¶ Introduction

The Treasury Management System (TMS) module provides end-to-end management of the loan lifecycle, from initial setup through to repayment and settlement. Loan journals are automatically generated using posting profiles and periodic jobs, with the option to make adjustments before posting. Manual corrections or other loan-related transactions can be captured in separate journals, ensuring clear record-keeping. The module also supports amortization schedules across different loan types, offering a comprehensive framework for managing treasury activities.

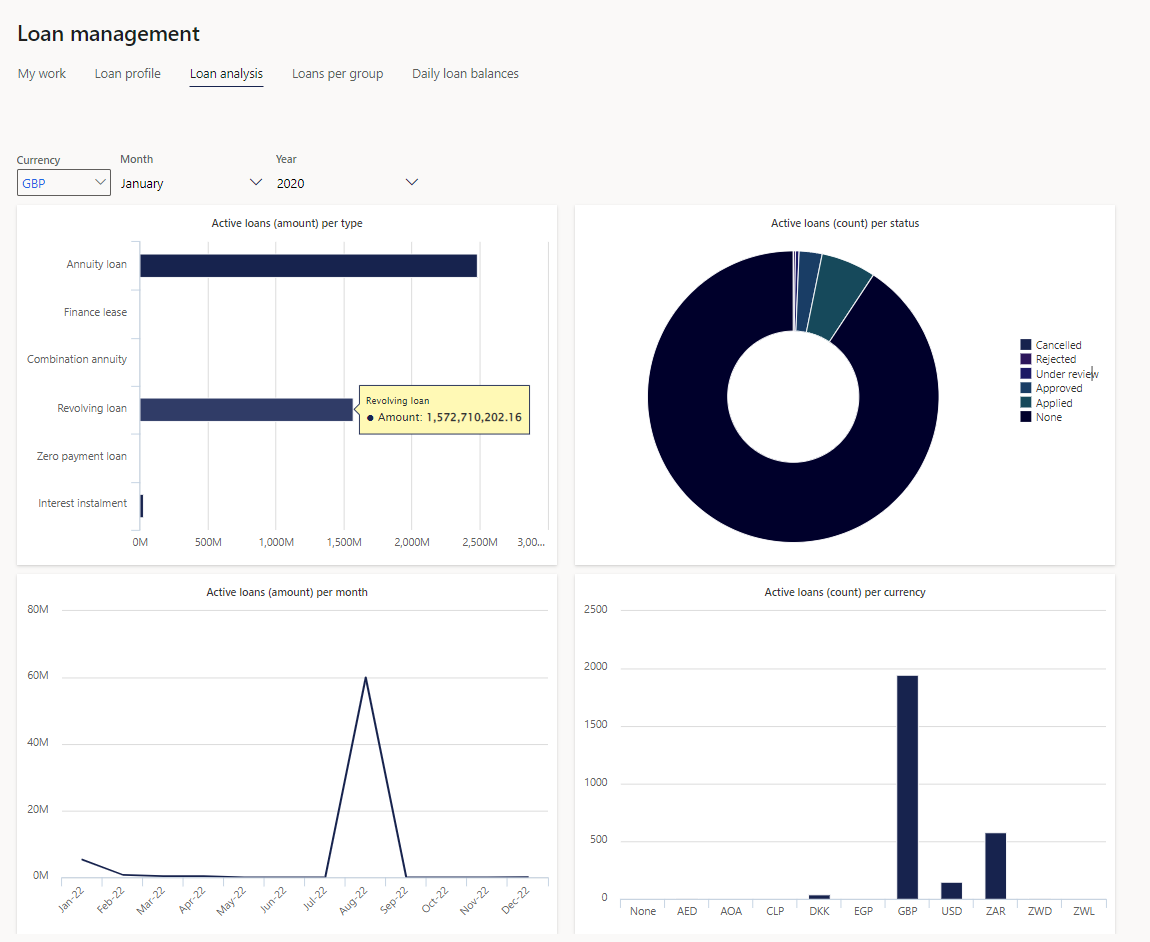

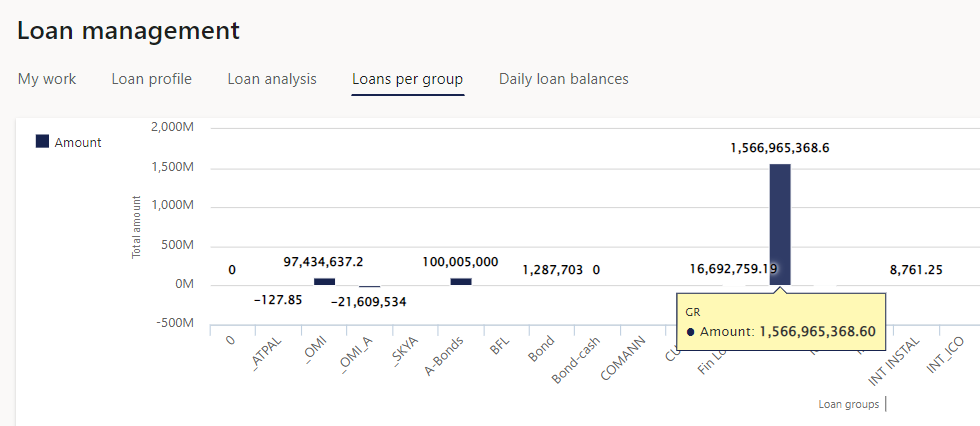

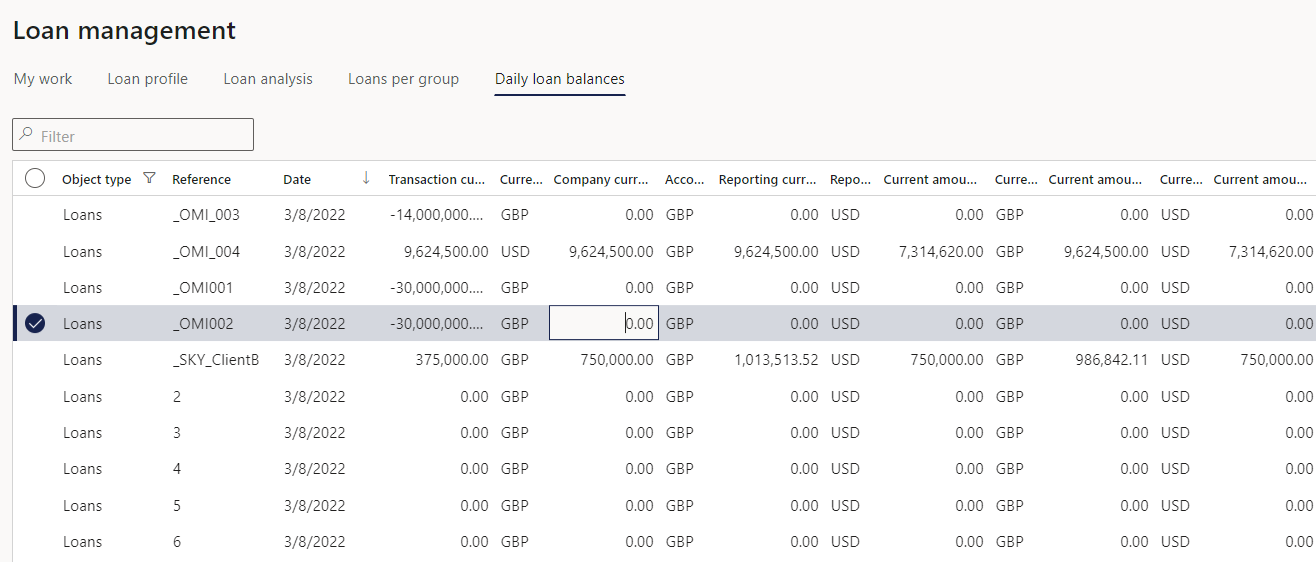

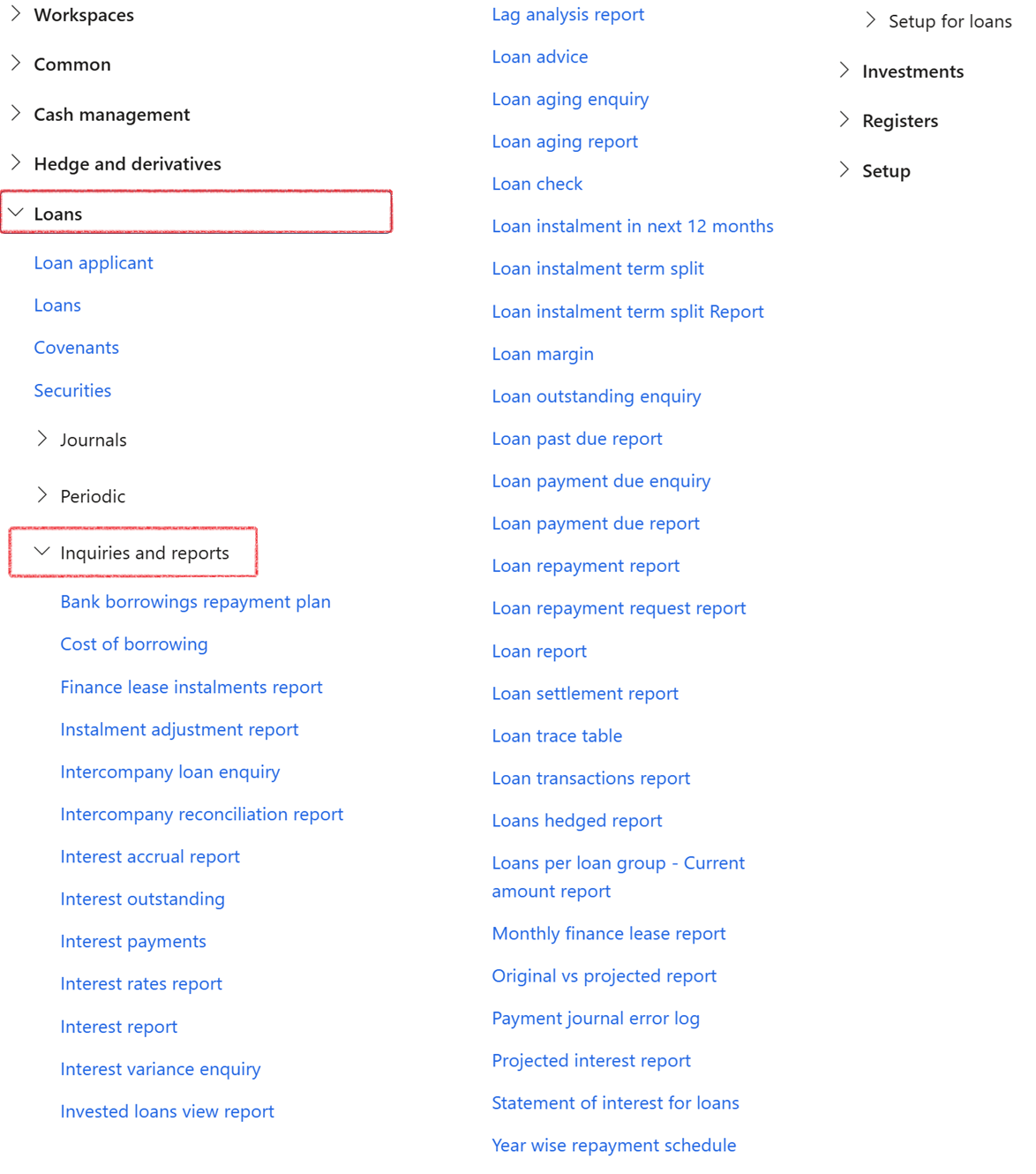

No separate ledger reconciliations are needed, since all transactions in the Treasury Management System flow directly into the general ledger, keeping control accounts consistently balanced. The module also includes a set of standardized reports, covering both transactional (dynamic) data and master (static) data, to support accurate tracking and analysis.

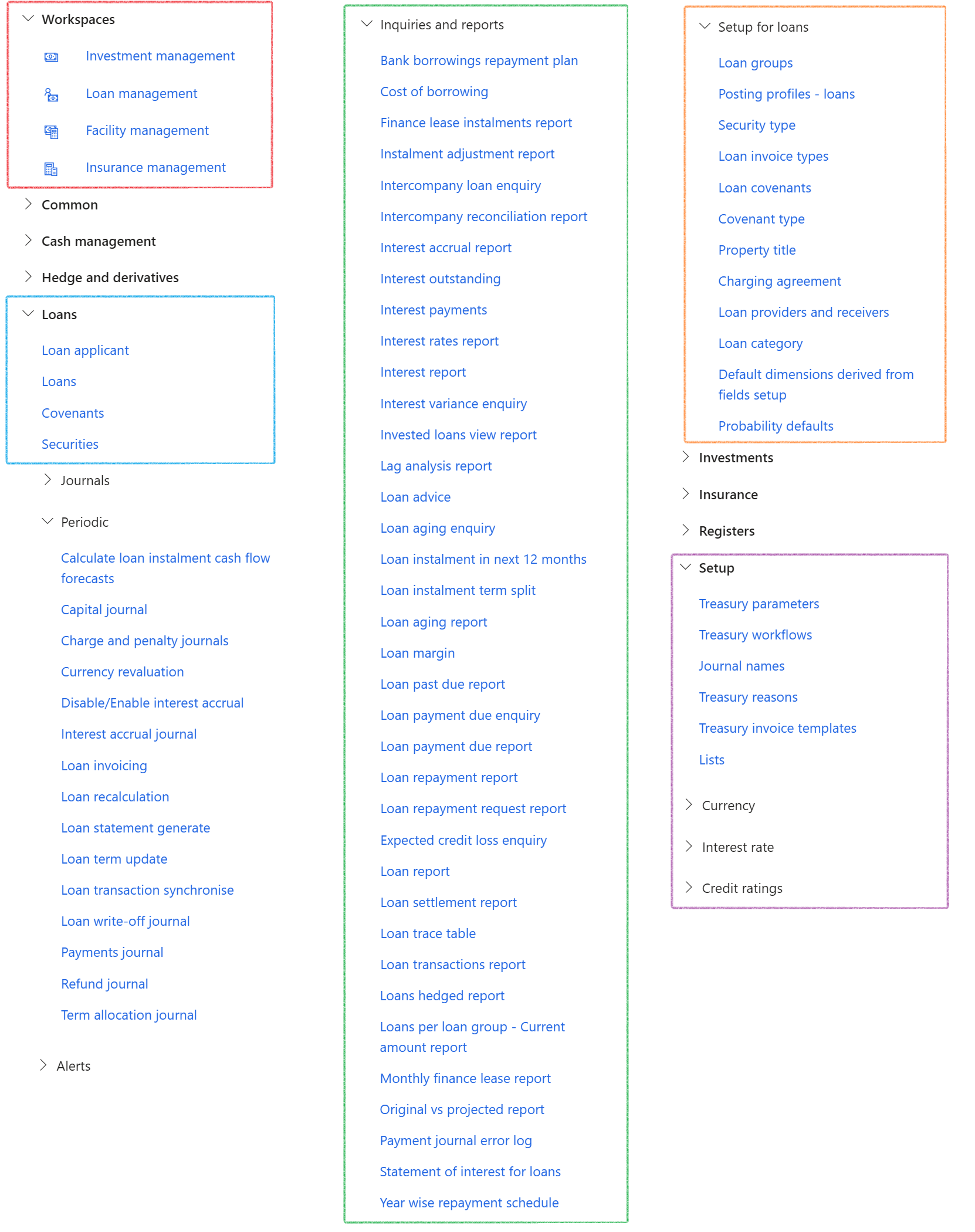

¶ Navigation

¶ Specific setup

The following items are required and will be explained in detail below:

- Loan types and rules applicable to each loan type

- Set up of Loan groups and its relation to loan types

- Set up Posting profiles for loans

- Creating Loan providers and receivers

- Set up Loan categories

- Set up of Default financial dimensions

¶ Step 1: Loan types and rules

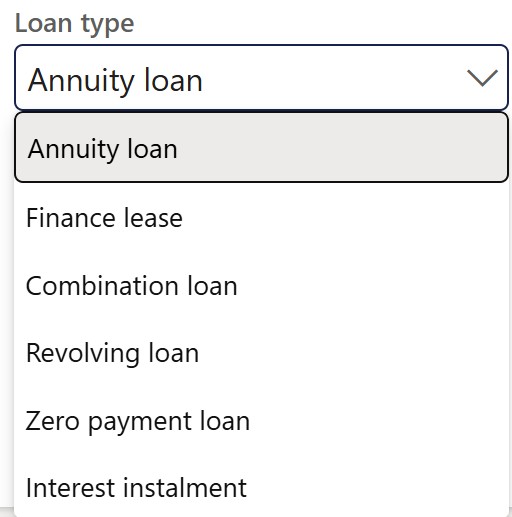

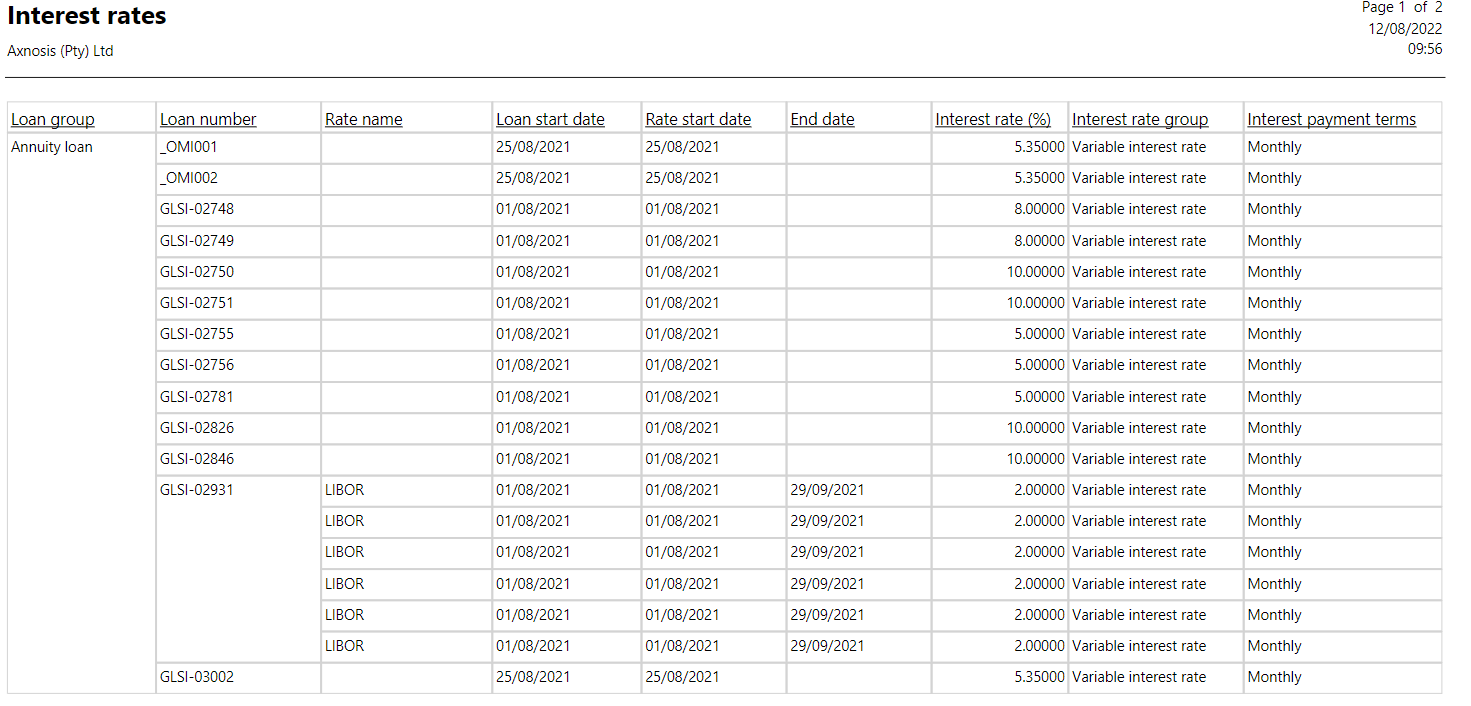

When a new loan group is created, a loan type is selected for it. Each loan type can be associated with multiple loan groups. Different loan types offer various options for consumers and businesses to effectively manage their finances. The loan type dictates how calculations are performed. Loan types are not created manually - they are generated based on the associated loan group.

Loan types include:

- Annuity loan - Loan payments are calculated monthly, quarterly or yearly based on terms. Interest is usually described as a nominal rate compounded over specific periods

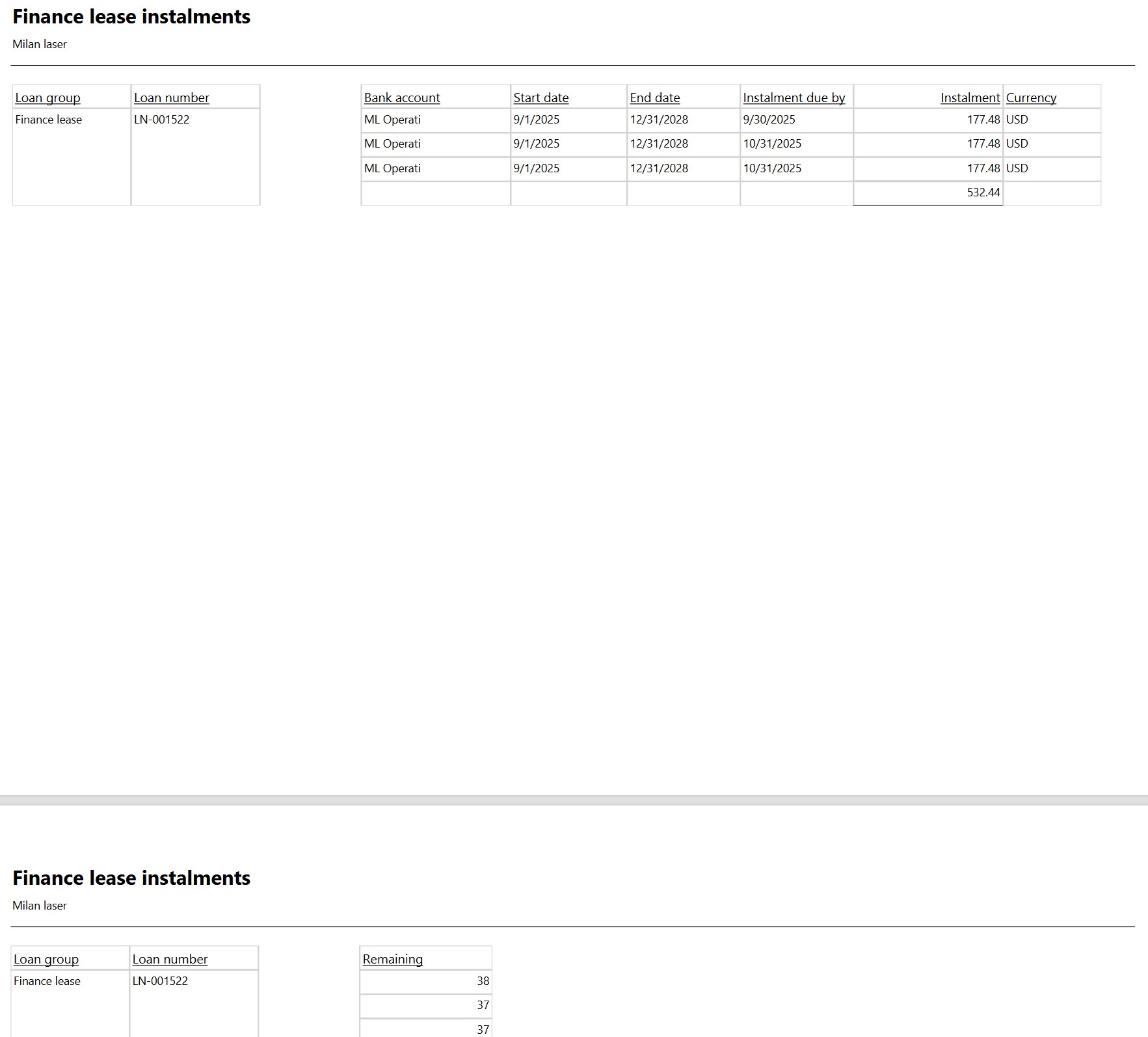

- Finance lease - Loan payments for an asset are calculated monthly, quarterly or yearly based on terms. Interest is usually described as a nominal rate compounded over specific periods

- Combination loan - A combination loan is a non-transacting parent loan to which sub-loans will be added. Each Sub-loan will have to select a loan type and group and will inherit most header setups

- Revolving loan - A loan type which allows withdrawals and repayments in a perpetual manner until the arrangement expires, e.g overdraft loan

- Zero payment loan - Zero payment of principal and interest with an optional end date

- Interest instalment - Interest is calculated and paid as per agreed terms with the capital amount only settled at loan end date

¶ Step 1.1: Annuity loans and Finance lease

Annuity loans: Loan payments are calculated on a monthly, quarterly, or yearly basis, depending on the terms. Interest is typically expressed as a nominal rate, compounded over specified periods.

Finance lease: Loan payments for an asset are calculated monthly, quarterly or yearly based on terms. Interest is usually stated as a nominal rate compounded over specific periods.

- Loan payments are calculated monthly, quarterly, half yearly or yearly based on the Loan payment terms

- Monthly interest is calculated based on the interest rate and the cumulative loan balance for each month

- For quarterly, half yearly and yearly interest, it would be the sum of the amounts for the months within the period

- Instalment calculated is based on the Microsoft financial function, where the periodic payment is calculated using the Interest rate, Total number of payments, the Current value of the loan and the Future value of the loan (if you want to attain a cash balance after the last payment), as inputs.

- Do not select End date of loan or None on Payment terms for Annuity or Finance lease loan types

¶ Step 1.2: Combination loans

A combination loan is a non-transacting parent loan to which subloans will be attached. Each subloan must have a selected loan type and group and will inherit most of the header configurations. When creating a combination loan, the user can create subloans (child loans) under the combination loan header. In this case, no transactions will occur on the combination loan itself; instead, transactions will be recorded on the subloans.

- To create automatic subloans for header loans (combination loan types), the user can set it up by navigating to Treasury parameters.

This can be a combination of any loan type

The subloan inherits the following fields from the Header (combination loan)

- Loan direction

- Loan provider and receiver

- Capitalise interest

- Month end

- Debit order

- Day

- Interest type

- Interest form

- Calendar convention

- Calendar

- Start date

- Calculation intervals

- Currency

- Some financial dimensions as per setup

Fields unique to the subloan (child loan) that will not be inherited from the header loan:

- Loan number

- Loan group

- Loan type

- Loan payment terms

Financial dimensions can be inherited by the subloan, depending on the Default dimensions derived from field’s setup.

The subloan (child loan) Loan ID financial dimensions will default to that of the Header (parent) loan.

A user will not be able to delete a header loan if there is an existing subloan with posted transactions.

¶

Step 1.3: Revolving loan

A loan type that permits withdrawals and repayments on an ongoing basis, continuing until the arrangement expires. An example of this is an overdraft loan.

- An arrangement that permits the loan amount to be withdrawn, repaid, and redrawn in any way and as many times as desired, until the arrangement expires.

- Credit card loans and overdrafts are examples of revolving credit.

- The end date is optional

¶

Step 1.4: Zero Payment loan

- Although the exact elements of non-performance status vary, depending on the specific loan's terms, no payment is usually defined as zero payments of either principal or interest with an optional end date.

- End date is optional

Additionally, ensure that the Use fixed capital setting is set to No for all zero-payment loan types, and that the Terminal amount is set to zero.

¶ Step 1.5: Interest Instalment

Interest is calculated and paid according to the agreed terms, with the principal (capital) amount being settled at the loan's end date.

- Capital payment is at the end of the loan

- Interest payments are calculated on a monthly, bi-monthly, quarterly, semi-annual, or annual basis.

- The instalment amount equals the interest payment calculated

- Payment terms should be selected, and one cannot select None as an option for Interest Instalment loan types. Also do not select End date of loan

¶

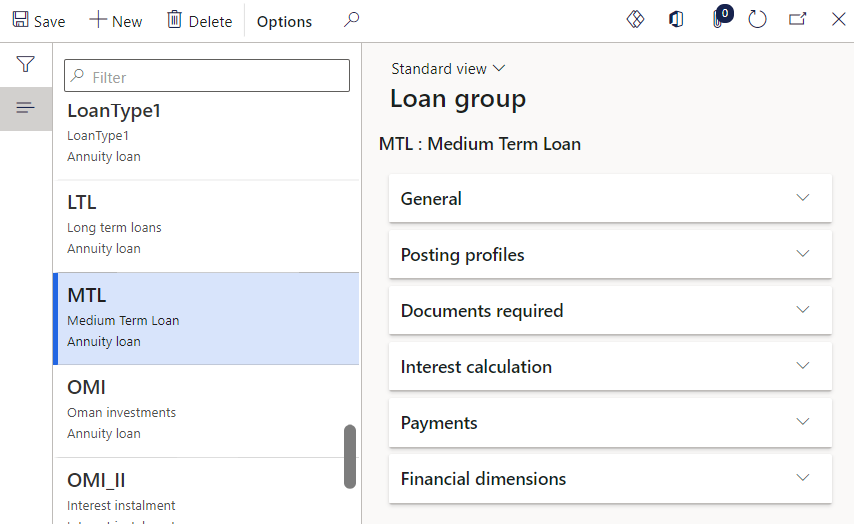

Step 2: Loan Groups

In the navigation pane, go to: Modules > Treasury > Loans > Setup for loans > Loan groups

The following FastTabs are available under loan groups:

- General

- Posting profiles

- Documents required

- Interest calculation

- Payments

- Financial dimensions

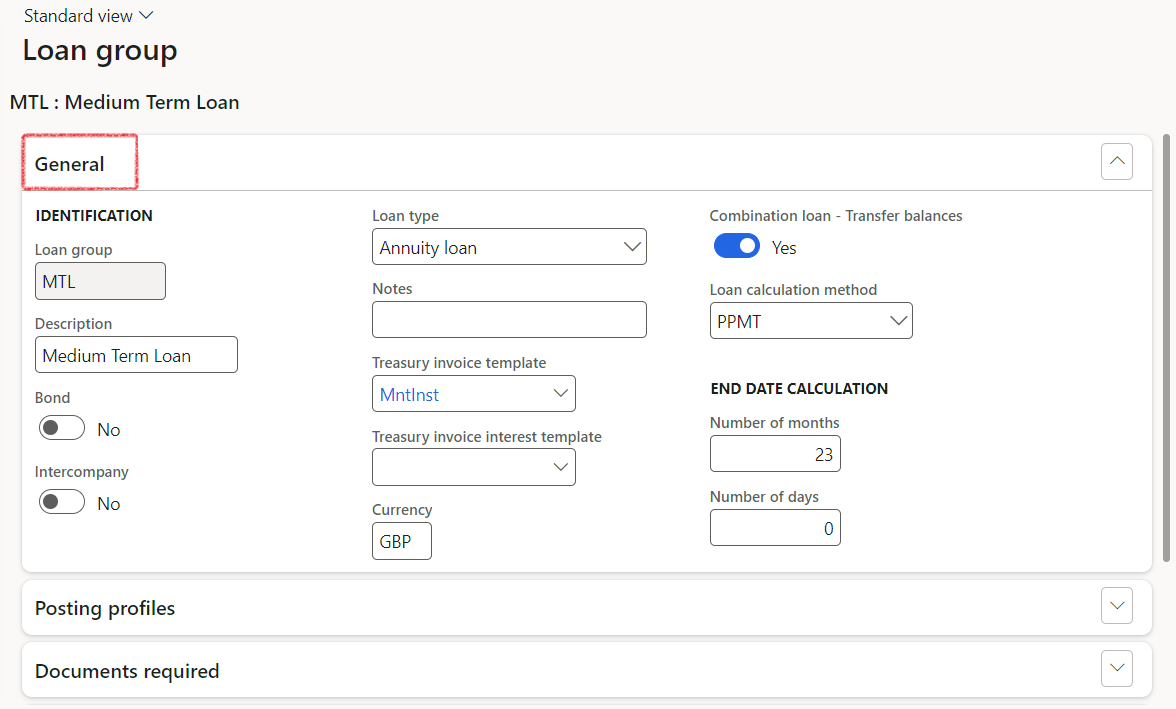

¶ Step 2.1: Loan group - General FastTab

- Go to: Treasury > Loans > Setup for loans > Loan groups

- Expand the General FastTab

- Click on the New button to create a new Loan Group

- Enter a name in the Loan group field

- Enter a Description

- Bond slider yes / no

- Intercompany slider yes / no

- Choose a loan type from the drop-down list. You can select from the following options:

- Annuity loan

- Finance lease

- Combination loan

- Revolving loan

- Zero payment loan

- Interest instalment

- The Notes field is a free text field

- Select a Treasury invoice template if you will be invoicing using Free Text invoices.

- Select a Treasury invoice interest template if you will be invoicing using Free Text invoices.

- Currency

- Combination loan – Transfer balances toggle yes / no. Choosing Yes will transfer the balance from the previous sub loan to the next sub loan

- Loan calculation method: PMT (Payment formula) and PPMT (Principal payment formula)

- When choosing the PMT (Payment formula) loan calculation method, the system will allow calculation of instalments based on the PMT method of calculation

- The PMT loan calculation method is a financial formula used to calculate the fixed payment amount required to pay off a loan over a set period of time, including interest charges. The PMT formula takes into account the loan amount, interest rate, and loan term to calculate the payment amount.

- PPMT (Principal payment formula) returns only the principal part of a payment during a given period of an amortizing loan.

- PPMT(period) = Total Payment − Interest Payment for that period

- End date calculation: Number of months will update the end date of the loan as per number of months. So, it is adding the number of months to the start date of the loan.

- Enter the Number of days to be added or subtracted to the start date of the loan, in order to calculate the end date.

When creating a loan group, the record title is user defined.

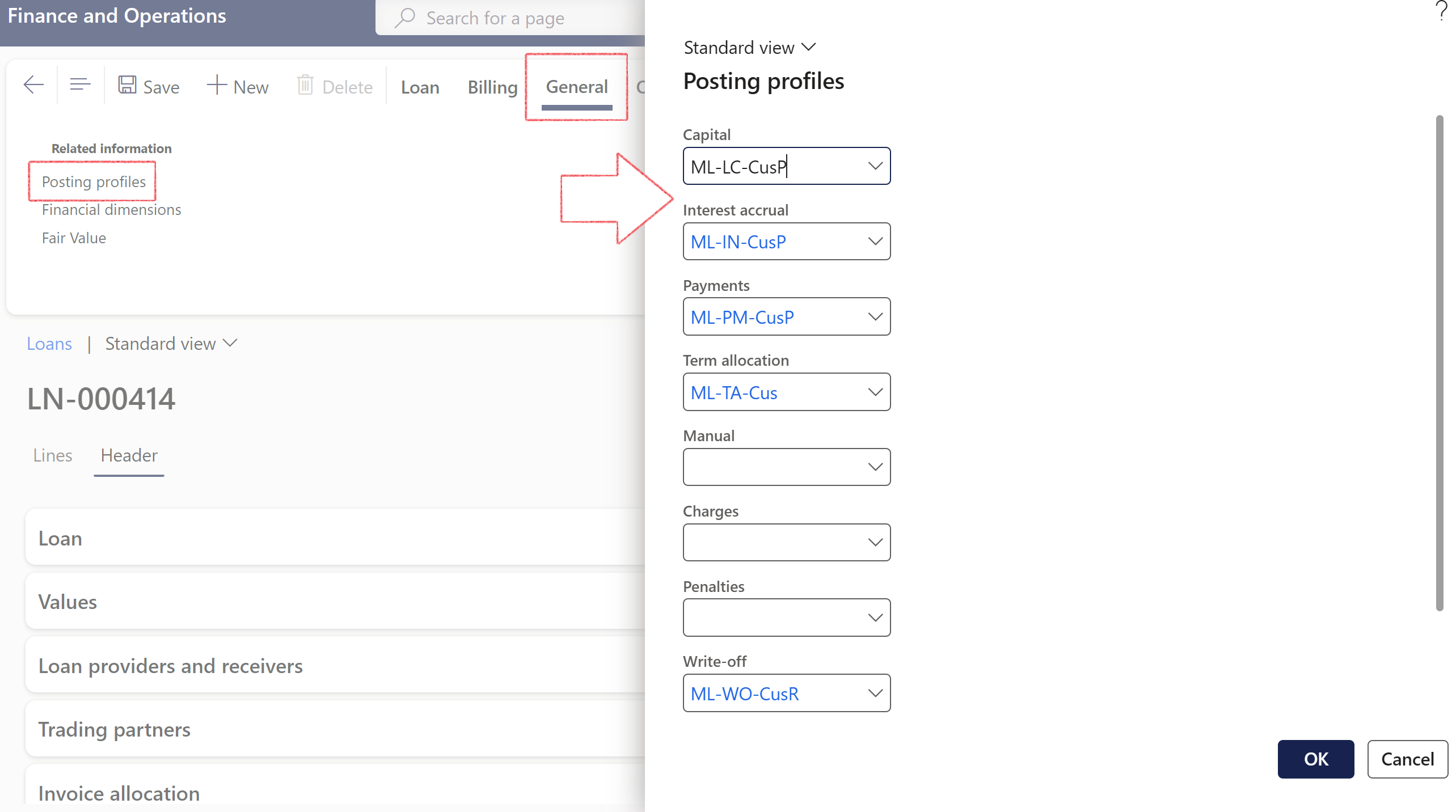

¶ Step 2.2: Loan group - Posting profiles FastTab

- Go to: Treasury > Loans > Setup for loans > Loan groups

- Expand the Posting profiles FastTab, and select the following Posting profiles:

- Capital (mandatory)

- Interest accrual (mandatory)

- Payments (mandatory)

- Term allocation (mandatory)

- Manual

- Charges

- Penalties

- Write-off

- Refund

- Transfer

- ECL account type (Expected Credit Loss)

- Expected credit loss (if Ledger is account type, select ledger account)

¶

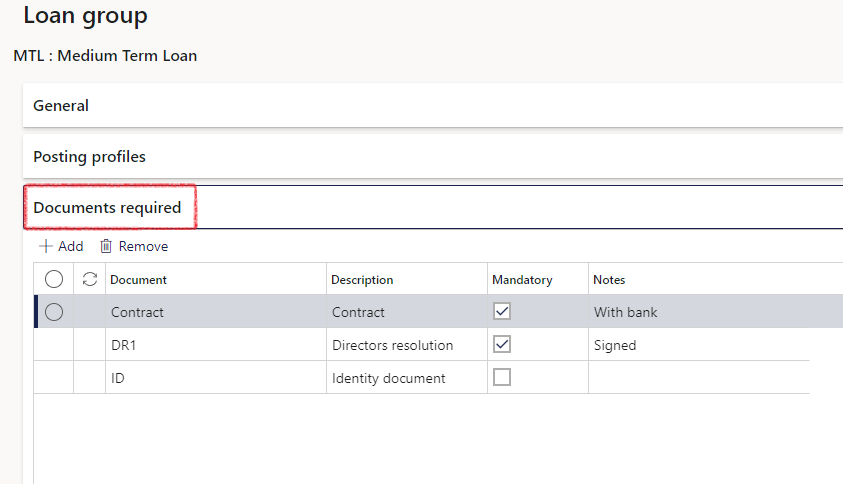

Step 2.3: Loan group - Documents required FastTab

- Go to: Treasury > Loans > Setup for loans > Loan groups

- Expand the Documents required FastTab

- Click on the Add button

- Enter a value in the Document field

- Type a Description

- Specify whether the documents required are mandatory or not

- If required, add more Notes

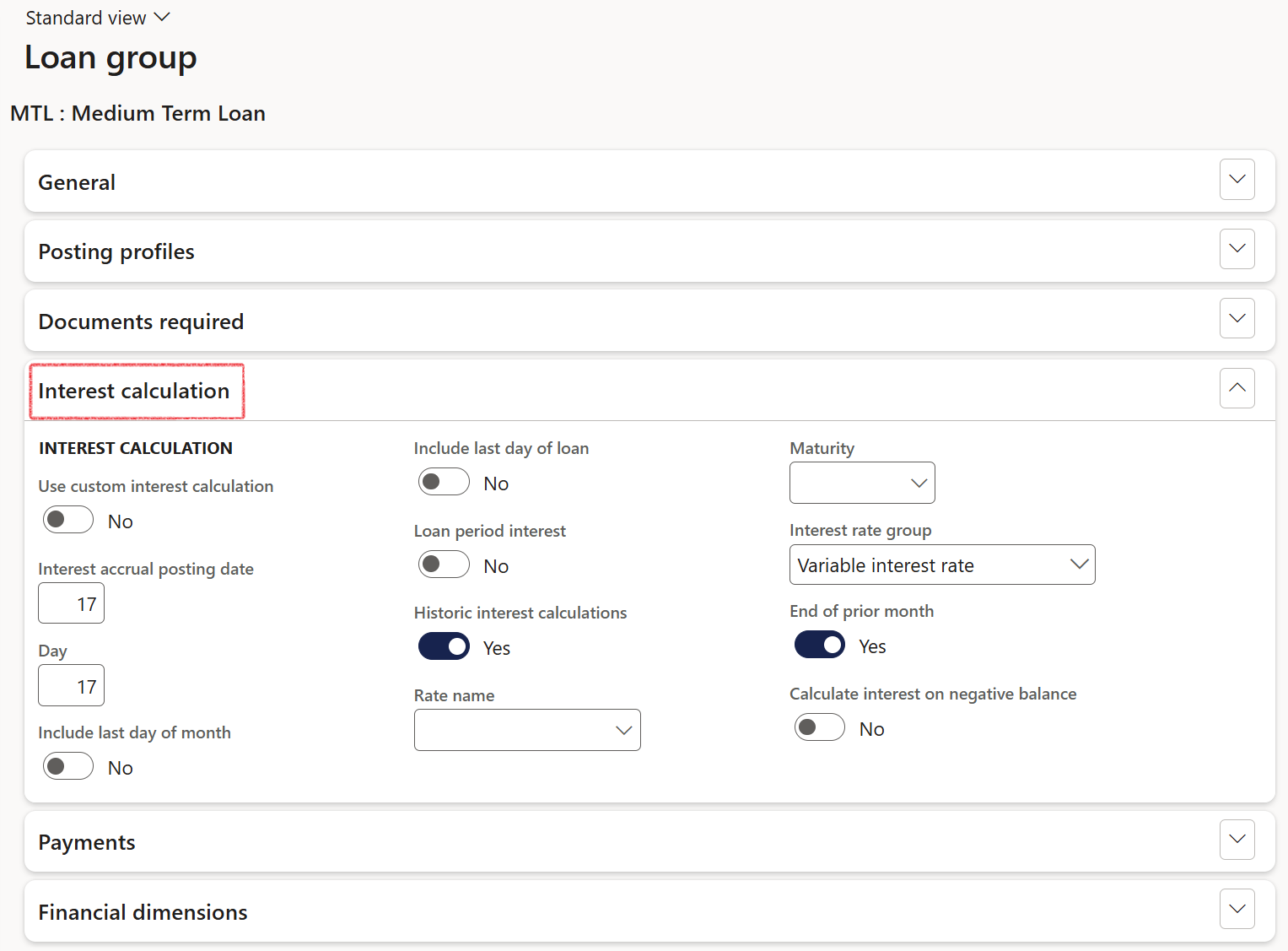

¶ Step 2.4: Loan group - Interest calculation FastTab

- Go to: Treasury > Loans > Setup for loans > Loan groups

- Expand the Interest calculation FastTab

- Set Use custom interest calculation to Yes, with a specific date of the month selection, to let the system use the balance on a specific date, to determine the interest for the month for all loans linked to these loan groups.

Capital repayments can be separate from the interest repayments, so there can be two separate cycles: I.e.: Interest repayment can be monthly and Capital repayment can be yearly.

- Interest accrual posting date: the date entered in this box, will default as a transaction date when running the interest accrual creation periodic job.

- Include last day of the month: Includes the night of the 31st as part of the number of days calculation for the first month of a loan.

- Include last day of loan: When the toggle is set to Yes , it will consider the end date of the loan as a date for Interest calculation. When it is set to No, it will exclude the last day of the loan.

If the Include last day of the month setting is set to No, loans with a start date on the last day of the month are excluded from the Period Interest Inquiry report. If the setting is set to Yes, those loans are included in the report.

- Loan period interest : When the toggle is set to Yes, it will do a single calculation and display of interest at the end of the loan period.

When the Loan period interest toggle is set to No, it will calculate and display interest on every payment date during a period. - When the Historic interest calculations are set to Yes, it will calculate the projected statement as normal historic interest.

When the Historic interest calculations are set to No, it will calculate only from the current month - A loan group can be linked to a Rate name .

This field is already present in TMS and used in the Interest trade agreement . Users can select either a Fixed or Variable interest rate group.

When creating a new loan and selecting a Loan group that has a Rate name linked to it, the corresponding interest rate will be automatically populated to the newly created loan’s Interest agreement FastTab.

In this scenario, users will not be able to modify or alter the interest rate. Any changes to the interest rate will need to be made from the Interest rate table and cannot be done directly via the loan. - Setting the End of prior month toggle to Yes will calculate interest on the principal balance at the end of the prior period.

- Calculate interest on negative balance should be set to No by default.

When a Rate name and Maturity are chosen for a Loan group, all active loans in that Loan group will have this rate as their single interest rate. All active and new loans for a loan group will derive their interest rate from this table. When creating a loan directly from the loan details form, and selecting a loan group with a rate name, the interest rate will be locked for editing.

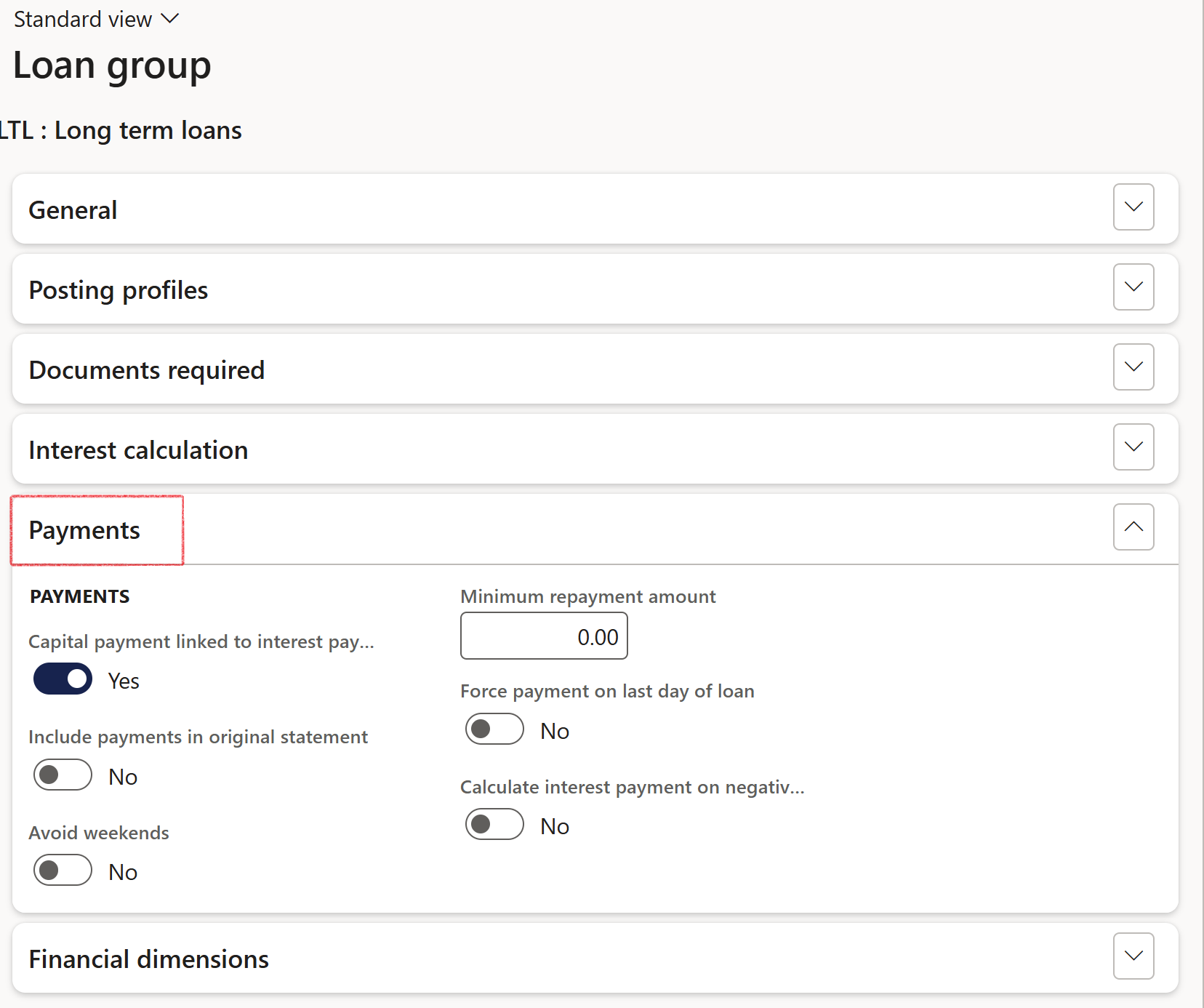

¶ Step 2.5: Loan group - Payments FastTab

- Go to: Treasury >Loans > Setup for loans > Loan groups

- Expand the Payments FastTab

- The Capital payment linked to interest payment slider can be set to Yes / No

- Select Yes / No to Include payments in original statement

- If the end date falls over a weekend, the user can setup the loan group to avoid weekends by sliding the Avoid weekends slider to Yes . So, when a payment is due on a weekend, it will be moved to the Friday before the weekend.

