¶ Introduction

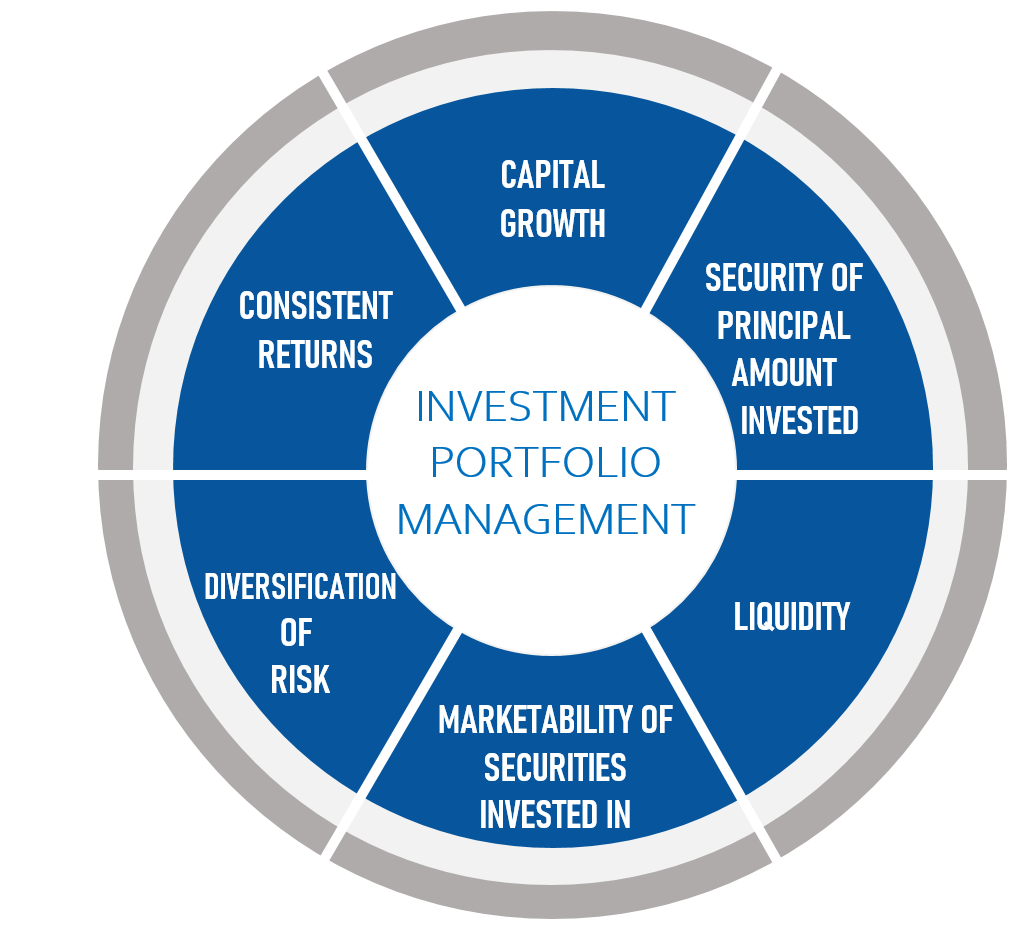

Investment management involves the oversight of financial securities and assets, including strategies for acquiring, disposing of, and growing investment portfolios. Portfolios can include both cash and non-cash investments, and may be actively traded to achieve specific investment objectives.

Diversification of portfolios often combines cash and non-cash investments. The Treasury Management System (TMS) also supports cryptocurrency investments and management of nominated beneficiaries.

