¶ Introduction

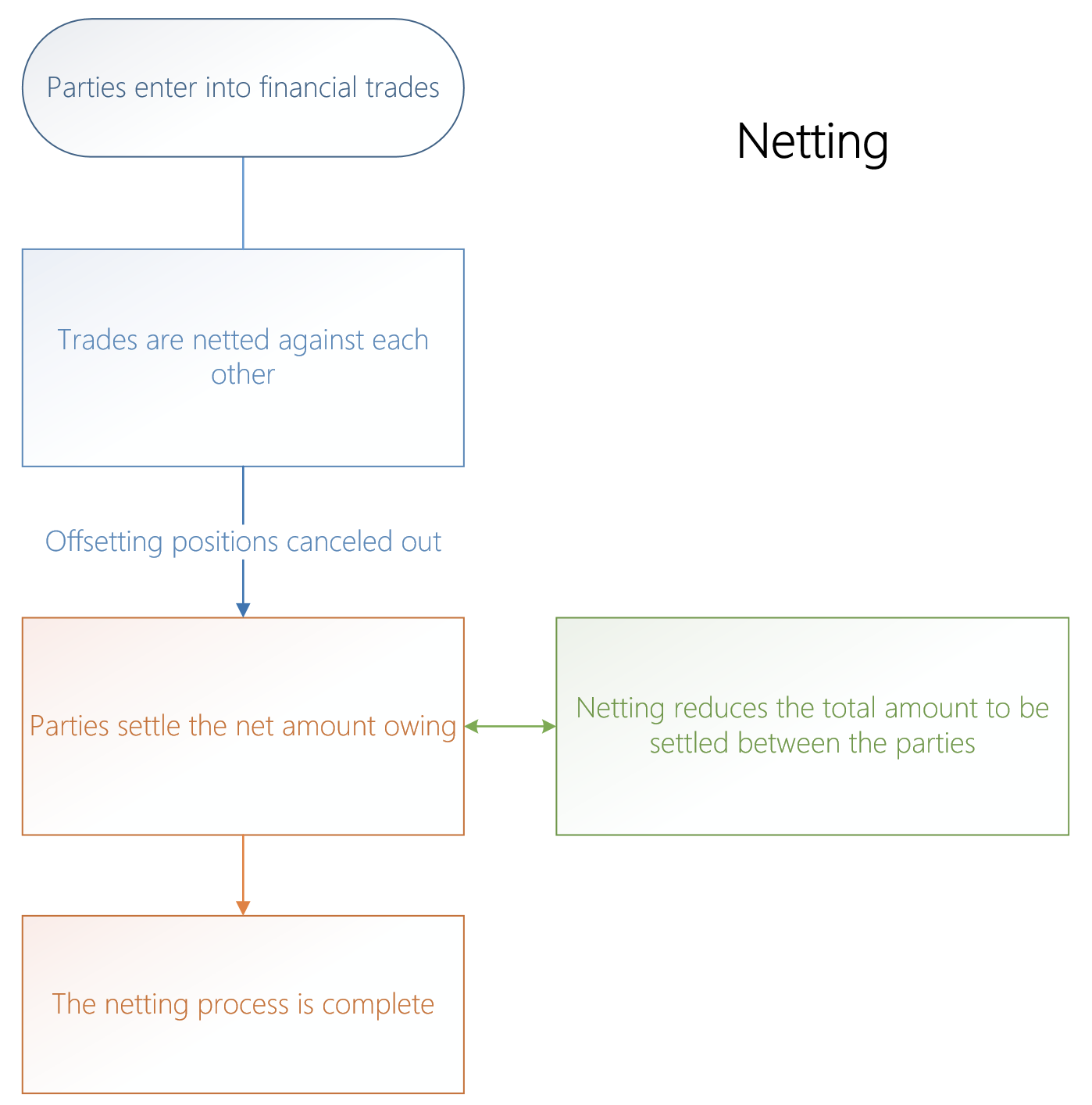

Netting is a financial process of consolidating and offsetting financial transactions or obligations between two or more parties to reduce the net amount that needs to be settled. It involves offsetting the value of cash flows or financial instruments between parties, so that only the net amount is exchanged, reducing the number of transactions and the amount of cash that needs to be transferred.

