¶ Introduction

In treasury, an exchange is a transaction where two parties agree to swap one security or asset for another. This practice is common in financial markets, allowing investors to exchange securities, currencies, or other financial instruments. Treasury exchanges are often used to manage risk or to capitalize on price movements across different markets.

Exchange refers to the market for Interest rate indexes.

- Equity exchange

- Interest rate exchange

- Crypto currency exchange

- Currency exchange

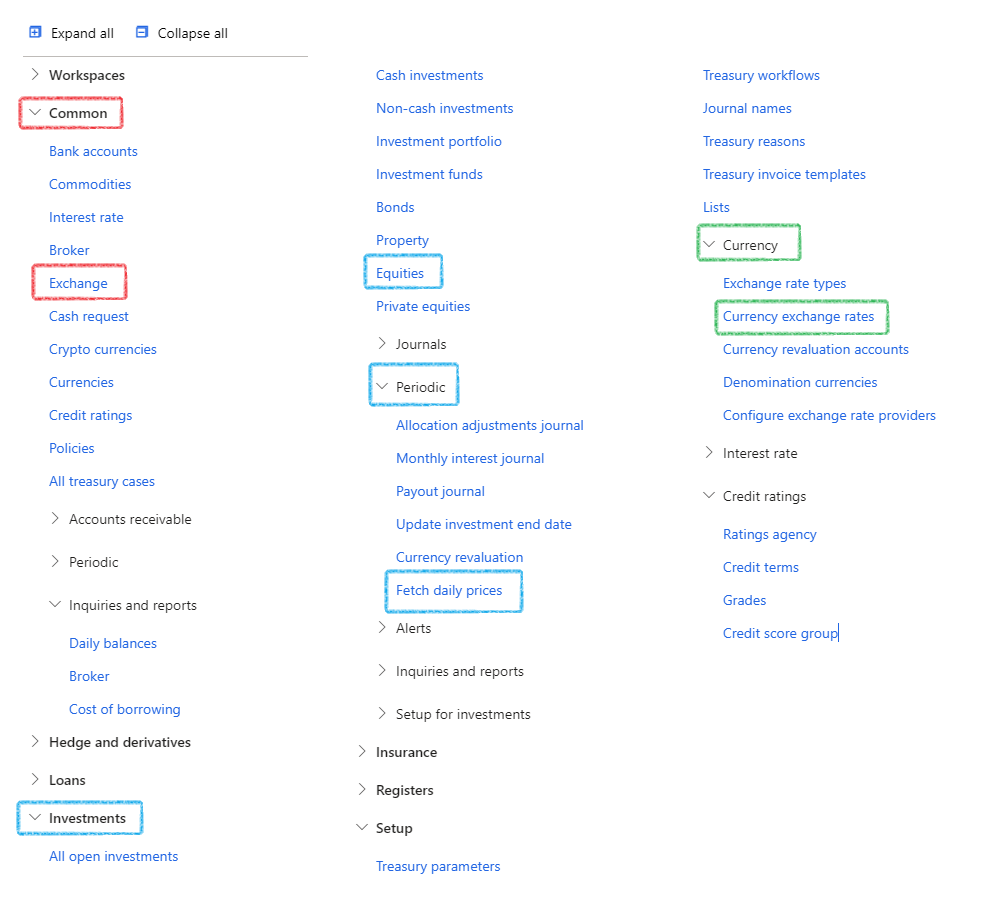

¶ Navigation

¶ Specific Setup

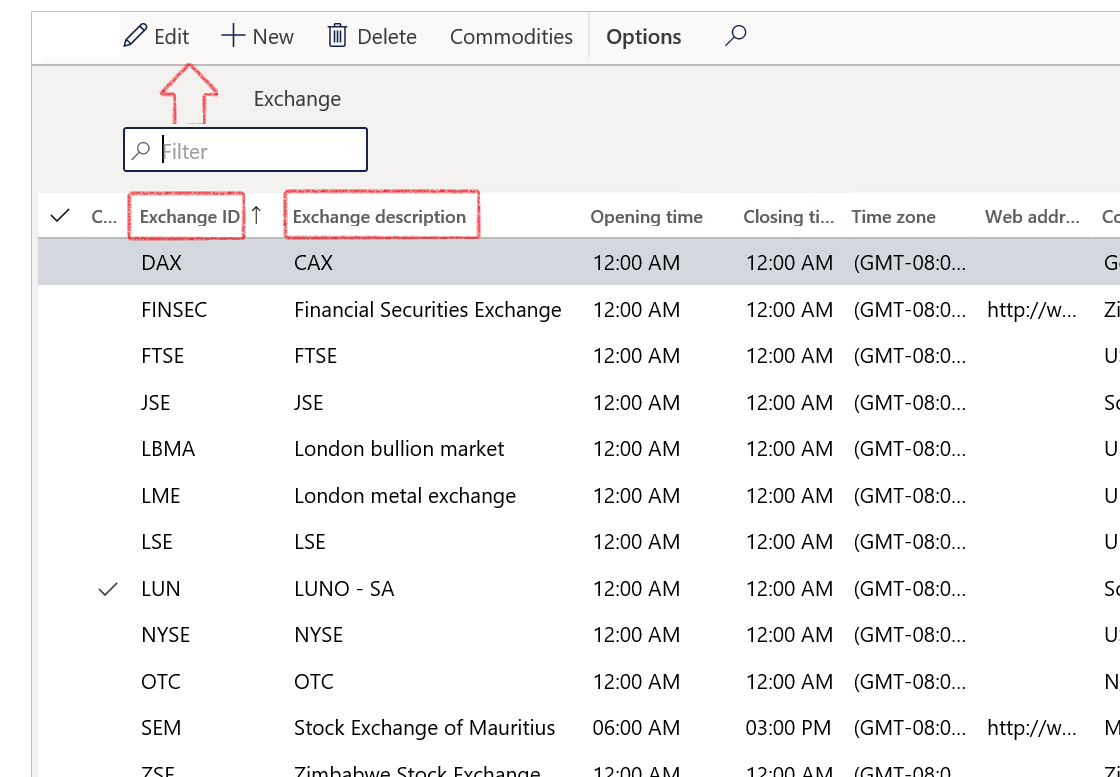

¶ Step 1: Setup Exchange

