¶ Introduction

Derivatives are financial instruments whose value is derived from an underlying asset, often used for hedging purposes. Futures for instance, are derivatives, which can be used to hedge. Hedging and derivatives are related terms in the financial and investment world.

Hedging is an investment strategy designed to reduce potential losses or risks in various market conditions, functioning like a form of insurance.

In different situations, hedging can either result in a profit or a risk loss. Derivatives are tools that contribute to either result. Both concepts are also different in nature. Derivatives come in the form of contracts or agreements between two parties.

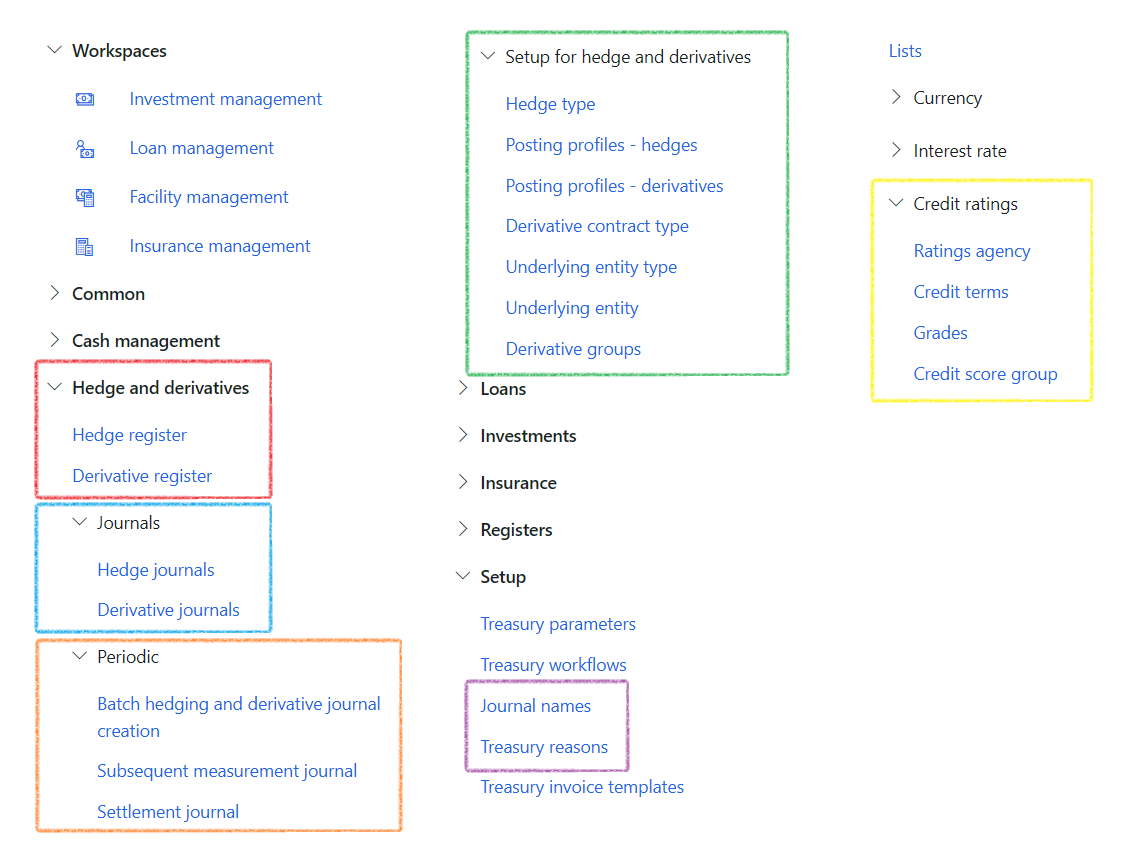

¶ Navigation

¶ Setup

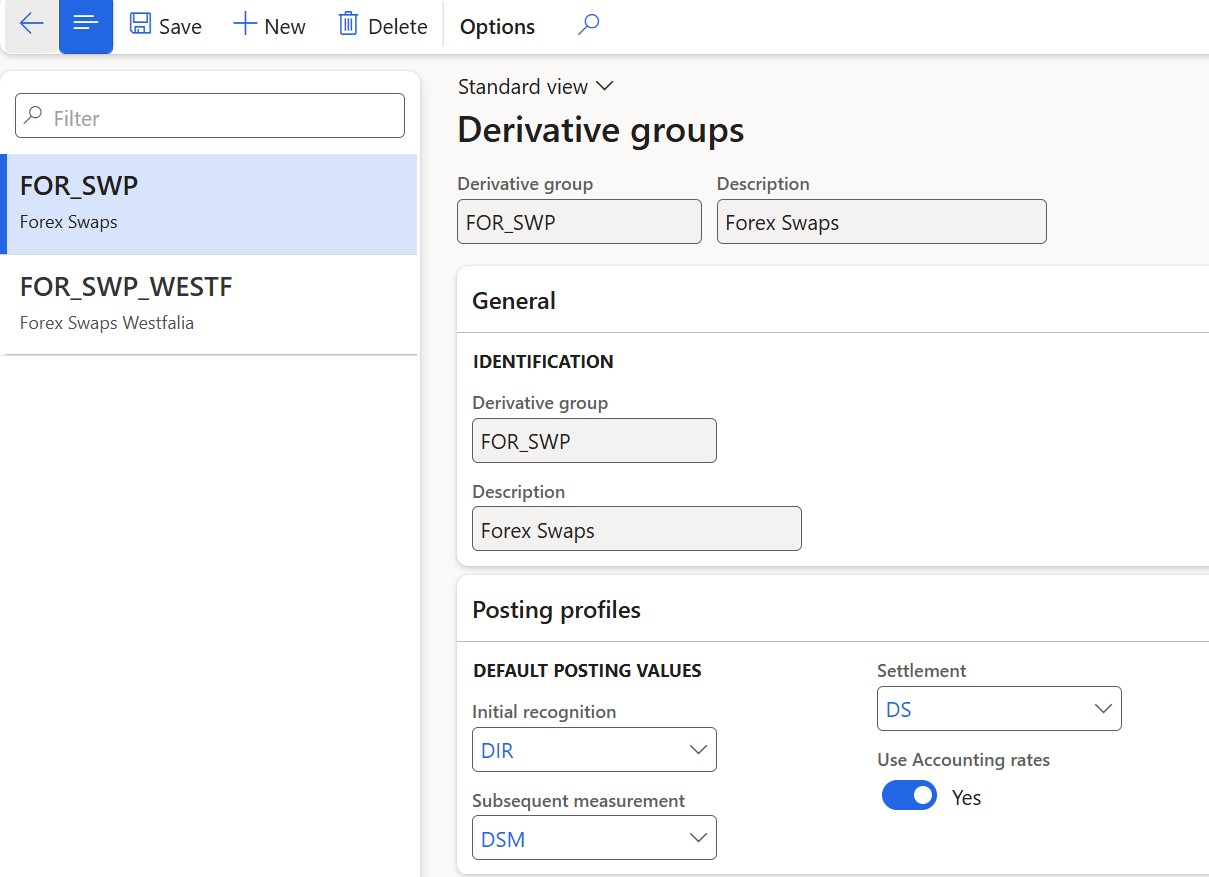

¶ Step 1: Setup Derivative groups

To create a Derivative group, go to:

- Treasury > Hedge and derivatives > Setup for hedge and derivatives > Derivative groups

- Create a new Derivative group and Description

- Select derivative Posting profiles

- Click the Save button

|

Derivative group |

Description |

| Cur/SW | Currency swaps |

| FT | Future contracts |

| FW | Forward contracts |

| In/SW | Swaps |

| OPC | Option - Call |

| OPP | Option - Put |

| SW | Swaps |

¶ Step 1.1: Initial Recognition Journal – Balancing Methods

The system supports two methods for balancing Initial Recognition Journals (IRJ) for currency swaps, providing flexibility in how forex-related journal entries are handled.

Balancing Options

- By default, the original method balances both the Spot and Forward legs by adjusting forex rates at the line level.

- Alternatively, the IRJ can balance at the total journal level using standard DFO GL exchange rates, without adjusting rates per individual line. This approach simplifies the journal structure and avoids custom rate calculations on each leg.

Configuration

The balancing method is controlled by the Use accounting rates toggle in the Derivative Groups setup:

- Yes – Uses accounting exchange rates from the last day of the period before the journal start date. The journal balances as a whole, and line-level variances offset each other.

- No – Applies the original method with calculated exchange rates per line to balance the Spot and Forward legs individually.

The profit and loss calculation logic remains unchanged across both methods.

No impact is expected on other derivative journals or reports.

This configuration supports a more transparent and standardized accounting approach for environments where use of official GL exchange rates is preferred.

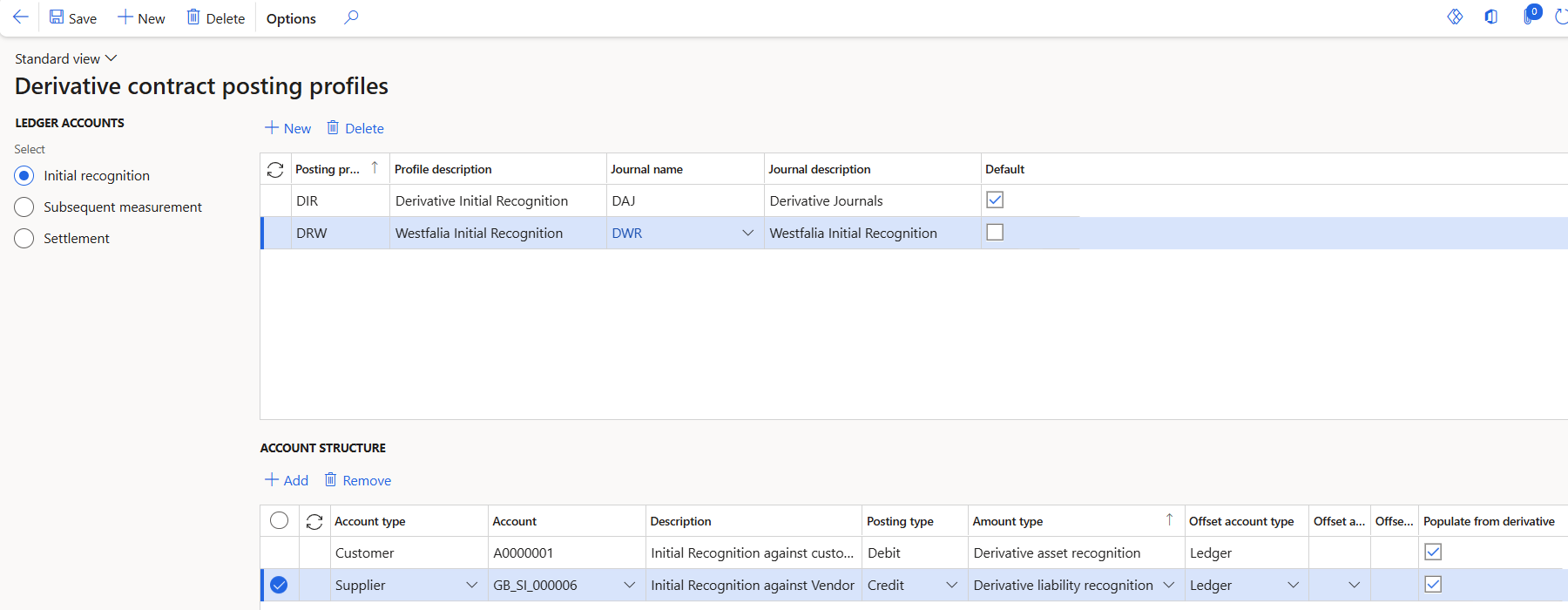

¶ Step 2: Setup Posting profiles - derivatives

To create Derivative posting profiles, go to:

- Treasury > hedge and derivatives > Setup for hedge and derivatives > Posting profiles - derivatives

- There are profiles for:

- Initial recognition

- Subsequent measurement and

- Settlement

- Click on New to add a posting profile line for each ledger account, in the posting profile header of the page

- Account type, Ledger account, Offset account type and Ledger accounts can be filled in on the Account structure

- When either customer or vendor is selected as the account type, the corresponding field can be left empty in the posting profile. The checkbox labelled Populate from Derivative can be used in the place of filling the customer or vendor account.

- Click the Save button

Wildcards can be used on Derivative journals. This applies specifically to the description field in the Derivative Posting Profiles setup page, under the Account Structure. The wildcard name that can be used is #Derivative ID. This can be used for all derivative journals (Initial recognition, Subsequent measurement and Settelement journals

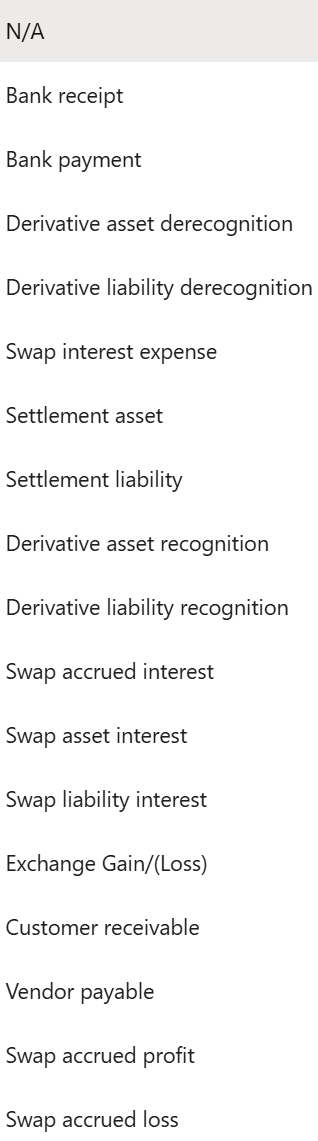

List of Amount types that can be chosen on Derivave posting profiles

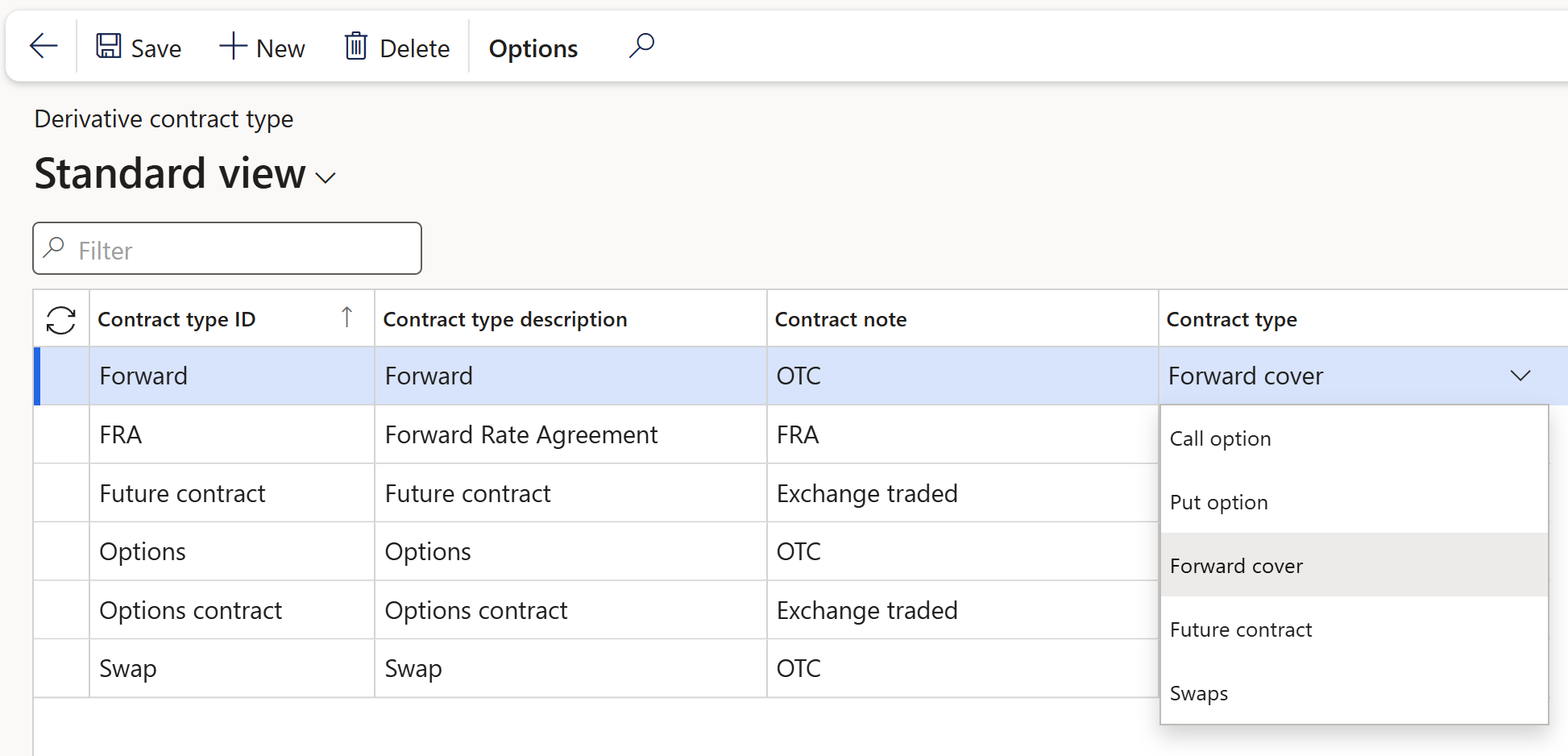

¶ Step 3: Setup Derivative contract type

To create Derivative contract type, go to:

- Treasury > Hedge and derivatives > Setup for hedge and derivatives > Derivative contract type

- Click on New: Create new Derivative contract type

- Type a new Contract type ID

- Enter a Description

- Type a Contract note

- Select a Contract type from the list

The following contract types can be selected:

- Call option

- Put option

- Forward cover

- Future contract

- Swaps

¶ Step 4: Setup underlying entity type

To create Underlying entity type, go to:

- Treasury > Hedge and derivatives > Setup for hedge and derivatives > Underlying entity type

- Click on New: Create new

¶ Step 5: Setup underlying entity

To create Underlying entity, navigate to:

- Treasury > Hedge and derivatives > Setup for hedge and derivatives > Underlying entity

- Click on New: Create new Underlying entity

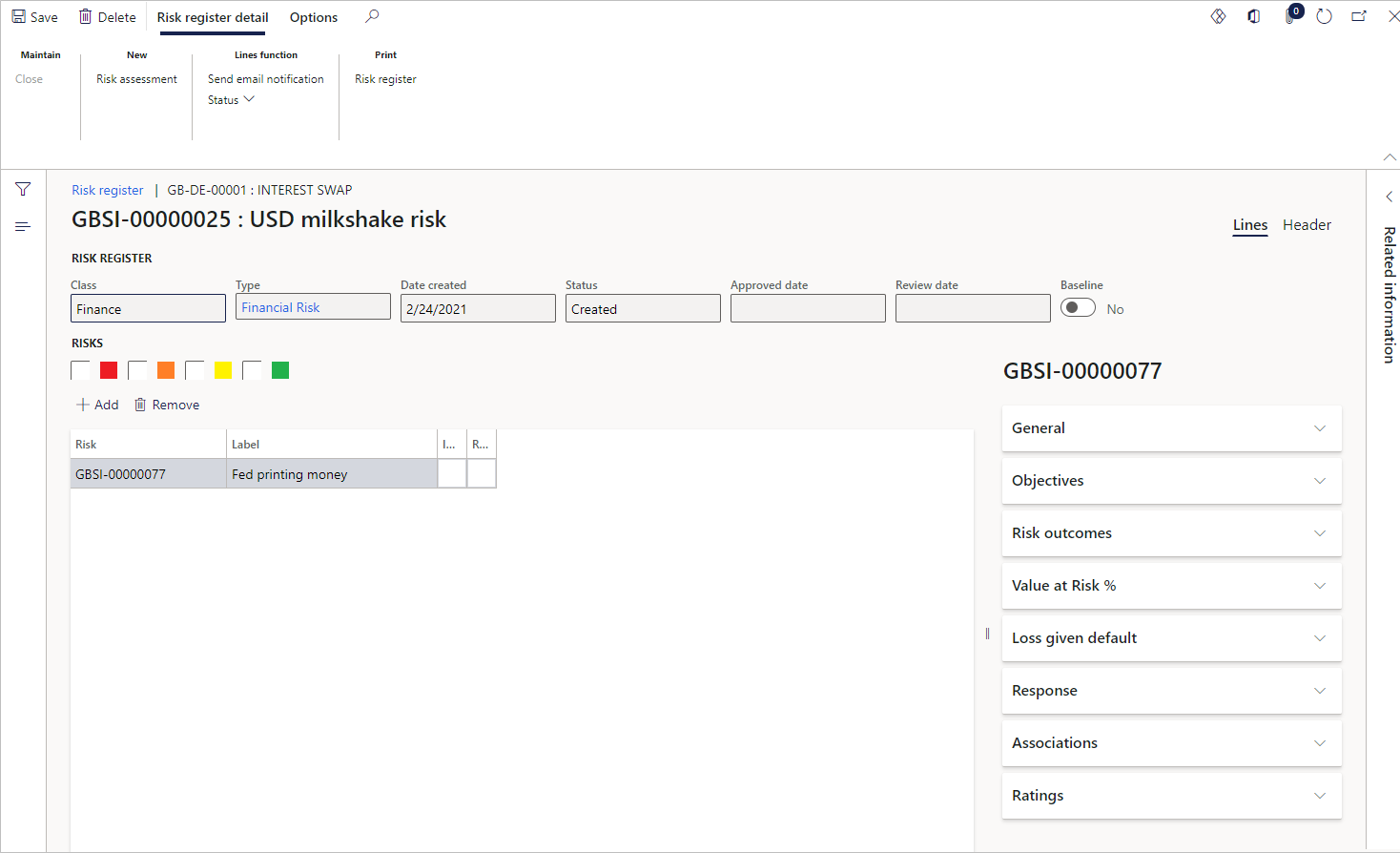

¶ Step 6: Financial Risk register (G2T)

For more information on the setup of the Financial risk register, open the GRC001 Test script Operational Risk management.docx document, which forms part of the Governance, Risk and Compliance module.

The GRC001 Test script Operational Risk management.docx document contain the following setup:

- Risk types

- Economic

- Health

- Strategic

- Safety, etc.

- Risk configuration

- Risk categories

- Risk Likelihood

- Inherent risk

- Residual risk

- Mitigation effectiveness

- Inherent consequence

- Residual consequence

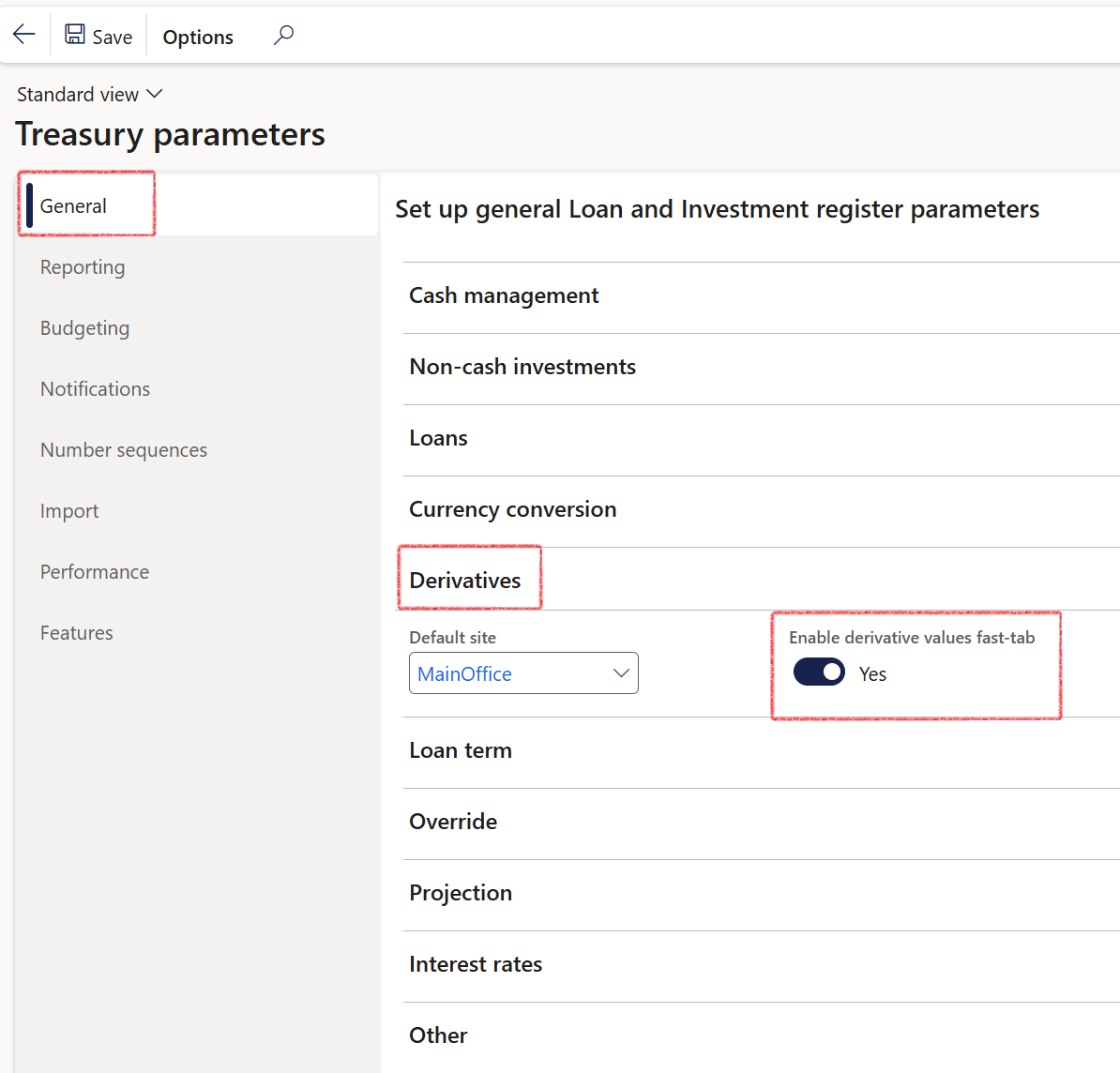

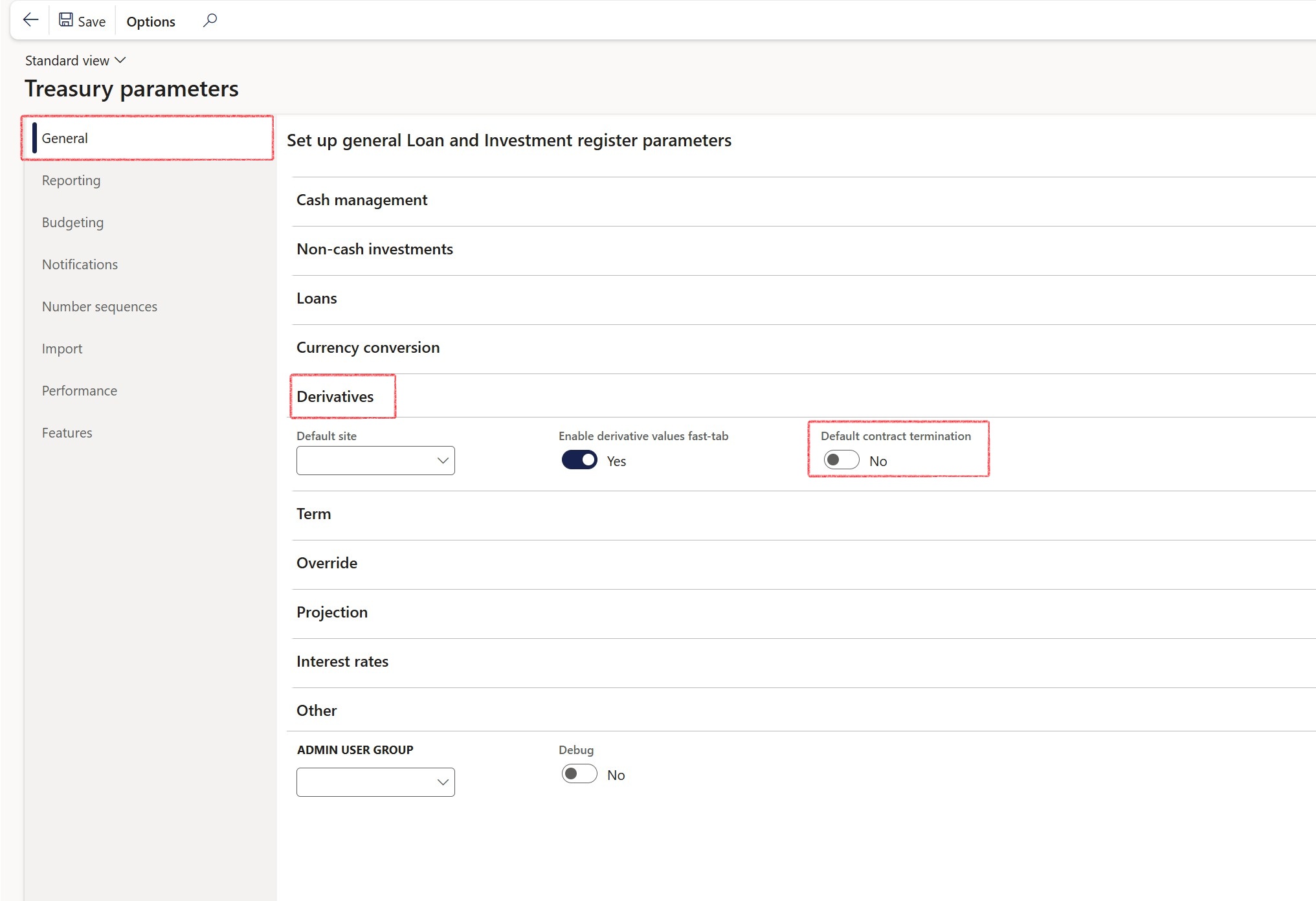

¶ Step 7: Setup Treasury parameters

¶ Step 7.1: Enable derivative values FastTab

To enable the Derivative values FastTab on Derivatives, go to:

- Treasury > Setup > Treasury parameters

- On the General tab, expand the Derivatives FastTab

- Slide the Enable derivative values toggle to Yes

- When set to Yes, the Derivative Values FastTab will be visible on the derivatives page, and when set to No, it will be hidden.

¶ Step 7.2: Display Contract termination FastTab

To display the Contract termination FastTab by default when registering a new derivative contract, go to:

- Treasury > Setup > Treasury parameters

- On the General tab, expand the Derivatives FastTab

- Slide the Default contract termination toggle to Yes

- If the toggle is set to Yes, the Contract Termination FastTab will automatically appear by default in the Register Derivative Contract dialog

- If set to No, the Contract Termination FastTab will remain hidden by default.

¶ Daily use

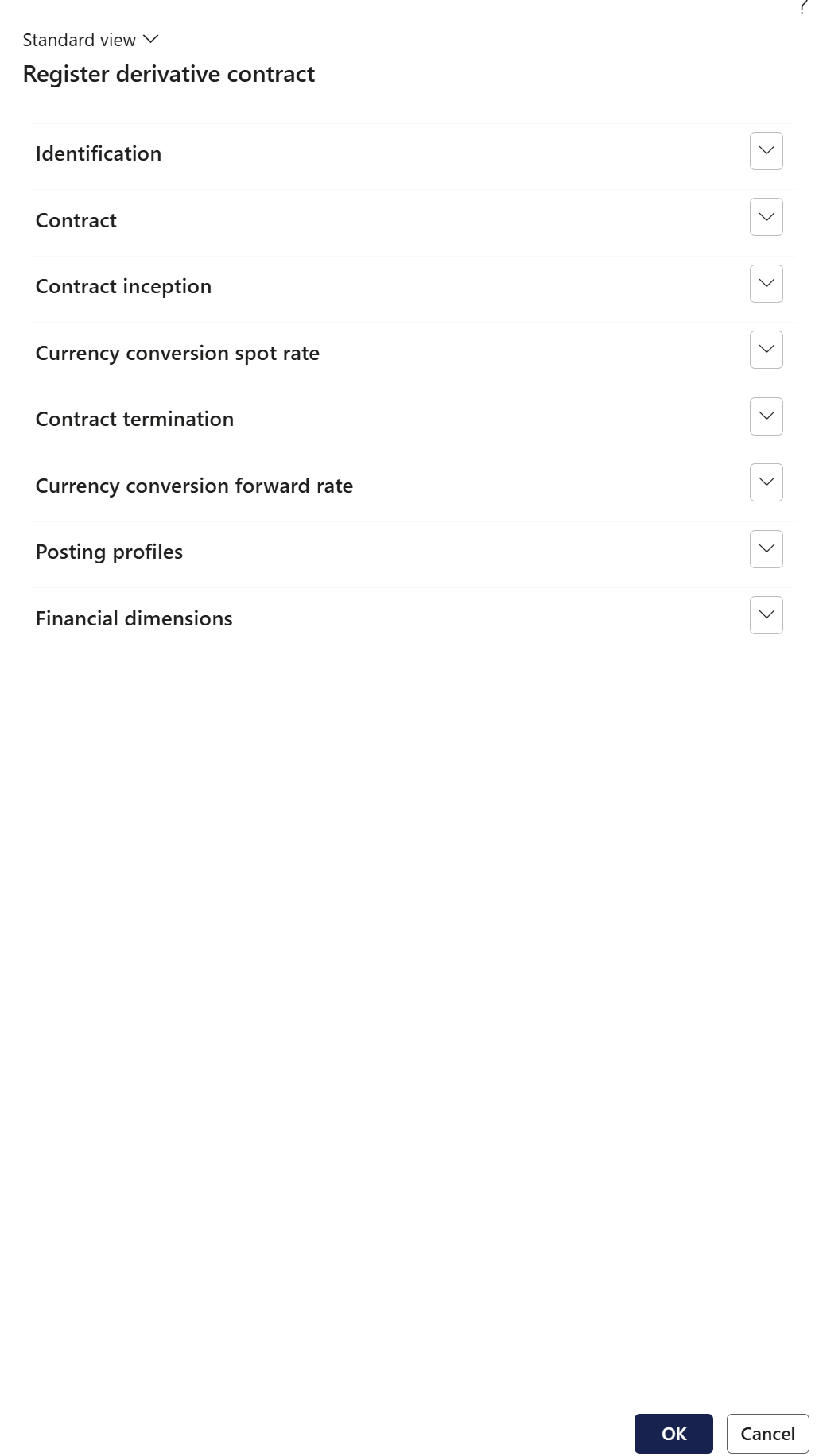

¶ Step 8: Create a new Derivative contract

The Create new Derivative contract dialogue consist of the following FastTabs:

- Identification

- Contract

- Contract inception

- Currency conversion spot rate

- Contract termination

- Currency conversion forward rate

- Posting profiles

- Financial dimensions

To create a derivative contract, go to:

- Treasury > Hedge and derivatives > Derivative register

- Click on the New button to create a new Derivative register contract

By default, the 'Position' field is set to Open upon swap creation.