- Enter a minimum repayment amount for this specific loan group (if required)

- Force payment on last day of loan - Yes / No slider

- Calculate interest payment on negative balance - Yes / No slider

- When the Calculate interest payment on negative balance field is set to Yes, the system will continue to calculate interest even when the loan balance is negative. In such cases, the interest amount will be displayed as a negative value (with a minus sign) in the Monthly interest accrual column of the Projected Loan Statement.

If the user changes the loan type at any time, the end date will be recalculated based on the settings of the selected loan type or group. This applies to both imported loans and manually created loans.

When Minimum repayment amount is filled in on a specific loan group, this value will be used by the system for the instalment recalculation in the event of a standard recalculated amount being less. This will apply to the Original and Projected loan statements. This could result in the loan being settled earlier than the original end date on the Interest agreement.

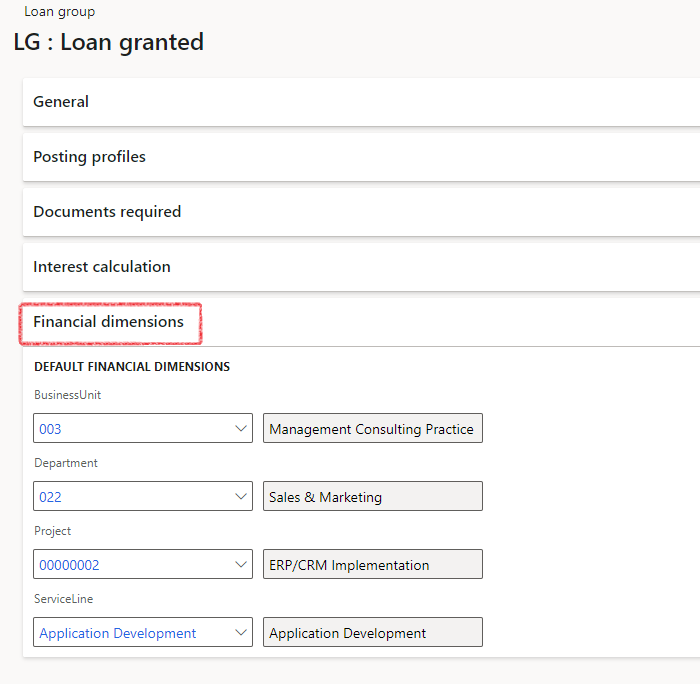

¶ Step 2.6: Loan group - Financial dimensions FastTab

- Go to: Treasury > Loans > Setup for loans > Loan groups

- Expand the Financial dimensions FastTab

- Select the Default Financial Dimensions on this specific loan group

The loan groups dimensions will default to the Loan dimensions on creation of the loan

Financial dimensions are applicable to Imported loans as well as manually created loans

¶

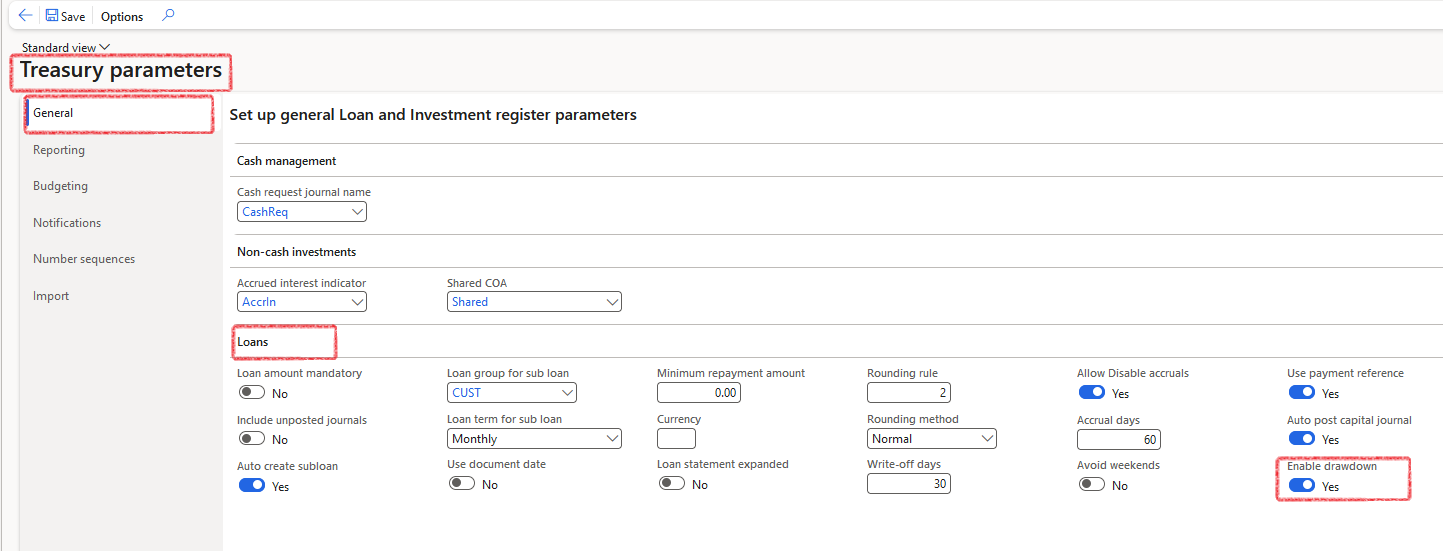

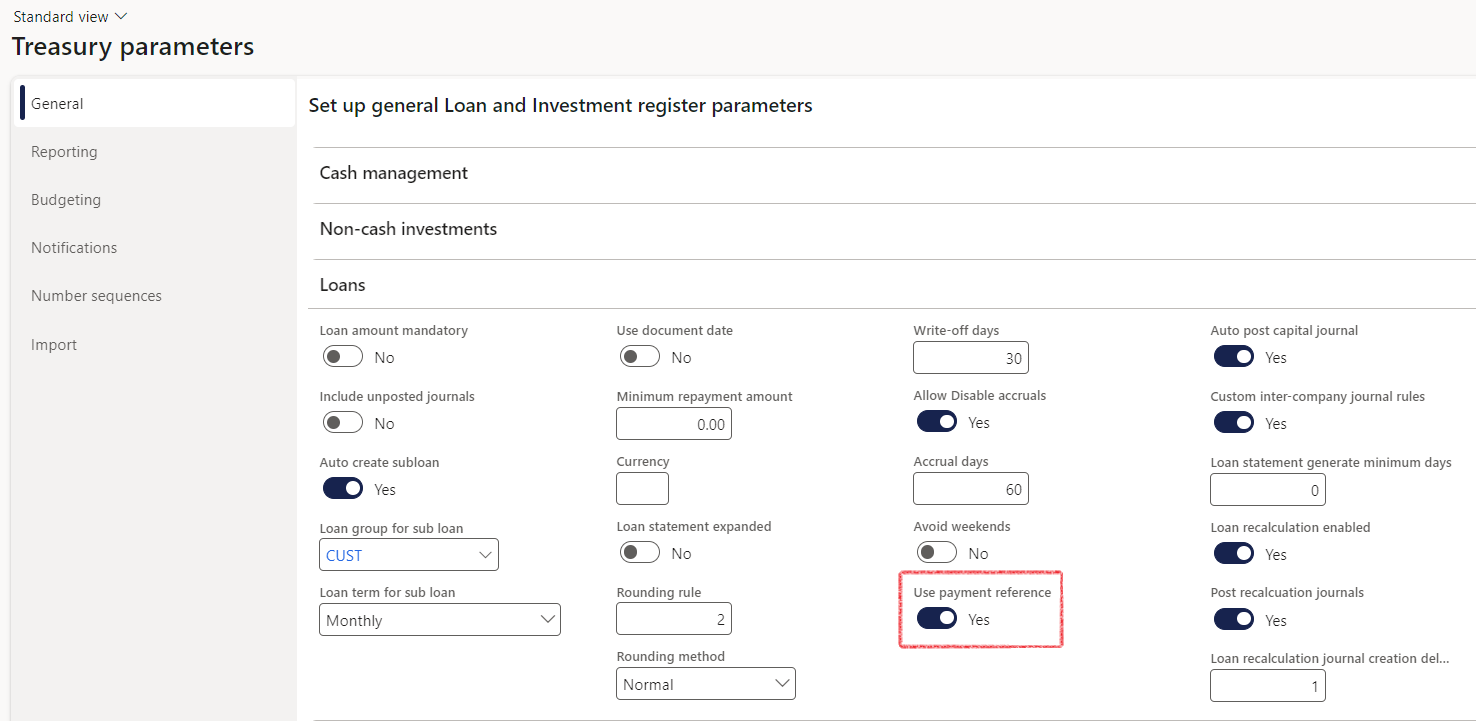

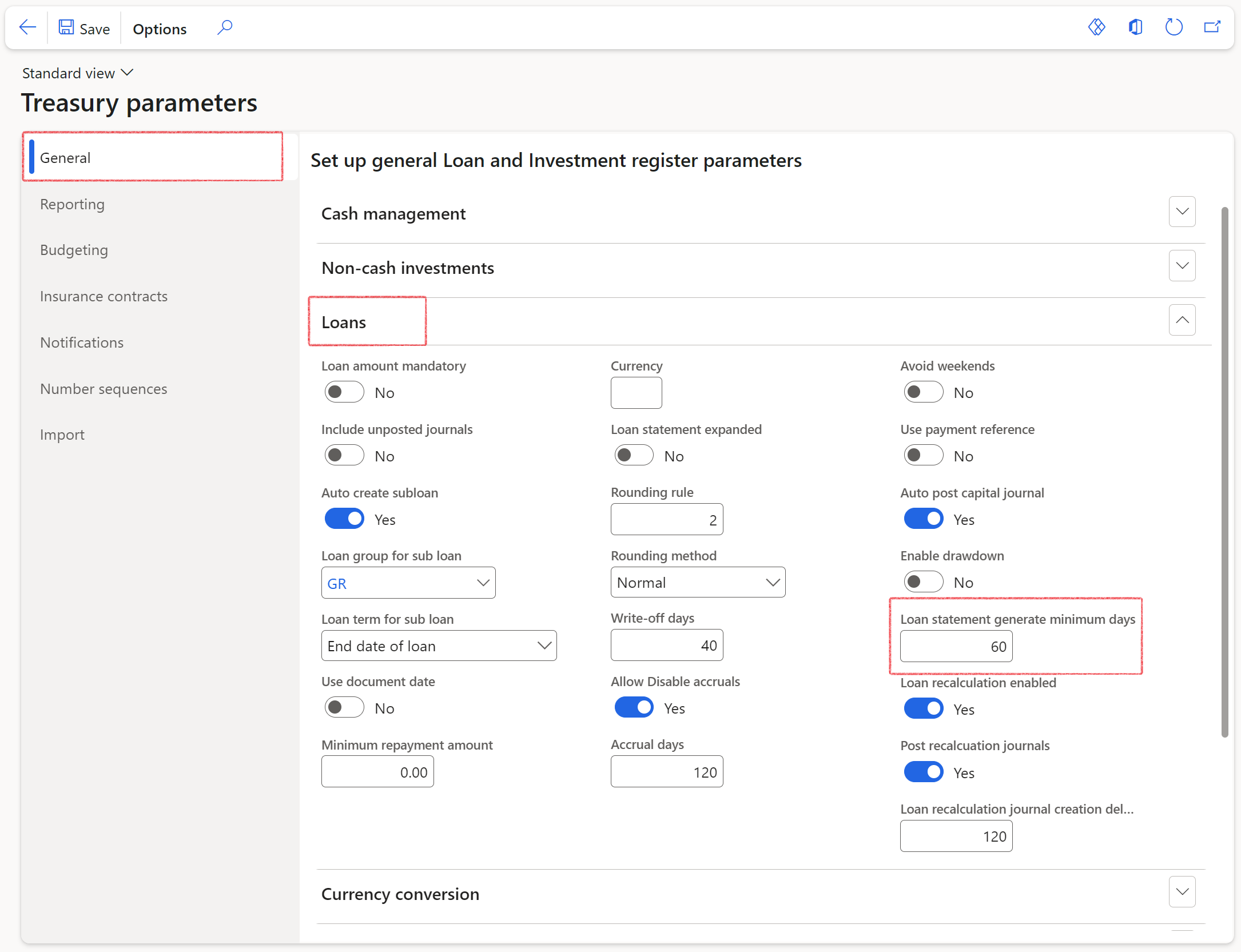

Step 3: Treasury parameters

Treasury parameters cover the setup of general loan and investment parameters.

The following setups will be loan specific:

¶ Step 3.1: Treasury parameters - General Tab - Loans FastTab

The following parameters can be set up for loans under the General Tab, Loans FastTab:

- Loan amount mandatory

- Include unposted journals

- Auto create subloan

- Loan group for subloan

- Interest payment terms for subloan

- Use document date

- Minimum repayment amount

- Currency

- Loan statement expanded

- Rounding rule

- Rounding method

- Write-off days

- Allow Disable accruals

- Accrual days

- Avoid weekends

- Use payment reference

- Auto post capital journal

- Enable drawdown

- Loan statement generate minimum days

- Intercompany loan group

- Prevent duplicate interest journals

- Loan recalculation enabled

- Post recalculation journals

- Loan recalculation journal creation delay

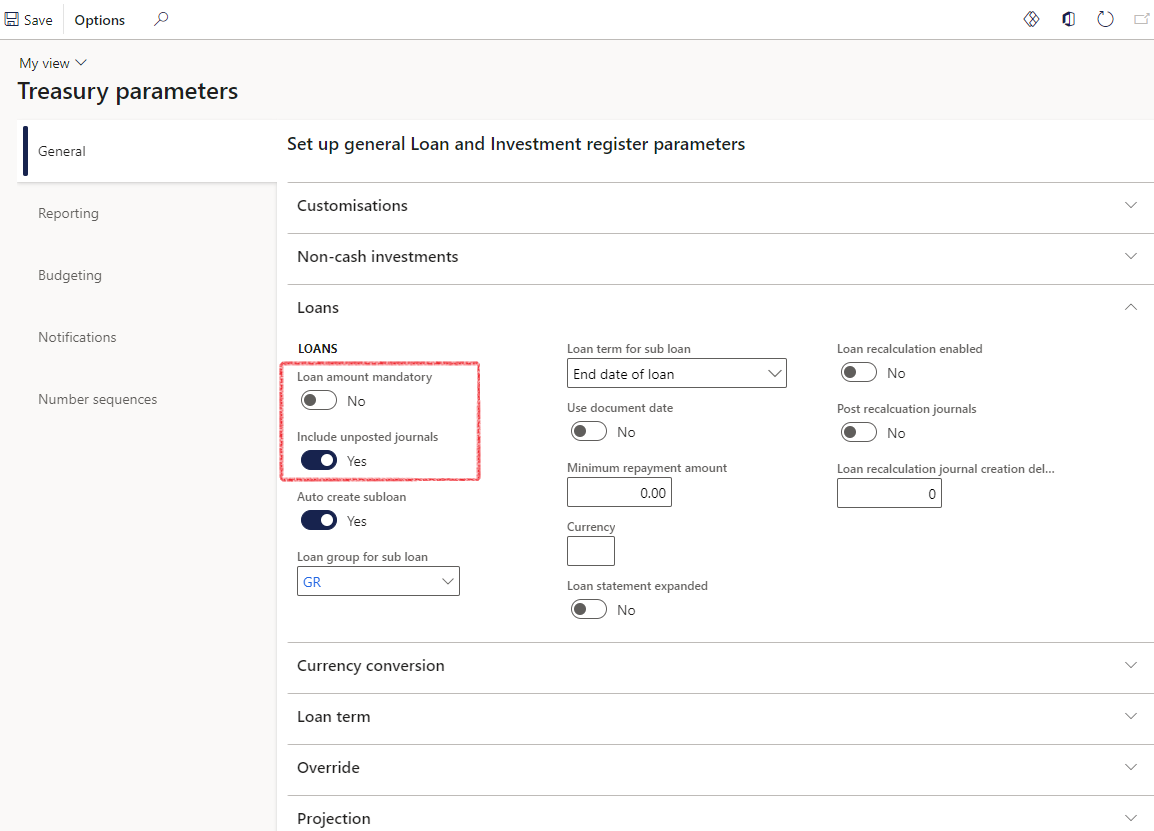

¶ Step 3.1.1: Loan amount mandatory

On the General tab for Treasury Parameters setup, there are options to make the loan amount mandatory

- In the navigation pane, go to: Modules > Treasury > Setup > Treasury parameters

- On the General Tab on the left-hand side, go to the Loans FastTab and select yes / no on the slider to make the loan amount mandatory

- If yes, then the loan amount should be more than zero.

¶

Step 3.1.2: Include unposted journals

- Setting this slider to Yes will include unposted journals in the Loan statements, as if it was posted.

- If unposted journals should be included in the creation of loan statements, change the Include unposted journals slider to Yes

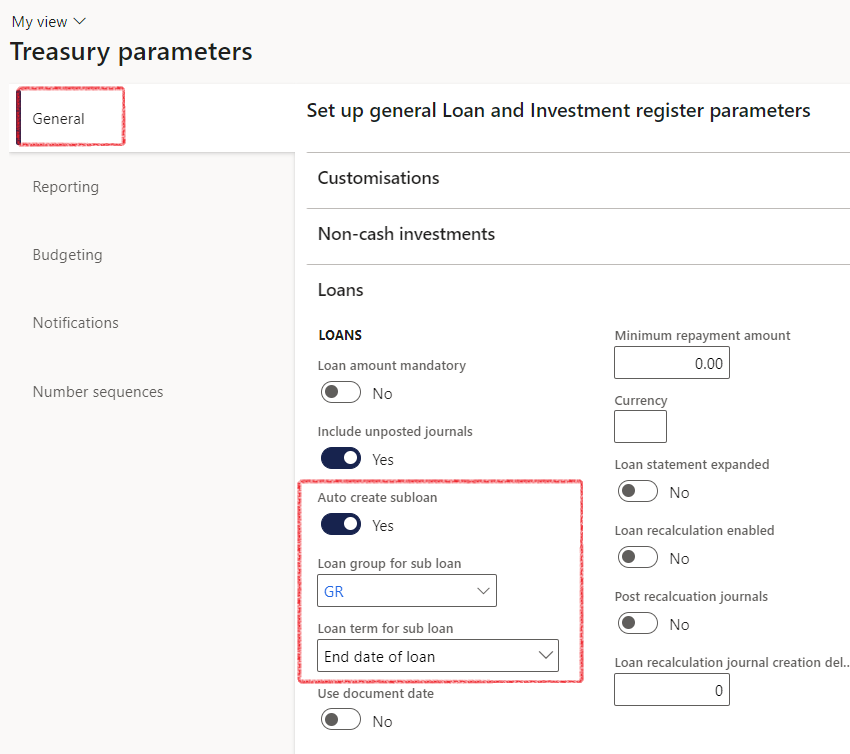

¶ Step 3.1.3: Auto create subloan

To set up the Automatic creation of a subloan when creating a Combination Loan,

- Go to: Treasury > Setup >Treasury parameters

- On the General FastTab on the left-hand side, expand the Loans FastTab and select yes / no on the slider to Auto create subloan

- If Yes, also select the Loan group for subloan from a drop-down list

It is very important to select the relevant Interest payment terms for subloan from the drop-down list, in accordance with the Loan group rules for payment terms. For example, a Revolving loan will have End date of loan or None Payment terms.

- The subloan can inherit specific financial dimensions from the header loan (for instance Loan receiver financial dimension and Loan ID financial dimension)

¶

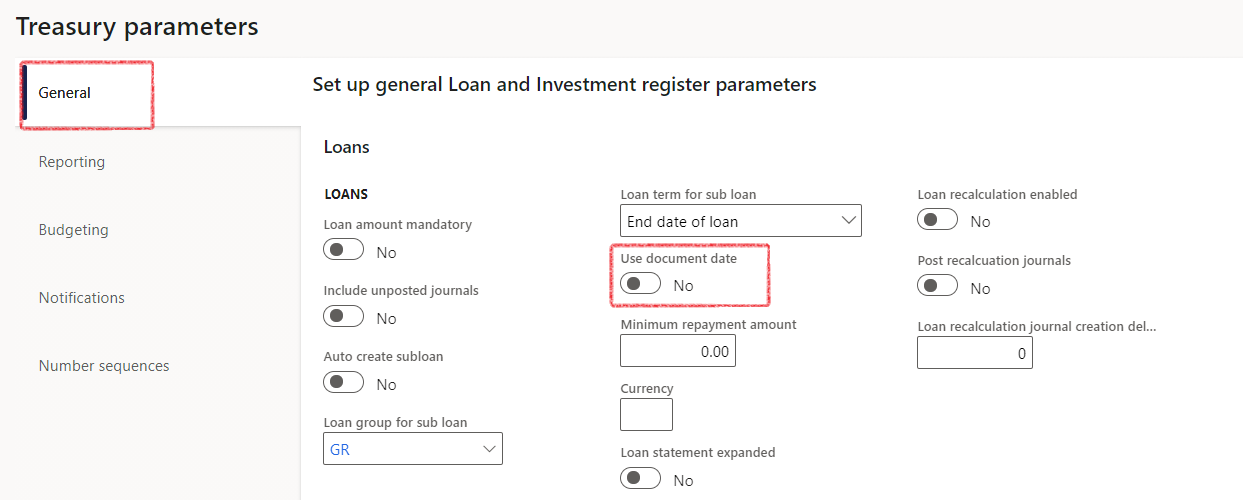

Step 3.1.4: Use document date

When document date is enabled on Treasury parameters, the document date will be mandatory on all loan transactions. The document date represents the actual transaction date, and the normal Date is always the current date.

- In the navigation pane, go to: Modules > Treasury > Setup > Treasury parameters

- Open the General tab

- Expand the Loans FastTab

- Change the slider Use document date to Yes

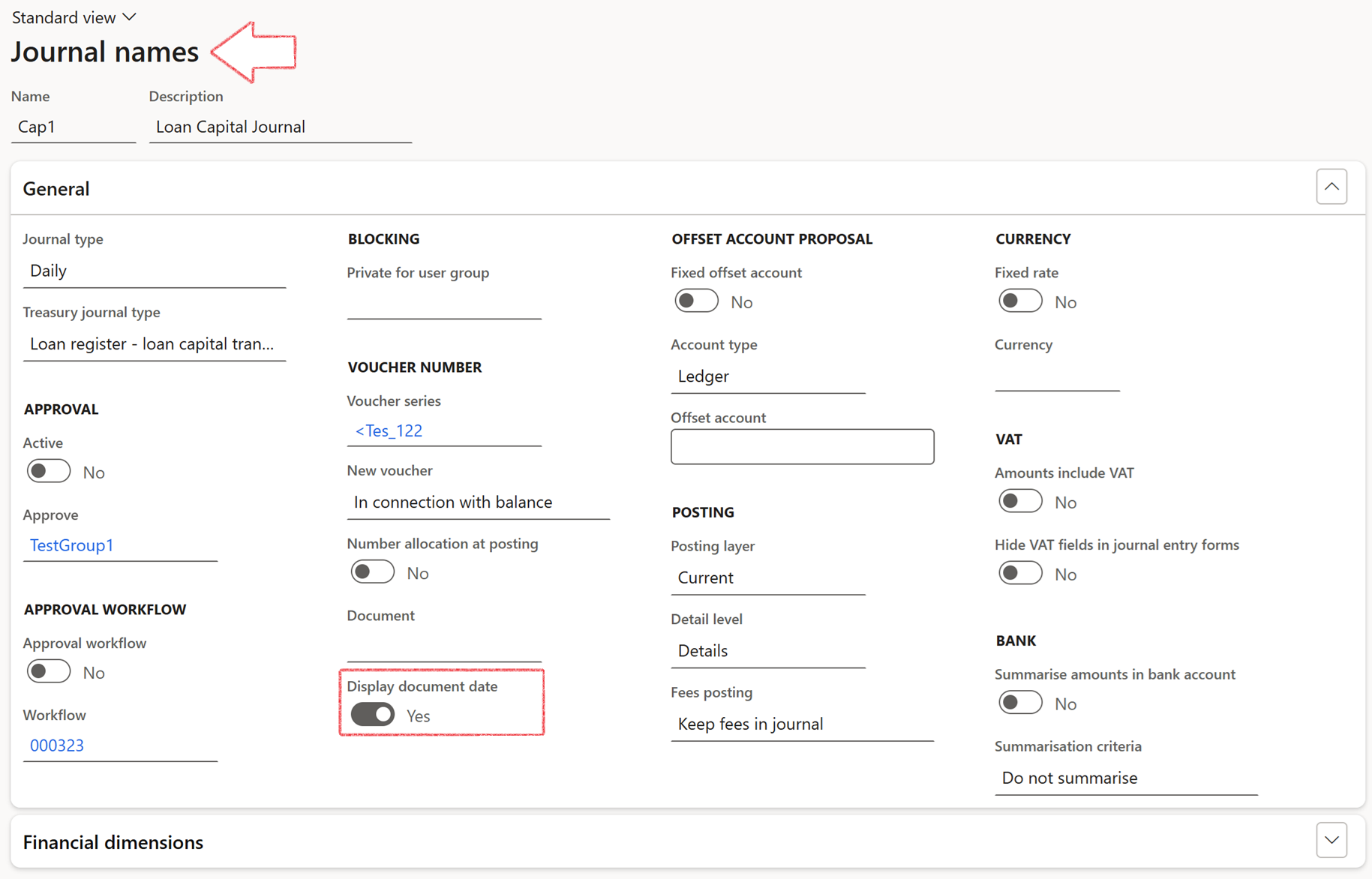

Remember to also configure the Journal names form where you want to display the Document date field.

- To display the Document date field on all journals, go to Setup>Journal names, select the journal. Click on edit and expand the General FastTab.

- Slide the toggle to Yes to Display document date

¶ Step 3.1.5: Loan recalculation enabled

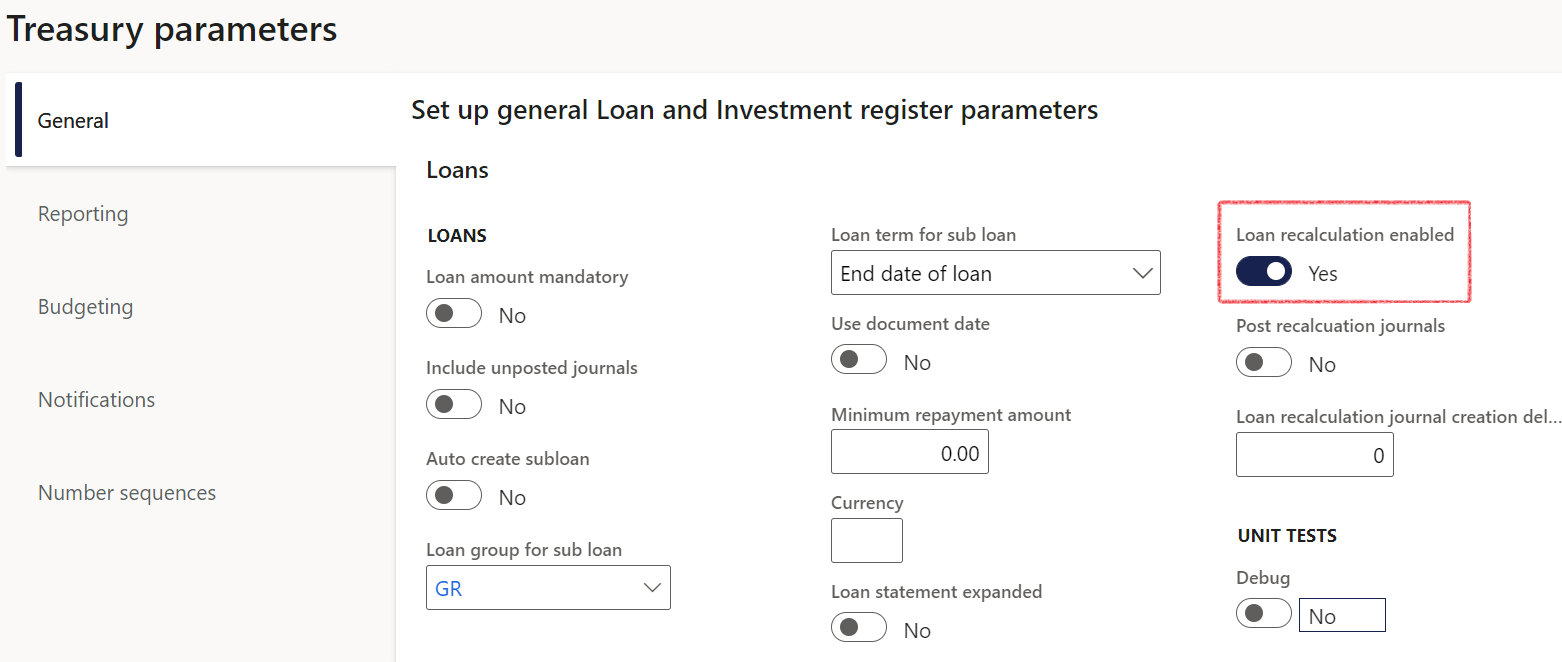

To enable loan recalculations on loans,

- Go to: Treasury > Setup > Treasury parameters

- On the General tab, expand the Loans FastTab

- Slide the Loan recalculation enabled toggle to Yes

There is also the option to automatically Post the recalculation journals

¶ Step 3.1.6: Auto post capital journals

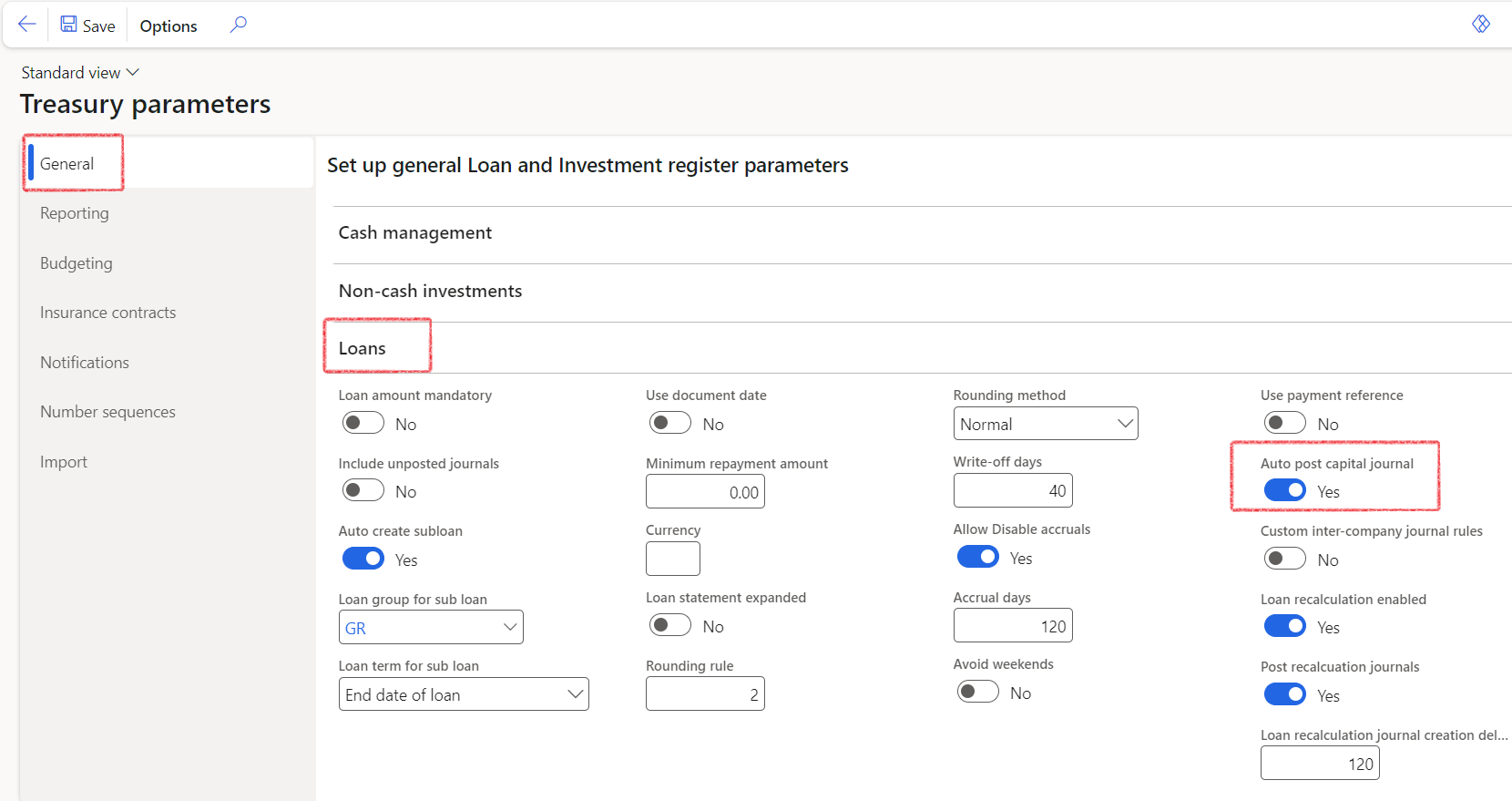

To enable the automatic posting of Loan capital journals,

- Go to: Treasury > Setup > Treasury parameters

- On the General tab, expand the Loans FastTab

- Slide the Auto post capital journal toggle to Yes

Upon creating a loan with a specified loan amount, an associated interest agreement, and a relevant capital posting profile, the system will automatically generate and post a Capital journal

¶ Step 3.1.7: Rounding

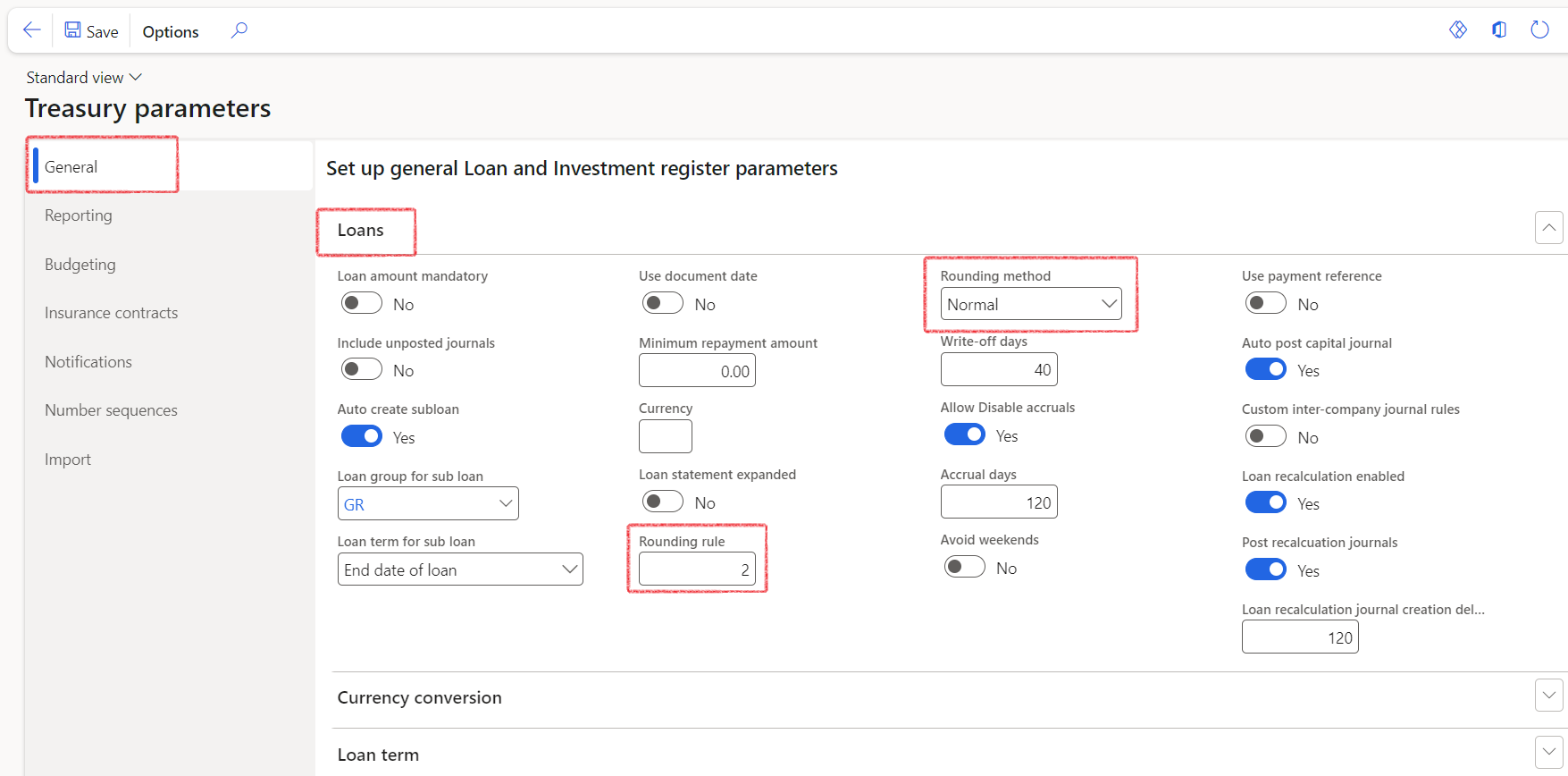

The rounding functionality allows users to apply different rounding conventions based on their preferences. With this feature, users can select the rounding method that applies to the round-off unit that is entered in the Rounding rule field.

These setup changes will then reflect on the Loan statements, once the Loan statement is generated.

- Go to: Treasury > Setup > Treasury parameters

- On the General tab, expand the Loans FastTab

- Enter a value in the Rounding rule field.

- Select a Rounding method from the drop-down list.

- Users can choose the Normal option to round up numbers 5 and higher, while rounding down numbers less than 5.

- Alternatively, they can select the Downward option to round down all numbers, or

- Choose Rounding-up to round up all numbers.

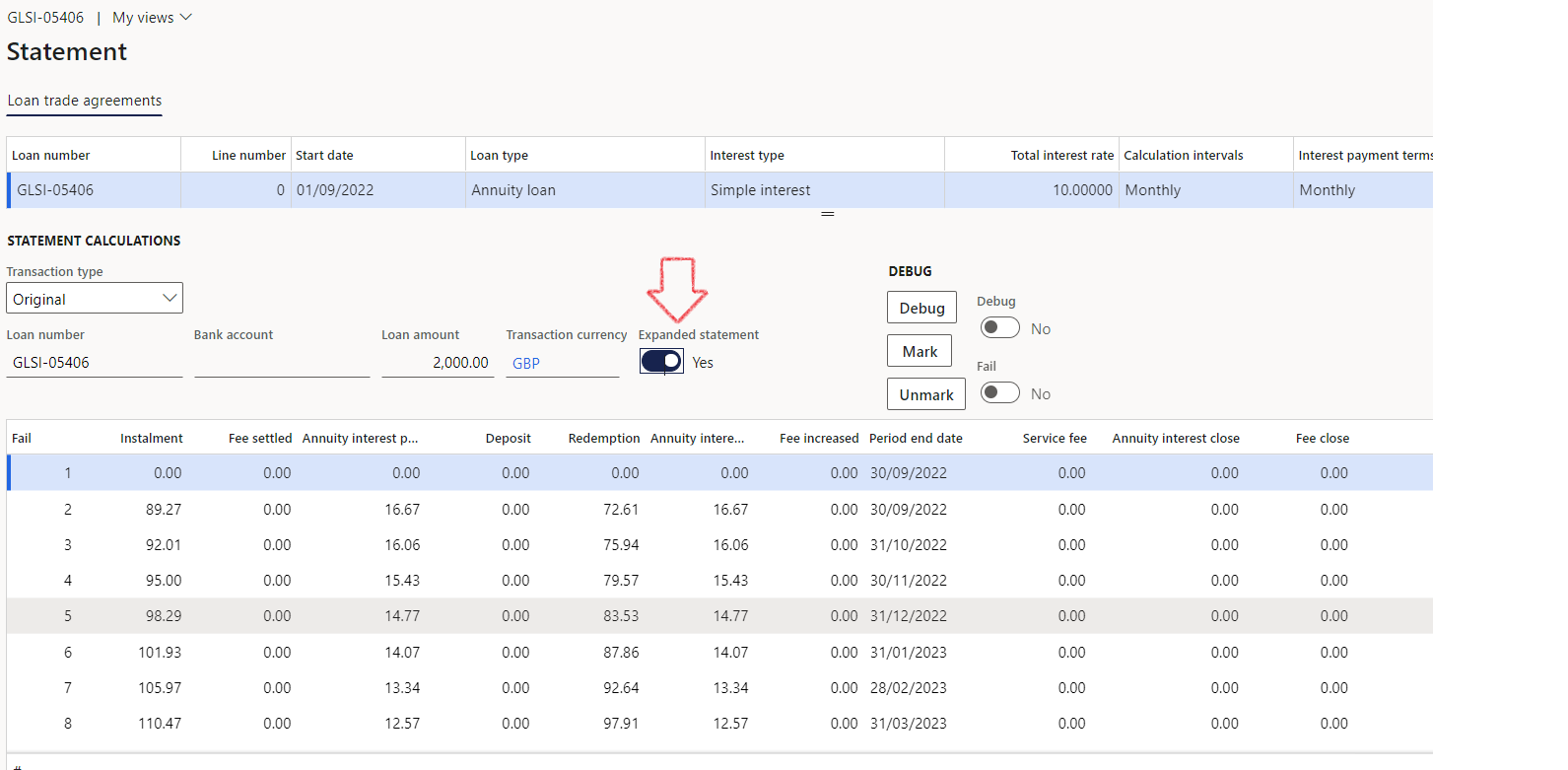

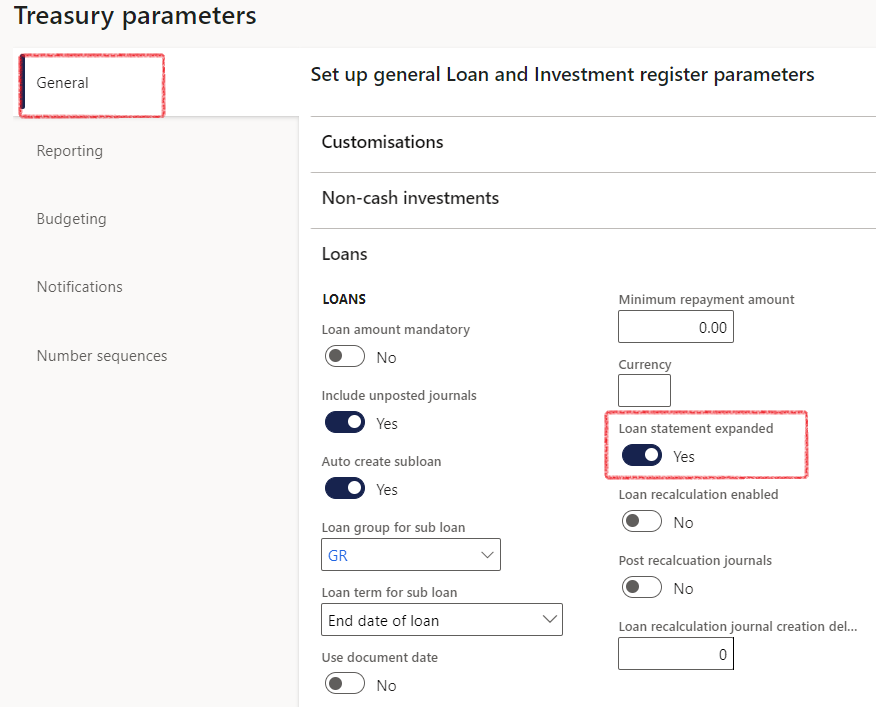

¶ Step 3.1.8: Loan statement expanded

When the Loan statement expanded toggle is slide to Yes on Treasury parameters, the Loan statement will by default open in expanded mode. The statement will have additional fields to show a more detailed breakdown of the Loan balance and the individual transactions. To setup this parameter, go to:

- Treasury > Setup > Treasury parameters

- On the General FastTab on the left-hand side, expand the Loans FastTab

- Change the Loan statement expanded slider to Yes

- Alternatively, the loan statement can be expanded on the Statement itself, by sliding the Expanded statement toggle to Yes

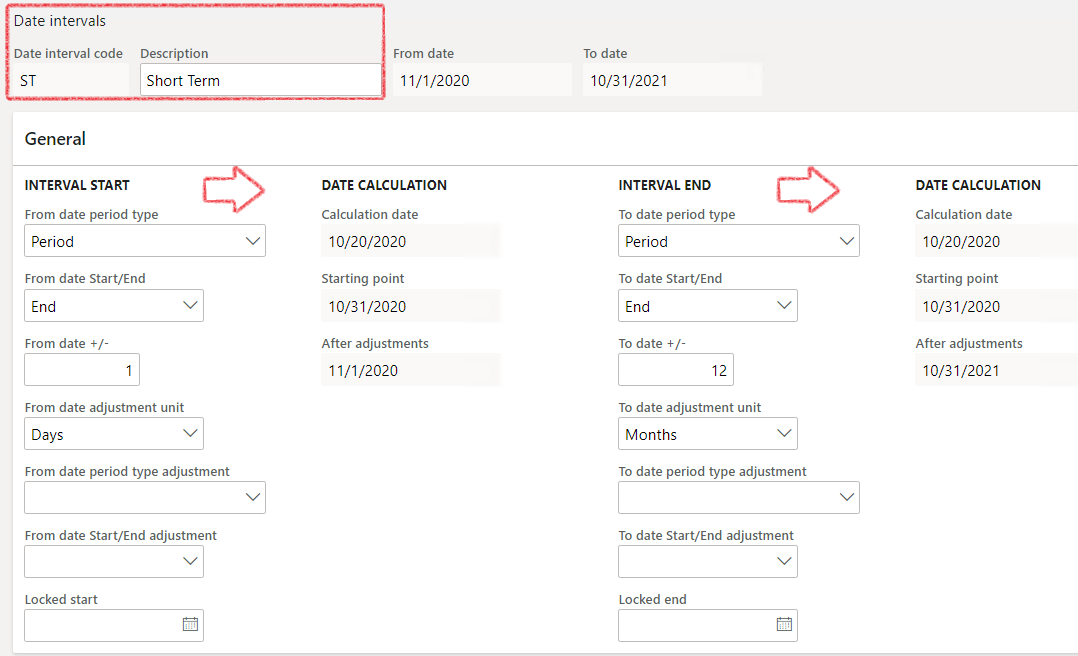

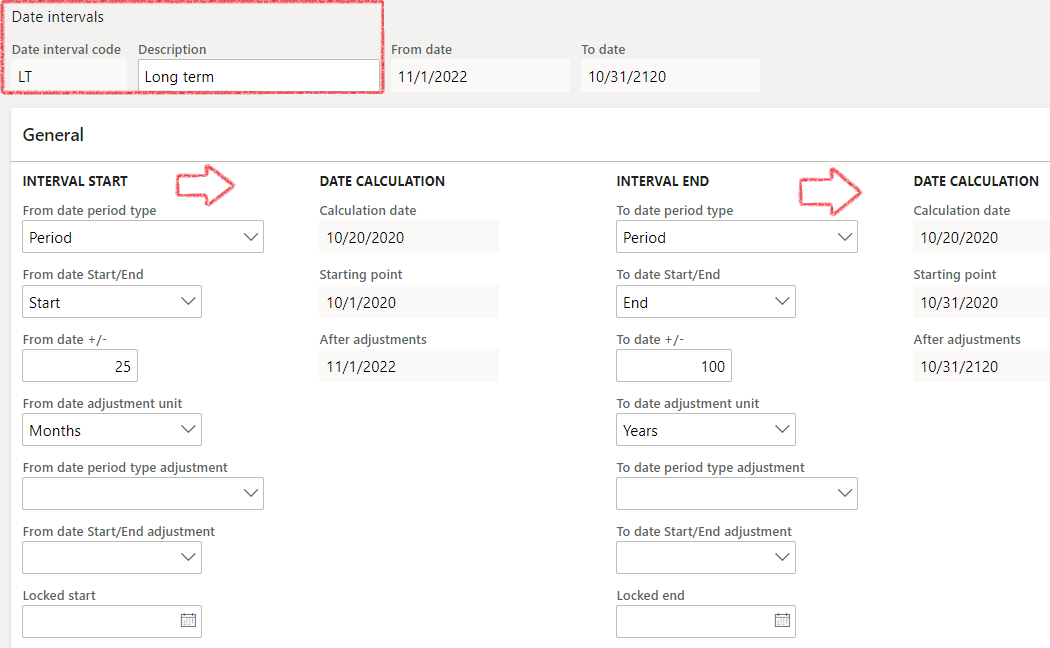

¶ Step 3.2: Treasury parameters - General Tab - Term

A term (loan term) is the period between when the loan is received and when the loan is fully paid. A short-term loan is usually paid within a year from getting the loan. Medium term loans are defined as loans with a repayment period between 2 and 5 years. Long term loans are usually repaid within 10 to 20 years.

