¶ Introduction

This module focuses on efficiently managing cash, claims, interest, and funds. Hedging, which involves transferring risk, is used to protect investments, often through derivative contracts or agreements between two parties.

Both hedging and extension derivatives are subject to regulation and government oversight, but neither provides guaranteed protection against losses or financial risks.

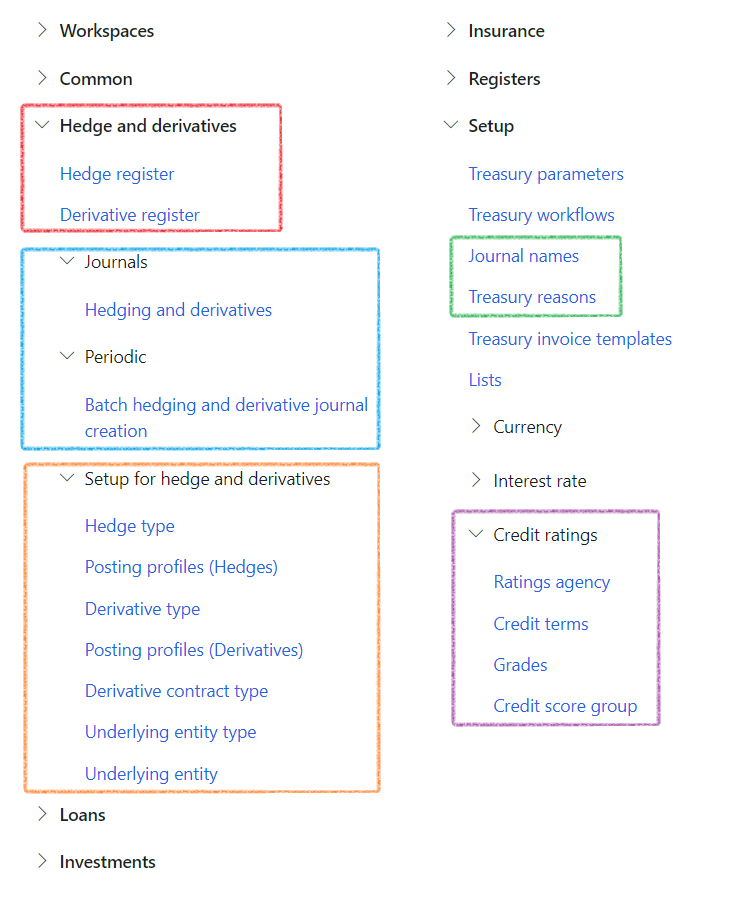

¶ Navigation

Inside Microsoft Dynamics 365, Axnosis created a storage area for Hedging. From the main menu, browse to Treasury, Hedge and derivatives.

¶ Specific setups

¶ Step 1: Setup Hedge type

To create hedge type, go to:

- Treasury > Hedge and derivatives > Setup for hedge and derivatives > Hedge type

- Click on New: New Hedge type

¶ Step 2: Setup Posting profiles - Hedges

To create Derivative posting profiles, go to:

- Treasury > Hedge and Derivatives > Setup for hedge and derivatives > Posting profiles - Hedges

- There are profiles for:

- Initial recognition

- Subsequent measurement

- Settled

- Derecognition

- Click on New to add a posting profile line for each ledger account, in the posting profile header of the page

- Account type, Ledger account, Offset account type and Ledger accounts can be filled in on the Account structure

¶ Step 3: Setup underlying entity type

To create Underlying entity type, go to:

- Treasury > Hedge and derivatives > Setup for hedge and derivatives > Underlying entity type

- Click on New: Create new

¶ Step 4: Setup underlying entity

To create Underlying entity, go to:

- Treasury > Hedge and derivatives > Setup for hedge and derivatives > Underlying entity

- Click on New: Create new Underlying entity

¶ Step 5: Financial Risk register (G2T)

For more information on the setup of the Financial risk register, open the GRC001 Test script Operational Risk management.docx document, which forms part of the Governance, Risk and Compliance module.

The GRC001 Test script Operational Risk management.docx document contain the following setup:

- Risk types

- Economic

- Health

- Strategic

- Safety, etc.