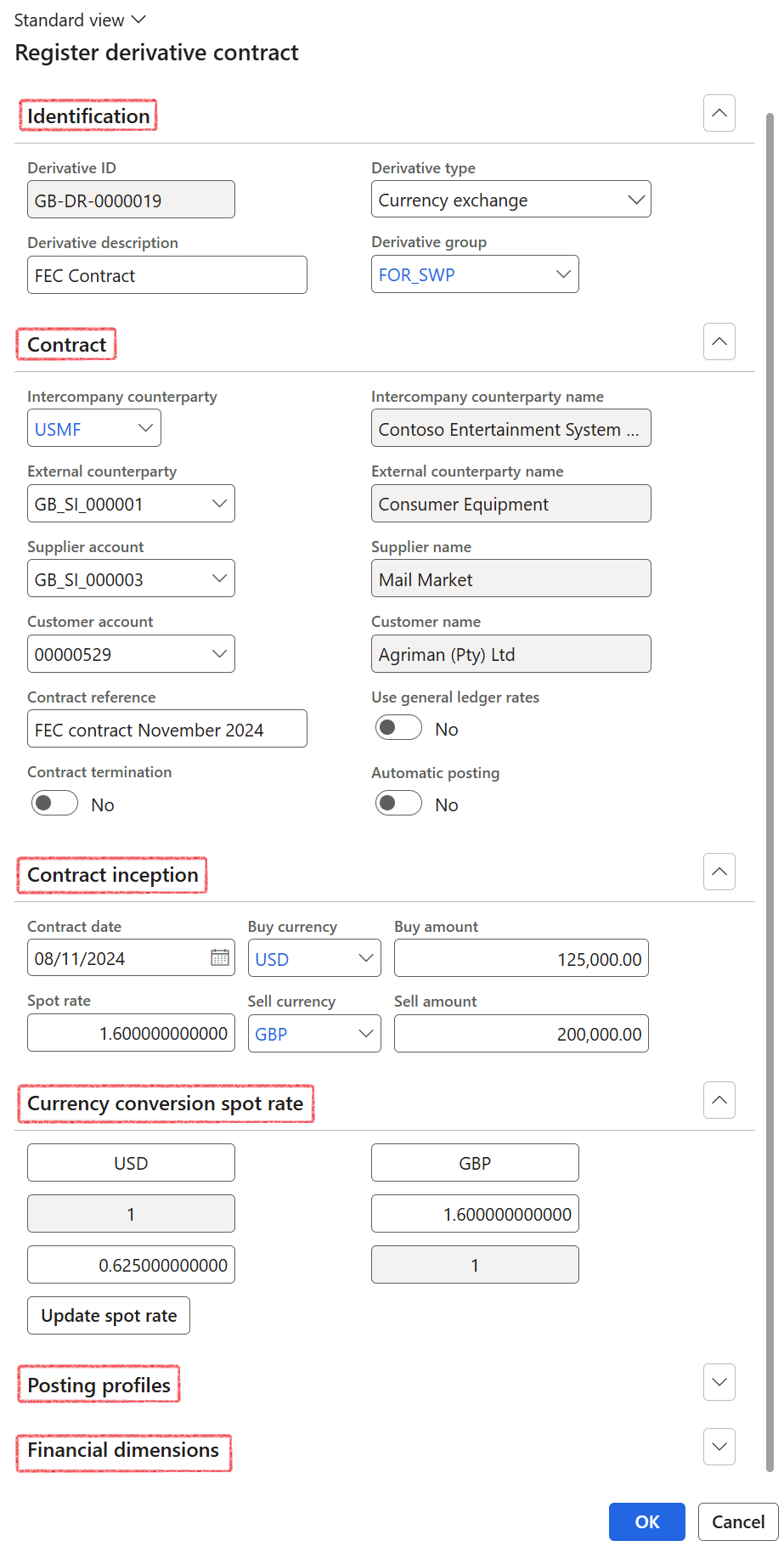

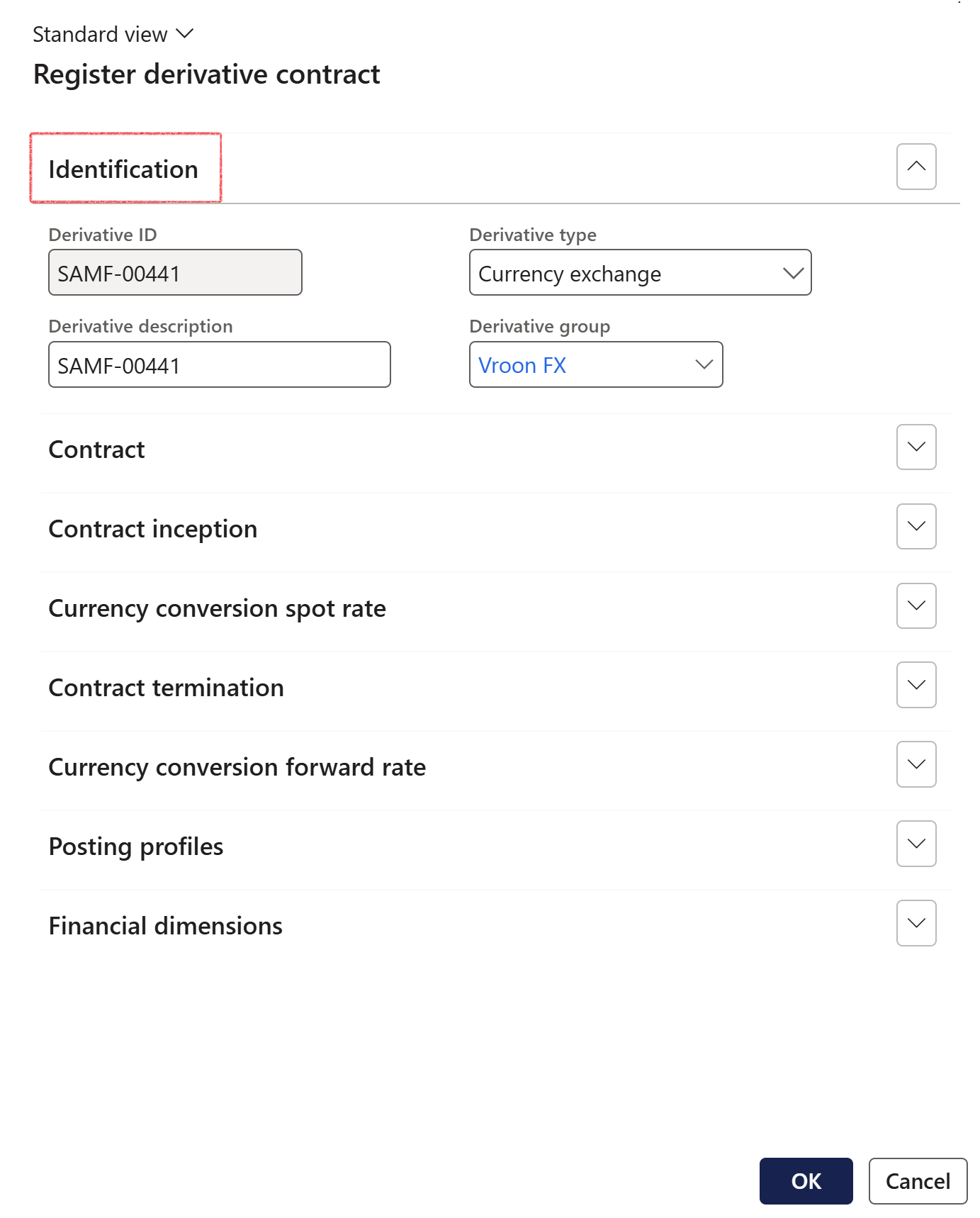

¶ Step 8.1: Identification

Expand the Identification FastTab

- The derivative ID populates automatically with a set up number sequence

- A derivative type as set up is specified.

- The derivative group is selected from the drop-down menu which was set up and created

¶ Step 8.2: Contract

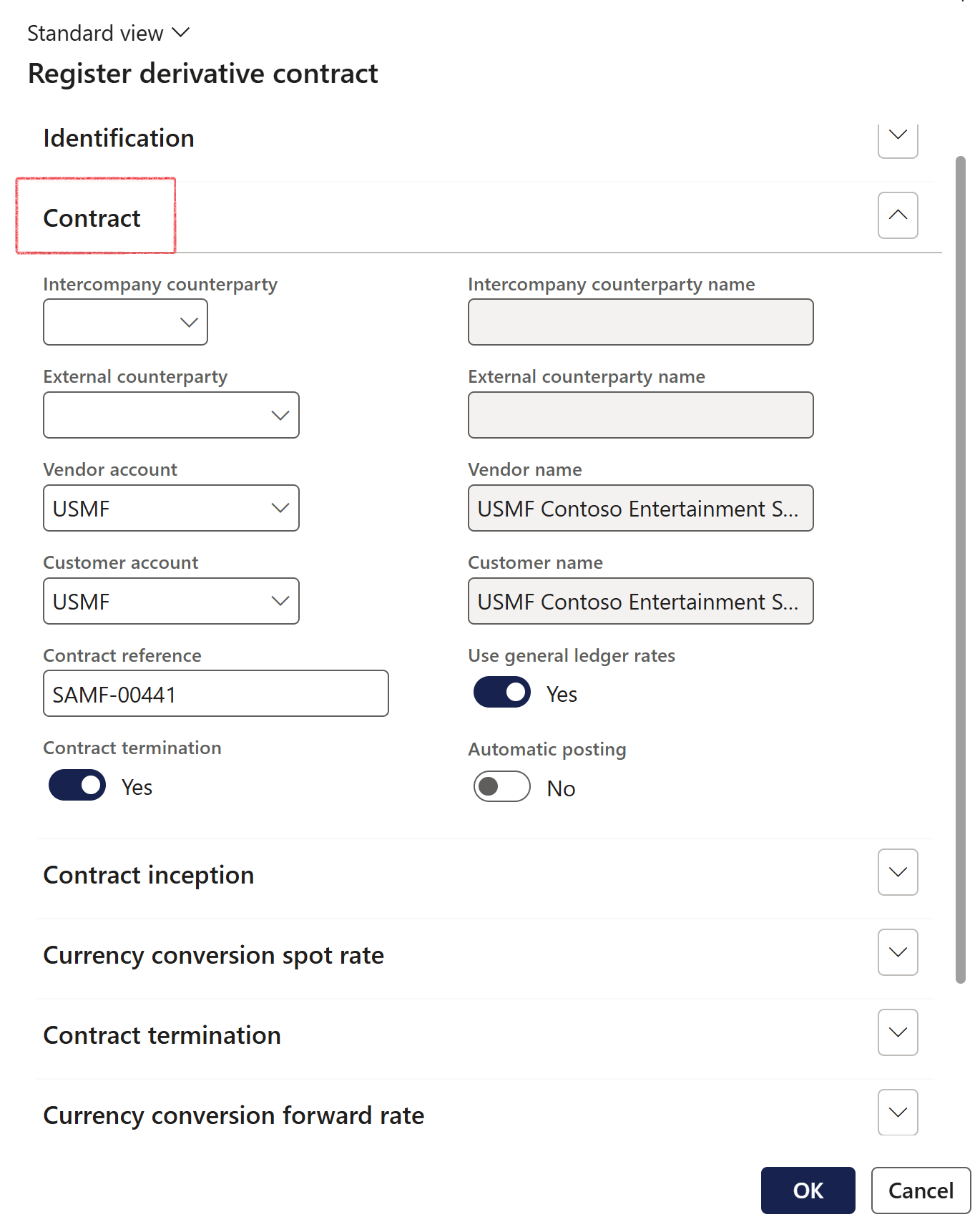

Expand the Contract FastTab

- If the derivative contract is an intercompany contract, a drop-down list of legal entities is available in the Intercompany counterparty field.

- Select External counterparty

- a Vendor account can be selected from the dropdown menu

- Select a Customer account

- Type a Contract reference

- If required, slide the toggle to Yes for Contract termination

- If Use contract termination toggle was set to Yes in the Contract section, this FastTab called Contract termination will appear and can be filled in

- Users have the option to default the exchange rate from the General Ledger instead of manually entering it.

- If Yes is selected, the rate for the exchange pair will automatically populate the spot rate field from GL > Exchange Rates.

- The contract date will be utilized to determine the correct rate from Currencies > Currency Exchange Rates.

- If No is chosen, the process will continue as before. The exchange rate type can be found in the General Ledger setup

- If no rate exists in the exchange rate setup, the process will proceed normally without a rate being defaulted

- If a rate for the specific contract date is unavailable, the latest available rate will be used.

- Users retain the option to edit the defaulted rate even if it is automatically populated.

- When Yes is selected in the new dialog box to Use general ledger rates, the initial journal will be created differently:

- If No is selected to Use general ledger rates, the journal will be created as it was previously.

- If Yes the debit and credit lines will be generated using GL exchange rates. If the user retains the spot rate, this will create a balanced journal for the accounting and/or reporting currency if it matches one of the swap currencies.

- However, if Yes is selected to Use general ledger rates and the spot rate is changed, the journal lines will still be created using GL exchange rates, resulting in an imbalance in the accounting or reporting currency. In this case, a third and fourth line will be created using the posting profile setup to fetch the account for exchange gain/loss, which will either be debited or credited to balance the journal

- If the swap currencies do not match either the accounting or reporting currencies, a third and fourth line will be created to reflect either a gain or a loss, which could result in one being a loss and the other a gain

- These specifically apply to a forex swap at the spot rate, relevant only for the contract inception portion of the record and not for the contract termination

- Set the toggle to Yes if you want the Inital recognition journal to automatically post

¶ Step 8.3: Contract inception

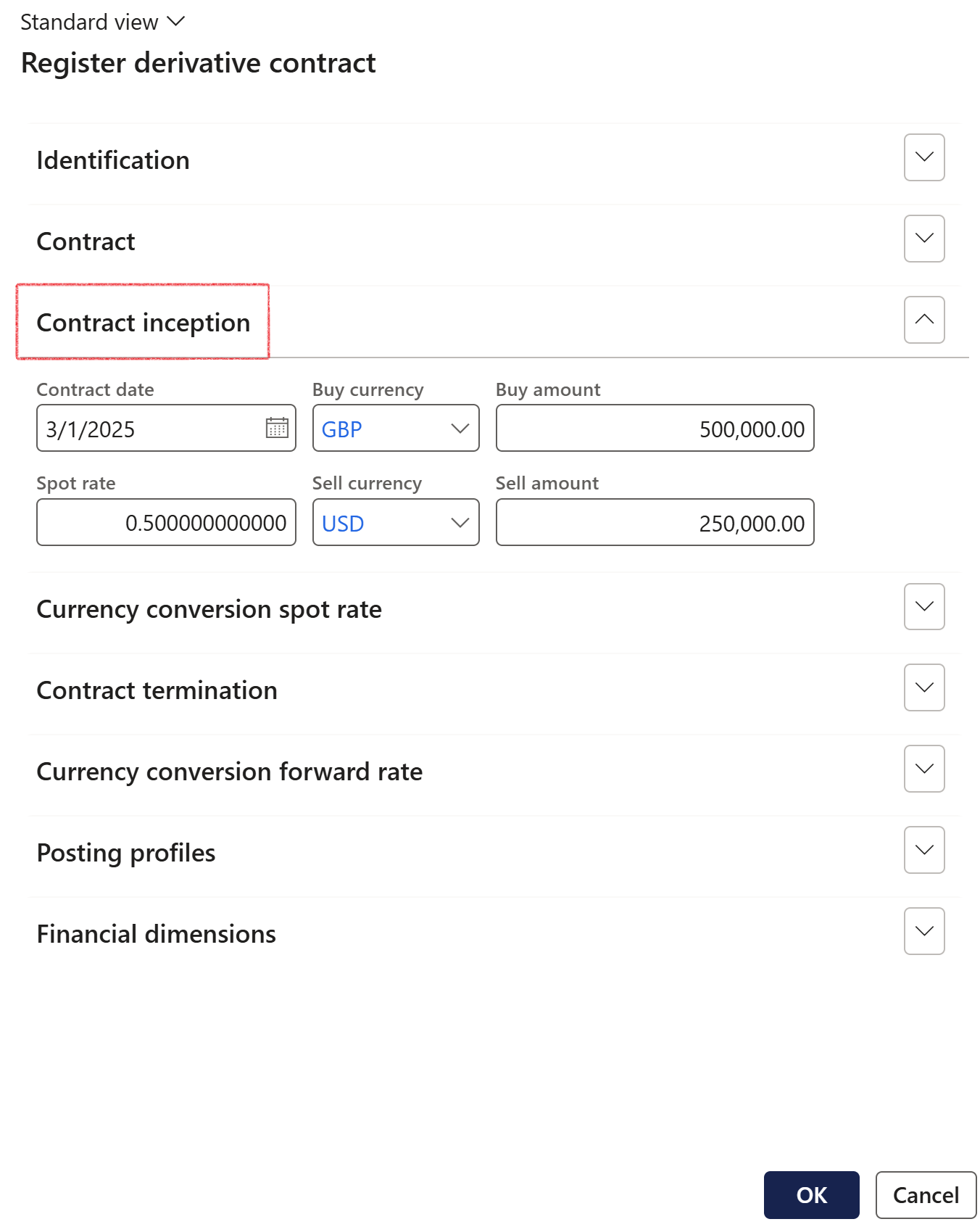

Expand the Contract inception FastTab

- Enter a Contract date. The contract date will be utilized to determine the correct rate from Currencies > Currency Exchange Rates.