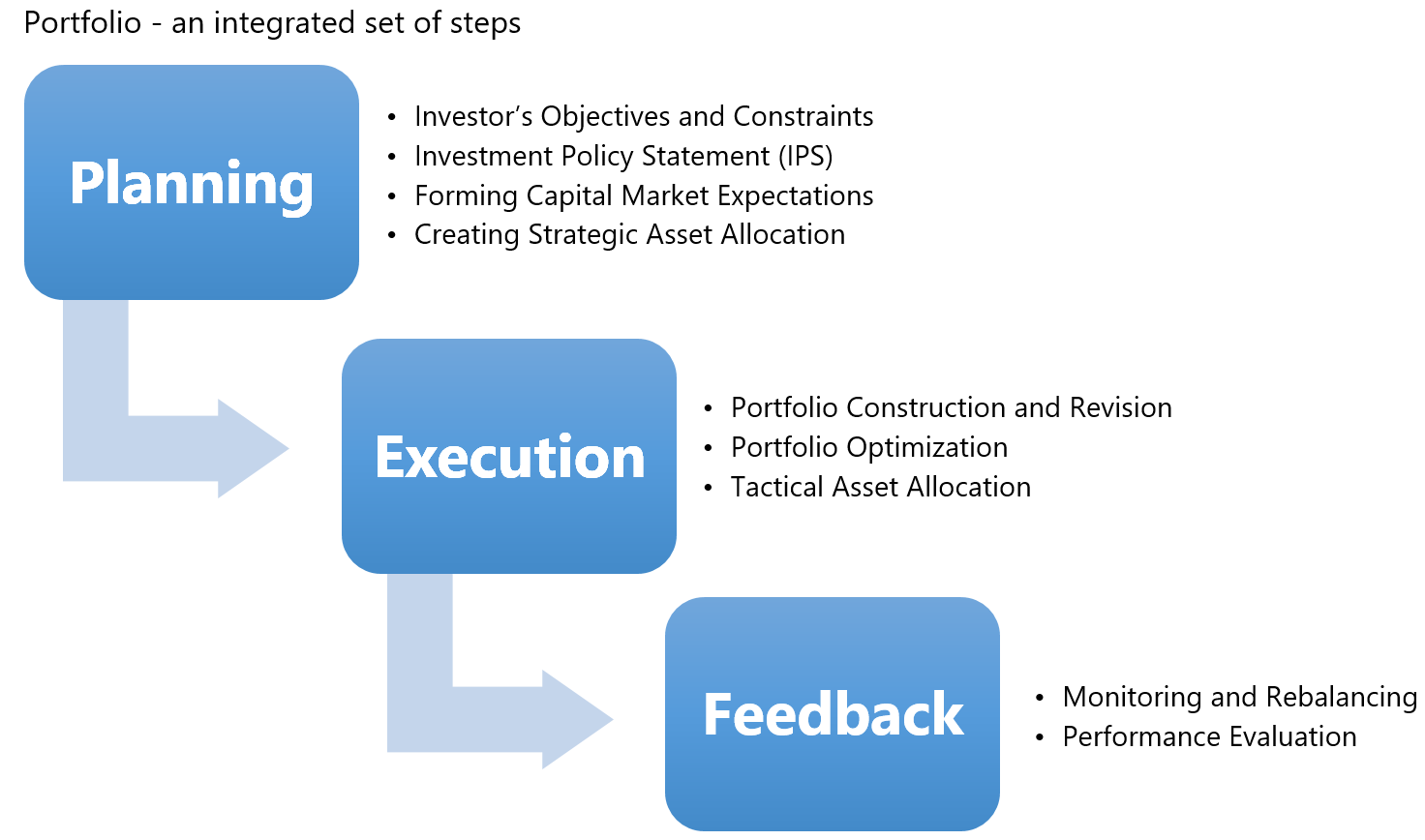

¶ Objectives of portfolio management

- Establishing the investment objectives

- Diversifying the portfolio to reduce risk and maximize returns

- Monitoring the performance of the portfolio and taking corrective action when necessary

- Rebalancing the portfolio in order to maintain the desired level of risk and return

- Tax planning and implications

- Asset allocation to determine the desired level of return and risk

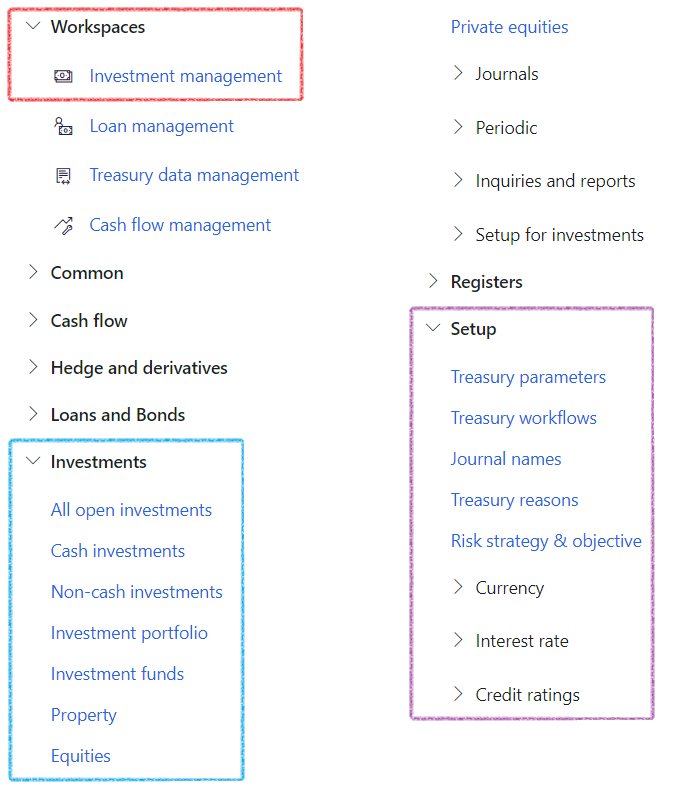

¶ Navigation

Inside Microsoft Dynamics 365, Axnosis created a storage area for Investments Portfolio management . From the main menu, browse to Treasury, Investments, Investment portfolio

¶ Assumed Setup

The following configurations are considered completed already:

- Number sequence

- User roles

- Treasury workflows

- Customers

- Vendors

- Cash investments

- Non-Cash investments

- Treasury parameters

- Risk profile

¶ Daily use

¶ Step 1: Create a new Investment portfolio

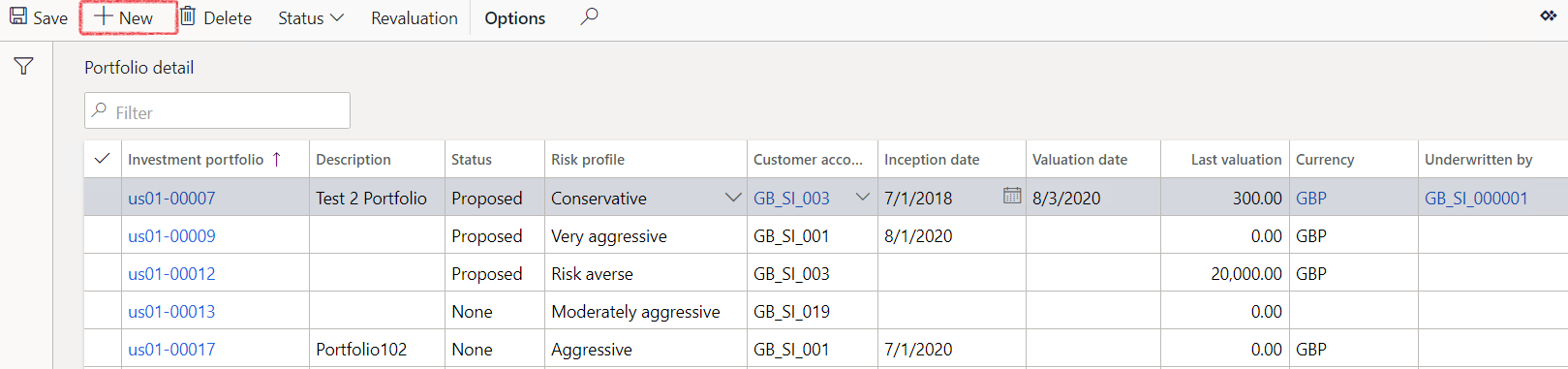

The portfolio management list page will provide an overview of the portfolios’ overall situation, so that the investment strategy is devised using all available information - Its valuation, performance and relation to individual benchmarks.

