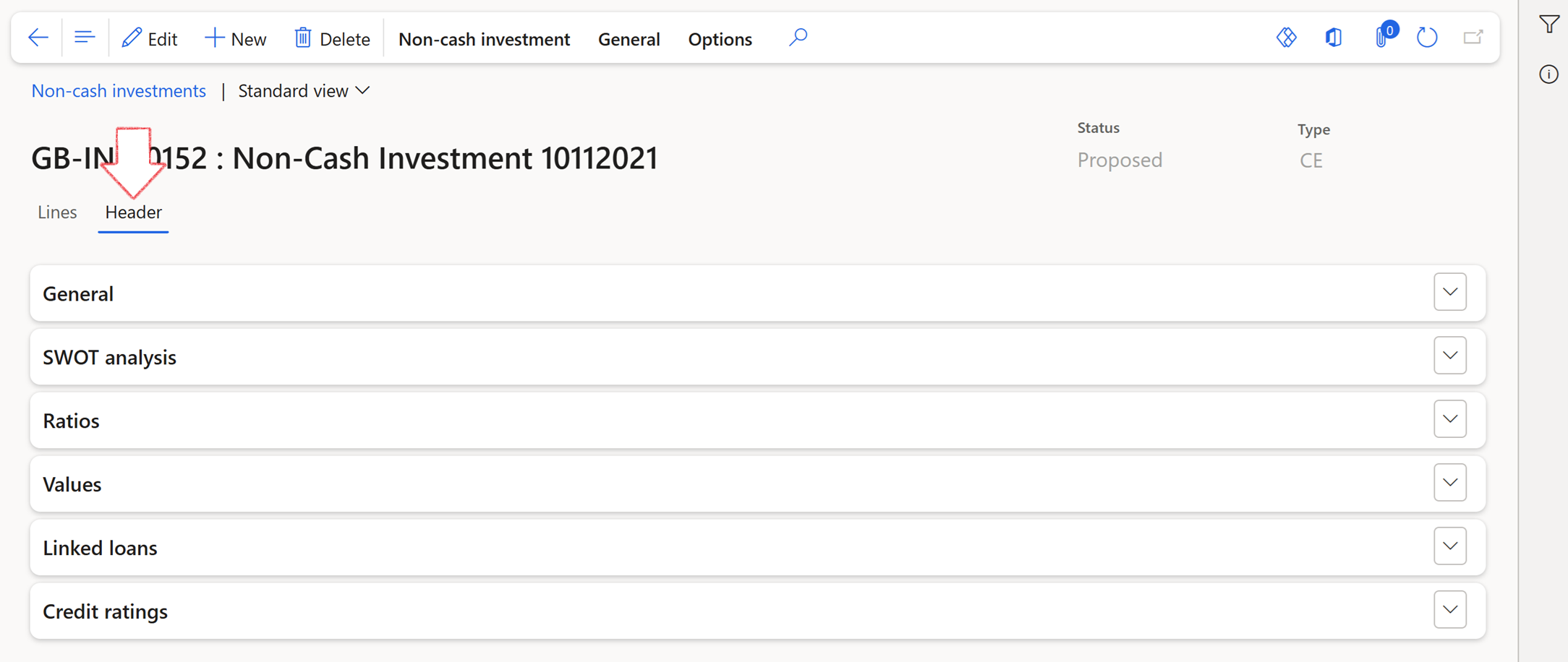

¶ Step 15.1: Non-cash investments Header section

- The Header section consist of the following FastTabs:

- General

- SWOT analysis

- Ratios

- Values

- Linked Loans

- Credit ratings

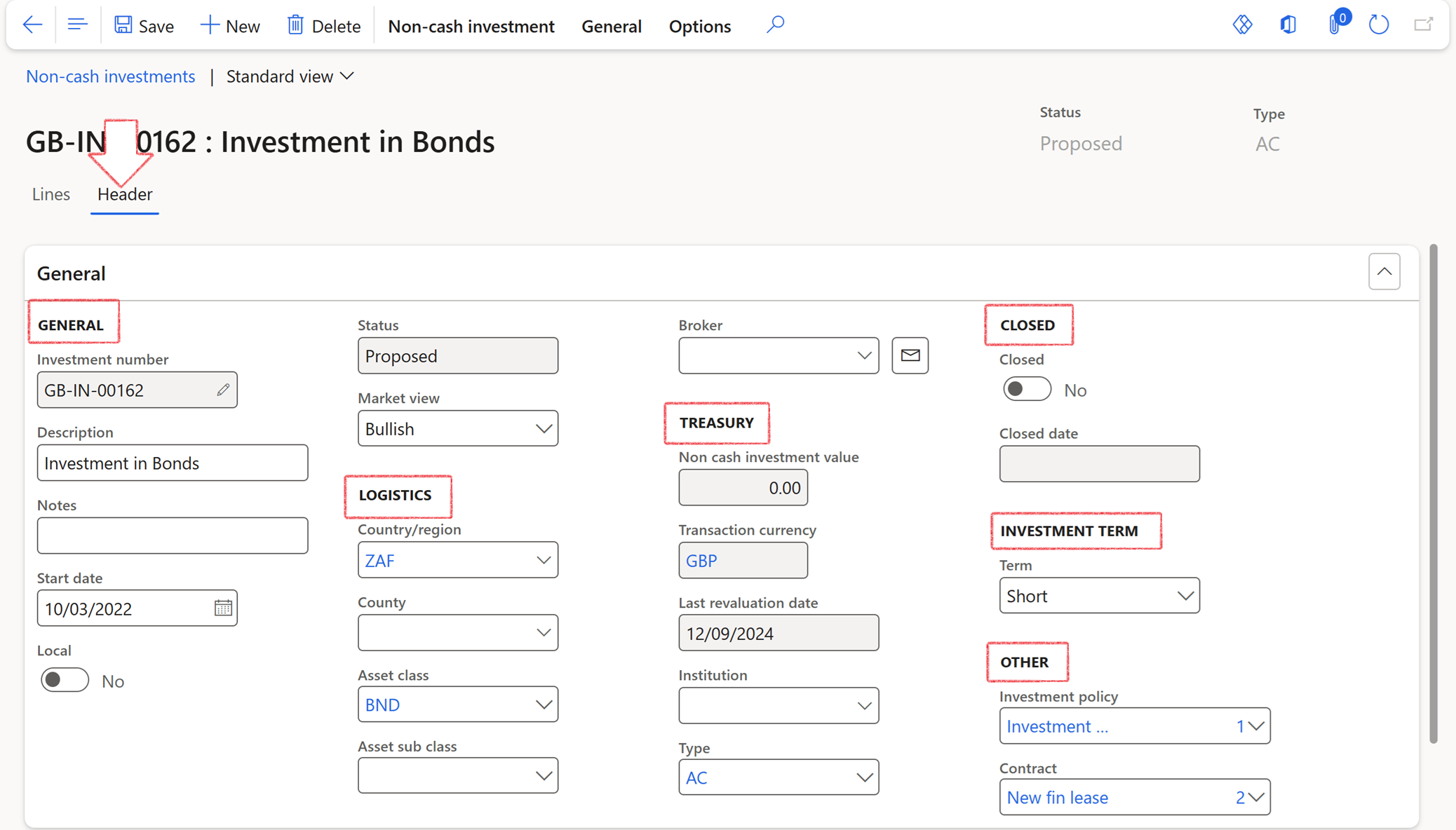

- General FastTab on header:

- General

- Investment number

- Description

- Notes

- Start date

- Local yes / no option

- Status

- Market view

- Logistics

- Country/Region

- State

- Asset class

- Asset sub class

- Broker

- Treasury

- Non-Cash investment value

- Transaction currency

- Last revaluation date

- Institution

- Type

- Closed

- Yes / No option

- Closed date

- Investment term

- Term

- Other (part of G2T)

- Investment policy

- Contract

When users add a Contract to the Non-Cash investment form, a record will be created in the Reference table with the new related value and populate the following:

- Investment ID in the description field

- Initial amount

- Currency

- To view the register, go to: Treasury > Registers > Contracts

The following rules apply to the Contracts lookup field

- PCR type should be Contract

- Status can be Draft, Submit, Approve or Revise

- Not baseline

- Not insurance

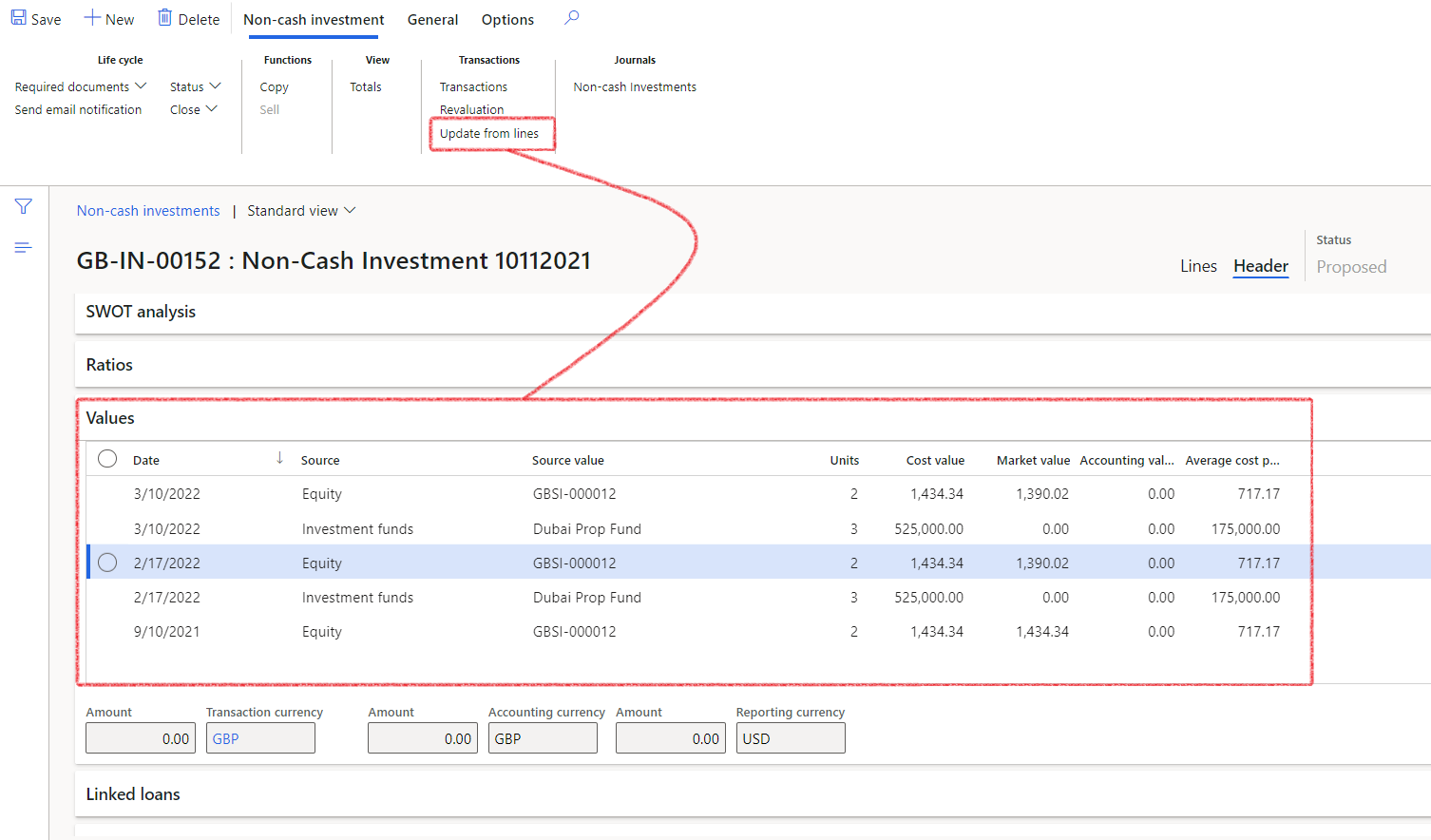

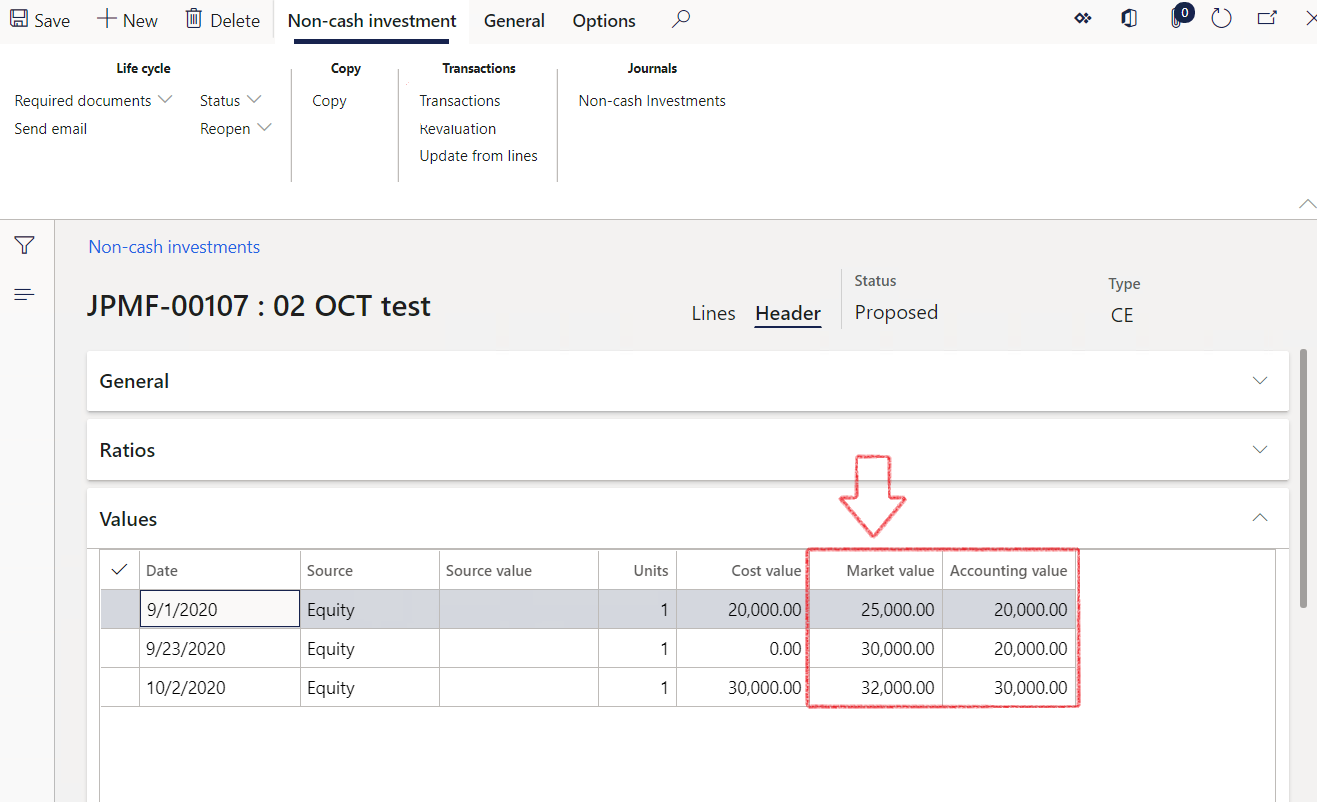

- To Populate the Values FastTab on the Header, click on Update from lines on the ribbon bar for Non-cash investment.

- This will copy the information from the Lines FastTab to the Values FastTab on the header page.

Remember, the Values FastTab can only be populated once the information on the Lines FastTab under the Lines section has been filled in.