- Select a Buy currency

- Enter the Buy amount

- The Sell amount can be captured, and the user will enter a rate per unit of the buying currency, and the system will calculate the buying amount

- Select a Sell currency

- The Sell amount can be captured, and the user will enter a rate per unit of the buying currency, and the system will calculate the buying amount

- The Spot rate will be calculated when the Buy amount and Sell amount has been entered

- The rate can also be captured in one of two ways:

- Manually, by calculating the Sell amount divided by the Buy amount and entering the result.

- By capturing a different conversion direction, and have the system calculate the rate and updating the spot rate. In turn this can be captured as a rate per unit of the buying or selling currency.

¶ Step 8.4: Currency conversion spot rate

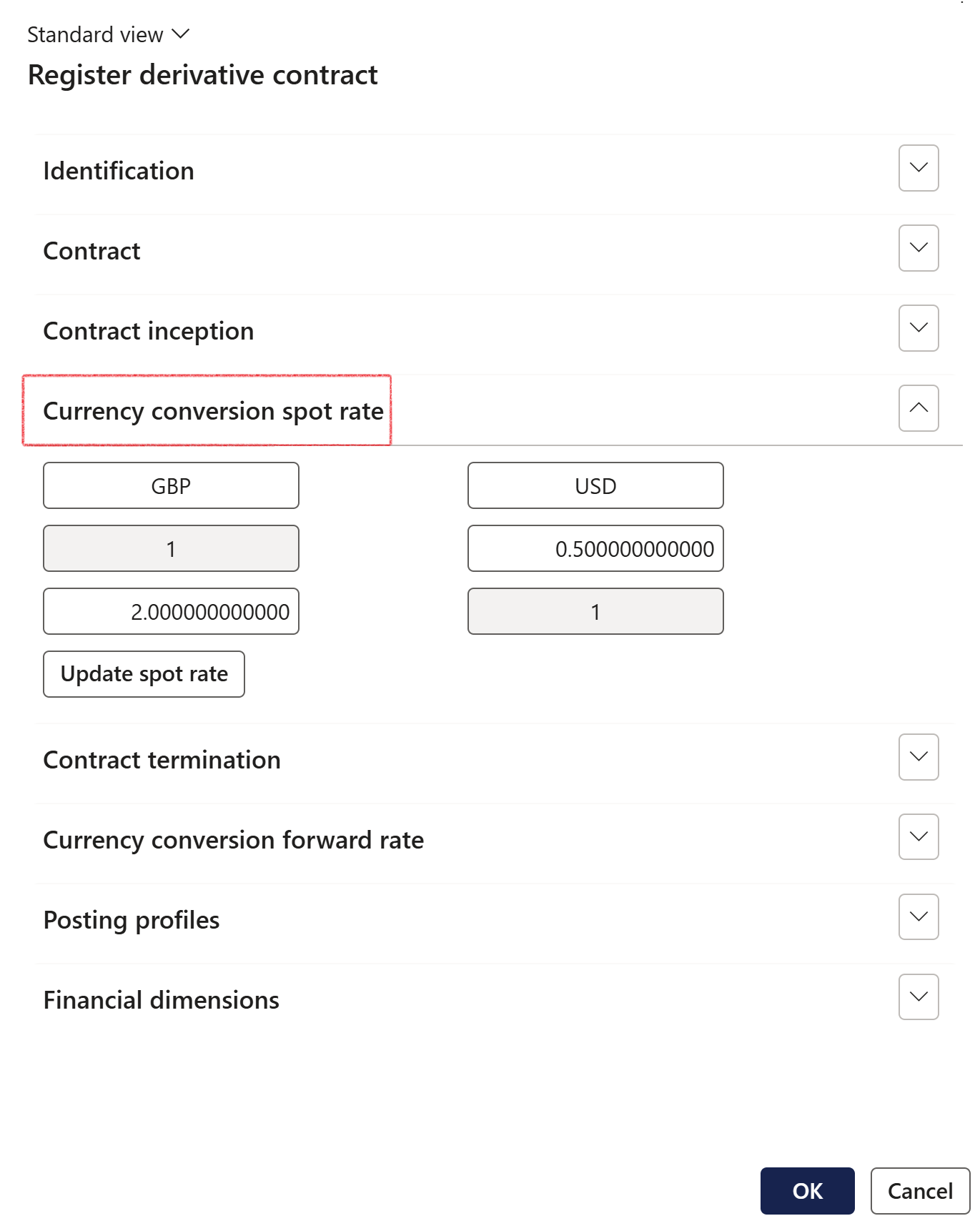

Expand the Currency conversion spot rate FastTab

- The Buy and Sell currencies will display

- Click Update spot rate to refresh the calculation

The currency swap method of input are allowing the user to capture a rate and the selling quantity, with the system calculating the buying quantity. The conversion tool enables the user to capture the rate in either buying or selling currency format, and the system converting to the appropriate rate for the currency swap.

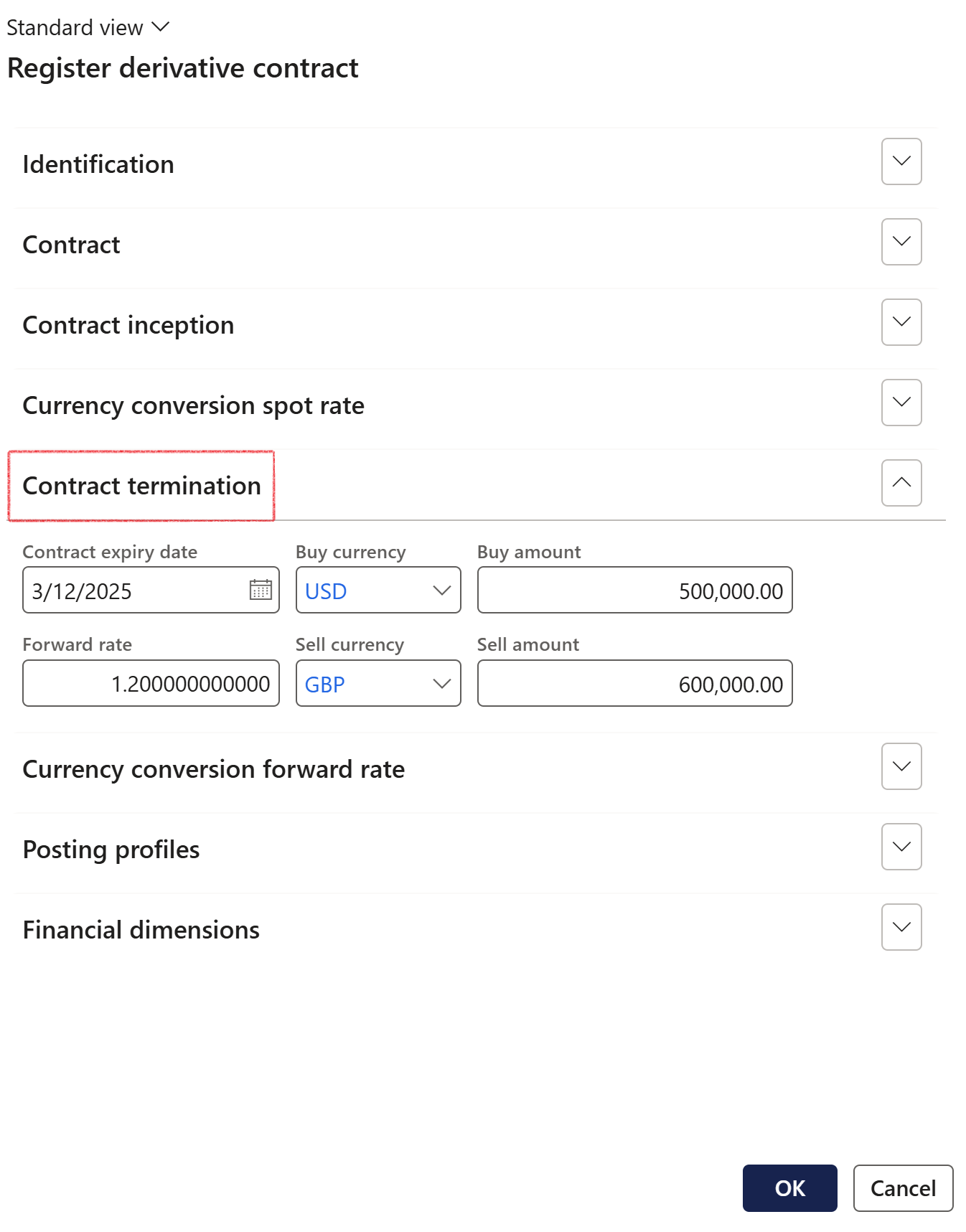

¶ Step 8.5: Contract termination

If the Contract termination was set to Yes on the Contract FastTab, the Contract termination FastTab will appear. Expand the Contract termination FastTab

- Select a Contract expiry date

- Select a Buy currency

- Enter a Buy amount

- Select a Buy currency

- Enter a Buy amount

- The Forward rate will automatically be calculated

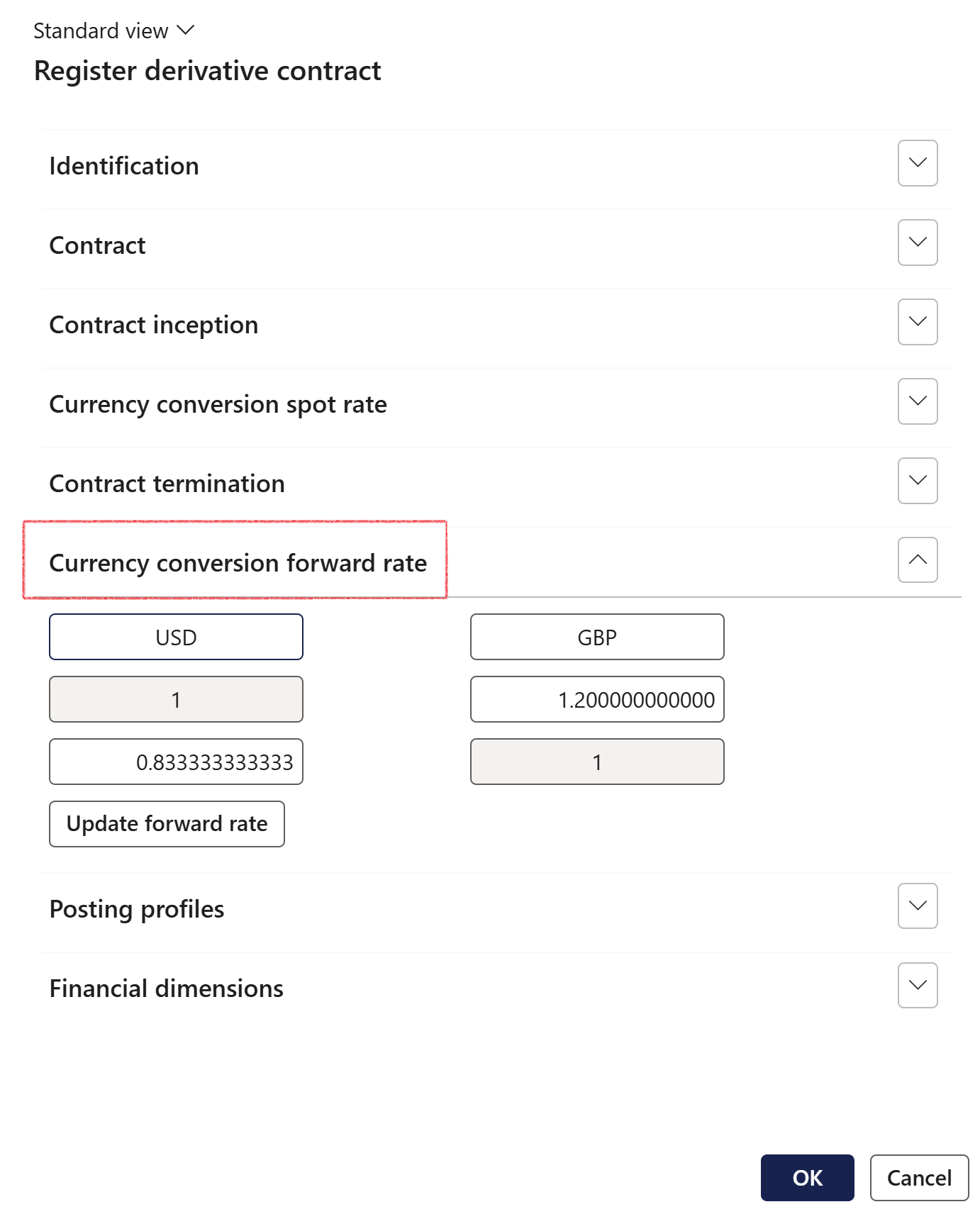

¶ Step 8.6: Currency conversion forward rate

Expand the Currency conversion forward rate FastTab

- Click the Update forward rate button

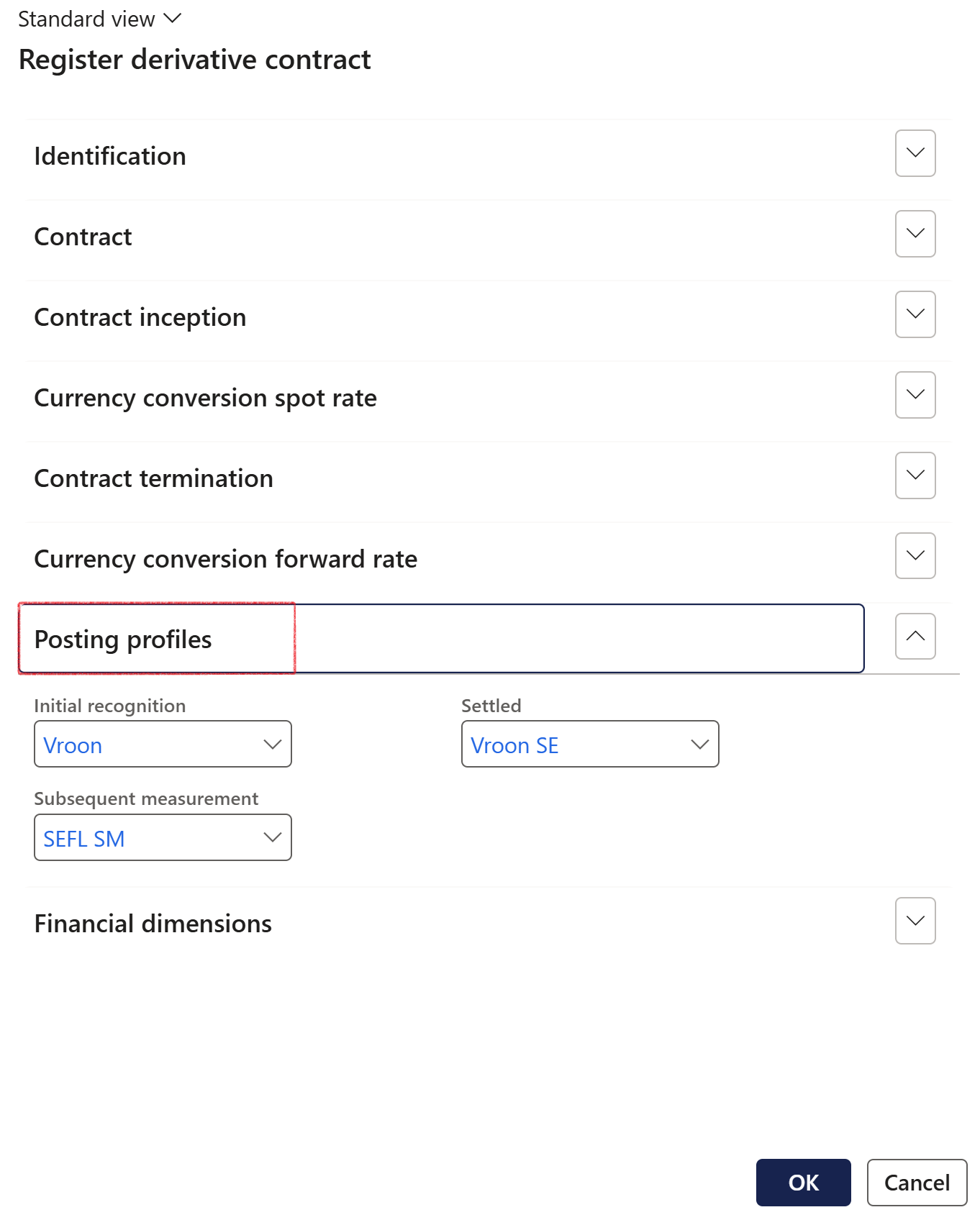

¶ Step 8.7: Posting profiles

Expand the Posting profiles FastTab. Posting profiles will automatically display, as per setup on the Derivative group. If required, other Posting profiles can be selected