The following columns will be displayed on the list page:

- Investment portfolio number

- Description

- Status

- Risk profile

- Customer account

- Inception date

- Valuation date

- Last valuation

- Currency

- Underwritten by

- Navigate to: Treasury > Investments > Investment portfolio

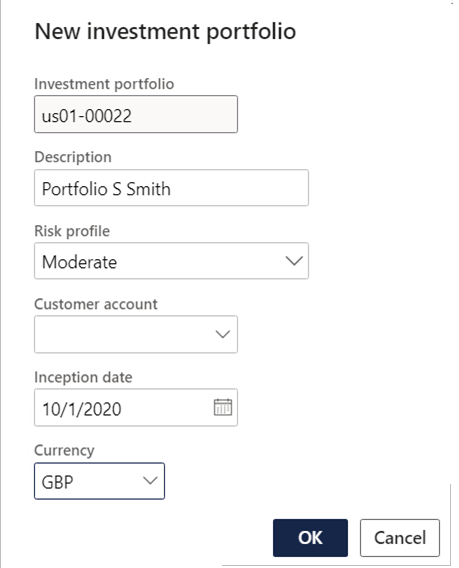

- Click on New

The Investment portfolio number is system generated

- Type a Description

- Select a Risk profile from the dropdown menu.

- Options to choose from:

- Select a Risk profile from the dropdown menu.

- Options to choose from:

- Very aggressive

- Aggressive

- Moderately aggressive

- Moderate

- Conservative

- Risk averse

- Options to choose from:

- Select a Customer account from the dropdown menu

- Enter an Inception date

- Enter a Currency

- Click OK

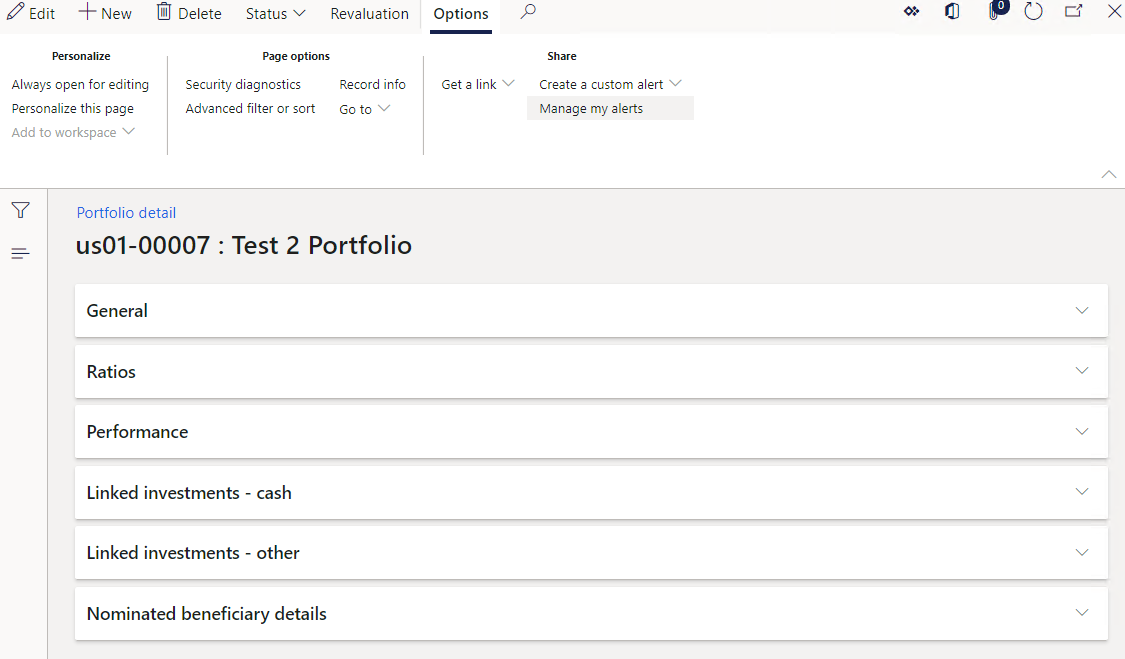

- The details page is divided into the following FastTabs:

- General

- Ratios

- Performance

- Linked investments – cash

- Linked investments - other

- Nominated beneficiary details

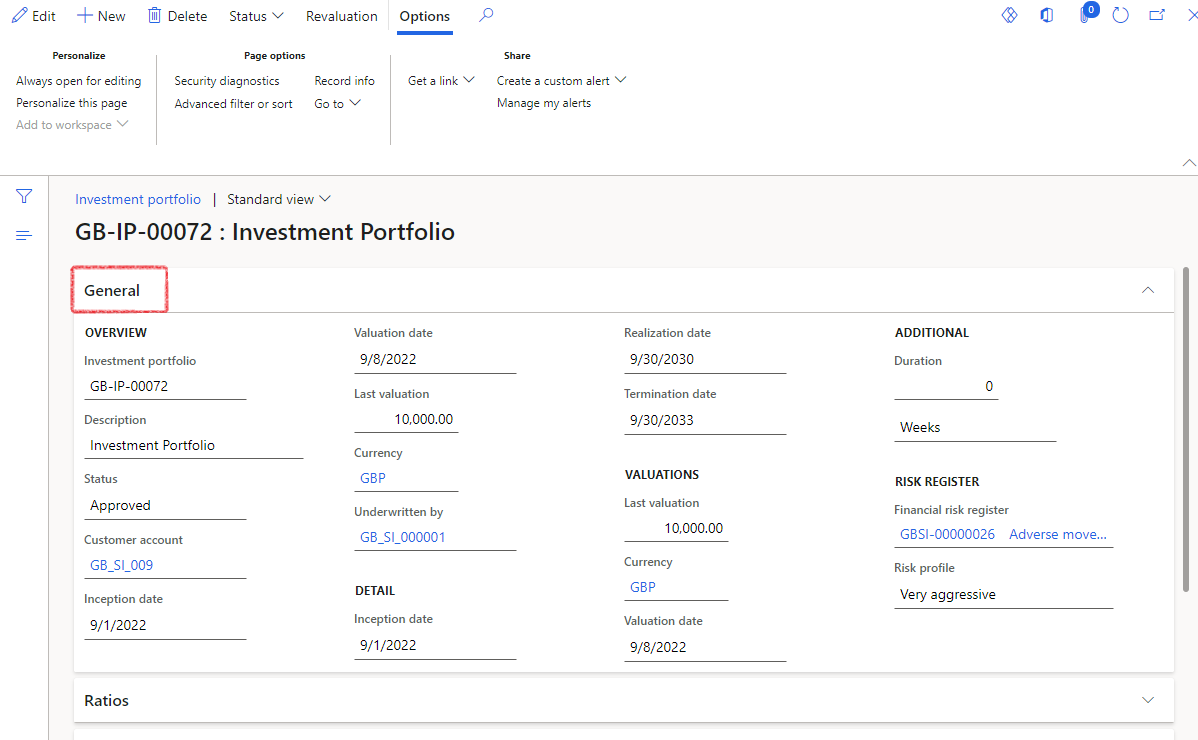

¶ Step 1.1: General FastTab

The General FastTab consists of the following sections:

- Overview

- Investment portfolio number

- Description

- Status

- Risk profile

- Customer account

- Currency

- Underwritten by

- Detail

- Inception date

- Realisation date

- Termination date

- Valuations

- Last valuation

- Amount

- Valuation date

- Currency

- Last valuation

- Additional

- Duration

- Days

- Duration

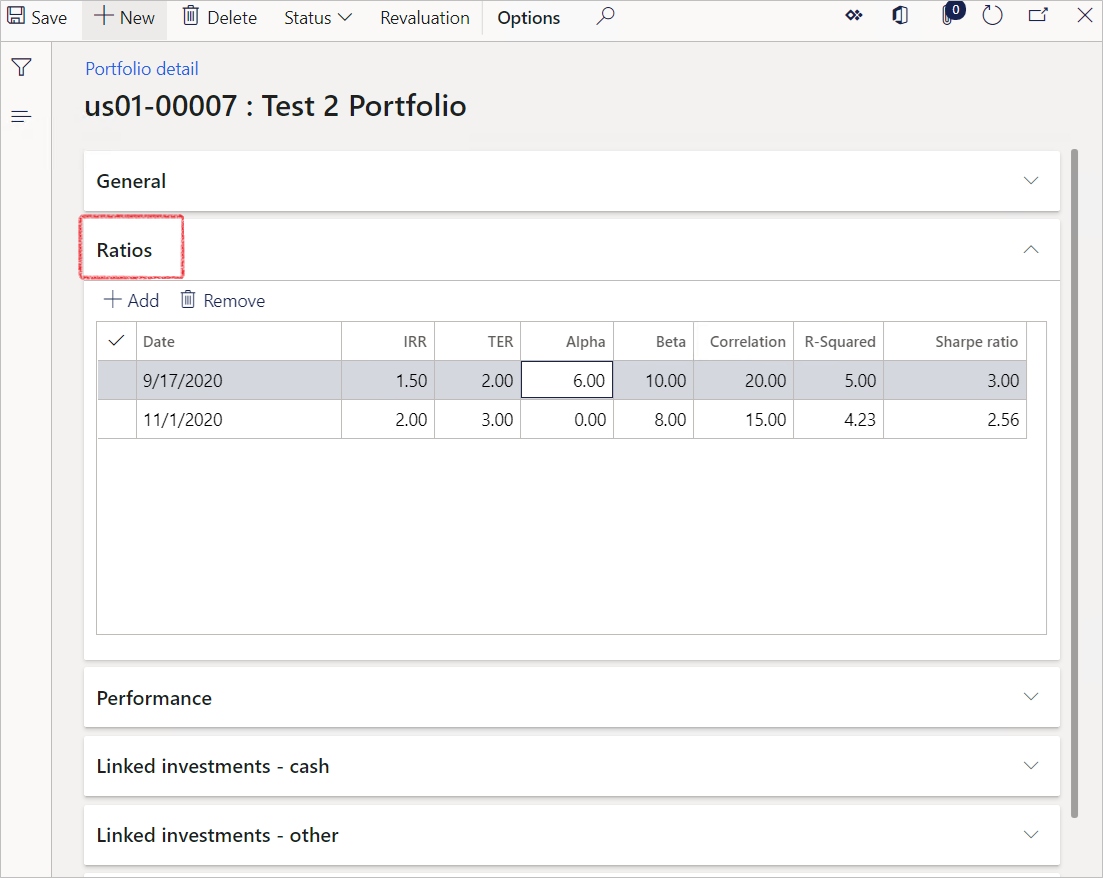

¶ Step 1.2: Ratios FastTab

Fields on the Ratios FastTab:

- Date

- Enter a date

- IRR

- Internal Rate of Return

- TER

- The total expense ratio

- Alpha

- The Alpha is the difference between what an asset returned and what its benchmark returned

- Beta

- Beta (β) is a measure of the volatility—or systematic risk—of a security or portfolio compared to the market as a whole

- Correlation

- Correlation, in the finance and investment industries, is a statistic that measures the degree to which two securities move in relation to each other.