In its simplest form, netting involves subtracting the amounts owed by one party to another from the amounts owed in the opposite direction. This results in a net amount, which is the only amount that needs to be paid or transferred between the parties. Netting is commonly used in various financial transactions, such as securities transactions, derivatives trading, and cash management.

Netting can occur in different forms, such as bilateral netting, in which two parties offset their obligations with each other, or multilateral netting, in which multiple parties offset their obligations with each other. Cross-currency netting is another form of netting that involves offsetting transactions denominated in different currencies. Netting can help reduce credit risk, transaction costs, and operational complexity in financial markets.

In this diagram, the parties initially enter into financial trades, such as buying or selling securities or other financial instruments. These trades are then netted against each other, with offsetting positions being canceled out. The netting process results in a reduction of the total amount that needs to be settled between the parties. Finally, the parties settle the net amount owing, and the netting process is complete.

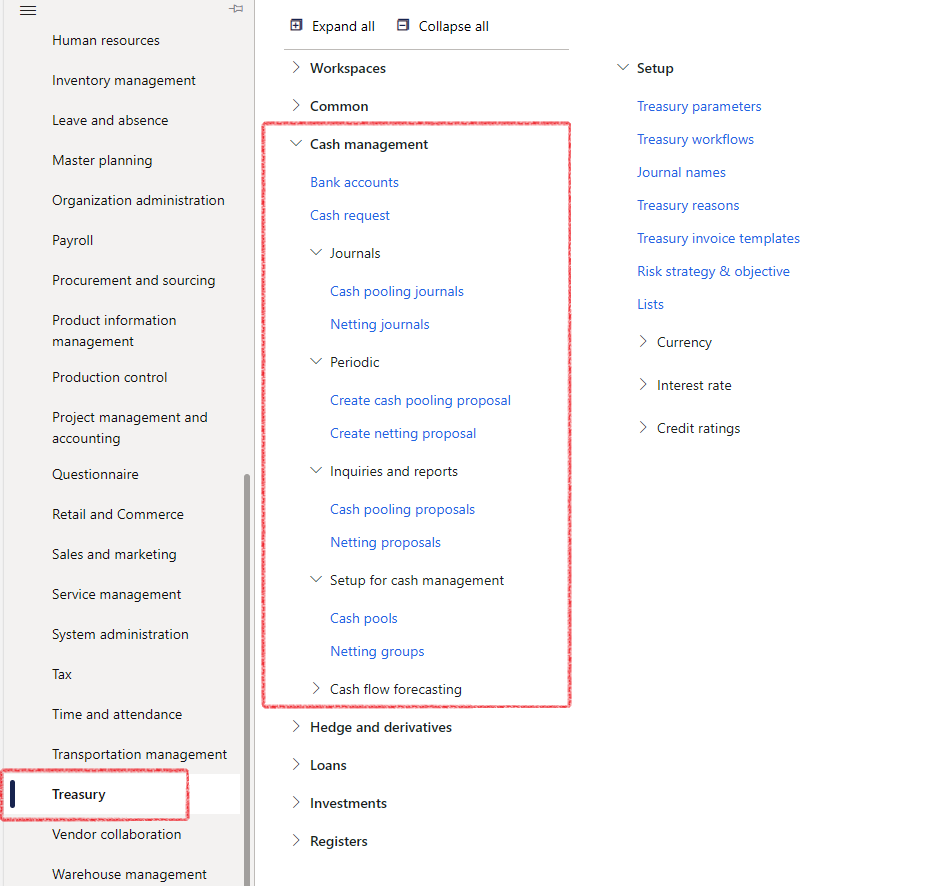

¶ Navigation

¶ Specific Setup

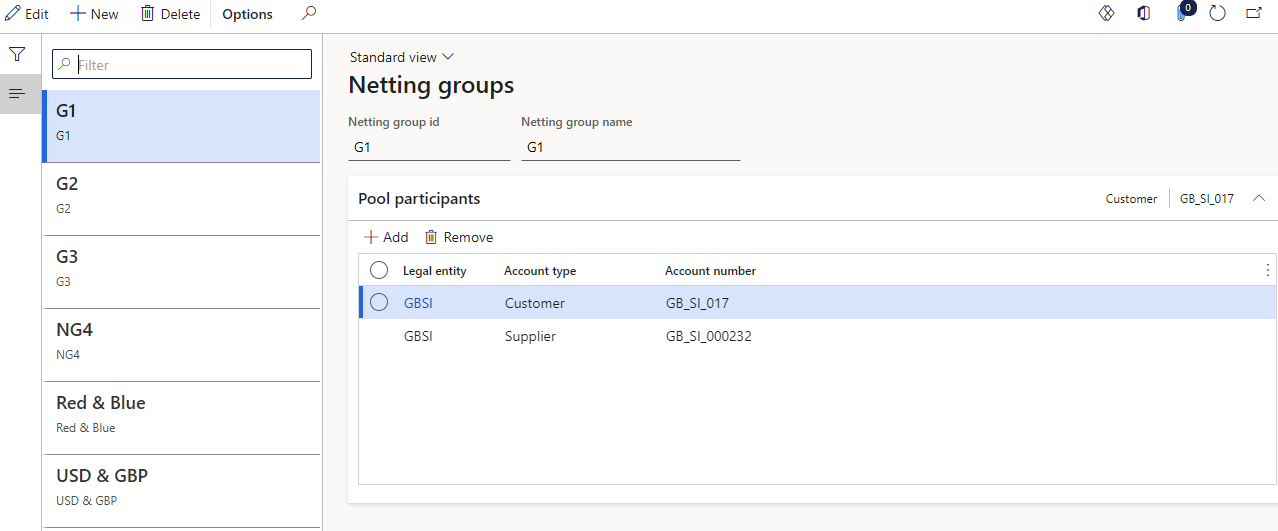

¶ Step 1: Set up Netting groups

A netting group can be comprised of any combination of parties that participate in the netting process.