- In the navigation pane, go to: Modules > Treasury > Setup > Treasury parameters

- On the General tab, expand the Term FastTab and create the loan terms for short term, medium term, and long-term loans.

- Date interval codes setup for Short-, Medium- and Long-term loans are done by navigating to: General Ledger>Ledger setup Date intervals

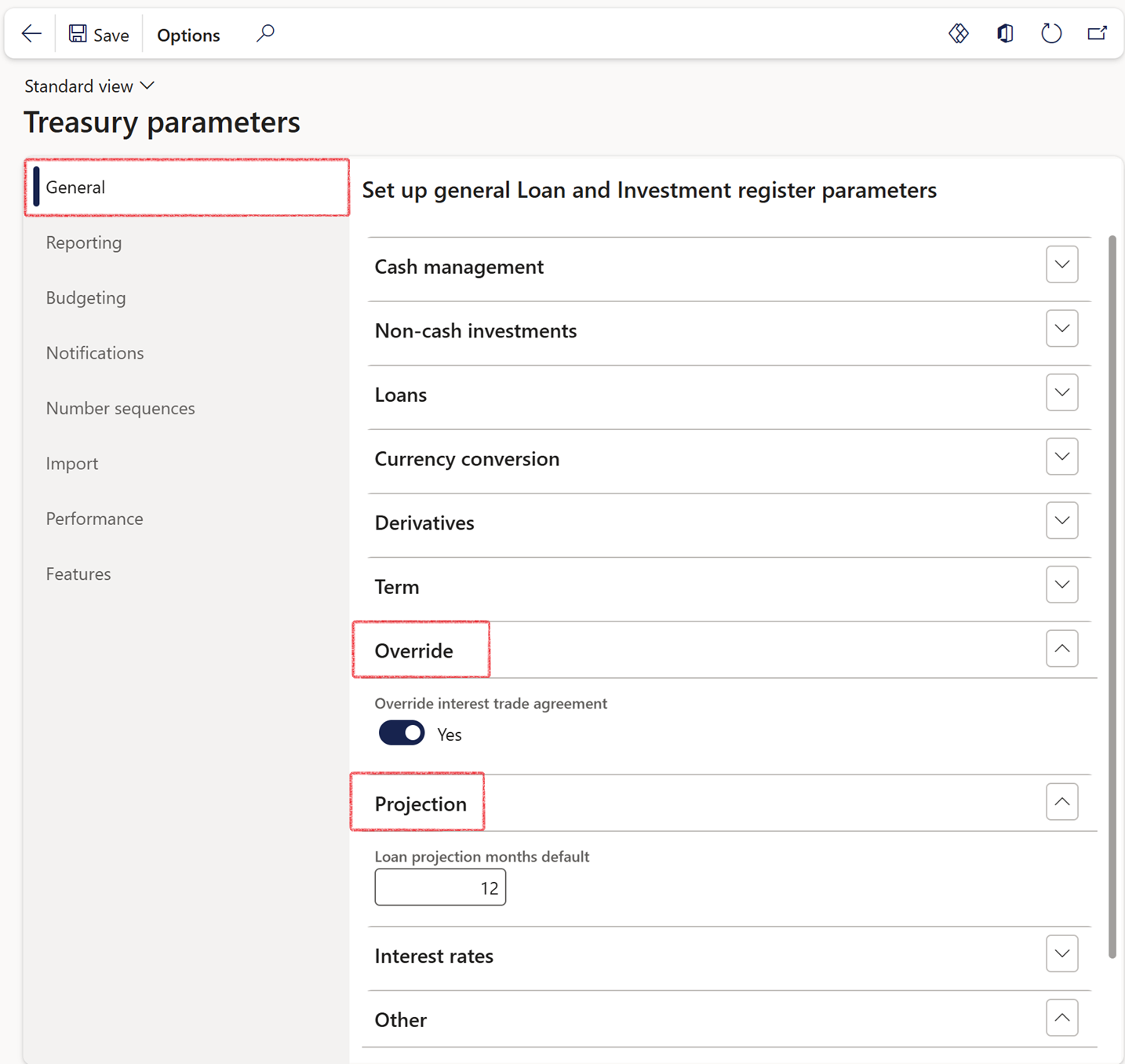

¶ Step 3.3: Treasury parameters - General Tab - Projection

Override interest trade agreement by sliding the toggle to Yes

Loan projection months will be the number of months for the loan to be Projected for on the Loan statement

- Enter the amount of months the Loan statement should project, if no end date was filled in on the Loan

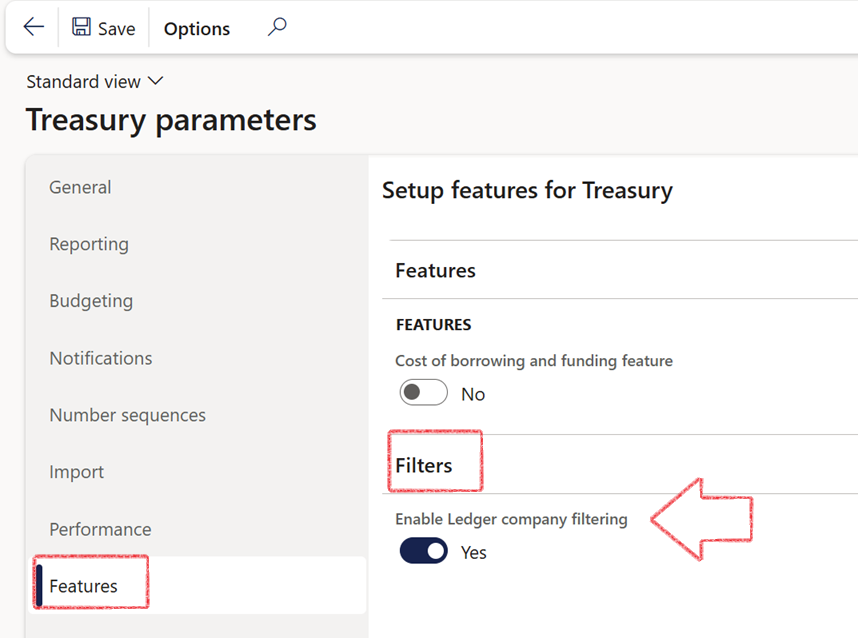

¶ Step 3.4: Treasury parameters - Features Tab - Filters

Enable ledger company filtering

- Navigate to Treasury > Setup > Tresury parameters

- On the Features tab, expand the Filters FastTab

- Set the Enable Ledger Company Filtering toggle to Yes

- When the Enable Ledger Company Filtering toggle is set to Yes, the Select companies filter becomes available on Loan Journal pages (Treasury > Loans > Journals), and the New button is hidden.

- When the Enable Ledger Company Filtering toggle is set to No , the Select companies filter is not shown on the Loan journal pages (Treasury > Loans > Journals), and the New button becomes available.

Regardless of this setting, the Select companies filter will not appear when navigating through Treasury > Loans > Loans and then opening the journals. On those pages, the New button is always available. Therefore, these pages are unaffected by the filter.

¶

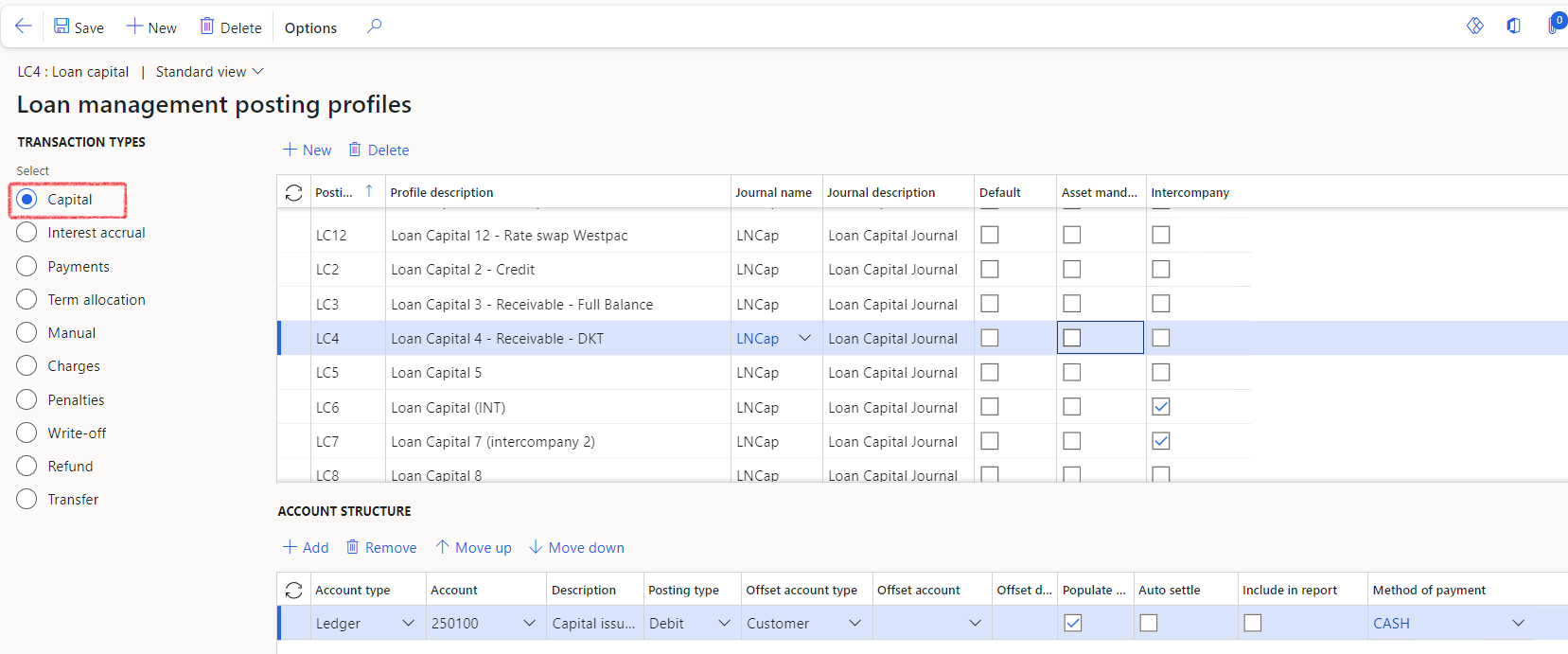

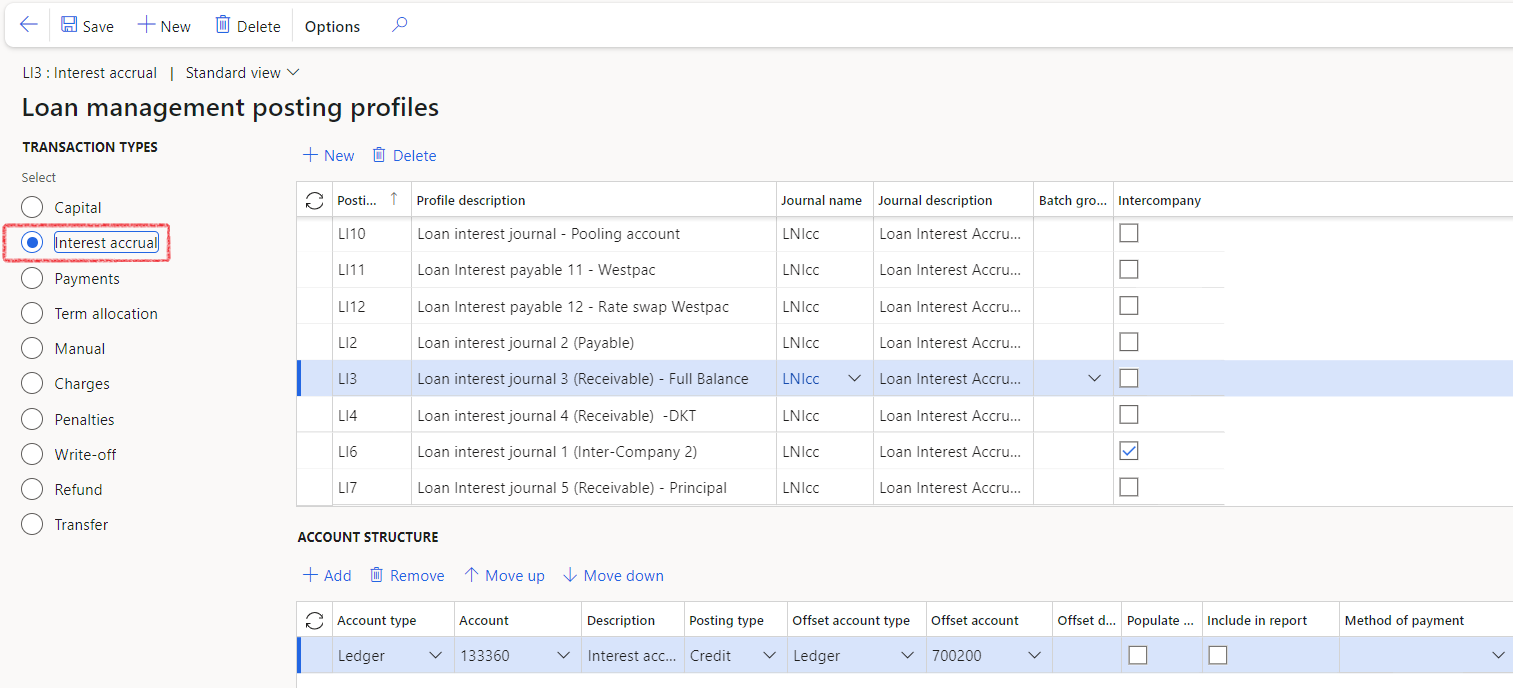

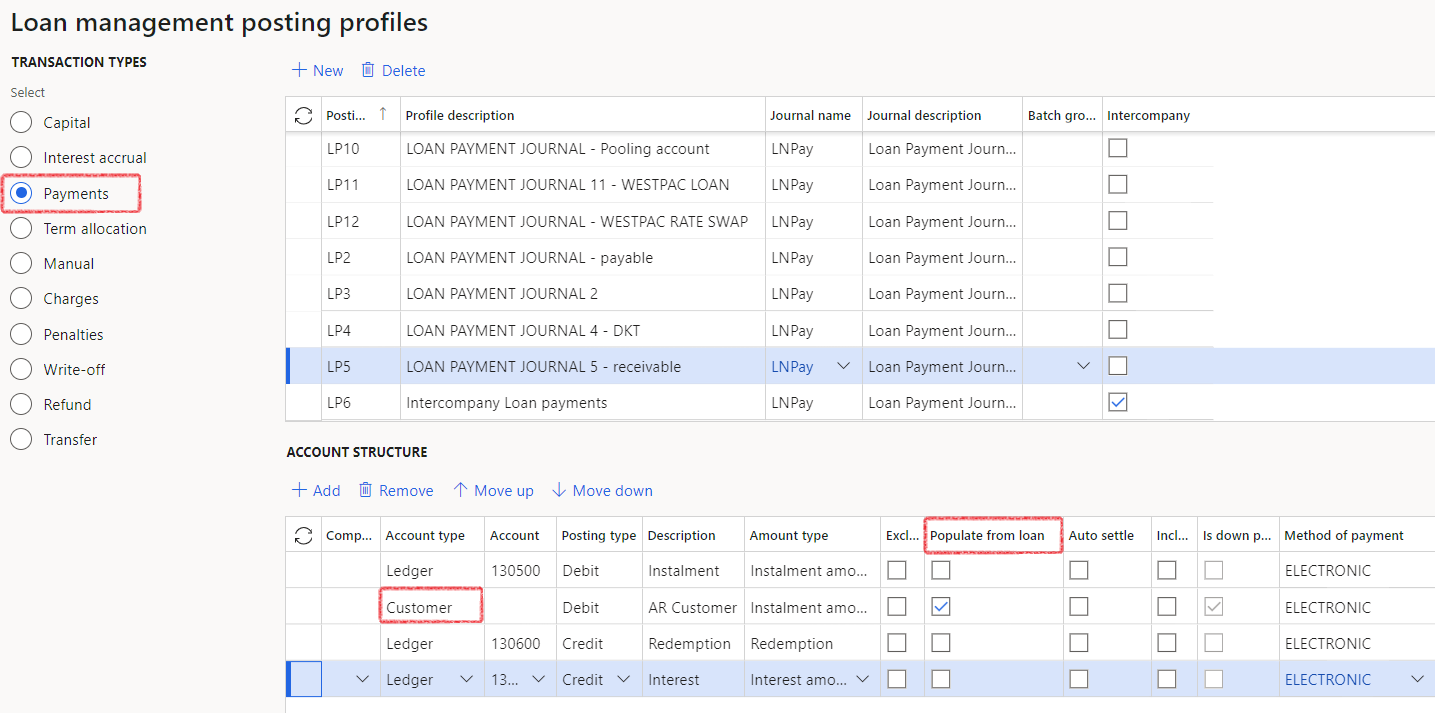

Step 4: Posting profiles

Posting profiles are the point of integration between the sub-ledger (fixed assets, accounts payable, inventory, banks, accounts receivable, TMS Treasury, etc.) and the general ledger. It is a set of main accounts that are used to generate the automatic ledger entry in which a transaction has occurred. In this scenario, it is used to post loan transactions. You can select different ledger accounts for each type of loan journal.

Posting profiles serve as a bridge between sub-ledgers and the general ledger. They ensure that transactions entered in the sub-ledgers are properly posted to the correct general ledger accounts and other accounting fields. By defining the default values for various accounting fields, posting profiles streamline the process of transferring transaction data from sub-ledgers to the general ledger. This integration is crucial for ensuring accurate financial reporting and analysis.

Posting profiles can be imported or exported, by using the data entity called Loan posting profiles. Alternatively, the posting profiles can be set up manually. For each loan journal type at least one posting profile must be set up. Additional posting profiles can be created when the same loan transactions for the same loan journal types need to be posted differently for a specific loan.

The main types of journals typically linked to loans, which can be anticipated and automatically created, include:

- Loan capital - raising of the capital principal amount

- Interest accrual - accrual of interest on capital outstanding

- Payments - periodic payments

Other types of journals for loans can also have posting profiles:

- Term Allocation - capital redemption amount for next 12 months

- Manual - manual transactions, additional capital movements

- Loan charges

- Loan penalties

- Write-off's

- Refunds

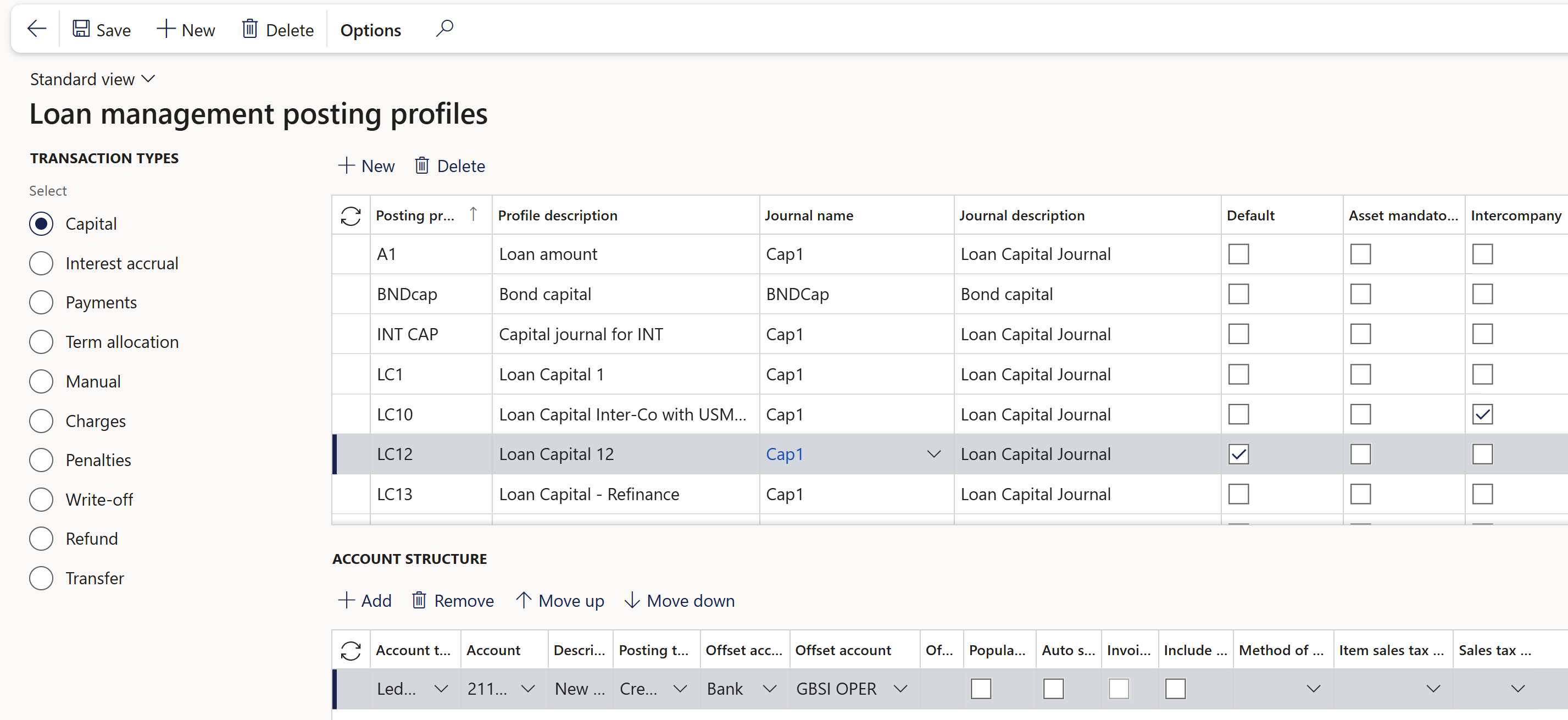

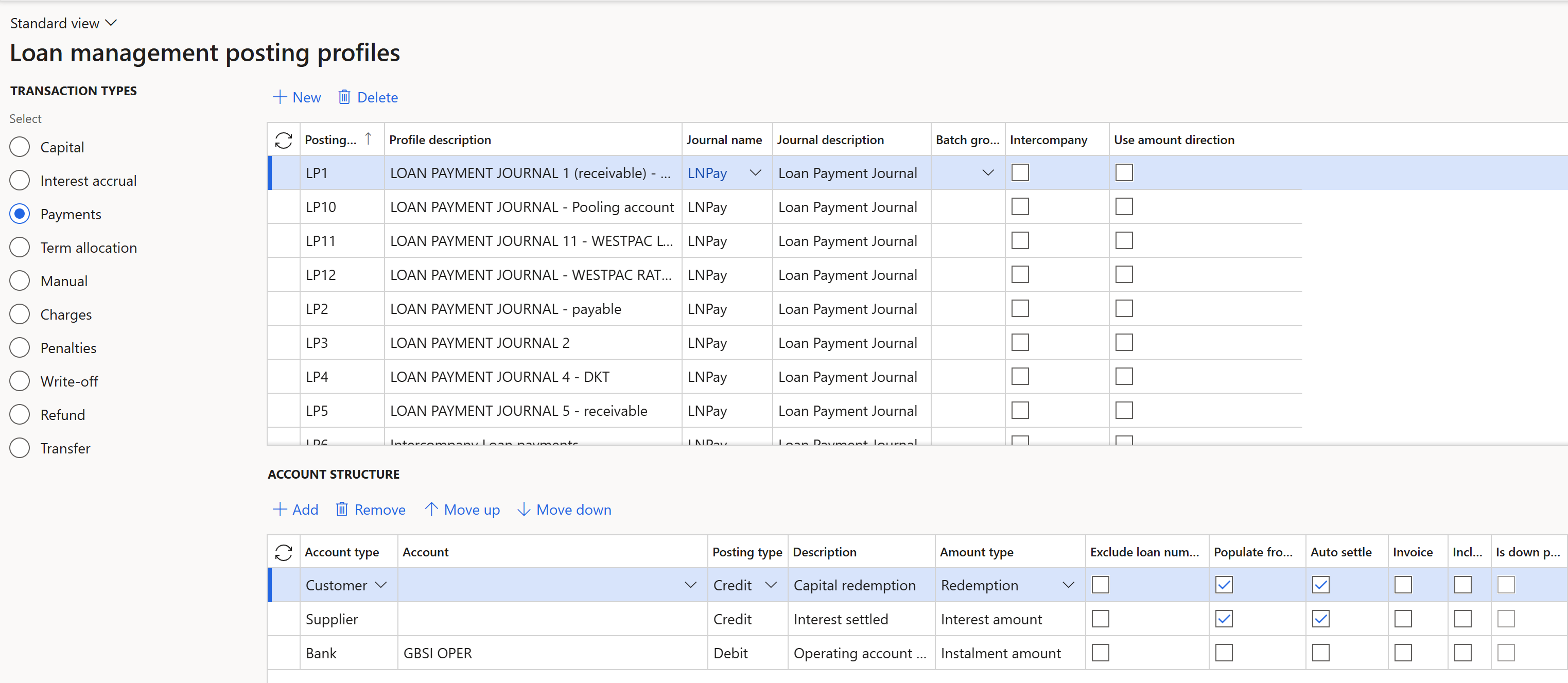

¶ Step 4.1: Set up Posting profiles for loans

- Go to: Treasury > Loans > Setup for loans > Posting profiles - Loans

- Select specific journal type on the left

- Create new posting profile by name and description, or view a list of current posting profiles

To create the Loan Capital Journal, the Treasury Journal Type must be connected to the Journal Name, and the Journal Name must, in turn, be linked to the Posting Profile.

¶

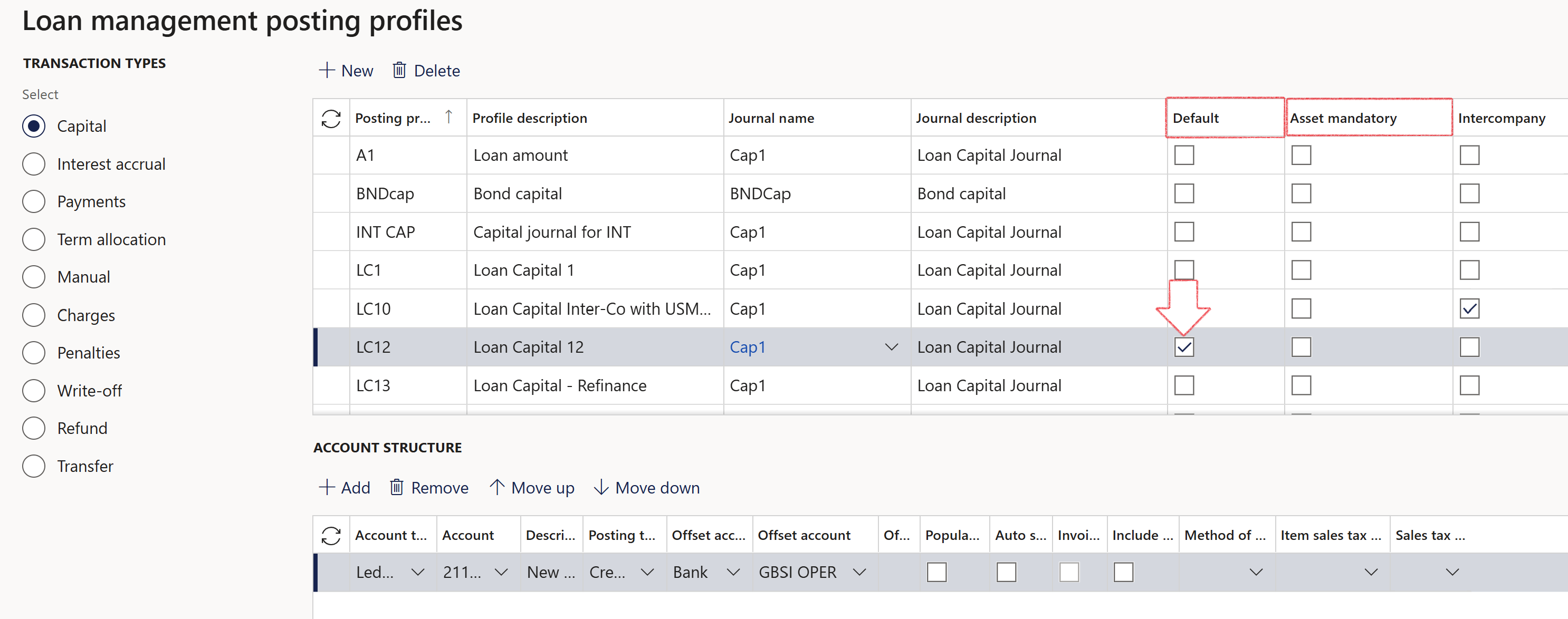

Step 4.1.1: Capital posting profile

For Capital and Allocation of Capital journals, a default posting profile can be selected. If no posting profile is selected in the loan details, the default Capital posting profile will be applied.

The Asset Mandatory option will require a fixed asset to be linked to the loan.

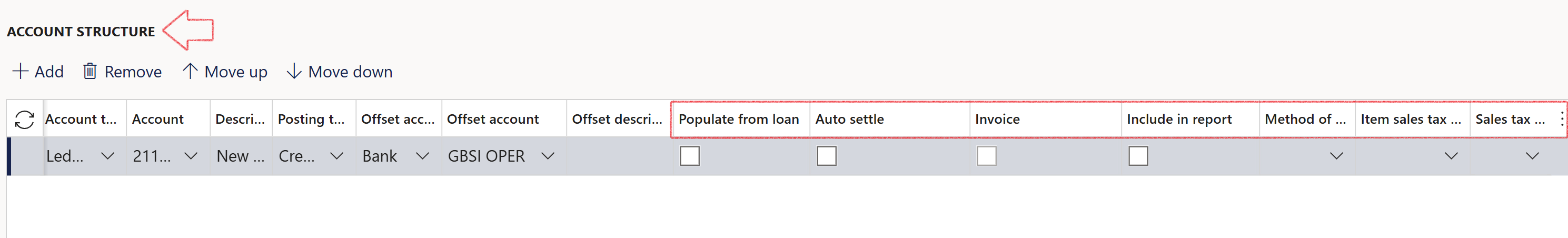

The Account structure for Capital posting profile includes several supplementary fields. It’s worth noting that these fields could also be relevant to other posting profiles . The specific fields include:

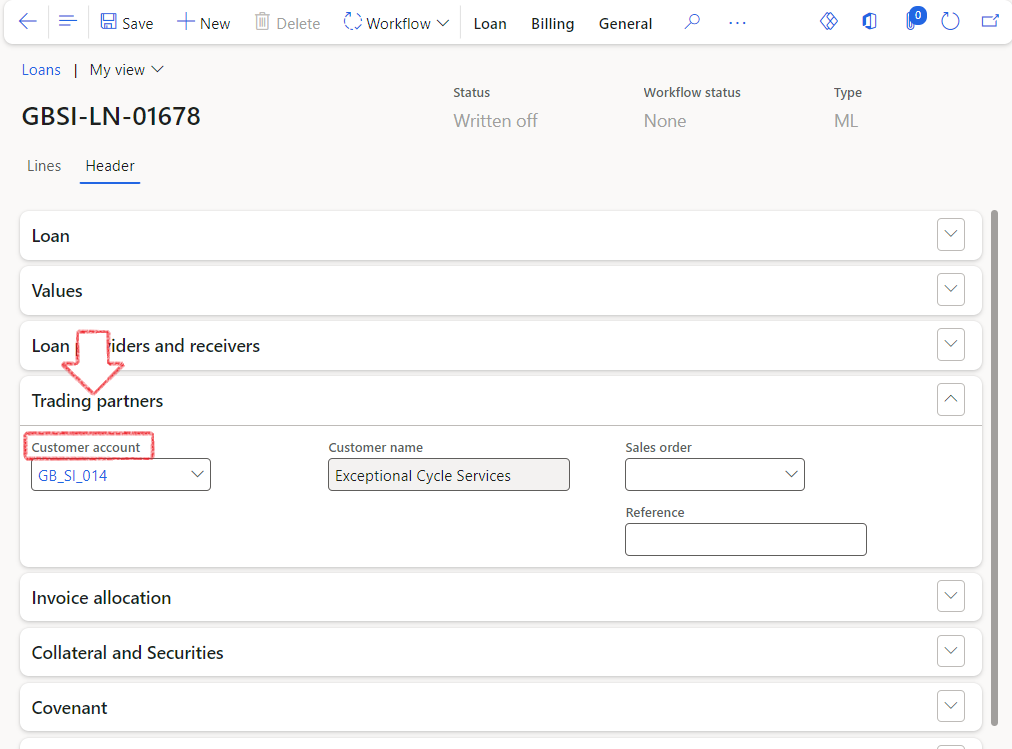

- Populate from loan

- The Populate from loan field allows for dynamic posting.

When this selection box is ticked on the posting profile, the Offset account type should be Customer and Customer account or Vendor and Vendor account, and can be left blank. - When a loan is linked to a customer or vendor under the Trading Partner FastTab, and a posting profile is selected, the system automatically retrieves the related customer or vendor account from the loan.

It then populates the posting profile on the Capital Journal with that account as the offset.

- The Populate from loan field allows for dynamic posting.

- Auto settle

- During the loan capital journal posting process, the system checks for the the auto-settlement flag associated with the capital posting profile.

If the capital journal is created for a loan using this selected posting profile, it automatically settles the initial entry with the sales order invoice

This settling process involves matching the entry with a specific date and amount in the customer table, effectively clearing the customer account. - When attempting to find a customer invoice for matching, the system will aggregate all open customer invoices for the date, for a specific loan, and if a match is identified, the system will mark it as settled.

- During the loan capital journal posting process, the system checks for the the auto-settlement flag associated with the capital posting profile.

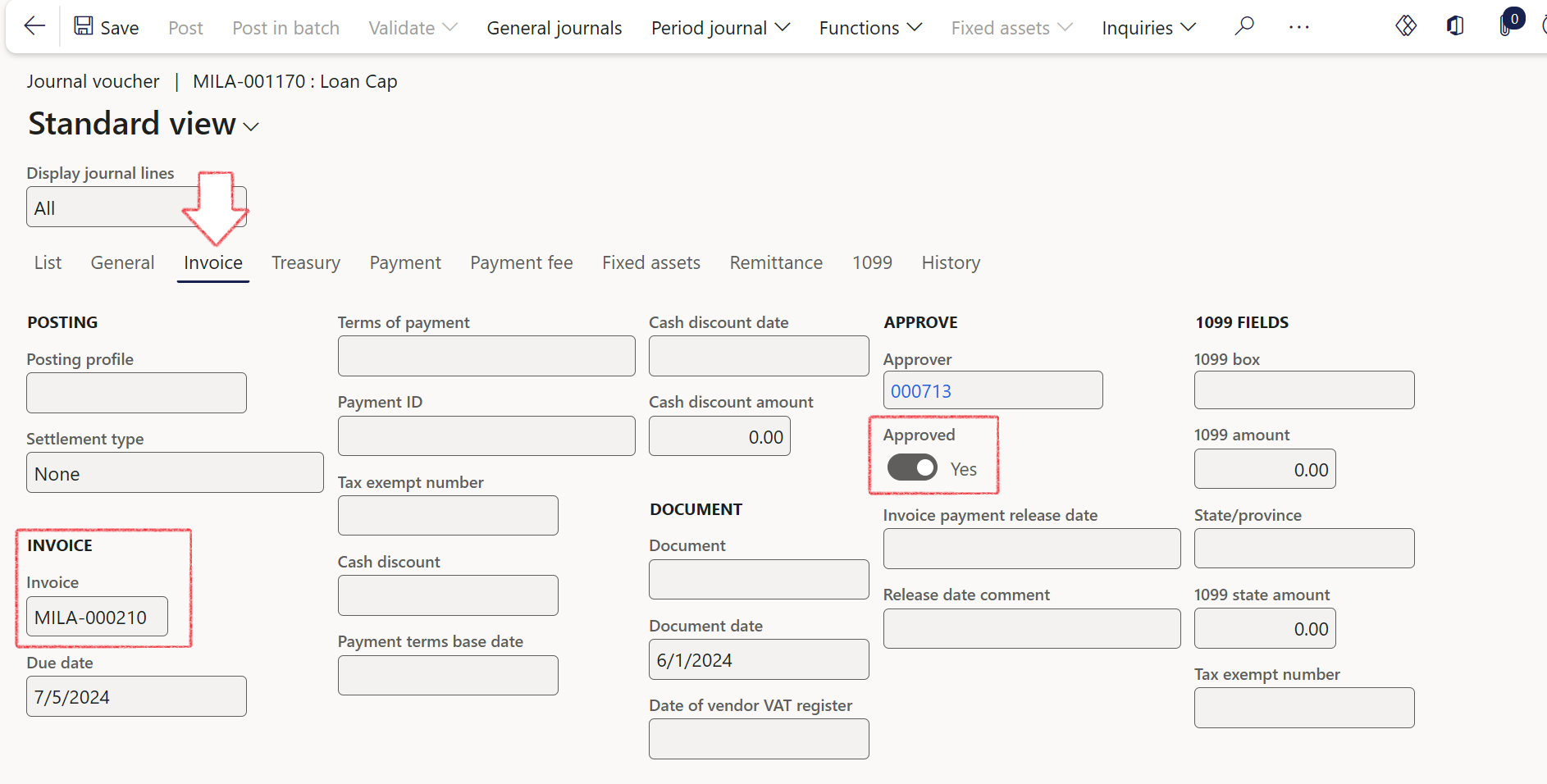

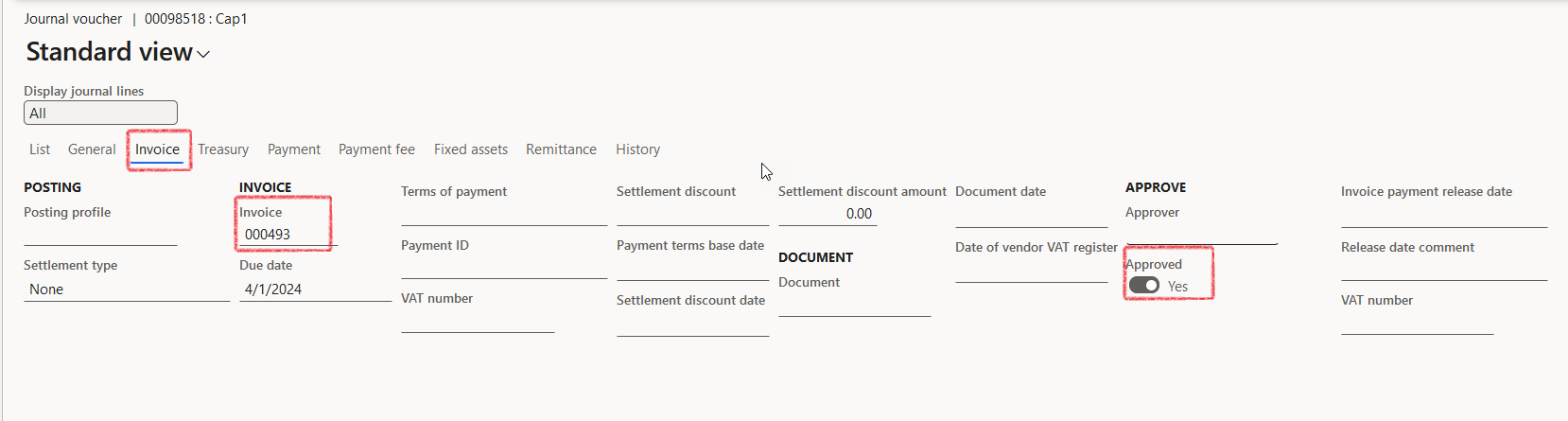

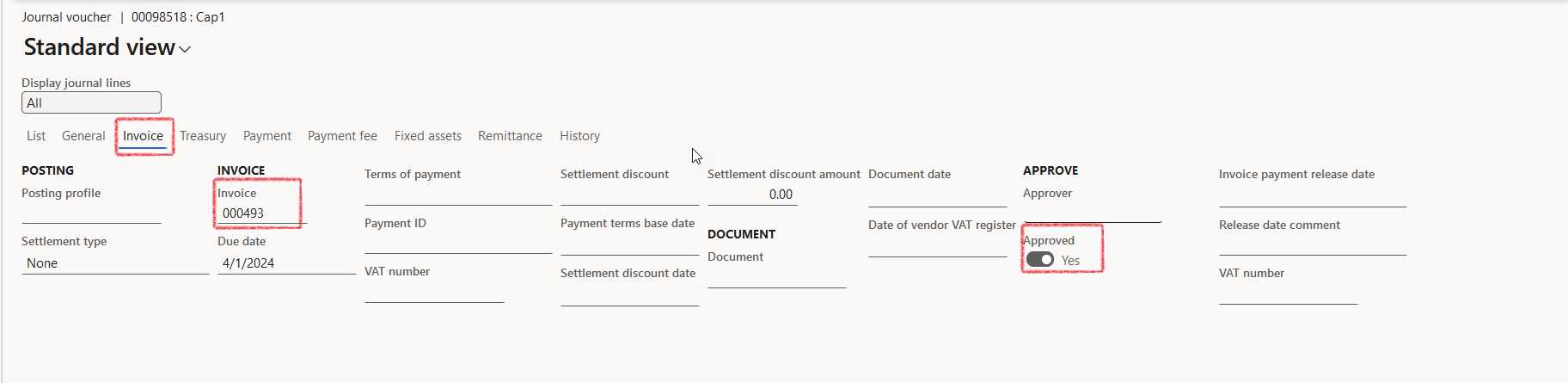

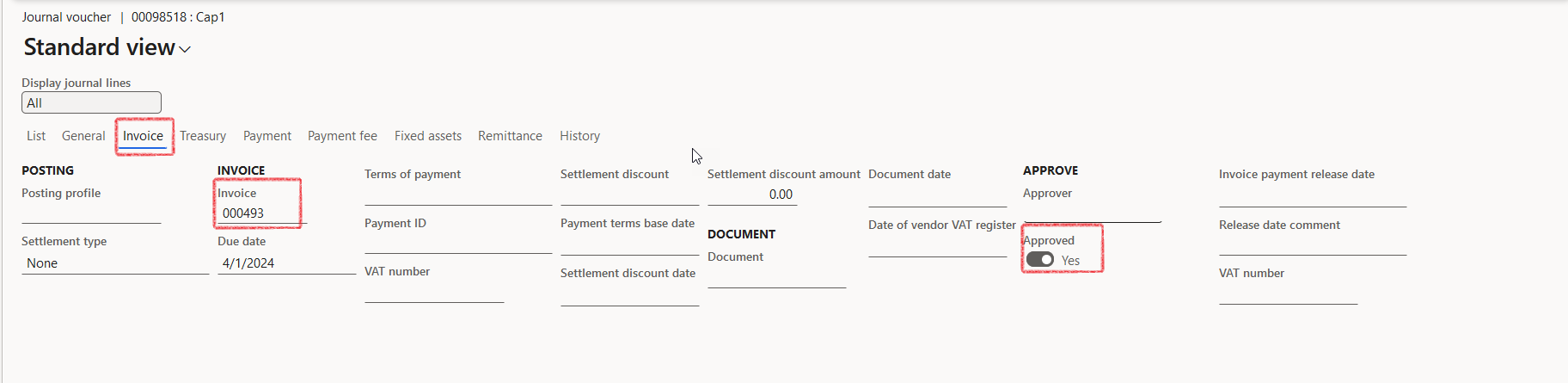

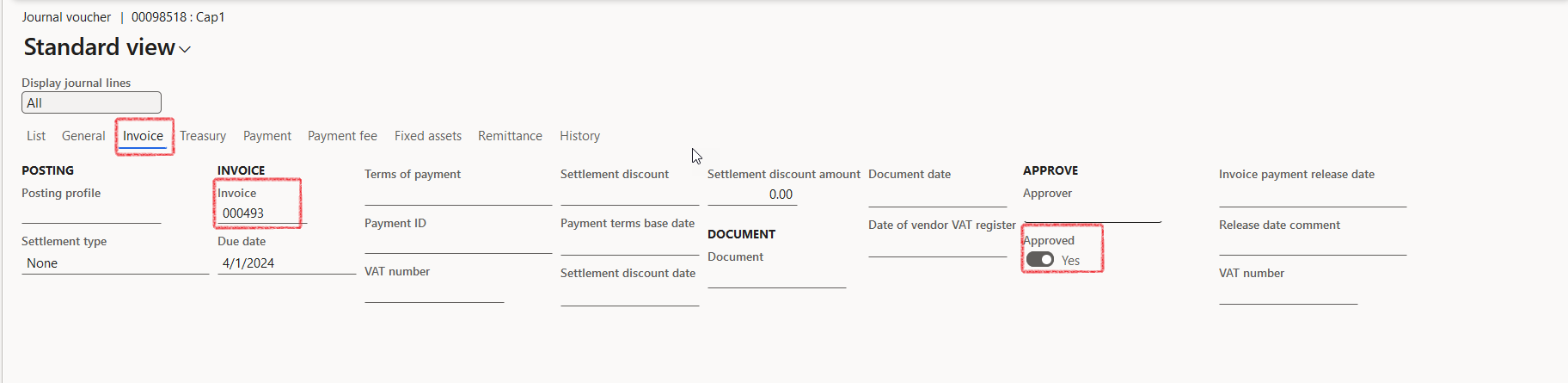

- Invoice

- When the Invoice tick is selected on the posting profile, and when the account or off-set account is a customer or a vendor, then an Invoice will automatically be created for the related journal.