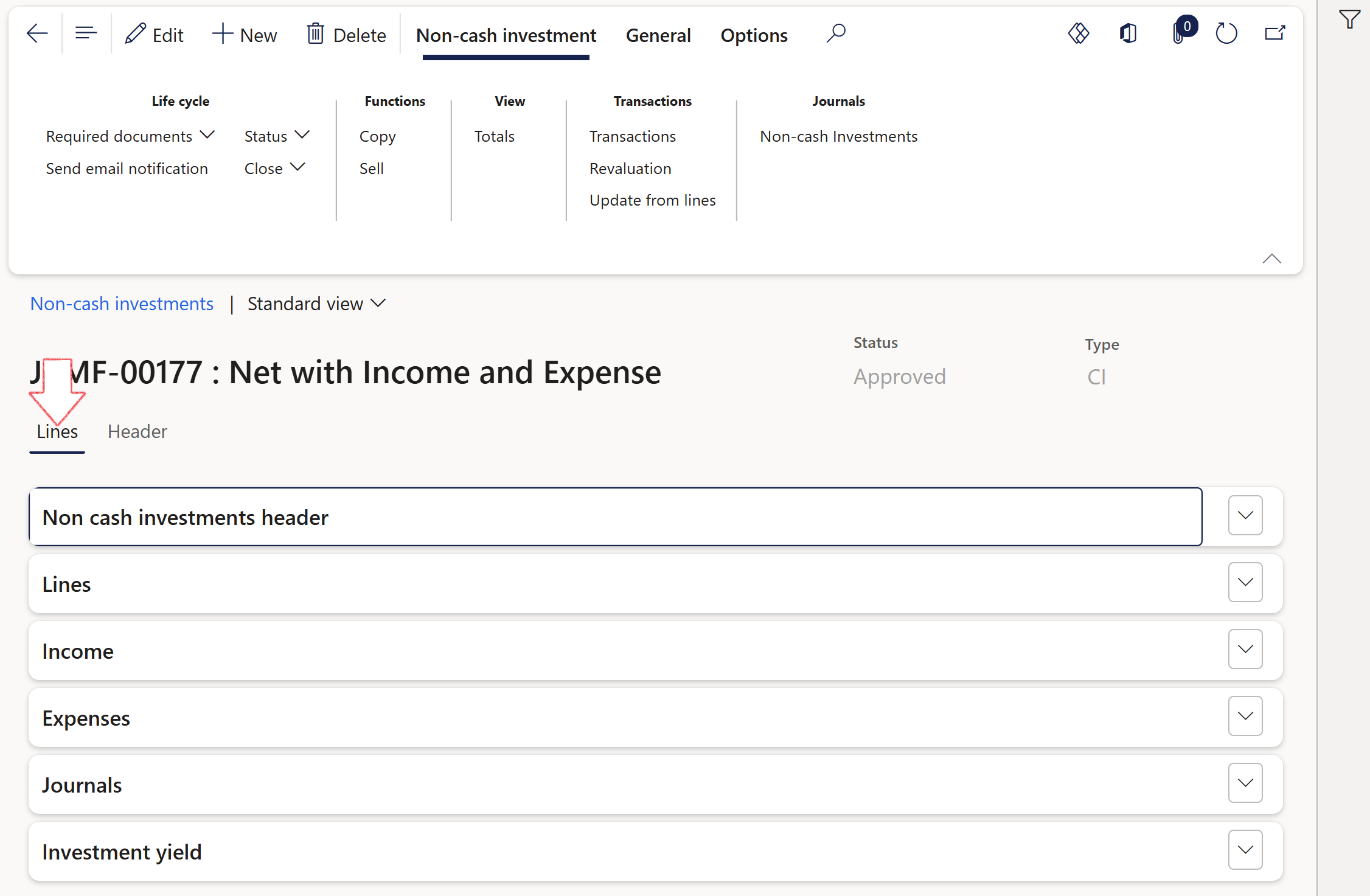

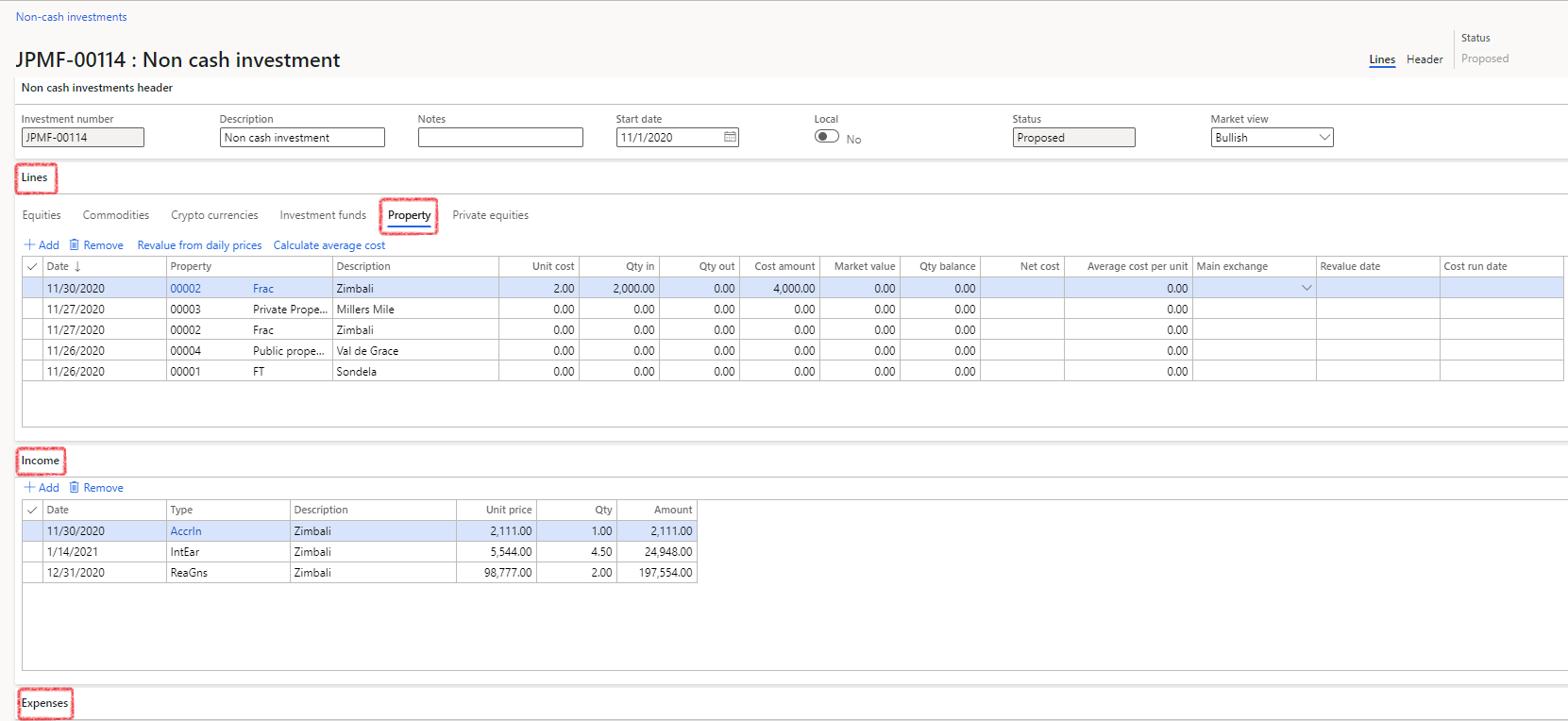

- The Lines section consist of the following FastTabs

- Non-cash investments header

- Lines

- Income

- Expenses

- Journals

- Investment yield

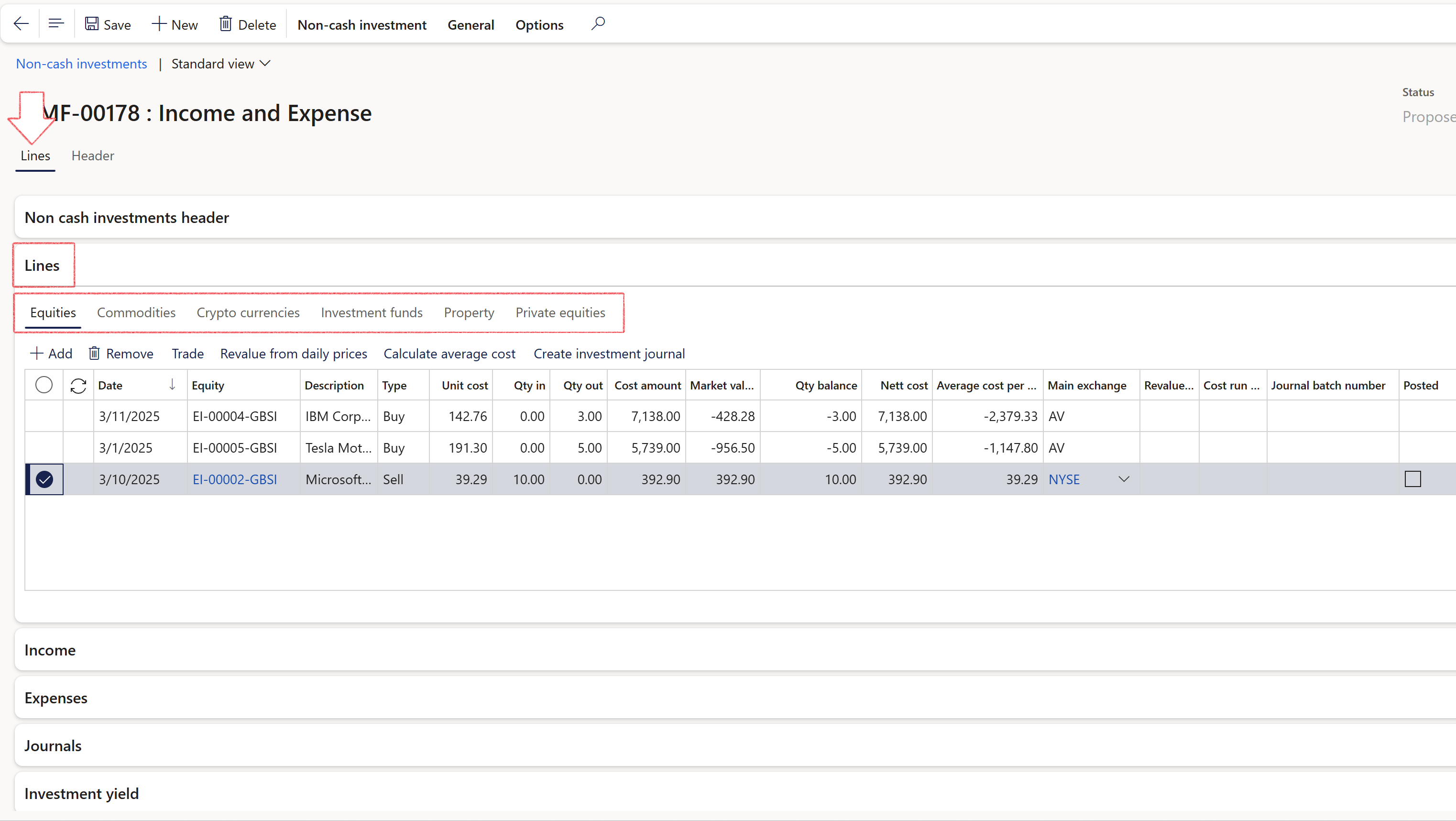

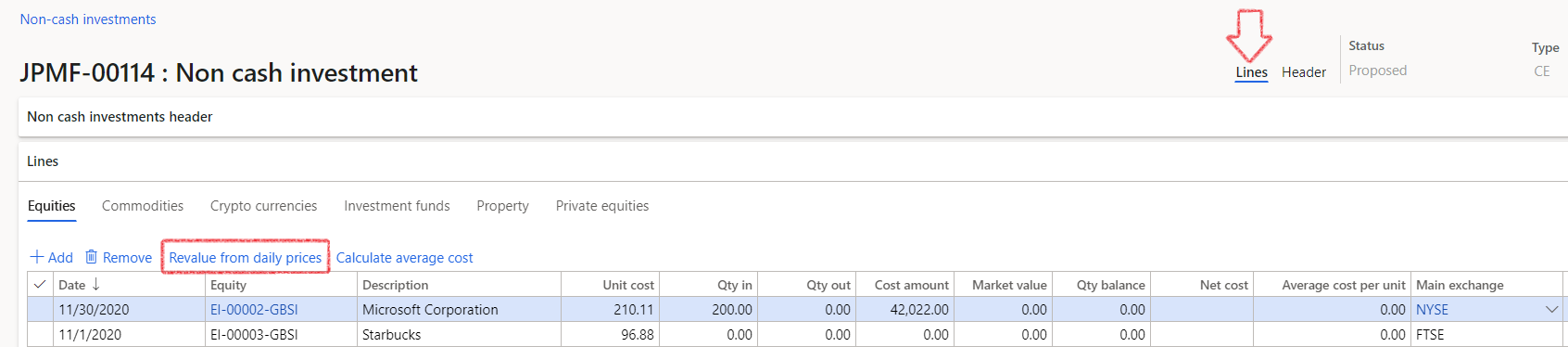

¶ Step 15.2: Create Non-cash investments Lines

Non-Cash Investments lines section consist of the Header, Lines, Income, Expenses and Journals FastTabs.

- Go to Treasury > Investments > Non-Cash Investments and open the Lines section

- Navigate to Treasury > Investments > Non-Cash Investments

- Open an existing record

- Expand the Lines FastTab on a Non-cash investment

- For each line on the Assets, the related Income and Expenses can be captured.

- Complete the Index tabs for the following assets:

- Equities

- Commodities

- Crypto currencies

- Investment funds

- Property and

- Private equities

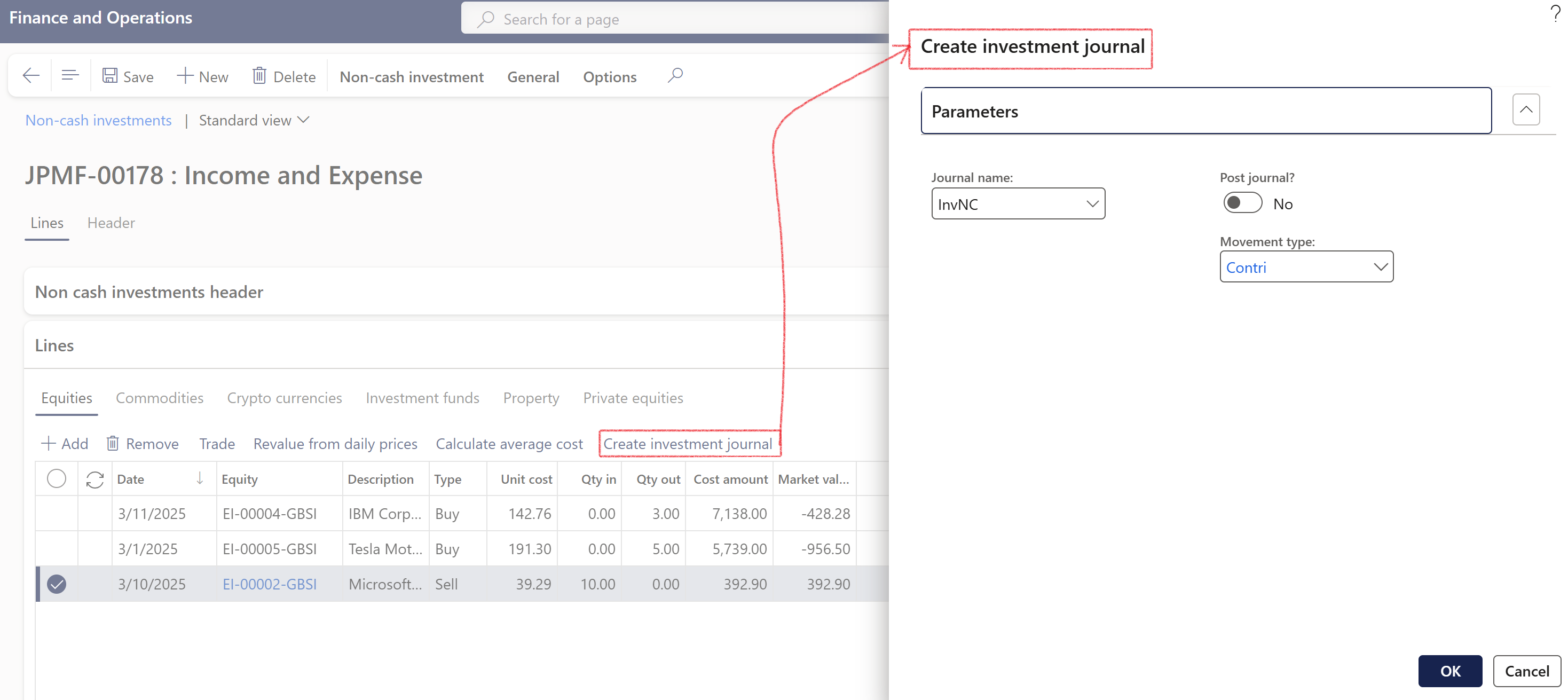

¶ Step 15.3: Create Investment journals

Automatic investment journals can be created for Non-Cash investments.

The Generate Journal button is located on the Lines index tab of Non-Cash investments, spanning across three FastTabs: Lines, Income, and Expenses.

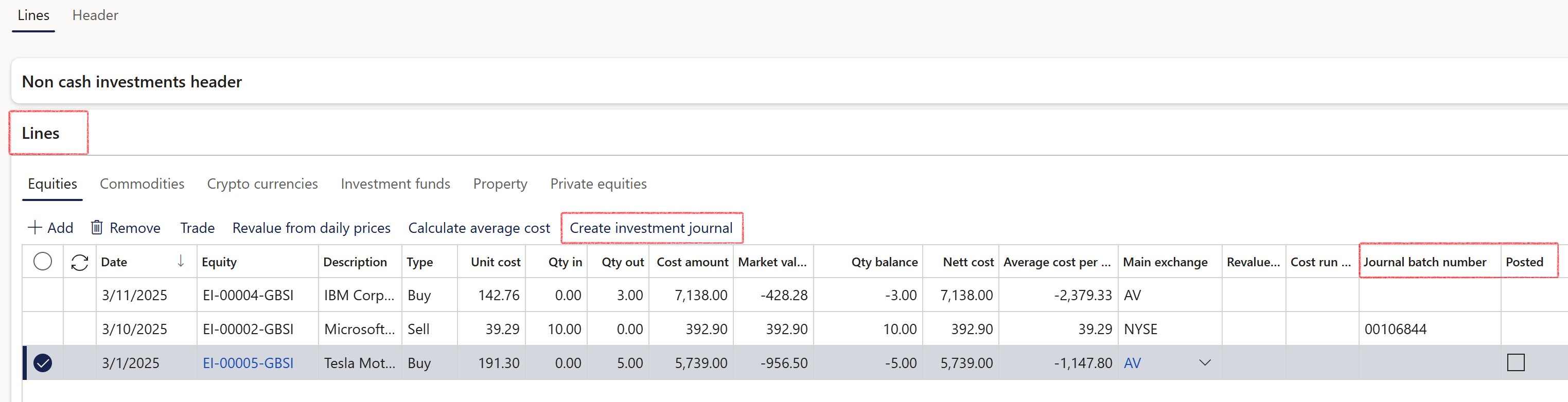

Each FastTab (Lines, Income, Expenses) includes a Journal Batch Number field and a Posted field.

- On the Lines FastTab, you can select the Create Investment Journal button to generate a journal for the specific line.

- On the Income FastTab, the Create Income Journal button is available.

- On the Expenses FastTab, the Create Expense Journal button can be clicked to automatically generate the expense journal for that line.

When clicked, a Create investment journal dialogue will open, allowing the user to fill in the following details:

- Journal name (drop-down selection)

- Post journal? (Yes/No toggle)

- Movement type (drop-down selection)

- Click the OK button to create the journal

- A journal header is created for the selected journal name.

- Journal lines are generated according to the posting profile and movement type, including the relevant offset account.

- The journal date is populated from the selected record.

- The journal amount is set to the Cost amount of the selected record, in the transaction currency.

- The investment number is pulled from the relevant investment.

- If the user selected Yes in the dialogue, the journal will be automatically posted.

- The journal batch number is populated in the respective FastTab.

- The posted indicator is updated if the journal is posted.

