¶ Introduction

A loan applicant is an individual or entity that submits a loan application to a lender, such as a bank, credit union, or other financial institution. A loan applicant means a prospective Borrower who has completed a Loan Application for a Loan.

As part of the process, the applicant provides details about their financial position, income, credit history, and the intended use of the loan. The lender reviews this information to assess eligibility and determine the loan terms. If approved, the applicant becomes the borrower and is responsible for repaying the loan under the agreed conditions.

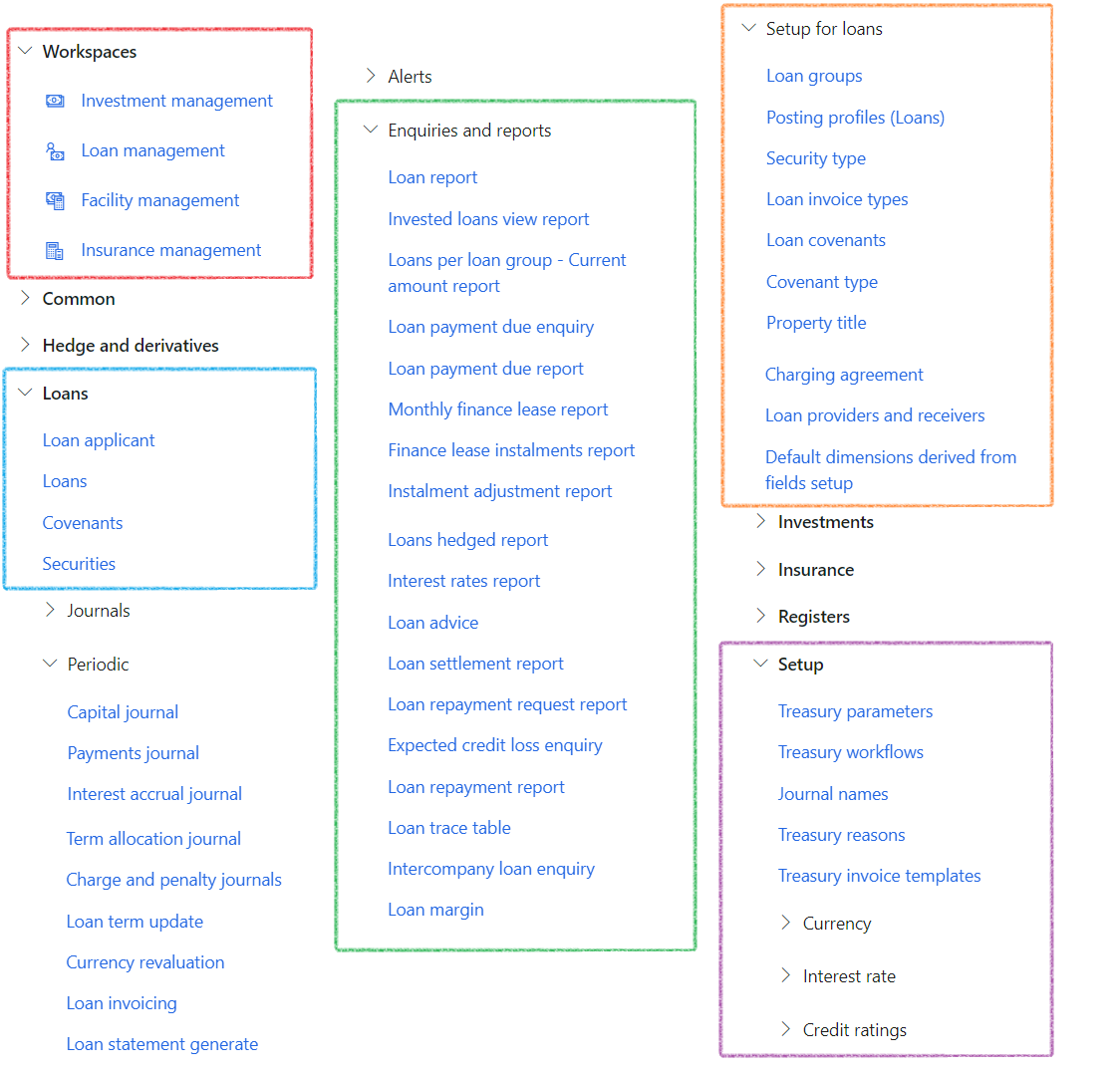

¶ Navigation

¶ Specific setup

- Set up Income and Expenditure lines

- Credit score group

¶ Step 1: Set up Income and Expenditure lines

To setup the Income and Expenditure lines for customers, go to

- Go to: Accounts receivable > Setup > Income and expenditure lines

- Click on the New button

- Enter a Line ID code

- Type a description

- Select a category. Choose between Asset, Expense, Income and Liability or Other