- Correlations are used in advanced portfolio management, computed as the correlation coefficient, which has a value that must fall between -1.0 and +1.0

- R-Squared

- R-squared measures the relationship between a portfolio and its benchmark index. It is expressed as a percentage from 1 to 100.

- R-squared is not a measure of the performance of a portfolio. Rather, it measures the correlation of the portfolio's returns to the benchmark's returns.

- Sharpe ratio (Sharpe index)

- The Sharpe ratio is a way to measure the performance of an investment by taking risk into account. It can be used to evaluate a single security or an entire investment portfolio.

- The Sharpe ratio is a measure of return often used to compare the performance of investment managers by making an adjustment for risk.

- The Sharpe Ratio is the difference between the risk-free return and the return of an investment divided by the investment's standard deviation. The Sharpe Ratio adjusts the performance for the excess risk taken by an investor.

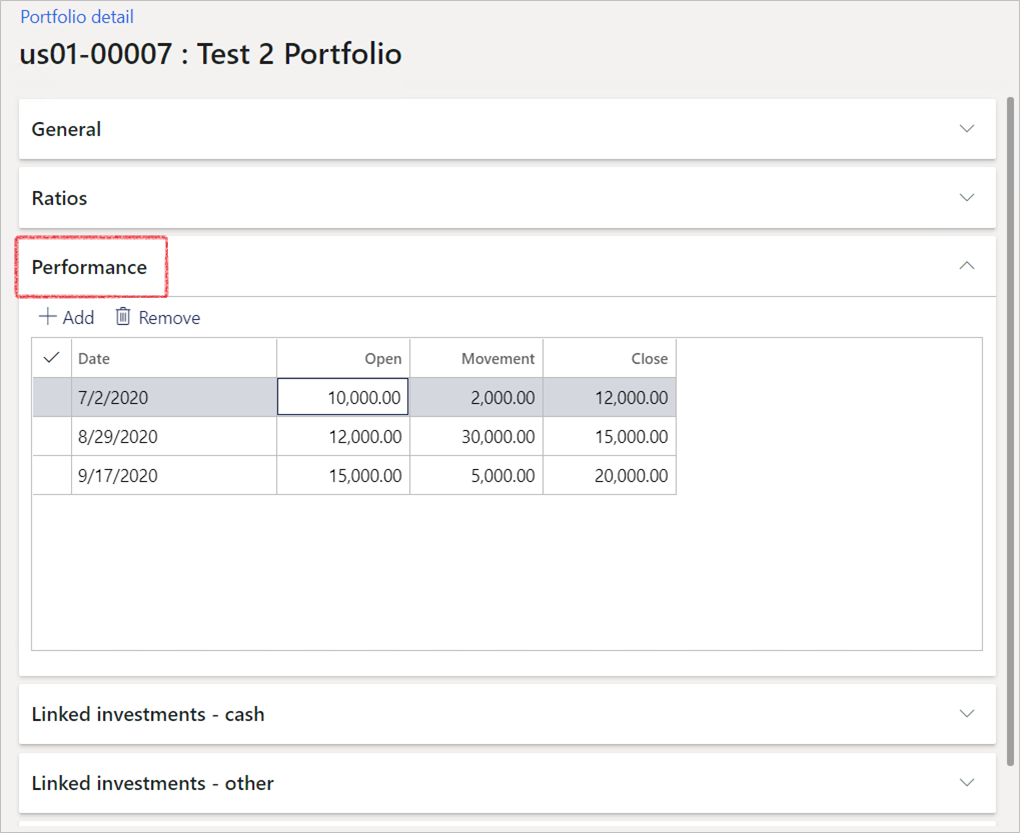

¶ Step 1.3: Performance FastTab

Expand the Performance FastTab and enter the necessary data:

- Enter a date

- Enter the Opening amount

- Enter the Movement

- Enter a Closing amount

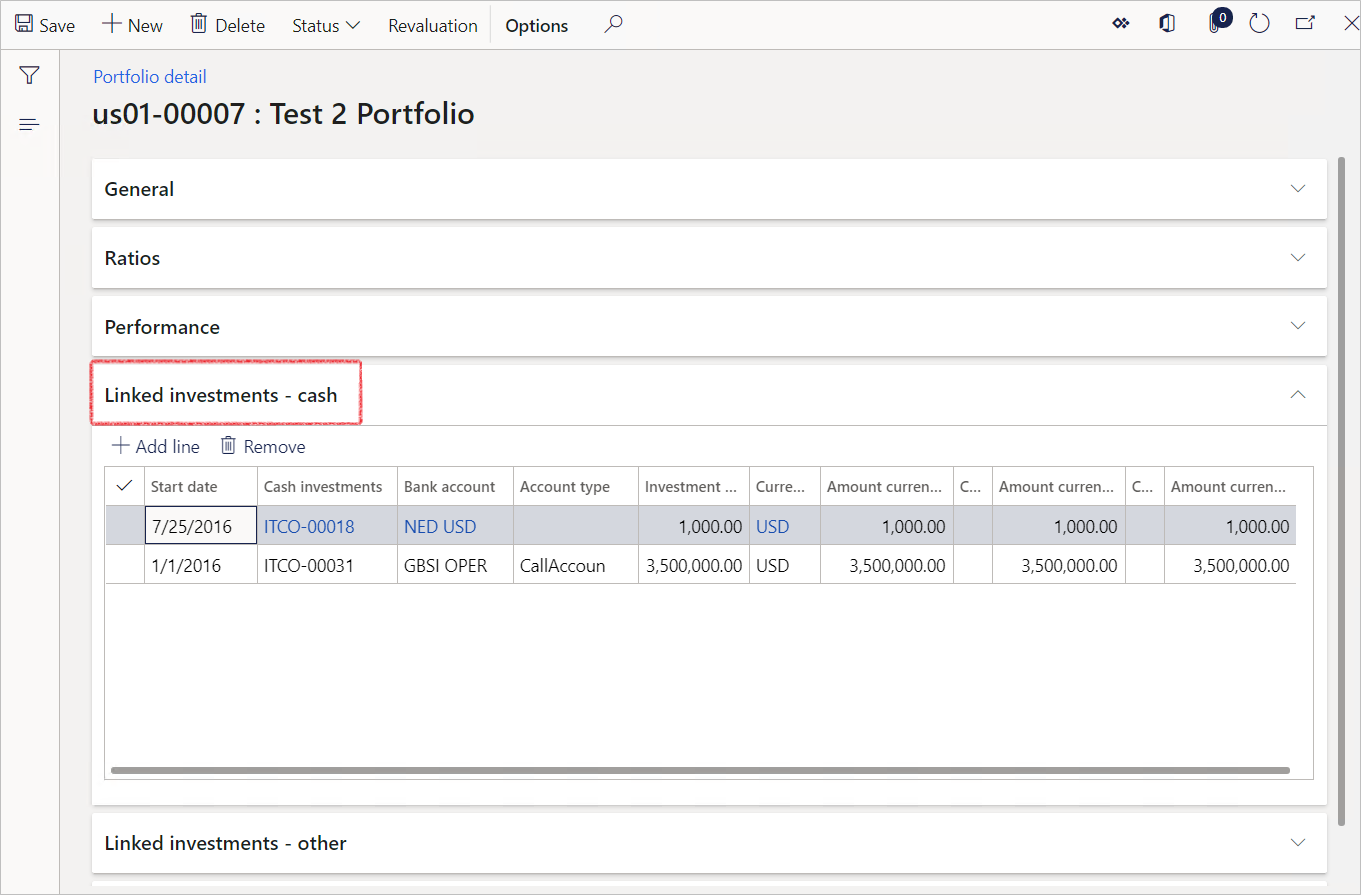

¶ Step 1.4: Linked investments – Cash FastTab

The following fields will be automatically filled out when adding an investment to a Portfolio record by utilizing the data from the chosen record:

- Cash investments

- Bank account

- Account type

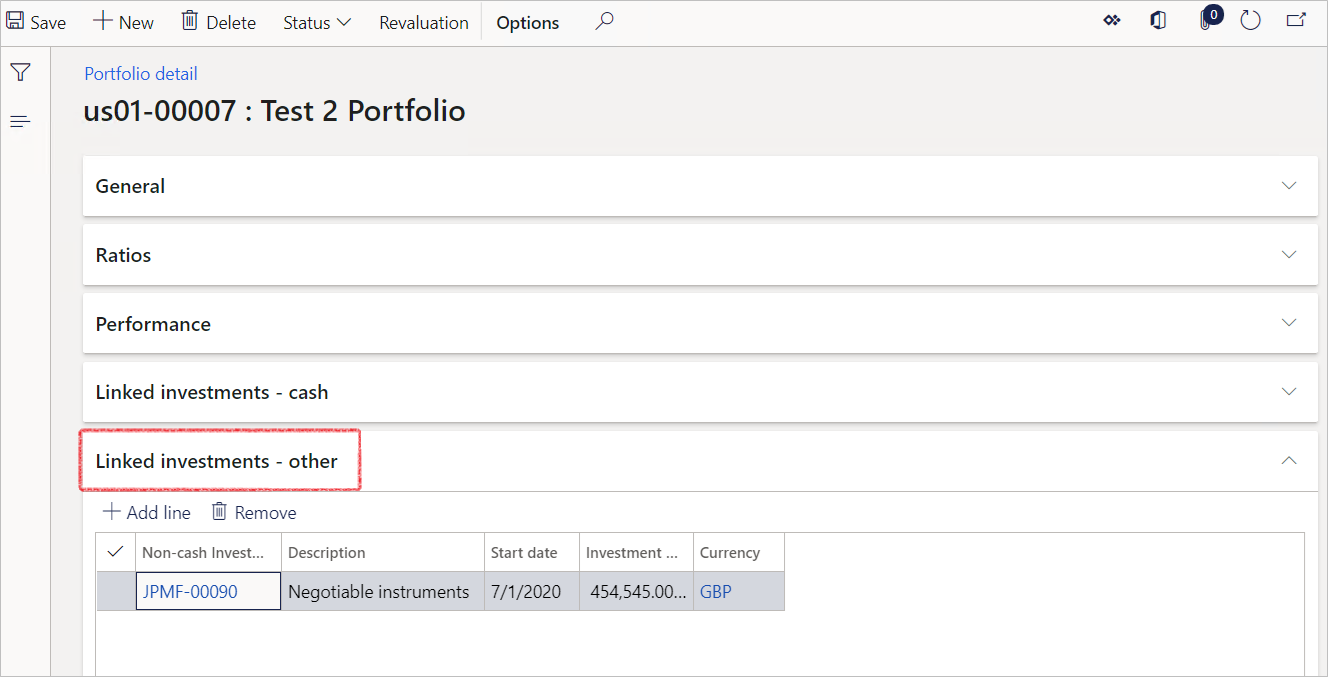

¶ Step 1.5: Linked investments - other FastTab

- A non-cash investment can be chosen from the dropdown menu.