An exchange is a marketplace where securities, commodities, derivatives and other financial instruments are traded. An interest rate index is an index based on the interest rate of a financial instrument or basket of financial instruments. The Exchange form under the Common sub-module makes provision for both Exchanges and Interest rate indexes. Typical market rate indexes include LIBOR, Bloomberg foreign exchange, and Reuter’s foreign exchange. An index categorizes the various market rates that you track.

- Go to: Treasury > Common > Exchange

- Click the New button

- Enter the Exchange ID and Description

- Also complete the Web address

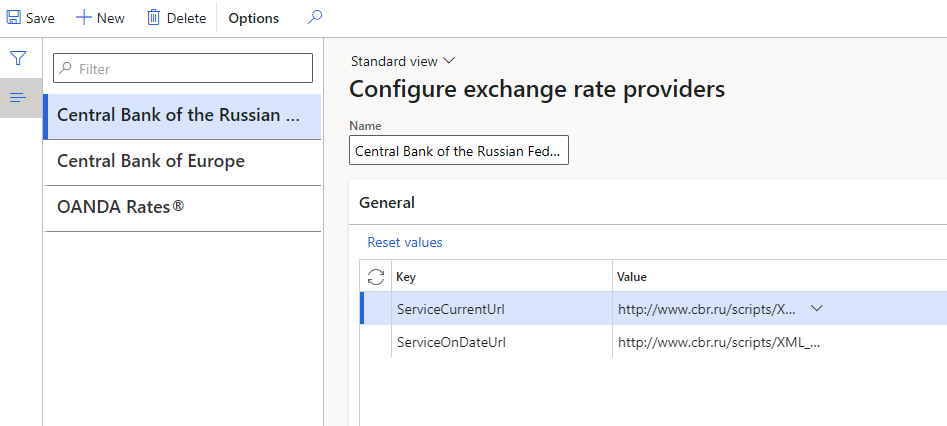

¶ Step 2: Configure Currency exchange rate providers

To import exchange rates automatically in Dynamics 365 for Finance and operations, the Currency exchange rate providers needs to be setup.