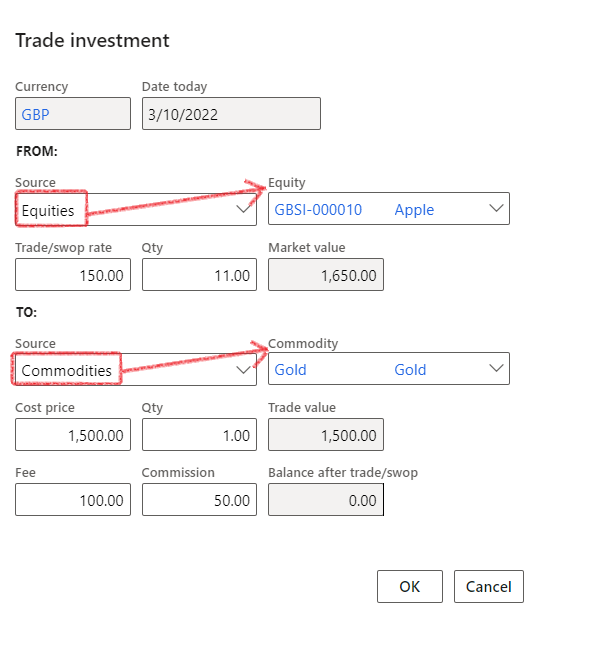

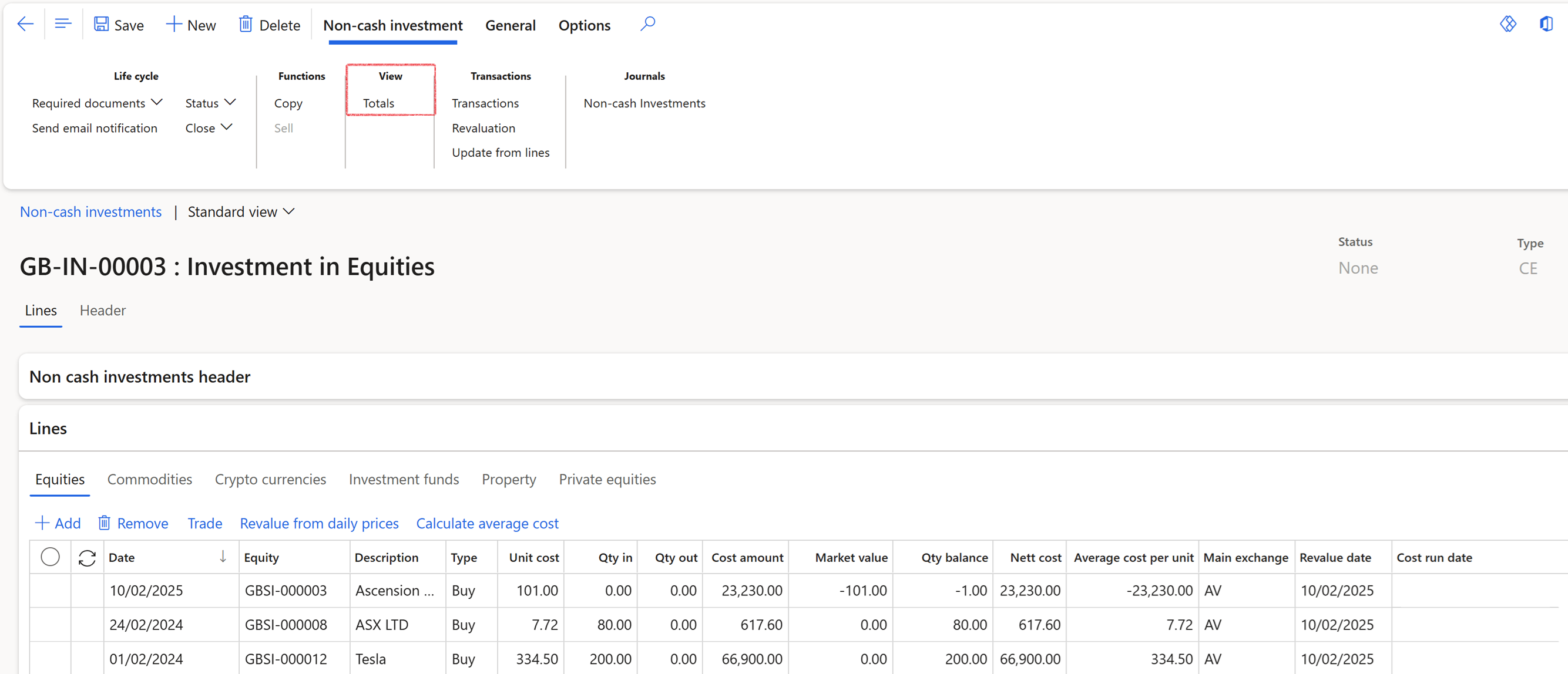

¶ Step 16: Trade

- Go to Treasury > Investments > Non-Cash Investments and open the Lines section and Lines FastTab

- To trade an asset, click on the Trade button. A trade investment page will open

- The From section contains the Out (selling)

- The To section contains the In (buying)

- All transactions will be in the same currency and within the same Investment

- Select the Source from a lookup

- Depending on the Source that was selected, a specific Asset should be selected. For this example, the source was Equity

- Trade / swop rate should be the conversion rate. Enter a Quantity

- The market value is a display only field, which calculates the Trade/swop rate x Quantity

- Select the Source on the To section

- Select the Asset/investment category (can be Equities, Commodities, Crypto, Investment funds, Property or Private equities, depending which Source was selected)

- Complete the Cost price and fill in the Quantity

- Enter any Fee or Commission value

- Maximum quantity will be the sum of all Ins and Outs, and by clicking OK, the system will validate that the Balance is 0.00

- Two lines will be created

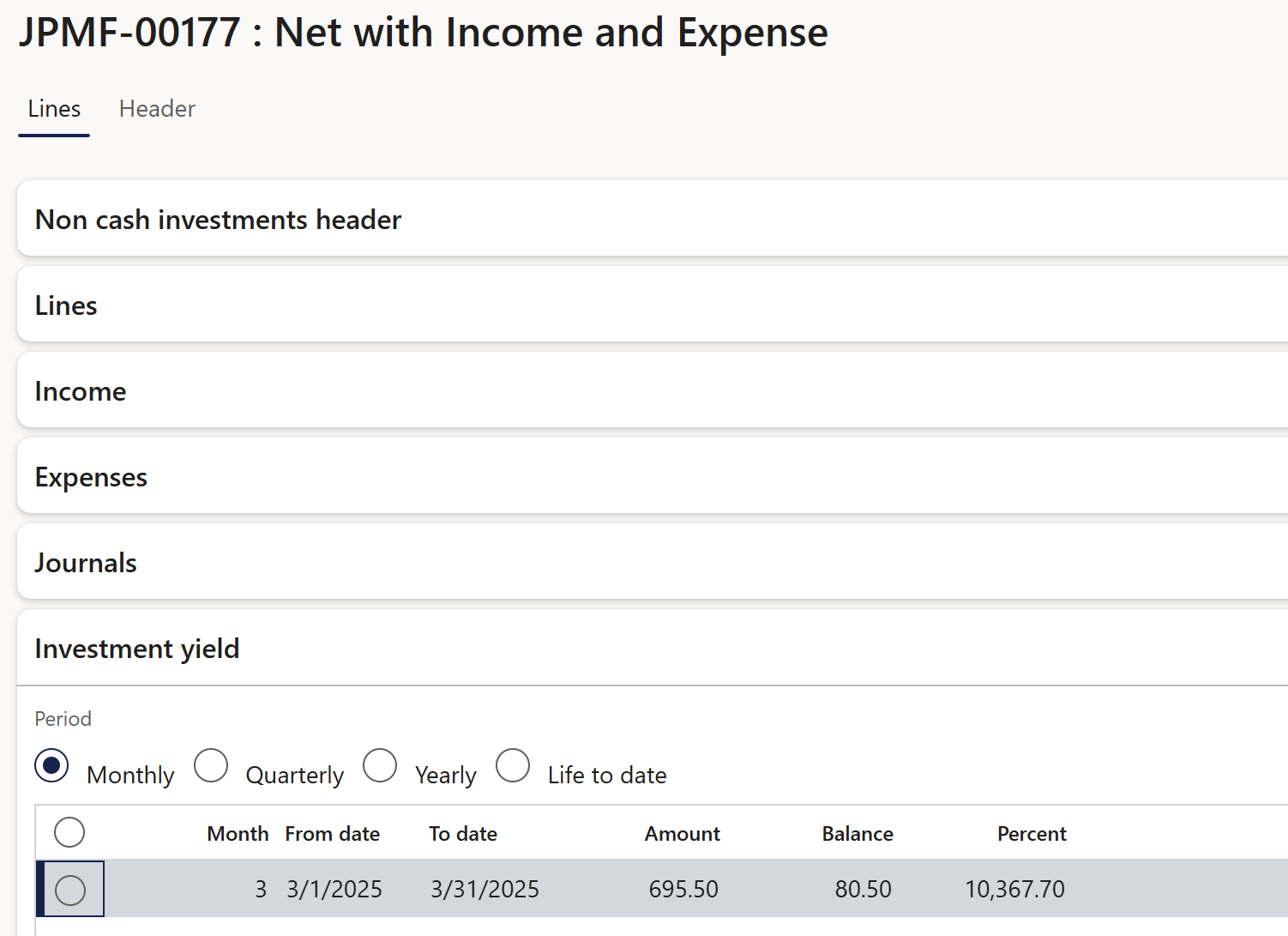

¶ Step 17: Investment yield

Yield represents the total return percentage on an investment, including more than just the interest.

Under the Lines index tab of Non-Cash investments, you'll find a FastTab called Investment Yield.

The following options are available:

- Monthly

- Quarterly

- Yearly

- Life to date

The column headings in the Investment Yield FastTab are as follows:

- Month

- Year

- From date

- To date

- Amount

- Balance

- Percent

Elements consist of Net of Income and Expenses, in the form of posted journals

- For non-cash investments, specific investment movement types

On the Investment Movement Type setup page, there is a column named Category. You can choose from the following options:

- Income

- Expense

- Capital

Investment price: Accounting cost

- Non-cash investment journals are used to aggregate all accounting values, for all capital value lines (Header>Values)

- Determine date range for the calculation (covers a month, quarter, year or life to date)

Calculation logic

- Add together all income for a date period (month, quarter, year, Life To Date "LTD")

- Determine price at the end of that period (end of that month, end of the quarter, end of the year, current date)

- Income/Price, reworked to 12-month period, x 100

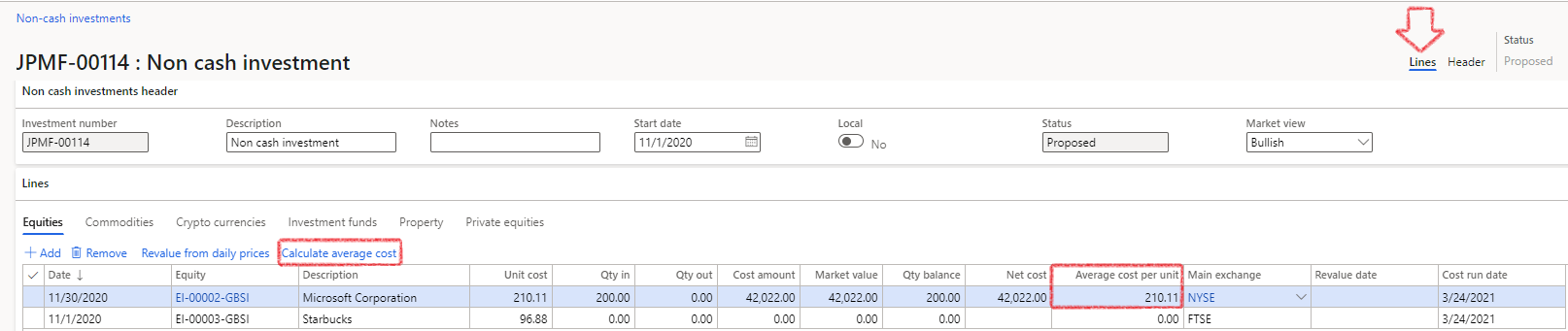

¶ Step 18: Revaluate from daily prices and Calculate average Cost

- Go to Treasury > Investments > Non-Cash Investments and open the Lines section and Lines FastTab

- Revalue from daily prices

- Click on Revalue from daily prices for the system to do a lookup to find the closest date in the price tables to get the new unit price.

- Calculation: Unit price x Quantity-In or Unit price x Quantity-Out

- Calculate average cost

- Click on Calculate average cost for the system to calculate the average cost per unit for each line.

- Calculation: Net cost / Quantity balance

- Property index tab:

- Select a property from the dropdown list

- Complete more information on the property, such as cost price, quantity in, quantity out, cost amount, market value, main exchange and revaluation date.

- Note that more information on a specific line of the property can be entered for Income and Expenses for the specific property that you are standing on.