This invoice number can be viewed on the Journal lines, Invoice Tab. - When creating loan journals (Capital journal, Interest accrual journal, Payments journal, etc.) that involve customer or vendor transactions in their accounting entries, these vouchers will automatically be approved

- Once the vouchers are approved, users can manually settle these transactions if necessary

- Invoices can also be created when no intercompany setup exists.

- You can select Invoice on the posting profile where the account or offset account is Vendor or Customer.

- On intercomppany transactions, the invoice number is transferred from the vendor to the customer or from the customer to the vendor, depending on which transaction occurred first.

- The invoice number can be generated and immediately used in the corresponding entity's journal.

- On intercomppany transactions, the invoice number is stored in the first legal entity and utilized in a subsequent journal creation event in the second entity.

- Additionally, a TMS vendor journal can originate the invoice number, which can later be utilized when creating a TMS customer journal.

- When creating a journal, the system looks up the invoice number used by the corresponding journal and populates it accordingly.

- Users can invoice loan payment journal lines and generate invoices for repayments. This means TMS can also generate an invoice number for a loan payment journal (similar to capital or interest journals)

- An invoice can be allocated even if the customer is the offset account entry. If the invoice number is generated first on the vendor side, the Accounts Payable number sequence is used and fetched when creating the customer journal.

- If the invoice is generated first on the customer side, the Free Text Invoice number sequence is used and fetched when creating the vendor journal

- When the Invoice tick is selected on the posting profile, and when the account or off-set account is a customer or a vendor, then an Invoice will automatically be created for the related journal.

- Item sales tax group

- Selecting the Item sales tax group and Sales tax group will enable default VAT groups when creating loan journals.

- When an Item sales tax group and Sales tax group is selected on the posting profile, those values will populate accross all journal lines where that posting profile is applied during journal creation.

- Sales tax group

- Include in report

- Method of payment

- The Method of payments chosen on the posting profiles, will be utilized in the Customer Ageing Report.

- The Method of Payment is accessible for selection on all TMS loan journals. Users can choose from the options available in the drop-down list found under Sales Ledger > Payment Setup > Method of Payment

- During journal creation functions, this Method of payment will default on all the relevant journal lines. (to view this inside the journal lines, click on the Payments tab, Method of payment).

- Amount type

- To support more complex capital journal requirements, future interest amounts can be included in journal entries.

- An enum value, Deferred interest, is available on the Amount type field on Capital journal posting profiles

- When selected, this option aggregates all future interest amounts - as defined in the original statement - and includes them in the capital journal (i.e., it sums all applicable interest accruals).

- This logic is automatically triggered during capital journal creation.

- Additionally, Capital posting profiles can support multiple lines, and all lines will be taken into account when generating the journal

No default can be chosen for Interest Accrual and Payments, thus these posting profiles must be defined when creating each loan.

¶

Step 4.1.2: Wildcard functionality for Loan Posting Profiles

- Wildcard functionality has been integrated into the Treasury module, specifically tailored for loan posting profiles.

- When setting up posting profiles in the Account structure users have the ability to employ hashtags (#) within the Description field.

This feature dynamically populates actual values from associated fields onto relevant journals - The following wildcards can be used on loan posting profiles:

- #LoanID

- #Customer

- #Vendor

- #ICO

- #SalesOrder

- Example: By including #Customer or #LoanID in the description field, customer numbers and loan IDs are automatically retrieved and displayed on the journal.

For instance, setting up the description as #LoanID, #Customer, #Vendor #ICO, the drawdown will result in the journal displaying details as follows:

Loan GBSI-007256, Customer AXN105, ICO USMF

¶

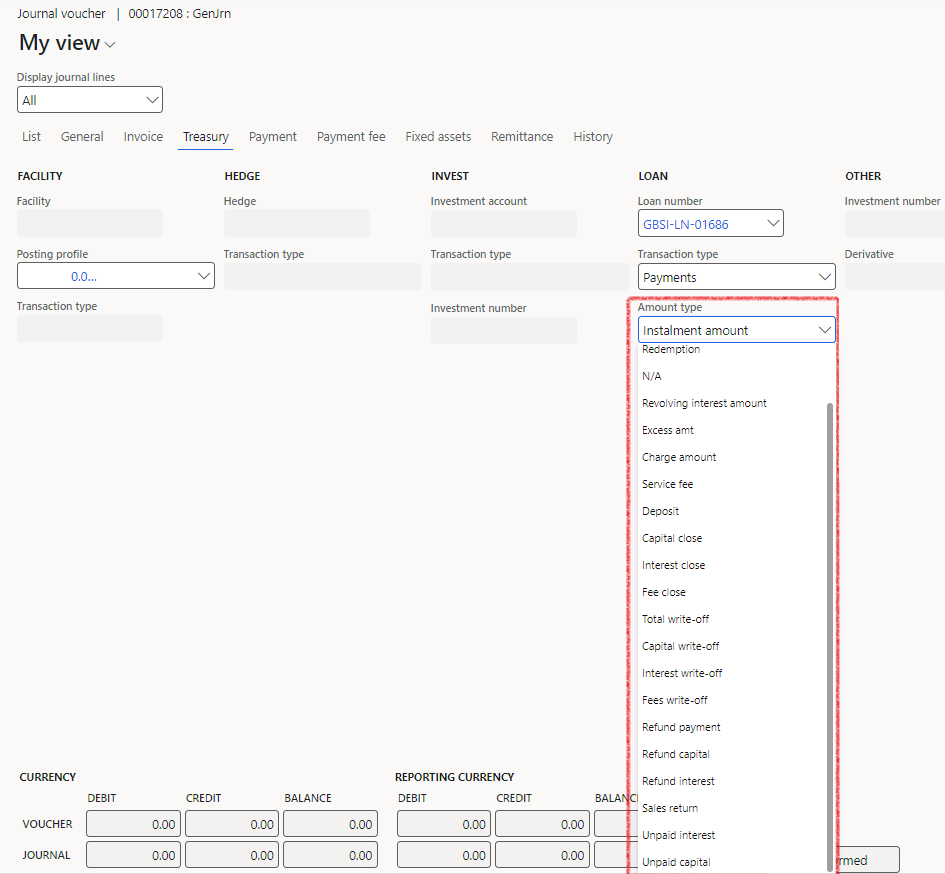

Step 4.1.3: Payments posting profile

Payment journals will usually have multiple line transactions, for example:

- A credit transaction for the Instalment amount for a Loan Payable

- A debit transaction for Interest payment for a Loan Payable

- A debit transaction for Redemption amount for a Loan Payable

- Amount types on the Payment posting profile may include, but are not limited to:

- Instalment amount

- Interest amount

- Redemption

- N/A

- Revolving interest amount

- Excess amount

- Charge amount

- Service fee (this amount does not impact any other balances or fields on the expanded loan statement).

- Deposit

- On the Account structure section of the page, under Account type, users have multiple options to choose from:

- Ledger

- Customer

- Vendor

- Project

- Fixed assets

- Bank

- Petty cash

- Select the relevant tick boxes for the following

- Exclude loan number

- Populate from loan

- Auto settle

- Include in report

- Is down payment

- Method of payment

- Down payments and regular instalments:

- If the payment received is a deposit, the system will use the line account setup where Is down payment is flagged to Yes.

- If the payment received is not a deposit, the system will use Instalment amount

- The loan statement will be updated in the same manner as a regular instalment.

When creating a Loan payment journal , it is first established if the payment is a down payment (deposit) or not. A down-payment is a payment that is posted on the same day as the loan start date.

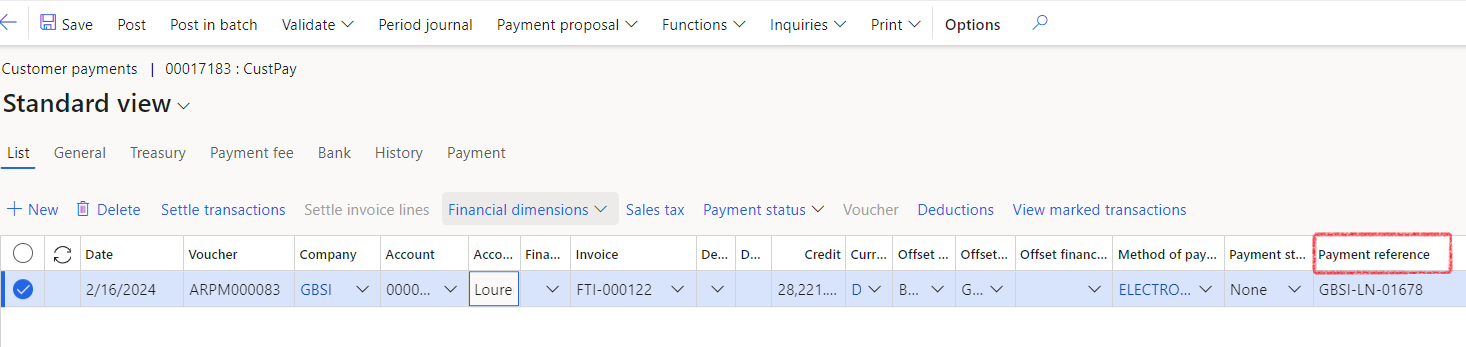

- Auto-settlement for customer payments:

- The loan payment journal for the down payment amount will settle against the remaining balance on the Capital journal .

- The settlement will only occur when a loan number is populated in the Payment Reference field of the Customer payment journal .

- In order for automatic settlement of customer transactions to occur successfully, it is imperative that the customer account and transaction date align for matching to take place

¶

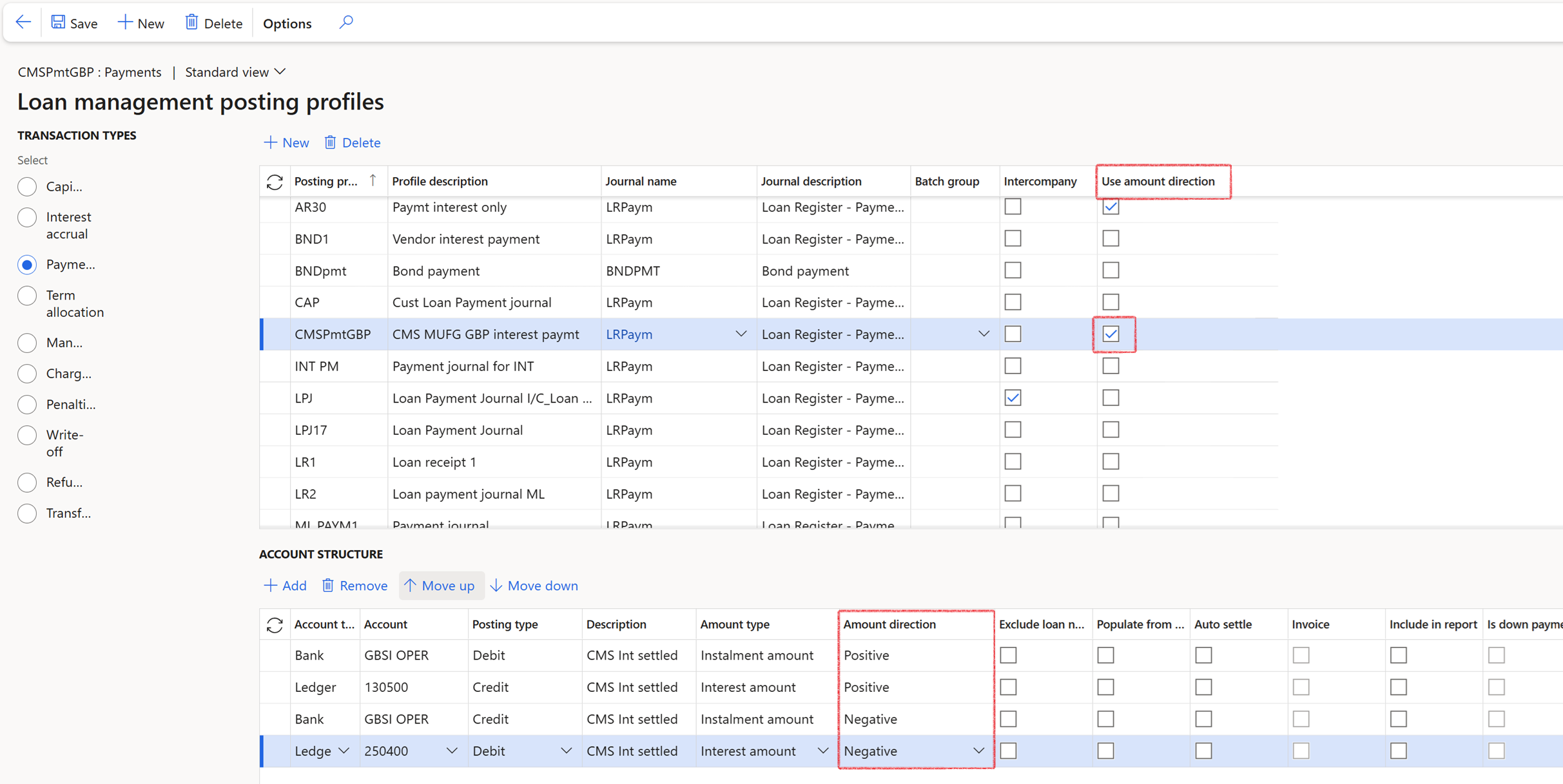

Step 4.1.3.1: Payments posting profile - Amount direction

The creation of loan payment journals supports both positive and negative interest on a loan, allowing the values to be distributed across different accounts. The amount types will be mapped to the interest and instalment fields in the actual statement.

This is facilitated by a setting in the Loan posting profiles, labeled Use amount direction , located in the header section.

The loan statement supports both positive and negative interest through the Unpaid Neg Interest and Unpaid Pos Interest columns.These columns track unpaid interest by separating it into positive and negative components. A loan facility can move into a negative balance, with interest accrued and repaid on that negative balance. Such amounts may need to be posted to different GL accounts, which is why these balances are tracked separately.

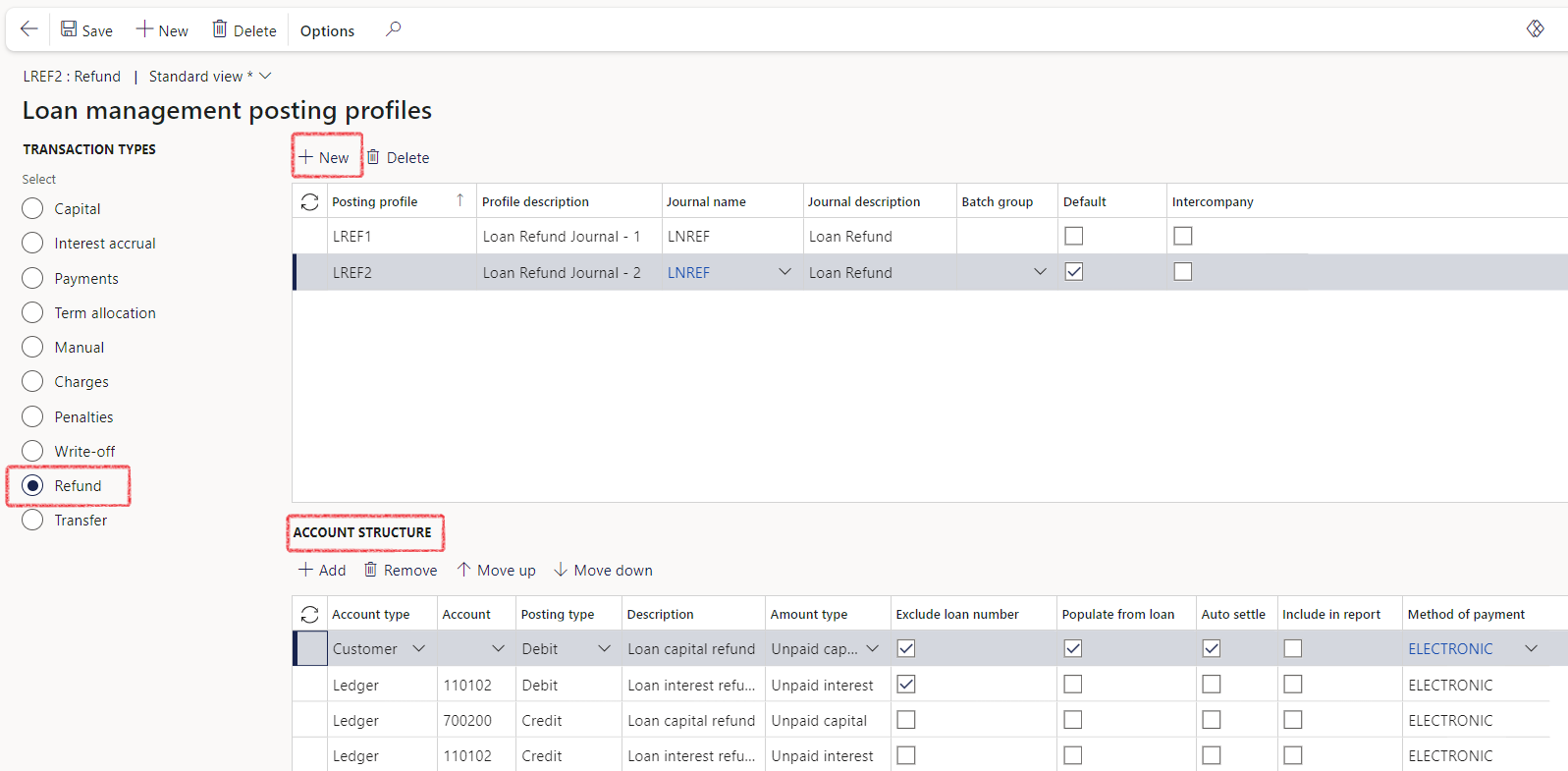

¶ Step 4.1.4: Refunds posting profile

To create a new posting profile for Refunds , navigate to:

- Treasury > Loans > Setup for Loans > Posting profiles – loans

- Within the Transaction types section, select the Refund radio button

- In the header section of the page, click on the New button

- Complete the following fields:

- Posting profile

- Profile description

- Select a Journal name from the drop-down list

The Treasury journal type for Refunds is referred to as Loan register - refund

- On the Account structure section of the page, click on the Add button to create a new line. Complete the following fields:

- Account type (choose between Ledger, Customer, Vendor, Project, Fixed assets or Bank)

- Account

- Indicate if this is a Debit or Credit Posting type

- Description

- Choose an Amount type from the provided list.

Below is a list of refund amount types , along with their corresponding display locations on the Loan statement:

- Refund payment - will be mapped to the Refund total column on the loan statement

- Refund capital - will be mapped to the Refund capital column on the loan statement

- Refund interest - will be mapped to Refund interest column on the loan statement

- Sales return - will be mapped to Capital balance trans column on the loan statement

- Unpaid interest - will be mapped to Annuity interest accrual column on the loan statement

Select the relevant tick boxes for the following:

- Exclude loan number (the Loan number will be excluded from the Refund journal)

- Populate from loan (When the account type is set to Customer , the Customer account field will automatically be populated from the Loan to the Refund journal)

- Auto settle

- Include in report

- If required, select a Method of payment

- Click on the Save button

¶

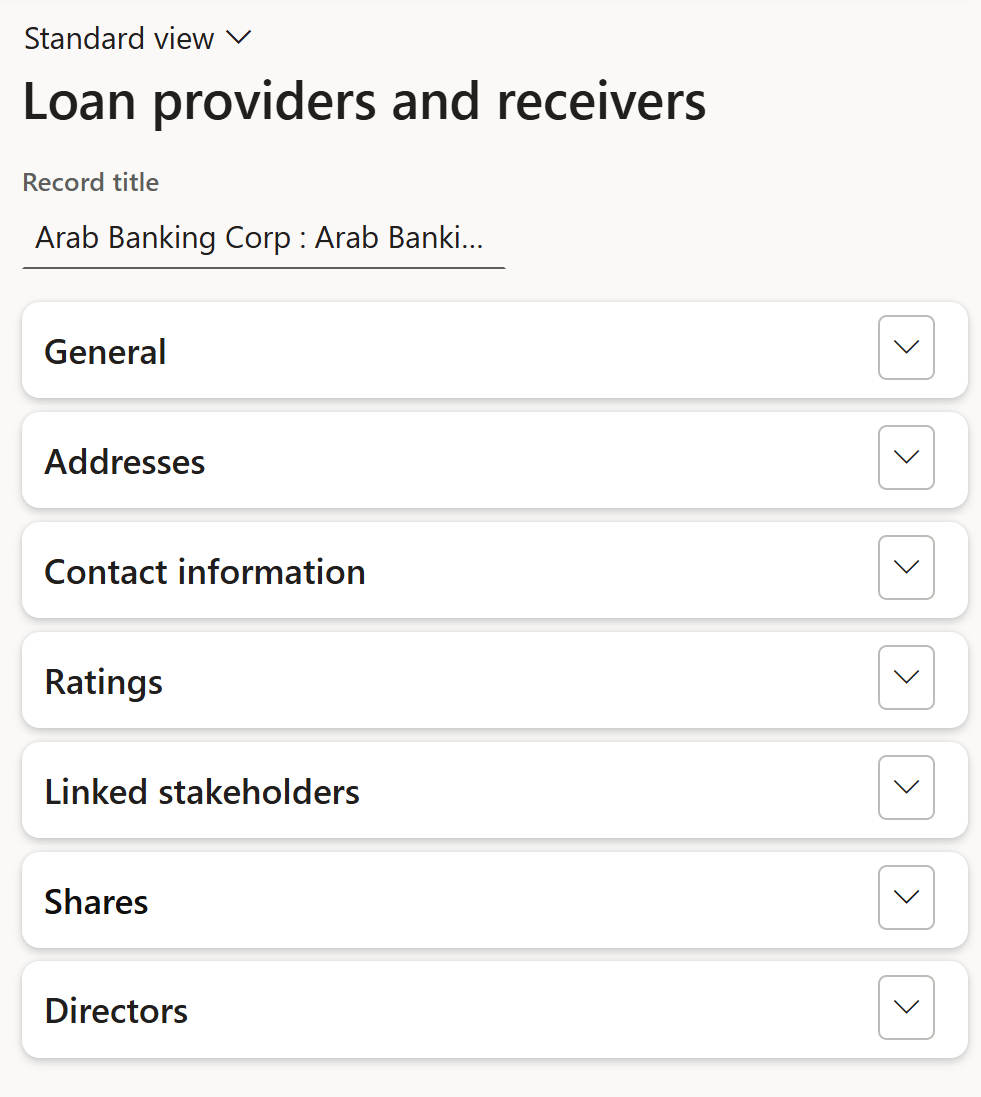

Step 5: Loan providers and receivers

A Loan provider is the lender or financial institution. The interest they receive provides an incentive for the lender to engage in the loan. Loan providers are individuals or entities that lend money to others with the expectation of being repaid over time, typically with interest. Examples of loan providers include banks, credit unions, and peer-to-peer lending platforms.

A Loan receiver is the borrower/ recipient, who incurs a debt and is usually liable to pay interest on that debt until it is repaid. Loan receivers, also known as borrowers, are individuals or entities that borrow money from loan providers and are obligated to repay the loan according to the terms of the loan agreement. Borrowers may use loans for various purposes, such as financing a home, purchasing a car, or funding a business venture. When borrowing money, borrowers typically pay interest on the loan, which represents the cost of borrowing and is typically calculated as a percentage of the loan amount.

¶

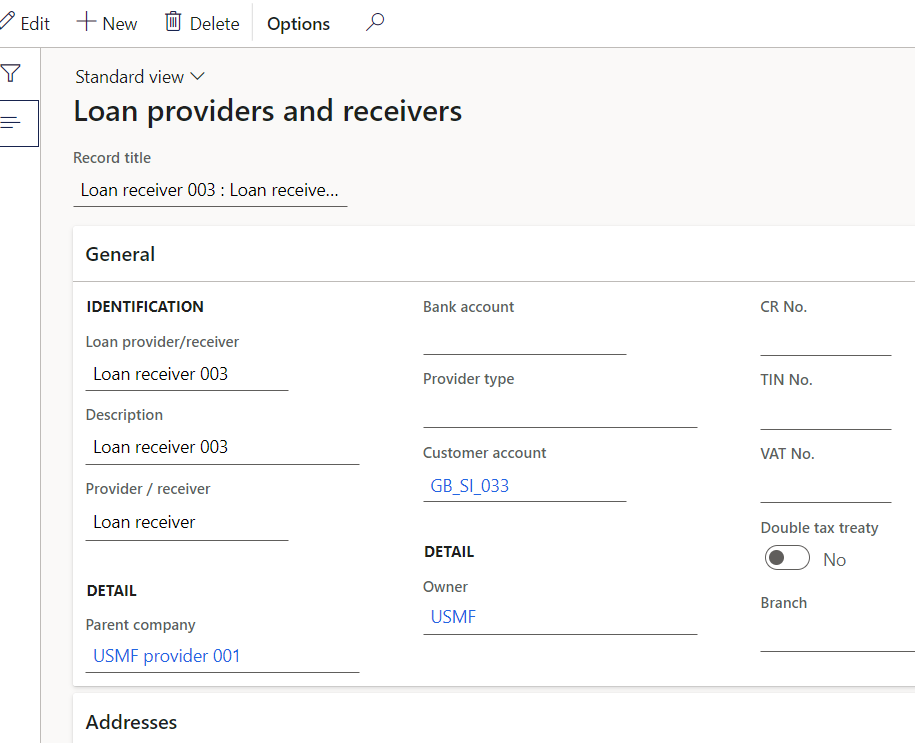

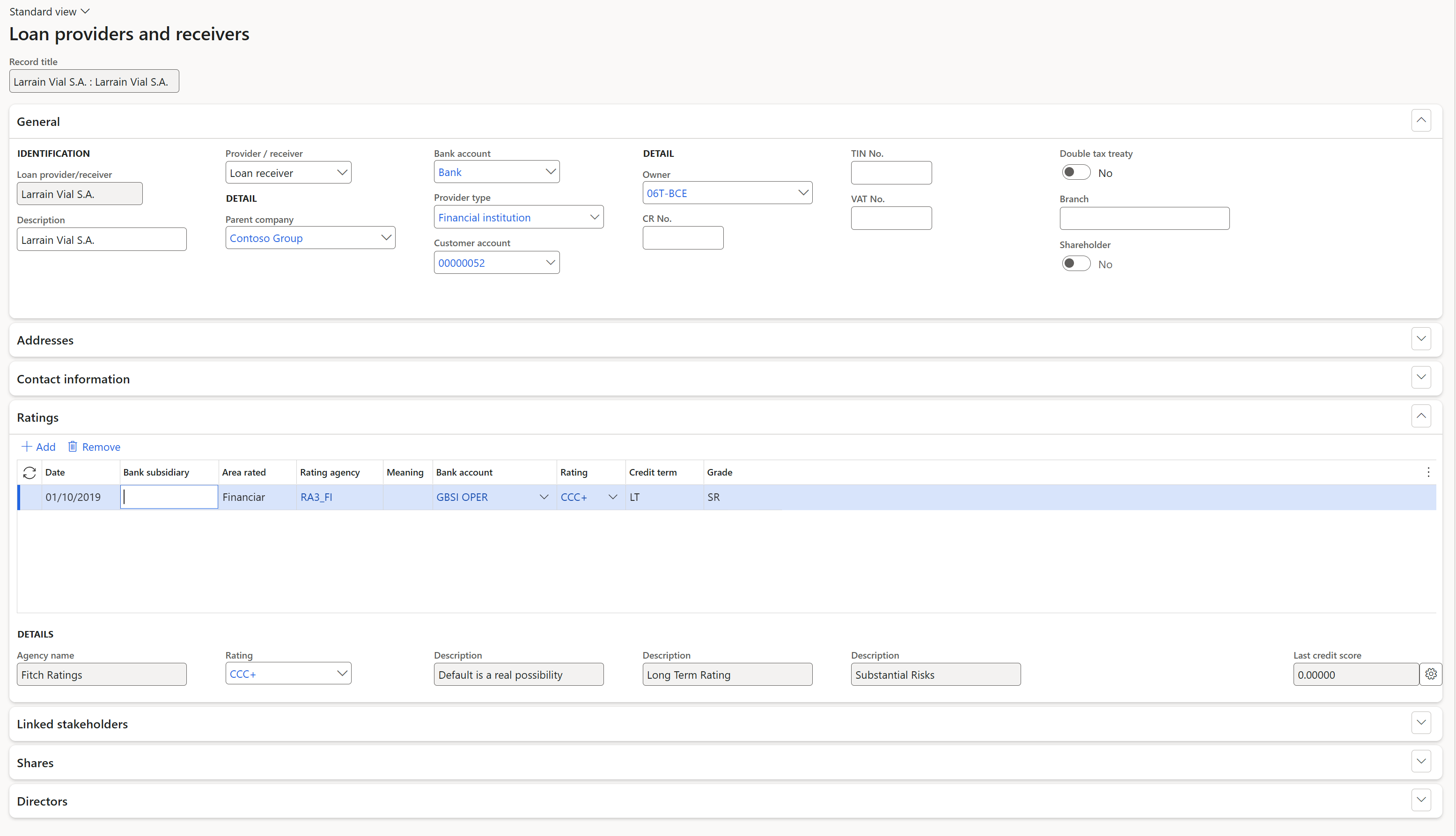

Step 5.1: General FastTab

- In the navigation pane, go to: Modules > Treasury > Loans > Setup for loans > Loan providers and receivers

- Click on the New button

- Indicate whether this is a Loan provider or a Loan receiver

- Enter the identification for loan provider/ receiver

- Give a description

- Parent company select the relevant Party

- Bank account selection

- Provider type selection, for instance Bank, Financial institution, Parent company, etc.

- Customer account: selection from a drop-down list

- Owner: select the relevant Party

- CR No. (company registration number)

- TIN No. (TAX information number)

- VAT No.

- Double tax treaty option Yes or No

- Branch

- Information on the address, contact details, and ratings FastTabs can be completed

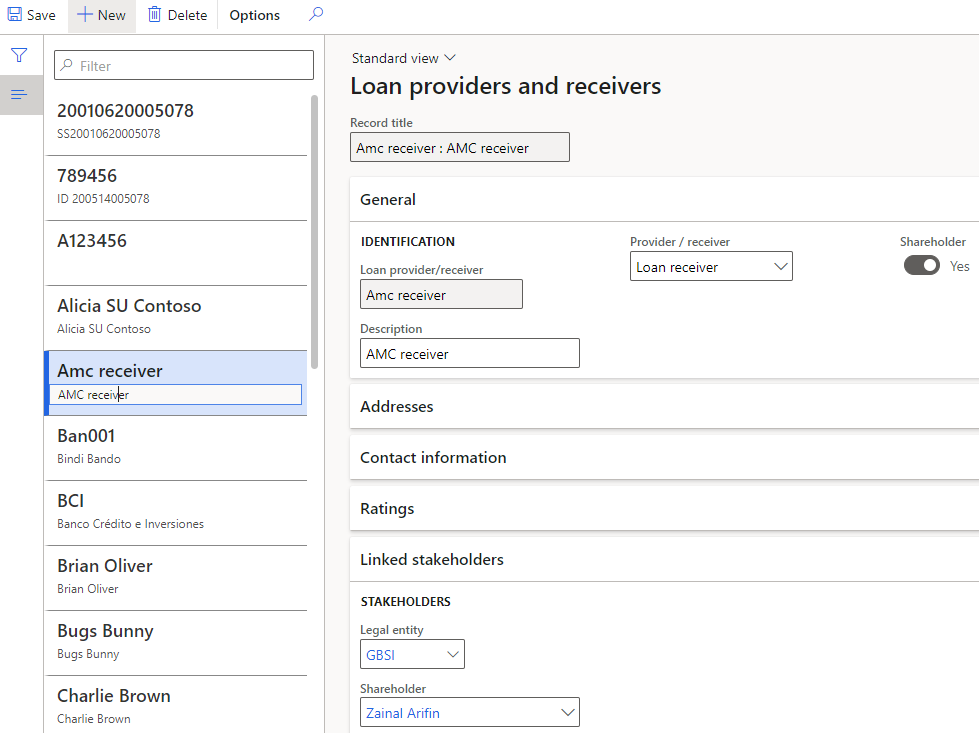

¶ Step 5.2: Linked Stakeholders FastTab * (G2T) or Linked Legal entity FastTab

- In the navigation pane, go to: Modules > Treasury > Loans > Setup for loans > Loan providers and receivers

- Expand the Linked Stakeholders FastTab (G2T) or the Linked Legal entity FastTab

The Linked Stakeholders FastTab will display when the GRC module is installed. The standard TMS module without the G2T integration will display a Linked Legal entity FastTab

- Select the company from a drop-down list

- Select a shareholder. (G2T)

- When this is done, the loan provider / receiver will display as a Shareholder on the Loans form under the Loan providers and Receivers FastTab, as well as on the General FastTab of Loan providers and receivers.

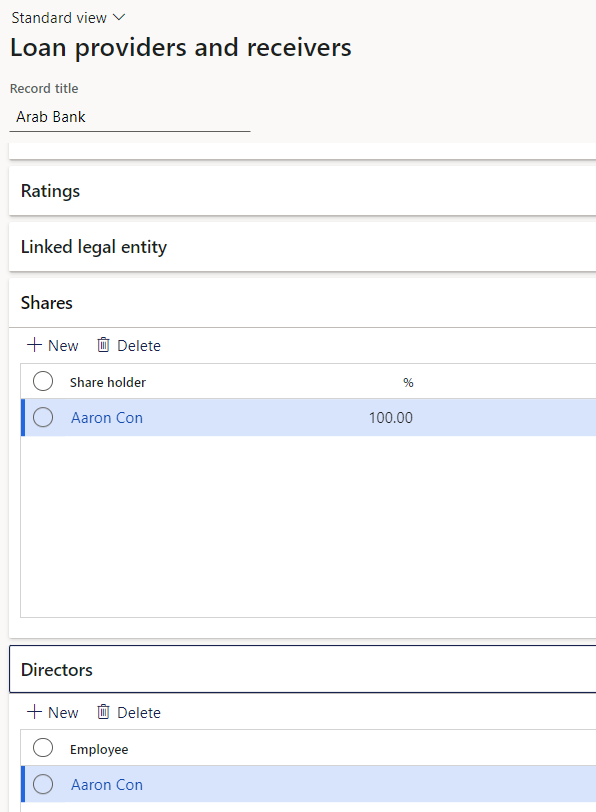

¶ Step 5.3 Shares FastTab

- In the navigation pane, go to: Modules > Treasury > Loans > Setup for loans > Loan providers and receivers

- Expand the Shares FastTab

- Select the shareholder party and enter percentage of shares

¶ Step 5.4 Directors FastTab

- In the navigation pane, go to: Modules > Treasury > Loans > Setup for loans > Loan providers and receivers

- Expand the Directors FastTab

- Select the relevant employee or add multiple names to the list

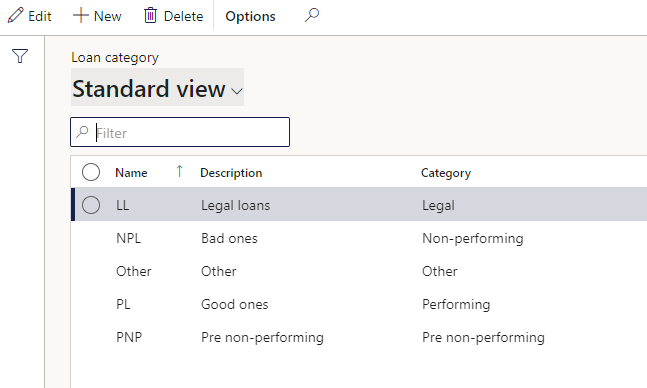

¶ Step 6: Loan categories

A Loan category setup contain the Name, Description and Category

- In the navigation pane, go to: Modules > Treasury > Loans > Setup for loans > Loan category

- Click on the New button

- Enter a Name

- Enter a Description

- Select a Category from the drop-down list and choose between one of the following:

- Legal

- Non-performing

- Other

- Performing

- Pre-non-performing

¶

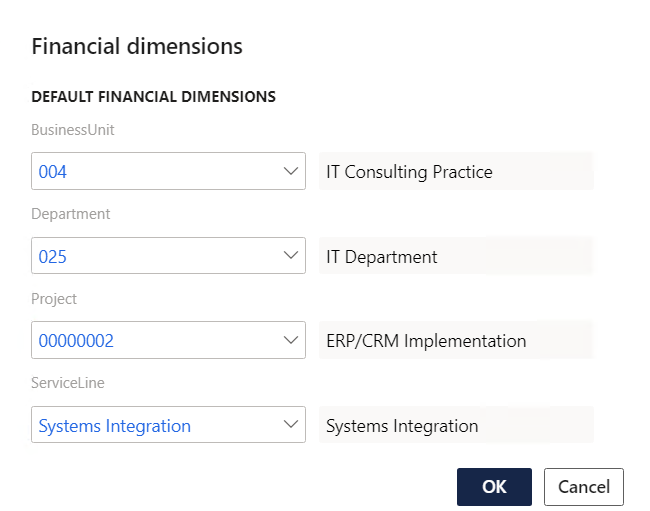

Step 7: Default dimensions

The purpose of dimensions is to add additional information to financial transactions which can be used for reporting and filtering purposes. The default dimension values are added to each transaction when posting in journals.

If all the setups are done, when importing loans via data management, the following fields will be created if they do not exist already:

- Loan receiver

- Loan receiver dimension

- Loan ID dimension and

- Loan group dimension

To view the newly created dimensions, go to:

- General Ledger > Chart of Accounts > Dimensions > Financial dimensions

- Select the dimension you want to view, for instance Loan receiver dimension

- Click on Dimension values tab in the Action pane

- Here you will see all the created dimension values

Keep in mind that the Financial dimensions in the General ledger should be configured prior to configuring individual dimensions for use on loans (whilst the system is in maintenance mode)

¶

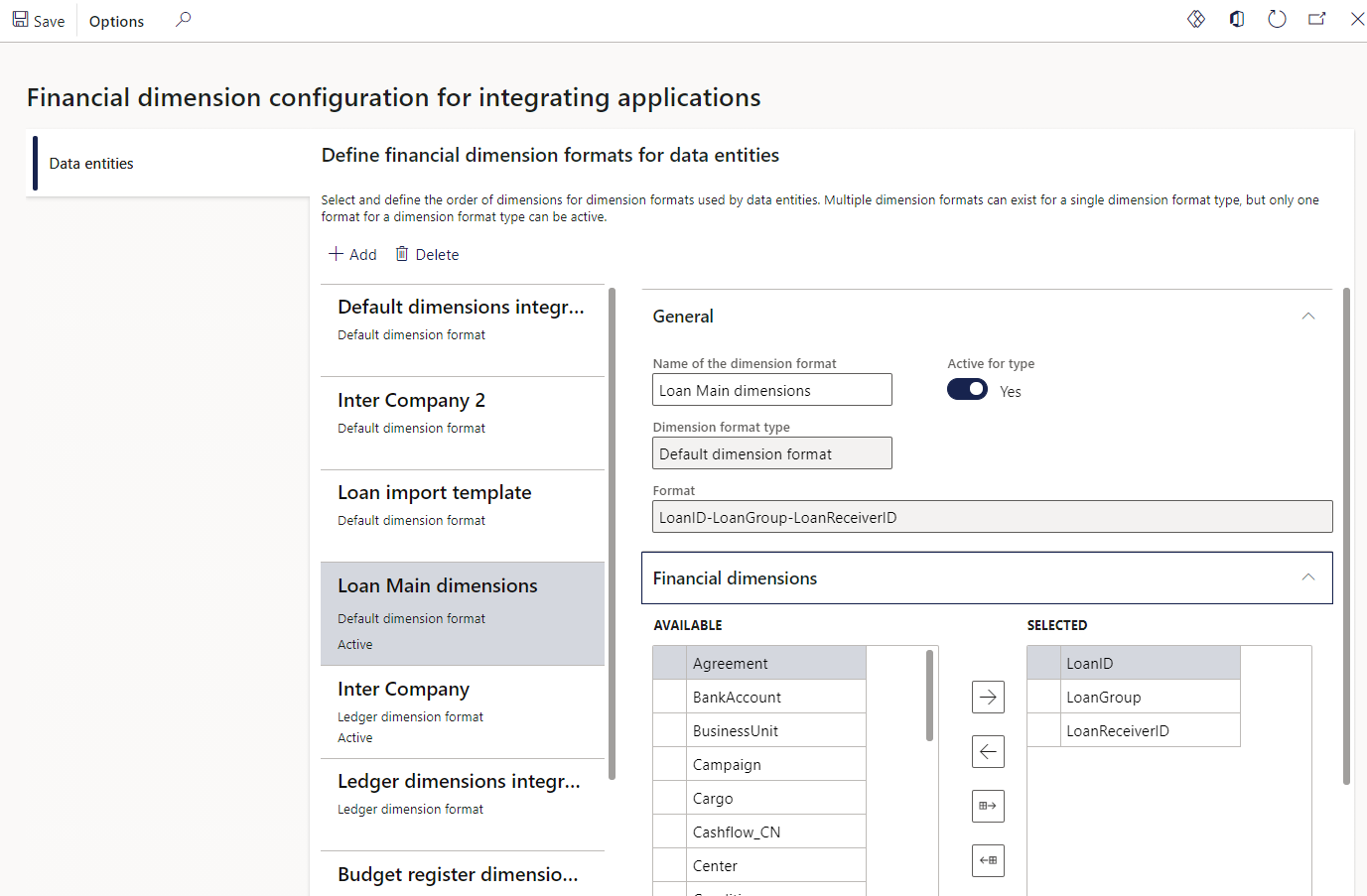

Step 7.1: Setup Financial dimension configuration for integrating applications

To configure the initial financial dimensions, go to

- General Ledger > Chart of accounts > Dimensions > Financial dimension configuration for integrating applications

- Click on the Add button

- Enter Name of the dimension format

- On the Financial dimension’s Available column, select the dimensions to be used and move it to the right-hand column, called Selected

- When done, ensure it is Active for type

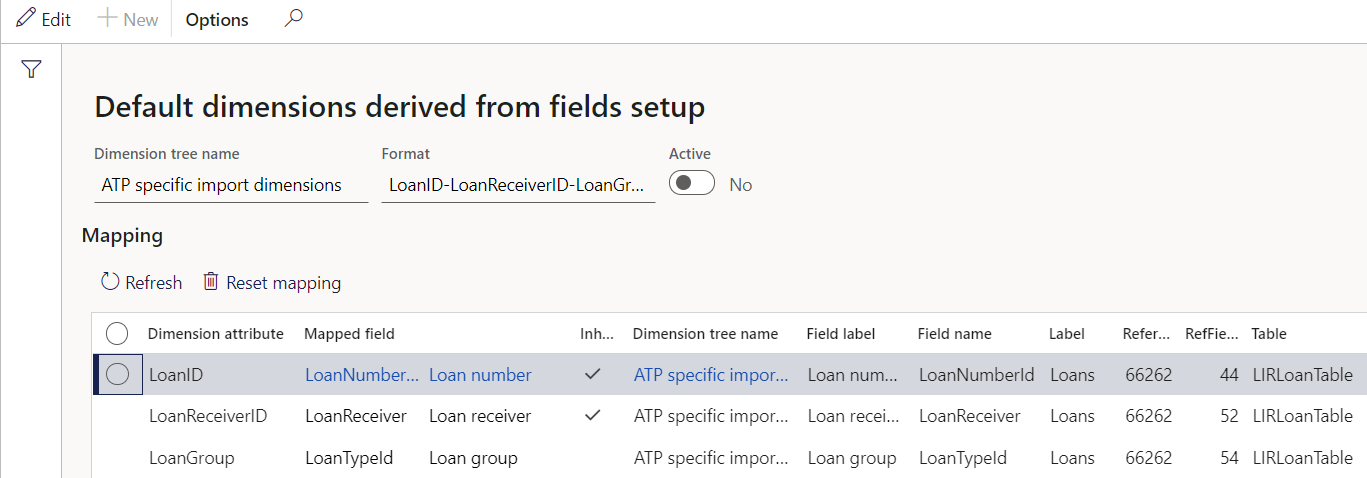

¶ Step 7.2: Setup Default dimensions derived from fields setup

To setup the Default dimension format for data entities to be used inside loans, go to:

- Go to: Treasury > Loans > Setup for loans > Default dimensions derived from fields setup

- Select the newly activated Dimension tree name from the drop-down list

- Loan ID, Loan receiver and Loan group can be set up to automatically by creating a financial dimension

- Map the fields related to the Dimension attribute

- Mark the tick box if the Dimension attribute should inherit parent dimension

- Slide the Active button to Yes to activate your changes.