- Click on Save

The same setup can also be done under Sales and Marketing module:

- Go to: Sales and marketing > Setup > Income and expenditure lines

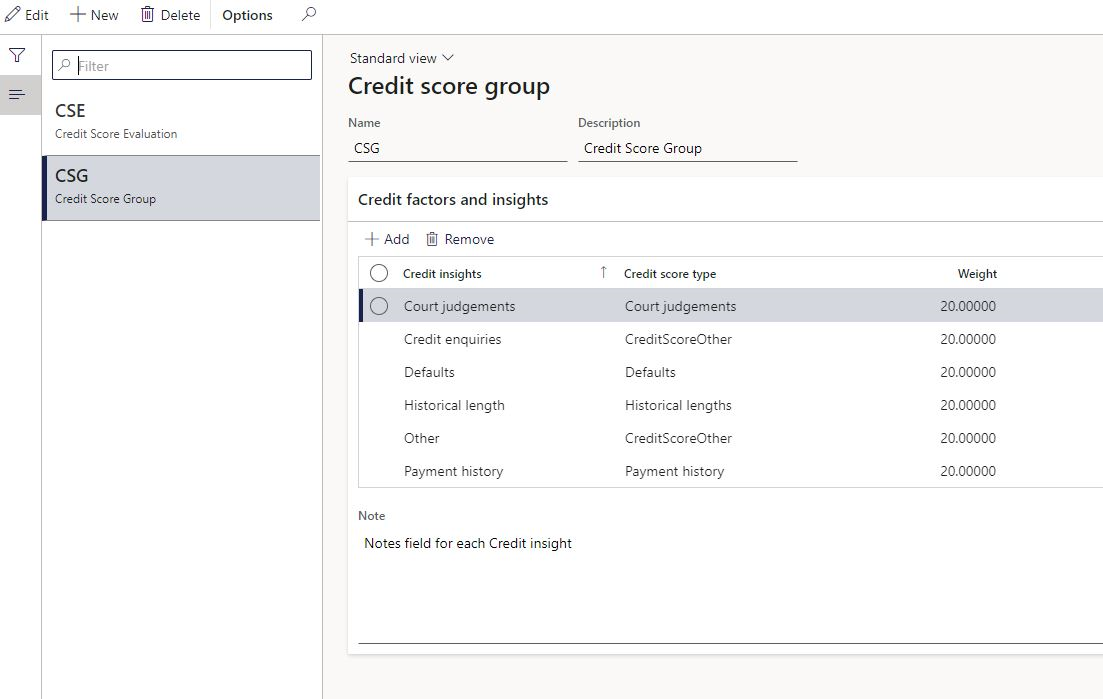

¶ Step 2: Credit score group

This credit score ratings engine will provide more depth for credit ratings that is done in the Treasury module. This setup forms the basis for the Last credit score that can be done on Customers, Vendors, Loan applicants and Loan providers and receivers.

- Go to: Treasury > Setup > Credit ratings > Credit score group

- Click on the New button

- Enter a Name

- Enter a Description

- Expand the Credit factors and insights FastTab

- Click on the Add button

- Enter a Credit insights name

- Select a Credit score type. Choose between:

- Payment history

- Defaults

- Court judgements

- Credit enquiries

- Historical length

- Other

- Enter a Weight percentage

- For each Credit insight, a Note can be added

¶ Daily use

The Loan application process starts with a prospect

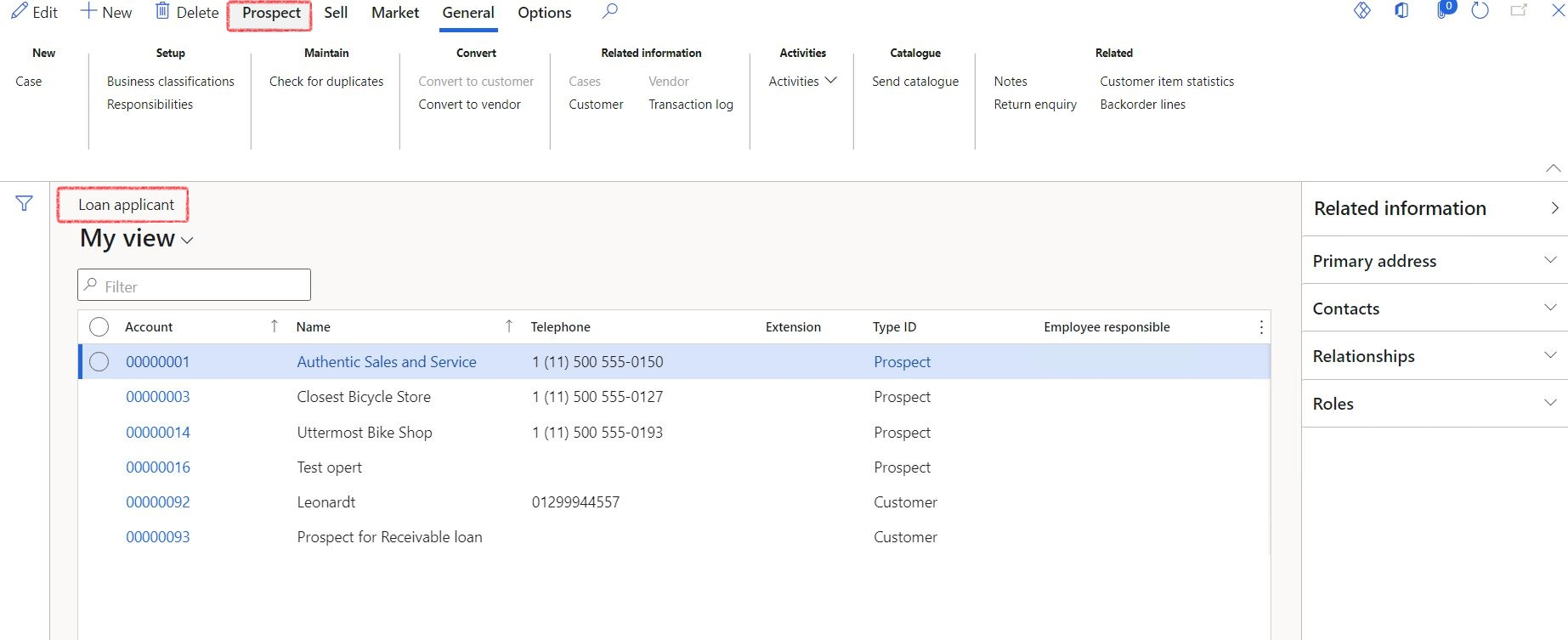

¶ Step 3: Loan application

- In the navigation pane, go to: Modules > Treasury > Loans > Loan applicant

- You will be greeted by a list page, where all the loan applicants can be viewed