- Properties can be added or removed from the Property index lines, with the Add and Remove buttons

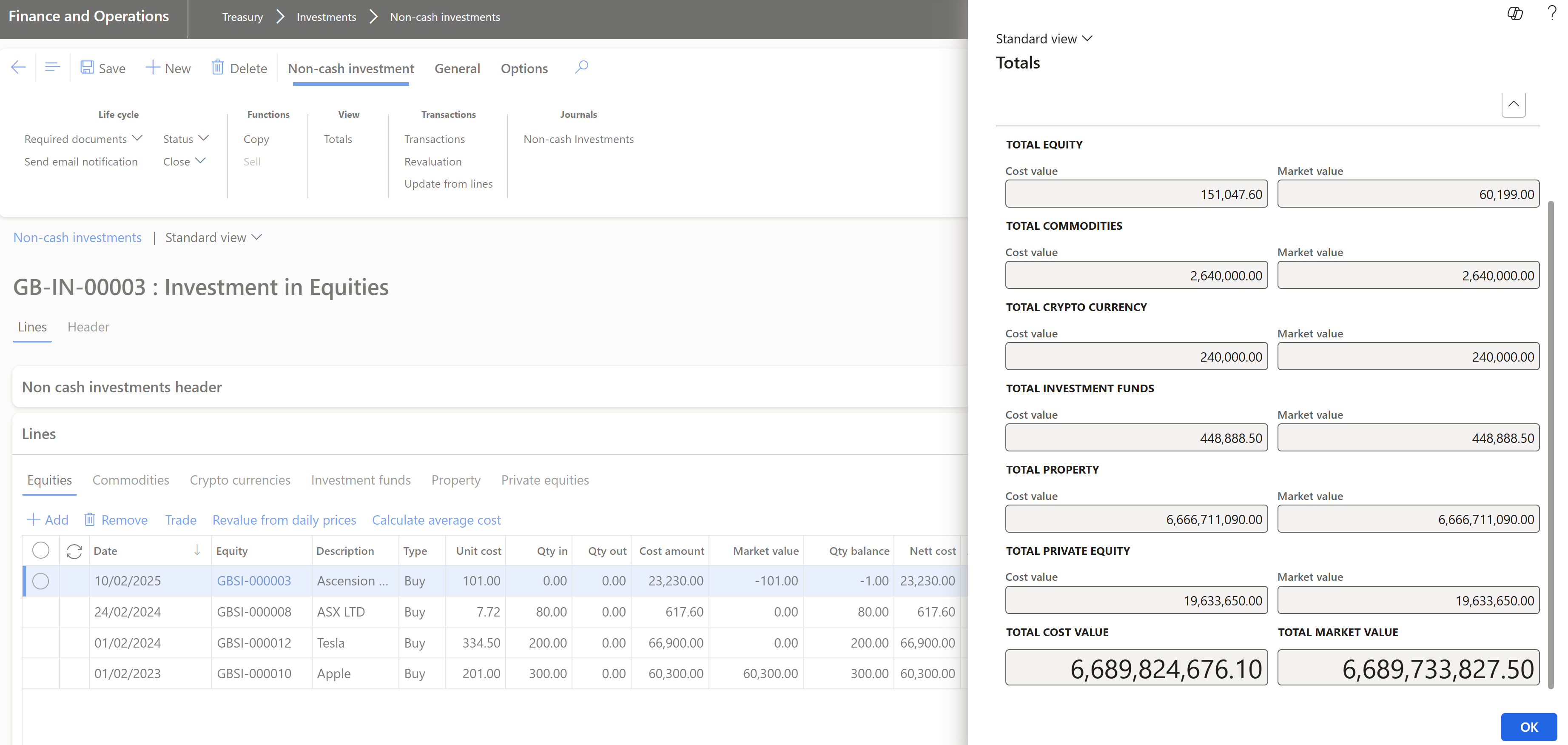

After the values have been updated in the Lines FastTab, the totals of all the non-cash investments can be viewed by clicking on the Totals button located in the Action pane under View.

The values that are displayed in the Totals form are generated from the Values FastTab information, and not from the Lines FastTab information. Therefore, before viewing the Totals form, ensure that you click on Update from lines button under the Transactions action pane

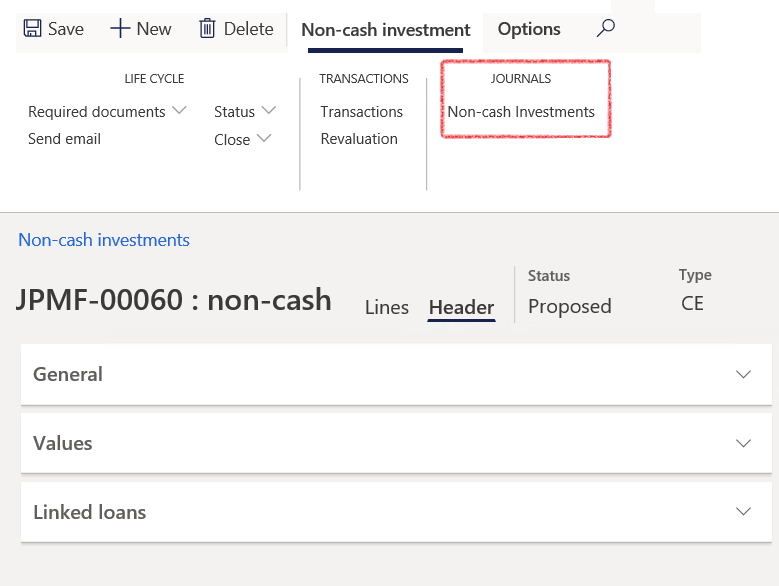

¶ Step 19: Create Transactions

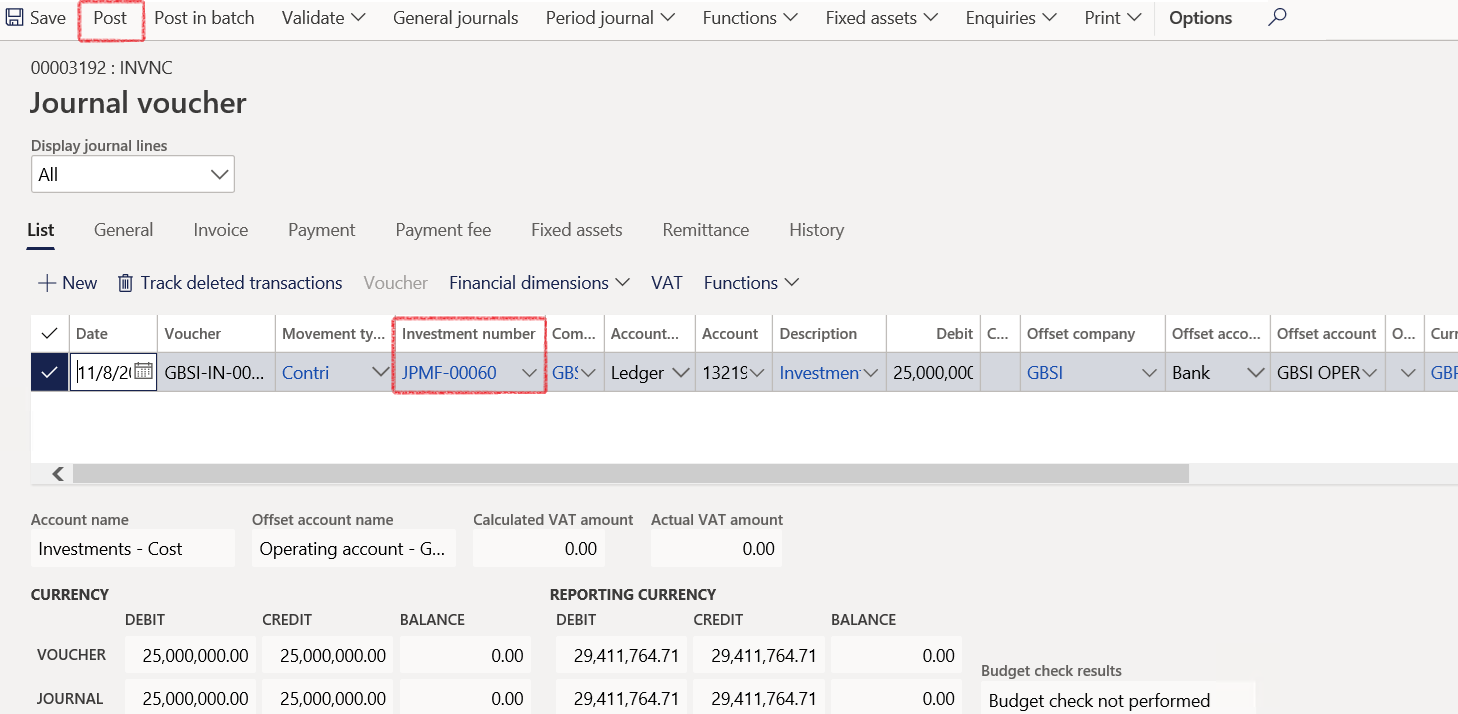

The first journal will be posted for movement type Contributions and will act similar to the Capital journal of Cash investments. The journals that follow can be of movement types: Accrued interest, Dividends capitalized, Interest earned, Investment management fees, Realized Gains or Unrealized Gains/Loss.

- After the Non-cash investment has been created, transactions can be created against the Investment

- Go to: Treasury > Investments > Journals > Non-cash investments

- Create new Journal Header and select the Lines button on top

- Select the Investment number

- Capture Movement for the period, per Movement type

- Select from list:

- Accrued interest

- Contributions

- Dividends Capitalised

- Interest earned

- Investment management fees

- Realised Gains

- Unrealised Gains/Loss

- The system will also force you to enter a debit or credit as per the posting profile setup

- On top, select Post

The Account and Offset Account will default based upon the movement type selection.

A Cost Centre may be required for Income Statement Accounts.

- Related information can be viewed under the General menu tab on top, and the user can enter financial dimensions for this non-cash investment.

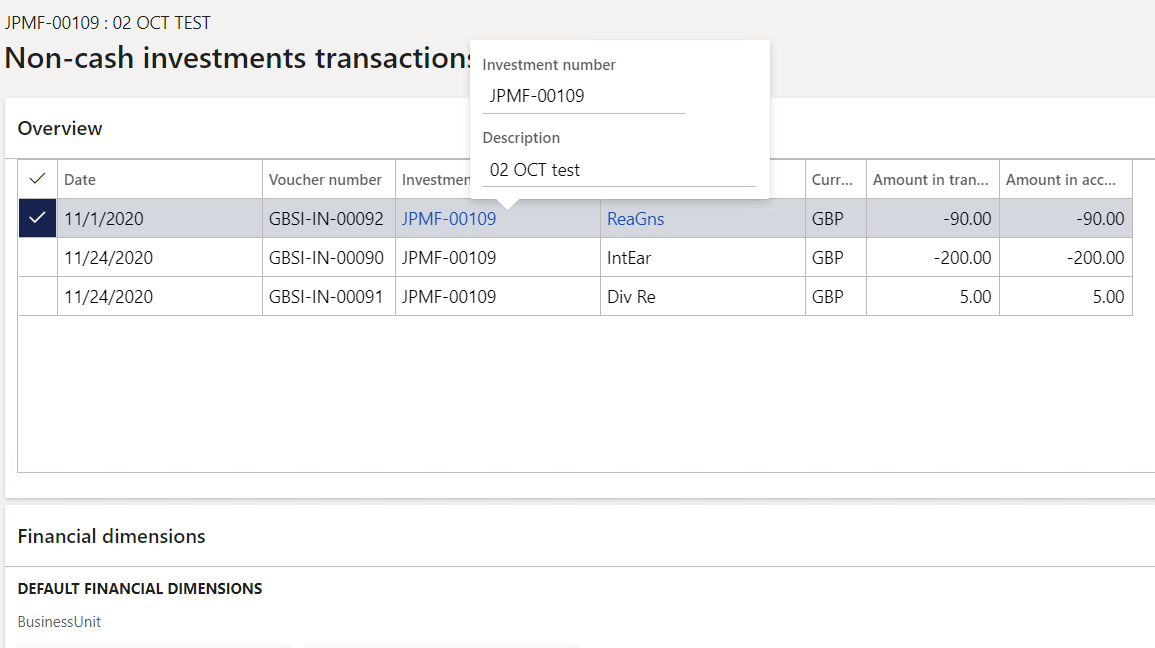

¶ Step 20: Viewing Transactions

- One can now view the transactions posted against the investment

- Go to: Treasury > Investments > Non-cash investments

- Select the investment that you posted against

- In the Action pane, select Transactions in the ribbon bar and view the transactions

- Select Voucher to view the GL voucher

¶ Step 21: Capturing the market values

As transactions are updated and posted, the accounting values are automatically updated. Market values can also be captured against the investment, if it differs from the actual transaction value.

