¶ Introduction

The Guarantees and Surety Register records formal assurances provided by one party to assume responsibility for another party’s obligations in the event of default. In finance, a surety or guarantor agrees to cover a borrower’s debt if the borrower fails to meet their obligations. Sureties are typically required when the primary party’s ability to perform is uncertain or when protection is needed for public or private interests.

A guarantee is a formal, usually written, commitment that specific conditions will be fulfilled, such as ensuring a product’s quality or assuming responsibility for another party’s obligation in case of default. Maintaining this register ensures that all guarantees and surety arrangements are documented, monitored, and easily accessible for legal and financial oversight.

¶ Navigation

¶ Specific Setup

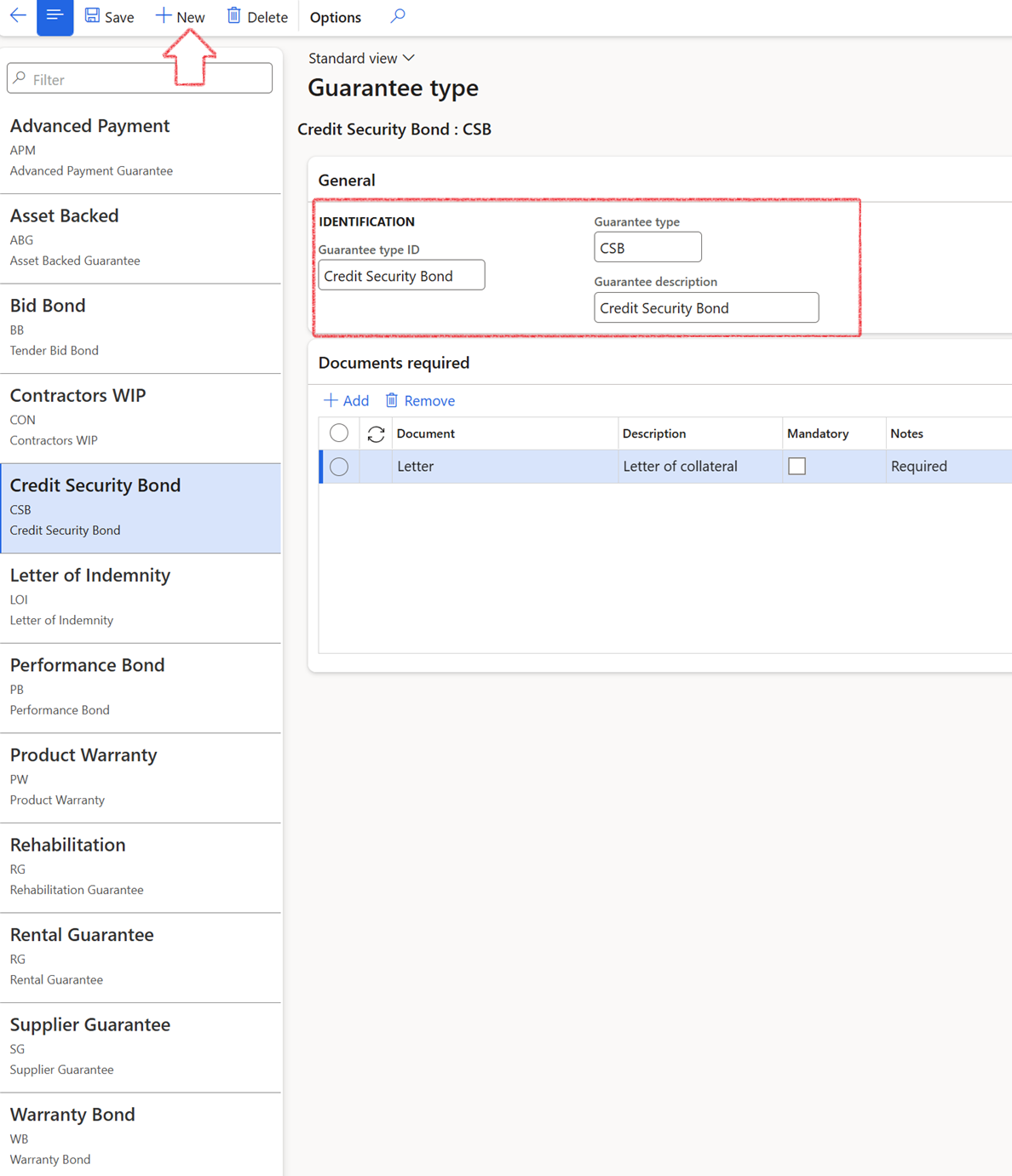

¶ Step 1: Set up Guarantee type

- Go to: Treasury > Registers > Setup for registers > Guarantee type

- Click New on top

- Create a Guarantee type ID, enter the type and description

- Expand the Documents required Fast Tab and create new documents

¶ Examples of Guarantee types:

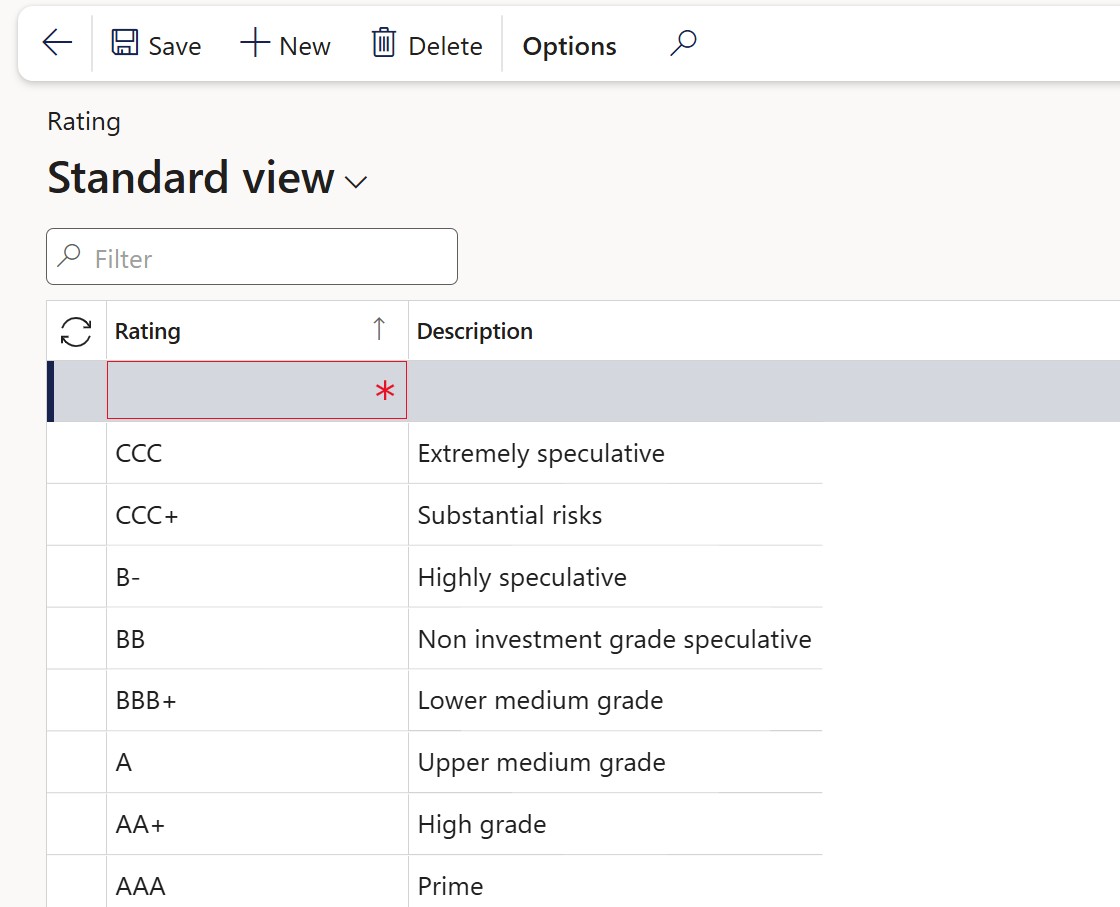

¶ Step 2: Set up Ratings

- Go to: Treasury > Registers > Setup for registers > Ratings

- Click New on top

- Enter a Rating

- Type a Description

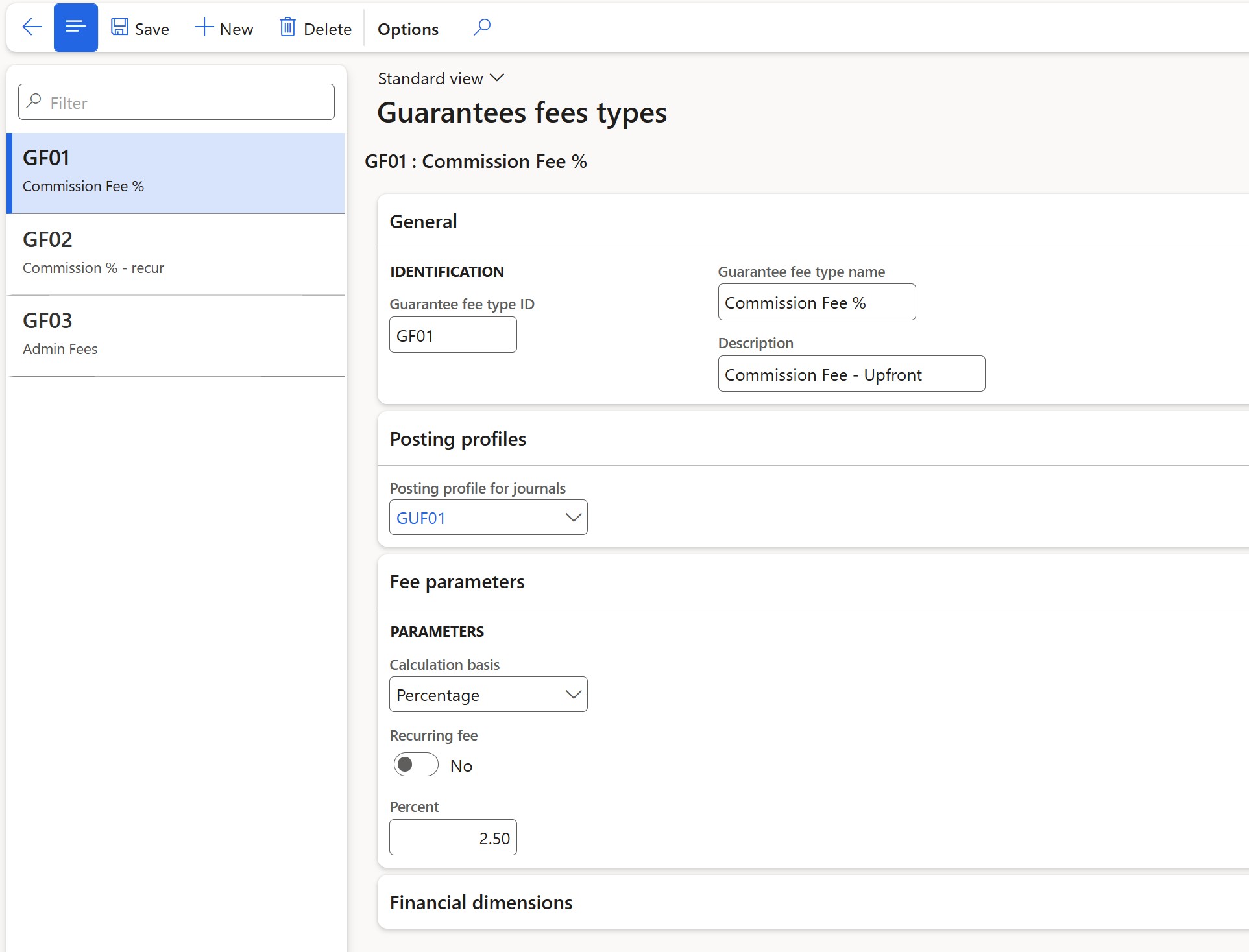

¶ Step 3: Set up Guarantees fee types

This page is organised into four FastTabs

- General

- Posting profiles

- Fee parameters

- Financial dimensions

- Go to: Treasury > Registers > Setup for registers > Guarantees fee types

- To create a new Guarantee fee type, click on the New button

- Expand the General FastTab

- Type a Guarantee fee type ID

- Enter a Guarantee fee type name

- Type a Description

- Expand the Posting profiles FastTab, and select a Posting profile for journals from the list

- Expand the Fee parameters FastTab

- Select Calculation basis from the drop-down menu. Options include Percentage or Fixed

- Indicate if it is a Recurring fee or not

- Enter a Percentage

- If required, expand the Financial dimensions FastTab and select the Default financial dimensions

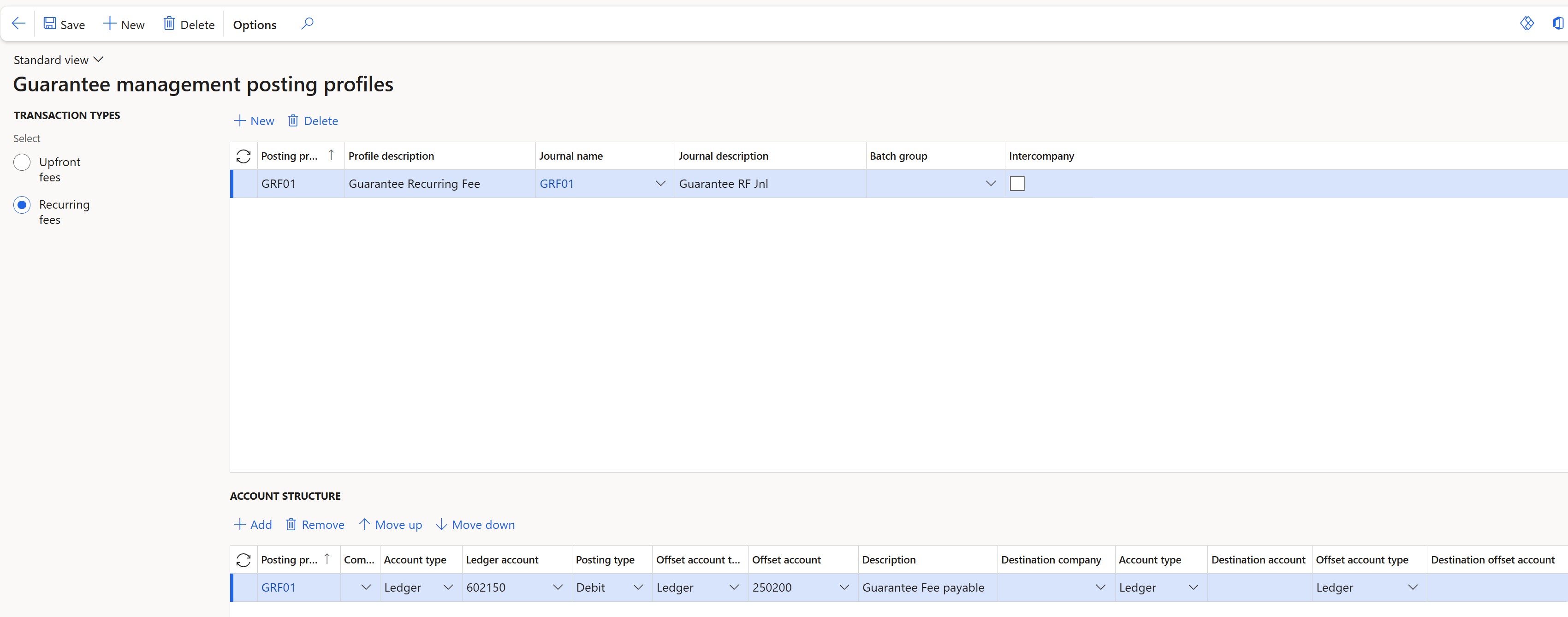

¶ Step 4: Set up Guarantee posting profiles

Setup Upfront and Recurring fees posting profiles

- Go to: Treasury > Registers > Setup for registers > Posting profiles - guarantees

- Click New on top

- Enter a Posting profile

- Type a Profile description

- Select a Journal name

- On the Account structure section:

- Click on the Add button to create a new line

- Select an Account type

- Select a Ledger account

- Select an Offset account type

- Select an Offset account

¶ Daily use

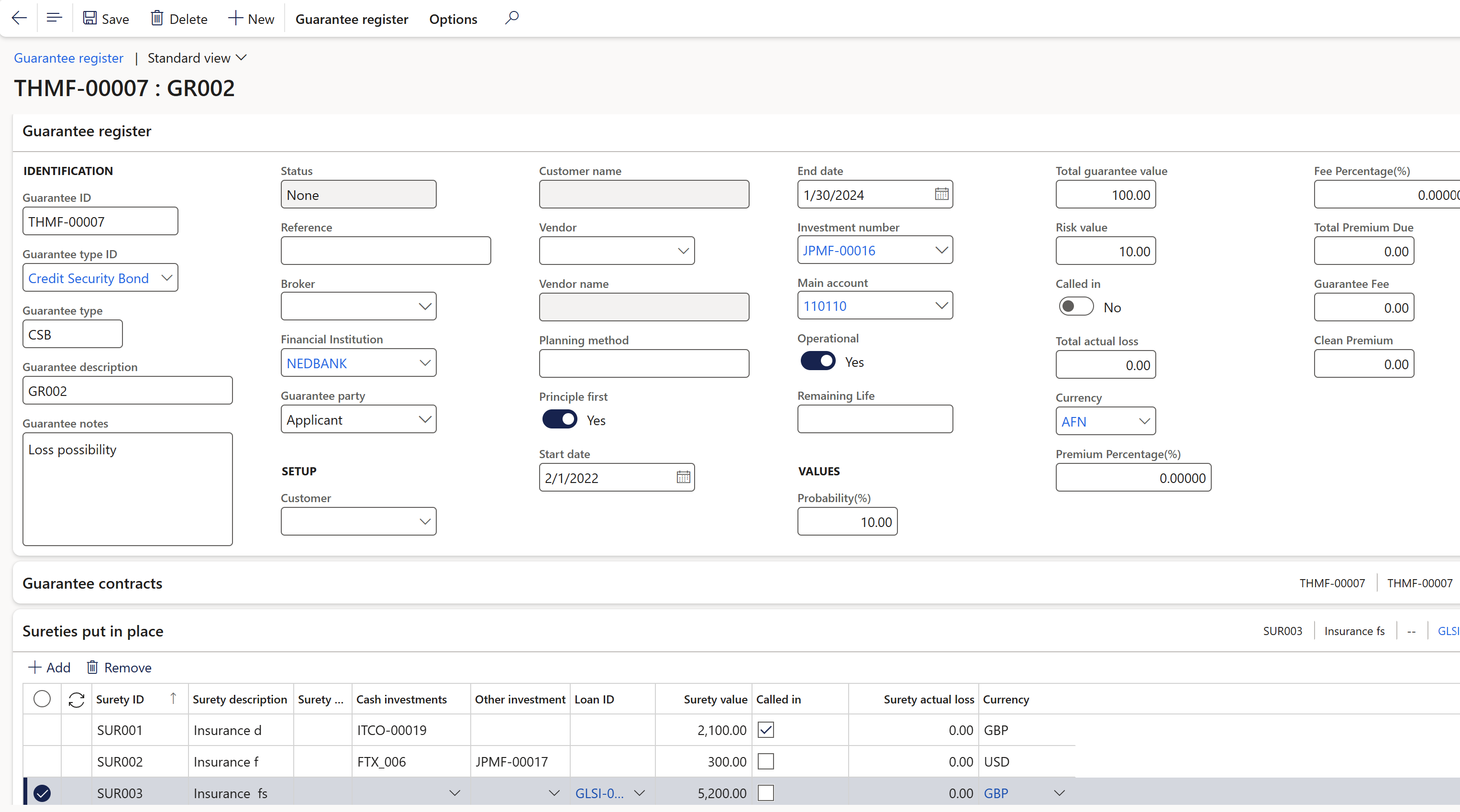

¶ Step 5: Guarantee register

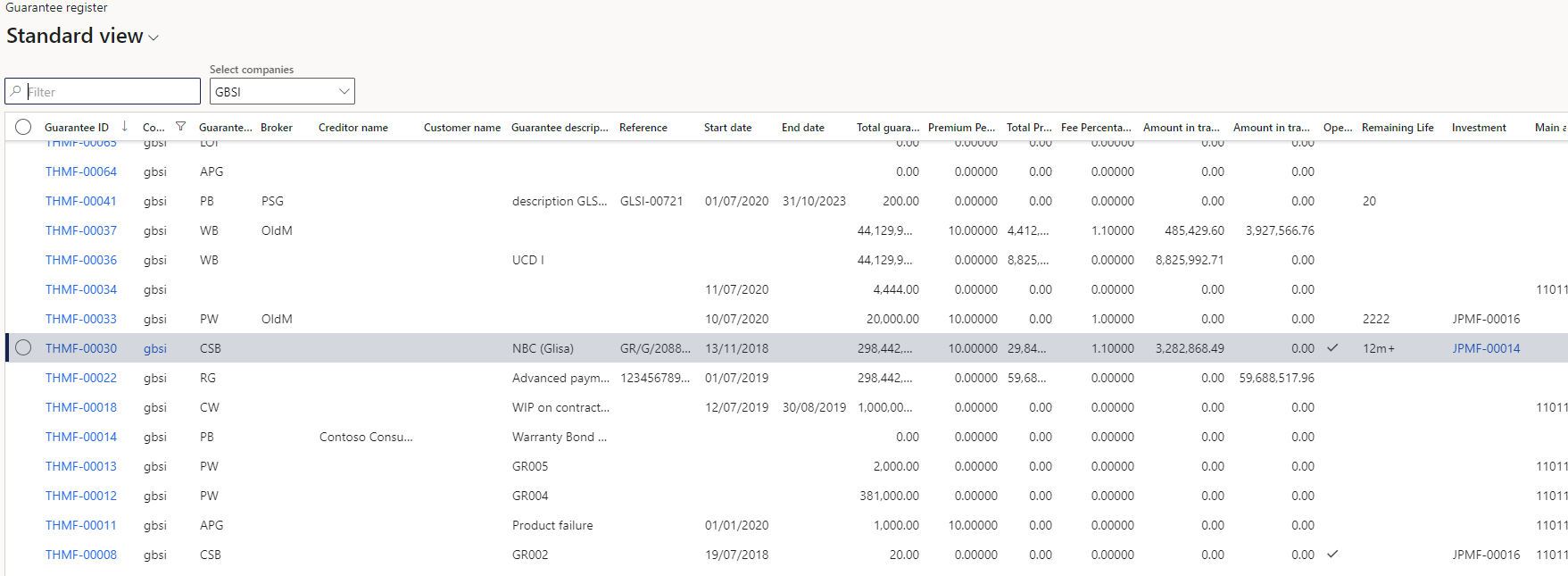

- Go to Treasury > Registers > Guarantee register

- A grid view can be seen

- Click on a Guarantee ID to open the details page

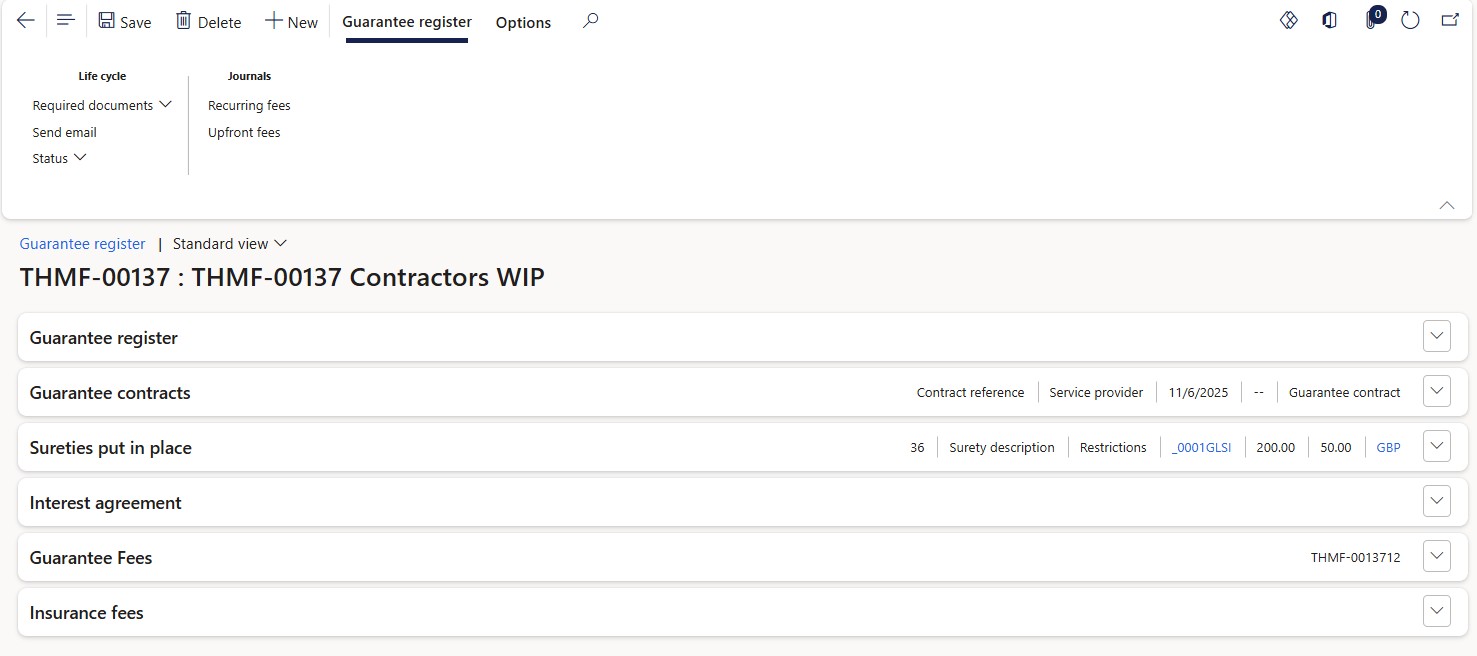

- The following FastTabs will appear:

- Guarantee register

- Guarantee contracts

- Sureties put in place

- Interest agreement

- Guarantee Fees

- Insurance fees

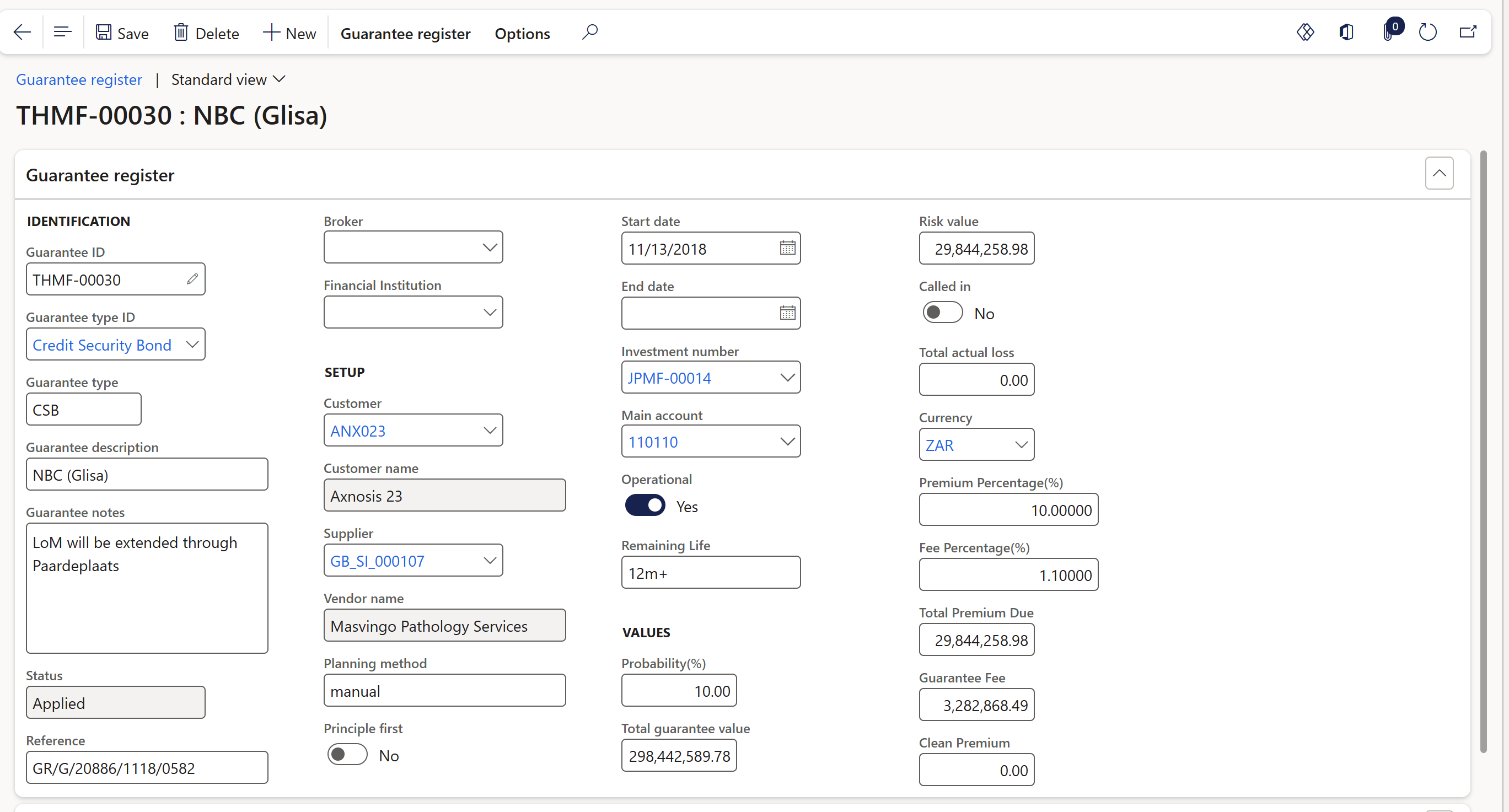

¶ Step 5.1: Guarantee register FastTab

- Identification area:

- Guarantee ID is a system generated ID that will be copied to the Surety register

- Guarantee type: choose between various types such as Rental guarantee, Performance bond, advanced payment guarantee, etc.)

- Guarantee description : short description

- Guarantee notes: free text field to add additional information

- Reference: free text field to insert a reference number

- Broker: a broker can be selected from a drop-down menu

- Setup area:

- Creditor name: automatically populated when creditor is selected

- Creditor: select vendor account number from dropdown list

- Planning method: free text field

- Principle first yes / no

- Start date: enter the start date

- End date: enter the end date

- Investment number: can link a non-cash investment to the guarantee

- Main account: functionality to select a main account and link to the guarantee

- Operational: yes/no slide option

- Remaining life: can enter a remaining life of the entity

- Customer

- Customer name

- Values area:

- Probability (%) enter percentage of likelihood

- Total guarantee value

- Risk value

- Called in yes / no

- Total actual loss

- Guarantee Contracts section, with contract referenced, service provider date, expiration date and Contract description

- Probability (%) enter percentage of likelihood

- Premium Percentage (%) this field is used to calculate the Total Premium Due

- Fee Percentage (%) type in a fee percentage: This field will be used to calculate the Guarantee Fee amount

- Total Premium due: The value of this field will originate from a calculation: Total Guarantee Value X Premium Percentage

- Guarantee fee: This will be a display field which will get its value from the Total Guarantee Value field x Fee Percentage field

- Clean Premium: This field will display the calculation of Total Premium Due Less Guarantee fee

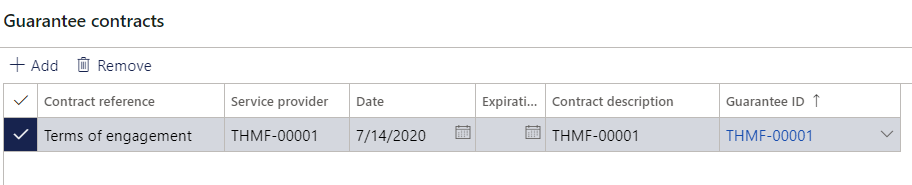

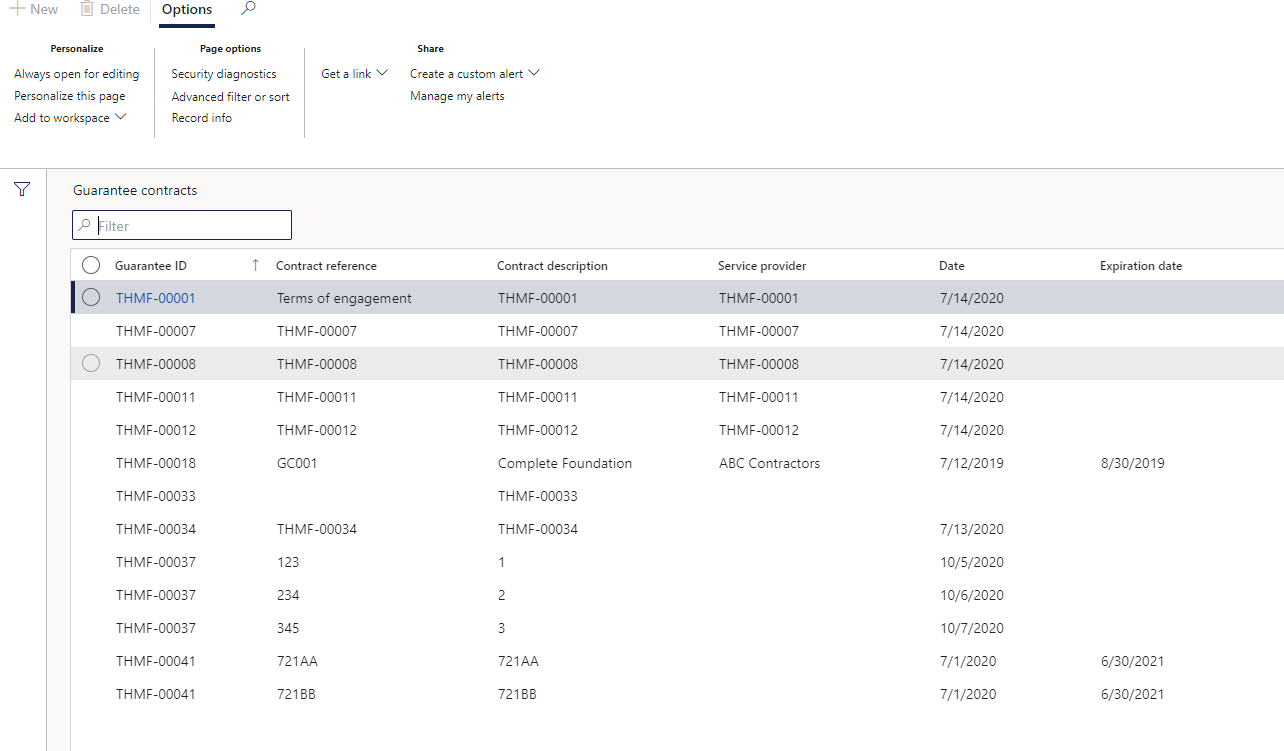

¶ Step 5.2: Guarantee contracts FastTab

- Expand the Guarantee contracts FastTab

- Click on the Add button

- Complete the following fields:

- Contract reference

- Service provider

- Date

- Expiration date

- Contract description

- Guarantee ID

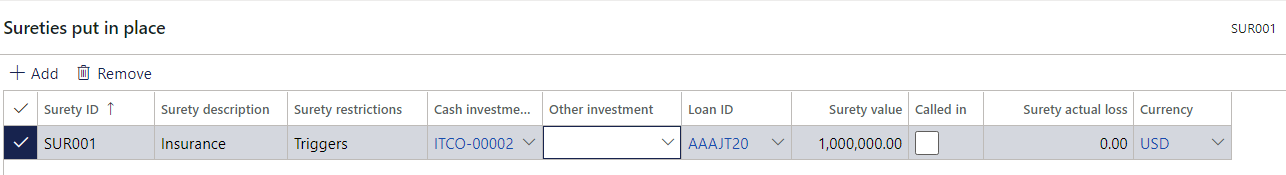

¶ Step 5.3: Sureties in place FastTab

- Expand the Sureties put in place FastTab

- Click on the Add button

- Complete the following fields:

- Surety ID

- Type a Surety description

- Enter any Surety restrictions

- Select any relevant Cash Investments

- Select any Other investment

- Select a Loan ID if it is required

- Enter a Surety value

- Indicate if the surety was Called in

- Enter the Surety actual loss

- Select a Currency

- When this section is completed, it will populate to the Guarantee Register

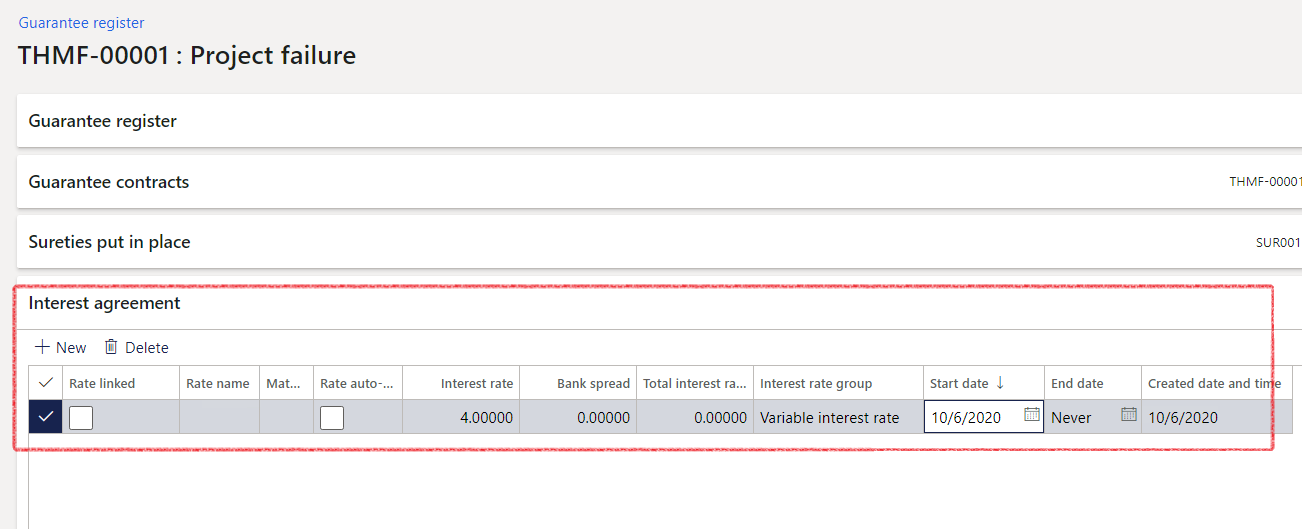

¶ Step 5.4: Interest agreement FastTab

- The user can capture an interest rate percentage on the details page. It will store a history of rates.

- Click on the New button

- Select a Rate name from the drop down menu if this interest rate is linked to a specific rate

- If a Rate name was selected, then also choose a Maturity from the dropdown menu

- Also indicate if the Rate should be Auto-updated

- If no Rate name was selected, then manualy enter an Interest rate percentage

- Enter Bank spread

- Total interest rate will be the sum of Interest rate and Bank spread

- The default Interest rate group is Variable interest rate, but Fixed interest rate can be chosen

- Enter a Start date and End date for the Interest agreement

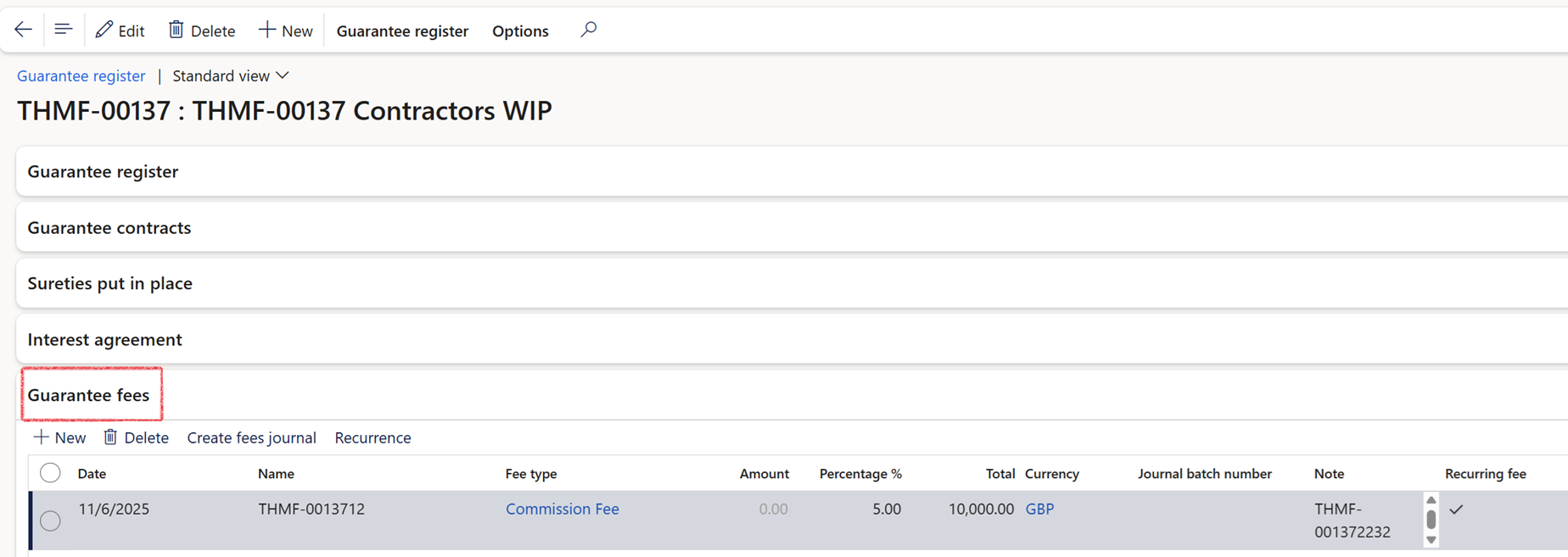

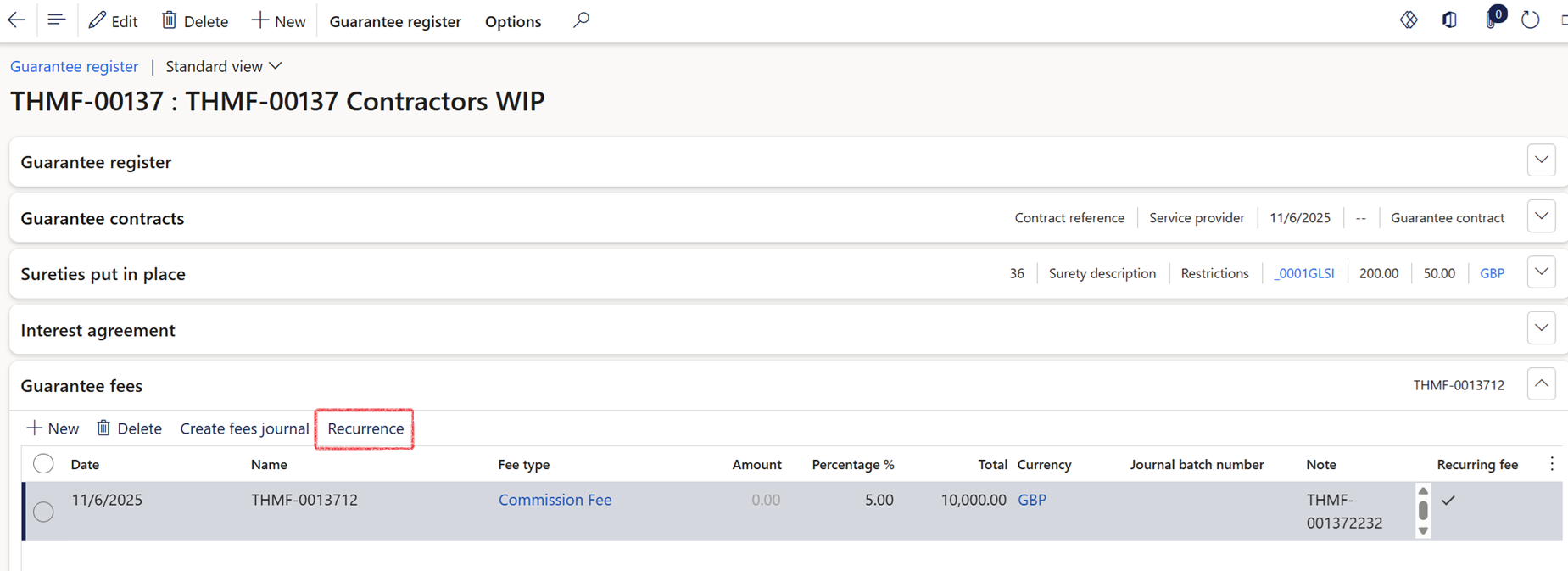

¶ Step 5.5: Guarantee fees FastTab

Transactions entered on the Guarantee Fees FastTab are posted either as Upfront fees or Recurring fees, depending on the selected Fee type.