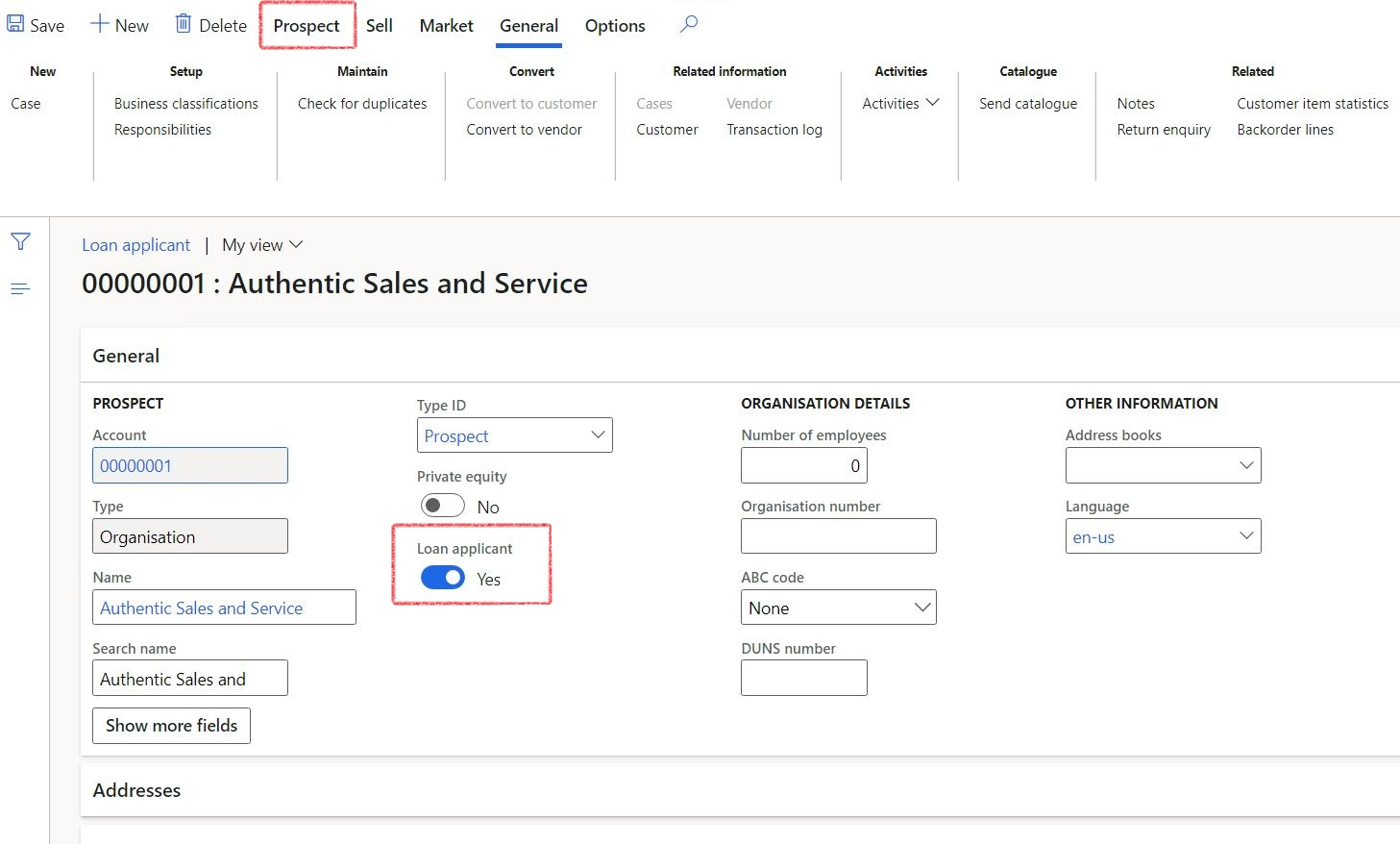

- When you click on a loan applicant, it will open the Prospects page

- Account

- Name

- Telephone

- Extension

- Type ID (Prospect / Customer)