- Capture market values of the investment if required

- Go to Treasury > Investments > Non-cash investments

- Select the non-cash investment that you want to Edit from the list page

- When the non-cash investment page opens, expand the Values FastTab

- The market/fair values can be captured against the investment, if this differs from the actual transactional value

¶ Step 22: Copy functionality for Non-Cash Investments

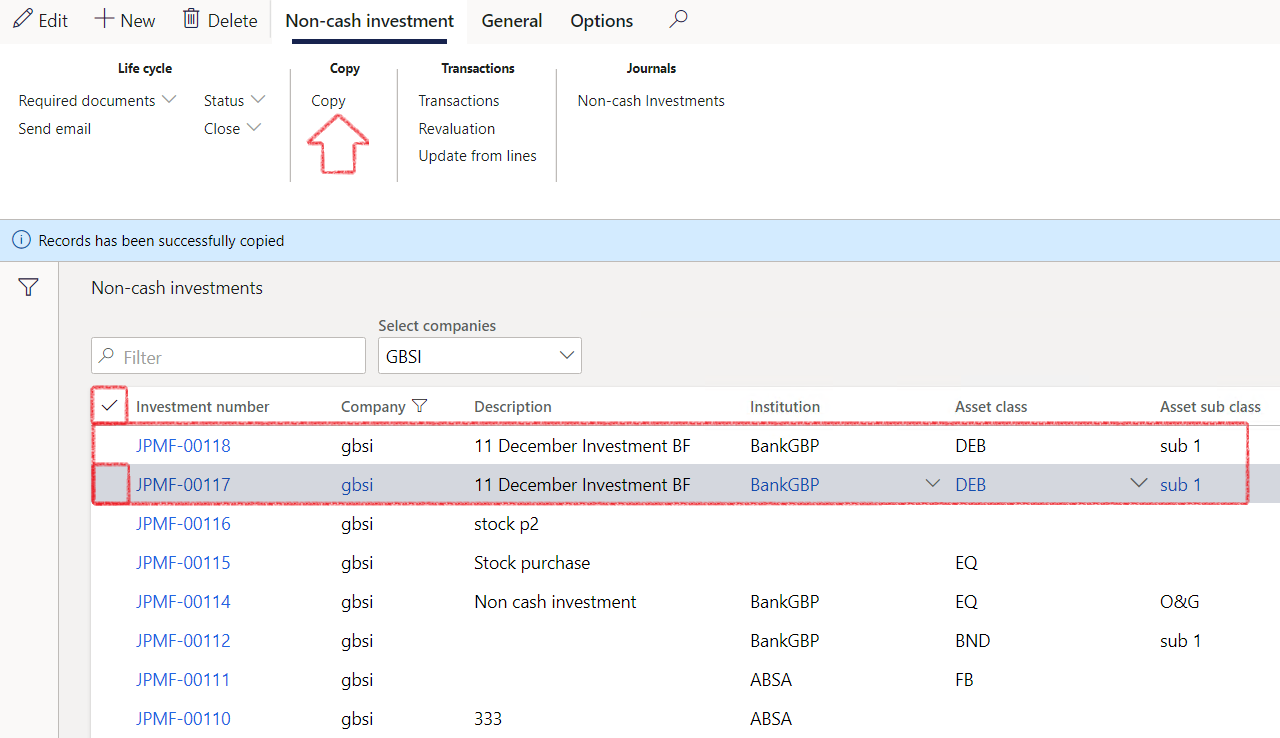

Users are able to copy a non-cash investment, which then triggers a job to create a new investment with the same main features as the current non-cash investment.

- Go to: Treasury > Investments > Non-Cash investments

- Click on the investment you want to copy

- Select Copy in the menu bar on top

- Your newly copied investment will automatically open

- The Status field’s value will be Proposed

- All information on the Header, General FastTab, will be copied from the selected Non-cash investment

- Alternatively, you may select multiple investments to copy

- New investment numbers will be allocated to the new non-cash investments that is created from an existing non-cash investment.

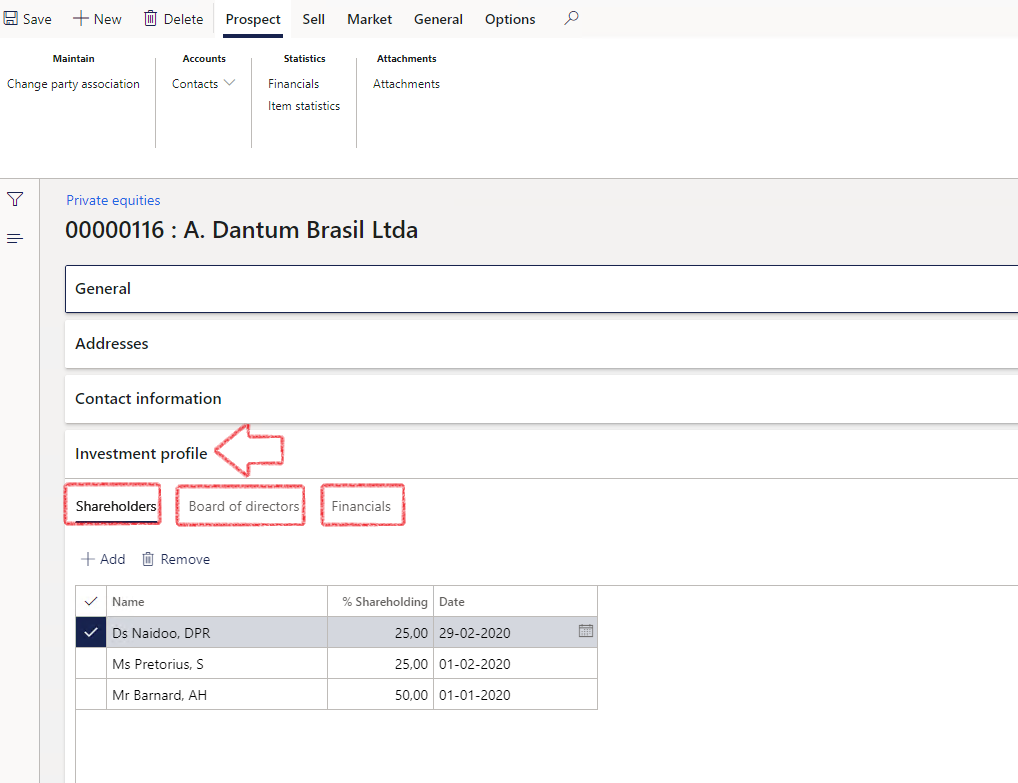

¶ Step 23: Private Equities

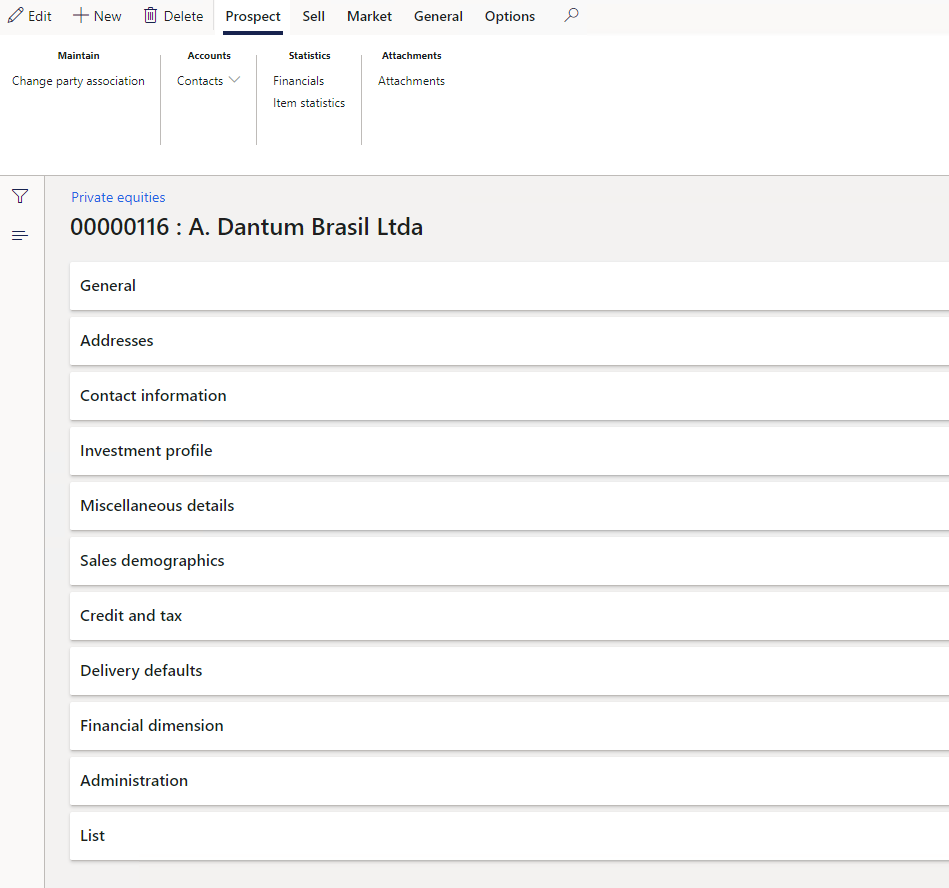

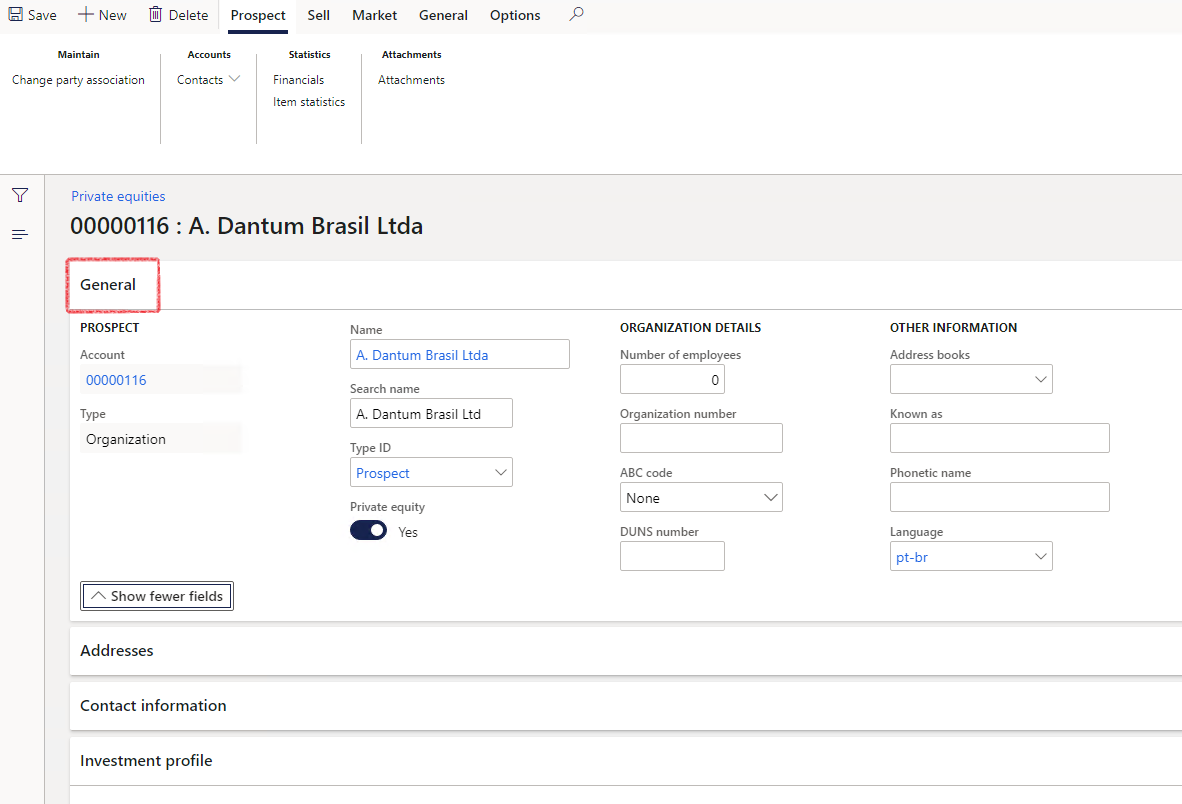

When investors want to invest in private companies, they do some research to qualify for the opportunity. In order to do that, private equities can be created for Investments as follows:

- Go to Treasury > Investments > Private equities

- Investment FastTab called Investment profile, with two index tabs called Board of directors and Financials, where users can insert more information on KPI’s on the financials table.