- Risk configuration

- Risk categories

- Risk Likelihood

- Inherent risk

- Residual risk

- Mitigation effectiveness

- Inherent consequence

- Residual consequence

¶ Daily use

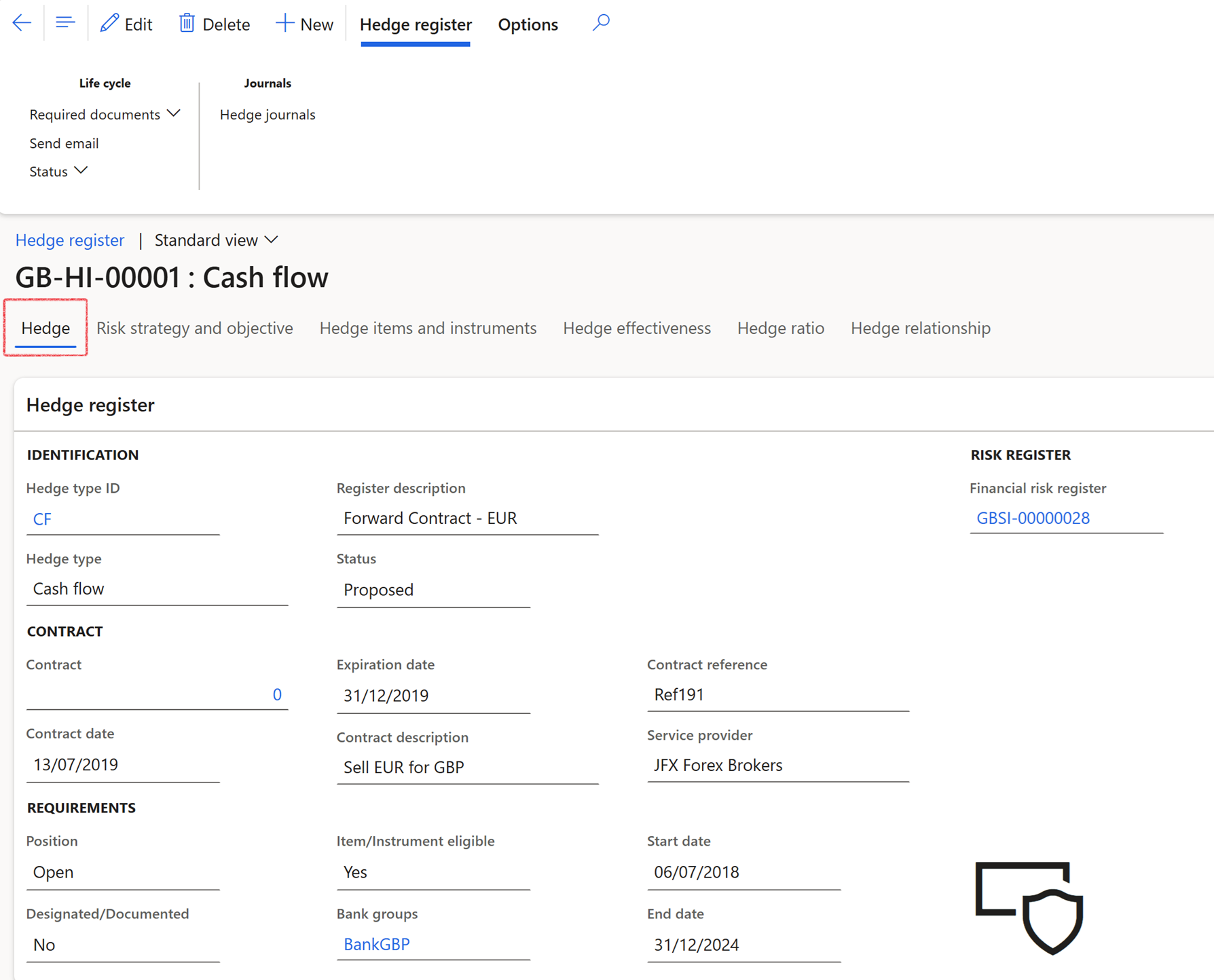

¶ Step 6: Hedge register

To add records to the Hedge register or create a new one, go to:

- Treasury > Hedge and derivatives > Hedge register

- A list page for the Hedge register will display

The following columns display on the list page:

- Hedge ID: system generated number for Hedge Identification number

- Company

- Register description

- Hedge type: can be selected from options from the dropdown menu

- Status: Created, Proposed, Approved, Rejected or Cancelled

- Position Open or Closed

- Bank groups: can be selected from options from the dropdown menu

- Designated/Documented: yes or no

- Start Date

- End date

- Item/Instrument eligible: yes or no

- Effectiveness: choose between yes or no

- Effectiveness measure

- Ineffectiveness measure

- Service provider

- Contract description

- Contract reference

- Expiration date

- Contract date

¶ Step 7: Create Hedge register

When clicking on New to create a new line, a Create hedge register dialogue page will open

Index tabs for the Hedge register

- Hedge

- Risk strategy and objective

- Hedge items and instruments

- Hedge effectiveness

- Hedge ratio

- Hedge relationship

¶ Step 8: Hedge index tab

To add records to the Hedge register or create a new one, go to:

- On the Hedge index tab, expand the Hedge register FastTab and complete the relevant fields:

- Identification

- Hedge type ID

- Hedge type will display automatically

- Requirements

- Position

- Designated/Documented yes / no option

- Register description

- Status

- Item/Instrument eligible yes / no option

- Bank groups

- Contract

- Contract

- Contract date

- Expiration date

- Start date

- End date

- Contract description

- Contract reference

- Service provider

In order to lookup contracts, the contracts should be

- Non baseline

- Status of open

- Non-archived

¶ Step 9: Risk strategy and objective

The Risk strategy and objective index tab contain three FastTabs:

- Hedge header

- Financial risk register

- Hedge risk management strategies and objectives

¶ Step 9.1: Financial risk register FastTab

- On the Financial risk register FastTab, Yes or No options are available for the following:

- Changes in overall fair value

- Interest rate risk

- Forex risk

- Credit risk

- Other

- A risk line can be selected from a drop-down menu (part of G2T)