A legal entity is a company or organization that has a legal identity separate from its owners, and it can conduct business, enter into contracts, and own assets in its own name. In the context of netting, a legal entity may have multiple customer or supplier accounts, and these accounts would be consolidated into a single transaction for the purposes of netting.

The specific parties included in a netting group will depend on the nature of the business and the relationships between the parties involved. However, the overall goal of a netting group is to simplify the payment process and reduce transaction costs by consolidating multiple payments into a single transaction.

It is imperative to ensure that the Number Sequence and Journal Names are established in a timely manner. In the present scenario, the Treasury journal type for the journal name will be "Netting".

- Go to Treasury > Cash management > Setup for cash management > Netting groups

- Click on the New button

- Enter a Netting group id

- Type a Netting group name

- Expand the Pool participants FastTab

- Click on the Add button

- Select a Legal entity from the dropdown list

- Under Account type, choose if this is a Customer or a Supplier

- Under Account number, select the relevant Customer or Supplier's account number from the list

- Click the Save button

¶ Daily use

¶ Step 2: Create a netting proposal

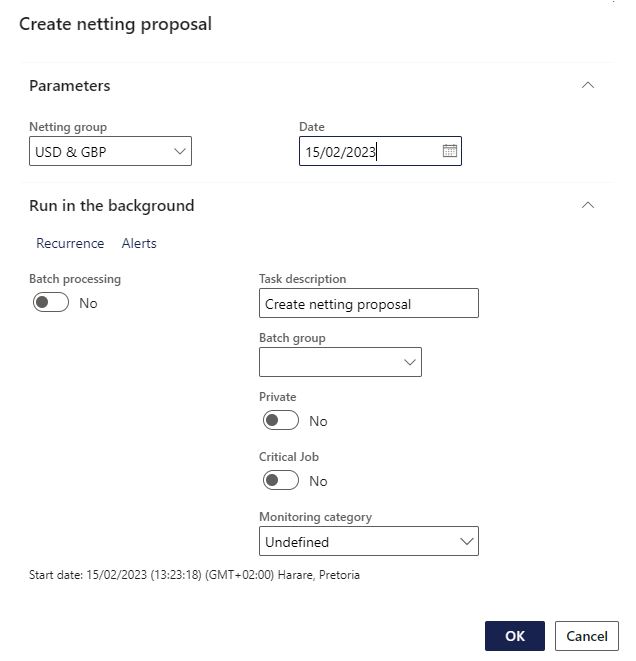

- To create a netting proposal, go to Treasury > Cash management > Periodic > Create netting proposal

