¶ Introduction

Insurance

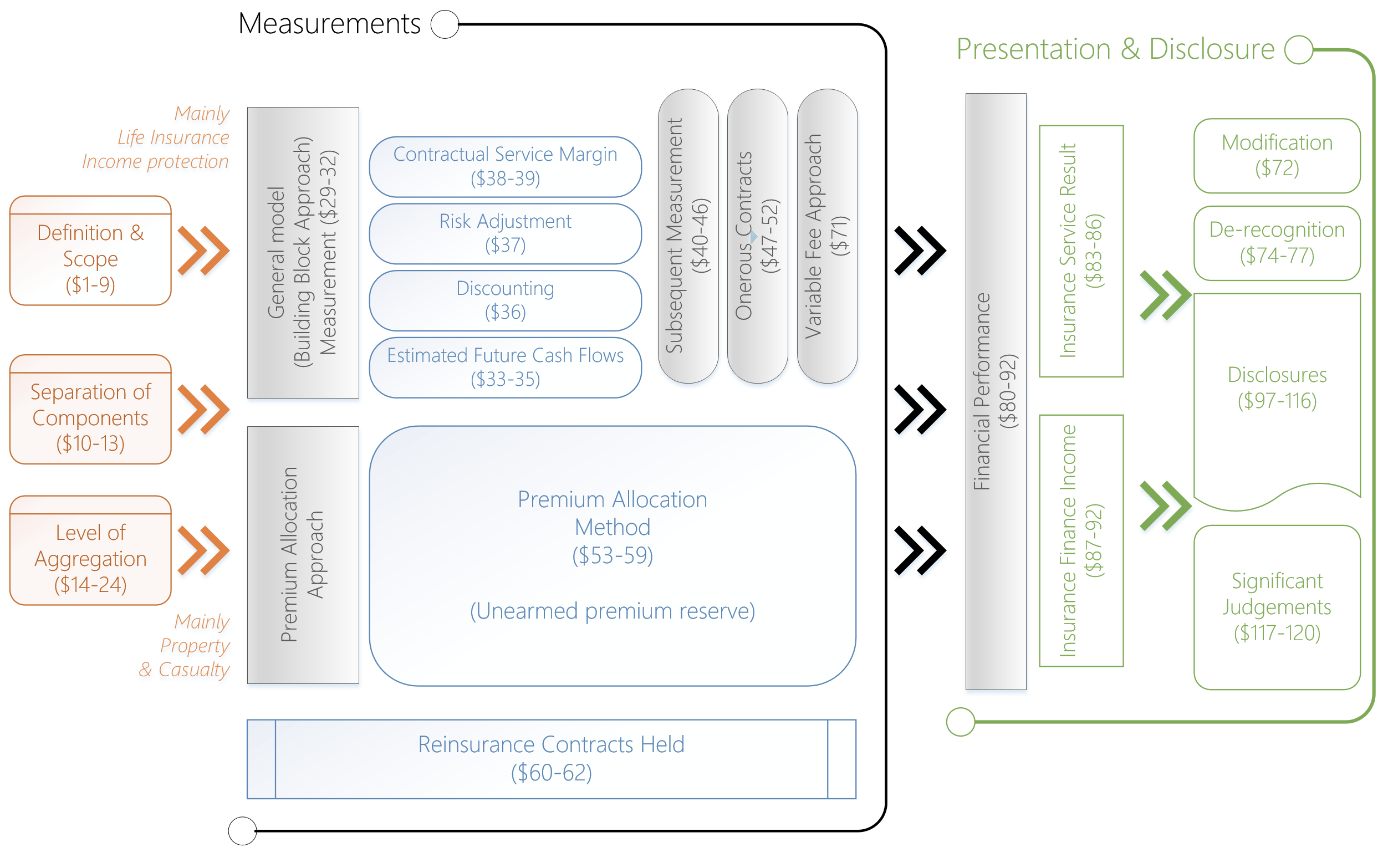

Dynamics 365 TMS is designed to manage incidents across various industries, offering a highly customizable platform for tracking claims across multiple lines of business. Insurance serves as a key risk management tool, primarily used to protect organizations from operational losses, although some forms are also employed to mitigate credit risk. Within TMS 365, functionality is included to support IFRS 17 compliance, ensuring that insurance-related processes align with regulatory and reporting requirements.

Insurance Management

• Insurance portfolio

• Insurance contracts

• Insurance policies

• Premiums

• Claims

• Insurance risk registers

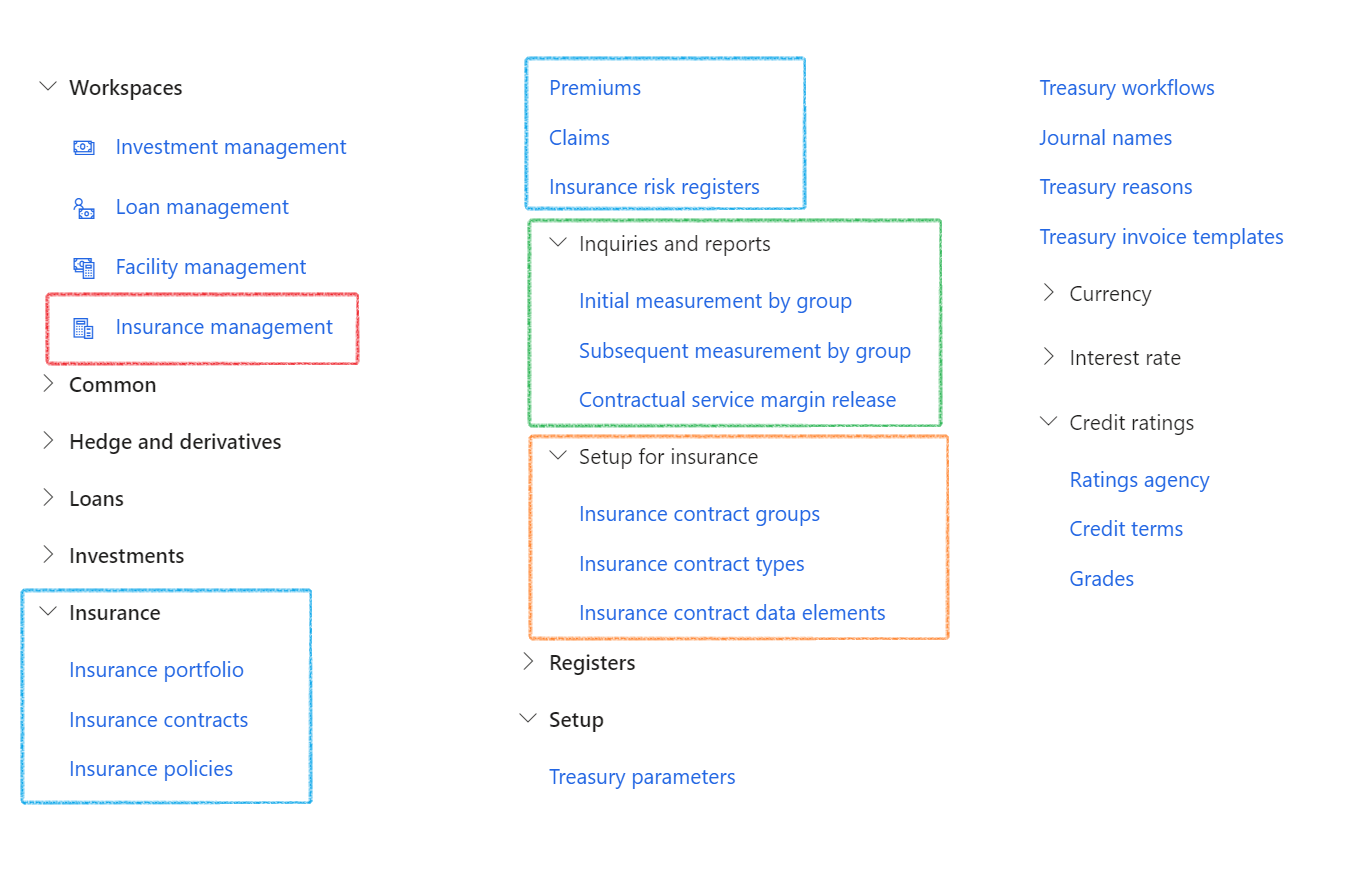

¶ Navigation

Inside Microsoft Dynamics 365, Axnosis created an area for Insurance. From the main menu, browse to TMS (Treasury Management System)