Note that this setup can be used with Combination loans where a subloan (child loan) is created; It can also be used where Combination loans are imported via Data management

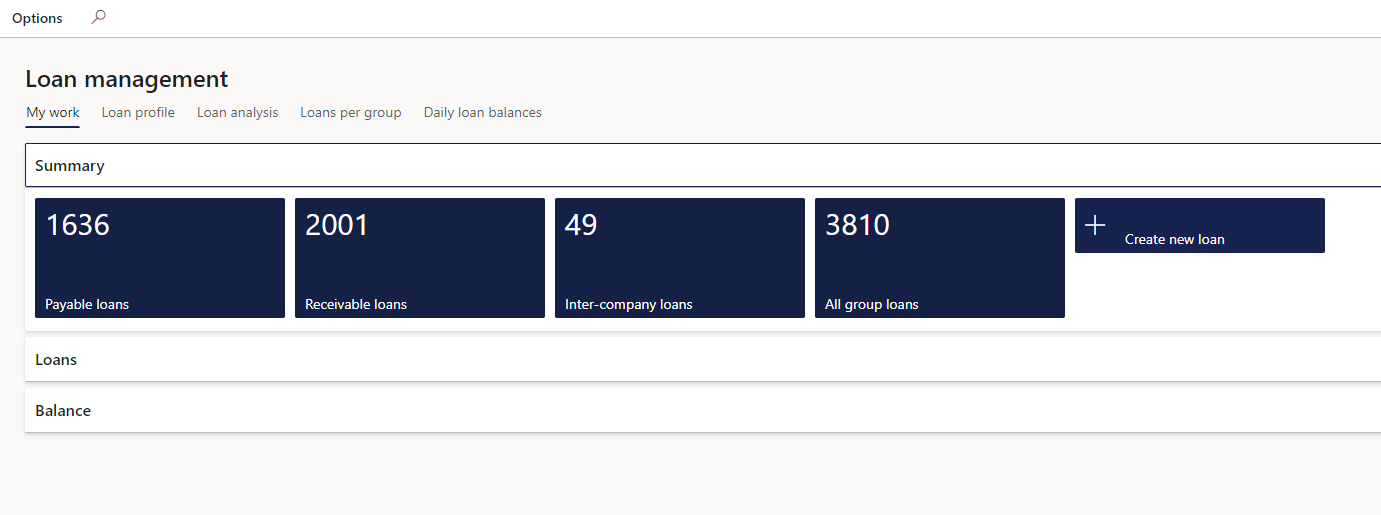

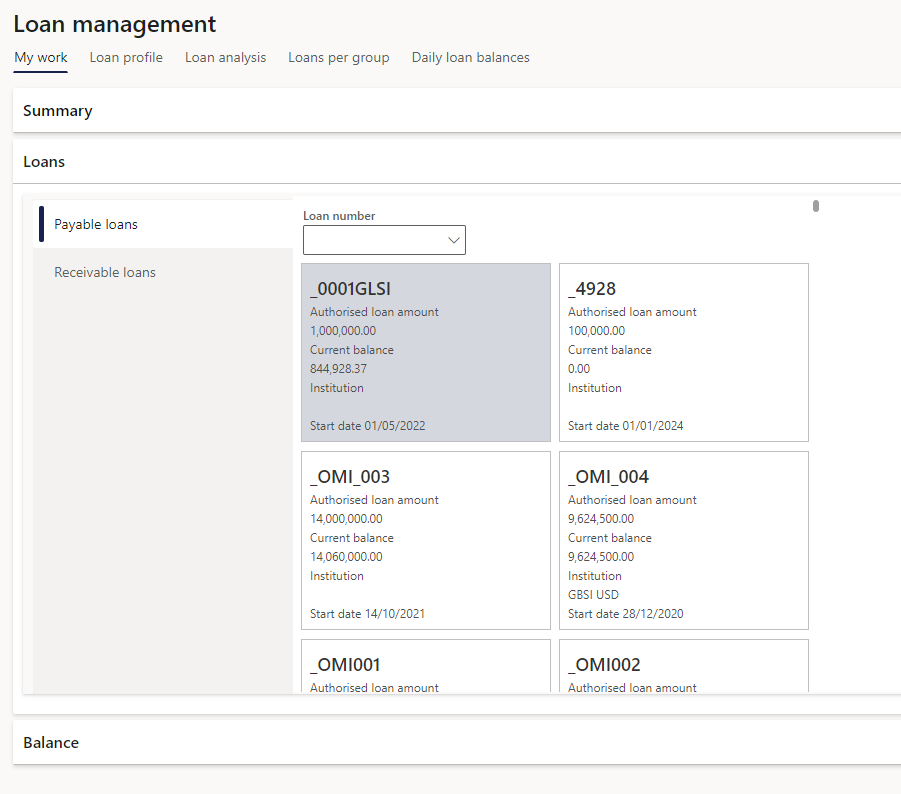

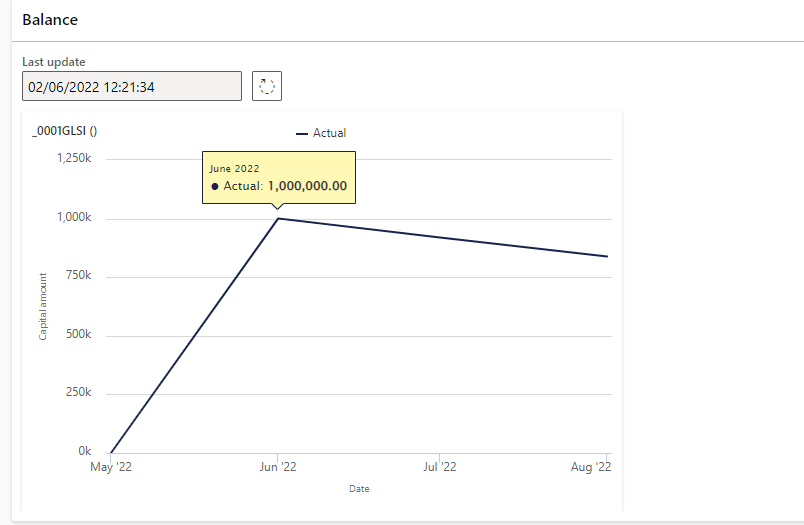

¶ Daily use

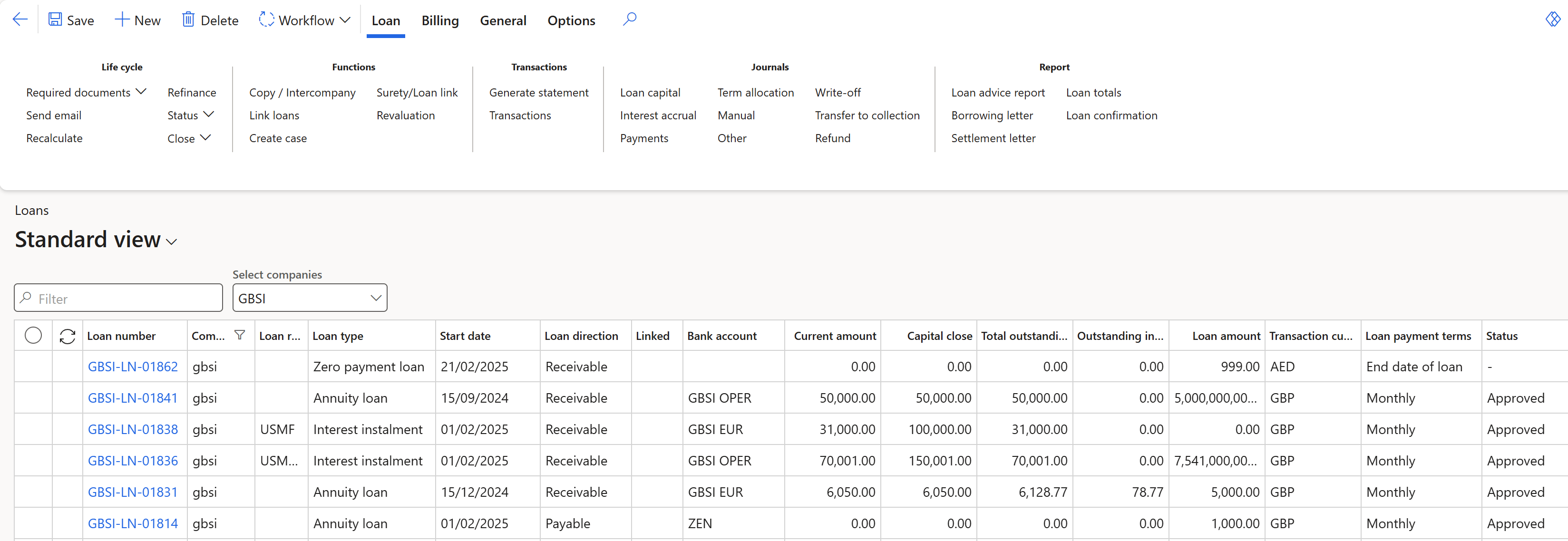

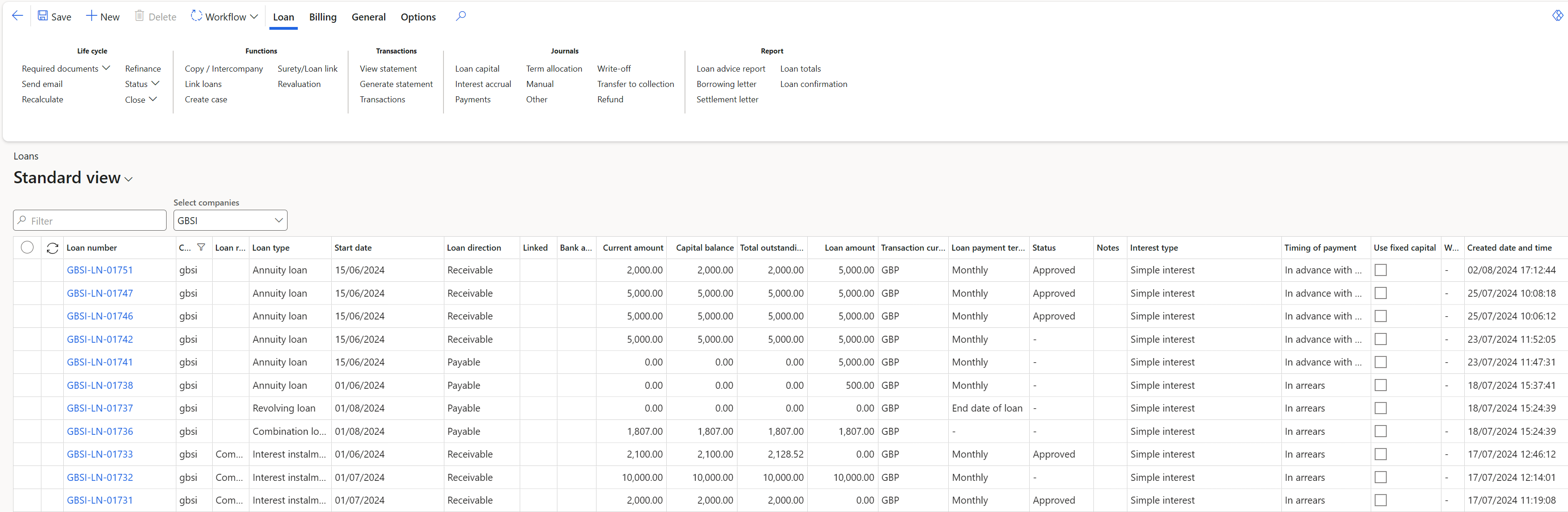

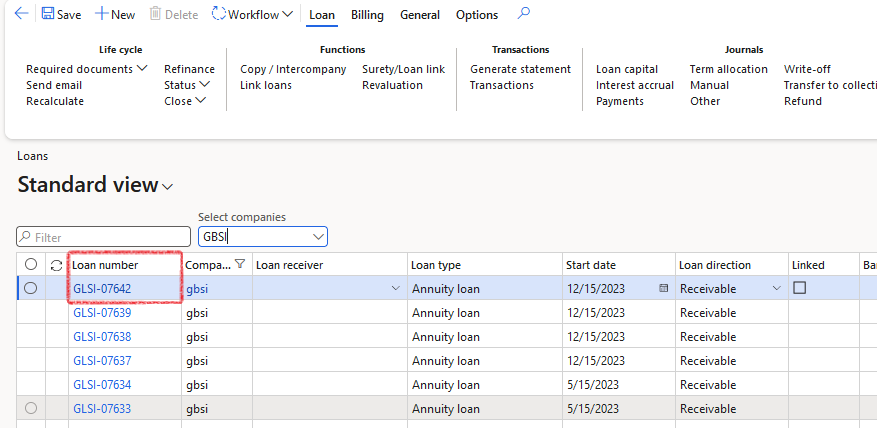

¶ Step 8: Create a new loan

- In the navigation pane, go to: Modules > Treasury > Loans > Loans

- You will be greeted by a list page

- All the loans for the current company will display

- To view any other loans for other companies, click on Select companies to filter

On the list page, you may see the key loan details, including:

- Loan number

- Company

- Loan type

- Start date

- Loan direction

- Capital close - This is the total of capital issued on a loan. This amount will never go down to zero

- Outstanding interest - This is the unpaid interest. This amount will go down to zero when the loan is fully paid. The Outstanding Interest amount is the sum of the Annuity Interest Close and Revolving Interest Close columns in the Actual Loan Statement.

The Outstanding interest column is the same as INTEREST BALANCE on the Customer loan balances data entity - Current amount - This amount indicates if any Capital is outstanding. This amount will go down to zero when the loan is fully paid

The Current amount column on the loans list page is the same as the PRINCIPAL BALANCE column on the Customer loan balance data entity. - Capital balance – total of the Loan capital journals posted

- Net debit displays positive for receivable loans (and vice versa)

- Net credit displays positive for payable loans (and vice versa)

- Loan amount

- Total outstanding - this is the sum of outstanding capital and outstanding interest.

The Total outstanding column is the same as the LOAN BALANCE column on the Customer loan balances data entity - Currency loan payment terms,

- Loan category (as per your setup, for example: Performing, Pre-non-performing, Non-Performing Legal and Other)

- On the list page, on the Action pane, click on the New button to create a new loan

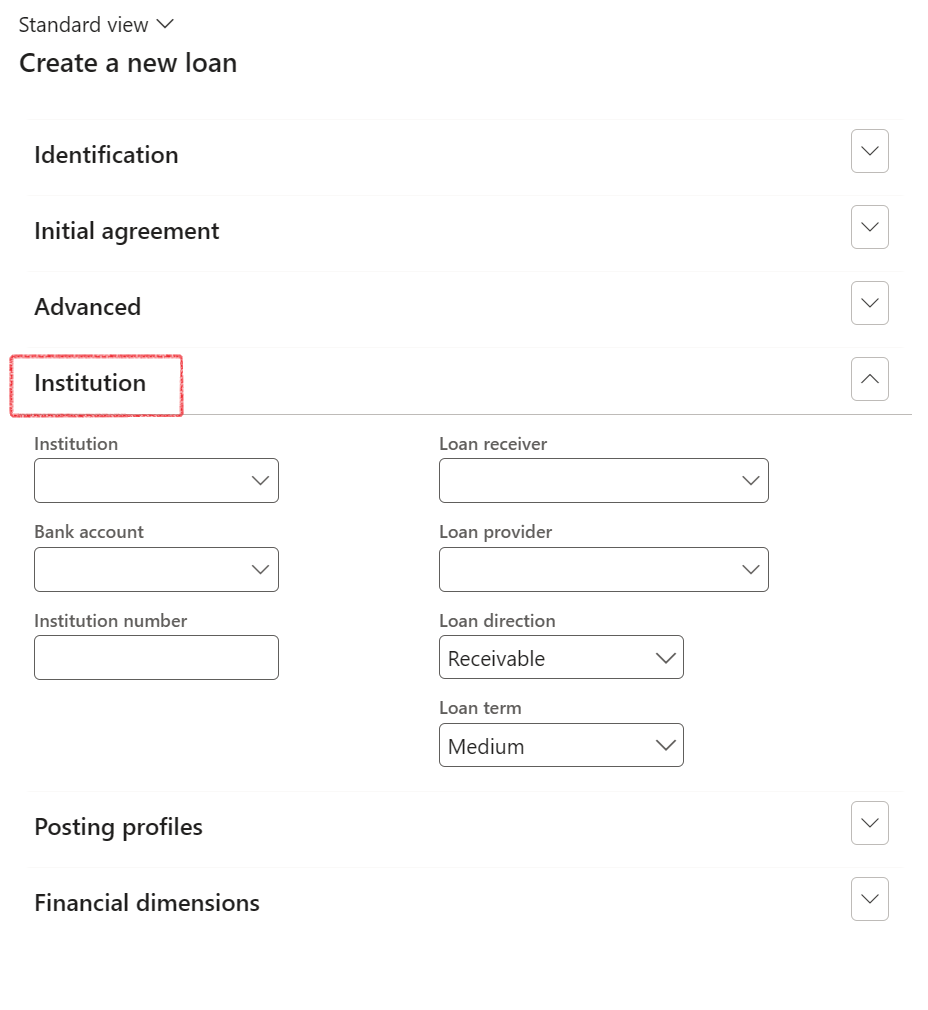

- A new form will appear, prompting users to fill in mandatory fields to initiate a loan. The form consists of the following FastTabs:

- Identification

- Initial agreement

- Advanced

- Institution

- Posting profiles

- Financial dimensions

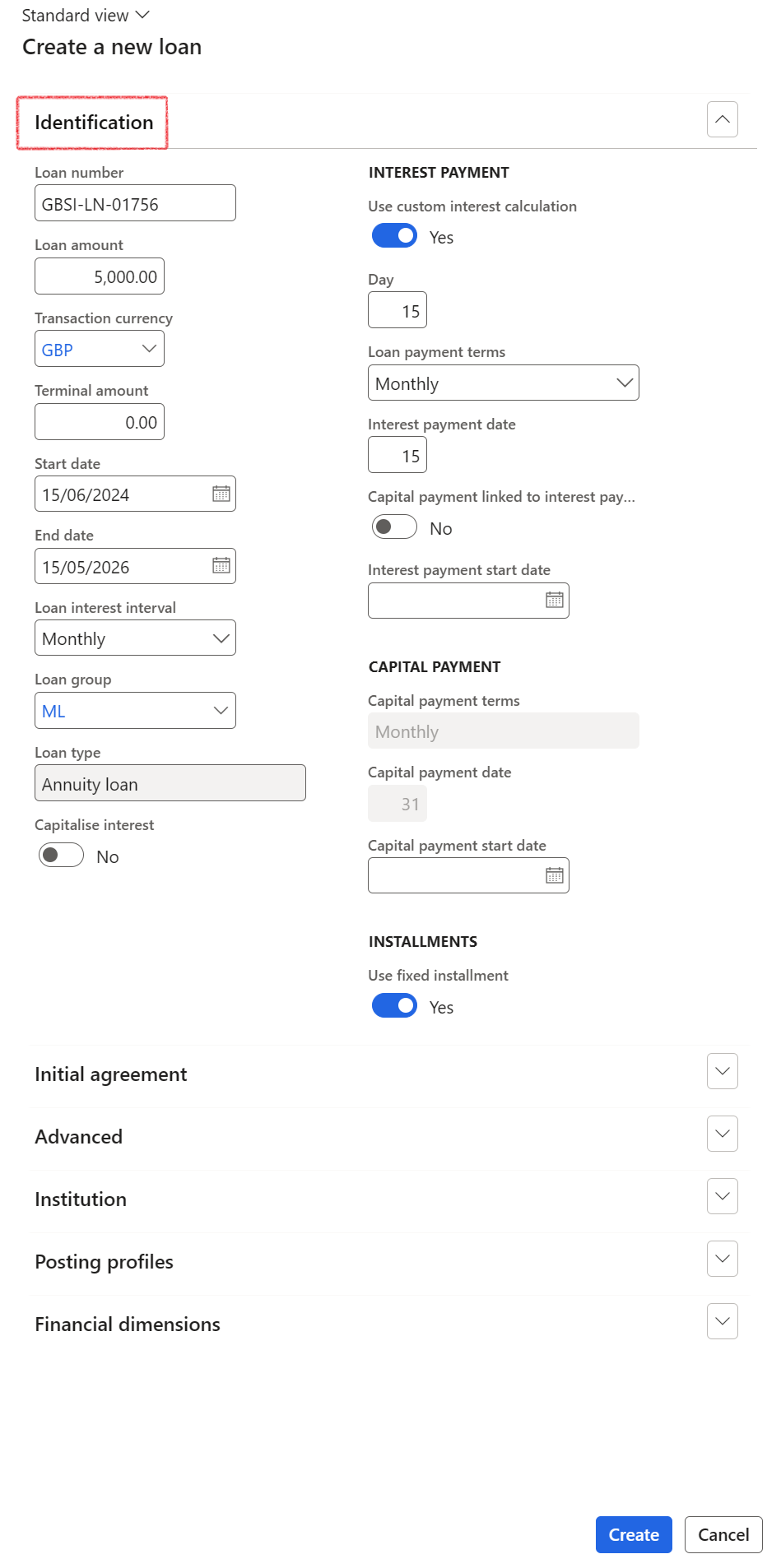

¶ Step 8.1: Identification FastTab

- The loan number is automatically created and used to identify the loan

- The loan description field is optional and can be filled in to provide additional details about the loan.

- Start date (mandatory) the start date of the loan as negotiated with the financial institution.

- Loan group the loan group must be selected, based on the client specific setup that has been done. The loan groups mainly determine the posting setup for the loan transactions, as well as loan type to be followed for this specific loan.

The Loan type will display automatically, depending on the Loan group selected.

- Loan interest interval: the way in which interest is calculated by the financial institution. Choose between Daily, Monthly (default) or Quarterly.

- Loan amount is the amount negotiated for with the financial institution. The loan amount can be left blank when creating the loan.

- Terminal amount: Terminal value is also known as residual value or balloon payment. Refers to a capital amount/value remaining at the end of the contract, usually a percentage of the initial capital amount. If terminal value is entered, the loan payments must be calculated bearing in mind the remaining future value of the capital remaining

- Currency (mandatory) field can be selected from a drop-down list

- Capitalise interest option: when selecting this option to Yes, it will capitalise interest accrual to the loan balance and the full instalment will be deducted off the loan balance

- Loan payment terms is the basis or periods the loan repayments will be made. Select one of the following options:

- Monthly

- Bi-monthly (every two months)

- Quarterly

- Half yearly

- Yearly

- None (this is specifically for zero payment loans and revolving loans)

- End date of loan (this is for zero payment and revolving loans)

- When the Fixed instalments slider is set to Yes, it may result in the loan end date being extended:

- This could happen when some instalments were missed

- The fixed instalments functionality enables the continuation of the initial instalment amount as was applicable at the inception of the agreement.

- Equalized loan instalments are calculated when choosing Fixed Instalment on a specific loan

- This results in the possible extension of a loans’ end date if some instalments were missed.

- The Use fixed instalment button is available on the Create a new loan dialogue page, (on the Instalments section) as well as the details page of an existing loan

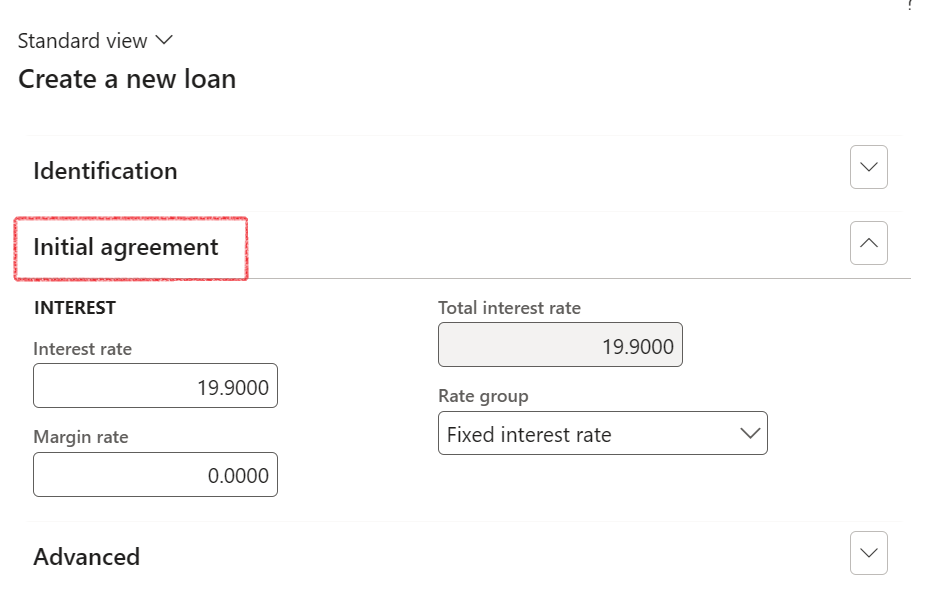

¶ Step 8.2: Initial agreement FastTab

The initial agreement FastTab allows the user to create an initial trade agreement from the Create New dialogue. If the fields are not completed, the user can create one manually later.

Only in cases where the Loan group is not connected to a particular Interest rate can an interest agreement be manually inserted (as per setup on Loan groups>Interest calculation FastTab)

- Interest rate

- Margin rate

- Total interest rate

- Rate Group

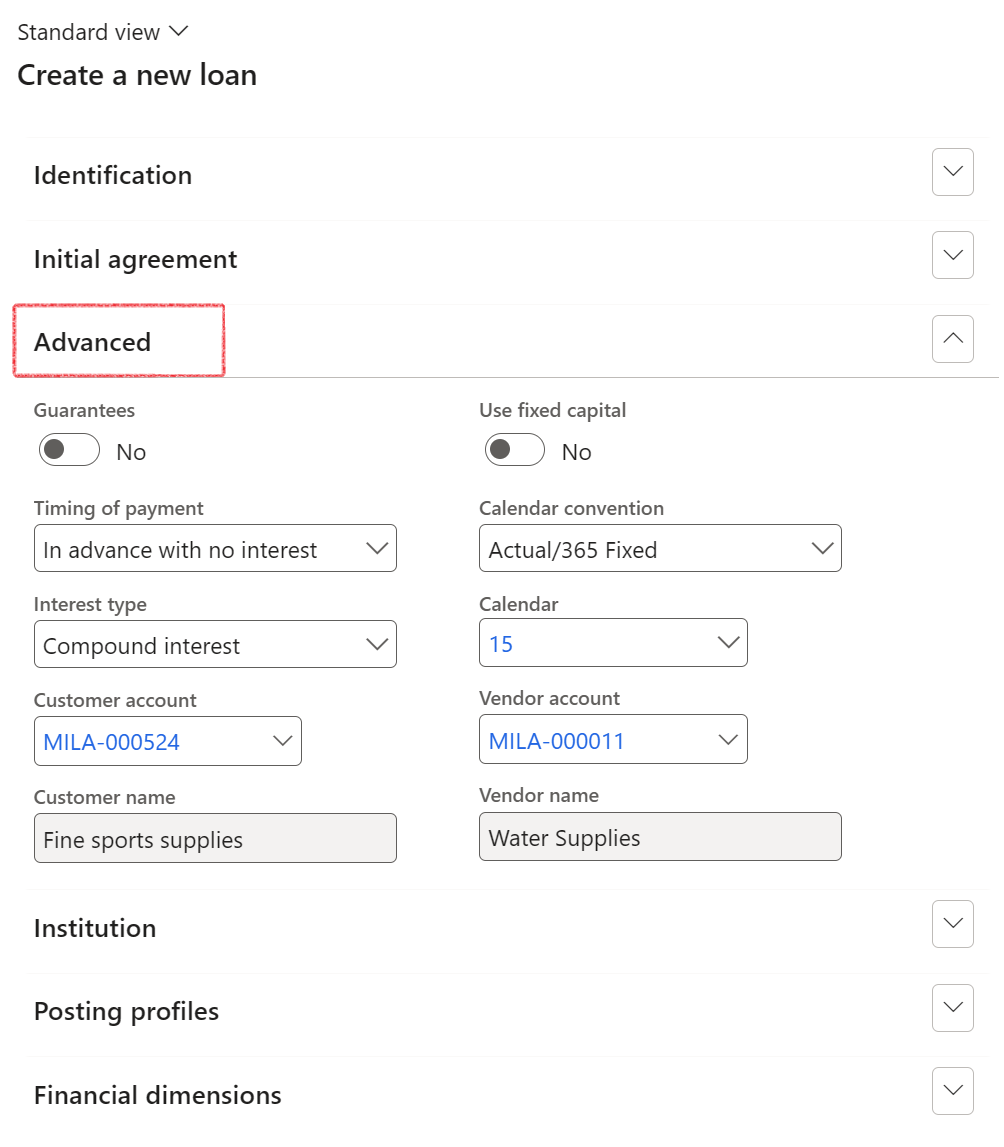

¶ Step 8.3: Advanced FastTab

- Guarantees (yes/ no)

- Use fixed capital (yes/ no) - Calculates a fixed amount of capital to be repaid with every instalment.

- Timing of payment can be either: In arrears, In advance with no interest, or In advance with interest. For In arrears, payment occurs at the end of the first period. Payment includes capital and interest for the month gone past. For In Advance with no interest, payment occurs at the start of the first period. Payment includes capital and no interest. For In advance with interest, payment occurs at the start of the first period. Payment includes capital and interest for the month ahead.

When selecting the In advance with interest or In advance with no interest option in the timing of payment selection field, the first instalment will be displayed on the first line of the Projected loan statement. (loan's start date). When selecting the In arrears option in the Timing of payment selection field, the first instalment will not be displayed on the first line (loan’s start date) of the loan statement

- Interest form can be Nominal or Effective. Nominal interest is always calculated based on the capital amount, i.e., not interest on interest. Effective interest is the real rate of interest paid which includes the effects of compounding.

- Month end (yes/ no)

- Debit order day – if Month end is set to No, then a custom debit order day can be entered.

- Terminal value - Terminal value is also known as residual value or balloon payment. Refers to a capital amount/value remaining at the end of the contract, usually a percentage of the initial capital amount. If terminal value is entered, the loan payments must be calculated bearing in mind the remaining future value of the capital remaining.

- Calendar convention refers to a specific day-count convention which can either be an Actual/ actual -, Actual/ 365 Fixed -, Actual/ 360 or 30/360 convention. A day-count convention measures how interest accrues on investments like loan, etc. Actual/ actual calculates the daily interest using the actual number of days in the year and then multiplies that by the actual number of days in each period. Actual/ 365 Fixed calculates the daily interest using a 365-day year and then multiplies that by the actual number of days in each period. Actual/ 360 calculates the daily interest using a 360-day year and then multiplies that by the actual number of days in each period. 30/365 calculates the daily interest using a 365-day year and then multiplies that by 30 (standardized month). 30/360 – calculates the daily interest using a 360-day year and then multiplies that by 30.

- Interest type can be Simple or Compound. Compound interest is always calculated on the sum of the capital and accumulated interest, i.e., Interest on interest. Simple interest is flat interest.

- Customer account

- Vendor account (supplier)

When creating a new loan, users can select both a customer and a vendor account, rather than choosing only one of the two.

Previously, for payable loans, users could only select a vendor trading partner, and for receivable loans, only a customer trading partner could be selected. Now, regardless of the loan direction, users can select a customer and/or vendor.

When you create a loan header or a new loan, note that when selecting Effective option on the Interest form, the Interest type must be Compound.

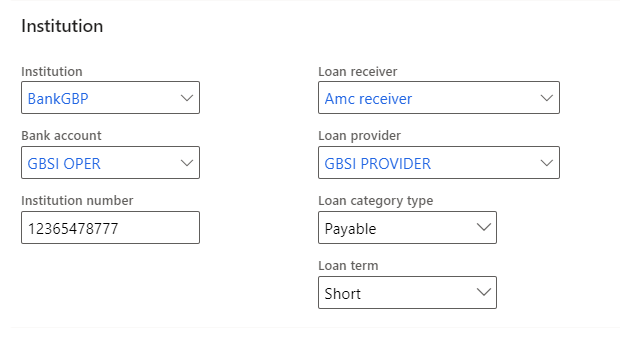

¶ Step 8.4: Institution FastTab

- Institution box: select bank group from a drop-down list. If selecting a specific institution, only the related bank accounts will be available from the Bank account drop down options.

- Select Bank account. If no institution was selected, all bank accounts will be available to choose from, else only the related bank account will be available.

Note: Multiple loans can be linked to a bank account. One bank account can be linked to a loan

To view Loans linked to a specific bank account:

- Go to Cash and Bank management>Bank accounts>Bank accounts.

- Select the specific bank account and expand the Treasury FastTab to view any related Loans on this bank account

- The Institution number is the reference number that the institution uses for correspondence regarding the loan.

- Loan direction (mandatory) Receivable / Payable

- Loan provider

- Loan receiver

- Loan term: Choose between Short, Medium and Long Loan term

¶ Step 8.5: Posting Profiles FastTab

Posting profiles will automatically populate, depending on the Loan Group selected.

- When changing a posting profile manually on the loan, the Interest accrual and Payment journal batch jobs will take into consideration the newly selected posting profiles, instead of using the posting profiles on the loan group.

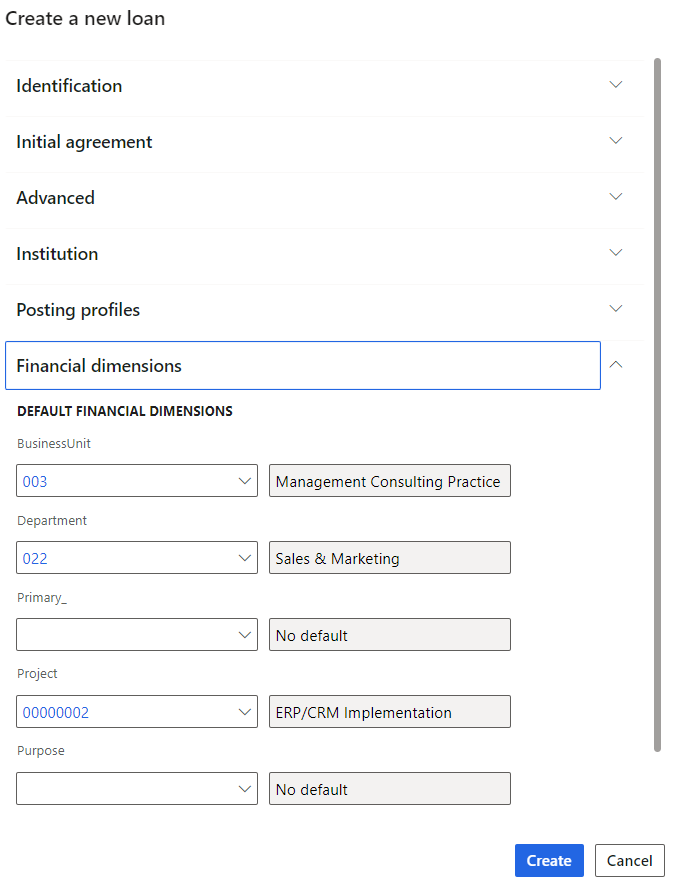

¶ Step 8.6: Financial dimensions FastTab

- When the loan group is populated the dimensions, which have been configured for that loan group, will appear. The user can then modify these dimensions further.

- Click the Create button once all the necessary fields have been filled in.

- The loan number is generated automatically. Go to the newly created loan on the loans list page and open.

- The loan details page consists of a Header index tab and a Lines index tab.

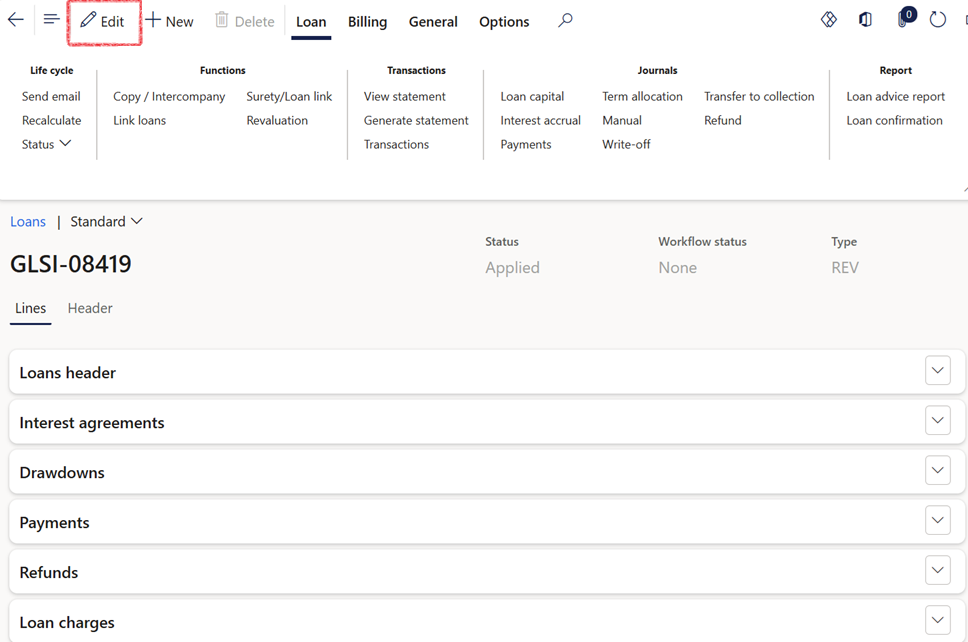

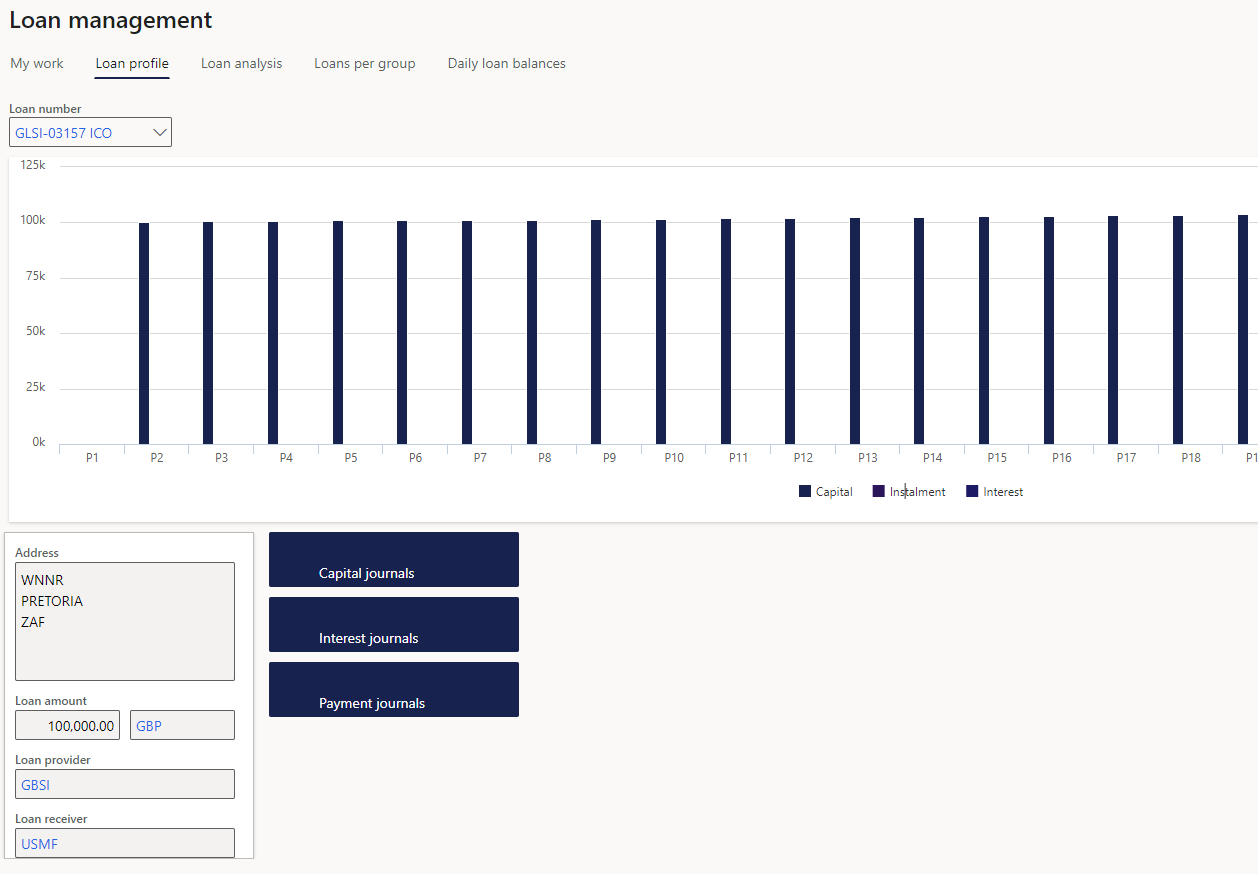

¶ Step 9: View the Loan

The Loan Details page (Treasury > Loans > Loans > [Select a Loan]) opens in a read-only state by default to help prevent unintentional changes to loan records.

- An Edit button is available next to the Save button in the action pane

- Users must click Edit to enable editing of loan details.

- This approach ensures that changes are made intentionally and with awareness.

The functionality behind each Action tab on loans, will be discussed in detail later in this document.

- To open the newly created loan, go to: Treasury>Loans>Loans

- On the list page, select the new loan number in the grid check box to open the Loan details page

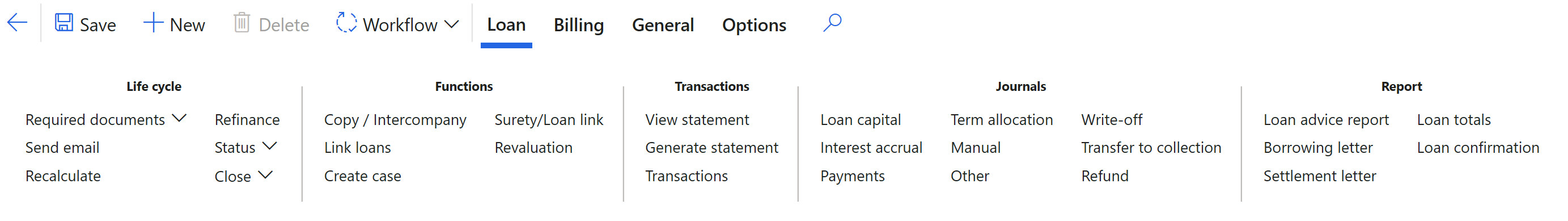

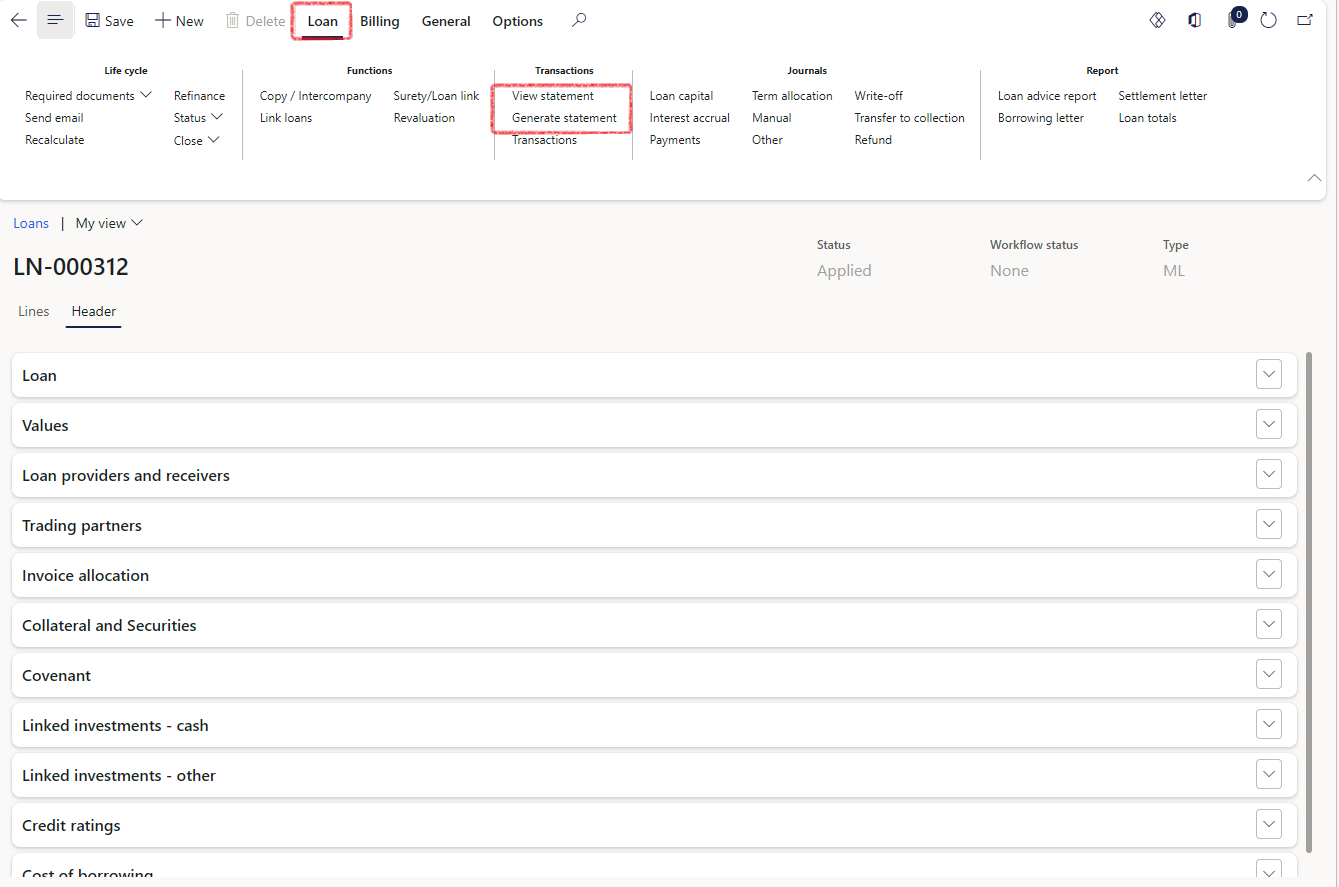

¶ Step 9.1: Loan tab

The Loan tab in the ribbon bar consist of the following sections:

- Life cycle

- Functions

- Transactions

- Journals

- Report

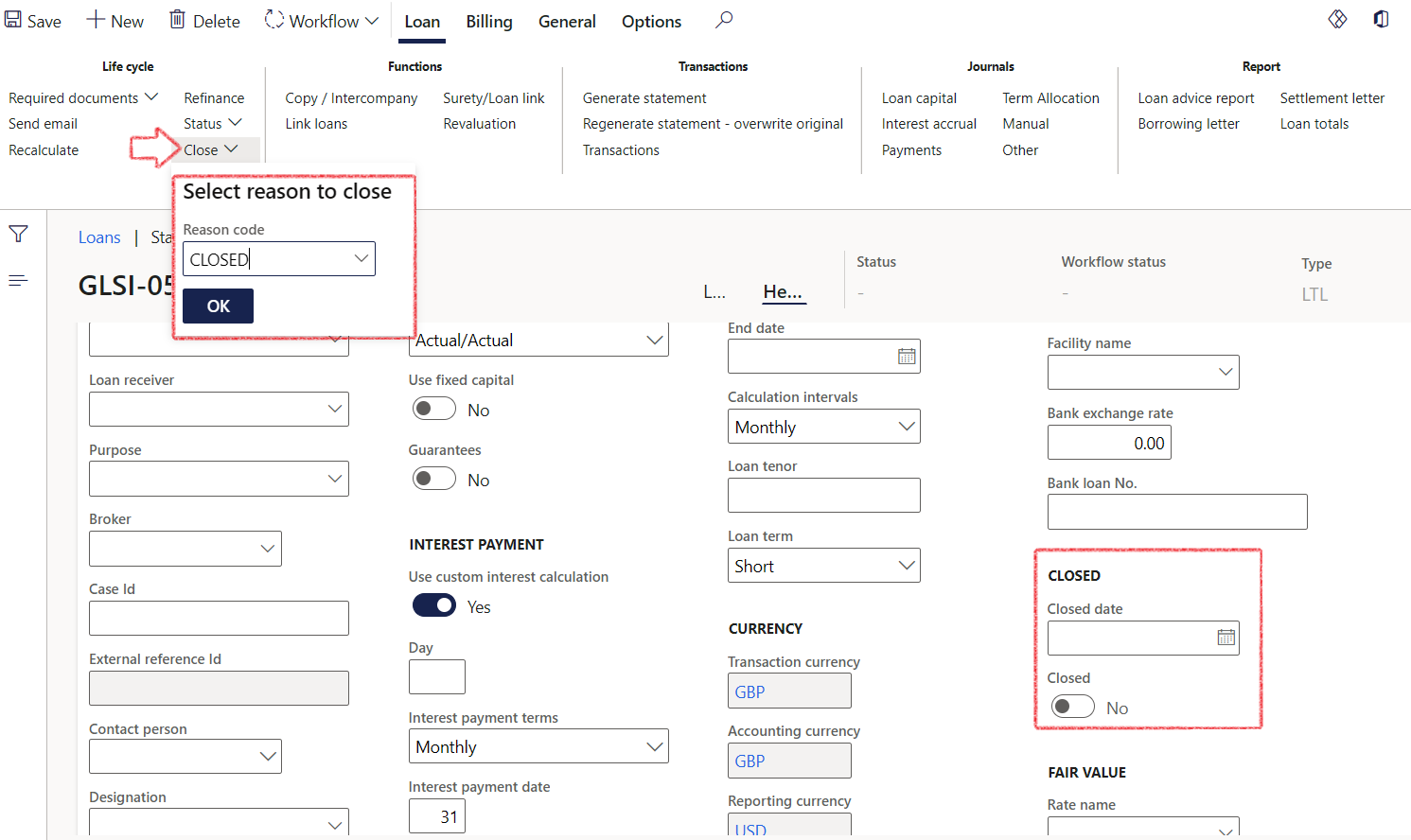

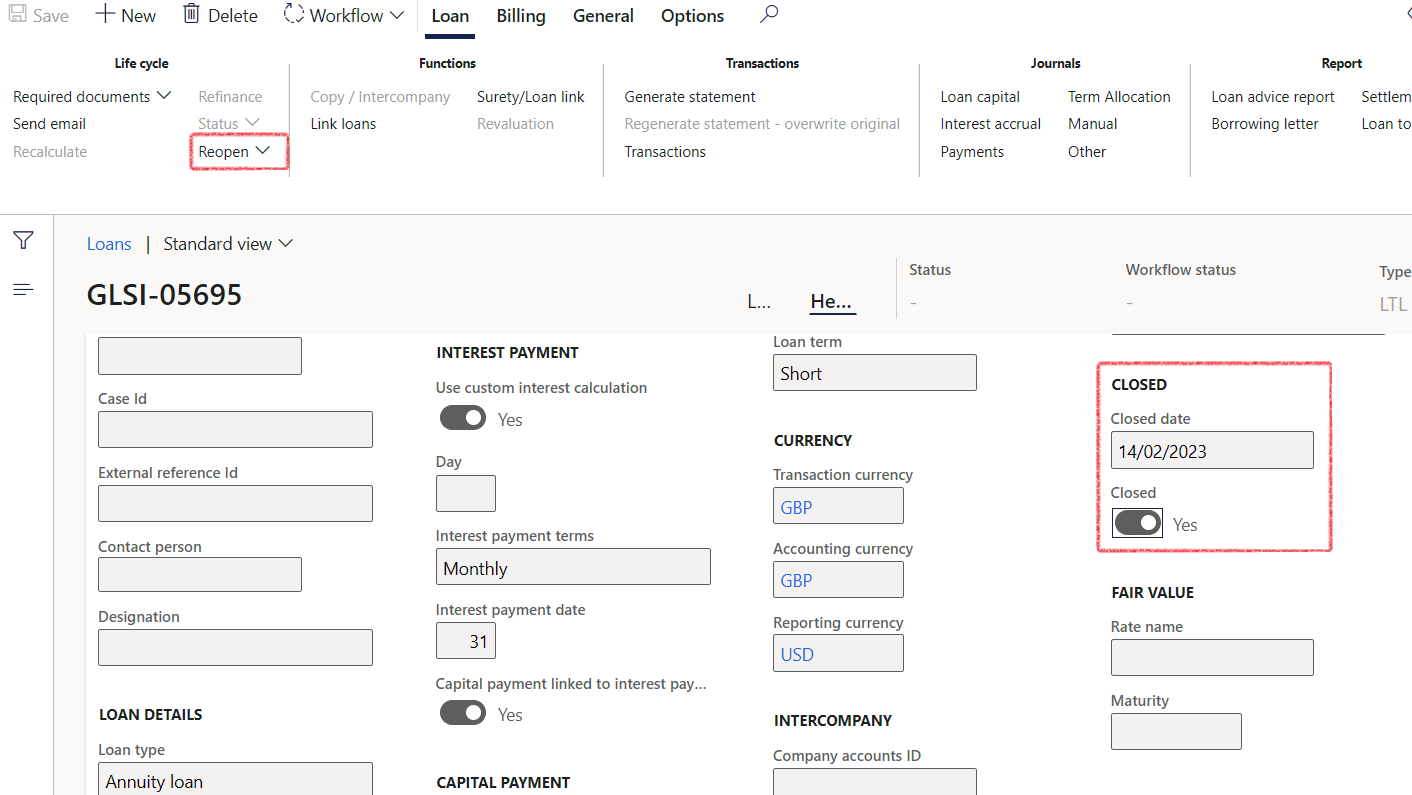

¶ Step 9.1.1: Loan action tab - Life cycle

- Required documents

- Send e-mail

- Recalculate

- Refinance

- Status

- Close

¶ Step 9.1.2: Loan action tab - Functions

- Copy/Intercompany

- Link loans

- Create case

- Surety/Loan link

- Revaluation

¶ Step 9.1.2.1: Surety/Loan link

- To link a Surety to a Loan, navigate to Registers>Guarantee register.