¶ Step 9.2: Hedge risk management strategies and objectives FastTab

- On the Hedge risk management strategies and objectives FastTab, Lines can be added for each Risk strategy

- Click on Add line

- Select a Strategy from the list

- Enter a Date

- Type a Purpose

- Click on Save

- The Objectives button will become available

- Click on Objectives

- New Objectives can be added for each Risk strategy line

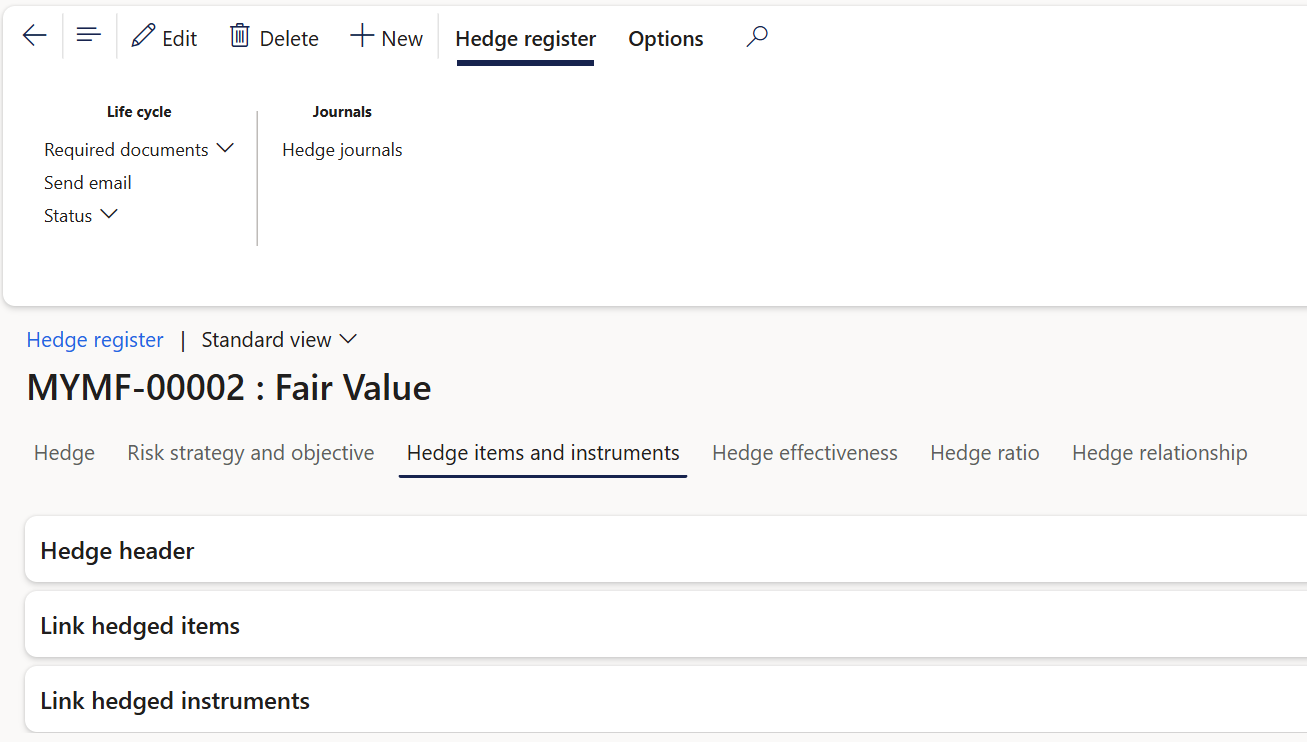

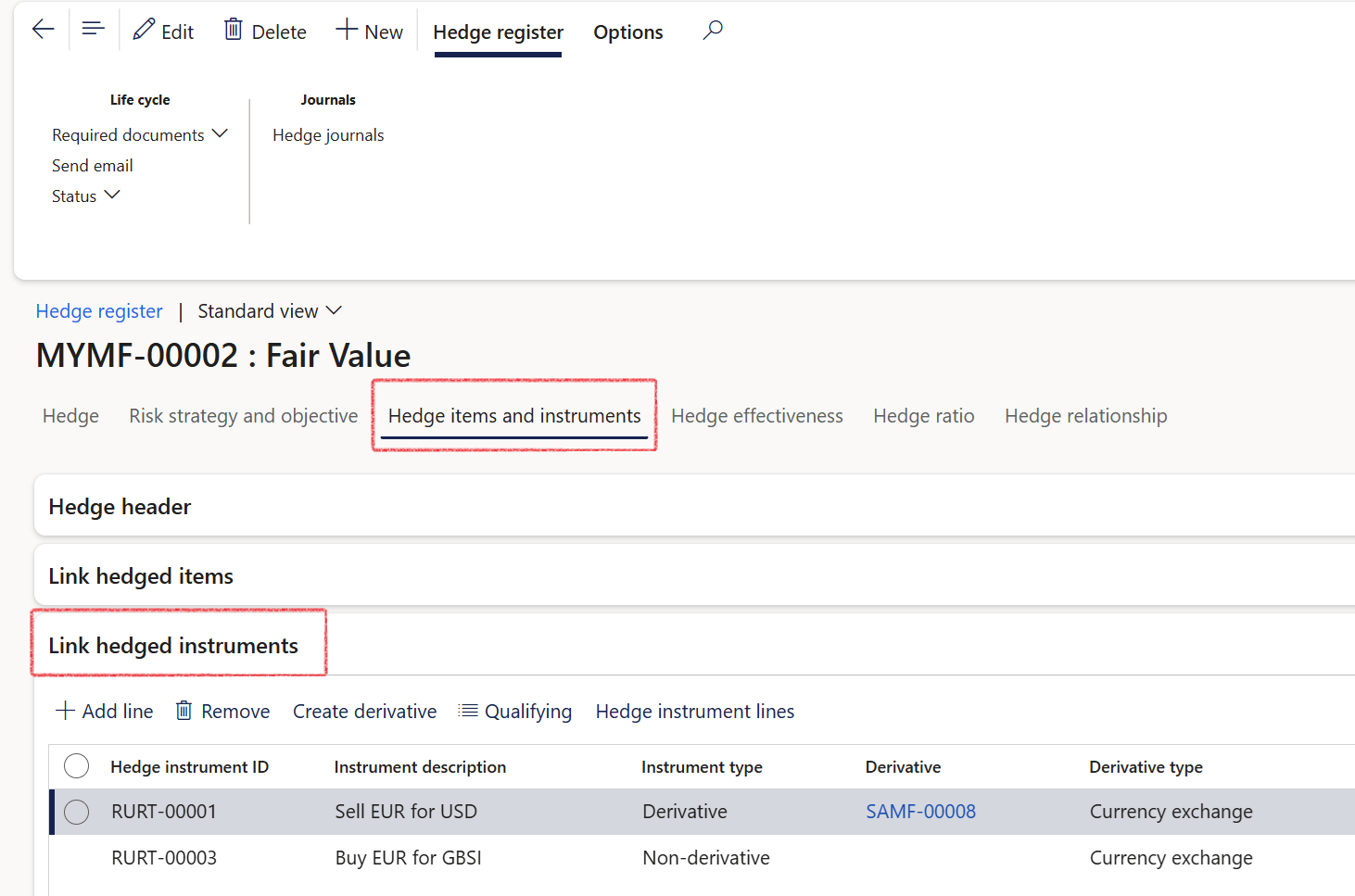

¶ Step 10: Hedge items and instruments

- Hedge items and instruments index tab consist of the following FastTabs:

- Hedge header

- Linked hedged items

- Linked hedged instruments

¶ Step 10.1: Link hedged items FastTab

- Expand the Link hedged items FastTab

- Click on Add line to add a new line

- Click on Remove to remove a line

- Enter a Description

- Select a Parent type

- Select an ID from the menu

- Type a Transaction description

- The following Hedge items (Parent types) can be selected:

- Fixed assets

- Items

- Sales orders

- Purchase orders

- Commodities

- Loans

- Non-cash investments

- Cash investments

- Qualifying button will open a questionnaire with the following questions:

- Is this item reliably measurable yes / no

- If Yes was selected above, then the following three fields will become available.

- Select an item type

- Select Item qualifying type

- Select Item relation type

- Commodity yes / no

- If yes, select a Commodity from the drop-down menu

- Enter a Currency

- Is this transaction with an internal party yes / no

- If Yes was selected for transaction with an internal party, the following three fields will become available

- Consolidated statements of an investment entity? yes / no

- Foreign currency risk of an intragroup monetary item where not fully eliminated? yes / no

- Foreign currency risk of a highly probable forecast intragroup transaction? yes / no

- Click on Update

- Hedge item lines button will open a new page where lines can be added