- Employee responsible

- Click on the New button

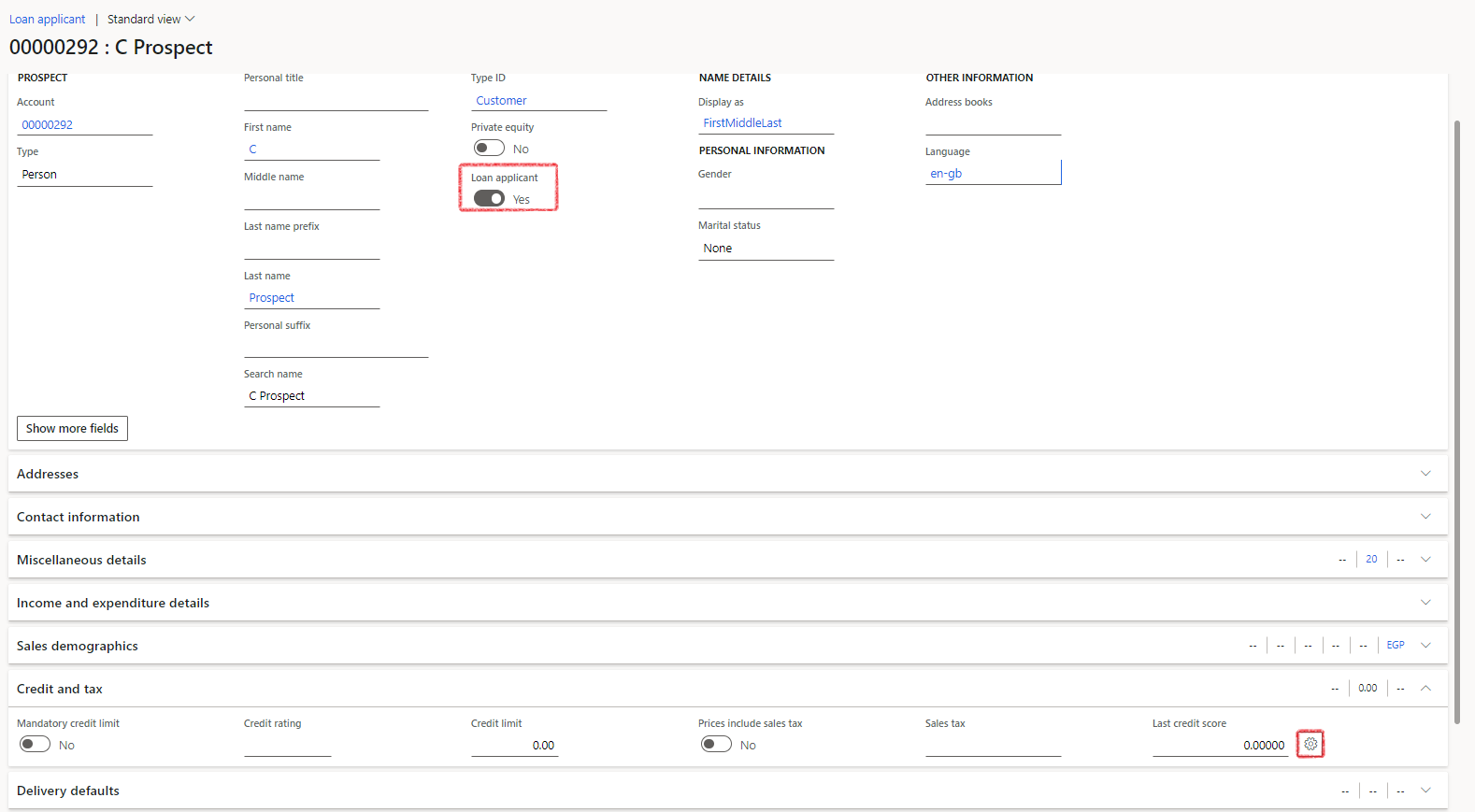

- For a Loan applicant to be classified as a loan applicant, and to display on the loan applicant list page, they have to have the setting selected, called Loan applicant set to Yes option on the Prospect page under the Sales and Marketing module

- The prospect can be converted to a Customer

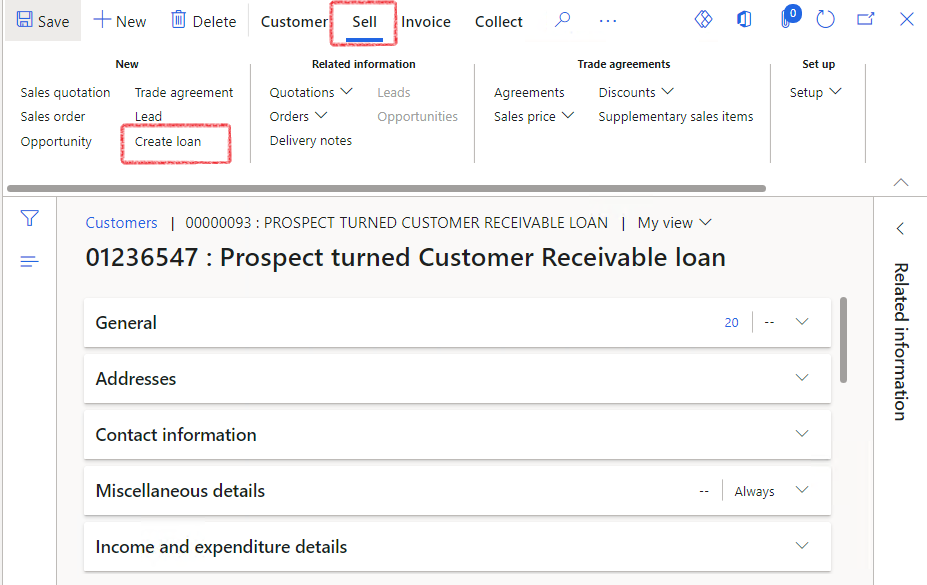

- On the Customer page, in the command bar, click on Sell, and Click on New in the ribbon bar