- Create a guarantee or open an existing guarantee.

- Expand the Sureties put in place FastTab

- Add a new line for a surety

- Select the relevant loan number from a drop-down menu

¶ Step 9.1.3: Loan action tab - Transactions

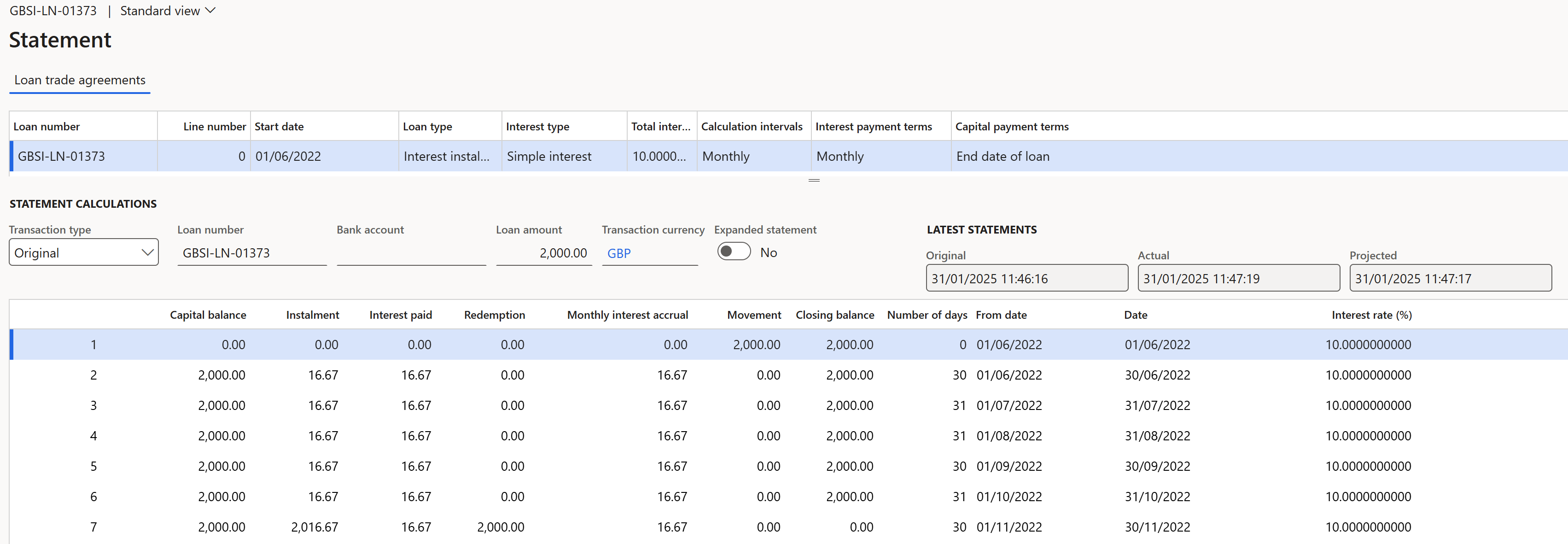

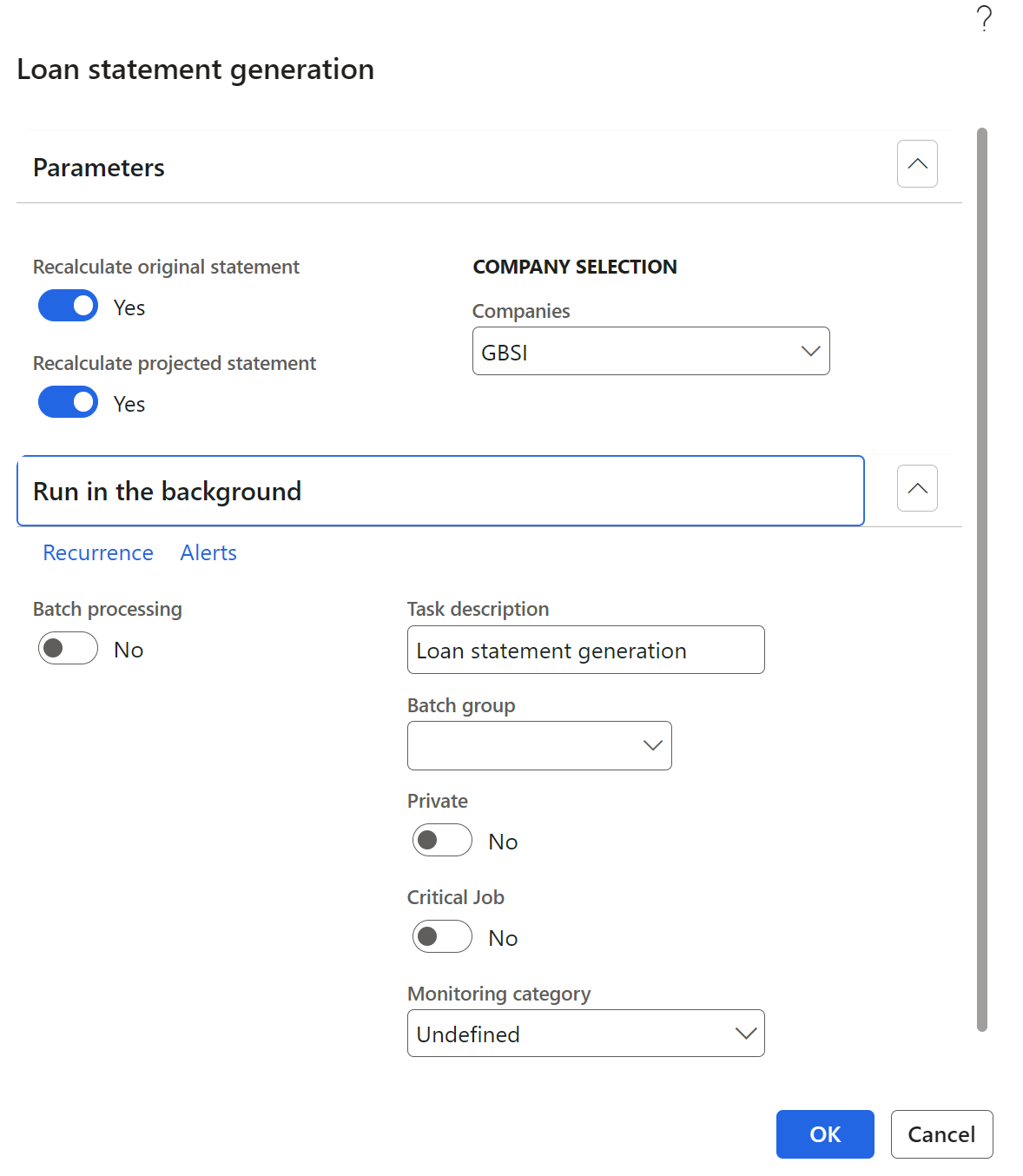

- View statement

- Generate statement

- Transactions

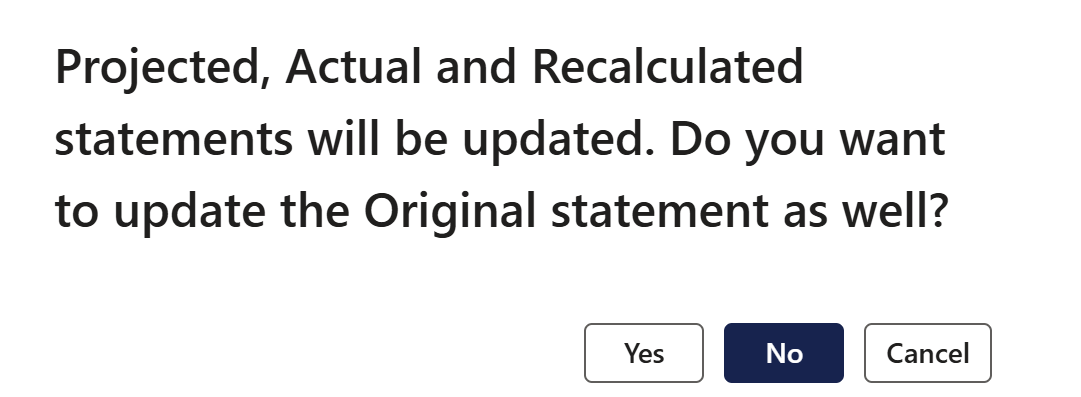

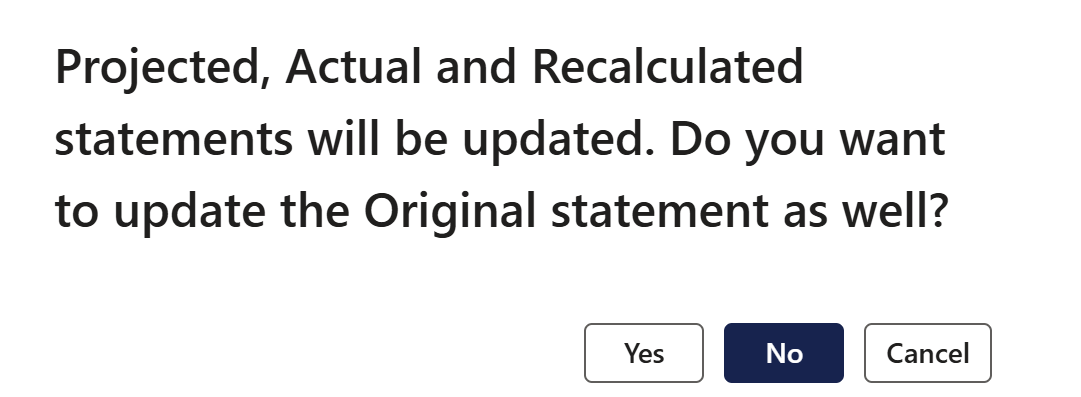

When you click on Generate statement, you'll see the following notification: Projected, Actual and Recalculated statements will be updated. Do you want to update the Original statement as well?

¶ Step 9.1.4: Loan action tab - Journals

- Loan capital

- Interest accrual

- Payments

- Term Allocation

- Manual

¶ Step 9.1.5: Loan action tab - Report

- Loan advice report

- Borrowing letter

- Settlement letter

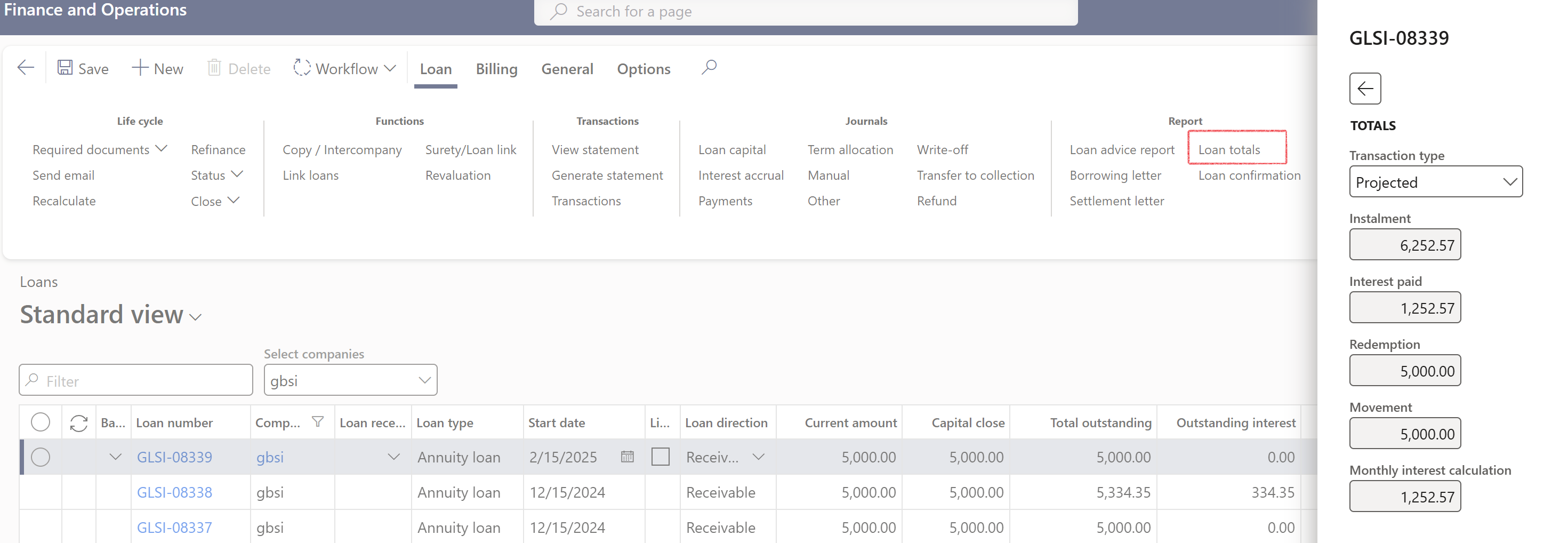

- Loan totals

- Loan confirmation

Loan totals can also be viewed in a fact box, by opening the Related information pane. Note that loan totals can be viewed for various Transaction types:

- Original

- Actual

- Projected

- Simulated

- Recalculated

Loan confirmation

- The loan confirmation will spell out the terms of a loan to its borrowers

- The format of the report is in Microsoft Word

- Fields on the loan document include:

- Start and End date of the loan

- Number of days (end date minus start date)

- Currency (Transaction currency)

- Principal amount (this is the Loan amount on the Loan header)

- Interest rate percentage (this is the Interest rate percentage on the Interest agreement of a loan)

- Interest amount (on the Original loan statement, the sum of Monthly interest accrual amounts will equal the Interest amount on the Loan confirmation document)

- Maturity amount (on the Original loan statement, the final amount in the Closing Balance column. If zero, it will be the final amount in the Instalment column)

- To access it, users can navigate to Treasury>Loans>Loans and click on Report and then select Loan confirmation

- The setup is done under Treasury>Setup>Treasury parameters and then the user can click on the Print management tab to select the Destination, Report format and Footer text

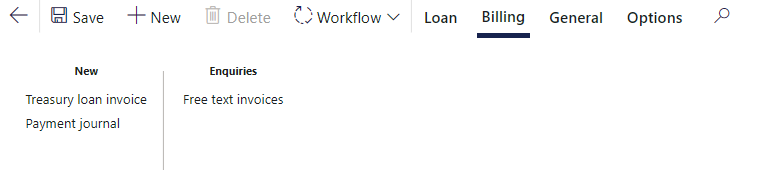

¶ Step 9.2: Billing action tab

The Billing action tab consist of the following action buttons:

- New

- Inquiries

¶ Step 9.2.1: Billing Action Tab - New

- Treasury loan invoice

- Payment journal

¶ Step 9.2.2: Billing Action Tab - Inquiries

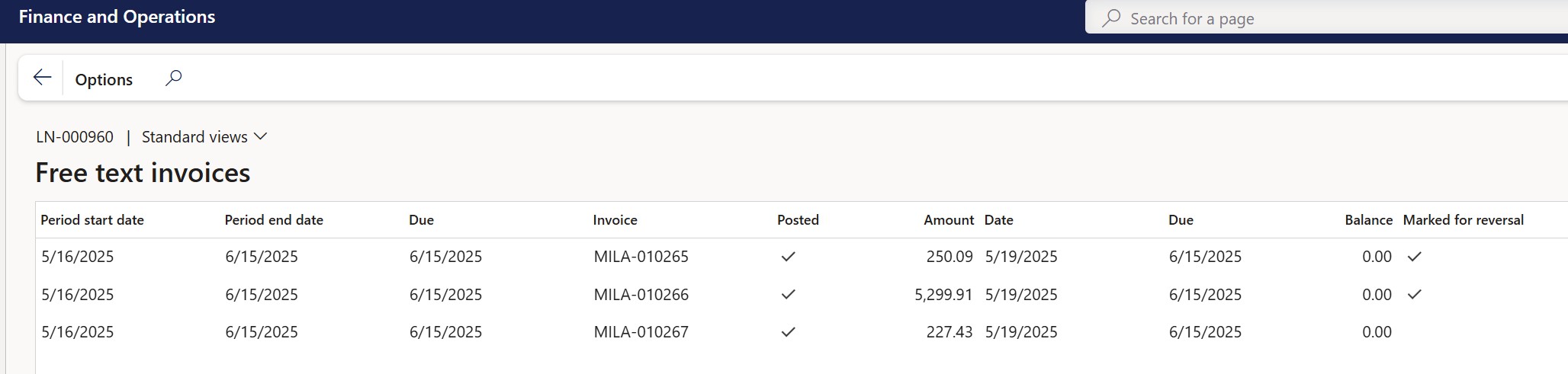

- Free text invoices:

The columns include:- Period start date

- Period end date

- Due: Indicates the due date of the posted invoice

- Invoice

- Posted

- Amount

- Date: Reflects the invoice date

- Balance: Displays the current balance of the invoice, consistent with the open value shown in Customer Transactions.

- Marked for reversal: This indicator specifies whether the invoice has been marked for reversal.

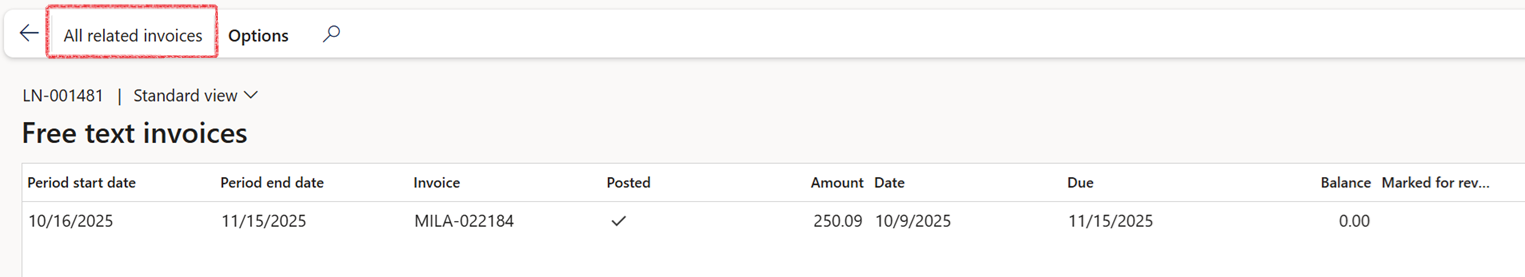

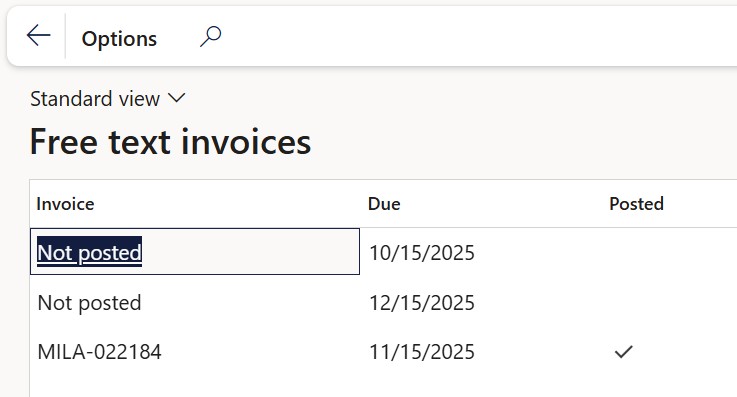

- All related invoices button

- Clicking on the All related invoices button will display all unposted treasury invoices associated with the specific loan.

- Additionally, clicking on the Not posted hyperlink will direct you to the corresponding unposted treasury invoice.

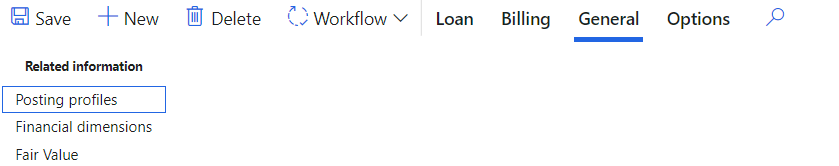

¶ Step 9.3: General Action Tab

- Related information

- Posting profiles

- Financial dimensions

- Fair Value

¶ Step 10: Header index tab

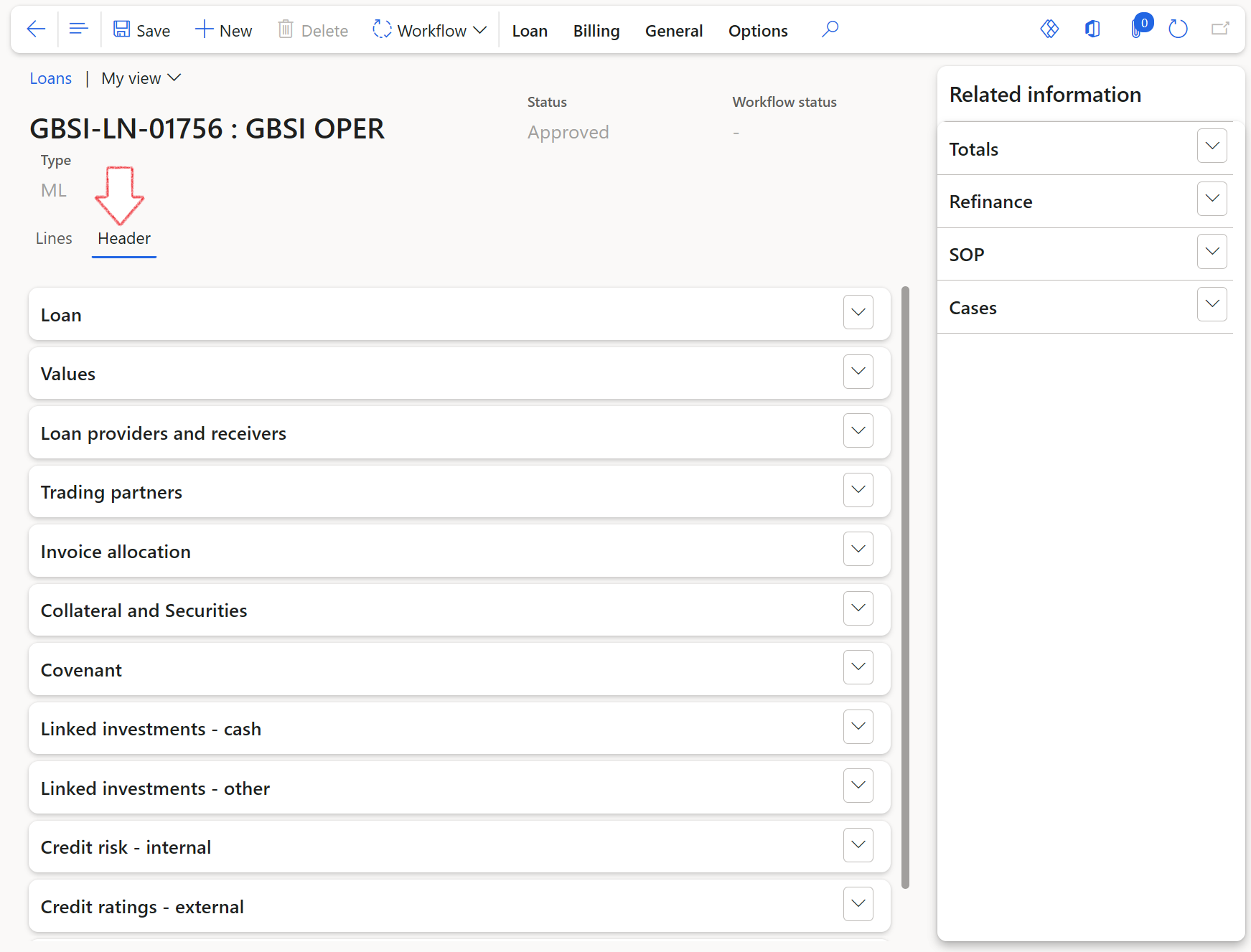

The Header index tab consist of the following FastTabs:

- Loan

- Values

- Loan providers and receivers

- Trading partners

- Invoice allocation

- Collateral and Securities

- Covenant

- Linked investments – cash

- Linked investments – other

- Credit risk – internal (only part of G2T module)

- Credit risk – external

- Credit ratings

- Cost of borrowing

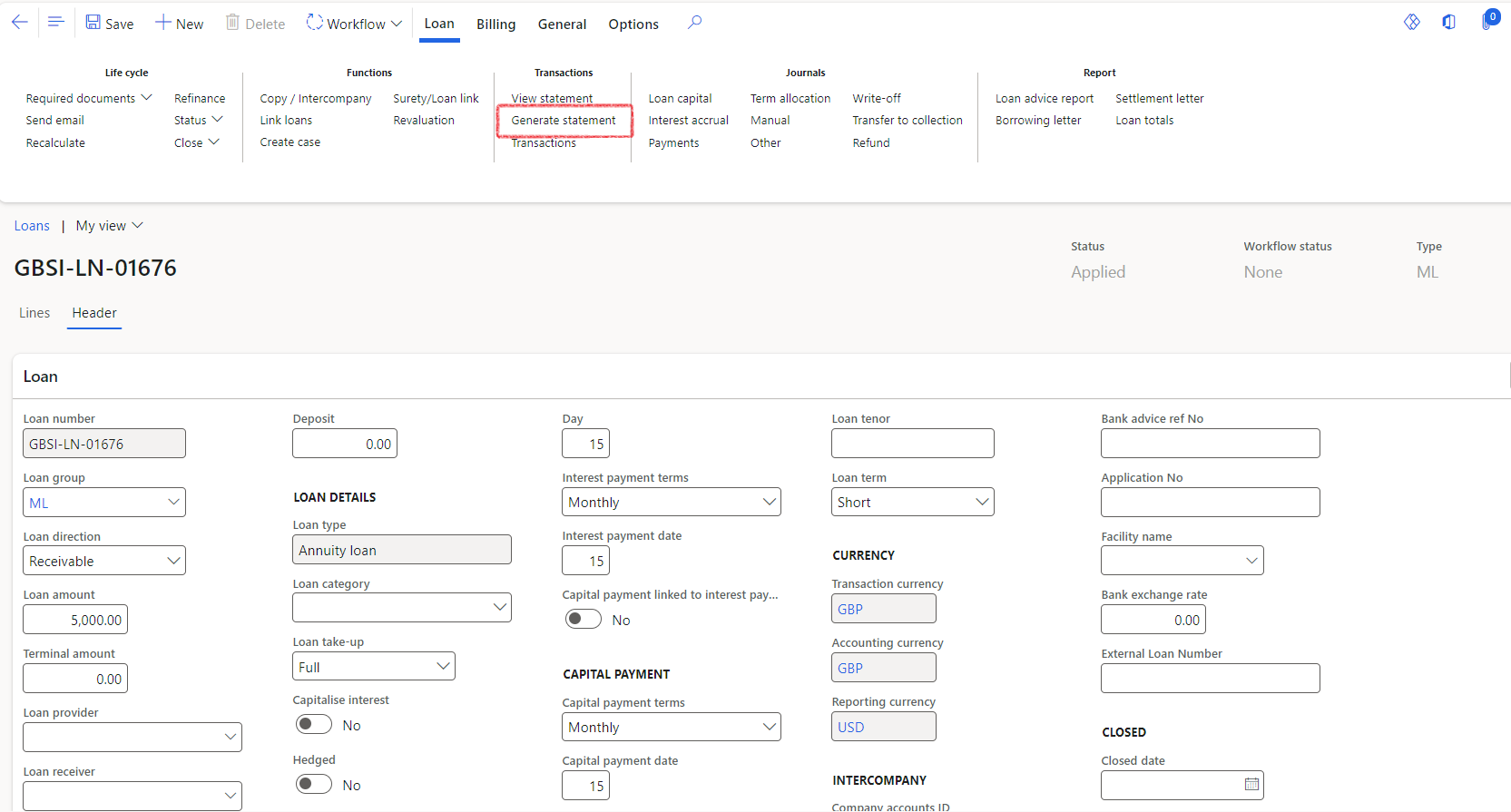

¶ Step 10.1: Loan FastTab

- In the navigation pane, go to Modules > Treasury > Loans > Loans

- Open an existing loan

- Stand on the Header index tab on top, and expand the Loan FastTab

- The Loan FastTab consist of the following sections:

- Loan identification

- Loan details

- Interest Payment

- Capital Payment

- Status (Applied, Reviewed, Approved, Rejected, Cancelled)

- Interval

- Currency

- Intercompany

- Security

- Institution

- Closed

- Fair Value

- Other

If the setting on Interest payment toggle is set to Yes for Capital payment linked to interest payment, then the Capital payment section will not display.

¶ Step 10.1.1: Identification

- Loan number

- Loan description

- Loan group

- Loan direction

- Loan amount

- Loan provider

- Loan receiver

- Broker

- Case Id

- External reference Id - This is a reference number of a counterparty (the loan number of the copied loan in the related entity)

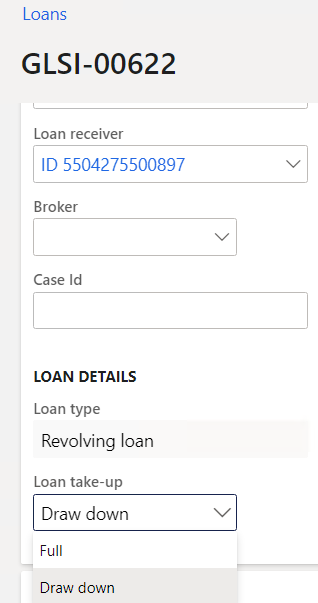

¶ Step 10.1.2: Loan details

- Loan type

- Loan category (performing, non-performing, legal, etc.)

- Loan take-up

- Capitalise interest option:

- When setting the Capitalise interest toggle to Yes , it will capitalise interest accrual to the loan balance and the full instalment will be deducted off the loan balance.

- Hedged option

- Interest type

- The Timing of payment option will have an impact on the instalments displayed on the Projected loan statement :

- Specifically, when selecting the In advance with interest or In advance with no interest option in the timing of payment selection field, the first instalment will be displayed on the first line of the statement. (loan's start date.)

- When selecting the In arrears option in the Timing of payment selection field, the first instalment will not be displayed on the first line (loan’s start date) of the statement.

- When selecting the In arrears option in the Timing of payment selection field, the first instalment will not be displayed on the first line (loan’s start date) of the statement.

- Calendar convention

- Used fixed capital option

- Terminal value

- Guarantees option

Loan category is used in the Financial Risk register, together with Default probability setup under Loans.

¶ Step 10.1.3: Interest payment

- Loan payment terms

- Interest payment date

- Capital payment linked to interest payment option

¶ Step 10.1.4: Capital payment

The system will only display this part if Capital payment linked to interest payment is set to No.

If set to no, then the Capital repayment can be split from interest repayments, and two separate cycles can be selected.

- Capital payment term

- Capital payment date

¶ Step 10.1.5: Status

- Status

- Notes

¶ Step 10.1.6: Interval

- Calendar

- Start date

- End date

- Calculation intervals

- Daily interest calculation works in combination with a new daily rate, with a maximum of 31 different rates per month

- When selecting Daily, the Interest will be paid every quarter

- For Daily, the Interest will be accrued up to the end of the month, including the last day.

- Loan tenor

- Loan term

¶ Step 10.1.7: Currency

- Transaction currency

- Accounting currency

- Reporting currency

¶ Step 10.1.8: Intercompany

- Company accounts ID - this is the legal entity of the related loan

¶ Step 10.1.9: Security

- Loan security cover (% of Asset market value on Collateral and Securities for this loan)

- Cover ratio (%) to calculate the Loan margin

¶ Step 10.1.10: Institution

- Institution

- Bank account

- Institution number

- Application No

- Facility name

- Bank exchange rate

- External Loan Number

¶ Step 10.1.11: Closed

- Closed date

- Closed option

¶ Step 10.1.12: Fair Value

- Rate name

- Maturity

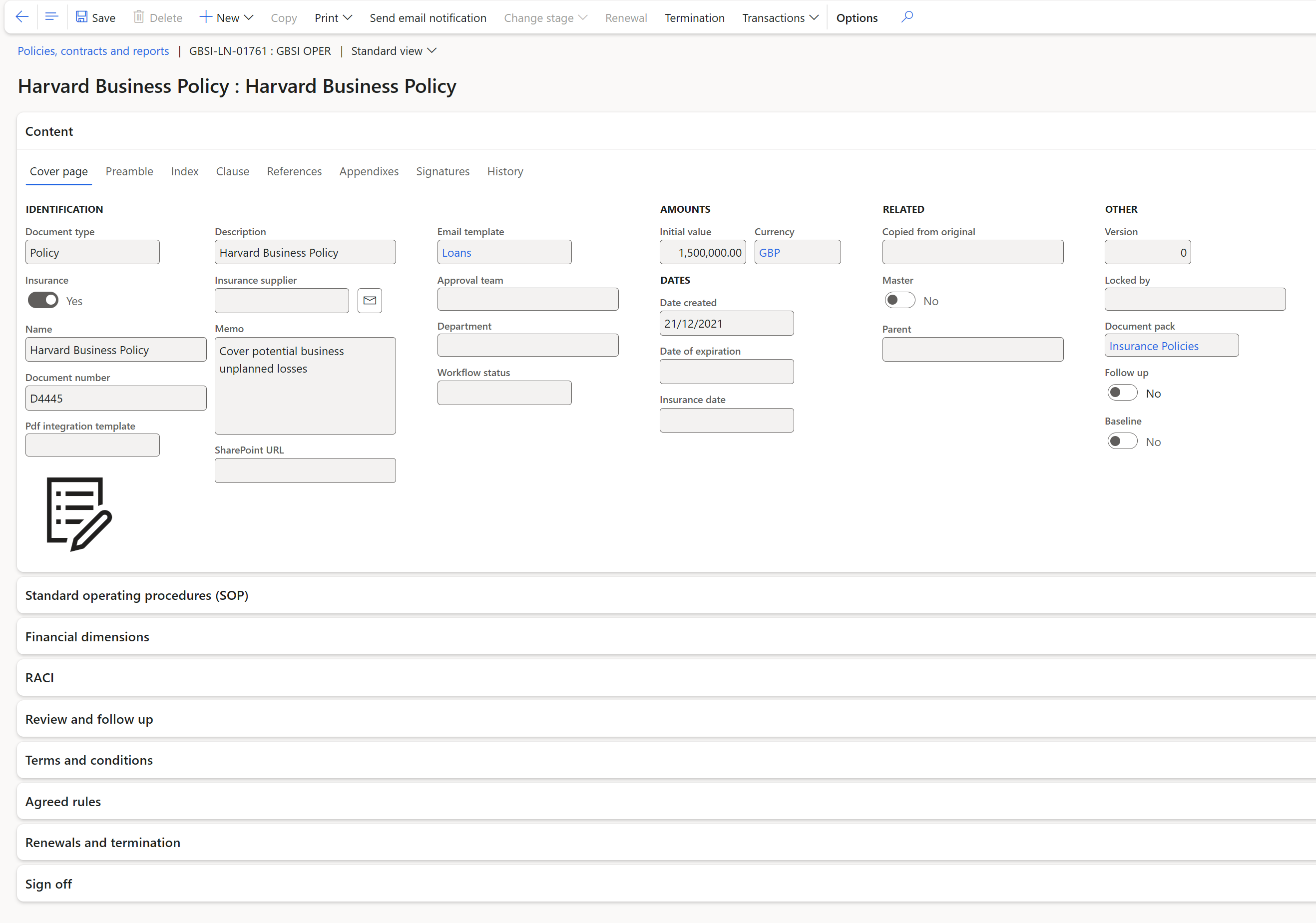

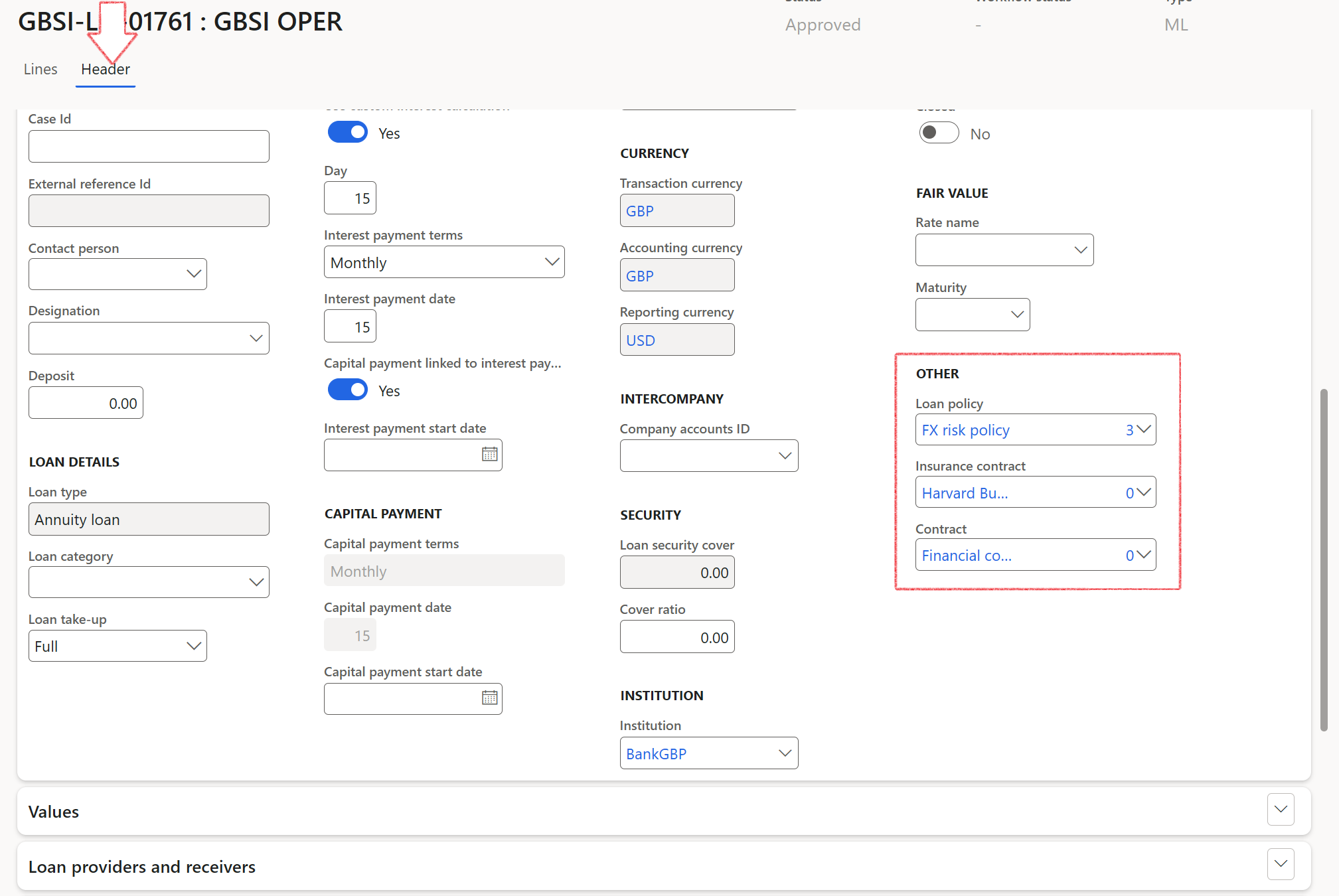

¶ Step 10.1.13: Other *(part of G2T)

- Loan policy

- Insurance contract

The Insurance contract lookup is under GRC module, Policies, Contracts and Reports table

The Document type is Policies

The Insurance tick is set to Yes

- Contract

In order to be able to select a contract from this drop-down list:

- The contract should have a PCR type of Contract

- The contract should have one of the following statuses: Draft, Submit, Approve or Revise

- It should not be Baseline

- The contract should not be Insurance

When users add a Contract or Insurance contract to the Loan or Investment form, a record will be created in the Reference table, located under Treasury>Registers>Contract register. The reference table will contain the Loan / Investment ID, Initial amount, and Currency

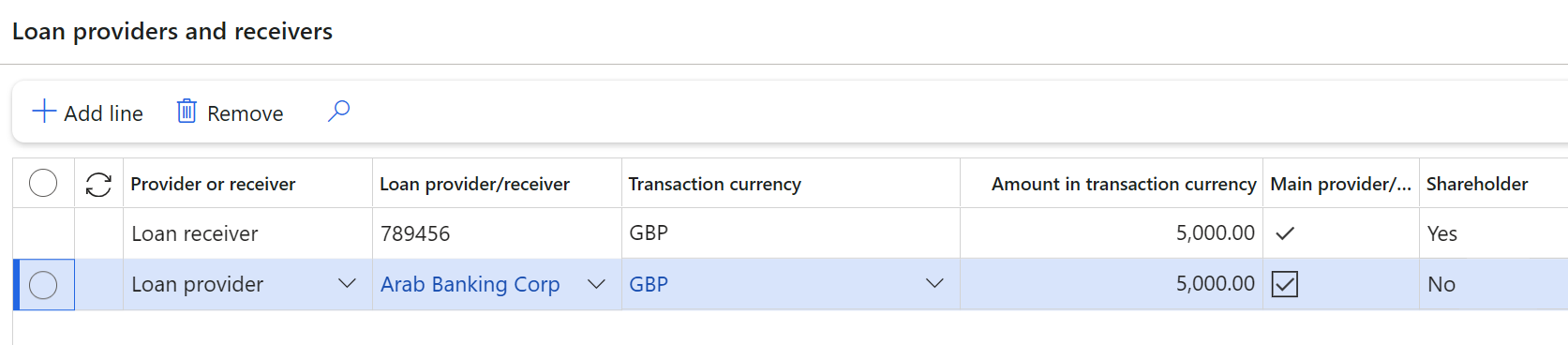

¶ Step 11: Loan providers and receivers

- The Loan providers and receivers FastTab is automatically populated and marked as the main provider/receiver. New entries can be added or deleted, where a pool of entities is lending/borrowing through this one loan.

- The Shareholder field is a display method and can be edited under Treasury>Loans>Setup for Loans>Loan providers and receivers, when expanding the Stakeholder FastTab.

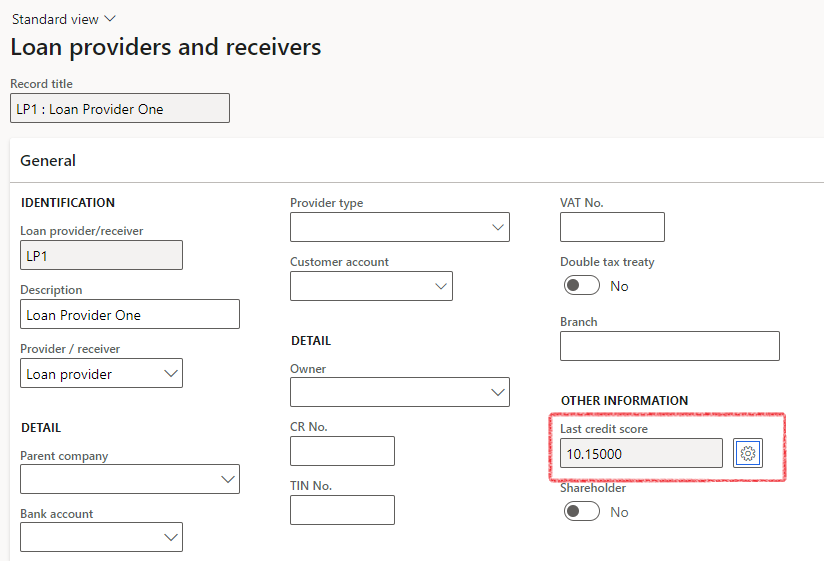

¶ Step 11.1: Calculate Last Credit score for Loan providers and receivers

- Navigate to Treasury > Loans > Setup for Loans > Loan providers and receivers

- Select a Loan providers and receivers record

- Expand the Ratings FastTab

- On the field Last credit score , click on the gear icon

- Select a Score group name

- Enter a date

- Select an Agency. This is a link to the Vendor lookup table

- Type in the Actual percentages for each line

- You will see that the Weighted score will then be calculated automatically

- Click the OK button

- The Last credit score is calculated as per the setup and the latest values that was entered.