- Prospect information under the General FastTab

- Investment profile FastTab displays information about

- Shareholders

- Board of directors

- Financials (details on KPI’s can be entered here)

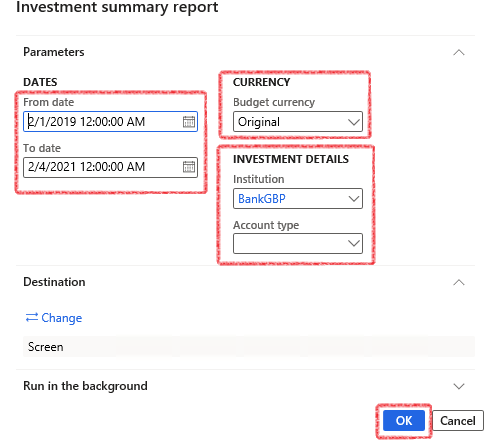

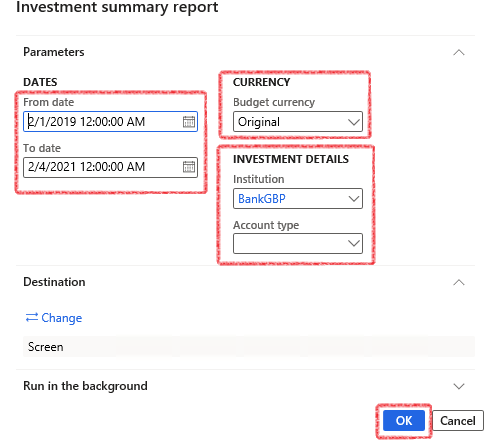

¶ Step 24: View and print Investment summary report

- Go to: Treasury > Investments > Inquiries and reports > Investment Summary report

- In the Parameters tab select a start and end date

- Select a Currency

- Select Investment details

- Select OK

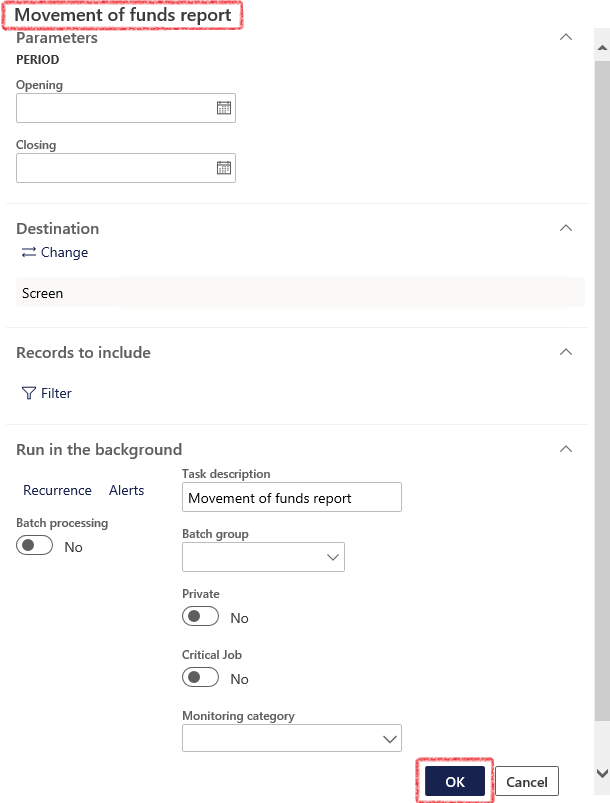

¶ Step 25: View Movement of funds report

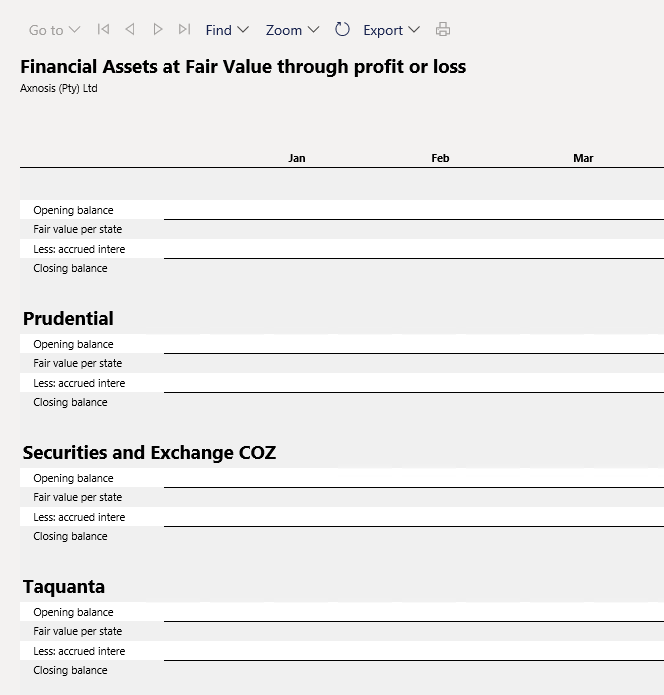

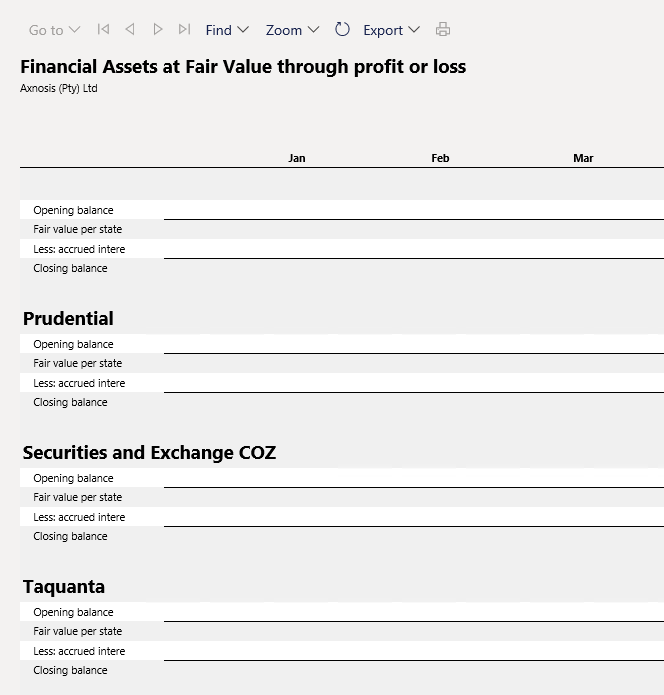

The movement of funds report will display the movement per asset manager broken into periods.

- Go to Treasury > Investments > Inquiries and Reports > Movement of funds report

- Select Opening and Closing dates for the period you are running the report for and select OK

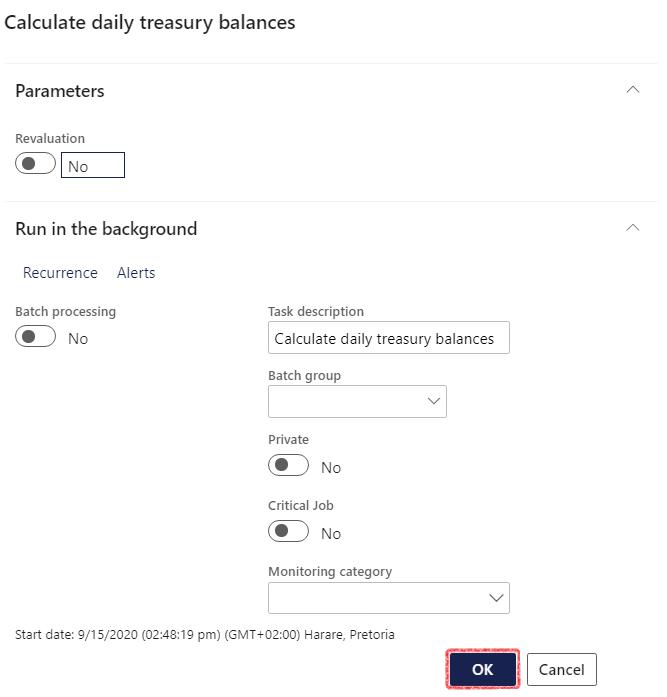

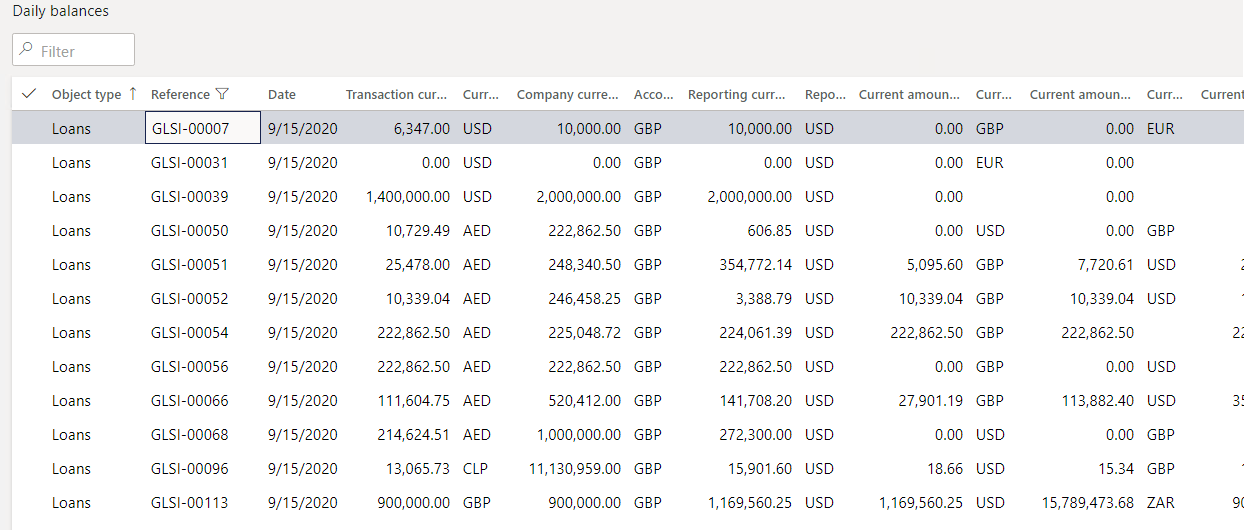

¶ Step 26: Daily balances

The periodic job for Daily balances will recalculate the balances as at today’s date.

To run the periodic job for the calculation:

- Go to: Treasury > Common > Periodic > Calculate daily balances

- To view the daily balances, go to: Treasury > Common > Inquiries and reports > Daily balances

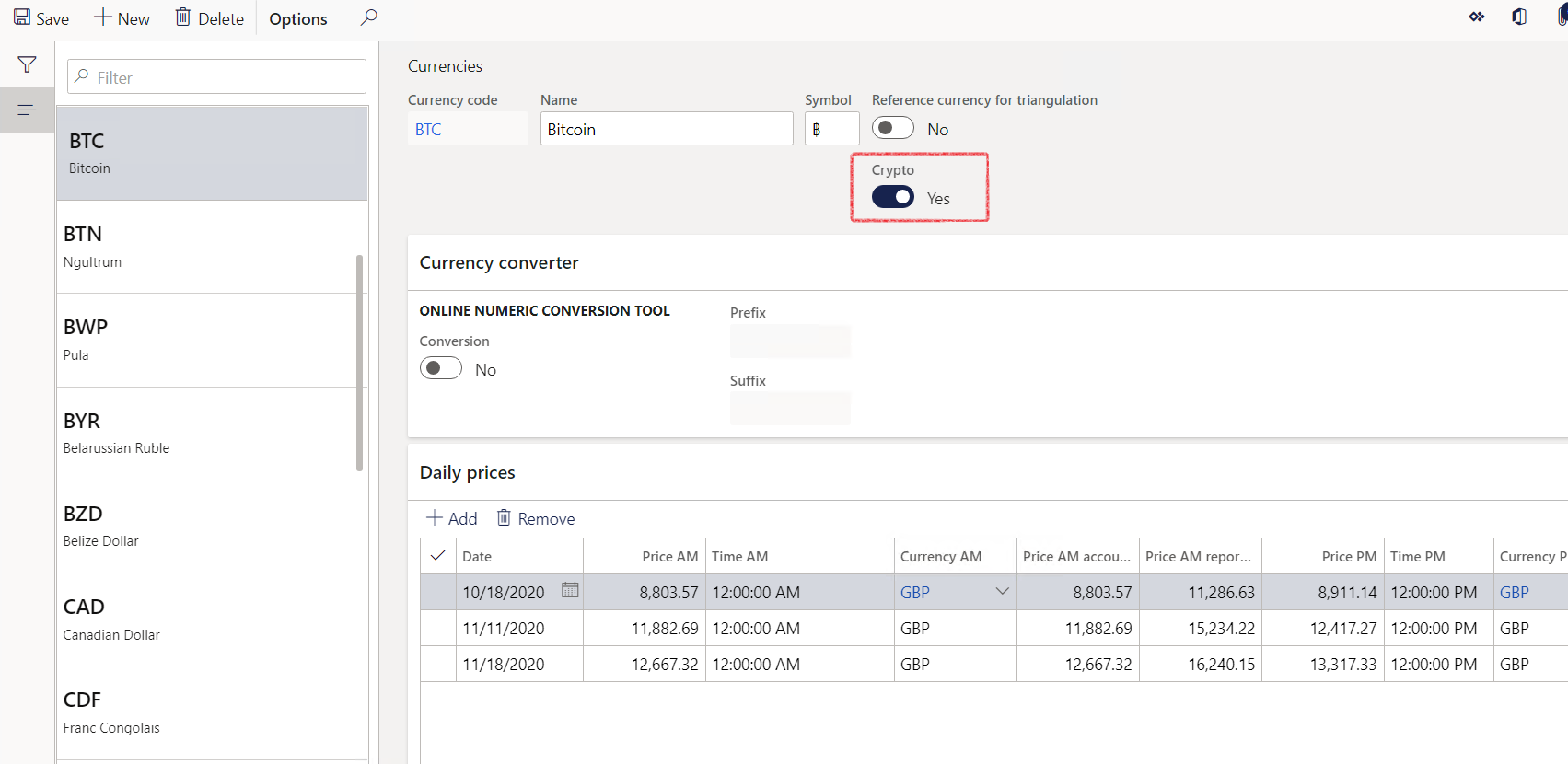

¶ Step 27: Crypto Currencies

Under the Common menu in TMS, one can view and set up crypto currencies.