- Initial recognition

- Subsequent measurement

- Settled

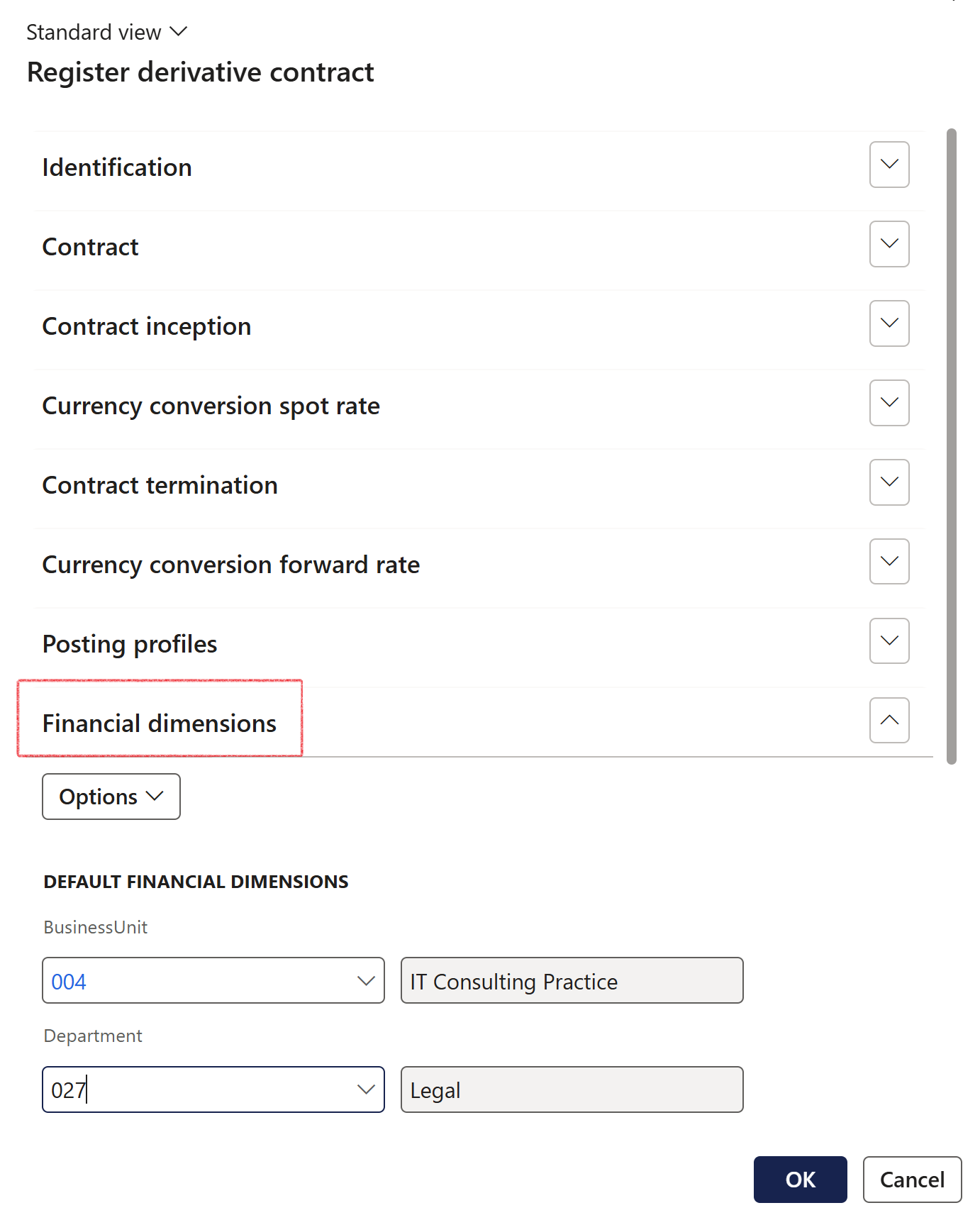

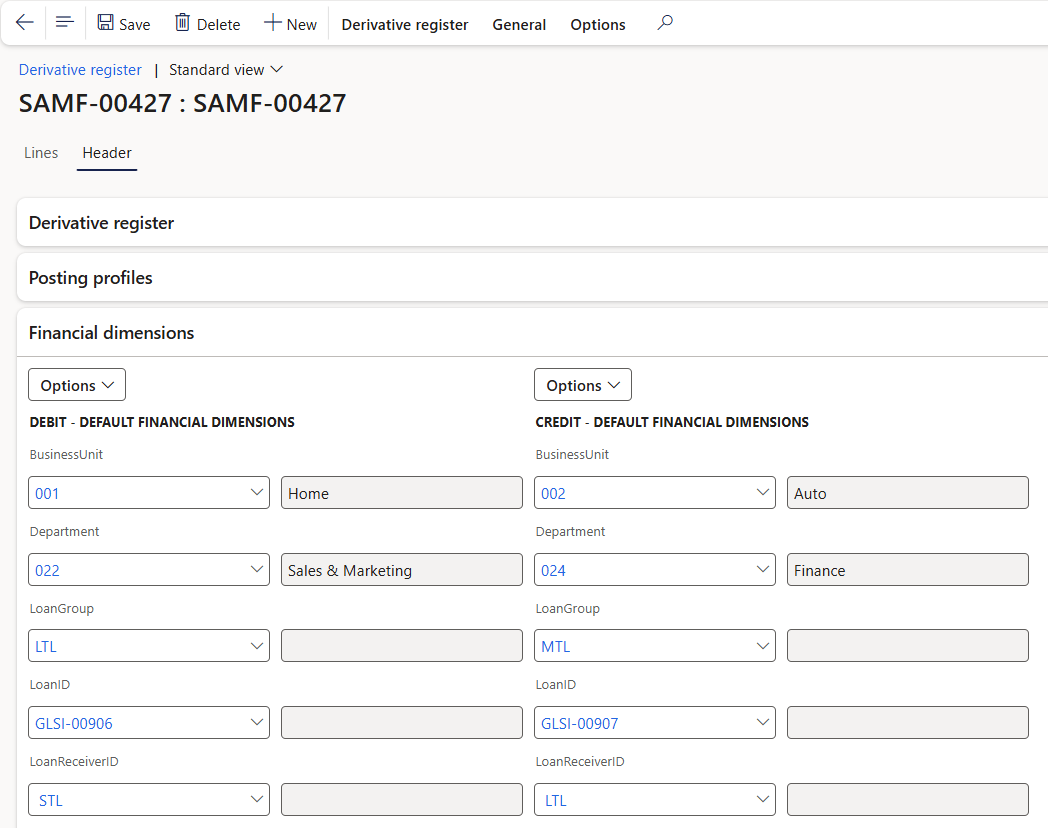

¶ Step 8.8: Financial dimensions

Expand the Financial dimensions FastTab

- Default financial dimensions can be selected

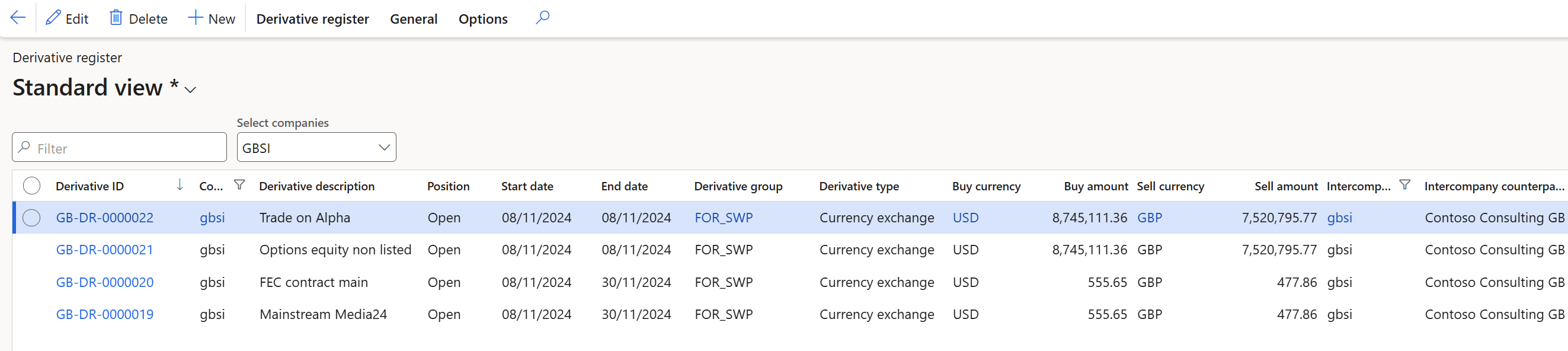

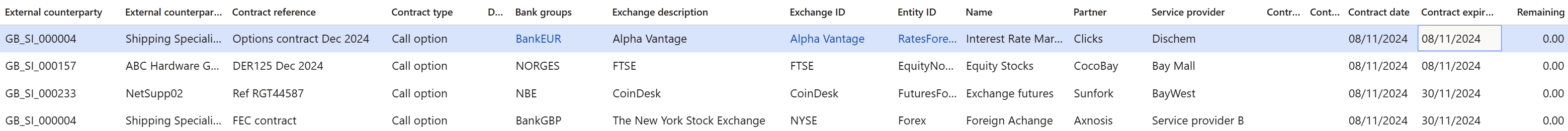

¶ Step 9: Derivative register list page

- Users can filter on Derivative type

- The column called Position displays Open derivatives

- Derivative register keeps track of the remaining value.

- View of list page when scrolling right

- Derivative ID: system generated number

- Derivative type: automatically populated when Derivative type ID is selected

- Derivative type ID: short code for Derivative type, can be chosen from options menu

- Currency swaps (Cur/SW)

- Future contracts (FT)

- Forward contracts (FW)

- Swaps (In/SW)

- Option – Call (OPC)

- Option – Put, etc. (OPP)

- Swaps (SW)

- Derivative sub-type to be selected from dropdown menu options:

- Call Option (OPC)

- Commodities (FT)

- Currency (Cur/SW)

- FEC contracts (FW)

- Interest (In/SWO

- Payments (SW)

- Put Option (OPP)

- Derivative description

- Bank groups

- Exchange description

- Exchange ID

- Position

- Risk strategy description

- Risk strategy ID

- Start date

- End date

- Entity ID

- Name

- Contract description

- Partner

- Contract reference

- Service provider

- Contract type ID

- Contract date

- Contract expiry date

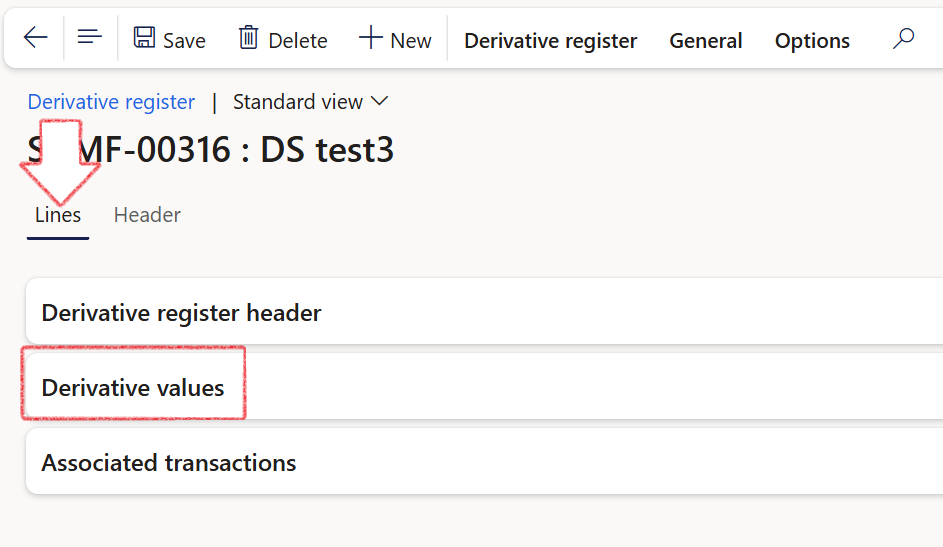

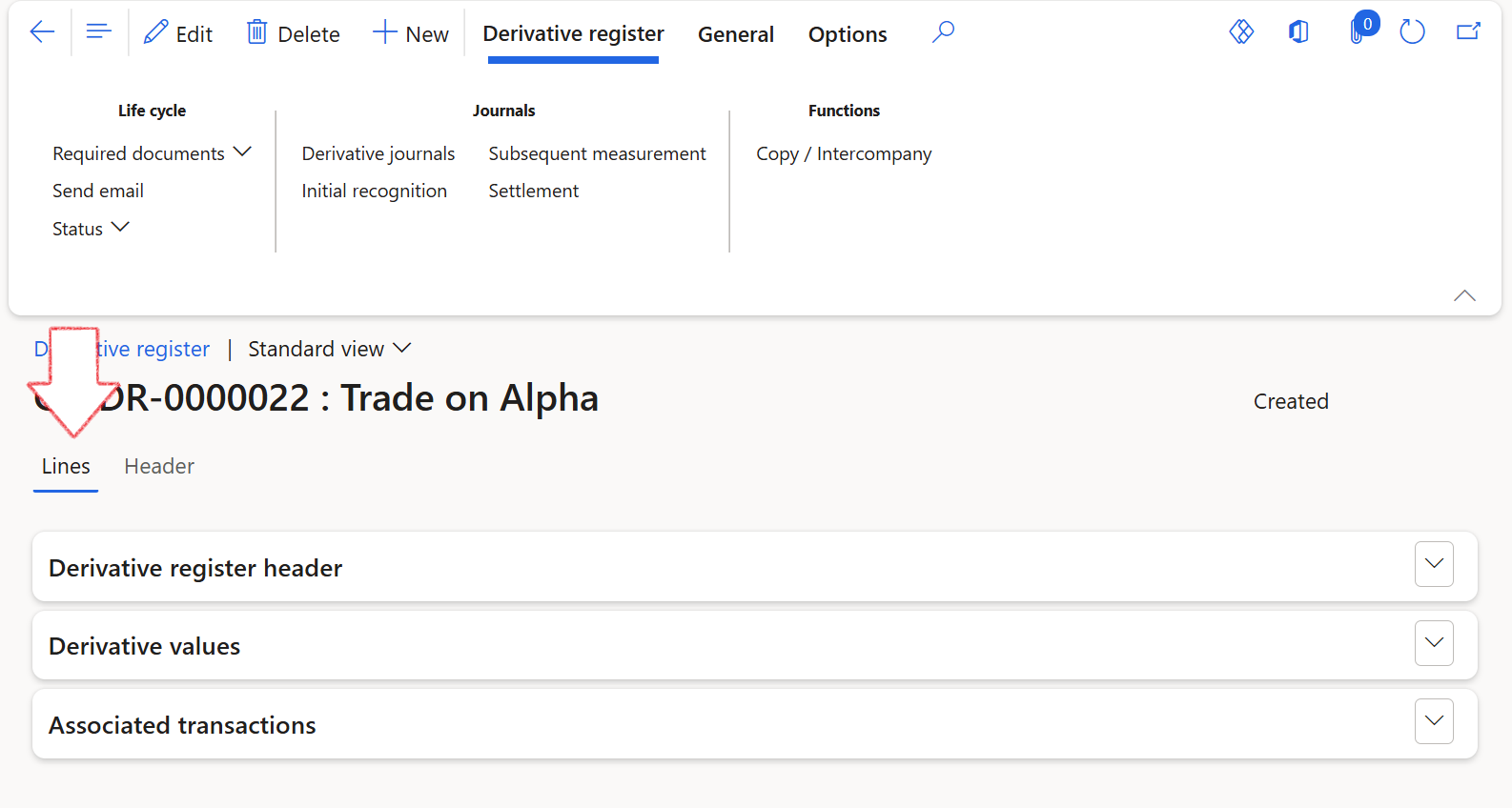

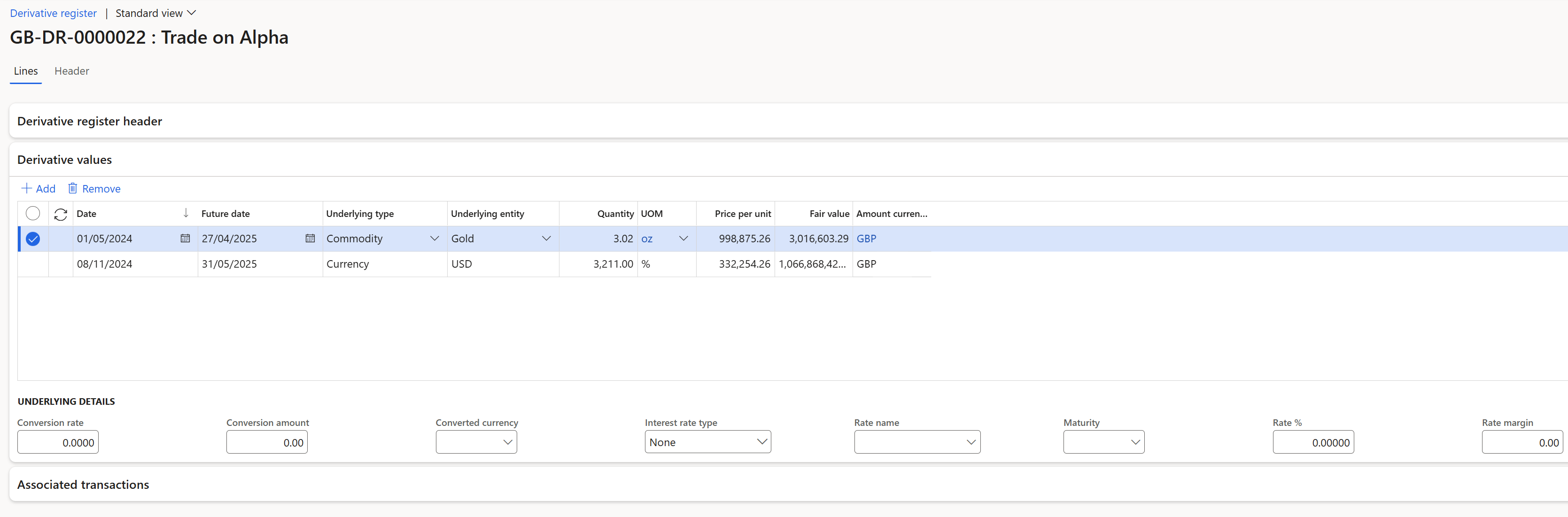

¶ Step 10: Derivative register details page

The following FastTabs can be viewed when opening a specific Derivative item on the Derivative Lines index tab:

- Derivative register header

- Derivative values

- Associated transactions

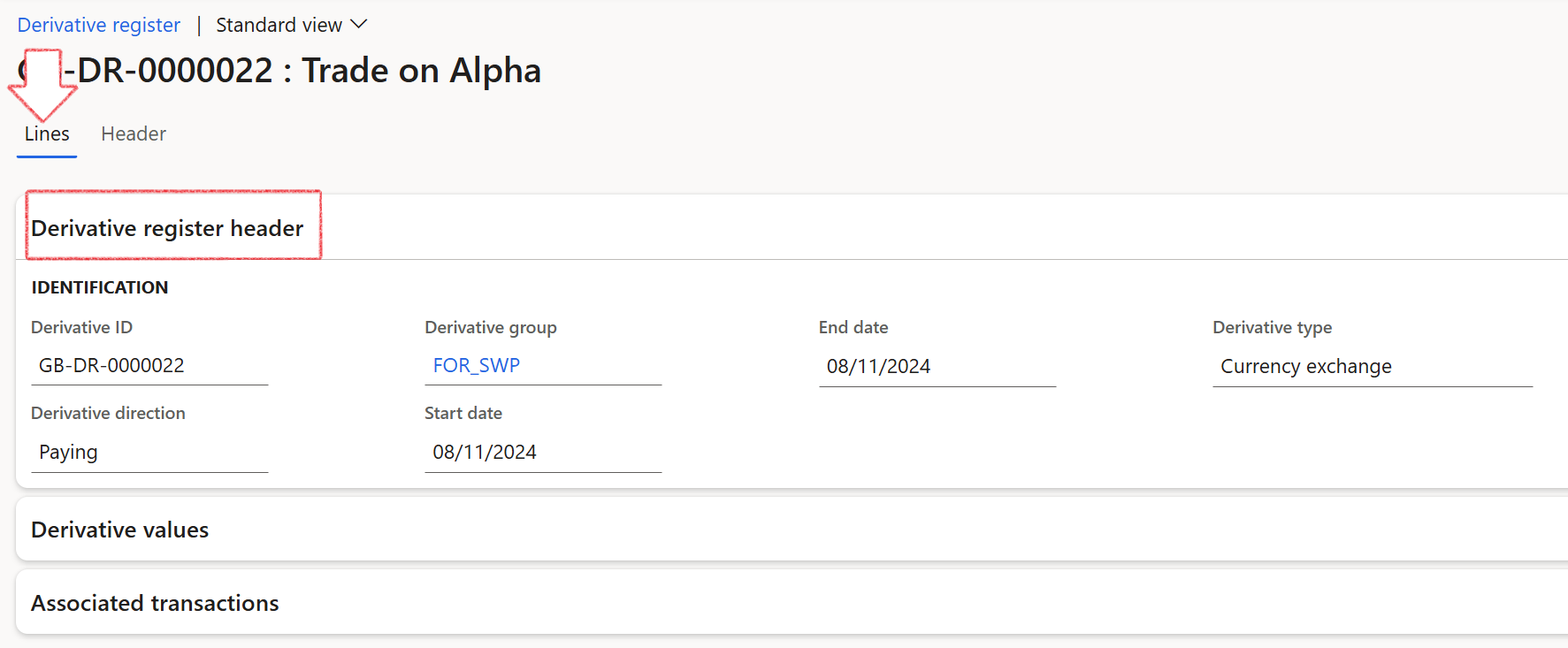

¶ Step 10.1: Derivative register header FastTab (under Lines section)

- Identification

- Under the Identification section, the user can select Paying or Receiving for the Derivative group from the drop-down list

- If the user selected a derivative group for Paying, that derivative will be available for use on Purchase Orders

- If the user selected derivative group of Receiving, that derivative will be available for use on Sales Orders.

The External counterparty field is a drop-down to the vendor master table.

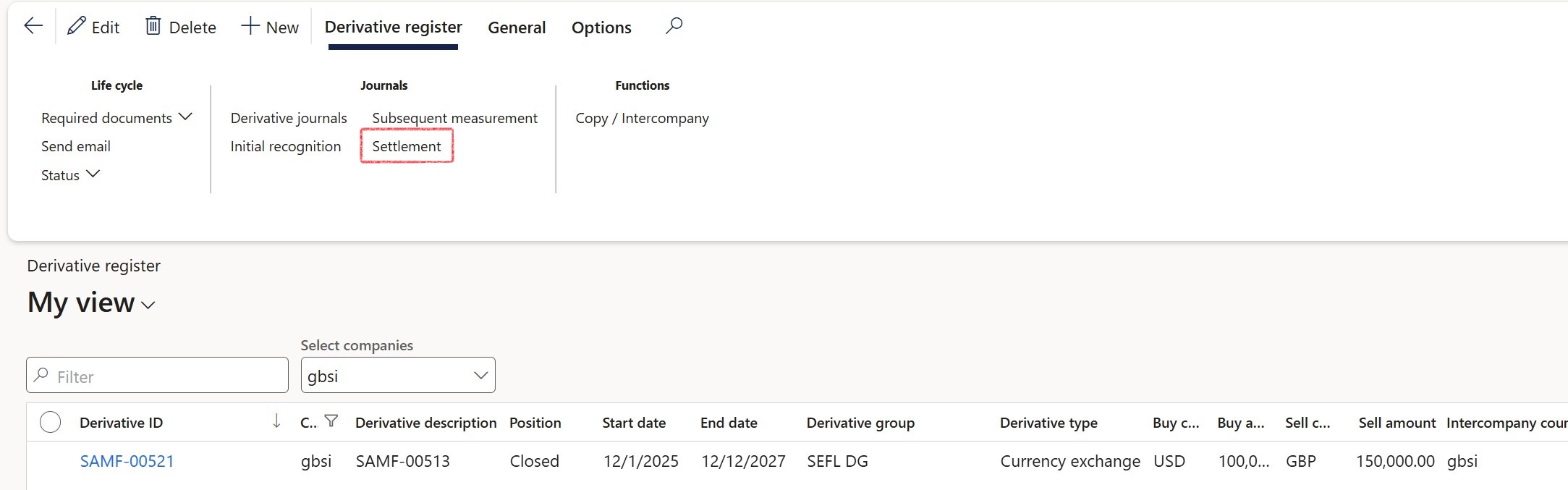

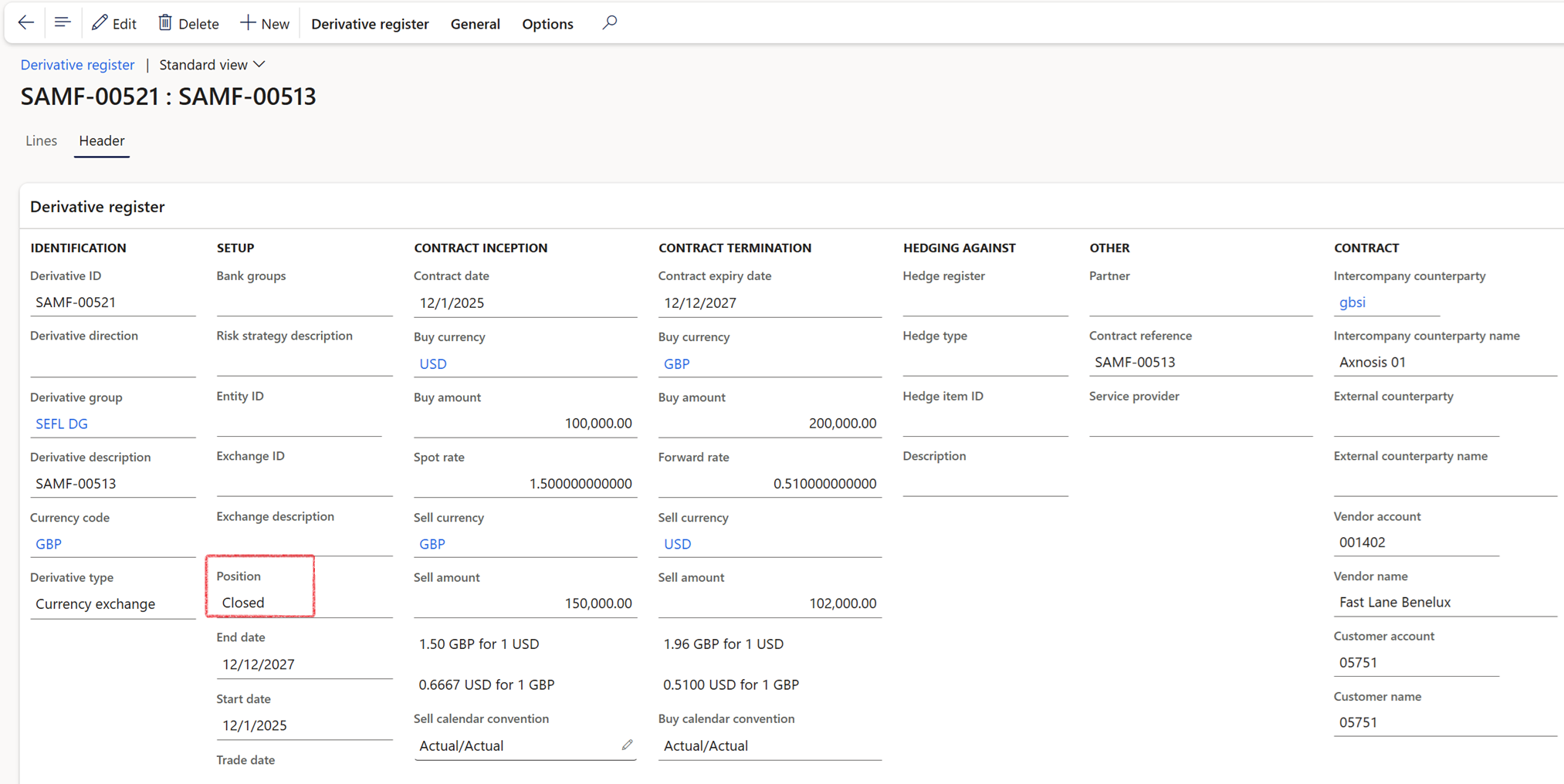

The Position field on each Swap header will automatically update from Open to Closed when a Settlement journal is successfully posted. By default, the Position is set to Open upon swap creation.

External counterparty is the vendor account of a third party

¶ Step 10.2: Derivative values FastTab

The following FastTabs can be viewed when opening a specific Derivative item on the Derivative Header section:

- Derivative register

- Derivative values

- Associated transactions

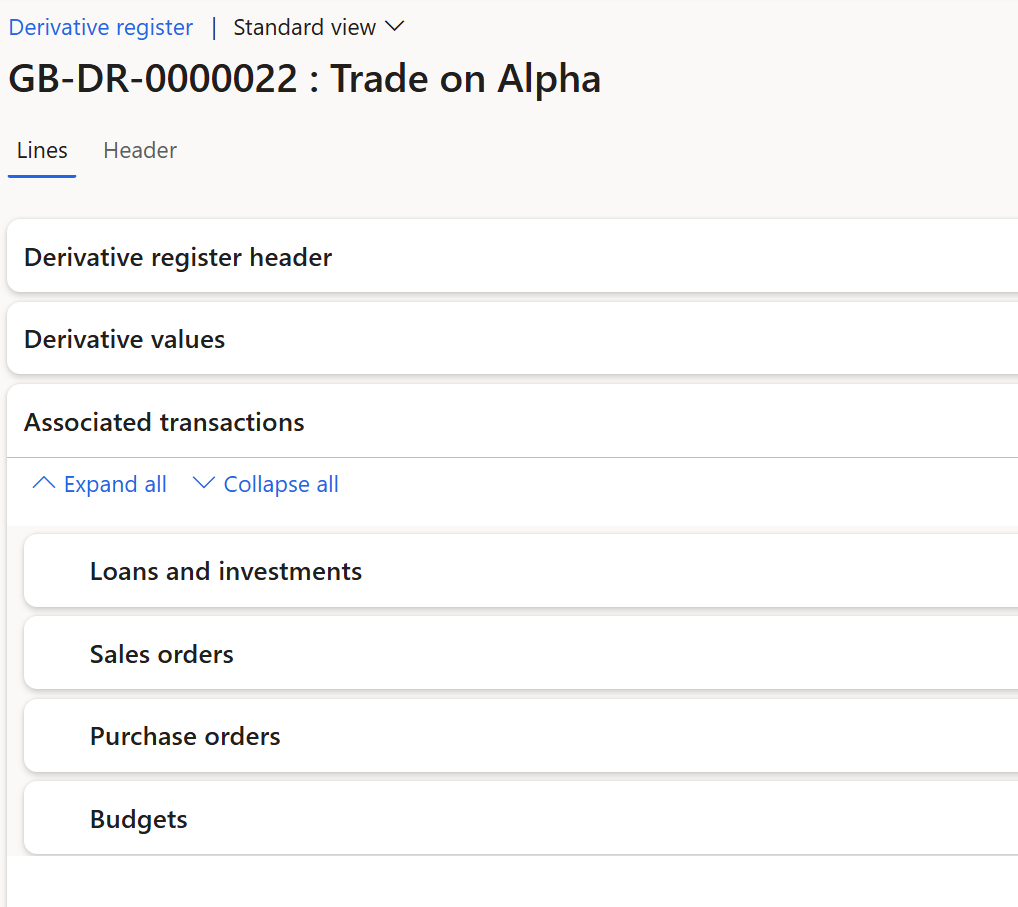

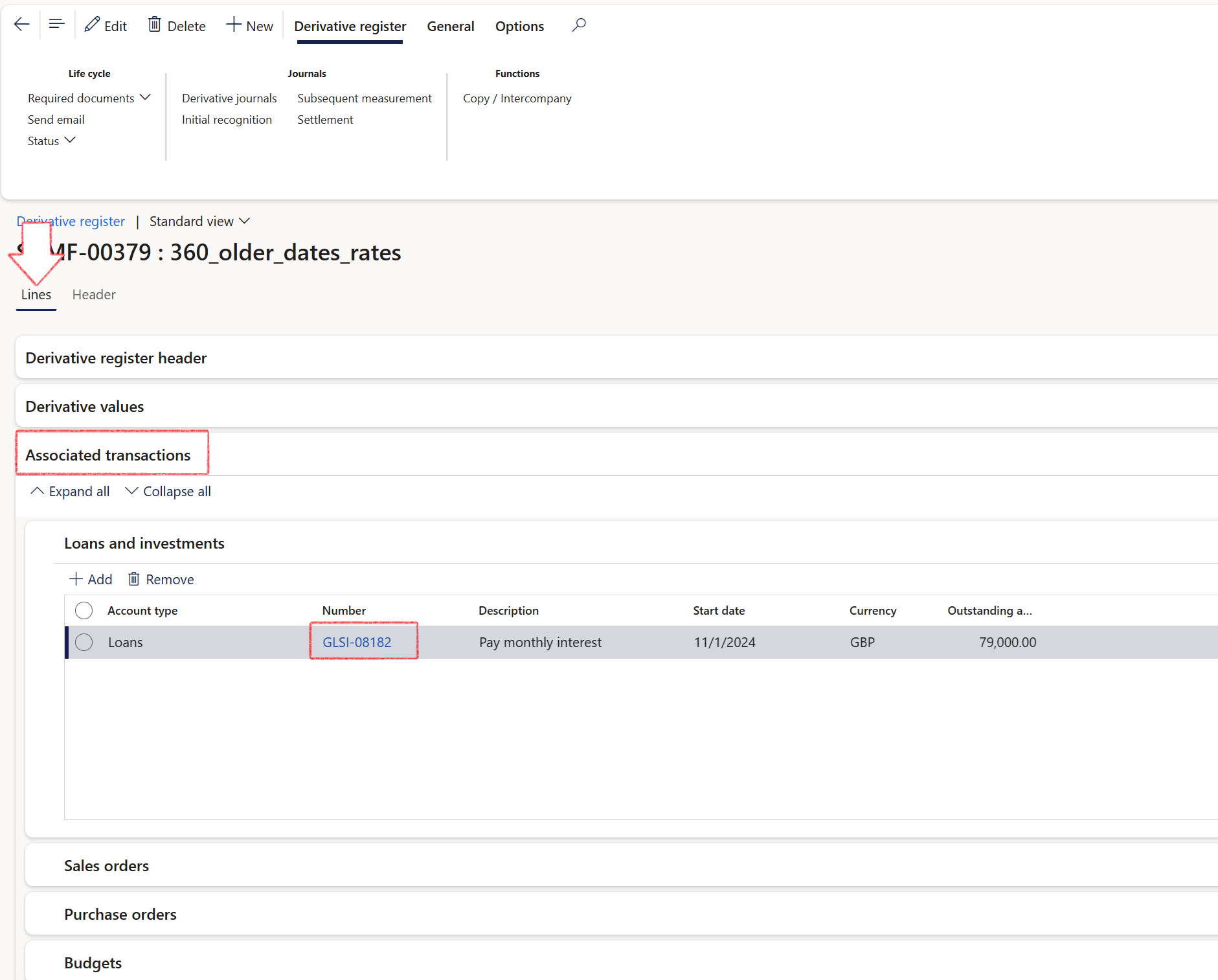

¶ Step 10.3: Associated transactions FastTab

- Loans and investments

- Sales orders

- Purchase orders

- Budgets

¶ Step 10.3.1 : Loans and Investments

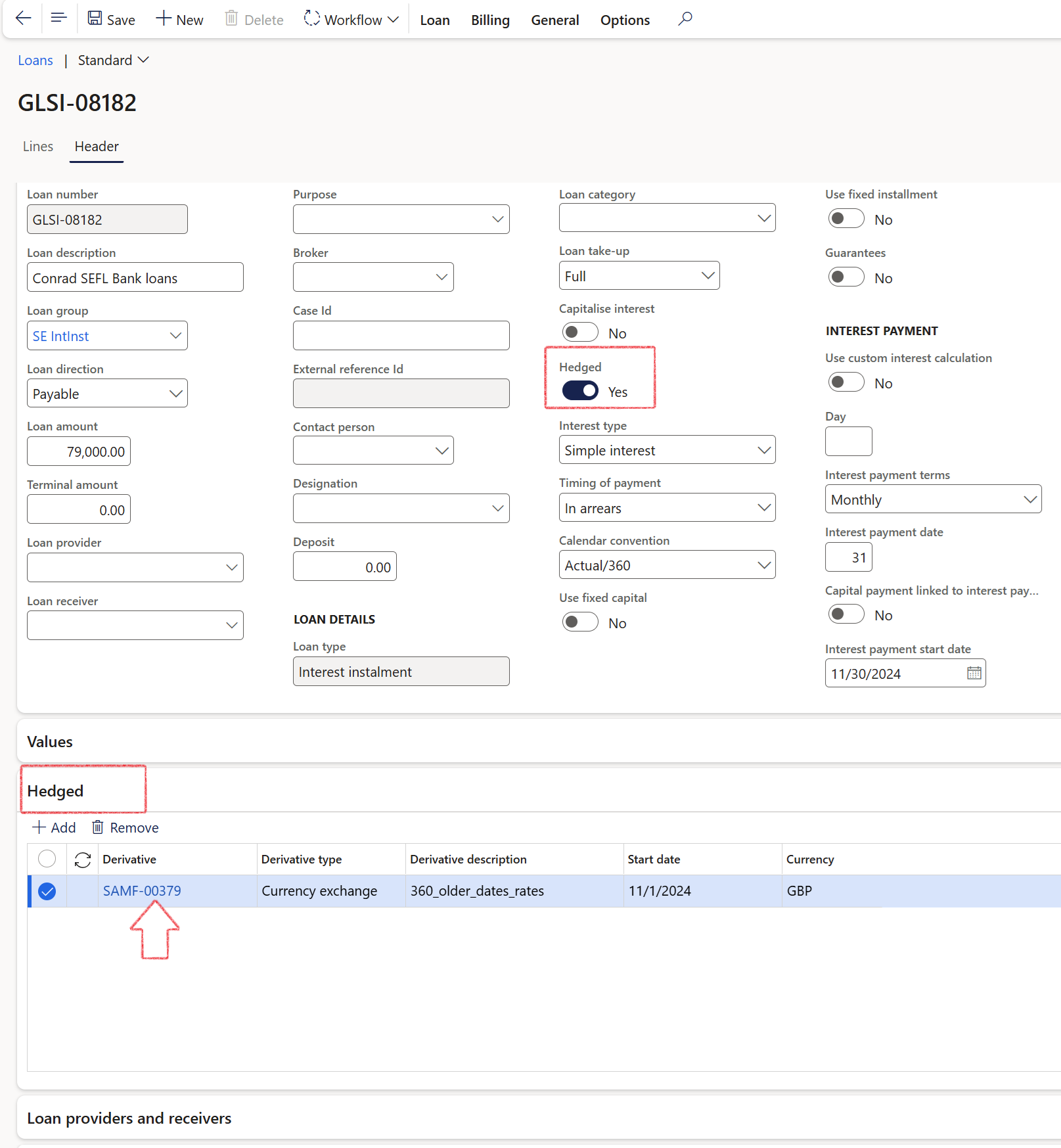

¶ Linking loans to currency swaps

The sequence of loan creation and derivative creation can occur in either order. Associating one product with the other will automatically register the linked record. When a loan is linked from the Derivative register, the loan fields are automatically populated, and the Hedge toggle is set to Yes with the FastTab displayed. Conversely, when a derivative instrument is linked from a loan, the relevant fields in the derivative register are also populated accordingly

When the toggle for Hedged is set to yes on the Header index tab of the loan details page, a FastTab labeled Hedged will appear. This section, known as the Hedged FastTab, includes options to add or remove entries. It contains columns for:

- Derivative

- Derivative type

- Derivative description

- Start date

- Currency

In the Derivative register, located under the Loans and investments FastTab, the associated Loan number appears as a hyperlink. This field is automatically populated when linking the derivative instrument from the Loan page

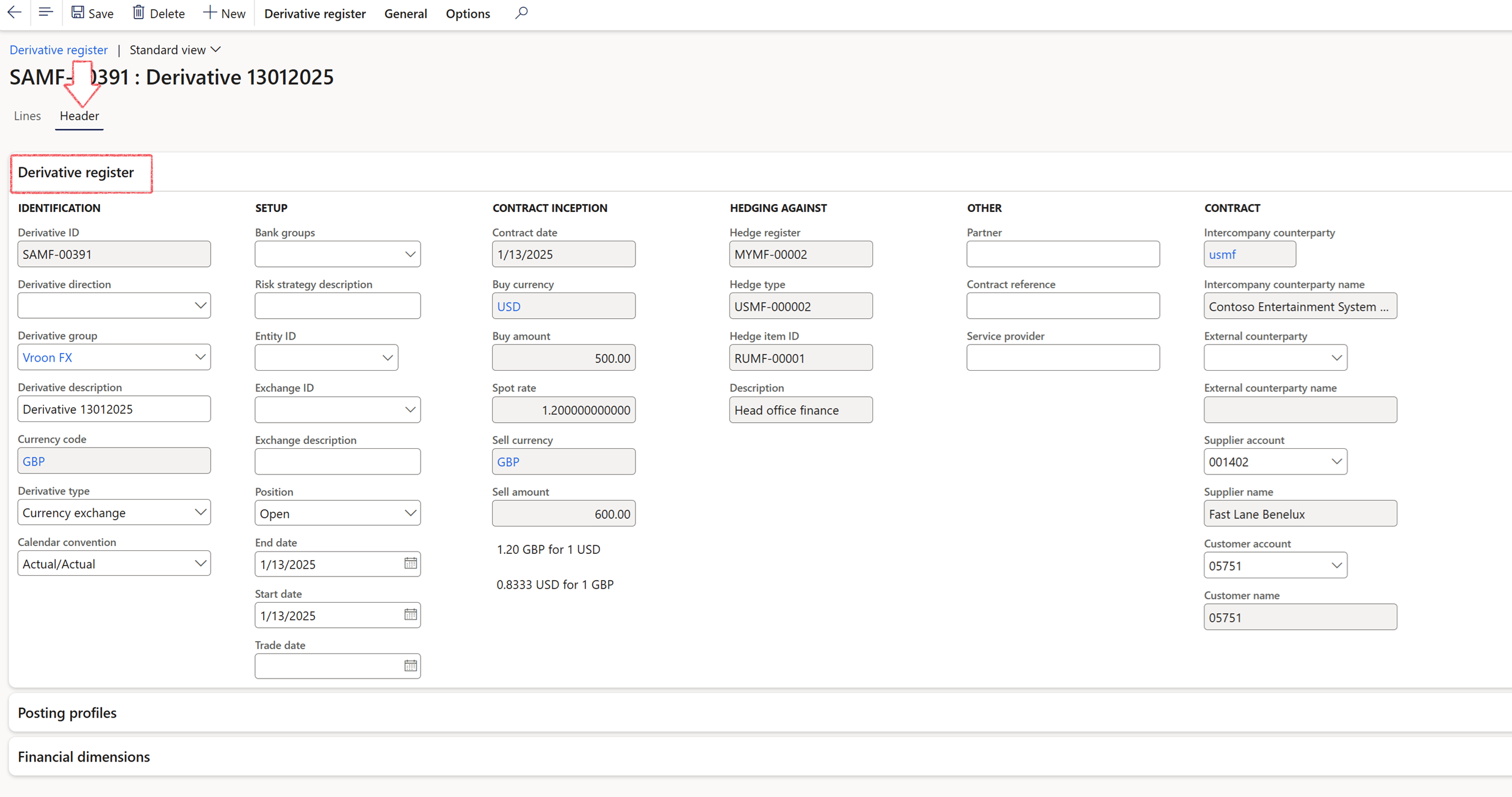

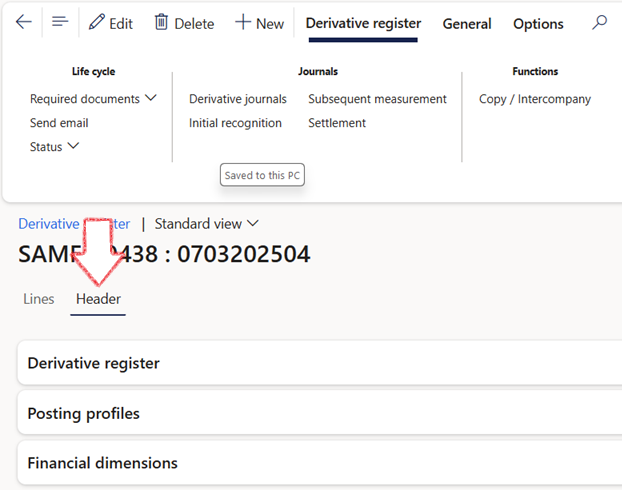

¶ Step 11: Header index tab

The following FastTabs can be viewed when opening a specific Derivative item on the Derivative Header index tab:

- Derivative register

- Posting profiles

- Financial dimensions

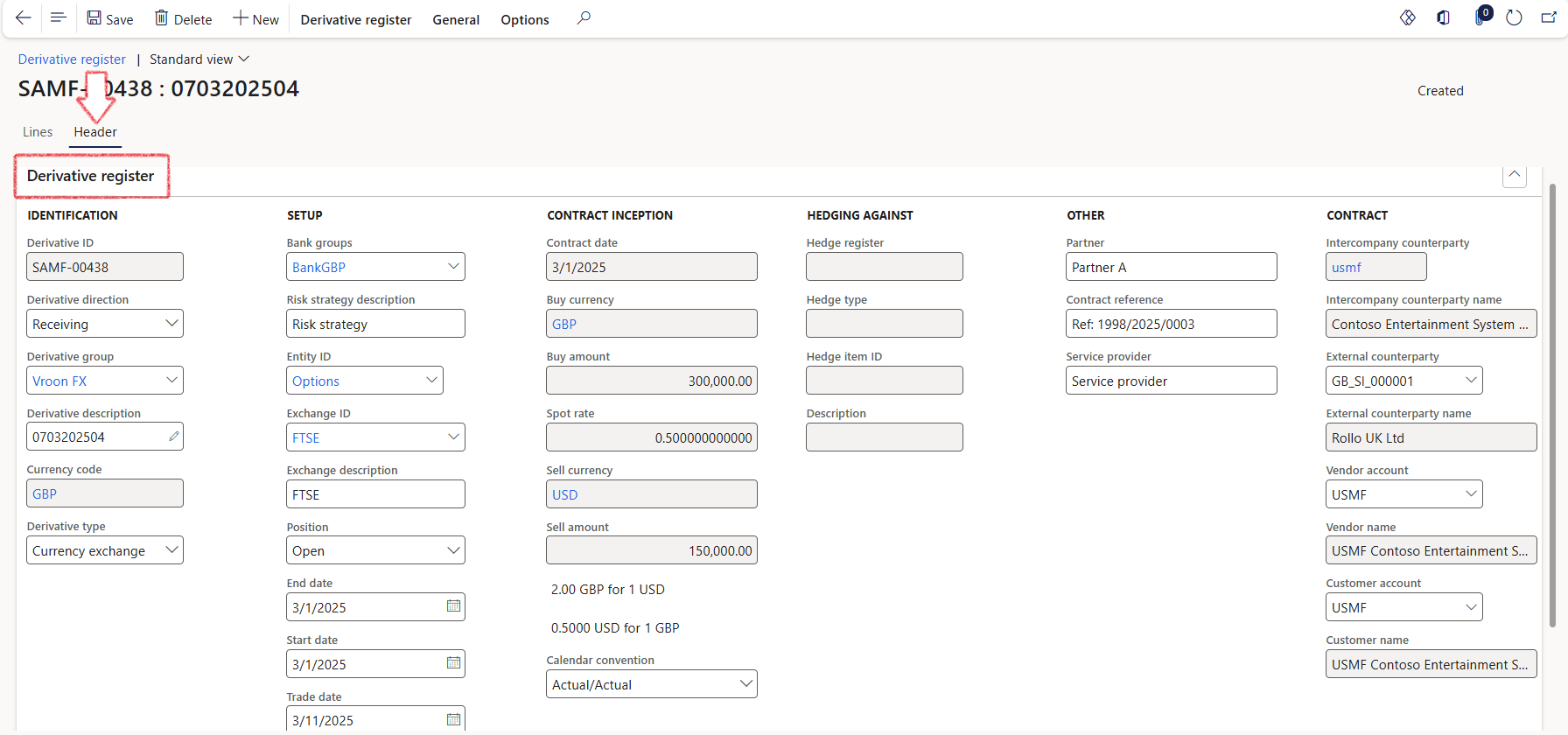

¶ Step 11.1: Derivative register FastTab

When expanding the derivative register FastTab, the following sections can be viewed:

- Identification

- Setup

- Contract inception

- Hedging against

- Other

- Contract

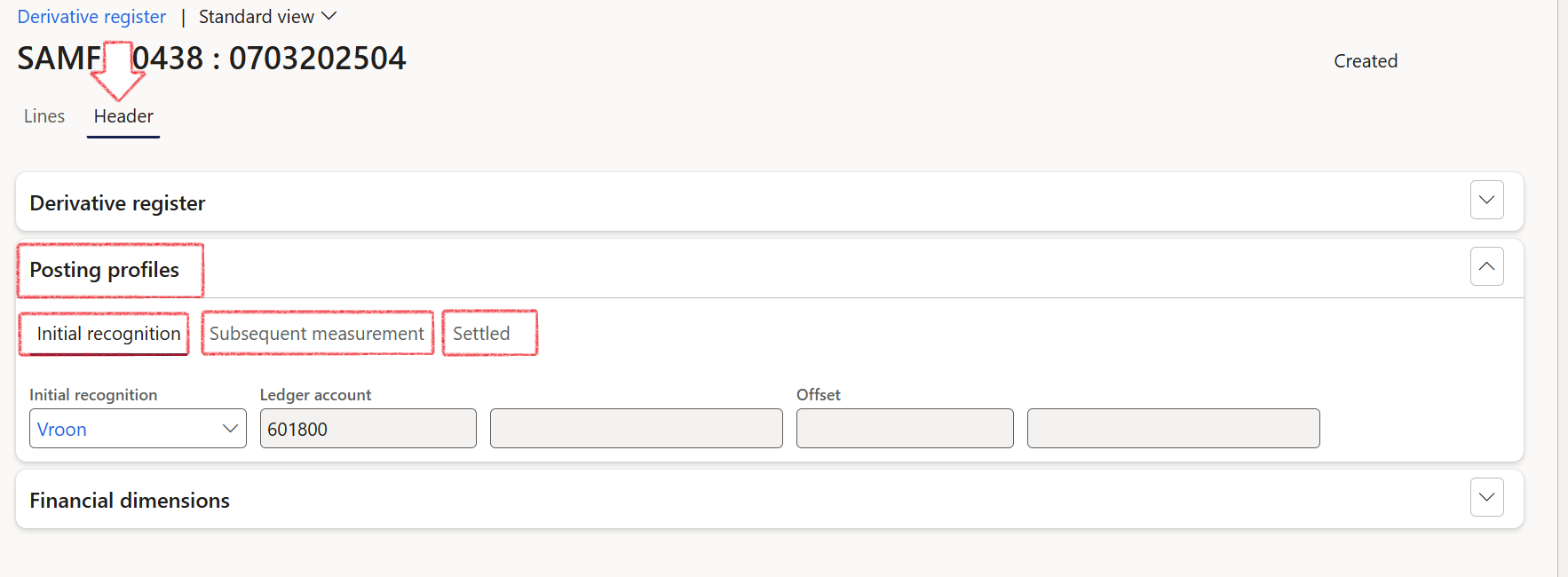

¶ Step 11.2: Posting profiles FastTab

Profiles linked to this derivative can be viewed by expanding the Posting Profiles FastTab.