¶ Step 10.2: Link hedged instruments FastTab

- Expand the Link hedged instruments FastTab

- Click on Add line to add a new line

- Click on Remove to remove a line

- Qualifying button will open a questionnaire with the following questions:

- Is the instrument contract with an external party Yes / No

- Are there any exceptions which could disqualify this transaction as a hedging instrument? Yes / No

- Reason

- Do you wish to jointly designate more than one qualifying hedging instrument? Yes / No

- If yes: Are the instruments offsetting derivative contracts? Yes / No

- Is only a component of the instrument designated? Yes / No

- Is the instrument the change in the value of an option (as opposed to change in time value)? Yes / No

- Is the instrument the change in the value of the spot element of a forward contract (as opposed to the forward element)? Yes / No

- Can the foreign currency basis spread be excluded with the remainder separately designated? Yes / No

- Can a part of the entire hedging instrument be designated (where the change in future value does not result from only a portion of the period during which it remains outstanding)? Yes / No

- Click the Update button

- When opening the Hedge item and instruments tab, the Hedge item lines button for Items and Instruments will only be available when a user is on a record where parent type value is one of the following:

- Non-Cash Investments,

- Sales Orders and

- Purchase Orders

- For any other parent record, the button will be greyed out

¶ Step 10.3: Create a derivative from Link hedged instruments FastTab

- Navigate to Treasury > Hedge and derivatives > Hedge register

- Click on any Hedge ID

- On the Hedge items and instruments tab

- Expand the Link hedged instruments FastTab

- Click on the Create derivative button

- The Register Derivative Contract dialogue will open, allowing you to fill in all the necessary fields to create a new derivative record.