Microsoft Dynamics 365 For Finance and Operations provides integration with 3 exchange rate providers: (out of the box)

- OANDA

- Central Bank of Russian Federation

- Central Bank of Europe

You can utilize any of these providers to import currency exchange rates directly into the system, depending on the country in which your activities are located or your preferences.. Usually, OANDA is the most popular.

- Go to: General Ledger > Currencies > Configure exchange rate providers form.

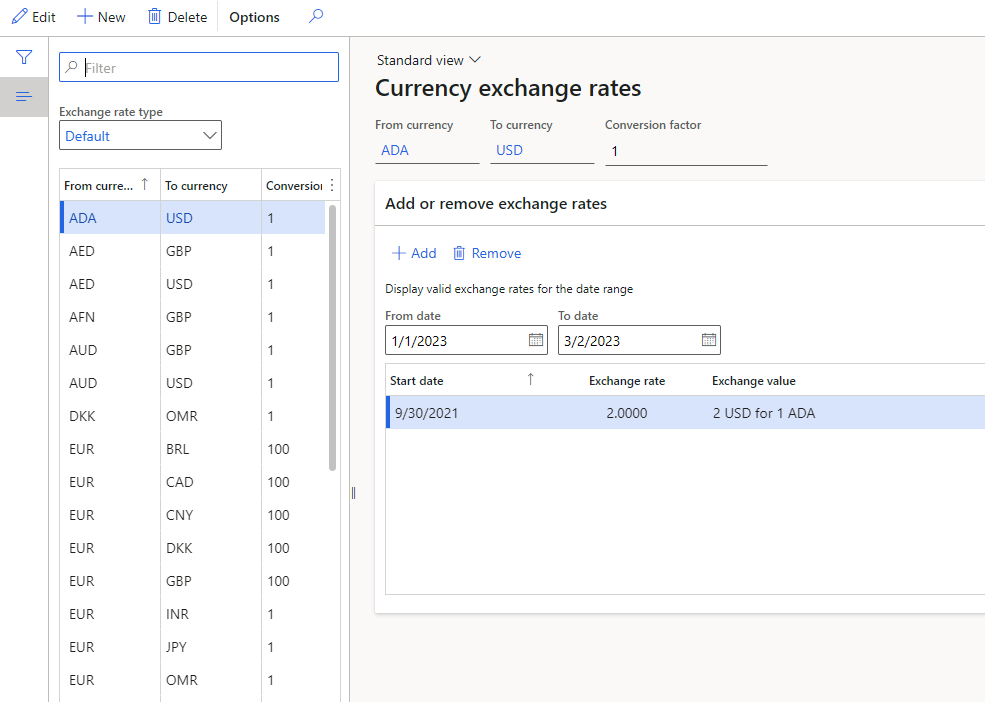

¶ Step 3: Set up Currency exchange rates