- A Create netting proposal dialogue page will open

- Select a Netting group from the dropdown menu

- Enter a date

- Click the OK button

A netting journal proposal is a document that outlines the details of a proposed netting journal.

¶ Step 3: View and Edit Netting proposals

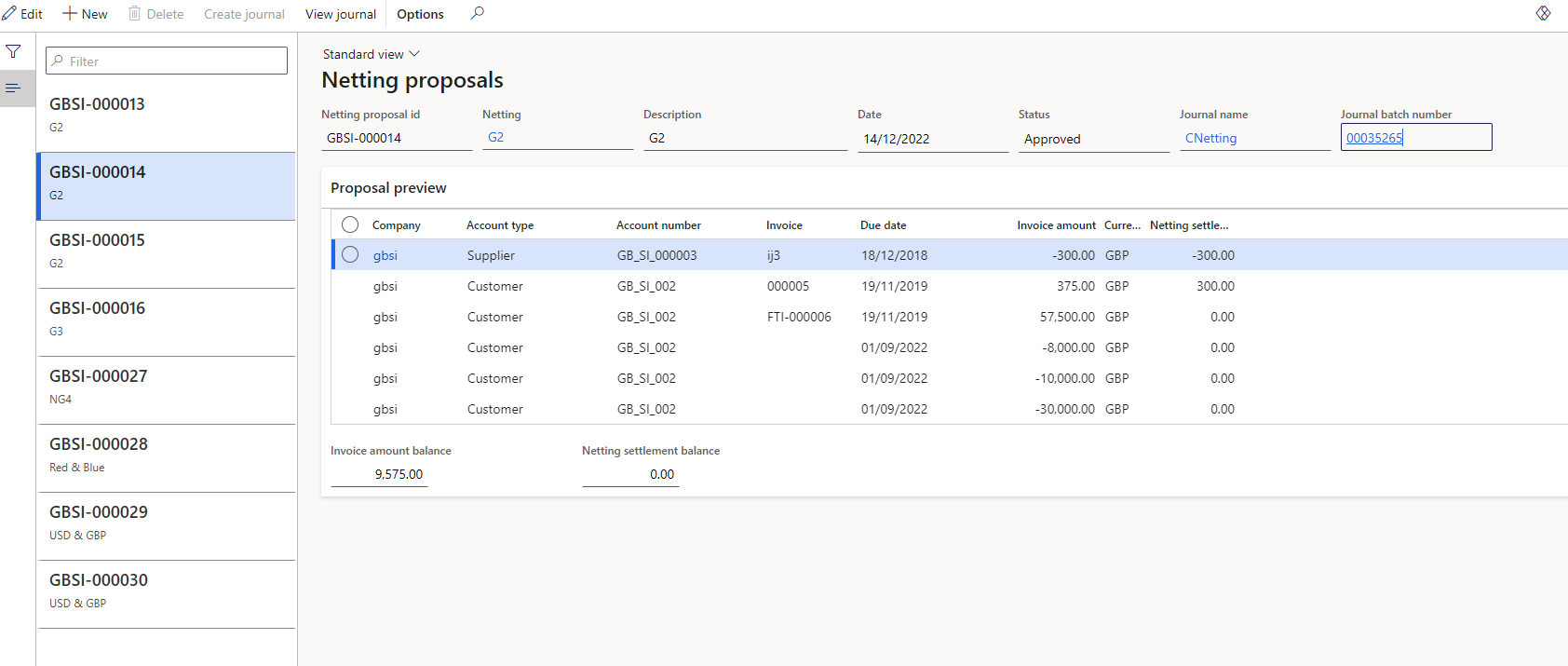

- To view Netting proposals, navigate to:

- Treasury > Cash management > Inquiries and reports > Netting proposals

- A page with all the created Netting proposals will display

- Click on a specific Netting proposal

- The proposal can be edited, by clicking on the Edit button

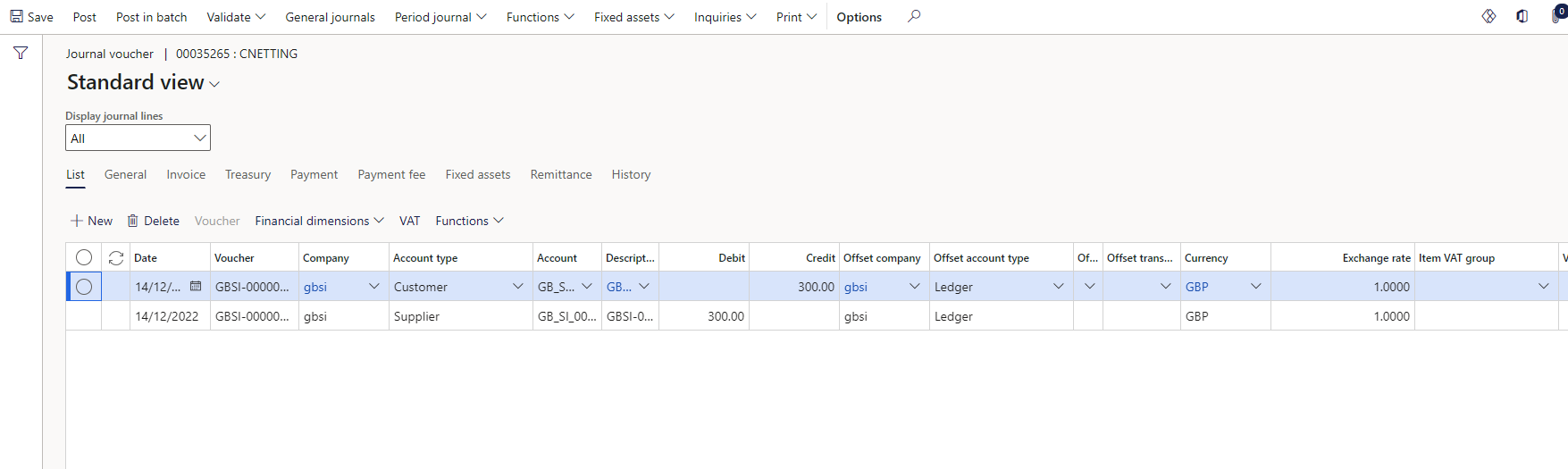

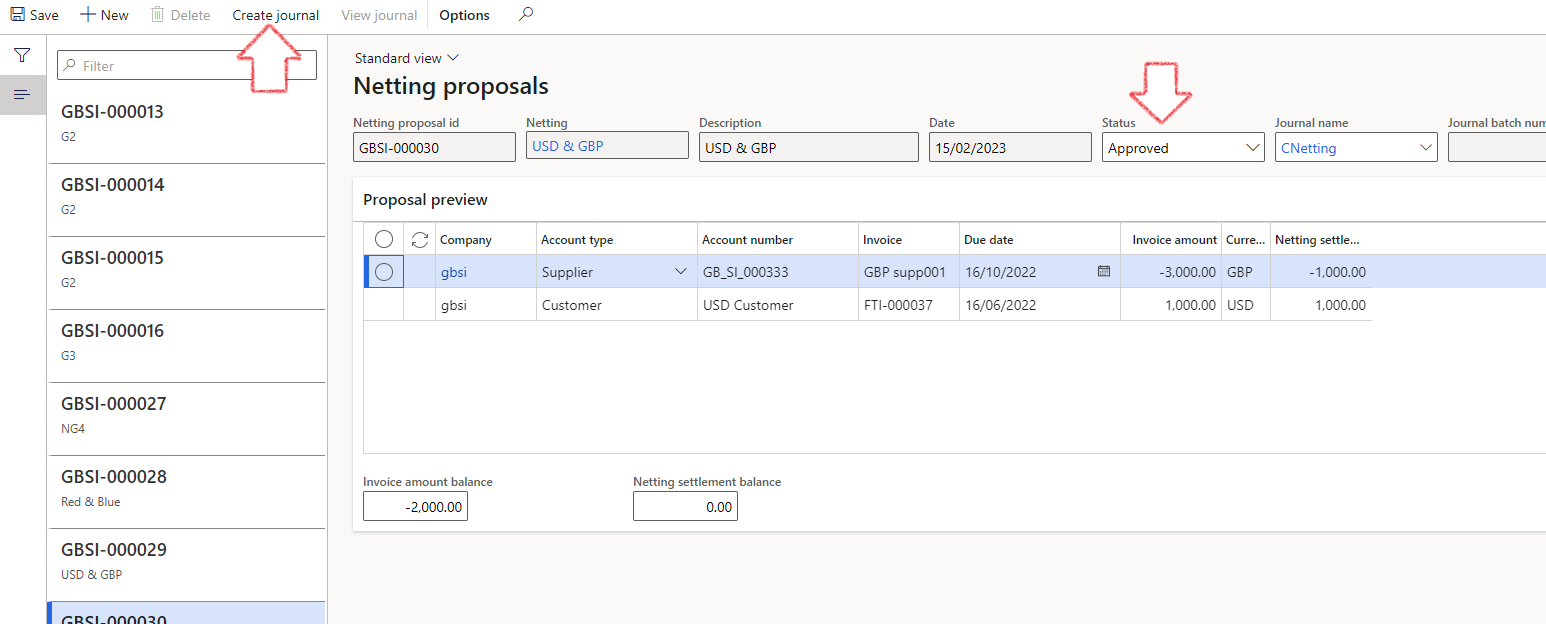

¶ Step 4: Create Netting journals

- To create Netting journals, navigate to:

- Treasury > Cash management > Inquiries and reports > Netting proposals

- Click on the Edit button

- Change the status to Approved

- Click on the Create journal button

- Click the Save button