The following sections can be completed:

- Identification

- Contract

- Contract inception

- Currency conversion spot rate

- Posting profiles

- Financial dimensions

¶ Step 11: Hedge effectiveness

- Navigate to Treasury > Hedge and derivatives > Hedge register

- Click on a Hedge ID record

- Click on a Hedge effectiveness

The Hedge effectiveness tab consist of the following FastTabs:

- Hedge register

- Economic relationship

- Effect of credit risk

¶ Step 11.1: Economic relationship FastTab

- On Hedge effectiveness index tab, expand the Economic relationship FastTab

- Click on Add line to add a new line

- Click on Remove to remove a line

- The Details button will open more information on the Economic relationship.

- Details with yes / no answers

- Are the hedged item and hedging instrument values moving in the opposite direction? Yes / No

- Is the expectation that the fair values will offset in response to movement in the same underlying? Yes / No

- Is the expectation that the fair values will offset in response to movement in underlying’s that are economically related? Yes / No

Analysis of behavior

- Indicate economic rationale

- Method used for analysis

- Select type of assessment from a dropdown menu. Choose between Qualitative and Quantitative

- Enter Values obtained

- Extent of critical terms matching: select from a drop-down menu

- Conclusion

- Can it be demonstrated that an economic relationship exists between the hedged item and the hedging instrument? Yes / No

- Motivate your answer

- Click on Update

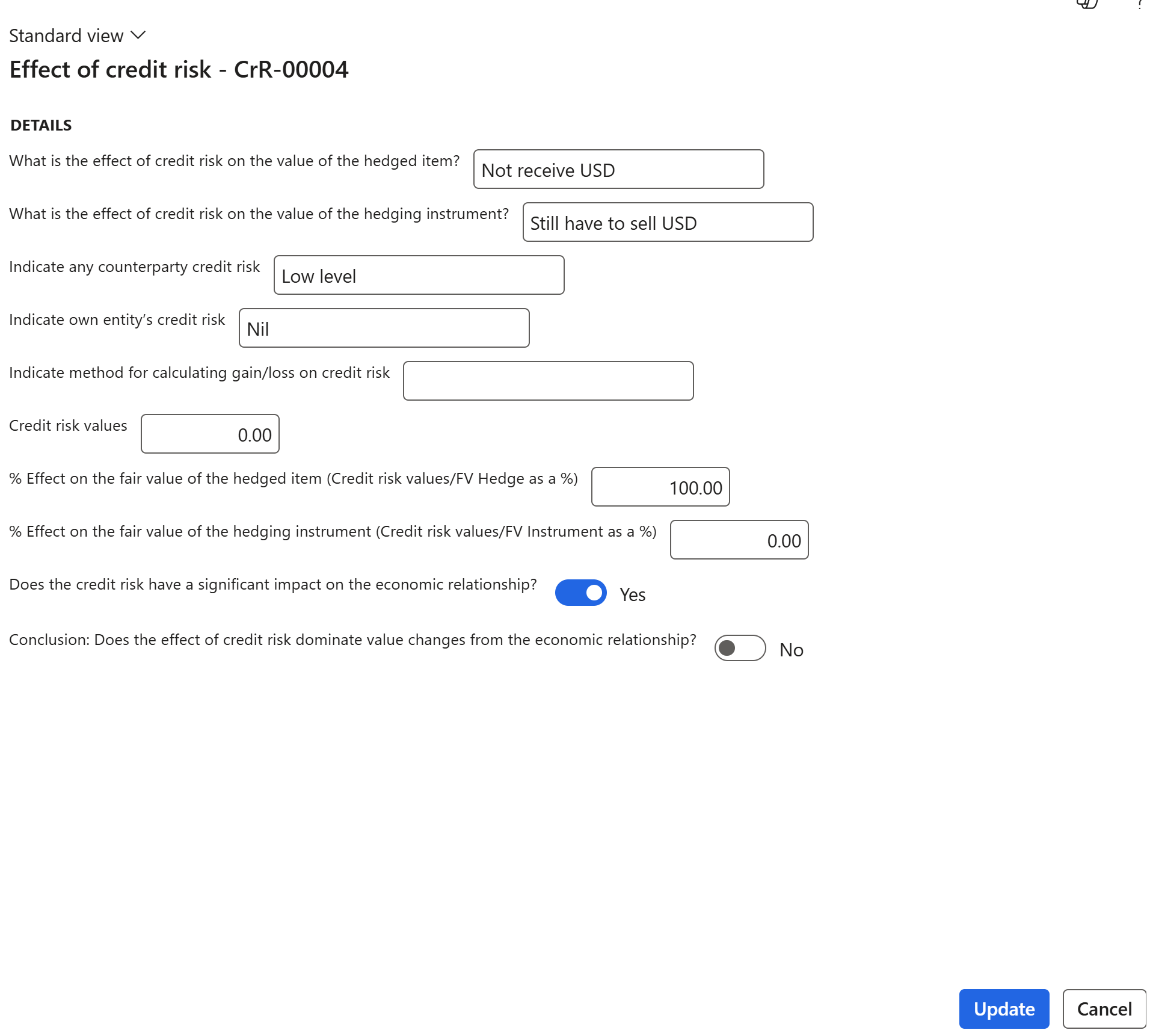

¶ Step 11.2: Effect of credit risk FastTab

- On Hedge effectiveness index tab, expand the Effect of credit risk FastTab

- Click on Add line to add a new line

- Click on Remove to remove a line

- Click on Details for a questionnaire to open

¶ Step 12: Hedge ratio

- The Hedge ratio index tab consist of the following FastTabs:

- Hedge header FastTab

- Hedge ratio tab tab

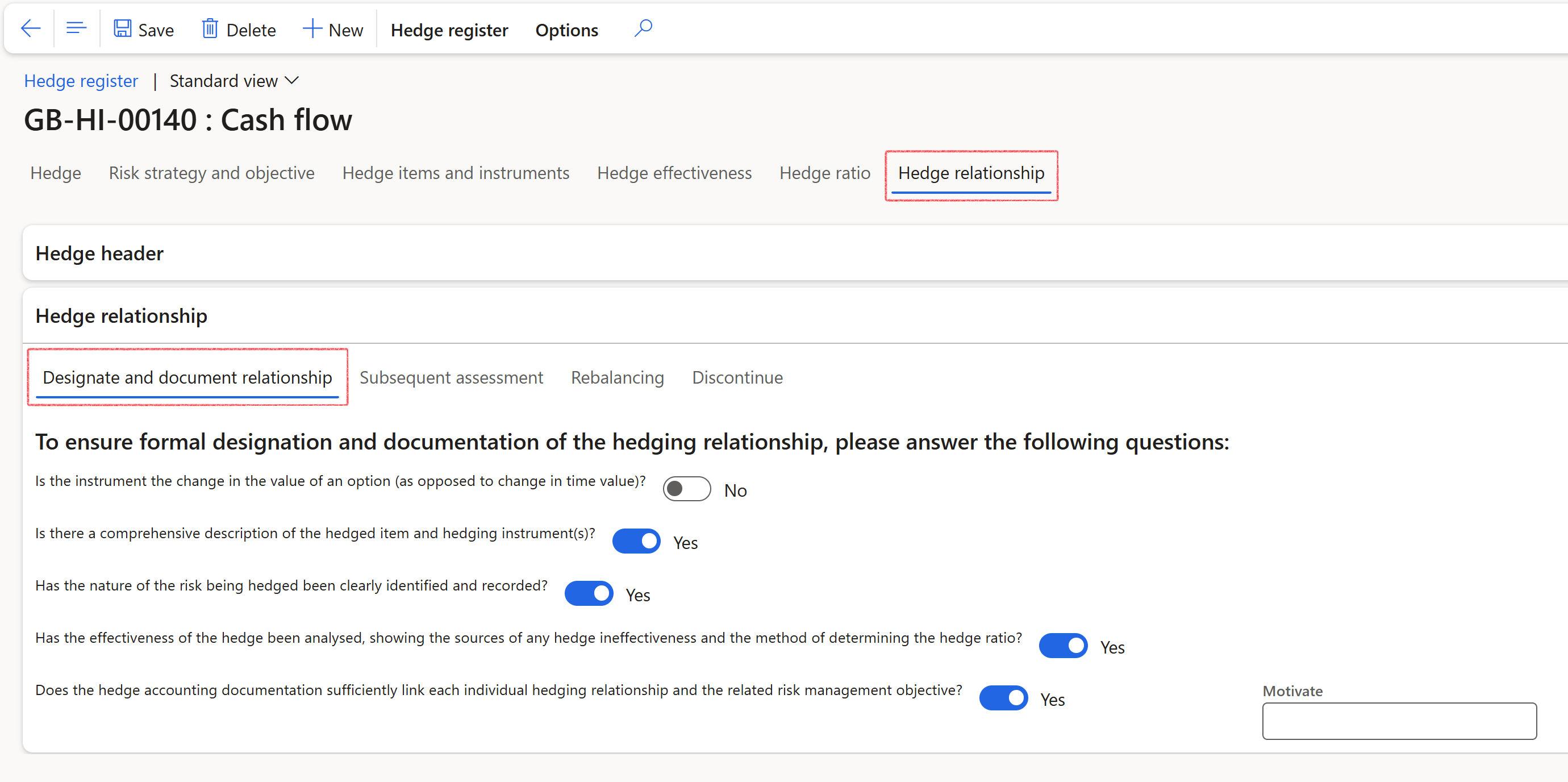

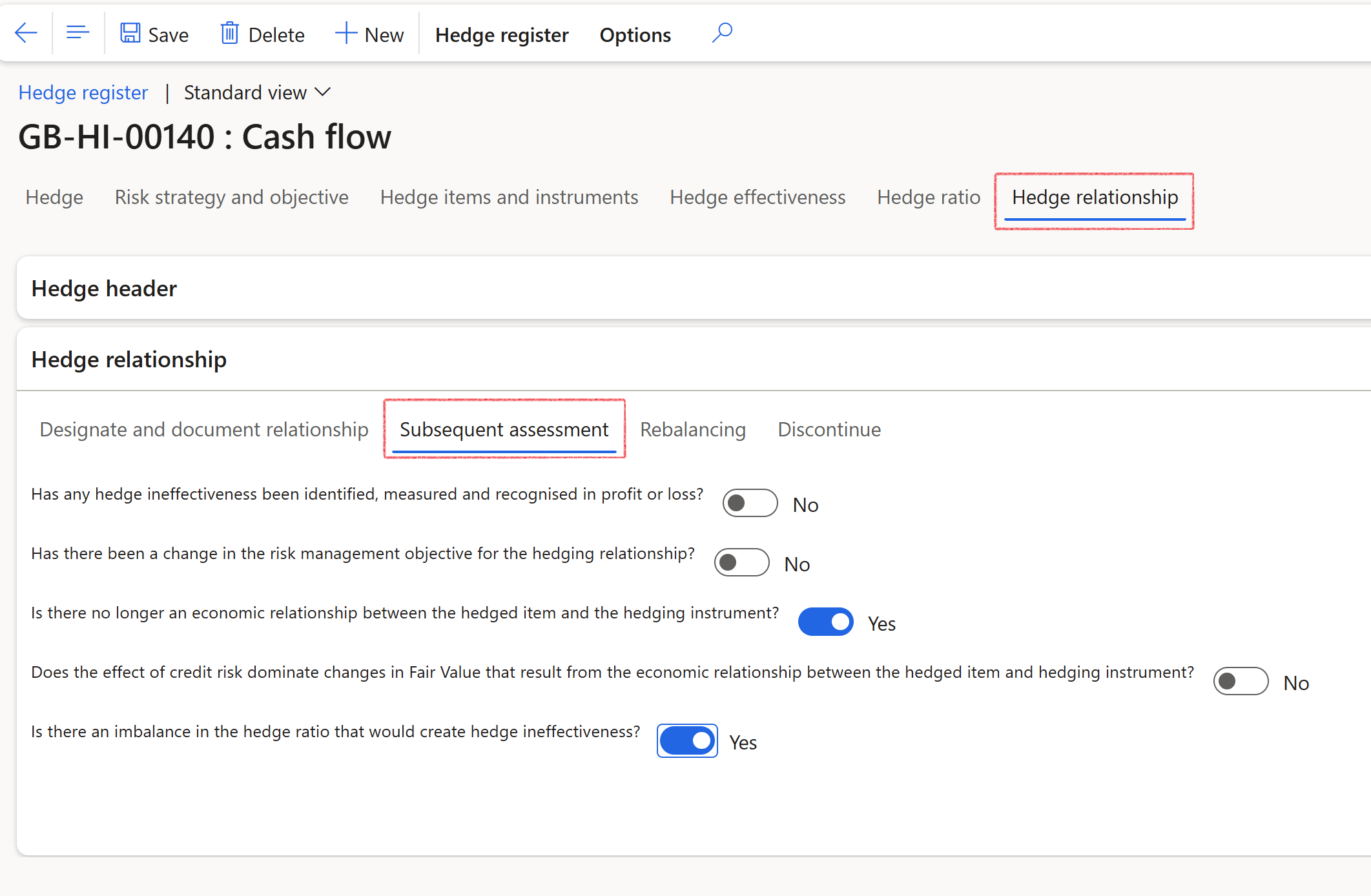

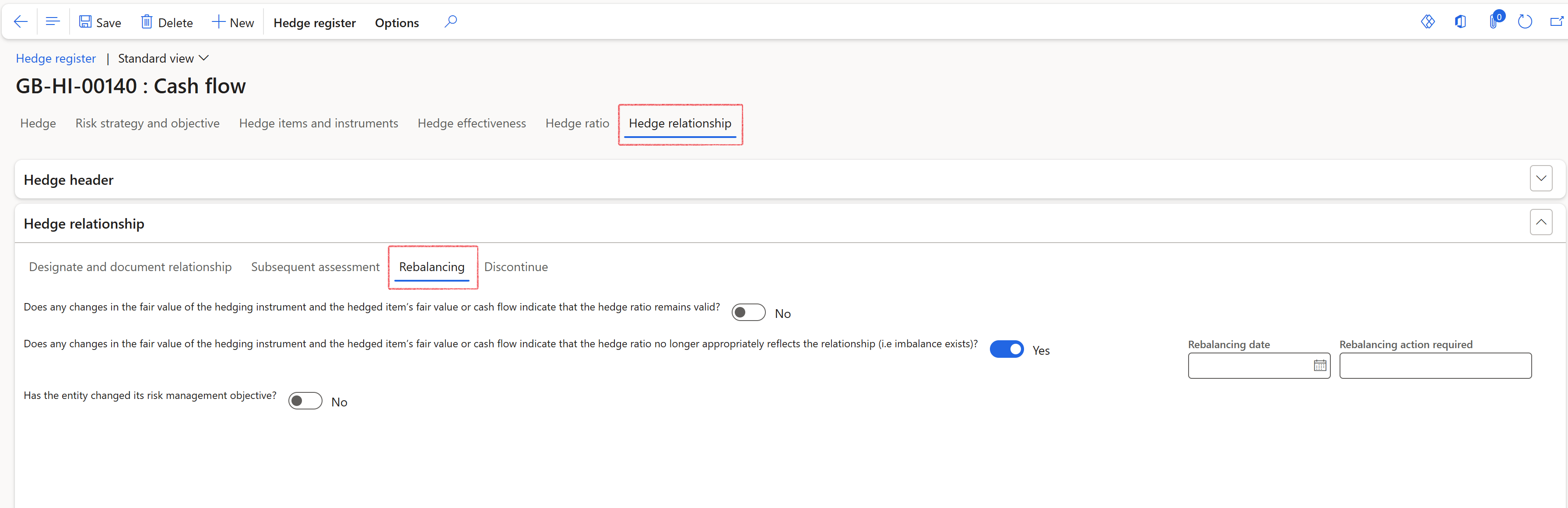