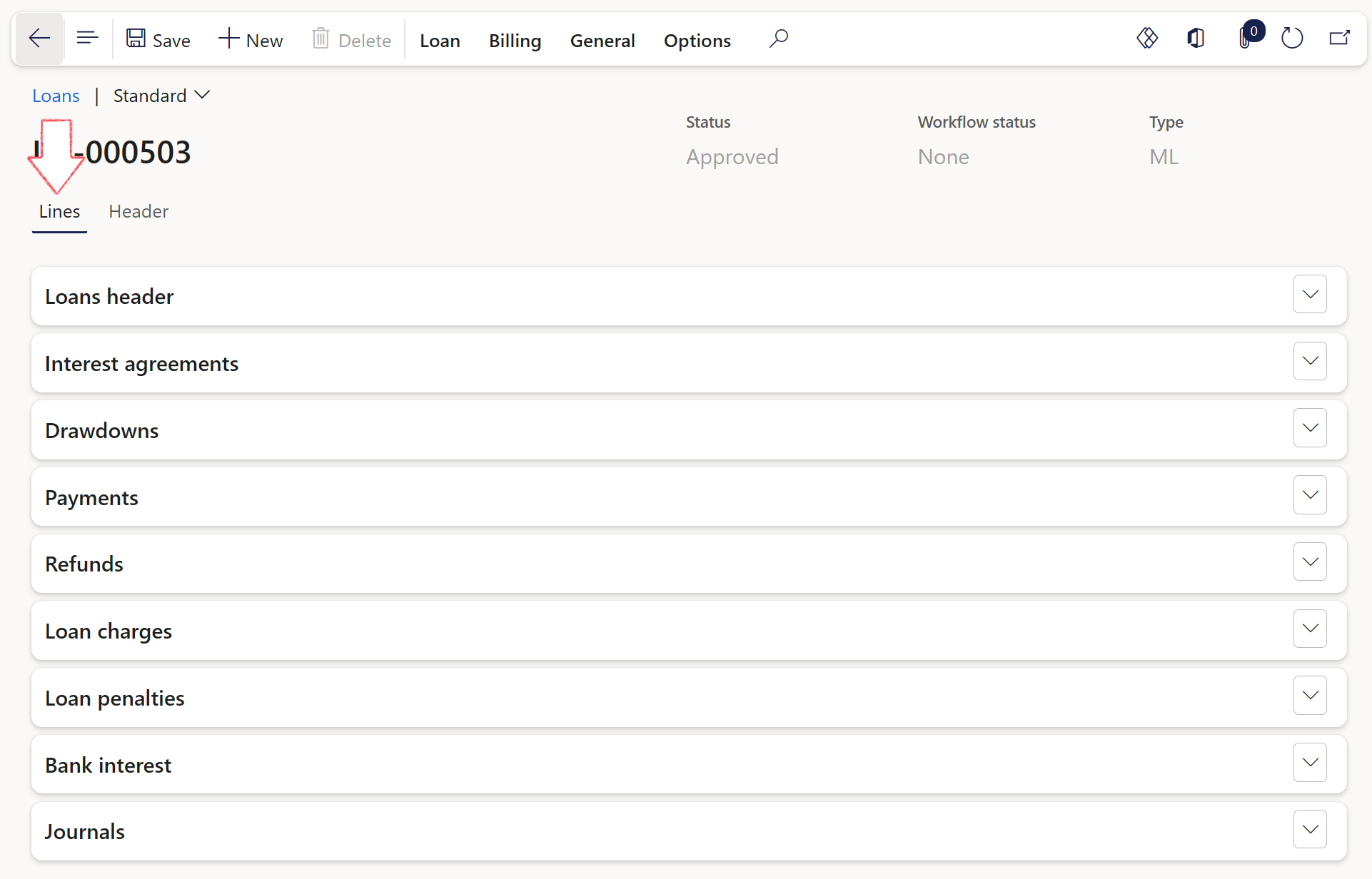

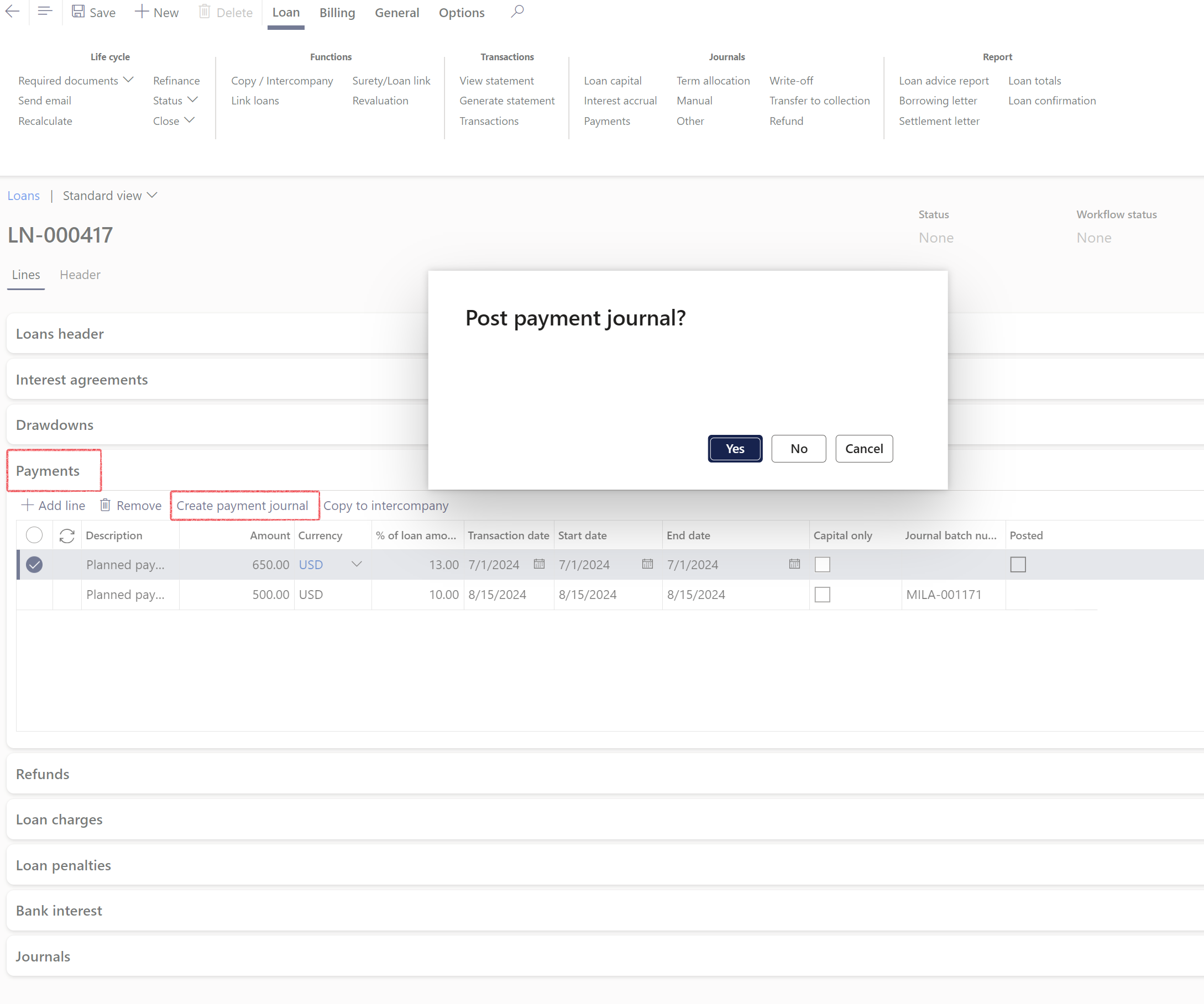

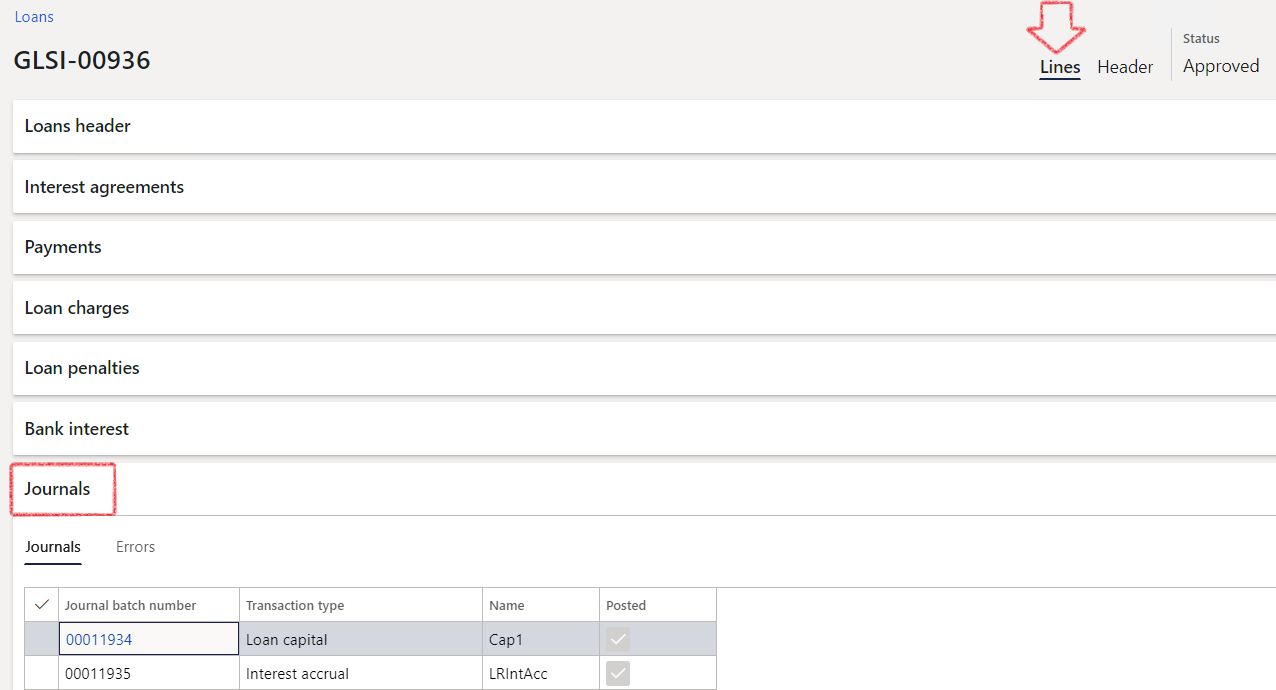

¶ Step 12: Lines index tab

The lines index tab consist of the following FastTabs:

- Loans header

- Interest agreements

- Drawdowns

- Payments

- Refunds

- Loan charges

- Loan penalties

- Bank interest

- Journals

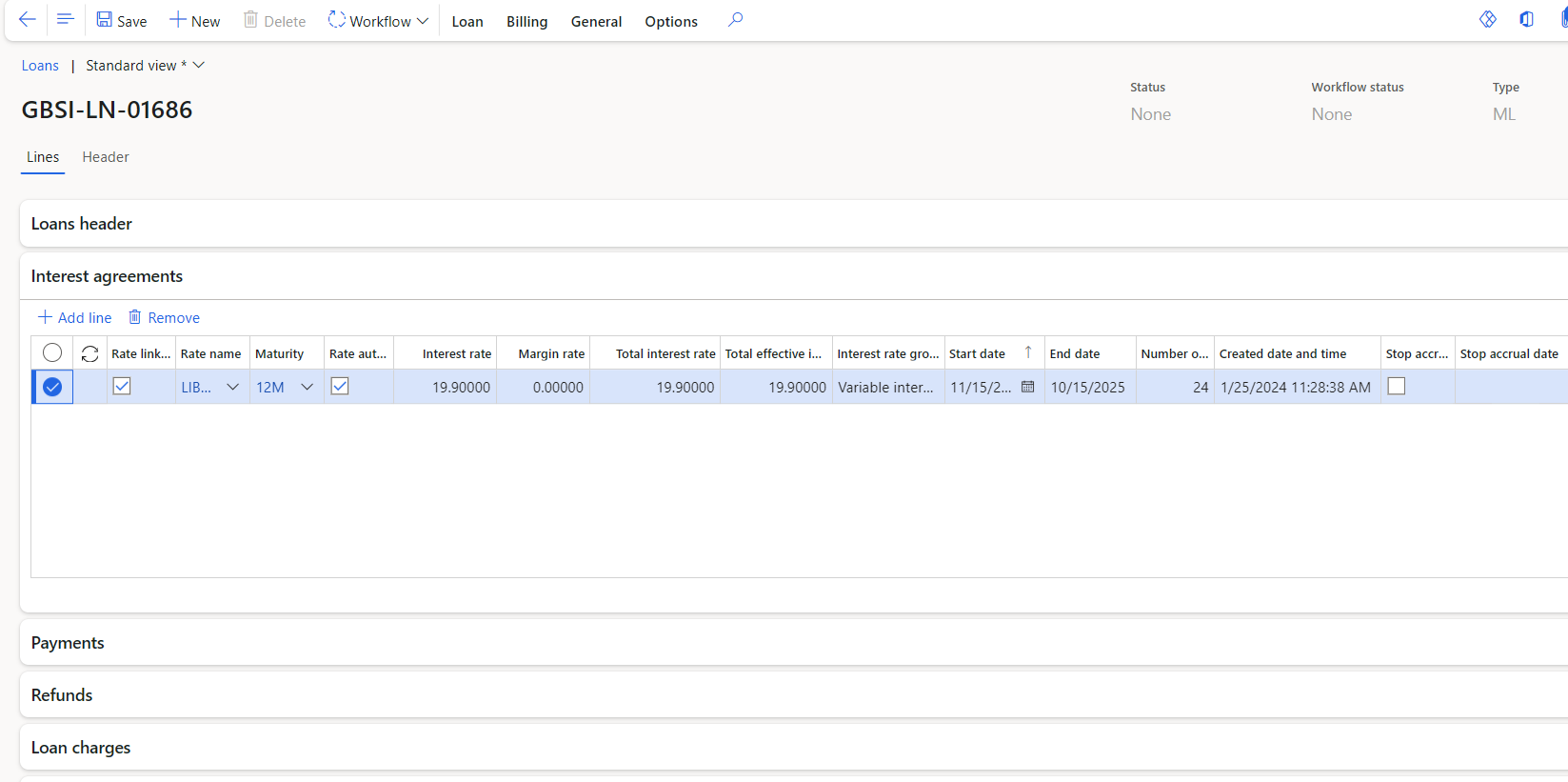

¶ Step 13: Interest agreements

Interest agreement interest rates contracted against the loan can be set up under Interest Agreements. It can be updated automatically or manually. The interest rates can be fixed or variable.

- In the navigation pane, go to Modules > Treasury > Loans > Loans and open an existing loan.

- When opening a loan, by default you will be taken to the Header form.

- Click on the Lines index tab

- Now expand the Interest agreements FastTab

- Click on the Add line button to add a new interest rate line

- Rate linked: select the tick box if this rate is linked to the interest rate table. This is used by the batch job to automatically create new interest rate agreements (Common> Periodic> Rate auto-updates on Interest agreements)

- Rate name can be selected from drop-down list as it was set up

- Maturity - choose between 12 months, 1 week, 2 weeks, 6 months or Overnight

- Rate Auto-update tick box

- Interest rate is mandatory field; this is the interest rate negotiated with the institution and should be entered as a percentage

- Margin rate is the difference between the interest rate that a bank charges a borrower and the interest rate a bank pays a depositor. It is a percentage that tells someone how much money the bank earns versus how much it gives out

- Total interest rate

- Total effective interest rate

- Interest rate group can be either fixed or variable.

- a fixed interest rate means that the agreed interest rate is applicable for the entire period of the loan

- a variable interest rate means that the interest rate will fluctuate according to market conditions. When creating a new Interest rate, Variable interest rate should be the default.

- If you select a Variable interest rate, you will be able to add additional lines on the trade agreement.

- When working with variable interest rate, ensure you enter a new Start date for each line, but keep the end date for all new lines on the trade agreement the same.

- Start date gets its value from the loan details header record. The first line of interest agreements start date is populated from the loan header.

- When adding additional interest rate lines, from the second line, the start dates can be filled in.

The initial start date is populated from the Loan header

- End date: The loan date together with the loan payment terms determines the number of payments that will be made and subsequently the number of statement lines that will be created.

- The end date is part of the base data for the loan and is negotiated with the institution on creation of the first agreement. This means that the end date must be the same across all agreement versions.

The end date is automatically populated from the Loan header

- Number of statement lines is a non-editable field that is calculated using the start to end dates and loan payment terms (interest calculation intervals)

- Interest payment terms: options to choose from is monthly, quarterly, half yearly and yearly

- Number of payments in loan

When all the relevant fields are completed, and the record is saved, a Loan Capital Journal will be created automatically if the loan amount is more than zero

Modifying the end date of the loan will cause the system to recalculate the instalment amount and adjust the Projected statement accordingly.

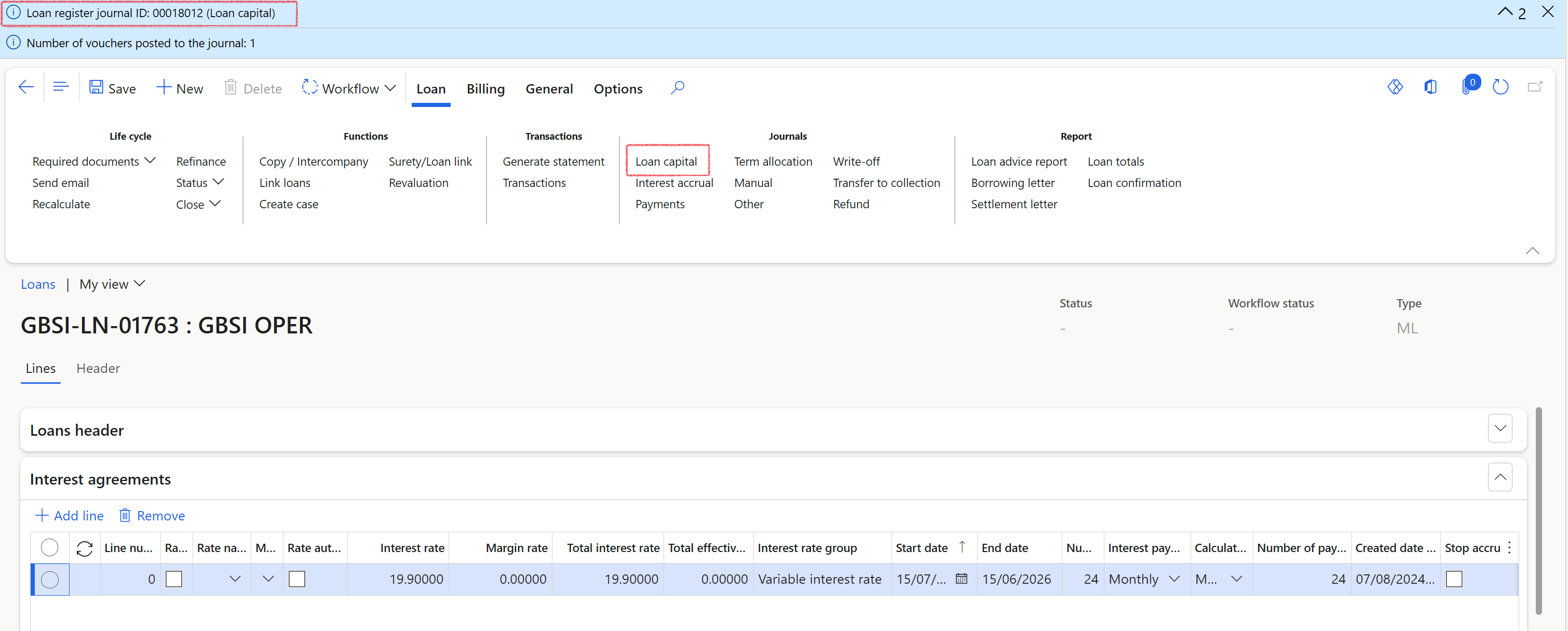

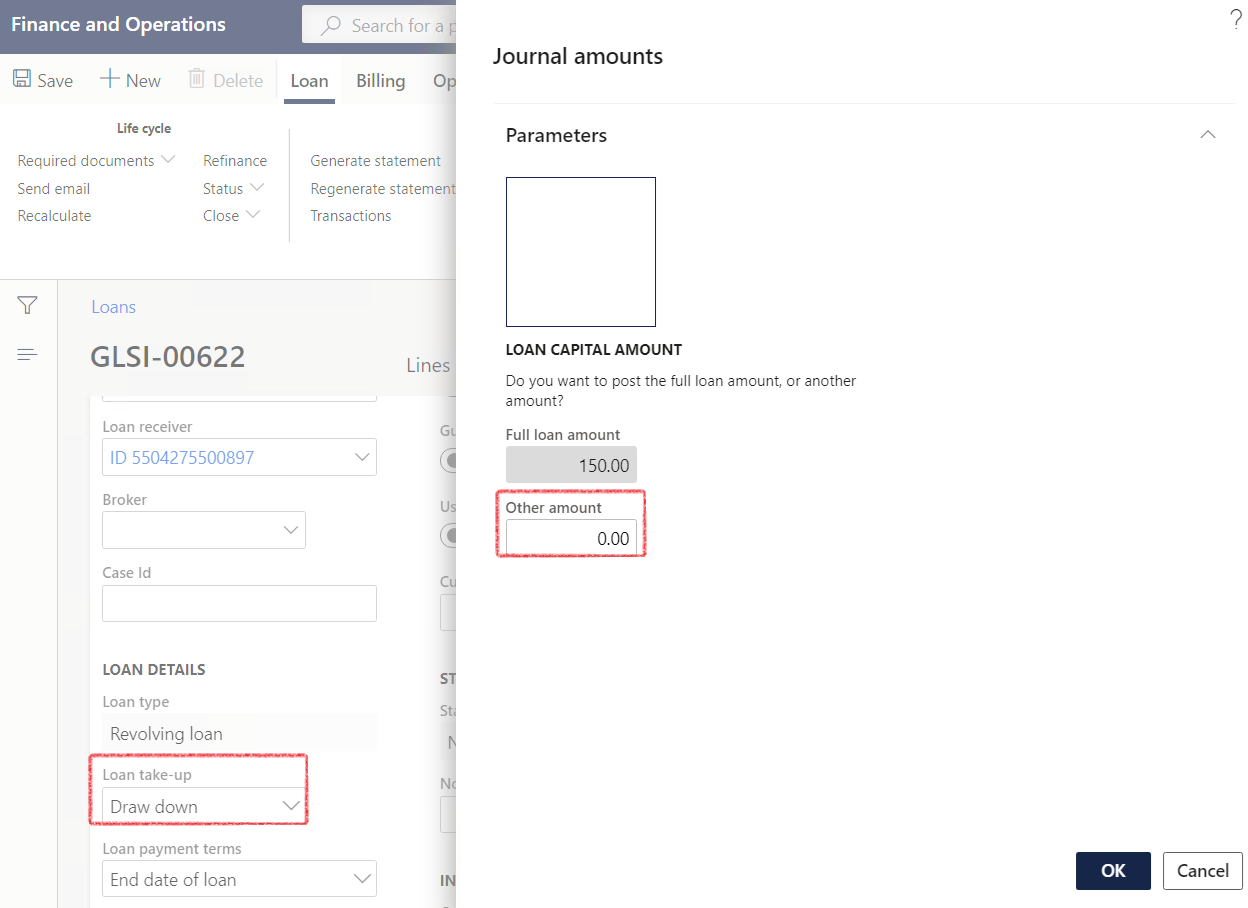

¶ Step 14: Loan Draw downs

- When creating a loan, or after successfully creating a loan and the first agreement record, the user can specify the amounts for which the first journals be created.

- If the Loan take-up is set to Full, the full loan amount will be used for the Loan Capital journal, and the dialog presented will prompt for all allocation amount to be entered.

- If no allocation amount is entered, an Allocation journal will not be created.

- If the Details FastTab for the loan is set to Draw down, the user will be presented with a dialog which will prompt the user to enter an Other amount and click OK .

- Draw down will require a percentage of the loan amount to be used in the loan capital journal

- If the loan capital journal amount is not entered, a Loan capital journal will be created for the full amount of the loan.

- If an allocation amount is not entered, an allocation journal will not be created.

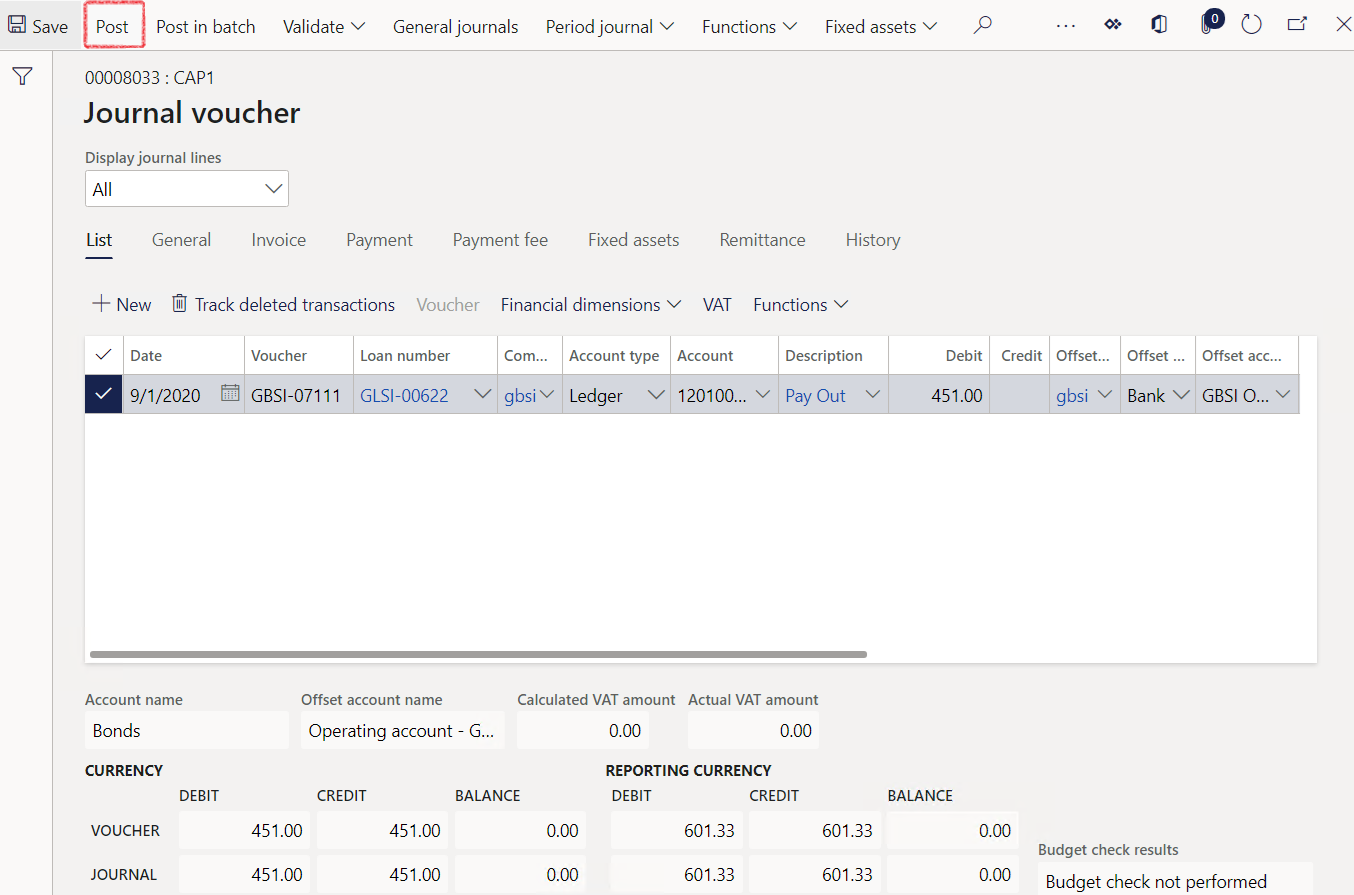

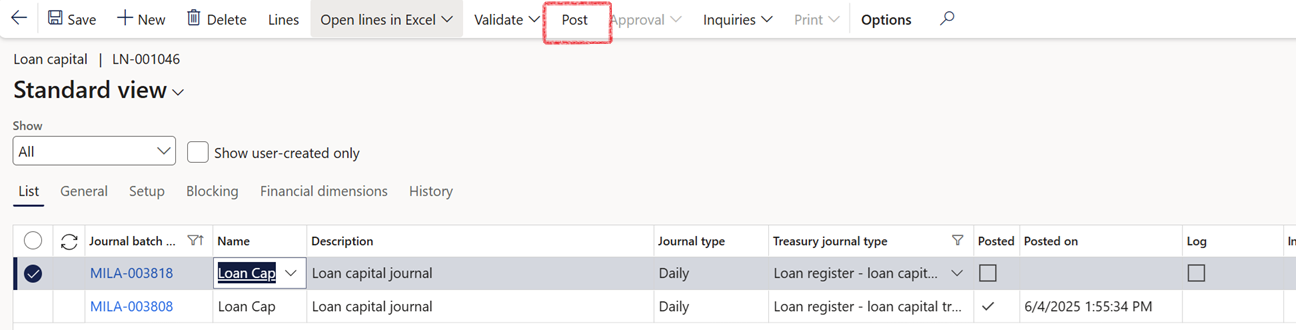

- The next step is to post the loan capital journal.

- Click on Loan Capital to open the journal.

- Click on Lines. View the journal voucher

- Click on the Post button to post the capital journal voucher

¶ Step 14.1: Enable Drawdown journals

Enabling the setting is to allow for additional and multiple drawdown journals to be created against a loan record.

- In the navigation pane, go to: Modules > Treasury > Treasury parameters

- Click on the General tab

- Expand the Loans FastTab

- Slide the Enable drawdown toggle to Yes

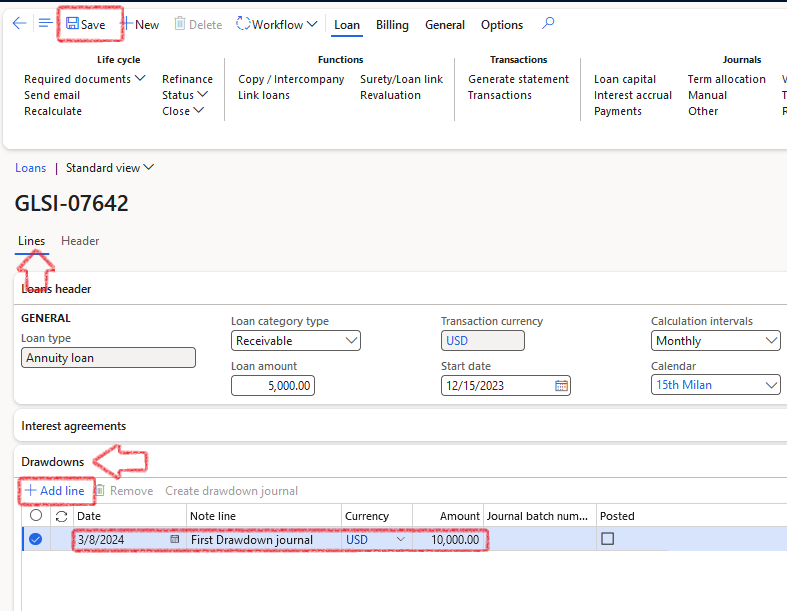

¶ Step 14.2: Create Drawdown

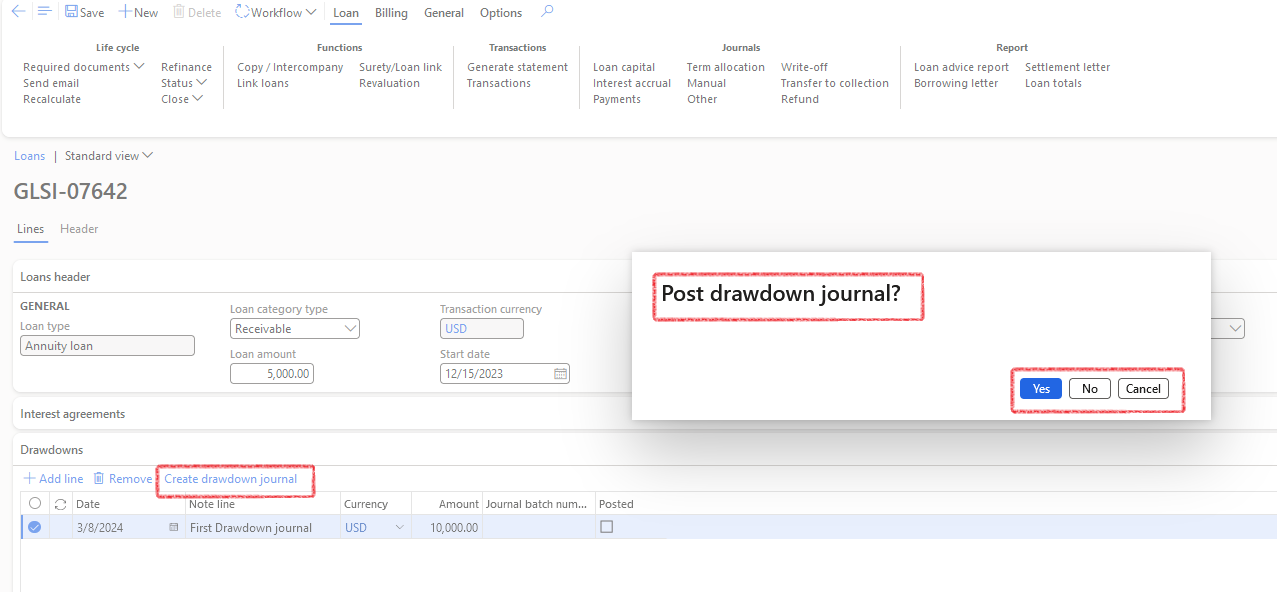

Multiple drawdown journals can be created and posted against an existing loan record, at any point in time during the term of the loan.

- In the navigation pane, go to: Modules>Treasury>Loans>Loans

- You will be greeted by a list page

- Filter on the specific loan number

- Click on the loan number to open the loan record

- On the Line index tab navigate to the Drawdown FastTab

- Click on + Add line to create a new line

- Complete the following fields:

- Date

- Note line

- Currency

- Amount

- Click on the Save button to save the record

- Click on Create drawdown journal

- Select Yes or No for the option to automatically post the Drawdown journal (Capital journal)

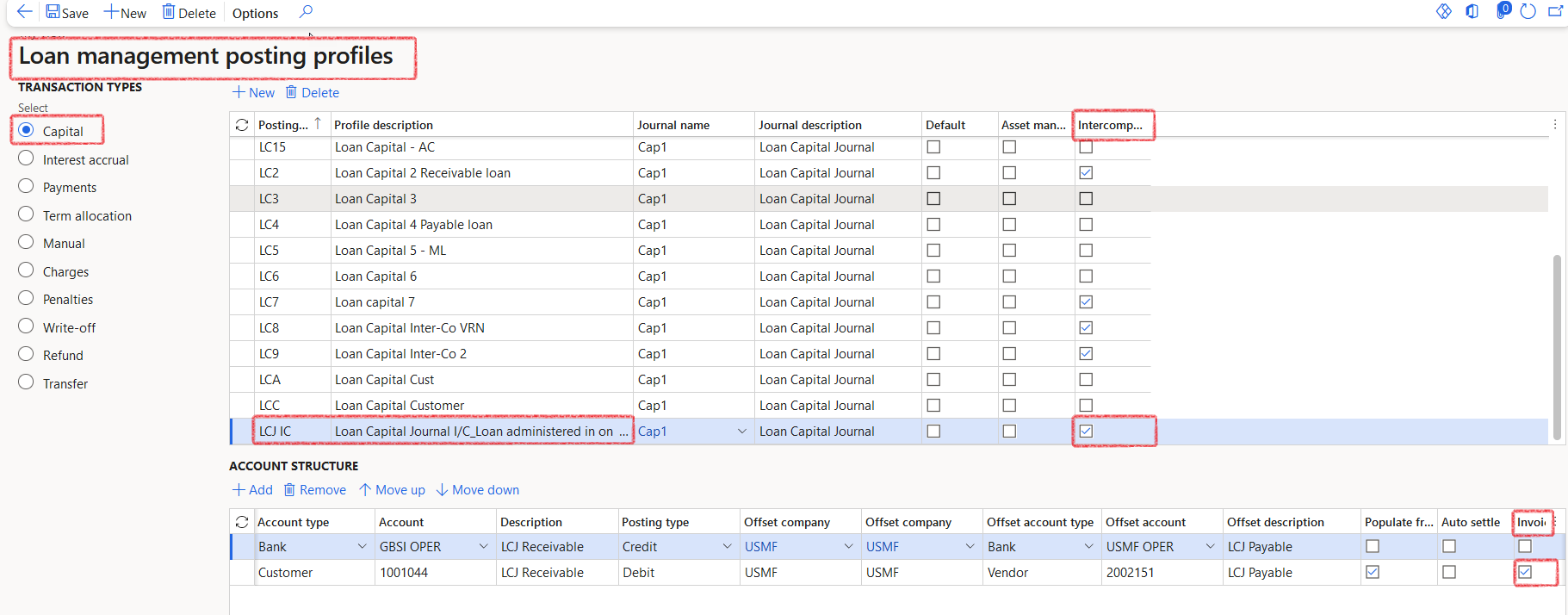

¶ Step 14.3: Invoice posting for drawdowns

Only when an intercompany loan capital or drawdown journal is created and posted, invoices can be configured to post automatically against the intercompany customer and vendor account.

To enable this automatic posting, certain conditions must be met:

- There must be an intercompany Loan capital journal or drawdown journal created and posted

- The Capital posting profile must be configured to indicate that automatic posting of the invoice must be done

- The Invoice field should be enabled on the posting profile

- An invoice number can then be created and posted against the internal customer account

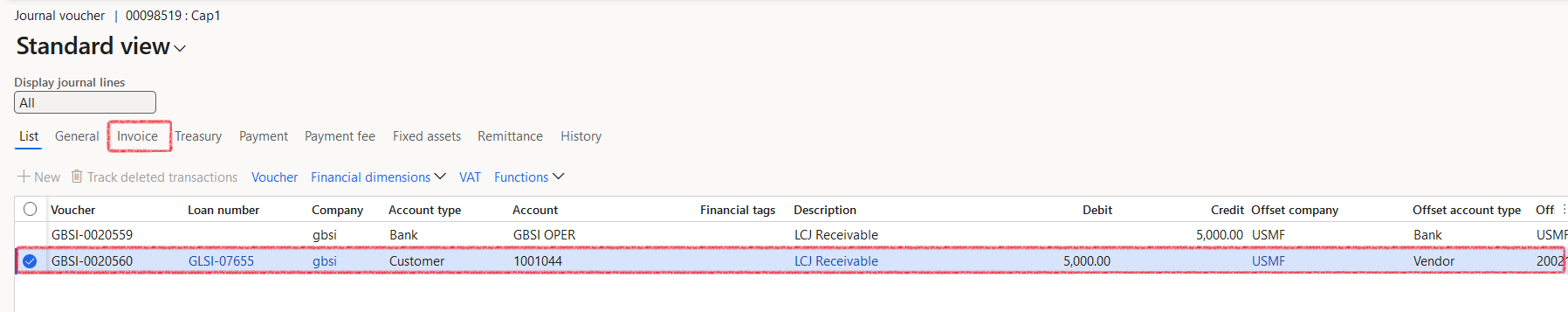

- Navigate to the lines of loan capital journal or drawdown journal of a loan record which have been posted

- The line should consist of an internal customer and internal vendor record according to the posting profile

- On the Invoice tab of the journal lines an invoice number will have automatically been populated and the invoice would have automatically been approved

- This invoice can also be viewed on the customer and vendor Transactions page.

- When navigating to the counterparty legal entity, the same invoice number will be found under the Invoice tab of the journal lines:

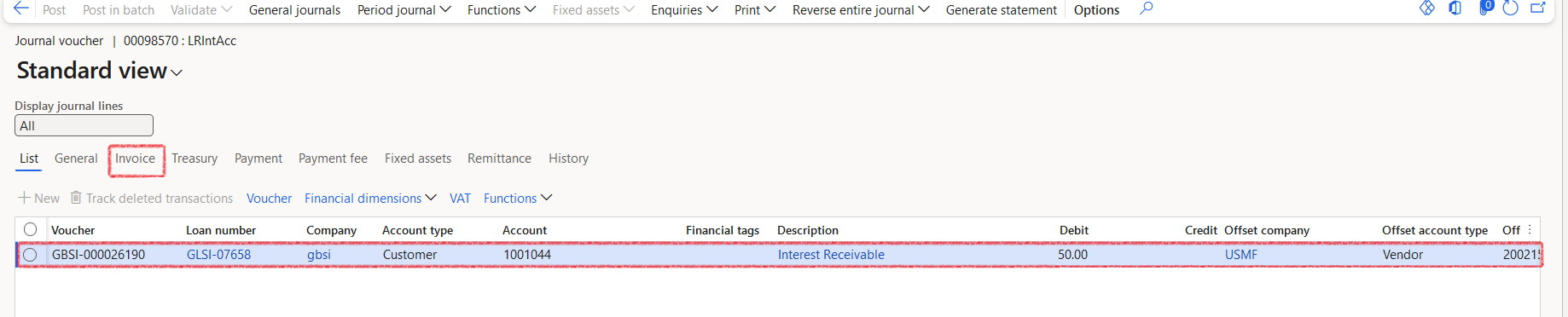

¶ Step 14.4: Invoice posting for Interest accrual journals on drawdowns loans

Only when an intercompany Interest accrual journal is created and posted, invoices can be configured to post automatically against the intercompany customer and vendor account.

To enable this automatic posting, certain conditions must be met:

- There must be an intercompany interest accrual journal created and posted

- The posting profile must be configured to indicate that automatic posting of the invoice must be done

- The Invoice field should be enabled

- An invoice number will then be created and posted against the internal customer account

- Navigate to the lines of the Interest accrual journal of a loan record which have been posted

- The line should consist of an internal customer and internal vendor record according to the posting profile

- On the Invoice tab of the journal lines an invoice number will have automatically been populated and the invoice would have automatically been approved.

- When navigating to the counterparty legal entity, the same invoice number will be found under the Invoice tab of the journal lines.

¶ Step 15: View loan Posting Profiles

- In the navigation pane, go to: Modules > Treasury > Loans > Loans and open an existing loan

- In the Action pane, click on the General tab on top to see related information

- Select Posting Profiles

- This will open a posting profiles information dialogue on the right-hand side with a FastTab for each posting profile type

The Interest accrual and Payment journal batch jobs will use the newly selected posting profiles in place of the posting profiles on the loan group if the posting profile on the loan is manually changed.

- The Create Payment Journal button: When capturing a line, users can effortlessly generate a Payment journal with the option to post it simultaneously.

- Automated Batch Number: Upon creation, the payment journal batch number will automatically populate the line.

- An indicator will also display whether the journal has been posted or not. It is labeled Posted

¶ Step 16: Financial dimensions

- In the navigation pane, go to: Modules > Treasury > Loans > Loans and open an existing loan

- Click on the General tab on top to view related information fact box

- Select Financial dimensions

- This will open a financial dimensions information dialogue on the right-hand side.

- Default financial dimensions per loan, can be selected which can be utilised in the creation of journals.

- When the user modifies the 'Loan number' field on the journal lines form, it will fetch the financial dimensions, first checking the loan header, and if that is blank, use the journal name setup.

- The offset accounts will also display the same financial dimensions as it is setup on the loan, or on the journal name setup

- When properly setup, these financial dimensions will be applicable for all journal transactions in TMS: Interest accrual journal, Capital journal, Payment journal, Manual journals, etc.

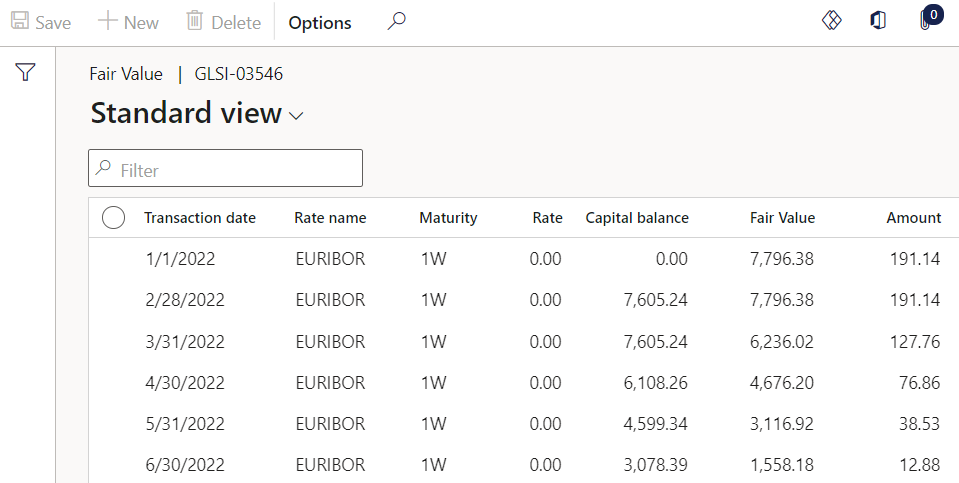

¶ Step 17: Fair Value functionality

Fair Value can be calculated against a loan, and it will show the difference compared to the Current value of the loan.

To view more information on the Fair value of a loan:

- Navigate to Treasury > Loans > Loans and open an existing loan

- Click on the General tab inside the Action pane, under Related information

- Select Fair Value

- A Fair Value grid will open

- Multiple rows can be added to the grid

- Columns (fields) of the Fair Value grid for this specific loan:

- Transaction Date

- Rate name

- Maturity

- Rate

- Capital balance

- Fair Value

- Amount

- The rate is obtained from the interest rate table

- The current amount is obtained from the Loan actual balance

¶ Step 18: Loan Journals

The following journal types are commonly associated with loans:

✓ Capital

✓ Interest accrual

✓ Payments

✓ Write-off's

✓ Refunds

✓ Transfer (Transfer to collection)

✓ Term allocation

✓ Manual journals, such as Manual adjustments, Penalties, and Charges (e.g., Upfront fees)

Before processing any journals, it is crucial to have Posting profiles configured properly.

A unique voucher number will be assigned to each loan for all loan periodic journal entries. If a loan has multiple transactions on different dates, each transaction date will also receive a unique voucher number

When posting any Treasury journal, it can trigger the background process of generating a Loan statement automatically for all loans included in the journal.

- The functionality is enabled by setting up a batch job for Loan Statement generate

- This is only applicable to the specific loans where a Treasury journal was posted. So it will not include all loans in the database.

- When creating loan journals (Capital journal, Interest accrual journal, Payments journal, etc.) that involve customer or vendor transactions in their accounting entries, these vouchers will automatically be approved. Once the vouchers are approved, users can manually settle these transactions if necessary

- The header/overview page of each journal includes a Post button, enabling users to post the entire journal in a single action without opening individual journal lines.

- This allows for a more efficient posting process after journal approval. If a journal is subject to workflow approval and has not yet been approved, the Post button is disabled and grayed out.