- Go to: Treasury > Setup > Currency > Currency Exchange Rate

- Click on New

- Enter a From currency

- Enter a To currency

- Enter the Conversion factor

- Expand the Add or remove exchange rates FastTab

- Click on Add

- Enter the Start date

- Enter the exchange rate

- The Exchange value will display

- Click on Save

¶ Daily Use

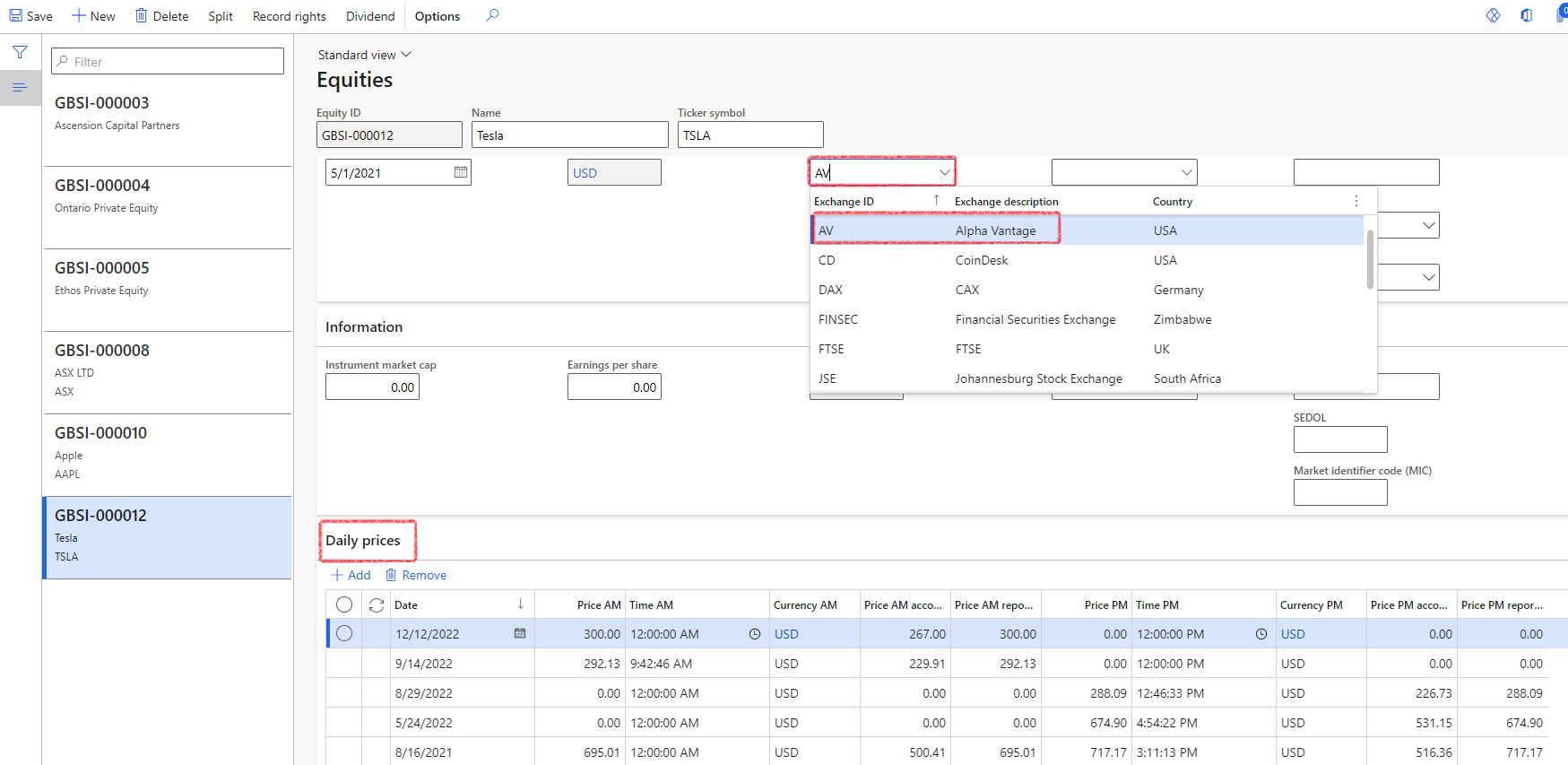

¶ Step 4: Capture daily price

Connect an Equity to the exchange, then record the price there

- Go to: Treasury > Investments > Equities

- Click on New