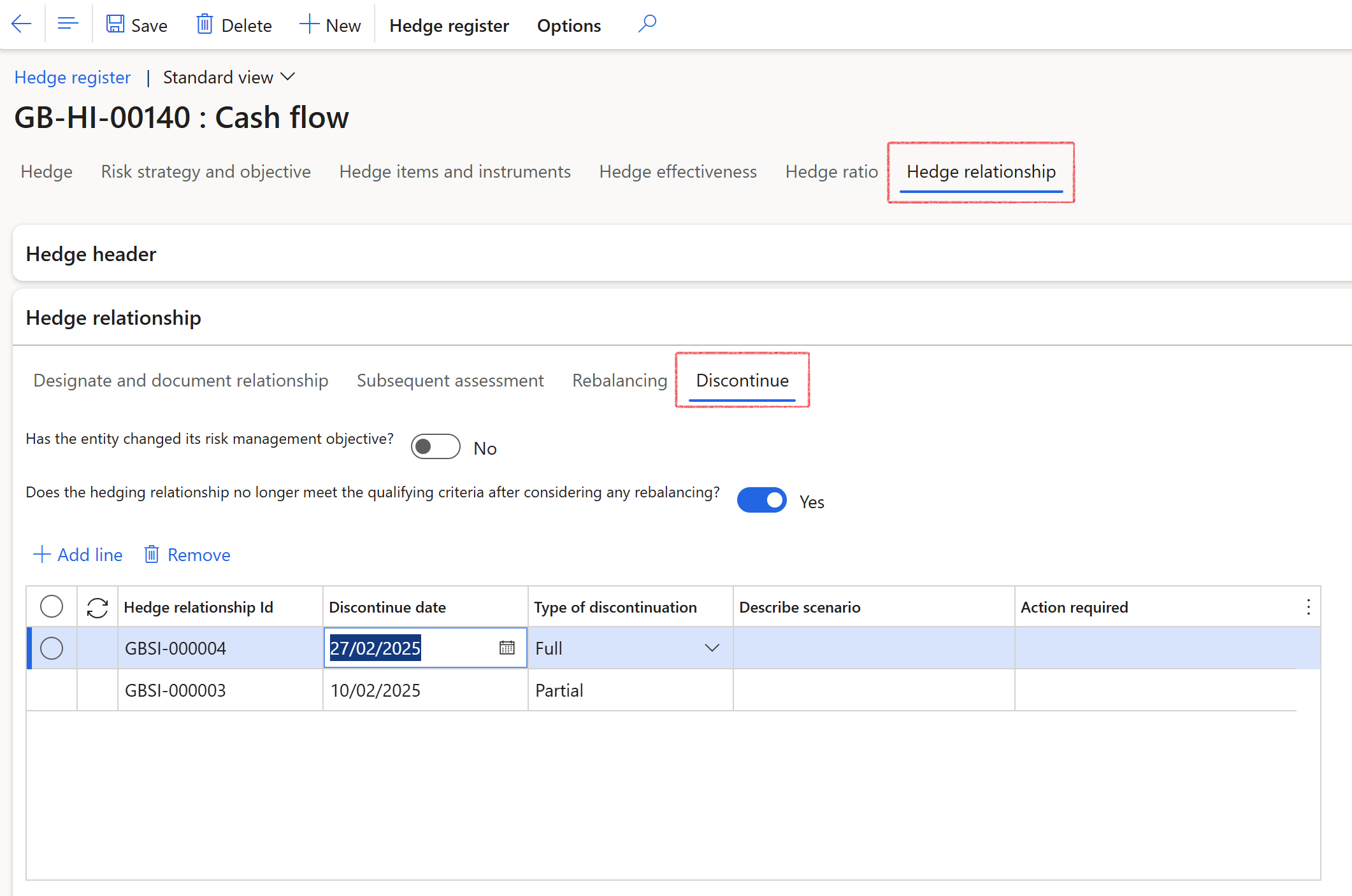

¶ Step 13: Hedge relationship

- The Hedge relationship index tab consist of the following FastTabs:

- Hedge header FastTab

- Hedge relationship FastTab

- Hedge relationship

- Designate and document relationship

- Subsequent assessment

- Rebalancing

- Discontinue