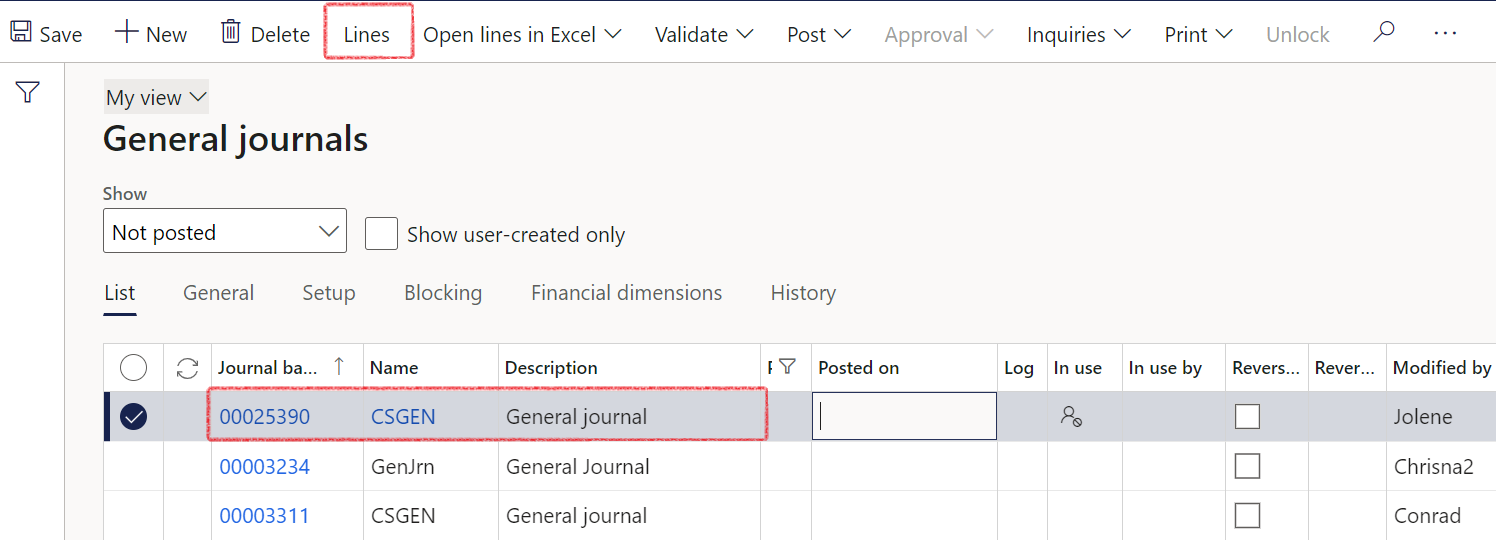

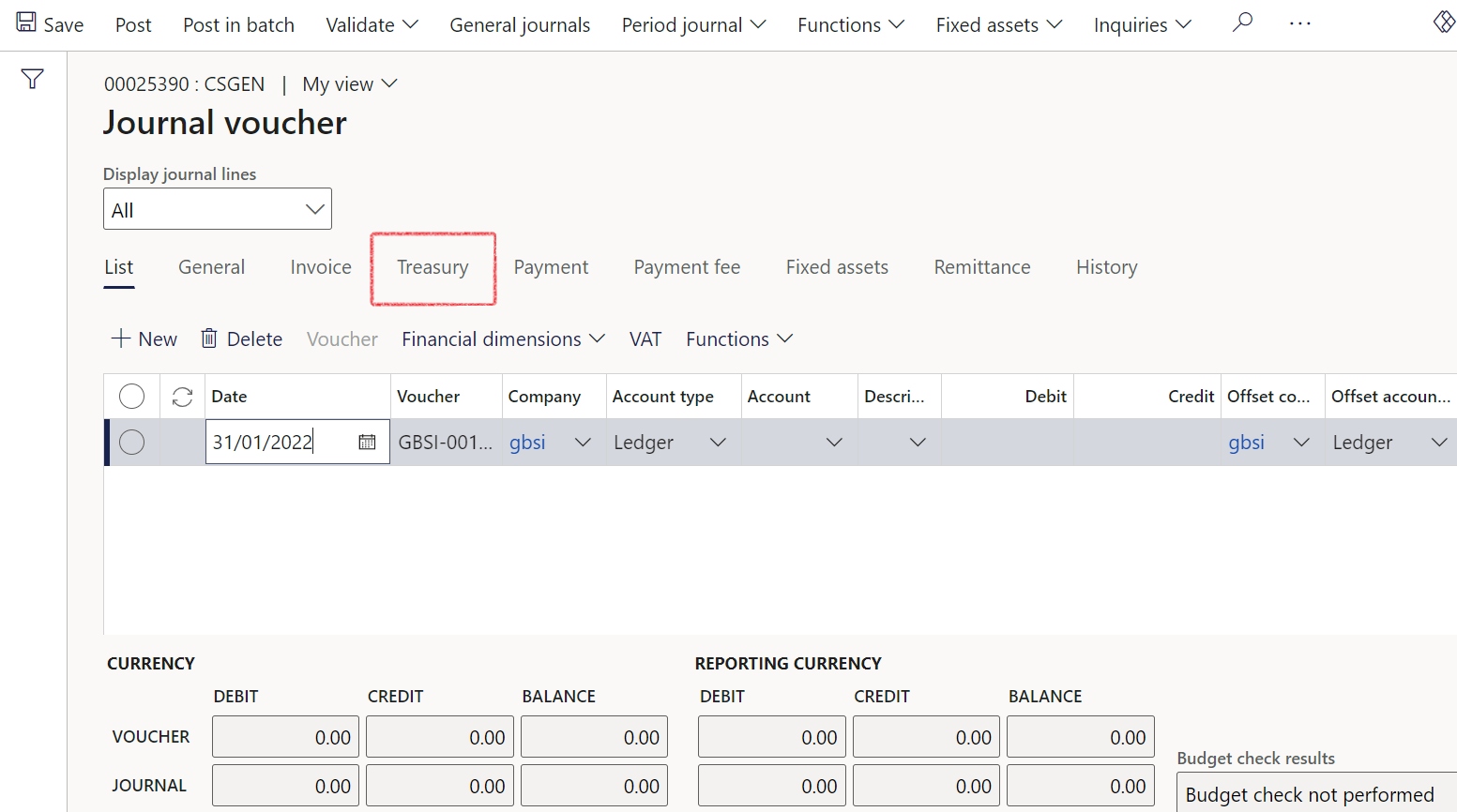

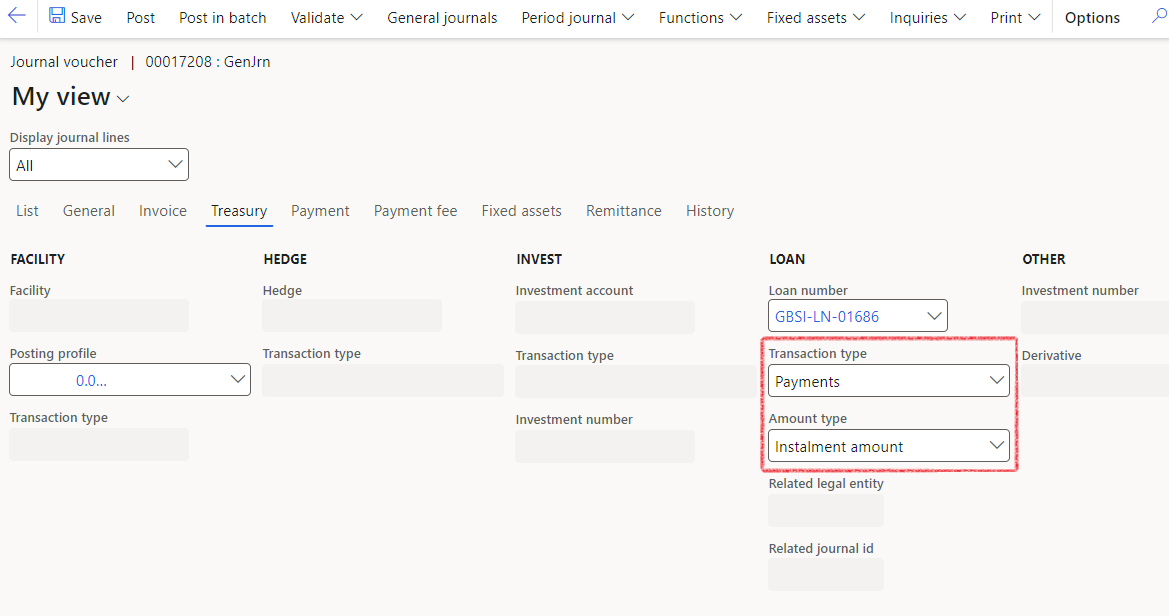

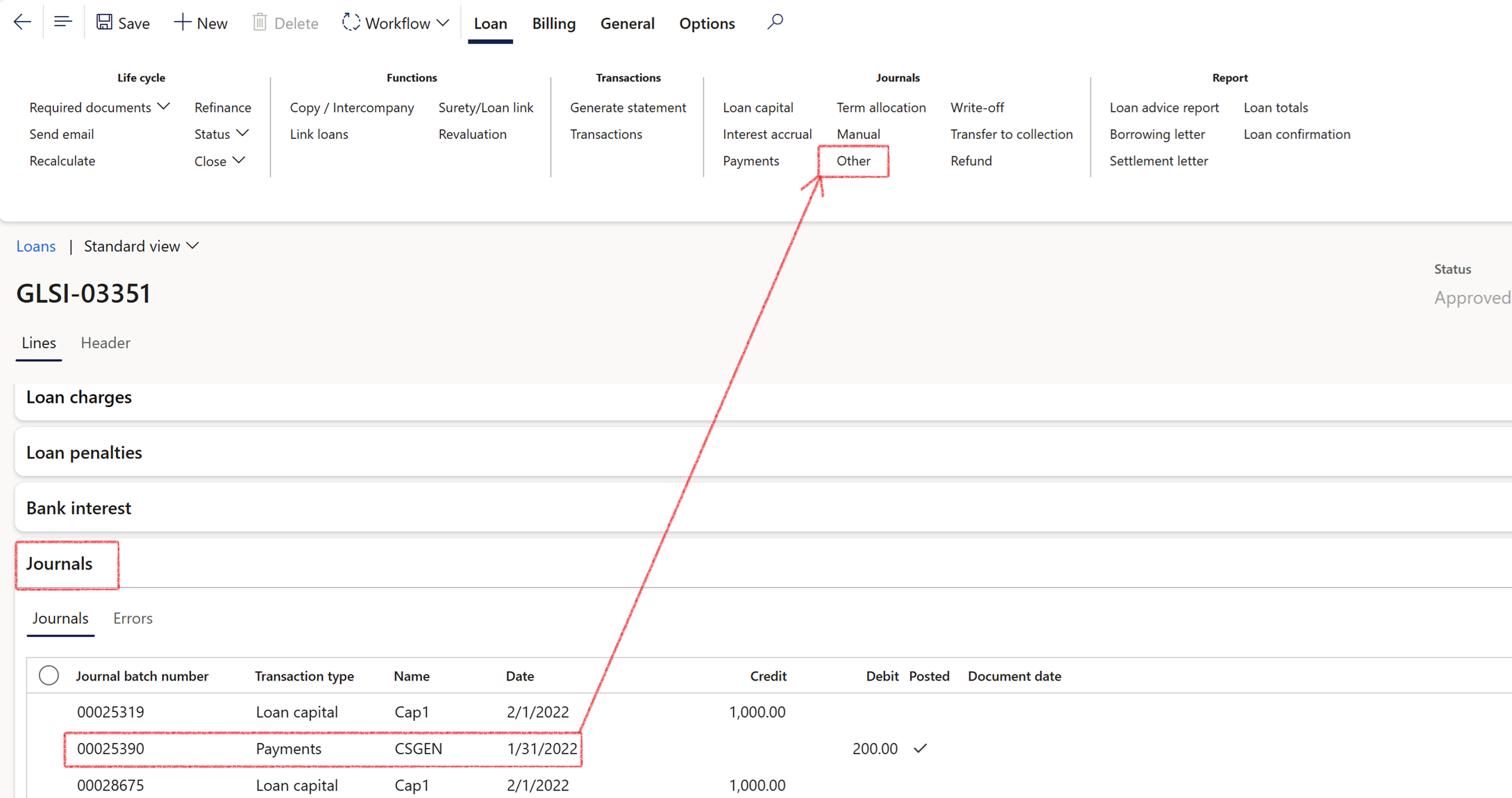

¶ Step 18.1: Creating Journals from General Journal

Treasury journals are incorporated into various modules, including the the General Ledger module. This allows users to generate a Treasury journal directly from the General journal interface.

- Navigate to: General ledger>Journal entries>General journals

- When clicking on Lines in the Action pane, select the Treasury tab

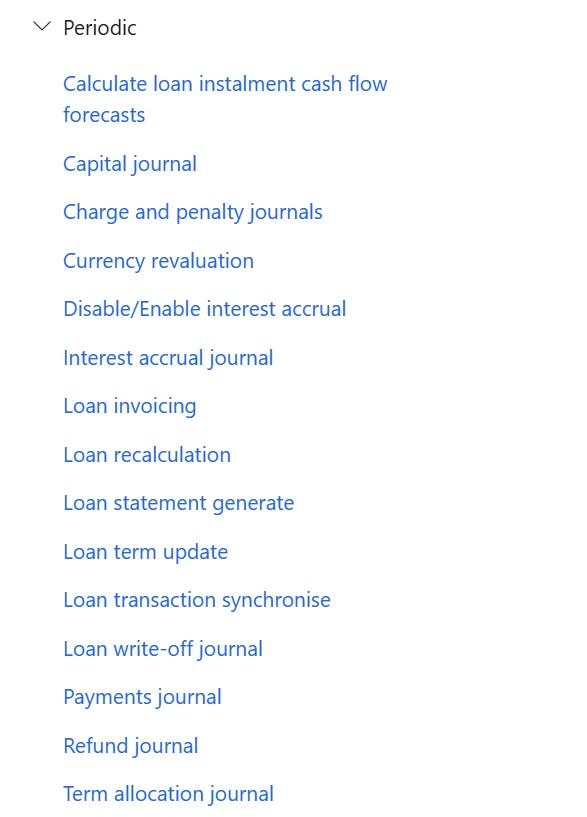

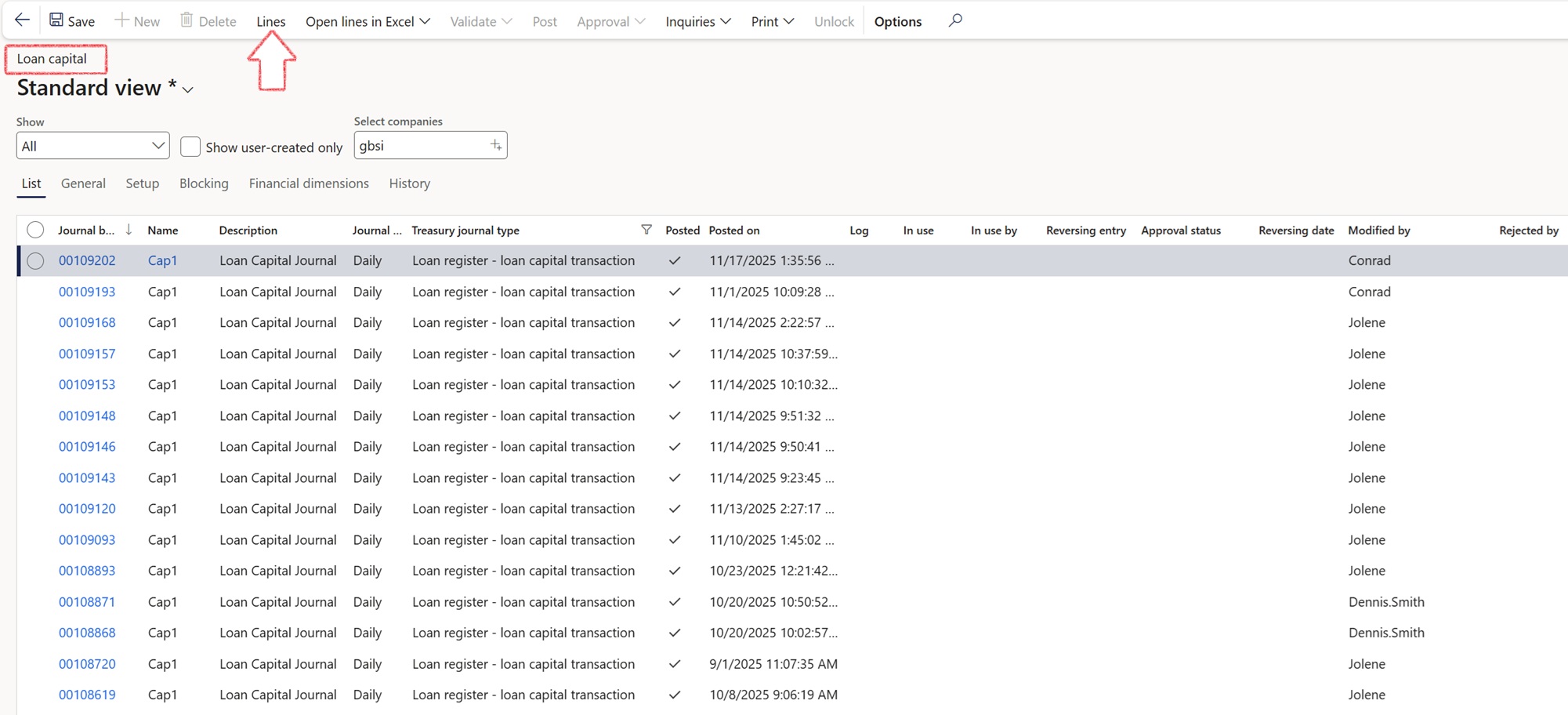

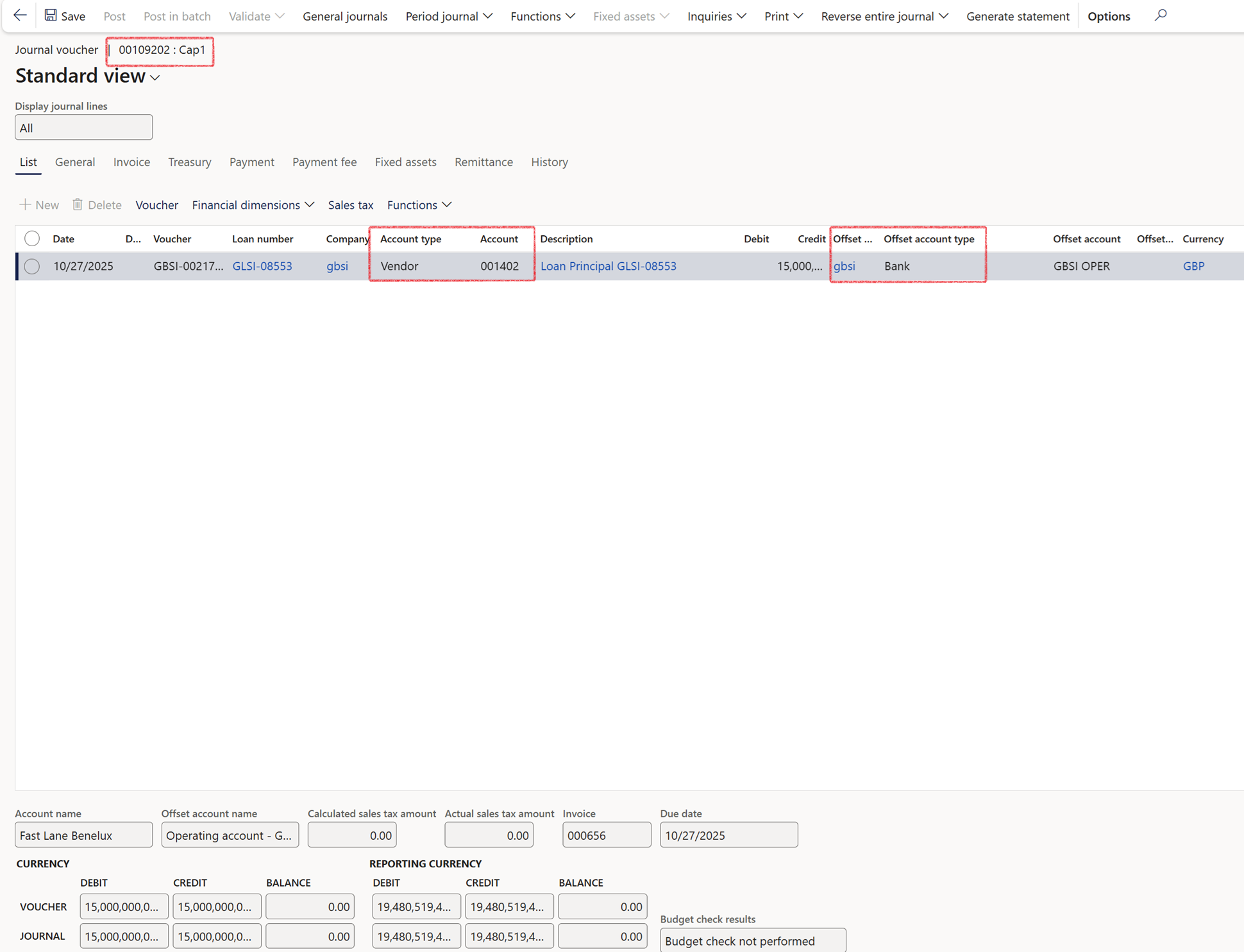

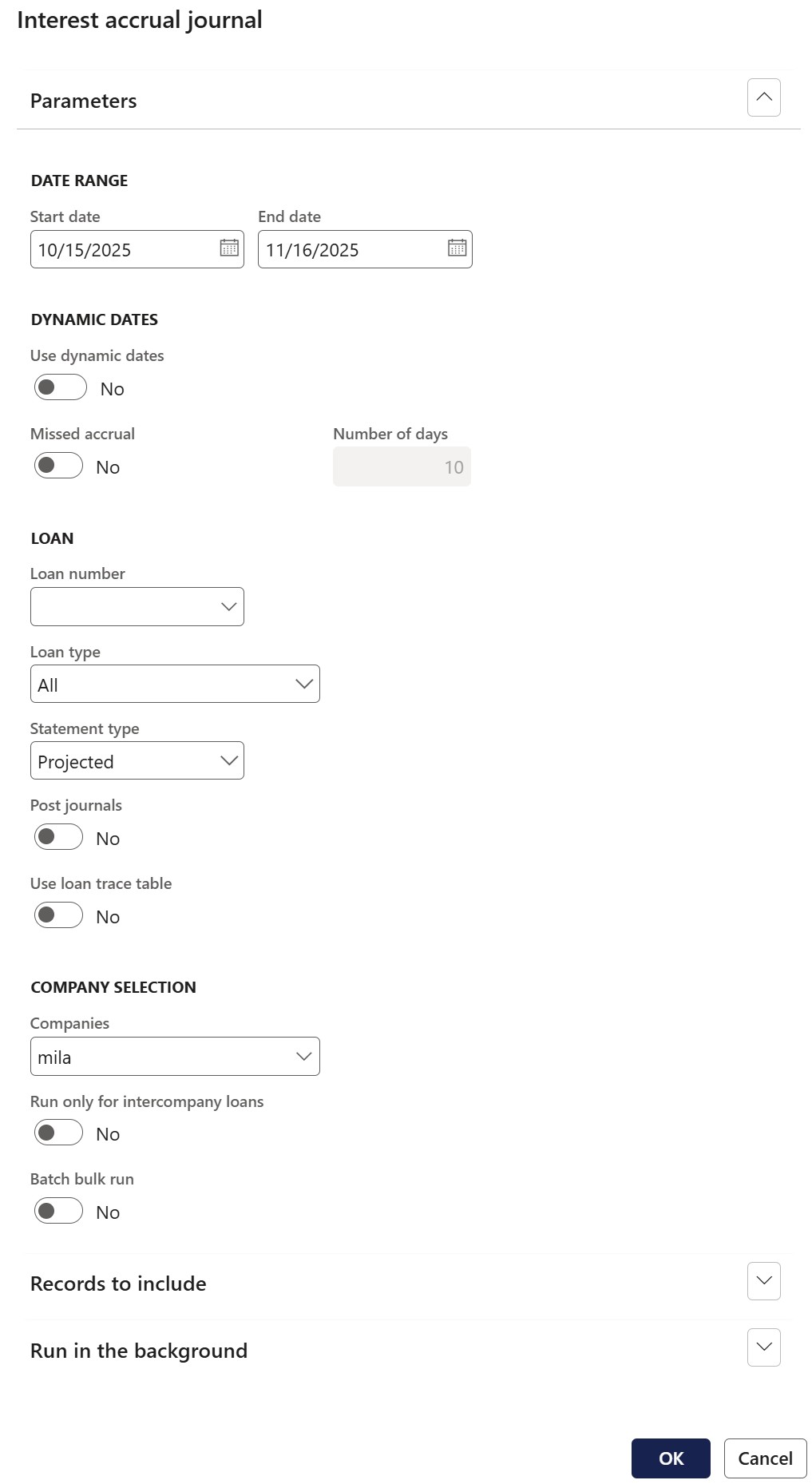

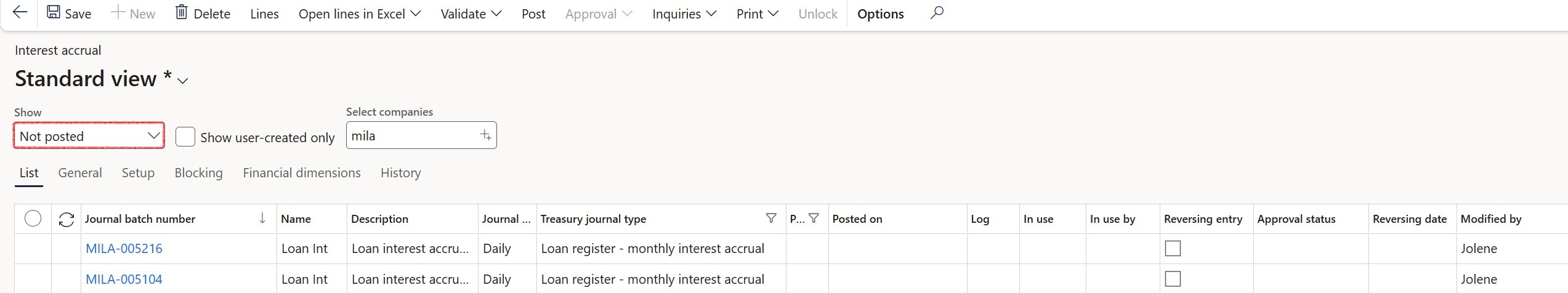

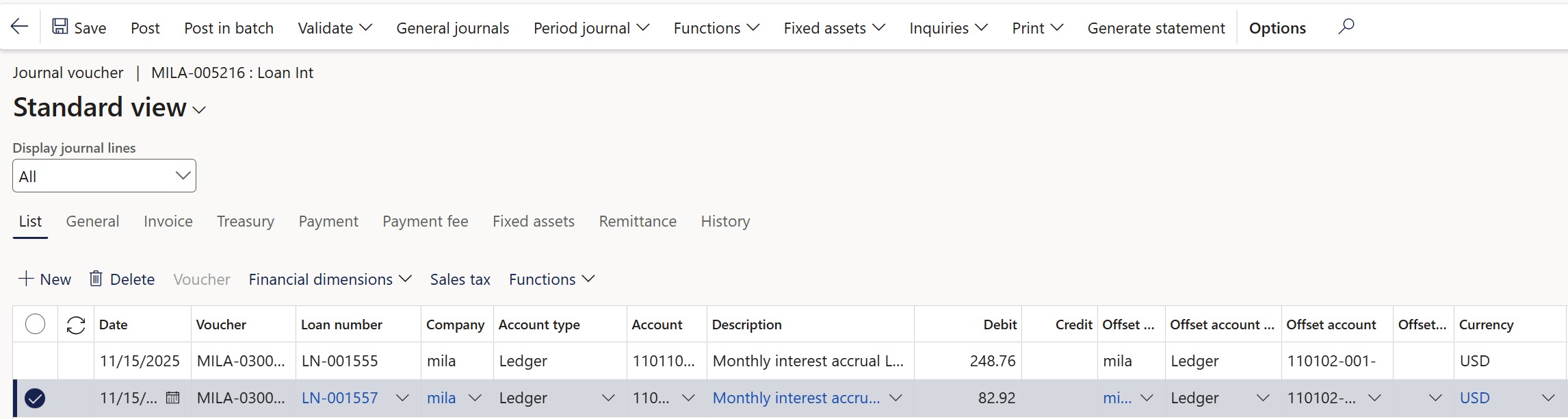

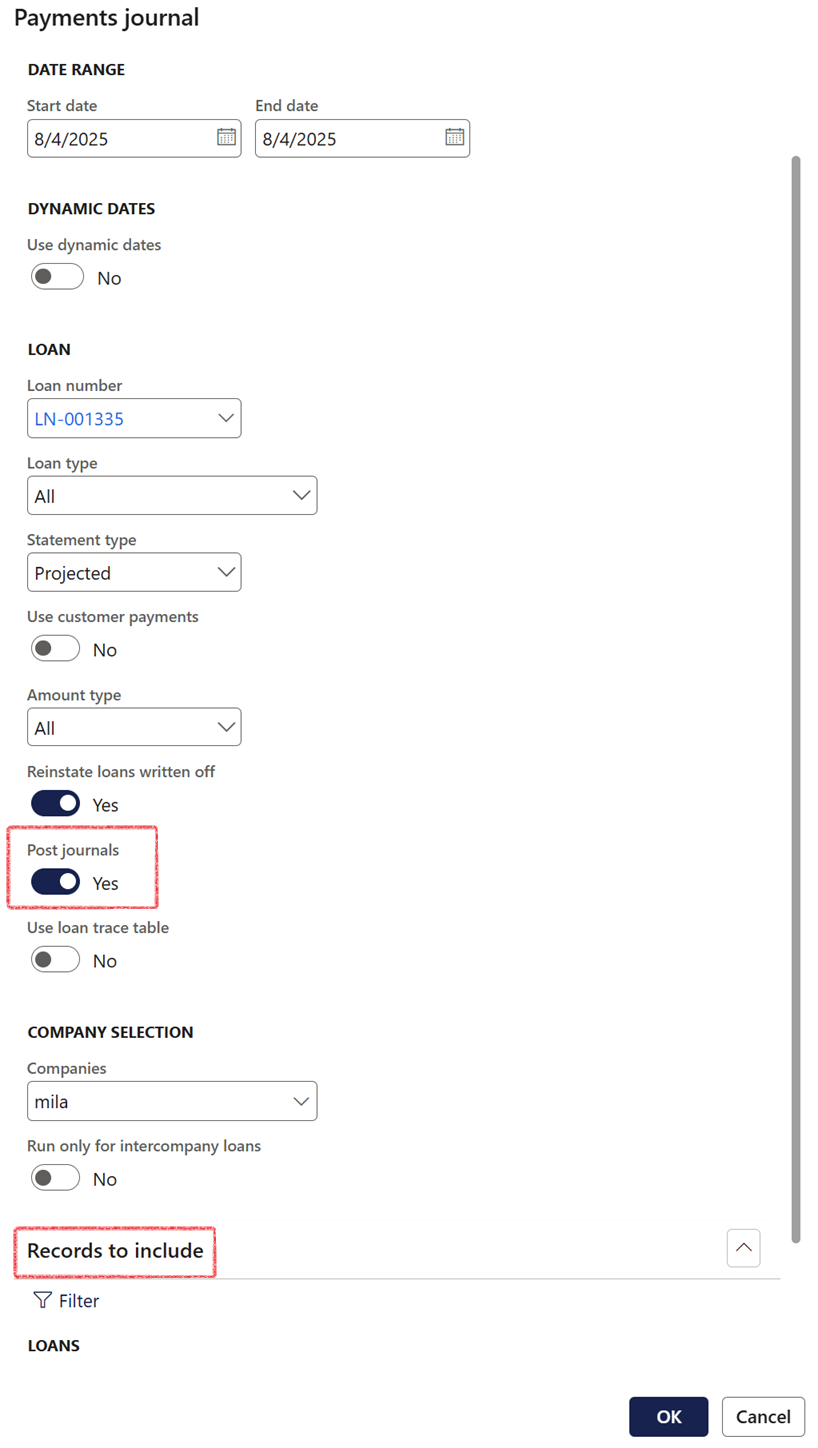

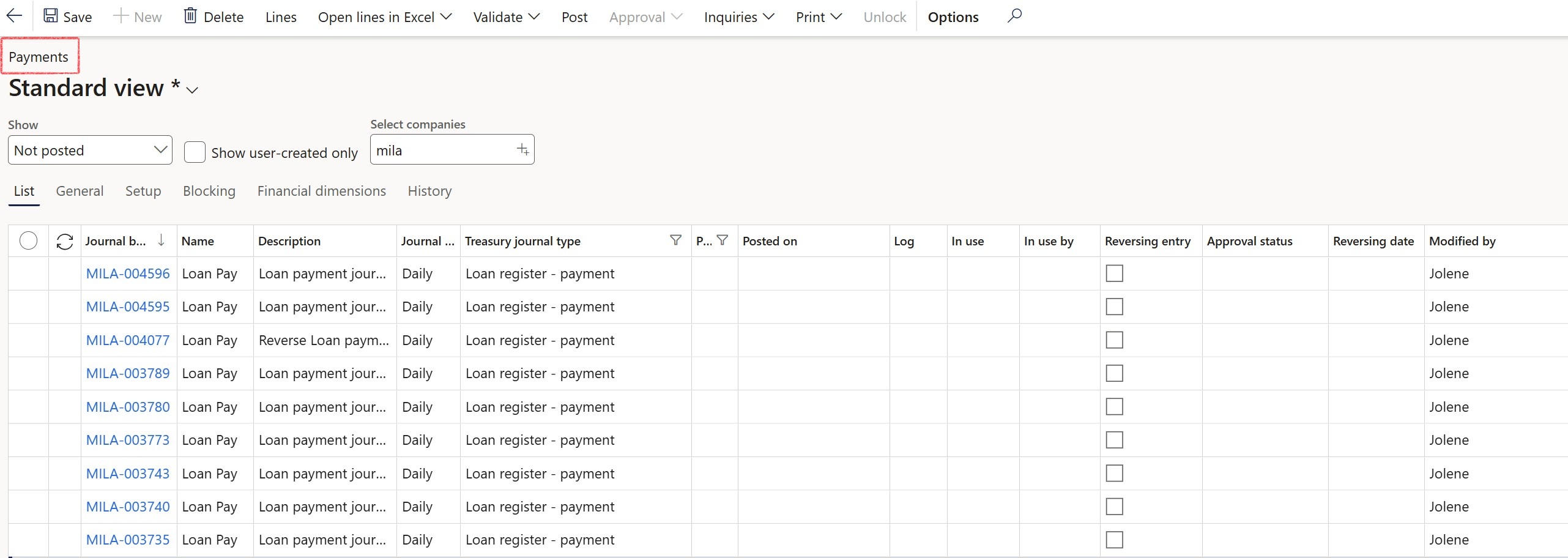

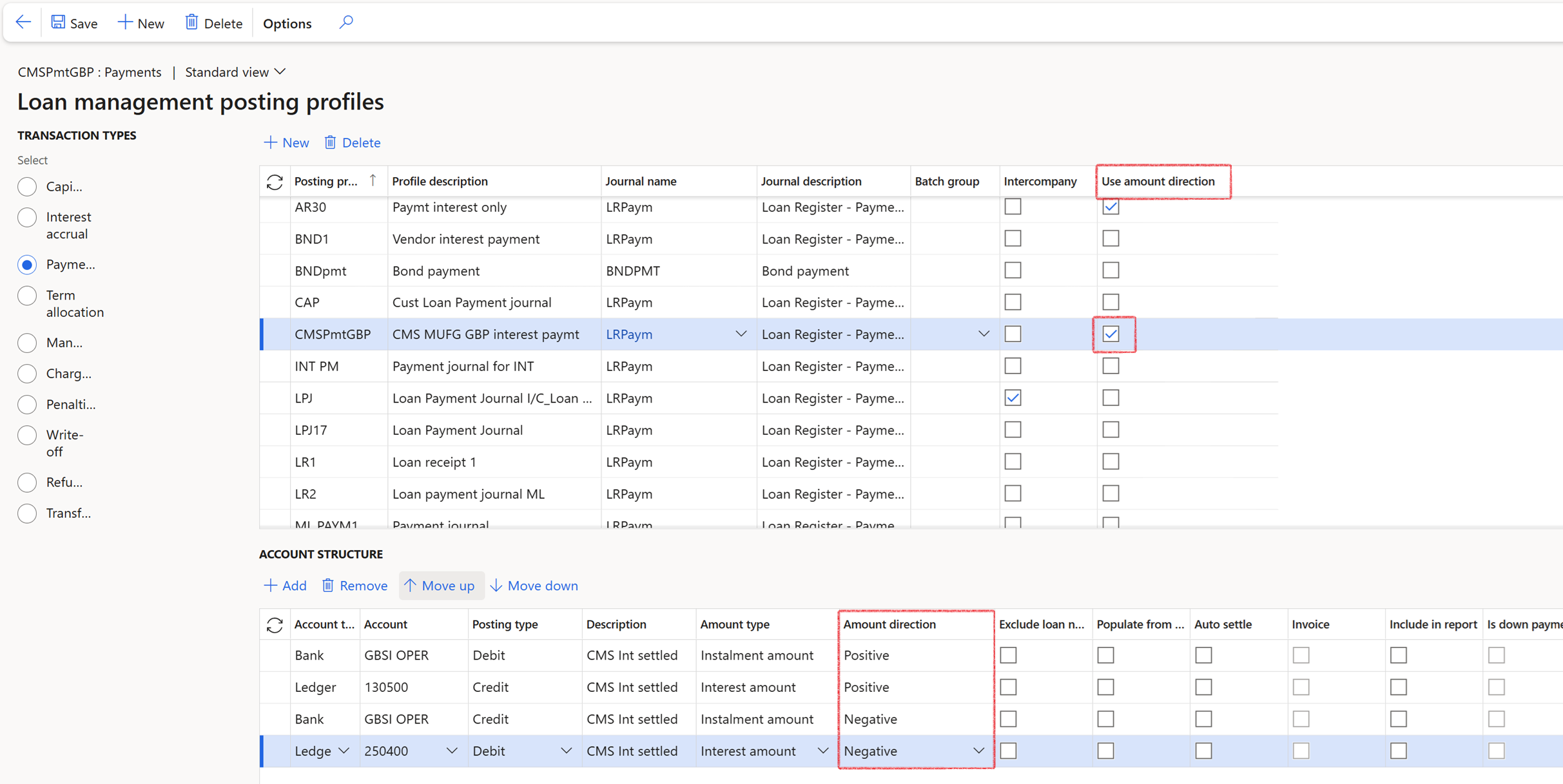

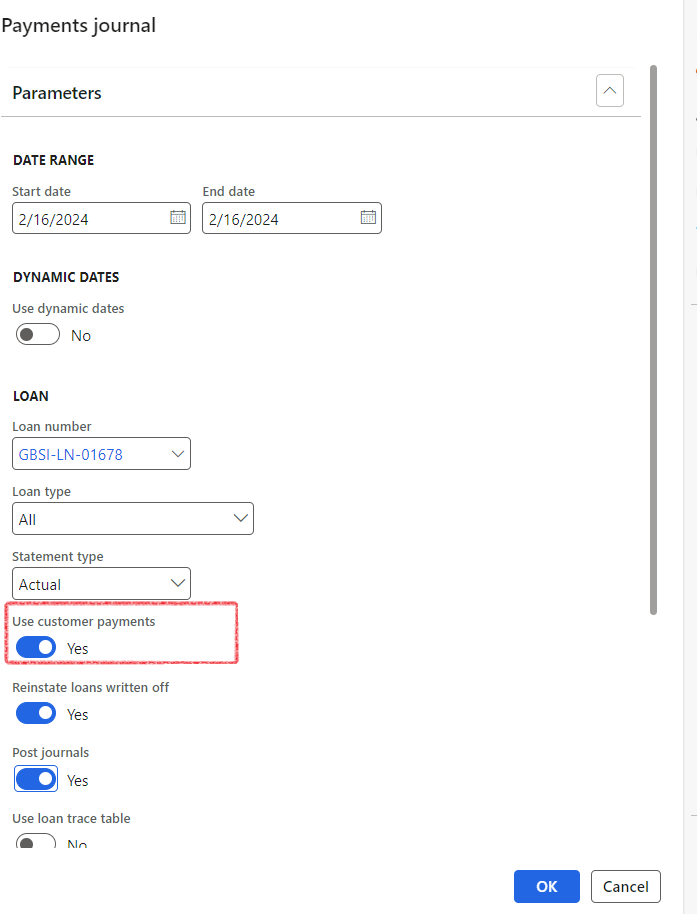

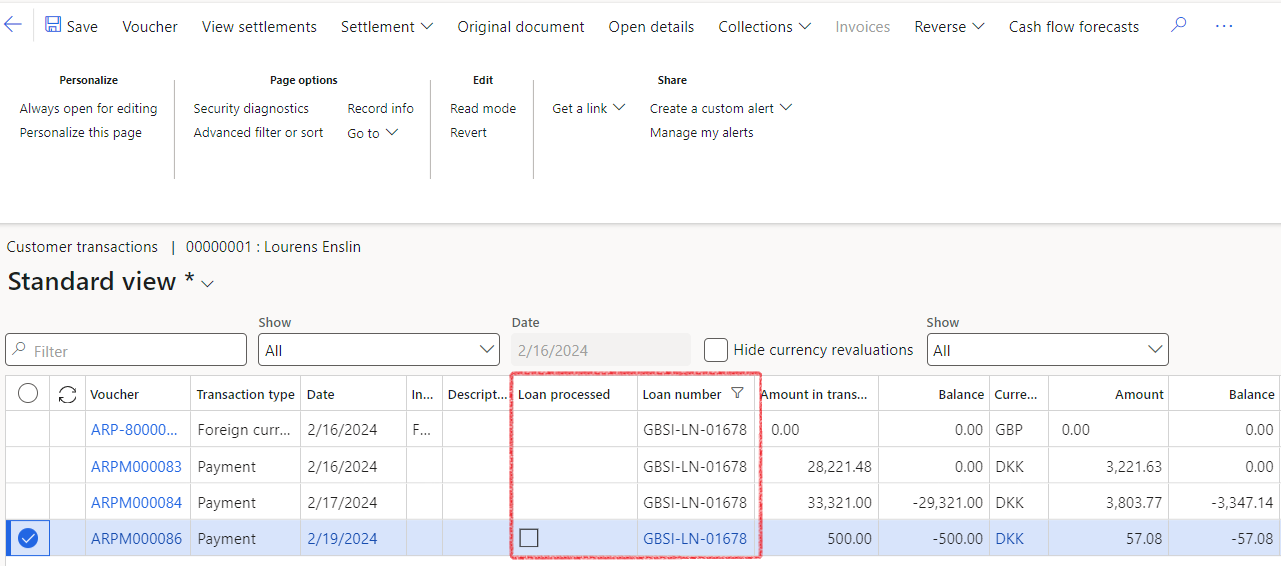

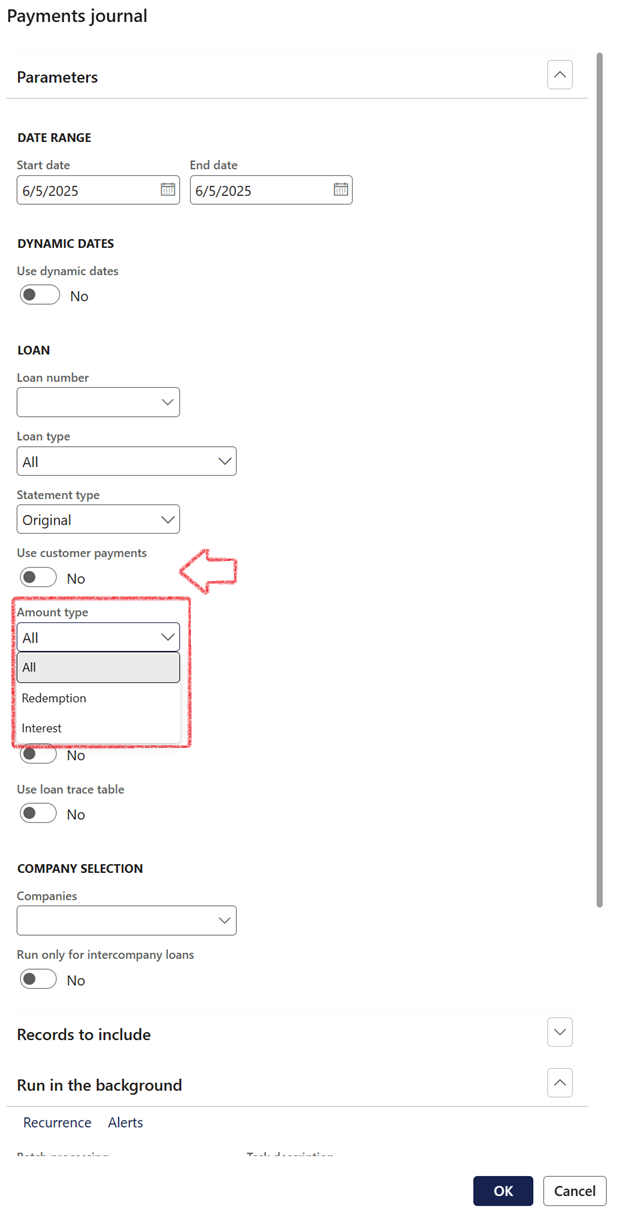

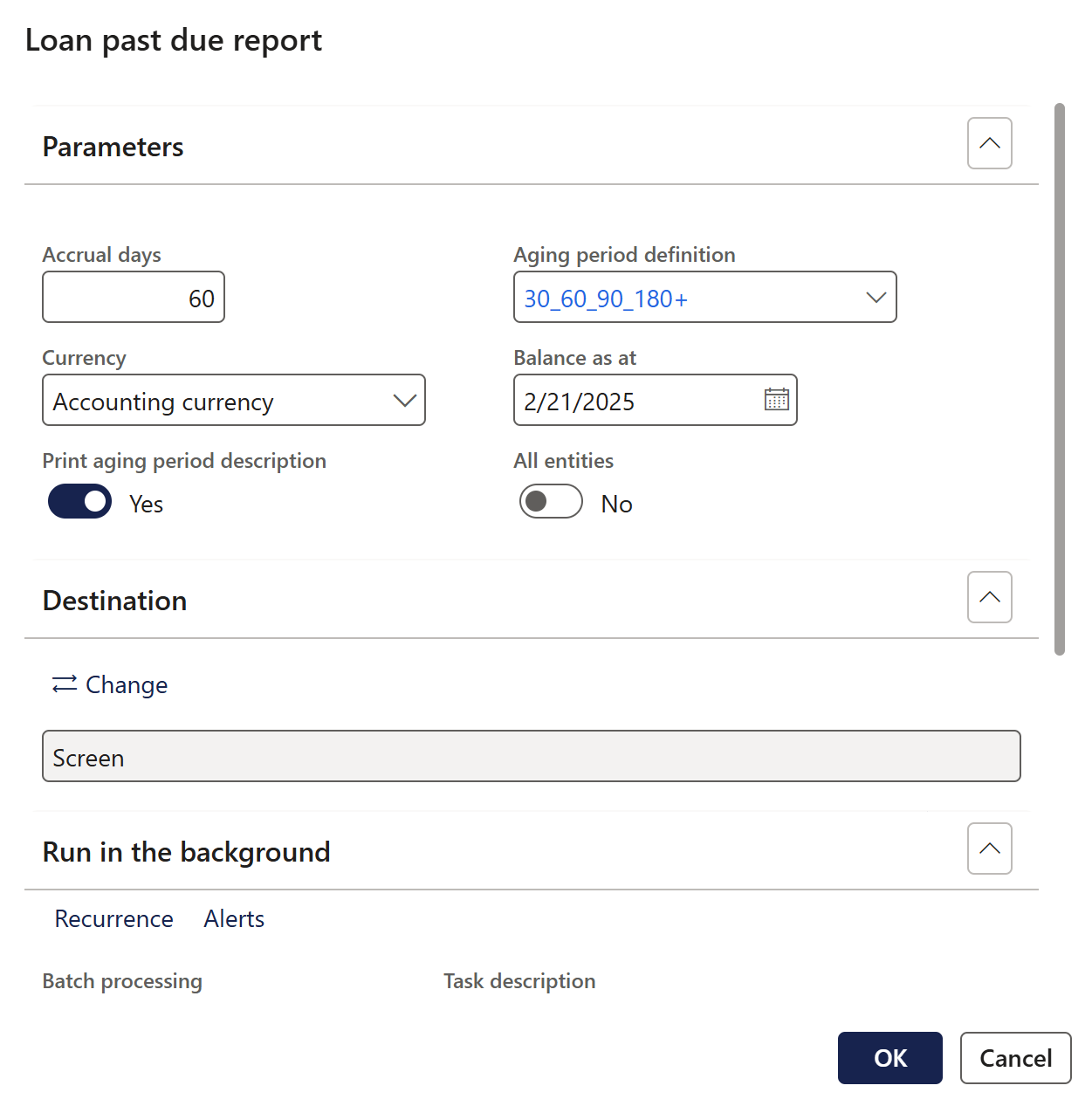

- On the Treasury tab, select the Loan number, Transaction type, and in the case of a Payment transaction type, select the relevant Amount type.