¶ Specific setups

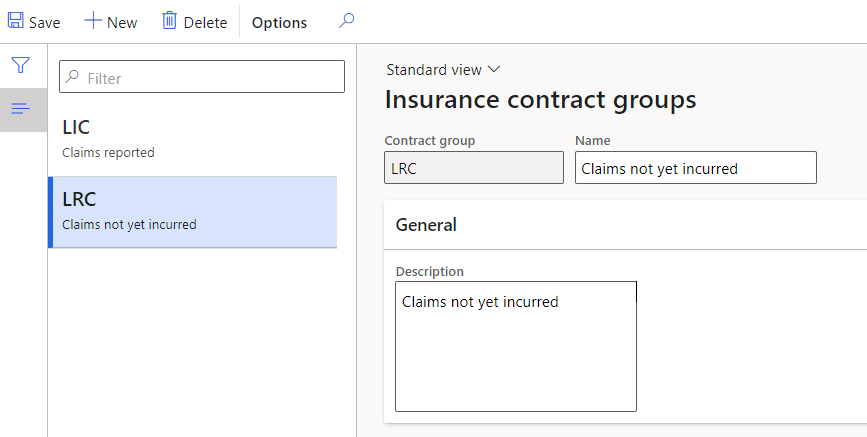

¶ Step 1: Setup Insurance contract groups

- Go to: Treasury > Insurance >Setup for insurance > Insurance contract groups

- On the Action pane, click on the New button

- Type the Contract group

- Enter a Name

- Enter a Description

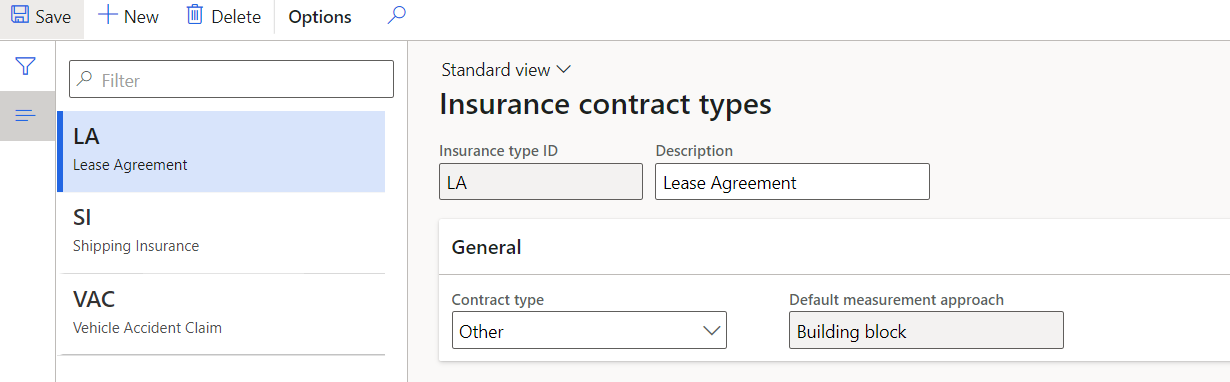

¶ Step 2: Setup Insurance contract types

- Go to: Treasury > Insurance > Setup for insurance > Insurance contract types

- In the action pane, click on New

- Enter an Insurance type ID

- Give it a Description

- Expand the General FastTab

- Select a Contract type

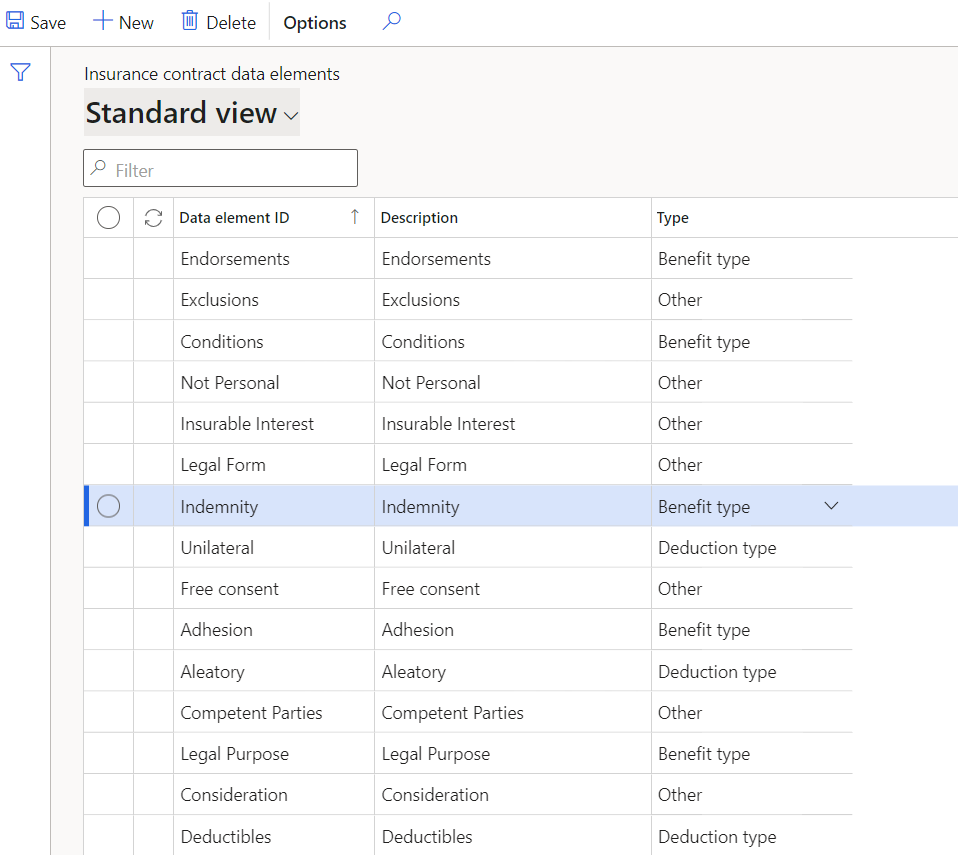

¶ Step 3: Setup Insurance contract data elements

To set up Insurance contract data elements, go to:

- Treasury > Insurance > Setup for Insurance > Insurance contract data elements

- In the action pane, click on New

- Enter a Data Element ID

- Give it a Description

- Select the Type from a drop-down menu

¶ Daily use

Working with Insurance

Claims start with Policies. Policies is a logical grouping of policy rules and pertinent clauses. Policies is the fundamental building block. An insurance policy contains the following elements:

- Definable risk

- Fortuitous event

- Insurable interest

- Risk shifting

- Risk distribution

There are three components of any type of insurance that are crucial:

- Premium

- Policy limit

- Deductibles

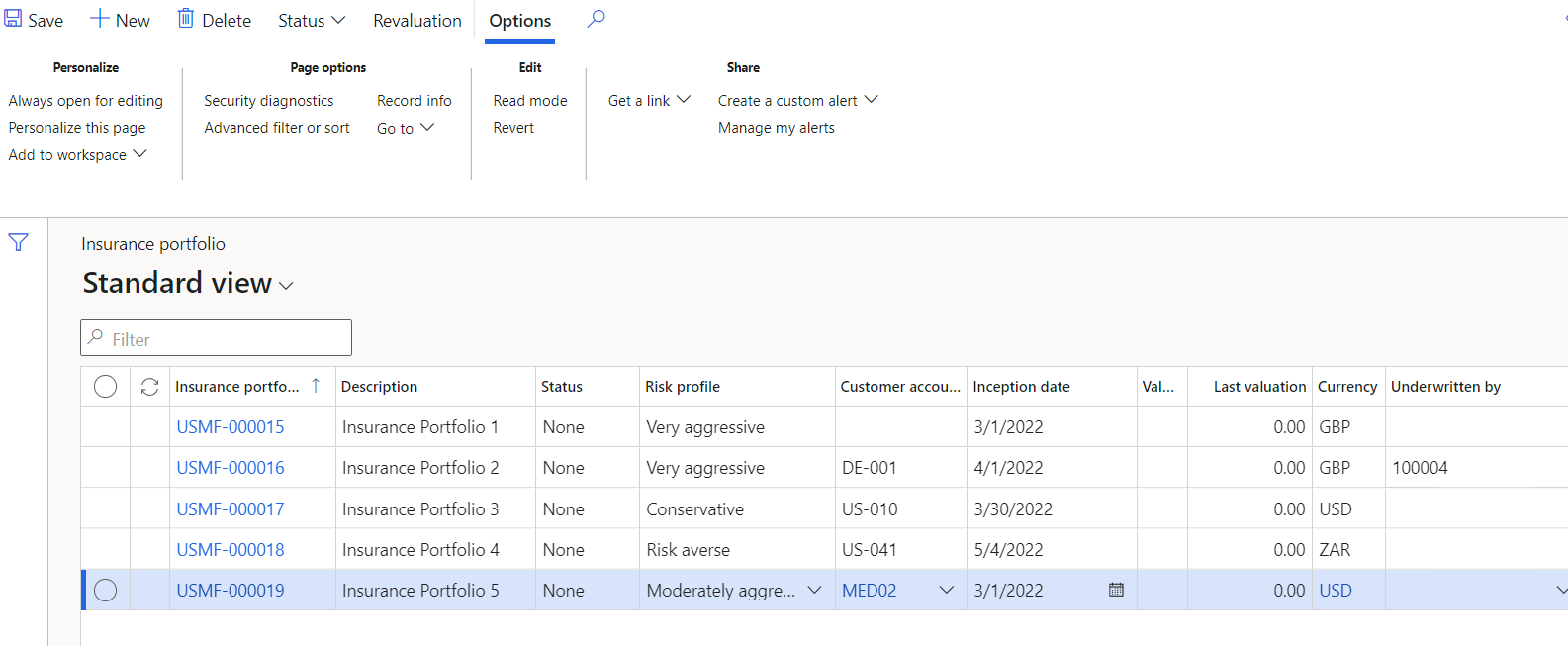

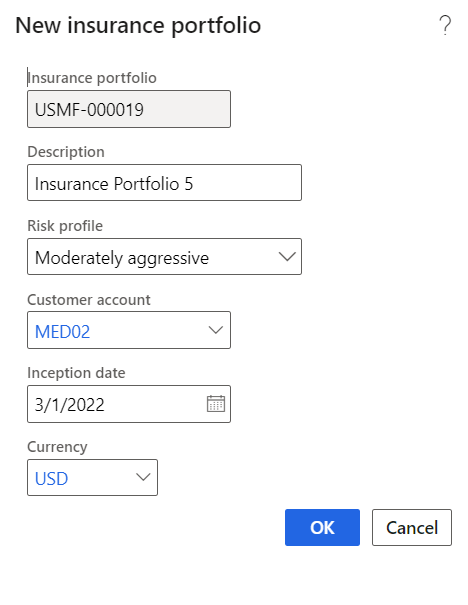

¶ Step 4: Create an Insurance portfolio

- Go to: Treasury > Insurance > Insurance portfolio

- A list page will show all the Insurance portfolios

- On the Action pane, click New

- Complete the following fields:

- Description

- Select a Risk profile from the drop-down menu

- Select a Customer account

- Enter an Inception date

- Select a Currency

- Click OK

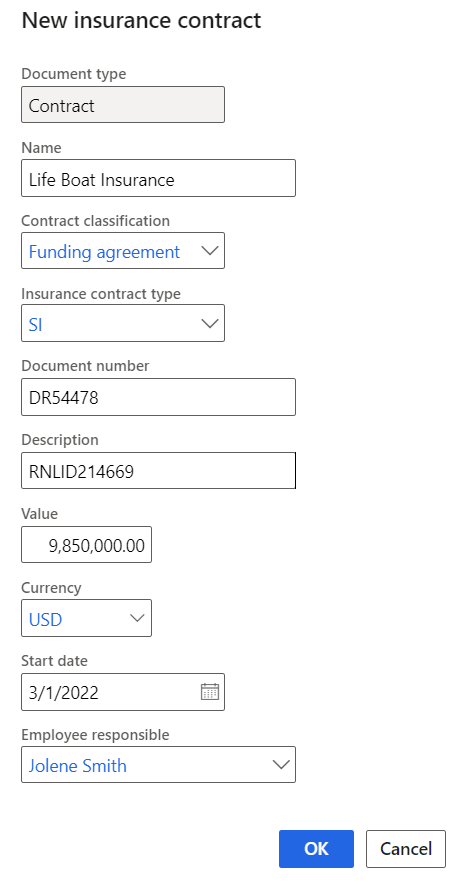

¶ Step 5: Insurance contracts

- Go to Treasury > Insurance > Insurance contracts

- A list page will display all the Insurance contracts

- To create a new Insurance contract, click on New in the action bar

- Complete the following fields:

- Name

- Select the Contract classification from the drop-down list

- Select the relevant Insurance contract type for the insurance contract

- Enter a Document number

- Type a Description

- Enter a Value

- Select a Currency

- Enter a Start date

- Select an Employee responsible

- Click OK

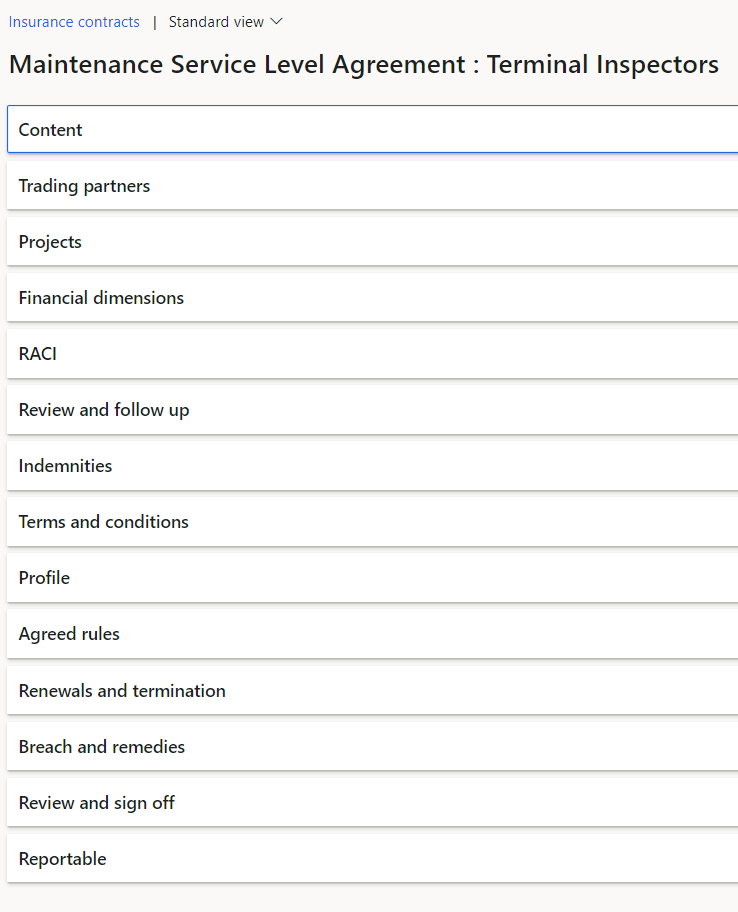

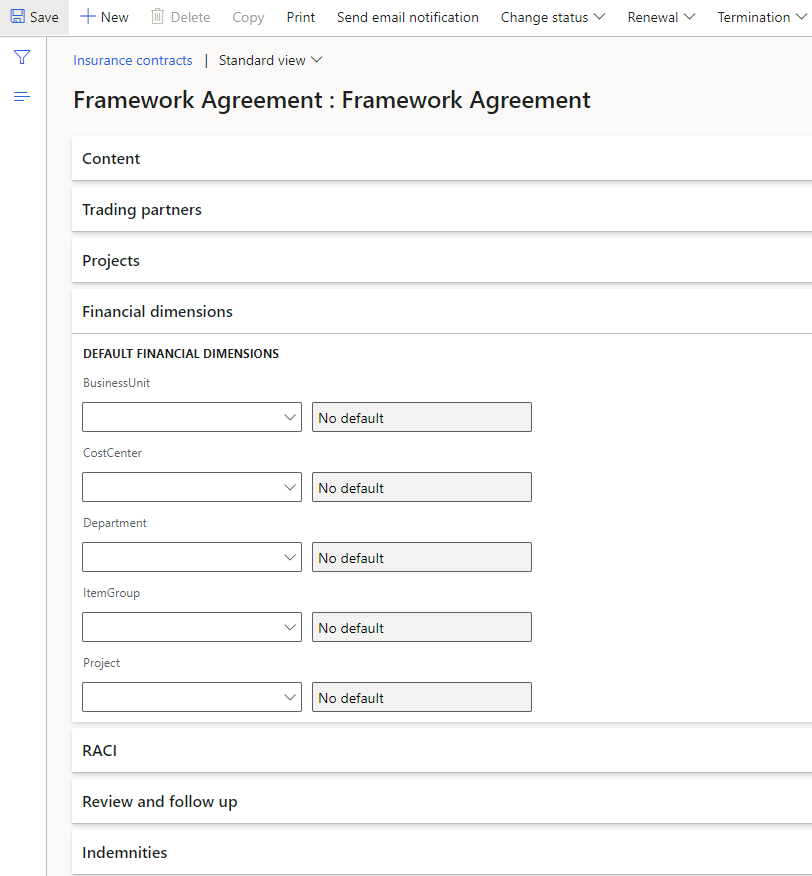

- The following FastTabs makes up the Insurance contract:

- Content

- Trading partners

- Financial dimensions

- RACI

- Review and follow up

- Indemnities

- Terms and conditions

- Profile

- Agreed rules

- Renewals and termination

- Breach and remedies

- Review and sign off

- Reportable

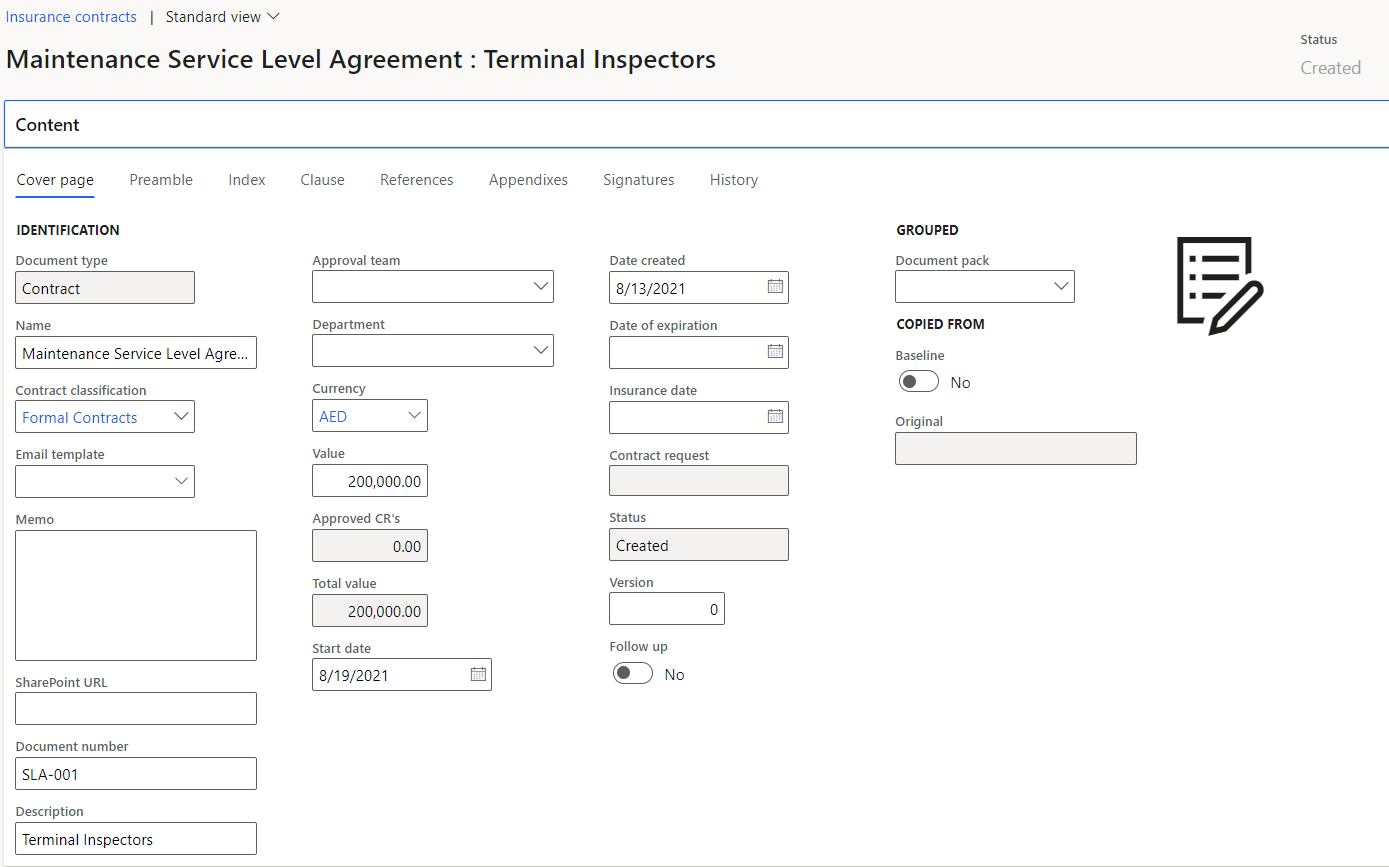

- Expand the Content FastTab

- More information can be added

- The following pages makes up the Contract:

- Cover page

- Preamble

- Index

- Clause

- References

- Appendixes

- Signatures

- History

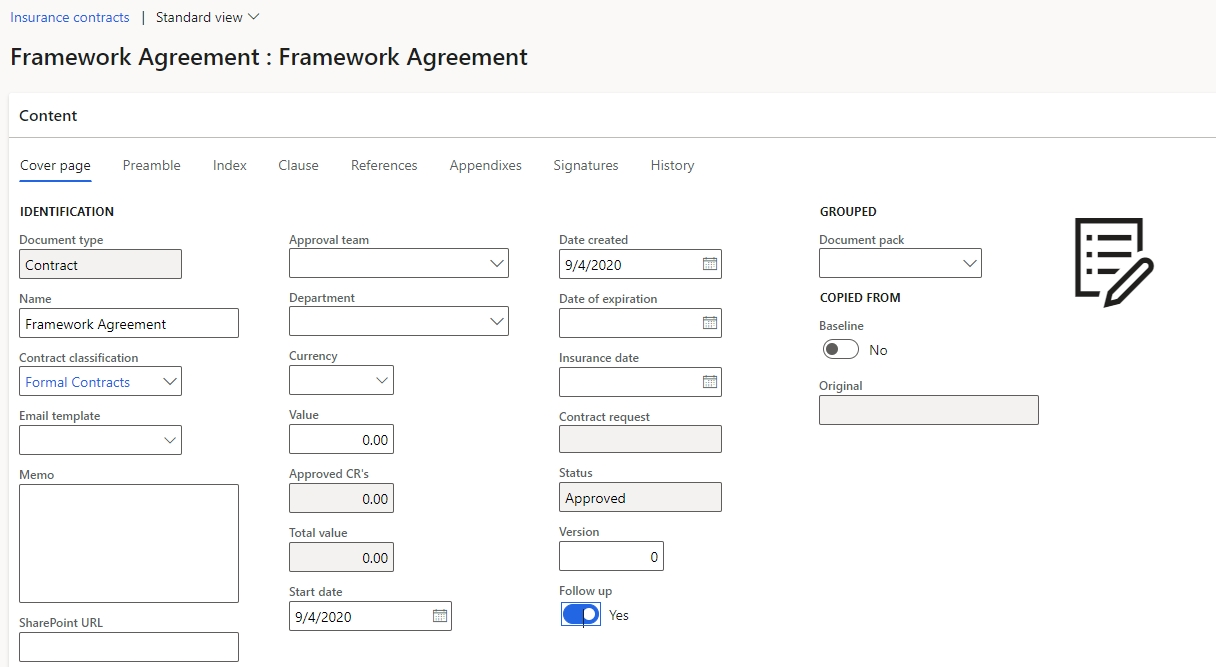

¶ Step 5.1: Create the policy Cover page

- Expand the Content FastTab

- Open the Cover page Index tab

- In the Document type

- Enter the Name of the document

- Select the relevant Contract classification from the dropdown list

- Select the relevant Email template from the dropdown list

- Enter a SharePointURL

- Enter a Document number

- Enter a brief Description of the document

- Select the Approval team from the dropdown list

- Select the Date on which the document was created

- Select the Status of the document from the dropdown list

- Enter the Version number

- Indicate whether this is document is a Baseline/template to be used for copy purposes (Please take note of the comment “For Baseline documents” below before moving the slider to Yes)

The Document type can only be selected on creation of the document

The Contract classification field and the Contract request field, will only be available if the Document type = Contract

The Renewals and termination FastTab will only be available if the Document type = Contract

If this was a requested contract, the request number will be displayed in the Contract request field

Only users who are members of the selected Approval team will be able to Approve the document. If the Approval team field is left blank, the user can change the status even if he is not a team member

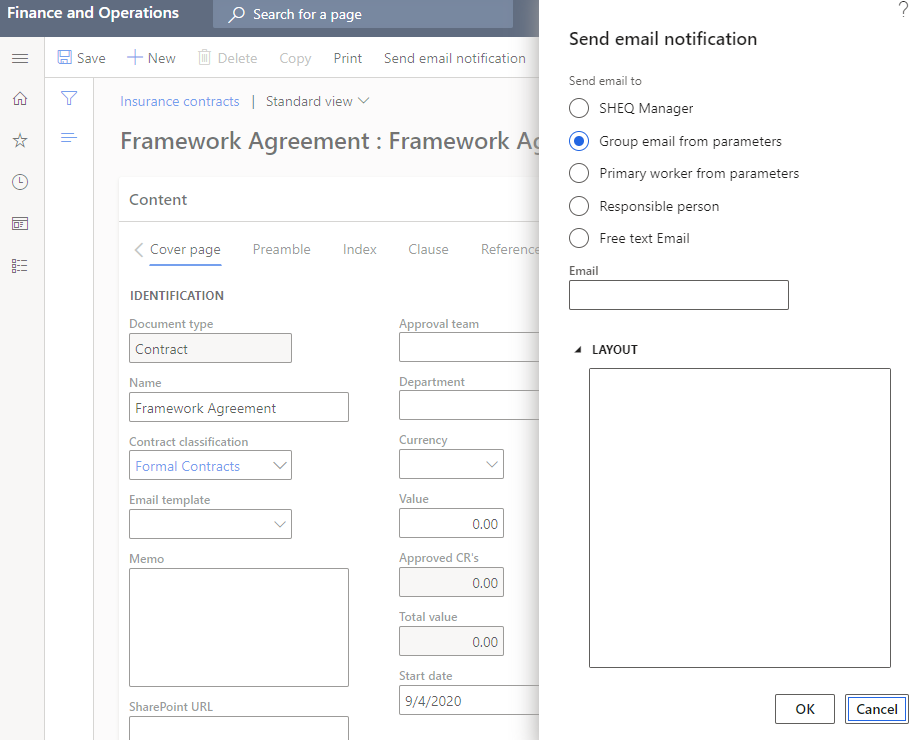

¶ Step 5.2: Send Email notification

- On the Action pane, click on the Send email notification button

- Click OK

An email notification will be sent to the selected stakeholders

|

Field on form |

|

%ReferenceNumber % %DateCreated% %ProjectDescription% %PlannedMethodOfProcurement % %EstimatedValue% %urlLink% |