Each Fee type is linked to a specific posting profile, either an Upfront posting profile or a Recurring fee posting profile.

Transactions from the Guarantee register are incorporated into budgeting. Expanding the Guarantee fees FastTab, will display the following buttons:

- New

- Delete

- Create fees journal

- Recurrence

- Clicking on the Recurrence button, will enable the user to setup a recurrence schedule (Start date, Amount, Currency and Frequency)

Click on the New button, and complete the following fields:

- Date

- Name

- Fee type

- Amount (Fixed fee gives the user the option to type in the value)

- Percent (Percentage auto-calculates the fee as a percentage of the Total guarantee value field)

- Total

- Currency

- Journal batch

- Note

- Recurring fee (tick box to indicate yes or no)

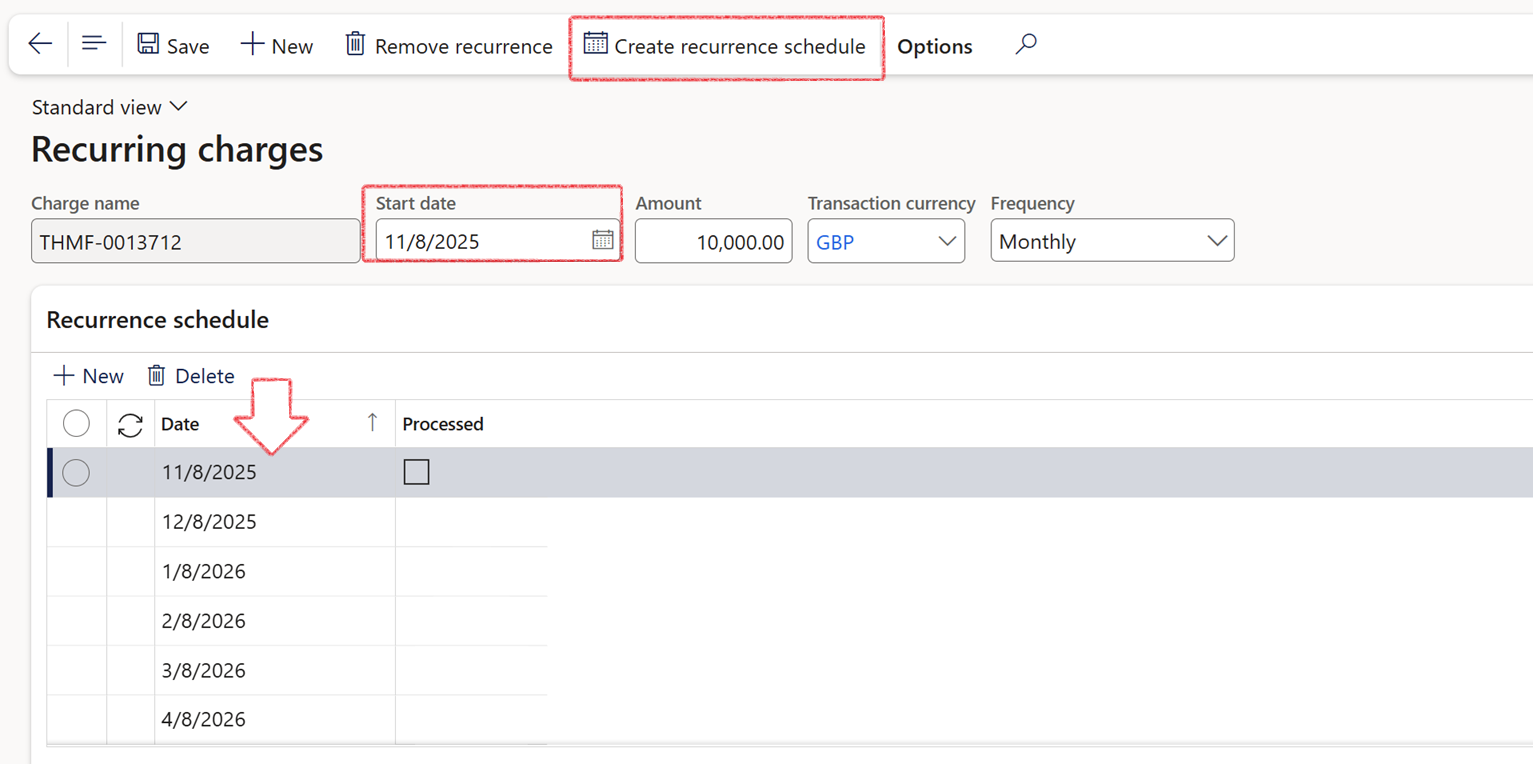

¶ Step 5.5.1: Create a Recurring schedule

Click on the Recurrence button

Charge name is a system generated number that will appear

- Enter a Start date

- Amount will be populated, but can be amended

- Transaction currency can be changed

- Frequency is Monthly or Annually

- Click on the Create recurrence schedule button

- On the Recurrence schedule FastTab, all the lines will be populated

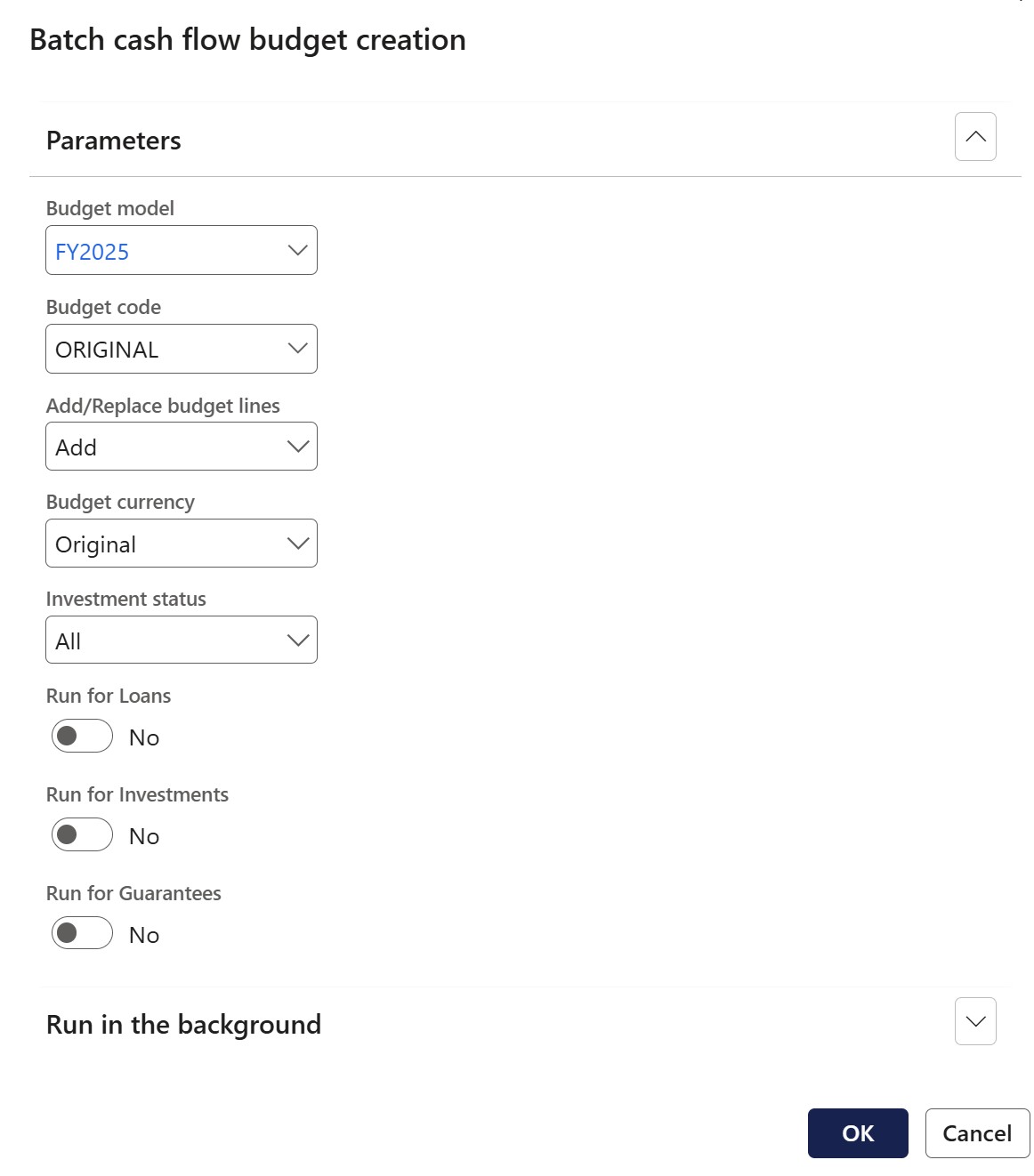

¶ Step 5.5.2: Batch cash flow budget creation

To include the Guarantee fees transactions, the Batch cash flow budget creation batch job should be run.