- Expand the Definition FastTab

- In the field called Exchange ID, select AV for Alpha Vantage

- Expand the Daily prices FastTab. The latest price will display in the top row

- Click on Save

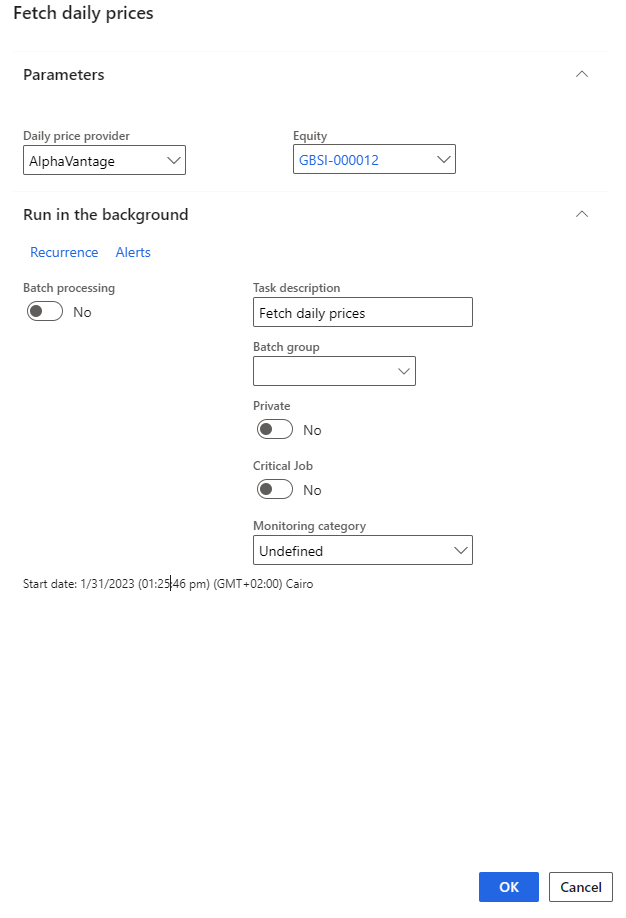

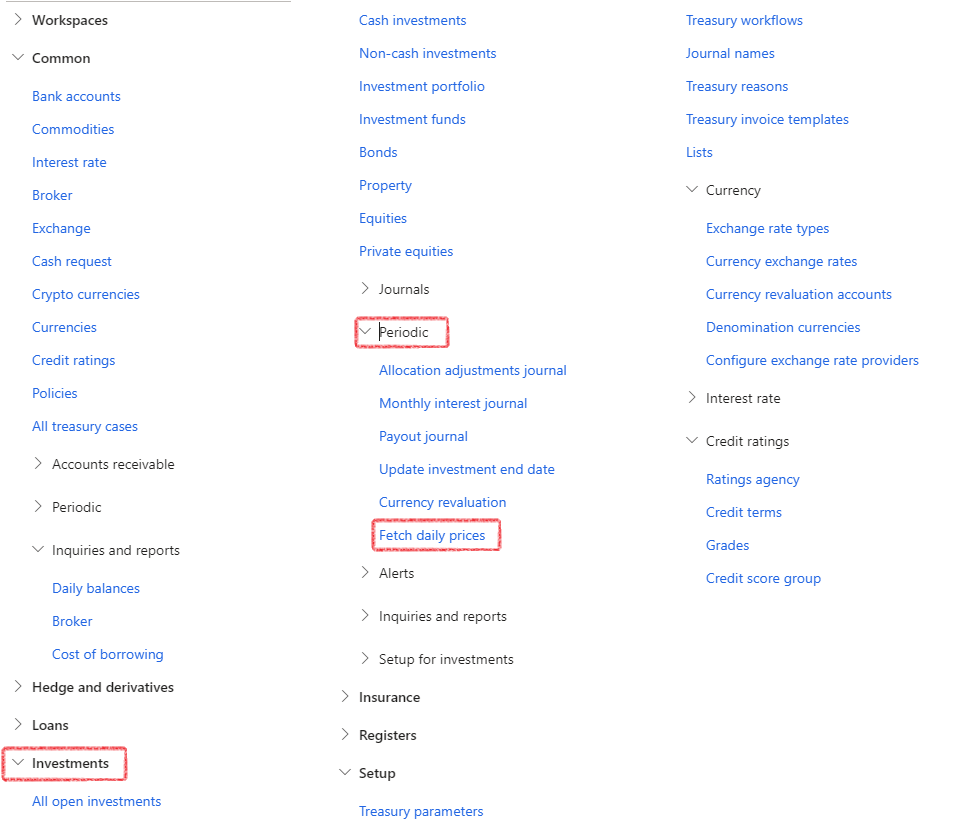

¶ Step 5: Fetch daily prices

To fetch daily prices for Equities:

- Go to: Treasury > Investments > Periodic > Fetch daily prices

- Select the Daily price provider from a dropdown menu. In this instance, it will be AlphaVantage

- Select an Equity from the dropdown menu

- Click the OK button