- Select Create Loan

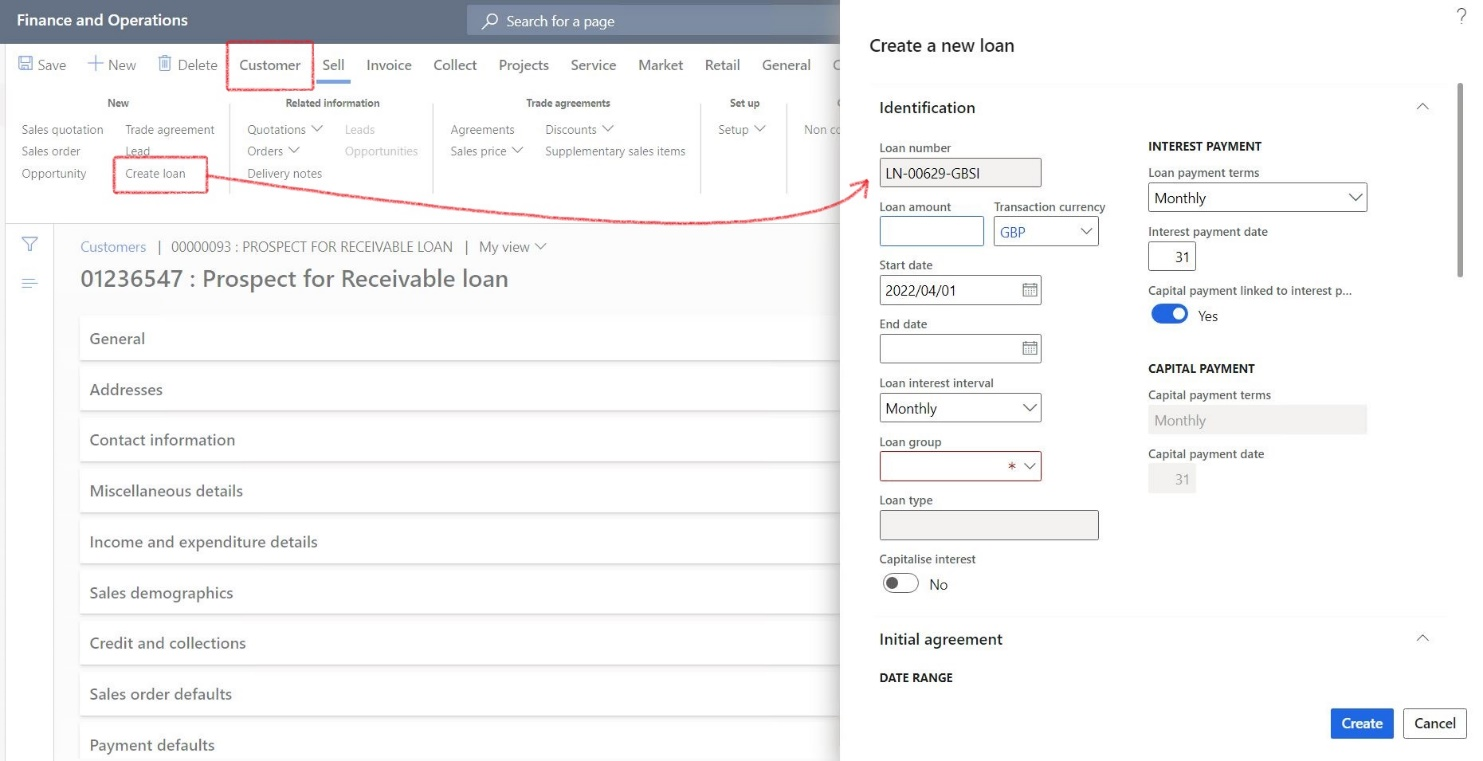

- The Create a new loan Dialogue will open

- Complete all the relevant information

- Click the Create button

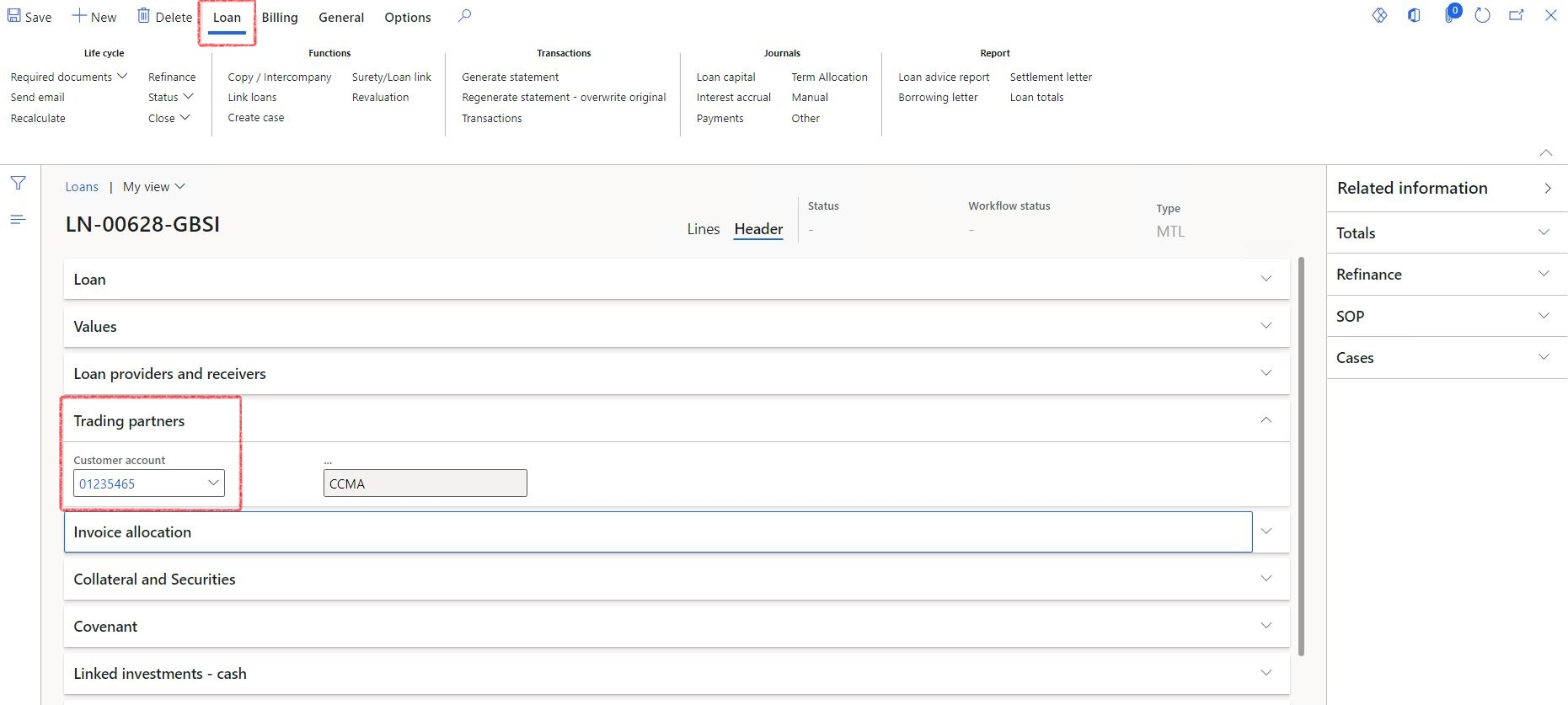

- When done, go to Treasury > Loans > Loans

- Open the newly created loan

- On the header section, expand the Trading partners FastTab

- You will find the Customer account number populated for the Receivable loan

¶ Step 4: Income and Expenditure Details

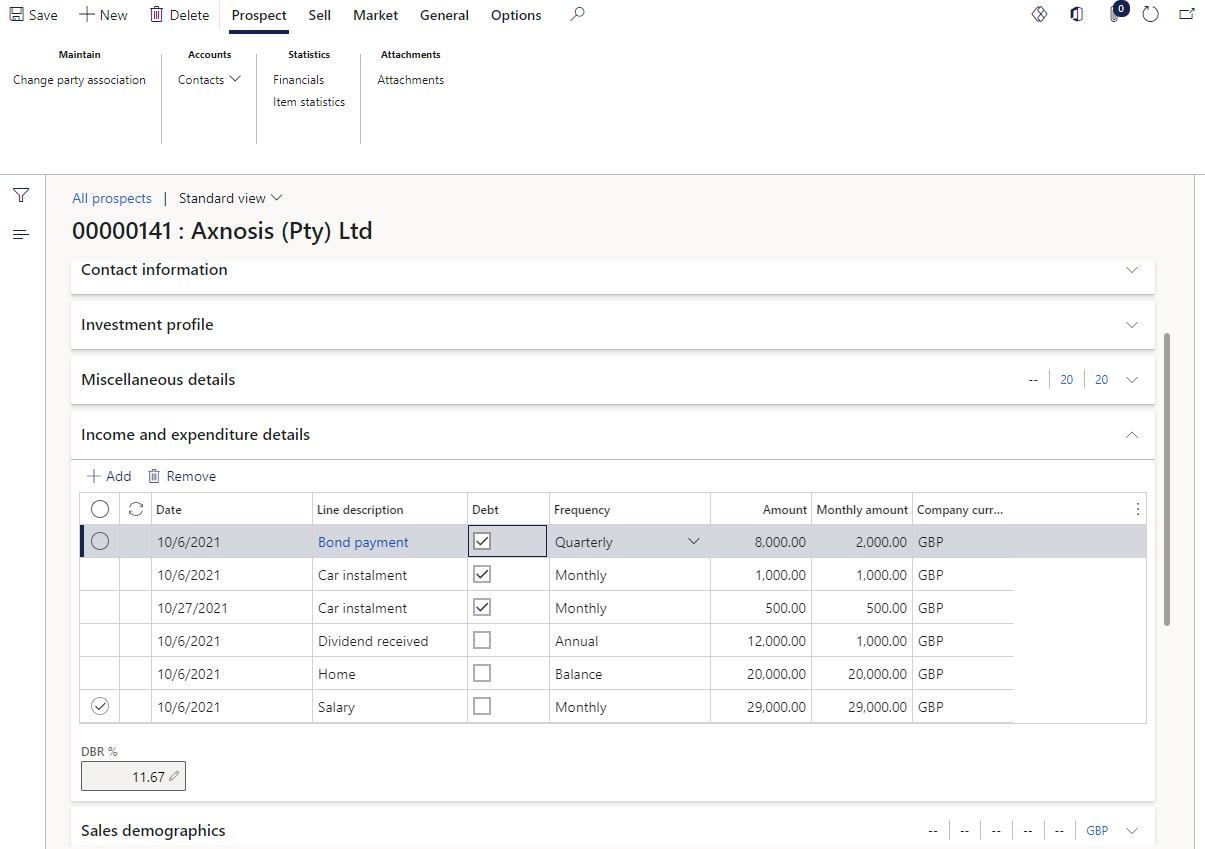

DBR is a mathematical ratio that is used by financial institutions to calculate whether your application is eligible for a loan. The DBR is calculated as the ratio of the Total Debt the applicant owes to Total Assets the applicant owns. So, it is the ratio of debt to your average monthly income.

- In the navigation pane, go to: Sales and marketing > Relationships > Prospects > All prospects