Reference number Date created Project description Planned method of procurement Estimated value Hyperlink |

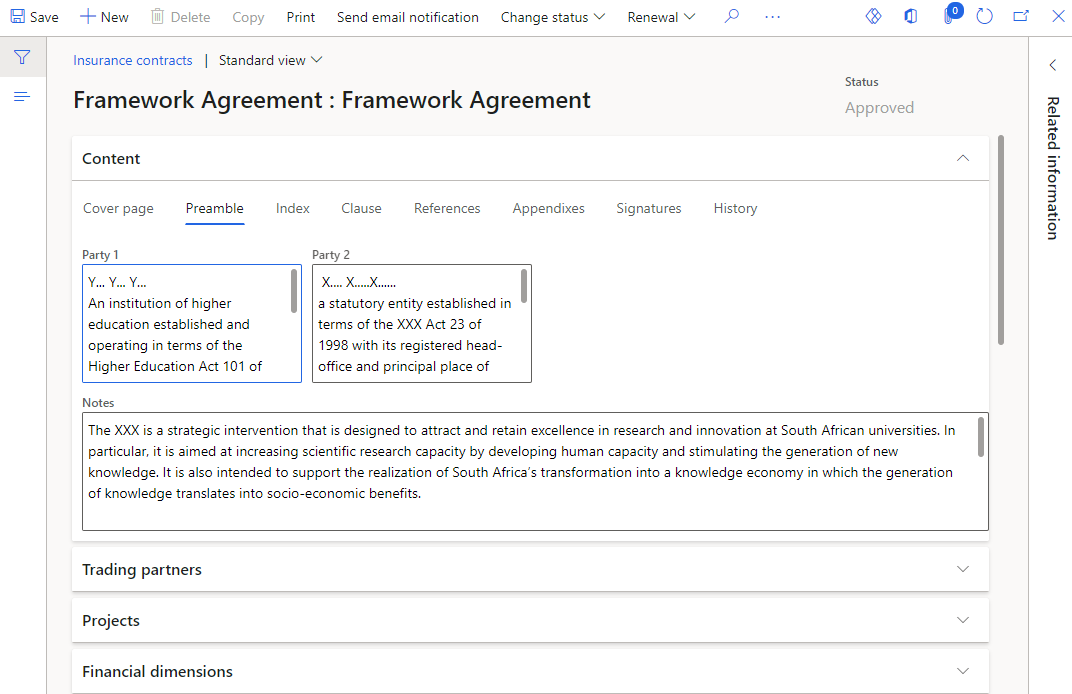

¶ Step 5.3: Create the Preamble

- Expand the Preamble Index tab

- Enter the details of Party 1 in the box provided

- Enter the details of Party 2 in the box provided

- Enter the Preamble text in the Notes box provided

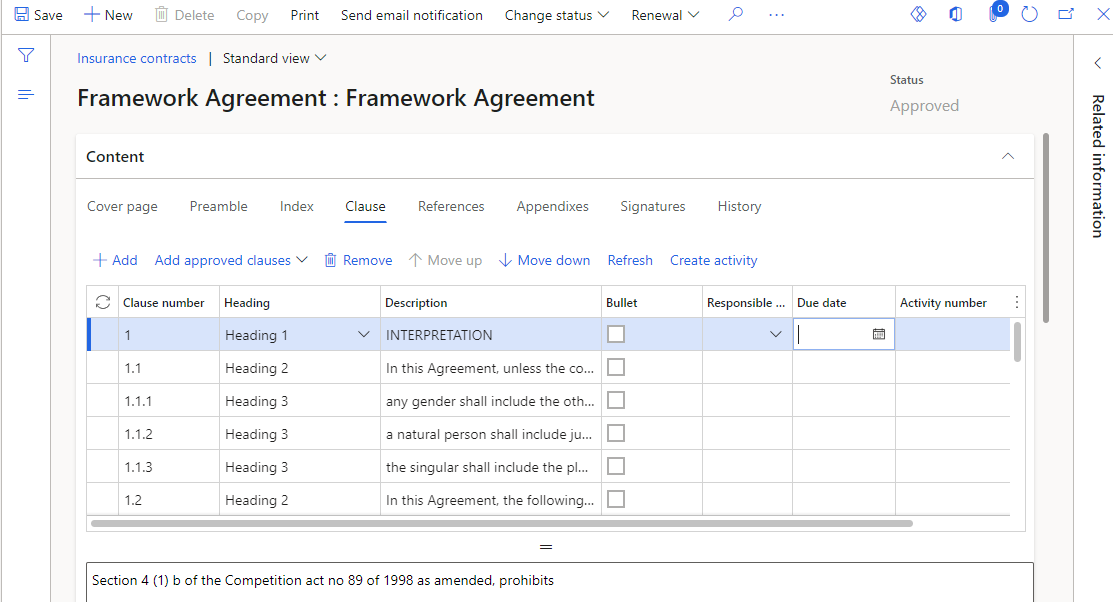

¶ Step 5.4: Create the policy Clauses

Contract clauses can be added under the Clause Index tab. This is useful so that users can see for example, which performance clauses, penalty clauses or breach clauses are applicable.

- Open the Clause index tab

- In the Task bar, click the Add button

- The Clause number will be generated by the system

- Select the Heading (Heading 1 for a primary heading, Heading 2 for a secondary heading)

- Enter a Description

- If required, select the worker responsible for doing the Action

- Select the date on which the action should take place

- Use the box provided to type the Clause definition

If there is a sub clause, tick the checkboxes in the Bullets column

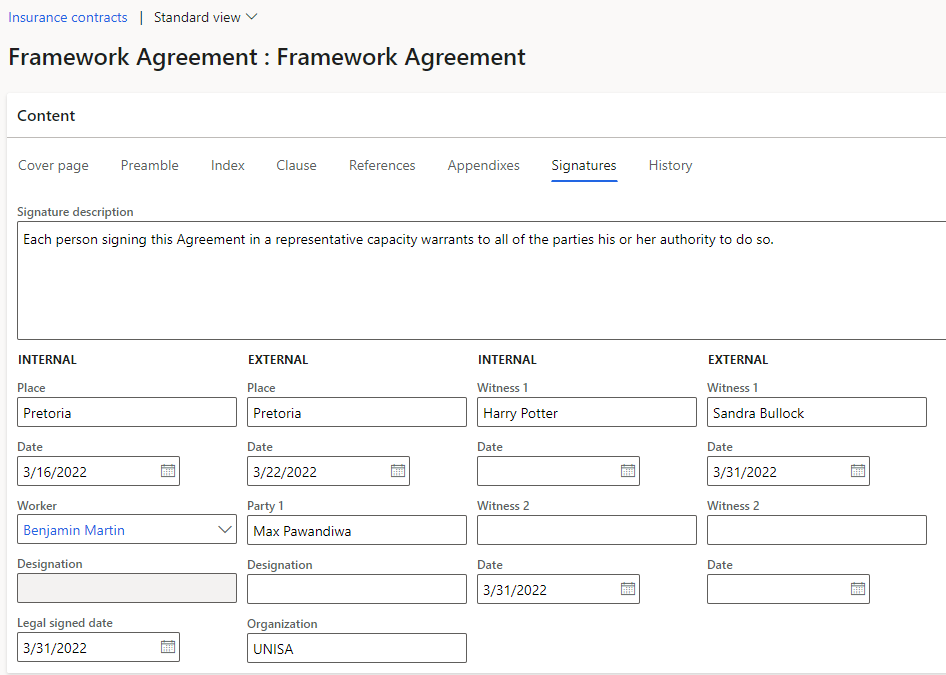

¶ Step 5.5: Add Signatures

- Open the Signatures index tab

- Enter a Signature description in the box provided

- Under the Internal field groups:

- Enter the Place where the document will be signed

- Select the Date on which the document will be signed

- Select the Worker whose signature is required for approval of this document, from the dropdown list

- Enter the names of the internal Witnesses that will be signing the document

- Under the External field groups:

- Enter the Place where the document will be signed

- Select the Date on which the document will be signed

- Enter the name of the person who will be signing on behalf of the External Party (Party 1)