- When the journal is created, a notification will appear showing the journal number.

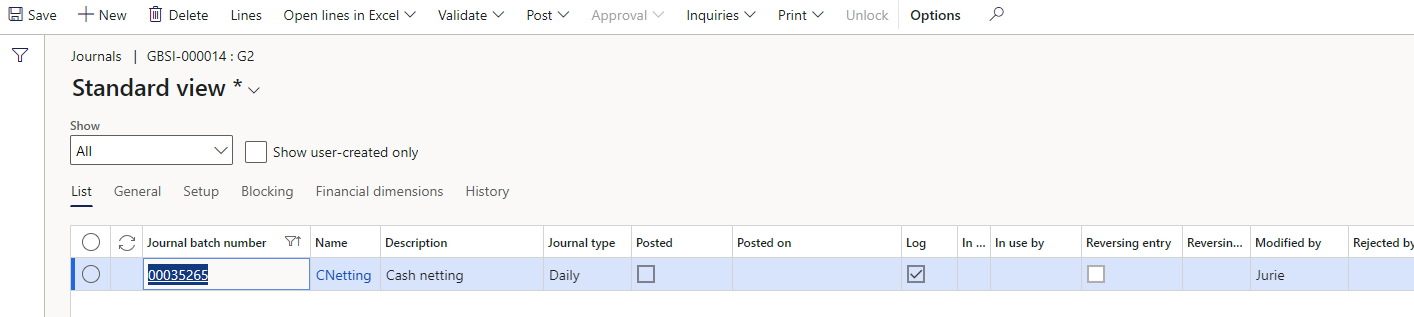

- Click on the View journal button

Before creating the Netting journal, it is essential to keep in mind that the Netting proposal needs to be approved.

¶ Step 5: Post Netting journals

- To view and post netting journals, navigate to Treasury > Cash and bank management > Inquiries and reports > Netting journals

- A list page with all the created netting journals will appear

- Click on the specific journal header

- Click on the Lines button on top of the journal header

- The journal lines will open

- Click on Validate

- Click on the Post button