- Navigate to Treasury > Common > Periodic > Batch cash flow budget creation

- Complete the following parameters:

- Budget model - select from a drop-down menu

- Budget code - select from a drop-down menu

- Add/Replace budget lines - choose to add budget lines, or to replace budget lines

- Budget currency - Original, Default or Secondary

- Investment status - choose between Proposed, Approved or All

- Run for Loans - Yes/No toggle

- Run for Investments - Yes/No toggle

- Run for Guarantees - Yes/No toggle

- Click on OK

¶ Batch cash flow budget creation logic:

- Create budget register entries going forward, using today as the start date

- If a line exist in the budget, it will not create it again

- The Date and Amount will be obtained from the Guarantee fee line

- If it is a recurring fee, it will use the future recurring lines (as configured, for example monthly)

- The account is obtained from the guarantee posting profile. It will use the first account in the setup

- It will default as an expense type

- The Budget type will default to Original

- More than one Account structure can be possible. Possibilities are setup in the General Ledger setup

¶ Step 5.5.3: View budget register entries created with the batch cash flow budget creation batch job:

To view budget register entries:

- Navigate to Budgeting > Workspaces > Budget register entries

- Select the latest Entry number

- Expand the Budget account entries FastTab to display the relevant information

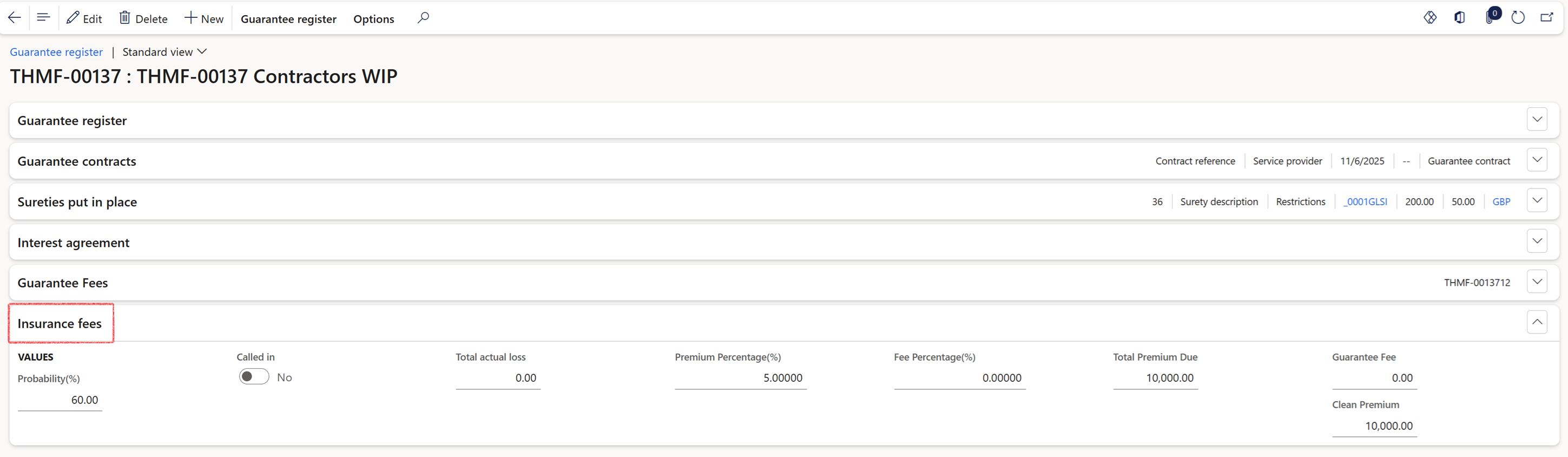

¶ Step 5.6: Insurance fees FastTab

- Probability(%)

- Called in

- Total actual loss

- Premium Percentage(%)

- Fee Percentage(%)

- Total Premium Due

- Guarantee Fee

- Clean Premium

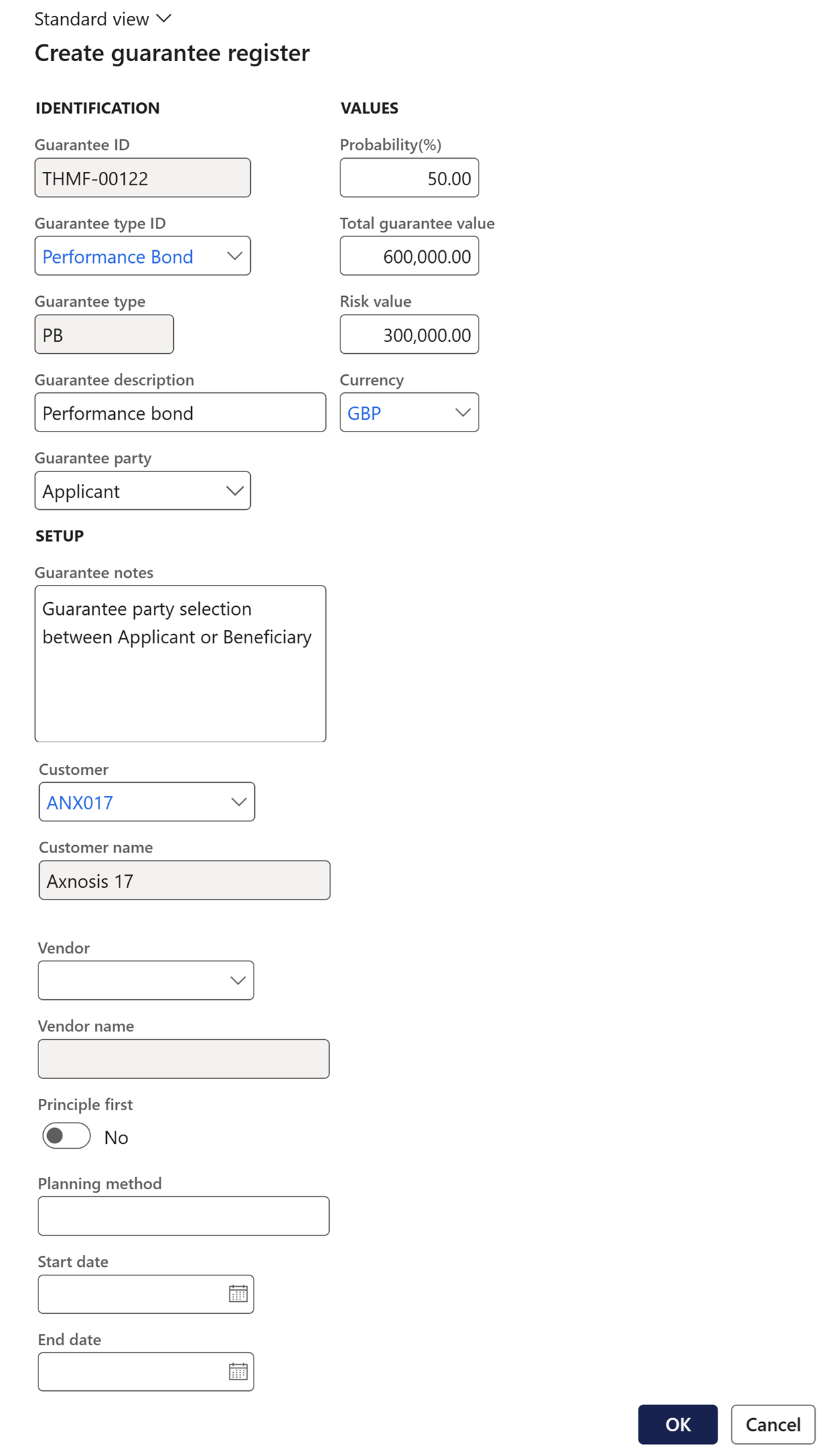

¶ Step 6: Create a new Guarantee

To create a new Guarantee register record, navigate to:

- Modules > Treasury > Registers > Guarantee register

- Select a Guarantee type ID from the dropdown menu

- Enter a Total guarantee value

- Select a Creditor and Customer

- Enter a Start date and End date

- Guarantee party: select between Applicant or Beneficiary

- Click the OK button

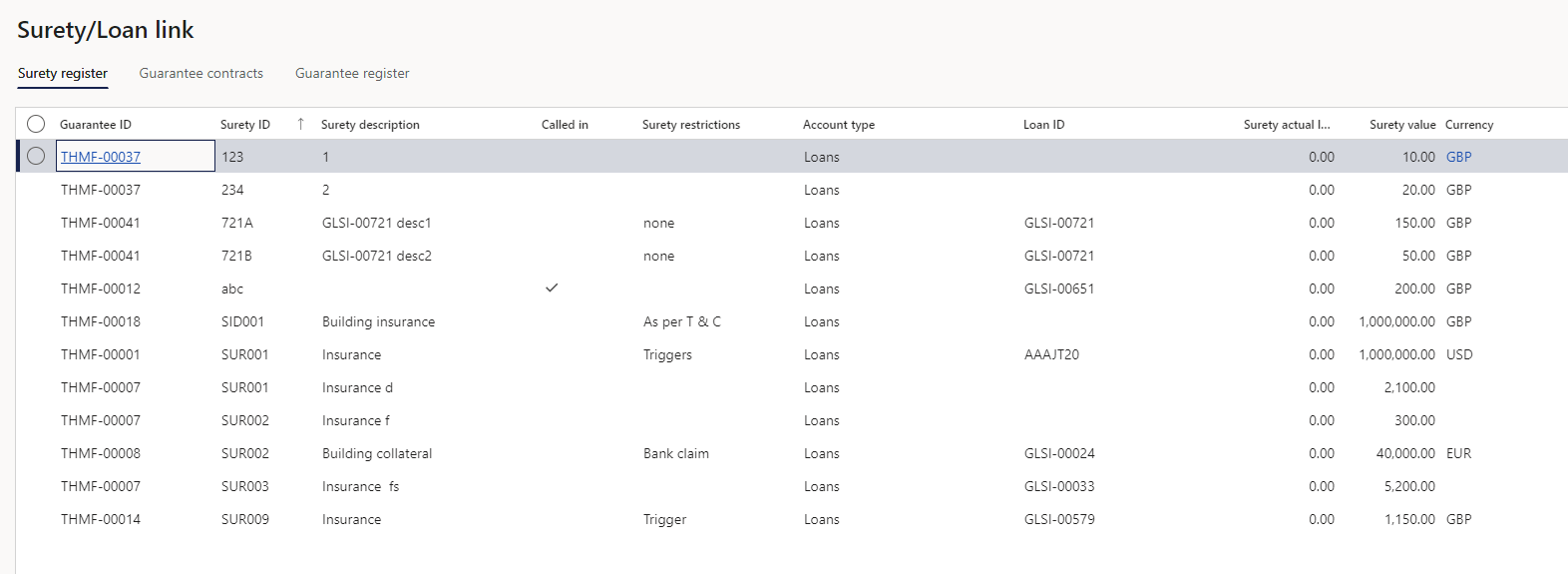

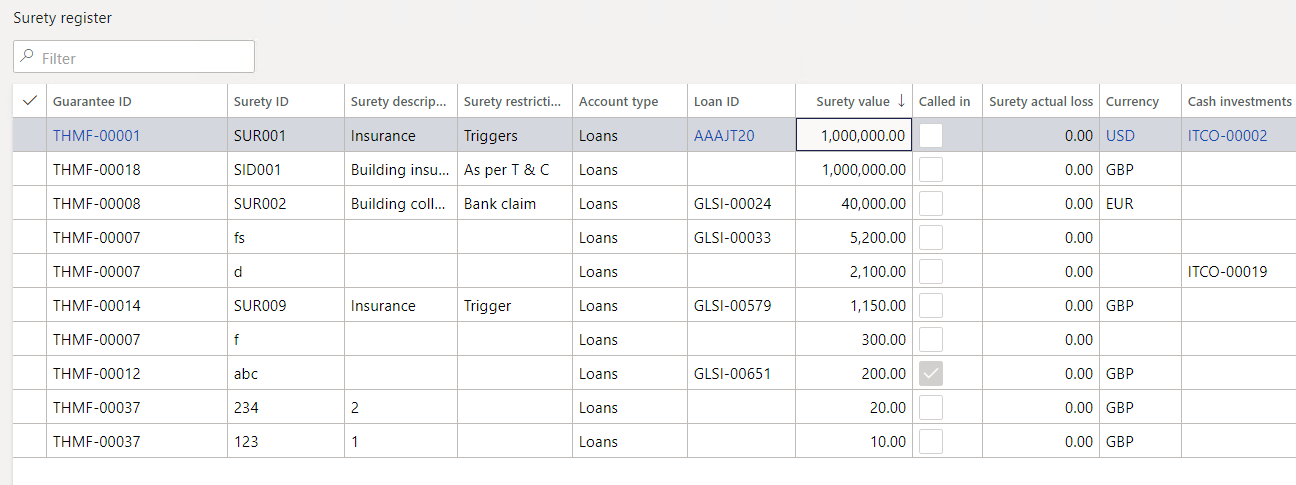

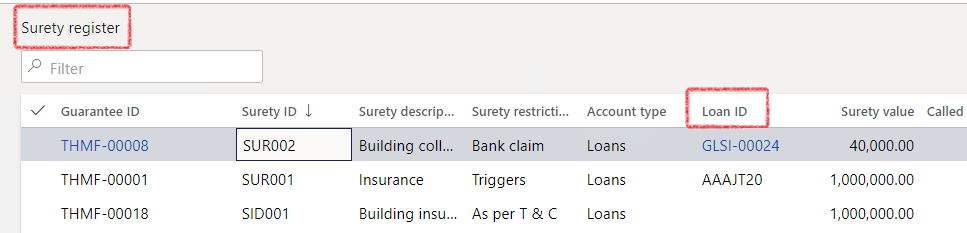

¶ Step 7: Surety register

- Go to: Treasury > Registers > Surety registers

- When the Sureties put in place section is completed under Guarantees, a Surety will display on this page as well.

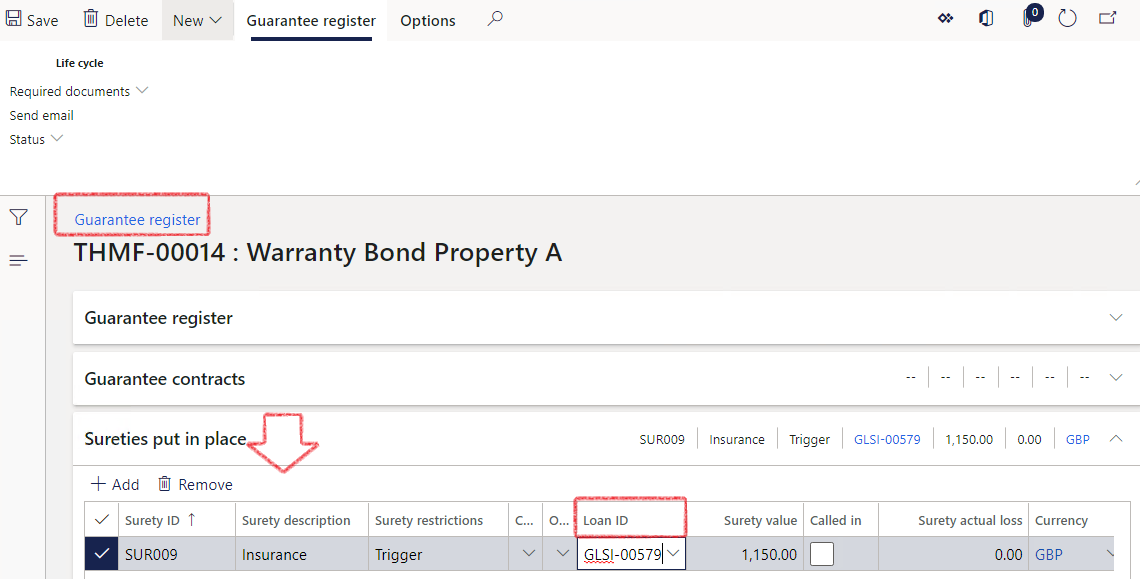

¶ Step 8: Surety linked to a Loan

To link a surety to a loan,

- In the navigation pane, go to: Modules > Treasury > Registers > Guarantee register

- Either create a new guarantee, or use an existing guarantee

- On the Sureties put in place FastTab, add a line for sureties, complete it and select the relevant loan number from the dropdown list.

- To view a list of sureties, go to Treasury > Registers > Surety register

¶ Reports

¶ Step 9: Guarantee contracts

Guarantee contracts

- Go to: Treasury > Registers > Inquiries and reports > Guarantee contracts

¶ Step 10: Surety / Loan link

Surety/Loan link

- Go to: Treasury > Registers > Inquiries and reports > Surety/Loan link