- Enter the person’s Designation

- Enter the name of the Organization

- Enter the names of the external Witnesses that will be signing the document

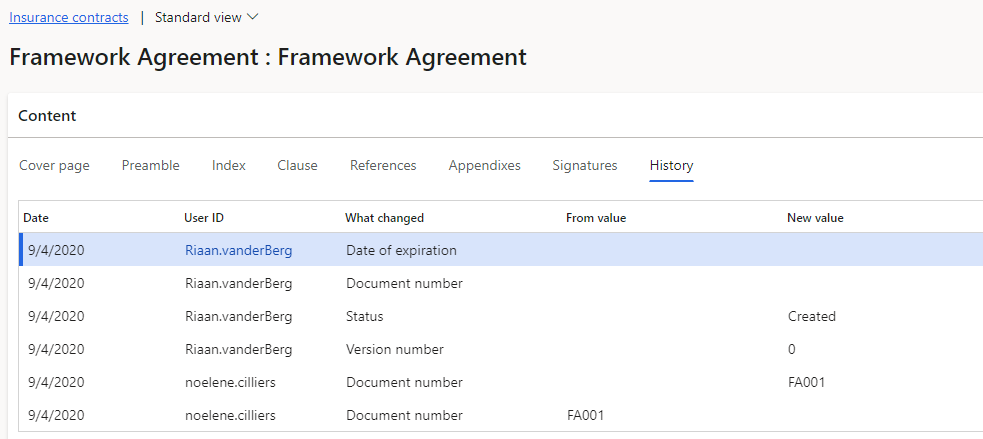

¶ Step 5.6: View the policy History

Dynamics 365 GRC will keep a full audit trial of changes made by users. This is visible on the History index tab below

¶ Step 5.7: Setup Financial dimensions

- Expand the Financial dimensions FastTab

- Select the relevant financial dimensions for the following:

- Business unit

- Cost Centre

- Department

- Item Group

- Project

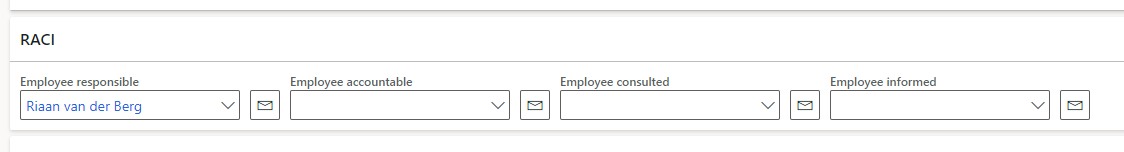

¶ Step 5.8: RACI (Responsibility matrix)

- Select the Employee responsible from the dropdown list

- Select the Employee accountable from the dropdown list

- Select the Employee consulted from the dropdown list

- Select the Employee informed from the dropdown list

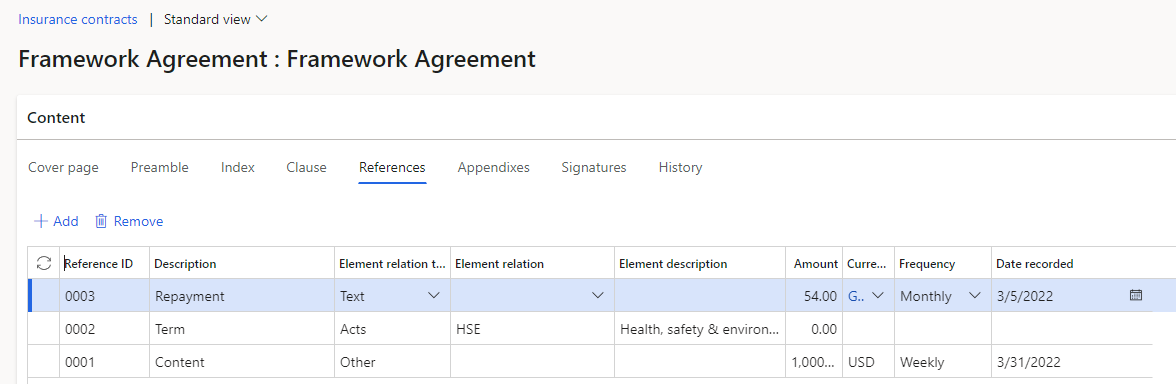

¶ Step 5.9: References index tab

- Open the References index tab

- In the Task bar, click the Add button

- Enter a Reference ID

- Enter a brief Description

- Select the relevant Element relation type from the drop-down list

- Select the relevant Element relation from the drop-down list

- Enter the Element description

- Enter the Amount

- Select the relevant Currency from the drop-down list

- Select the relevant Frequency from the drop-down list

- Enter the Date recorded

¶ Step 5.10: Contract statuses

| Status | Rules |

| Created: |

|

| Draft: |

|

| Receive: |

|

| Submit: |

|

| Approve: |

|

| Revise: |

|

| Reject: |

|

| Archive: |

|

¶ Step 5.11: Printing contract content

- Go to: Treasury > Insurance > Insurance contracts

- Select the record that you want to print the report/contract for

- On the Action pane, click on the Print button

- On the dialog, select whether you want to print the cover page or not

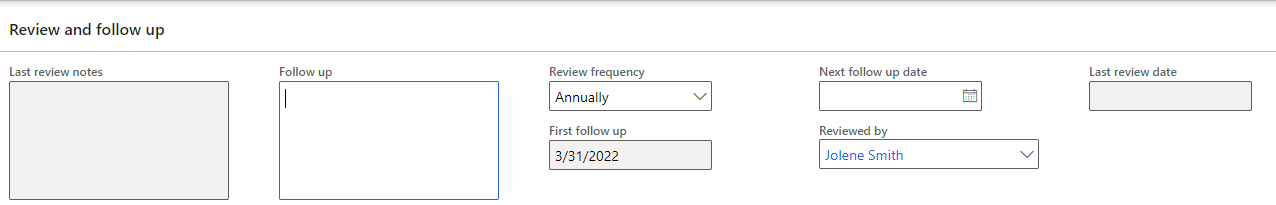

¶ Step 5.12: The Review and follow up FastTab

- Go to: Treasury > Insurance > Insurance contracts

- Select the relevant contract

- Under the Content FastTab, move the Follow up slider to Yes

- Expand the Review and follow up FastTab

- Enter the Follow up notes in the box provided

- Select the worker’s name who did the review, from the drop-down list

- The Last review date field will be populated with today’s date (Can be edited)

- The Next review date field will be populated with the date calculated by the system (Calculated by using Last review date and Review frequency)

- Under the ContentFastTab, move the Follow up slider to No

- The notes entered in the Follow up note box will be moved to the Last review notes box, and the Last review date field will be populated