To mark a currency as Crypto, go to

- Treasury > Common > Currencies

- Set the slider to Yes for Crypto

- You can view and edit crypto currencies here as well

¶ Reports & Workspaces

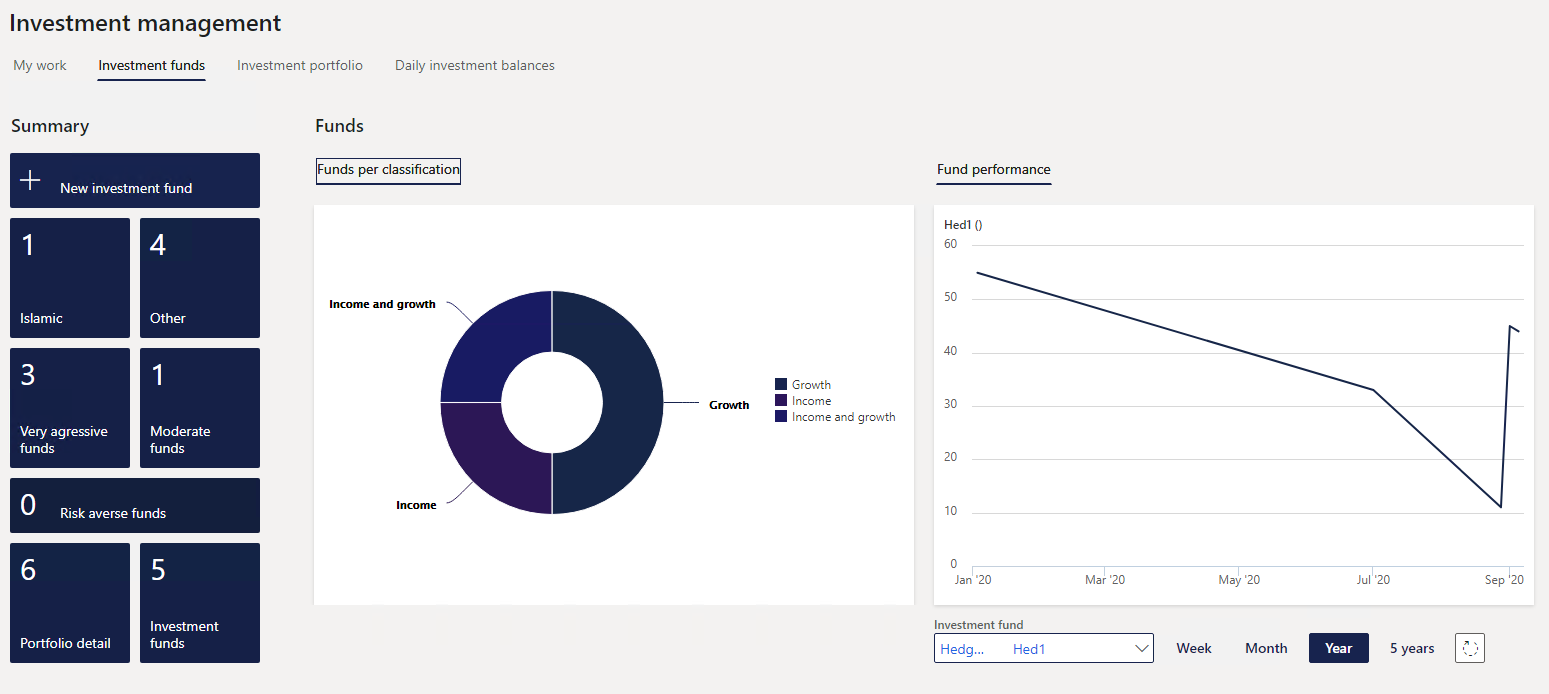

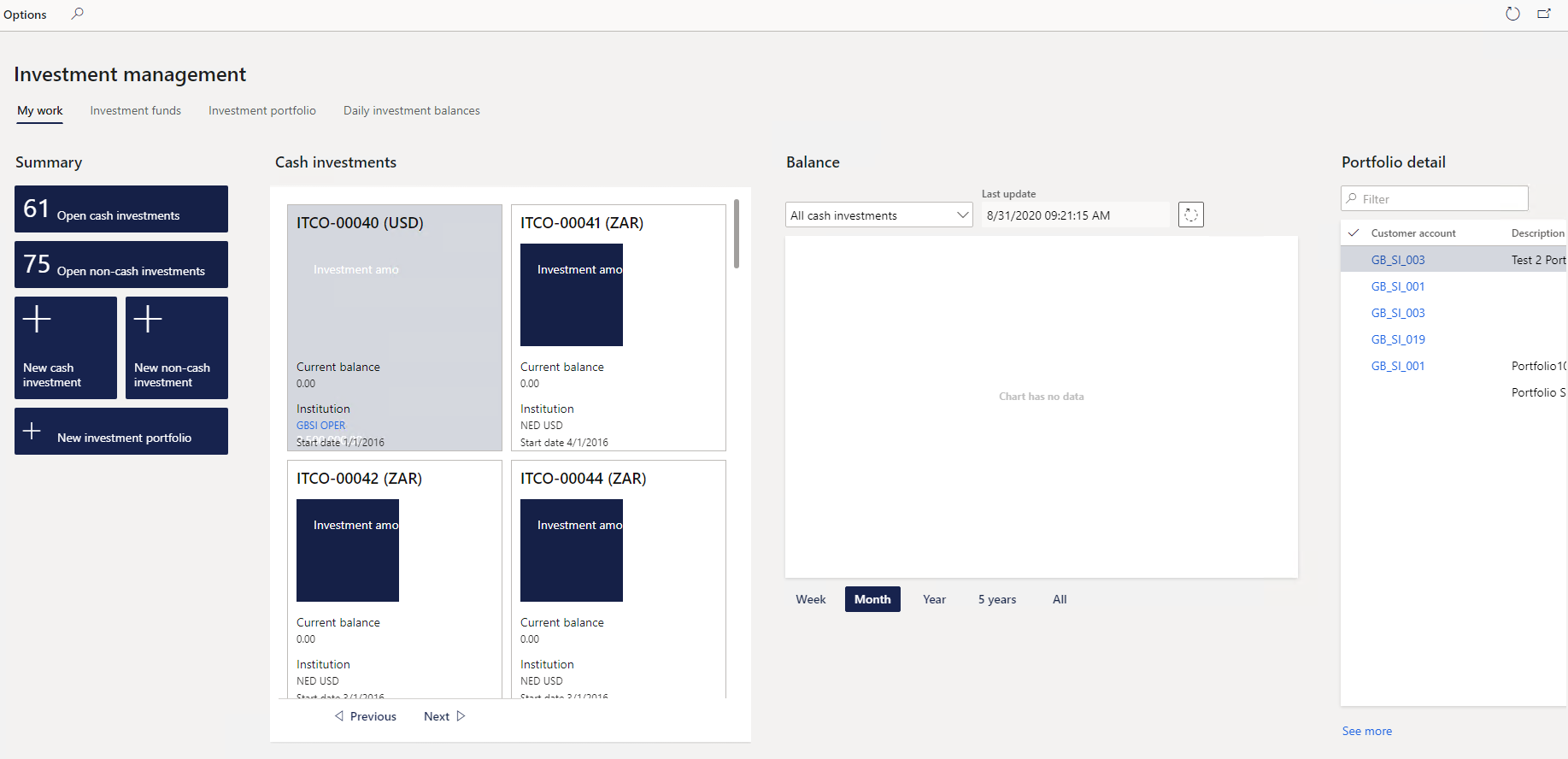

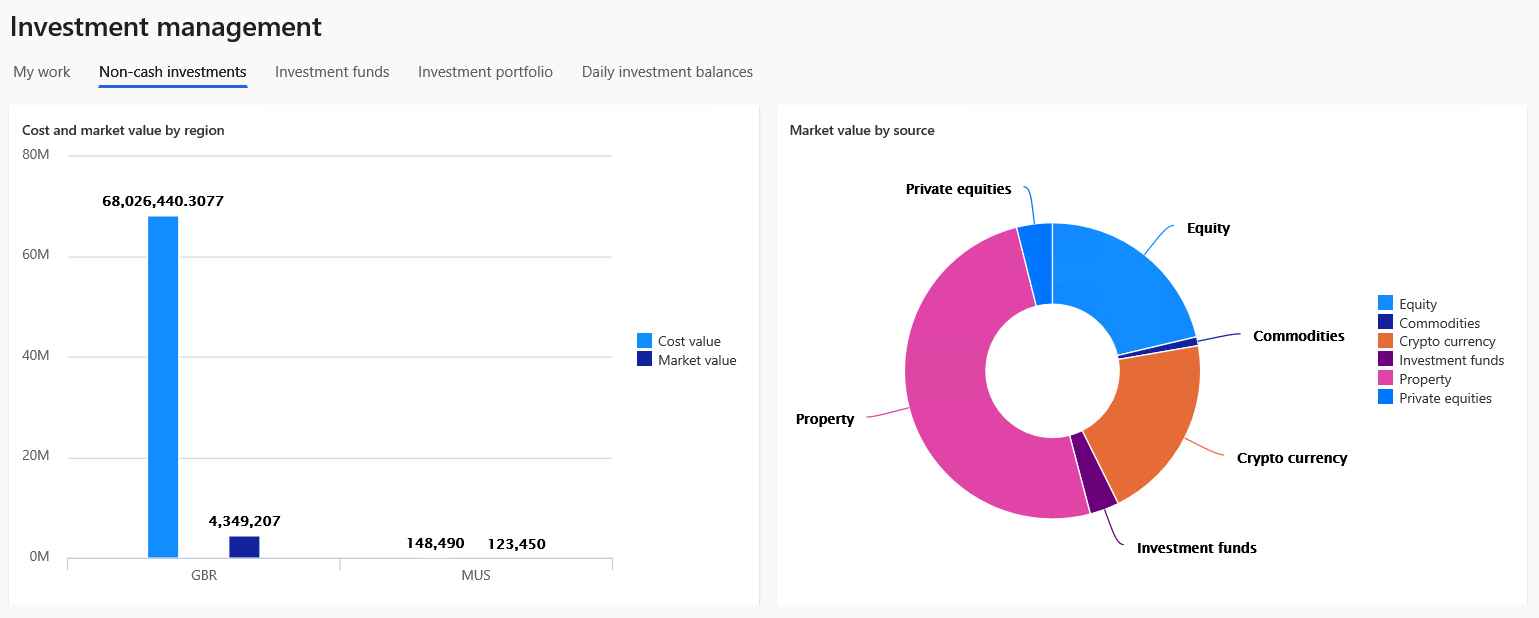

¶ Step 28: Investment Management Workspaces

- Go to Treasury > Workspaces > Investment management

- The Investment management workspace is divided into five main sections:

- My work

- Non-cash investments

- Investment funds

- Investment portfolio and

- Daily investment balances

- Under My work, you will find summary tiles with

- Open cash investments

- Open non-cash investments

- Create new cash investment

- create new non-cash investment and

- create new investment portfolio

- Non-cash investments tab

- Investment funds tab

- Summary:

- New investment fund

- Islamic funds

- Other funds

- Very aggressive funds

- Moderate funds

- Risk averse funds

- Portfolio detail

- Investment funds