A single Investment cannot be connected to more than one Portfolio or Loan

One portfolio may be linked to a number of investments (both Cash- and Non-Cash investments)

¶

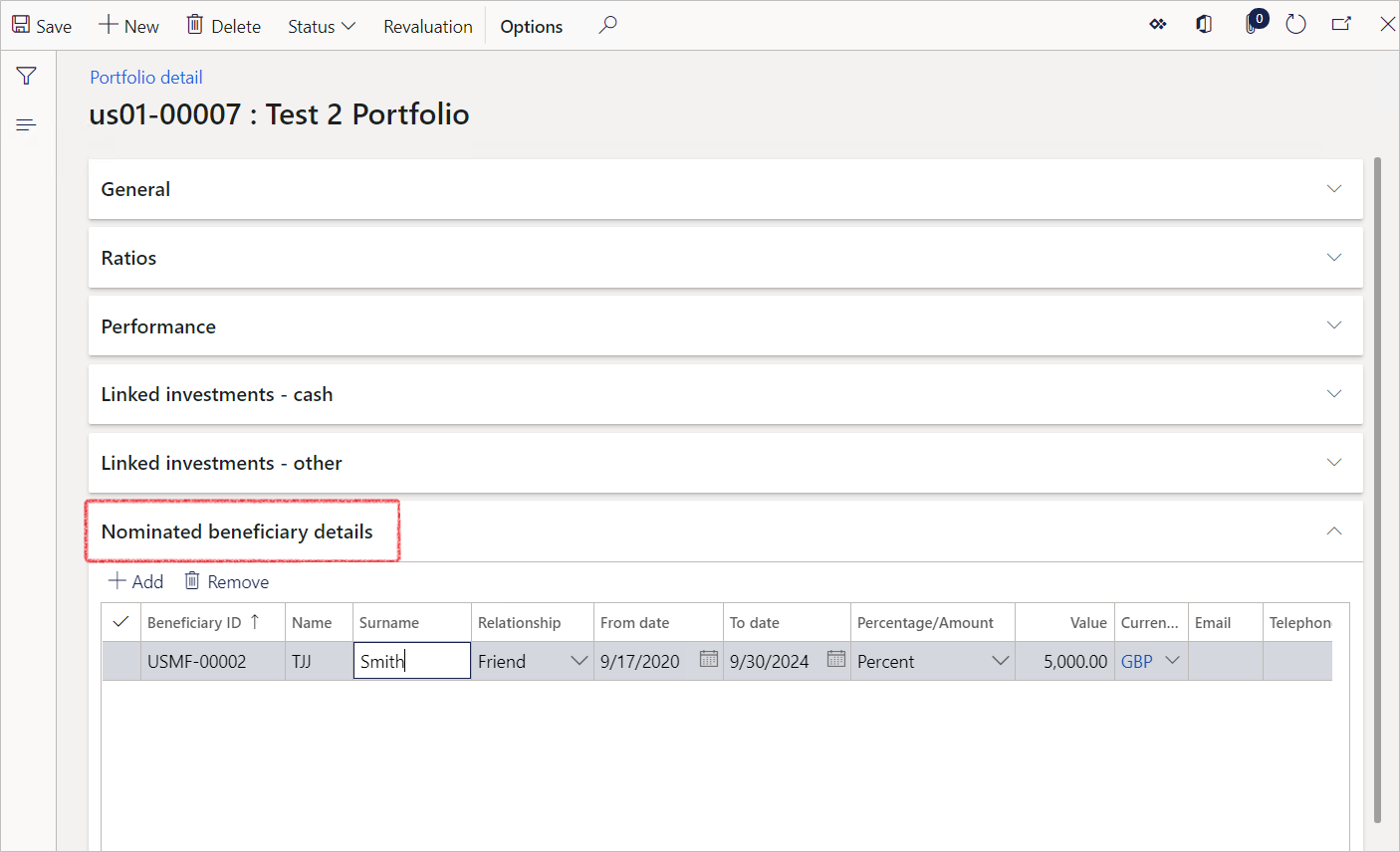

Step 1.6: Nominated beneficiary details FastTab

- Expand the Nominated beneficiary details FastTab

- Click on Add to add a new line

- The Beneficiary ID is system generated

- Enter a Name

- Enter a Surname

- Select the Relationship. Choose between

- Father

- Mother

- Grandfather

- Grandmother

- Child

- Brother

- Sister

- Friend or

- Other

- Enter a From date

- Enter a To date

- Choose between Percentage or Amount

- Enter a Value

- Select a Currency

- Type an Email address

- Enter a Telephone number

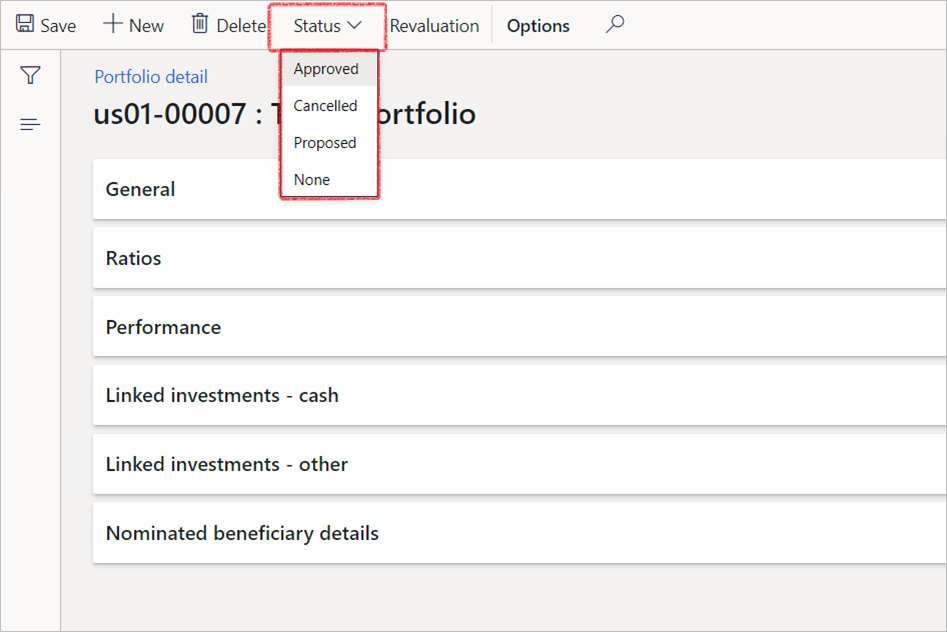

¶ Step 2: Status

The Status of an Investment portfolio can be set to:

- Approved

- Cancelled

- Proposed

- None

These statuses can be used in conjunction with Workflows.

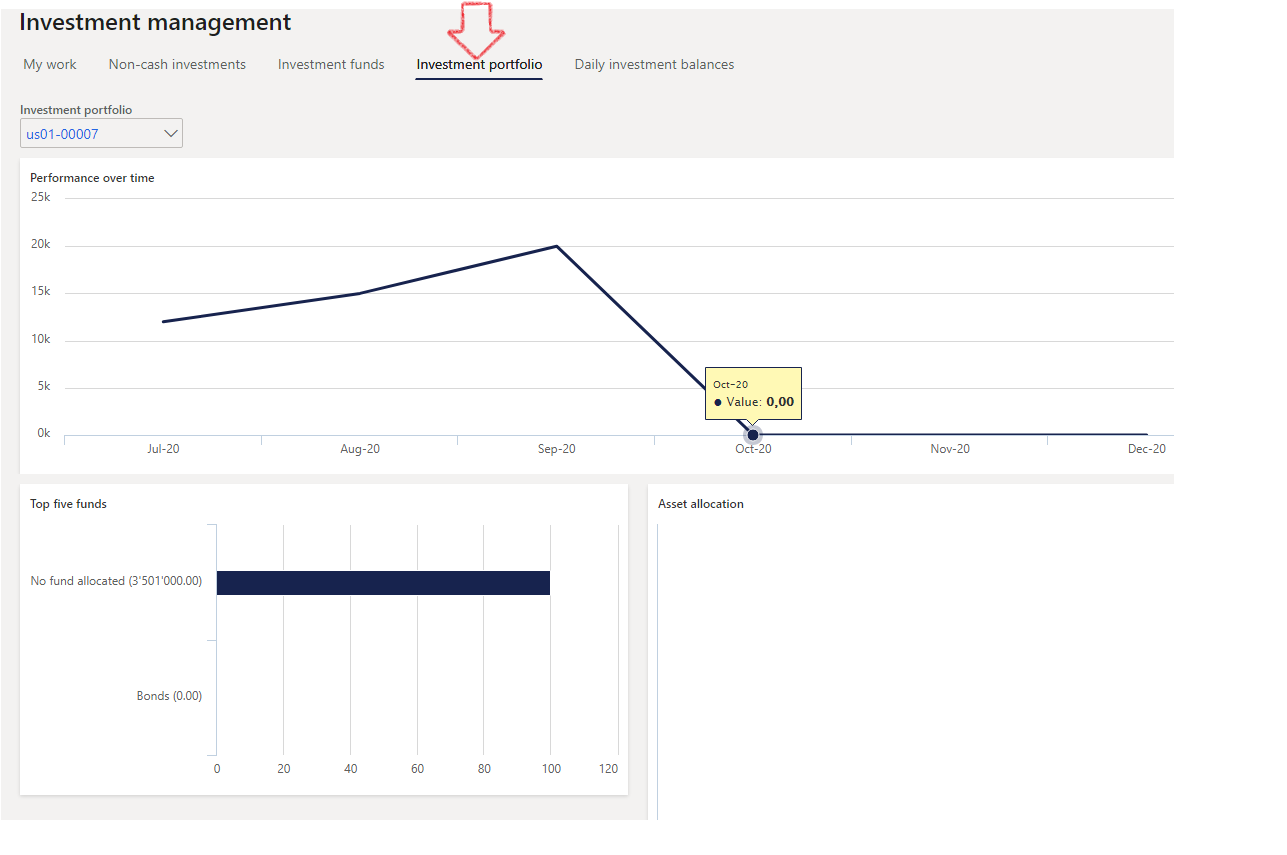

¶ Step 3: Investment portfolio Workspace

The portfolio management Workspace will provide an overview of the portfolios’ overall situation, so that the investment strategy is devised using all available information - Its valuation, performance and relation to individual benchmarks.

The list page will show the Investment portfolio number, Description, Status, Risk profile, Inception date, Valuation date, Currency and Customers or Vendors.

- Navigate to: Treasury > Investments > Investment portfolio

- Click on the Investment portfolio tab on top

- This page is divided into three sections:

- Performance over time

- Top five funds and

- Asset allocation