- Another follow up can be done now

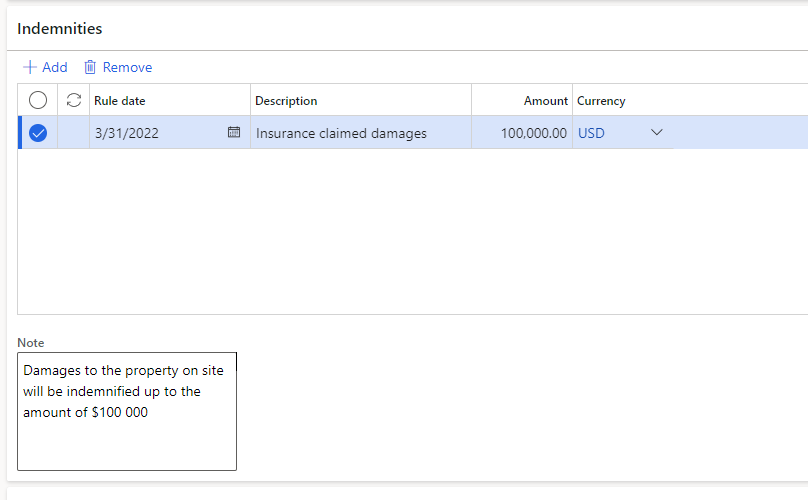

¶ Step 5.13: The Indemnities FastTab

- Go to: Treasury > Insurance > Insurance contracts

- Select the relevant contract

- Expand the Indemnities FastTab

- In the button strip, click on the Add button

- Enter the Rule date

- Enter a brief Description

- Enter the Amount

- Select the relevant Currency from the dropdown list

- Enter additional details in the Note box provided

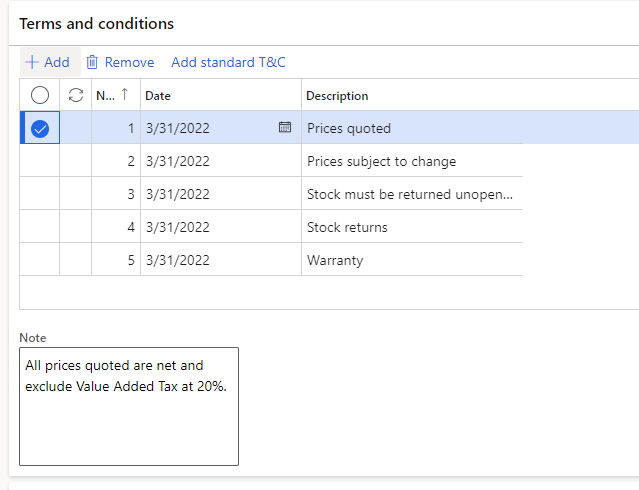

¶ Step 5.14: Terms and conditions

- Go to: Treasury > Insurance > Insurance contracts

- Select the relevant contract

- Expand the Terms and conditions FastTab

- In the Button strip, click on the Add button

- Enter the Number of the term/condition

- Enter the Date on which the term/condition was added

- Enter a brief Description

- Enter additional information in the Note box provided

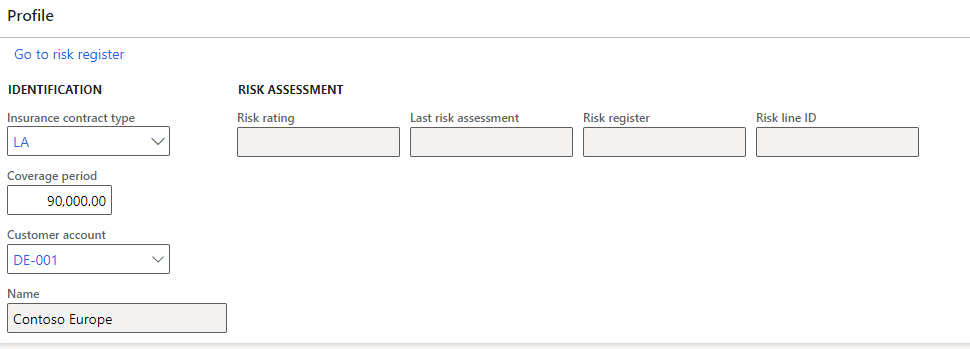

¶ Step 5.15: Profile

If a Risk assessment was done on the contract, the details will be displayed here

- Go to: Treasury > Insurance >Insurance Contracts

- Select the relevant contract

- Expand the Profile FastTab

The Identification Field group will only be available if the Insurance slider under the Content Fast tab is set to Yes

¶ Step 5.16: Review and sign off

- Go to: Treasury > Insurance > Insurance Contracts

- Select the relevant contract

- Expand the Review and sign off FastTab

- In the button strip, click on the Add button

- Select either a Worker or Supplier, or enter a Contractor employee

- Enter the Date signed

- Select the relevant Signature type from the dropdown list

- Indicate which actions have been done by the Worker/Contractor employee

- Notified

- Legal counselled

- Risk assessed

- Approved

- Activities completed

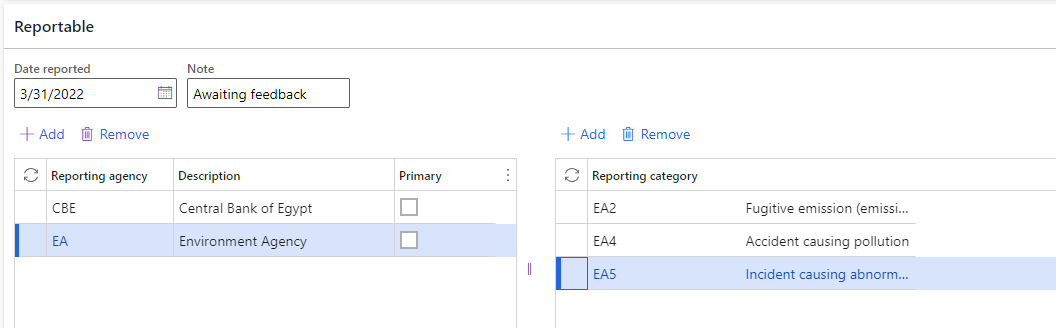

¶ Step 5.17: Reportable

- Go to: Treasury > Insurance >Insurance contracts

- Select the relevant contract

- Expand the Reportable FastTab

- Enter the Date reported

- Add a Note

- In the button strip, click on the Add button

- Select the relevant Reporting agency from the dropdown list

- Indicate whether this is the Primary reporting agency

- To select the Reporting category, click on the Add button above the right-hand side grid

- Select the relevant Reporting category from the dropdown list

When a contract must be reported to Government or Local authorities

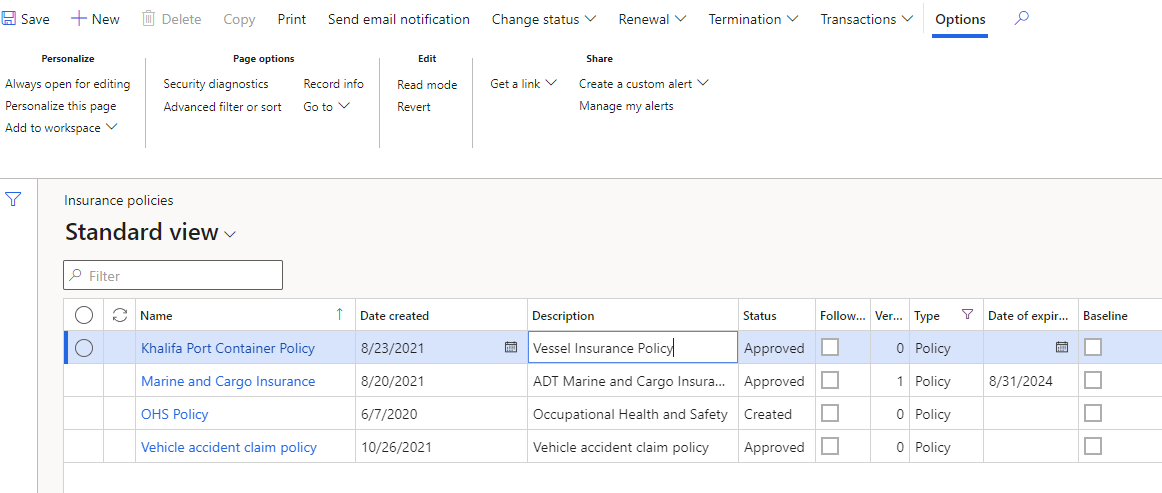

¶ Step 6: Insurance policies

Insurance coverage is the amount of risk, liability, or potential loss that is protected by insurance. It helps individuals recover from financial losses as a result of incidents, such as car accidents, damaged property, or unexpected health issues.

- Go to Treasury > Insurance > Insurance policies

- To create a new policy, click on New in the ribbon bar

¶ Step 7: Premiums

An insurance premium is the amount of money an individual or business pays for an insurance policy. Insurance premiums are paid for policies that cover healthcare, auto, home, and life insurance. Once earned, the premium is income for the insurance company.