- Alternatively, go to Accounts receivable > Customers > All customers

- Open an existing prospect or customer

- Expand the Income and expenditure details FastTab

- Click on the Add button and capture the following

- Date

- Select a Line description from the dropdown menu (Asset, Expense, Income and Liability)

- Indicate if it is debt or not (select tick box)

- Select the frequency (Quarterly, Monthly, Balance, Annual or Weekly)

- Enter an amount

- The Monthly amount will be automatically calculated based on the frequency selected

- The DBR (Debt burden ratio) percentage will also be calculated based on all the above information entered.

- Date

- Select a Line description from the dropdown menu (Asset, Expense, Income and Liability)

- Indicate if it is debt or not (select tick box)

- Select the frequency (Quarterly, Monthly, Balance, Annual or Weekly)

- Enter an amount

- The Monthly amount will be automatically calculated based on the frequency selected

- The DBR (Debt burden ratio) percentage will also be calculated based on all the above information entered.

This can be setup on Prospects or Customers

¶ Step 5: Calculate last credit score

- Go to: Treasury > Loans > Loan applicant

- Select a loan applicant record

- Note that the slider for Loan applicant should be set to Yes in the General FastTab

- Expand the Credit and VAT FastTab

- On the field Last credit score, click on the gear icon

- Select a Score group name

- Enter a date

- Select an Agency. This is a link to the Vendor lookup table

- Type in the Actual percentages for each line

- You will see that the Weighted score will then be calculated automatically

- Click the OK button

The Last credit score is calculated as per the setup and the latest values that was entered