- Go to Treasury > Insurance > Premiums

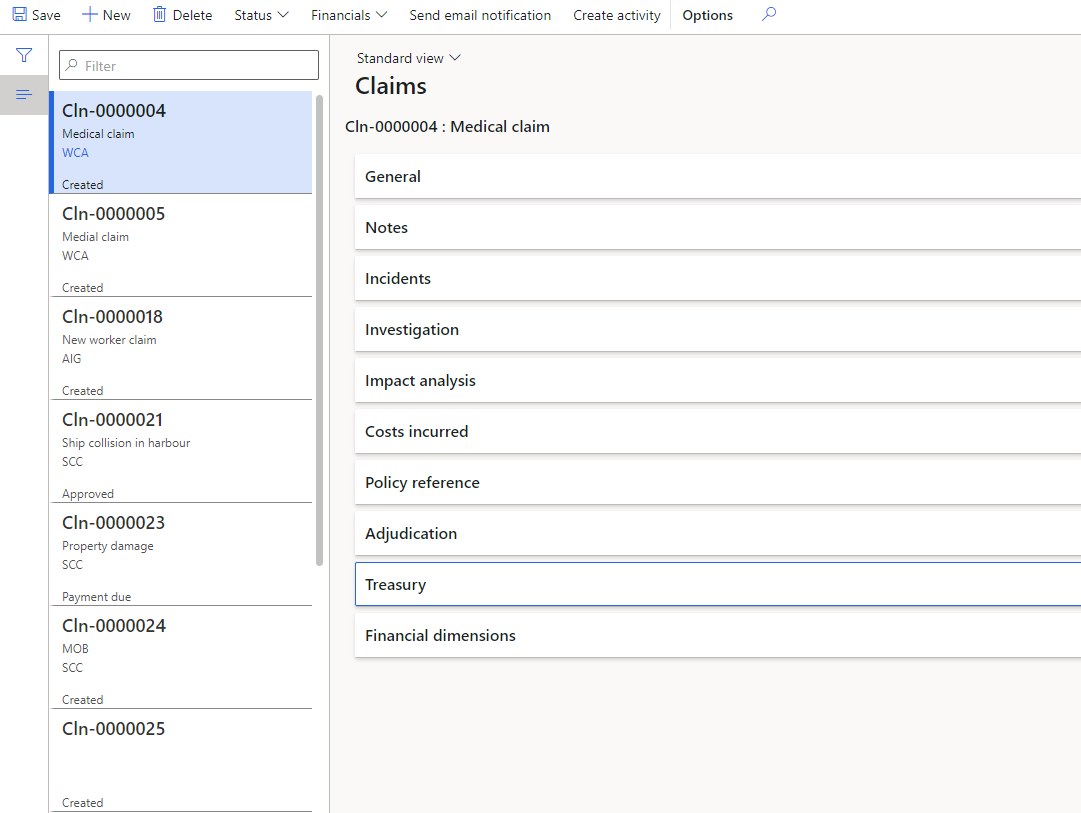

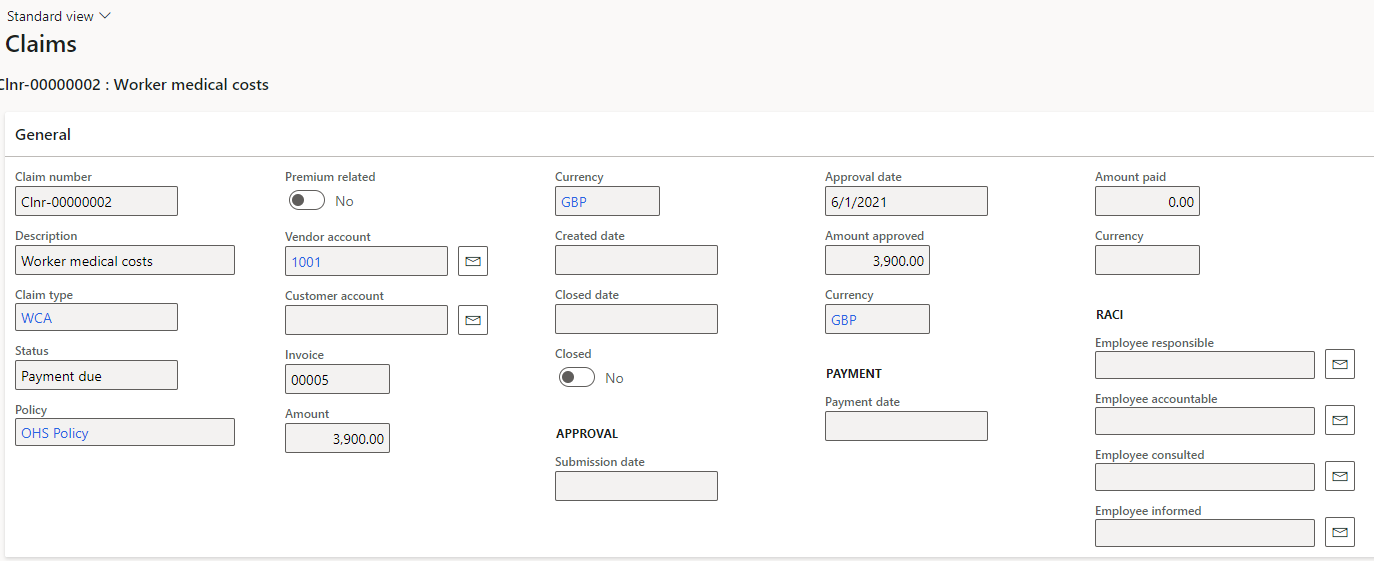

¶ Step 8: Claims

An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event. The insurance company validates the claim and once approved, issues payment to the insured or an approved interested party on behalf of the insured.

- Go to Treasury > Insurance > Claims

- Expand the General FastTab

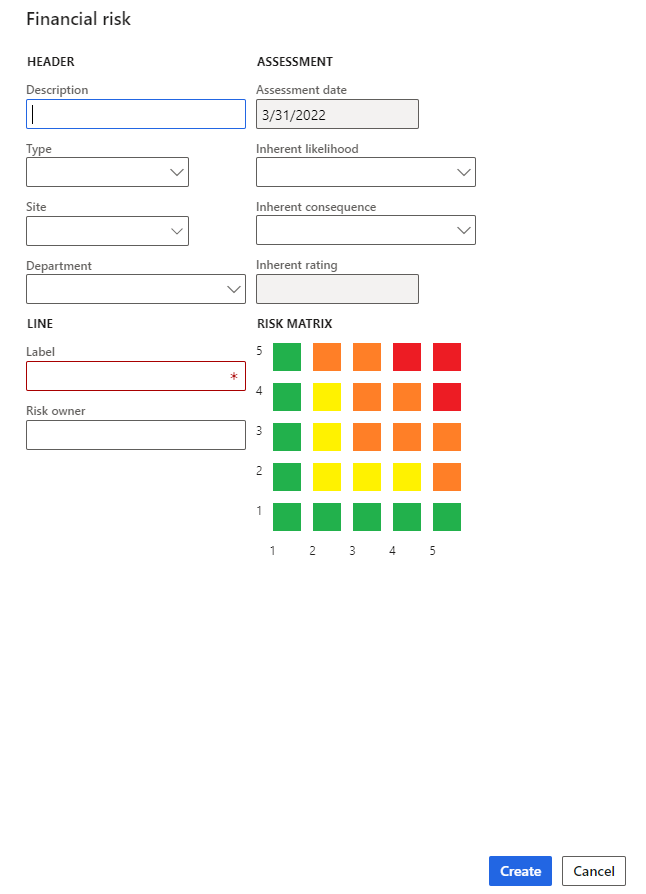

¶ Step 9: Insurance risk registers

A risk register records risks identified at the beginning and during the life of your corporate strategy

- Go to Treasury > Insurance > Insurance risk registers

- In the Button strip, select New and choose one of the following:

- Financial

- Enterprise

- Operational risk

¶ Reports and Inquiries

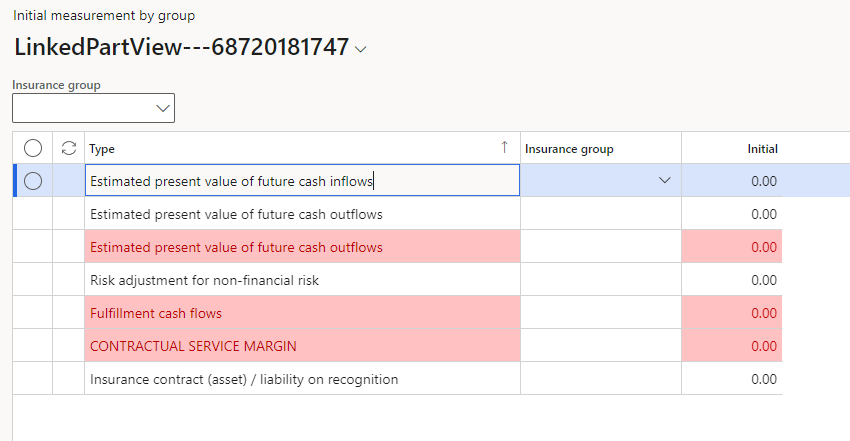

¶ Step 10: View Initial measurement by group

- Go to: Treasury > Insurance > Inquiries and reports > Initial measurement by group

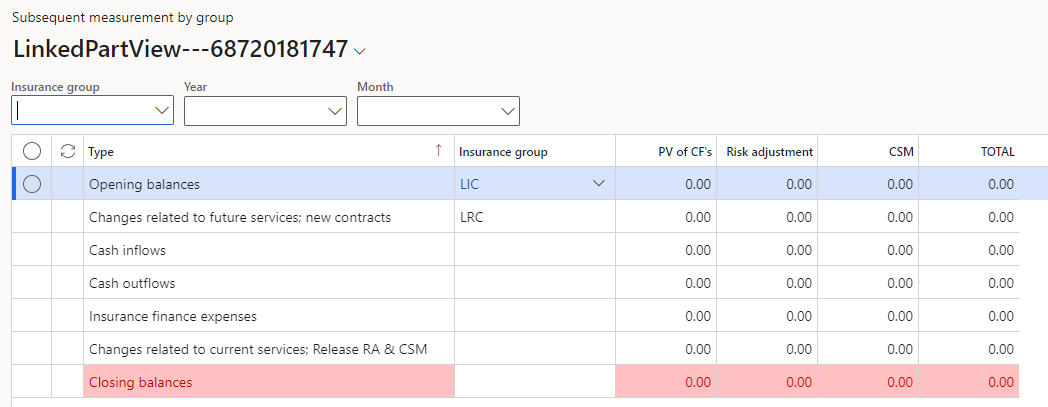

¶ Step 11: View Subsequent measurement by group

- Go to: Treasury > Insurance > Inquiries and reports > Subsequent measurement by group

¶ Step 12: View Contractual service margin release

- Go to: Treasury > Insurance > Inquiries and reports > Contractual service margin release