- Initial recognition

- Subsequent measurement

- Settled

¶ Step 11.3: Financial dimensions FastTab

When you expand the Financial Dimensions FastTab, the Debit and Credit default financial dimensions will be displayed in detail.

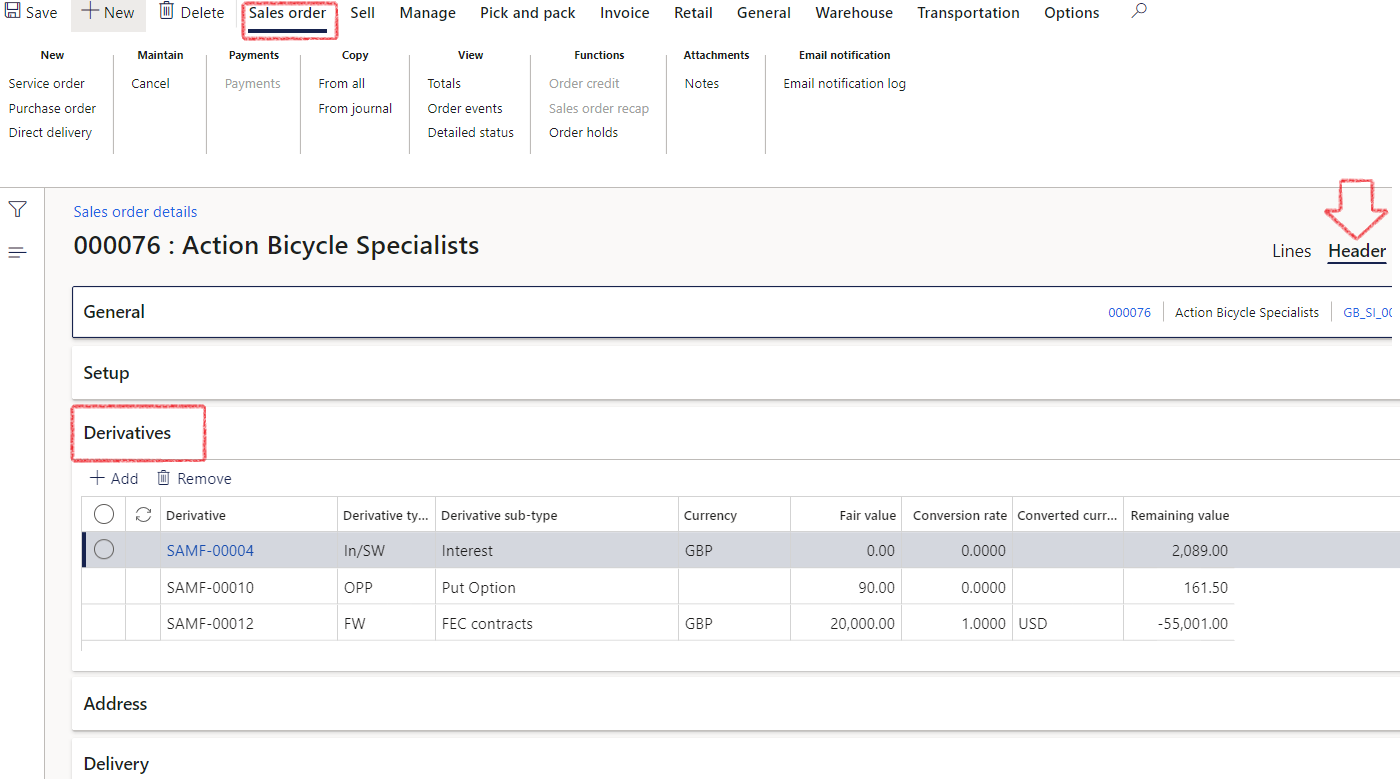

¶ Step 12: Sales orders and Derivatives

To link a derivative to a specific Sales Order, go to:

- Accounts Receivable > Orders > All sales orders

- Open an existing sales order

- Expand the Header section

- Expand the Derivatives FastTab

- Click on Add

- Select a Derivative from the drop-down menu

- Click Save

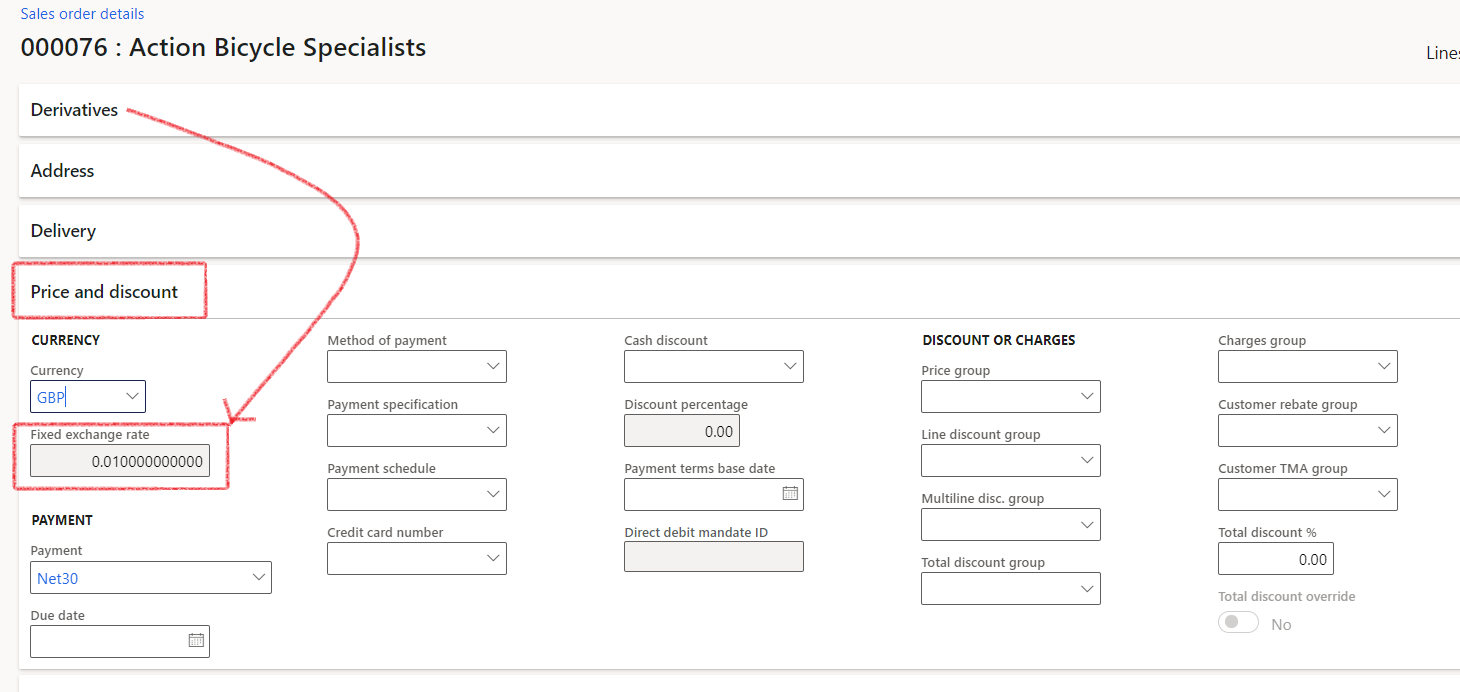

The rate negotiated on the forward exchange contract (Derivative) will populate to the Price and discount FastTab, into the field Fixed exchange rate on the Sales Order header and be used for posting purposes.

- Once the derivative has been selected on the Sales order, it will update the Fixed Exchange Rate field and Derivative conversion rate fields on the Derivatives fast tab on the Sales Order.

- An open value to exist, if value is less than zero, an error message will appear

- When changing the Derivative, it will update the exchange rate on the Sales Order header. Creating a second derivative against the same Sales Order, will override the rate.

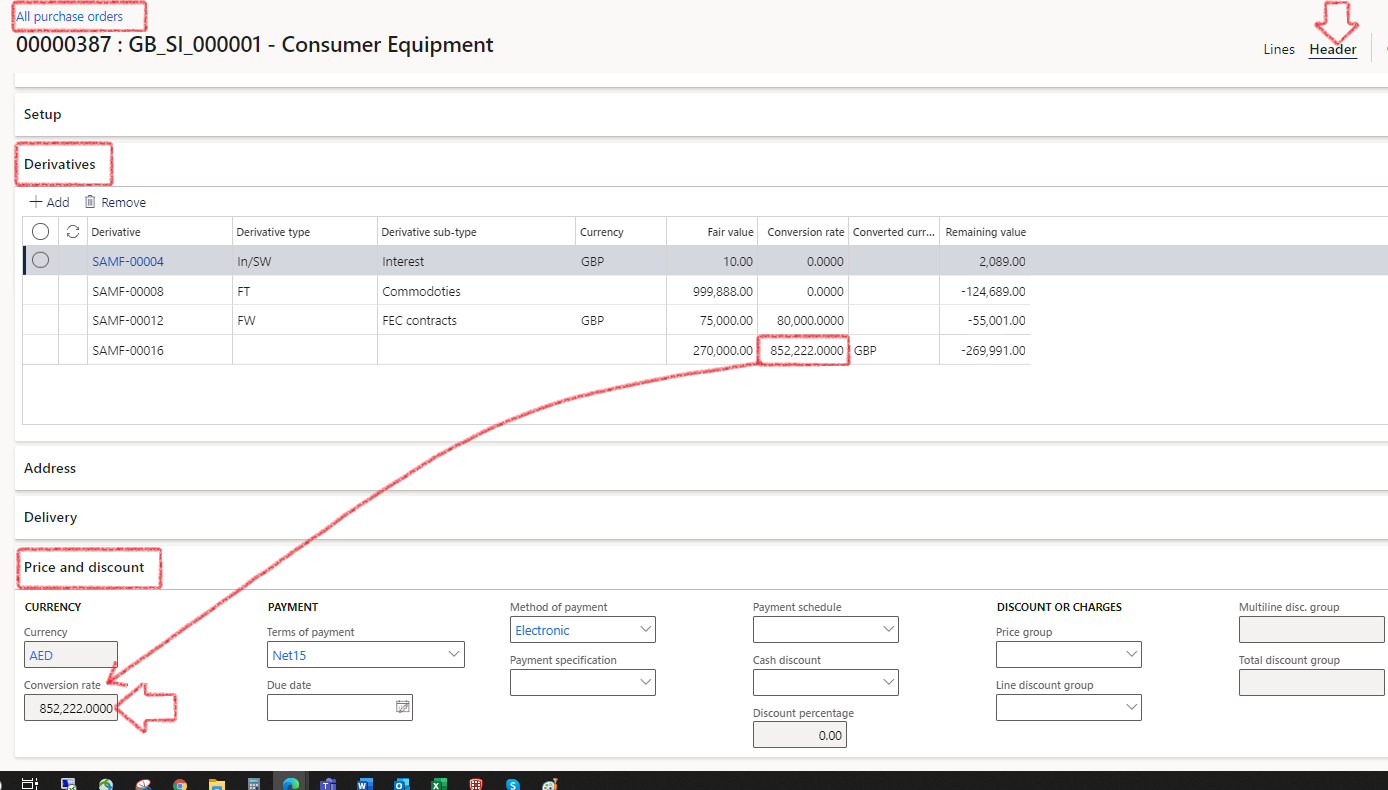

¶ Step 13: Purchase orders and Derivatives

When adding a Purchase order to the Derivative, it will automatically appear on the Purchase Order as well. To view the linked derivative or to add derivatives to the Purchase Order, go to:

- Accounts Payable > Purchase orders > All purchase orders

- Open an existing purchase order

- Expand the Header section

- Expand the Derivatives FastTab

- Click on Add

- Select a Derivative from the drop-down menu

- Click Save

The rate negotiated on the forward exchange contract (Derivative) will populate to the Price and discount FastTab, into the field Conversion rate on the Purchase Order header and be used for posting purposes.

- On Purchase Order Invoice posting stage, on the Invoice header, Setup FastTab, the user can choose to include derivatives or not

Once the derivative has been selected on the Purchase order, it will update the Fixed Exchange Rate field and Derivative conversion rate fields on the Derivatives FastTab on the Purchase Order.

- An open value to exist, if value is less than zero, an error message will appear

- When changing the Derivative, it will update the exchange rate on the Purchase Order header. Creating a second derivative against the same Purchase Order, will override the rate.

¶ Step 14: Derivative Journals

Derivative journals are created to record the accounting transactions of derivative contracts. It includes the initial recognition journal, subsequent measurement journal and settlement journal. Posting profiles should be set up before derivative journals can be created and posted.

If a derivative has any posted or unposted journals, it will be non-deletable. When attempting to delete a derivative with an Intercompany counterparty that has existing journals (posted or unposted), the following warning will be displayed: Note: Journals already exist for the intercompany counterparty. Are you sure you want to delete? with options for Yes or No

All derivative journals generated will be marked with an Approved status, ensuring they are available for settlement at a later time. This applies to entries posted to both customer and vendor accounts.

Intercompany counterparty is the legal entity of the copied counterparty

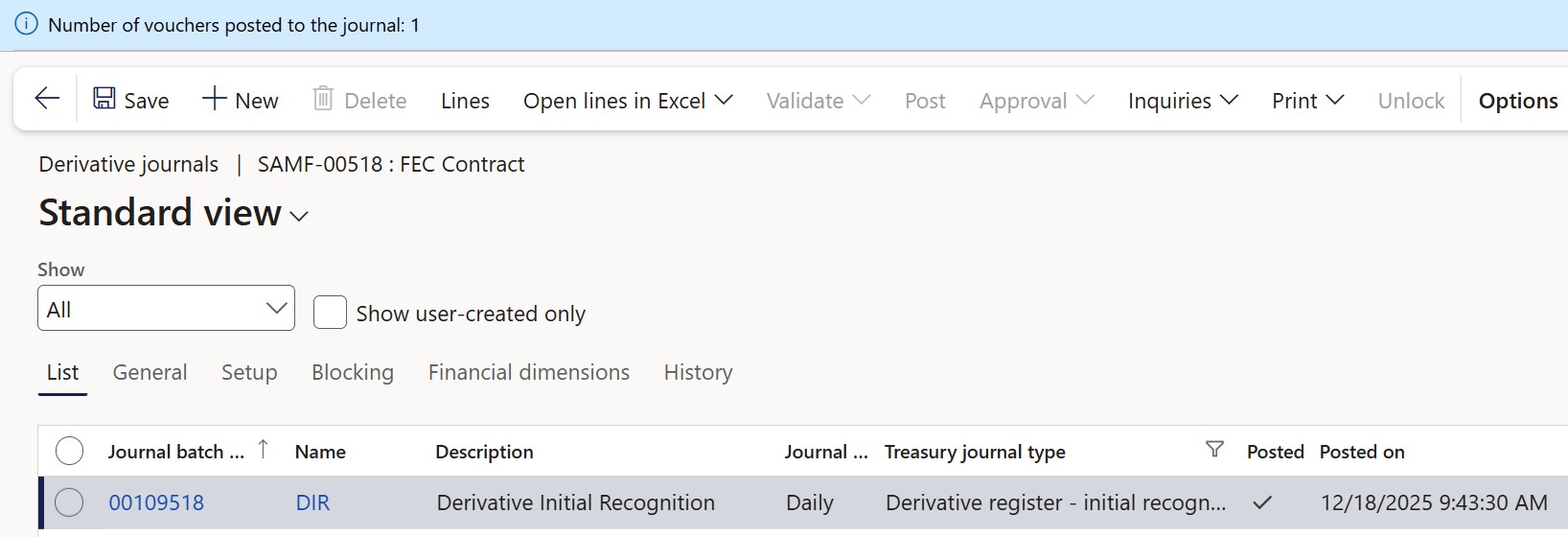

¶ Step 14.1: Initial Recognition Journal

Once the derivative contract has been created the initial recognition journal is created. It can be set up with that the journal is automatically posted, or the journal can be reviewed before the journal is posted.

- Navigate to: Treasury > Hedges and Derivatives > Derivative register

- Click on New and complete the necessary fields

- Click on OK

- The journal is automatically created

- Navigate to the Derivative Register menu on the Derivative contract, the journal has been created:

The system supports two methods for balancing Initial Recognition Journals (IRJ) for currency swaps, providing flexibility in how forex-related journal entries are handled.

Balancing Options

- By default, the original method balances both the Spot and Forward legs by adjusting forex rates at the line level.

- Alternatively, the IRJ can balance at the total journal level using standard DFO GL exchange rates, without adjusting rates per individual line. This approach simplifies the journal structure and avoids custom rate calculations on each leg.

Configuration

The balancing method is controlled by the Use accounting rates toggle in the Derivative Groups setup:

- Yes – Uses accounting exchange rates from the last day of the period before the journal start date. The journal balances as a whole, and line-level variances offset each other.

- No – Applies the original method with calculated exchange rates per line to balance the Spot and Forward legs individually.

The profit and loss calculation logic remains unchanged across both methods.

No impact is expected on other derivative journals or reports.

This configuration supports a more transparent and standardized accounting approach for environments where use of official GL exchange rates is preferred.

On the Initial recognition journal for Derivatives, when a profit situation exist (i.e., the sum of Liability Accrual and Asset Accrual resulted in a credit balance), the GL account is identified for Swap profit to accrue.

The line for the Swap Asset Accrual will balance with a corresponding debit and credit.

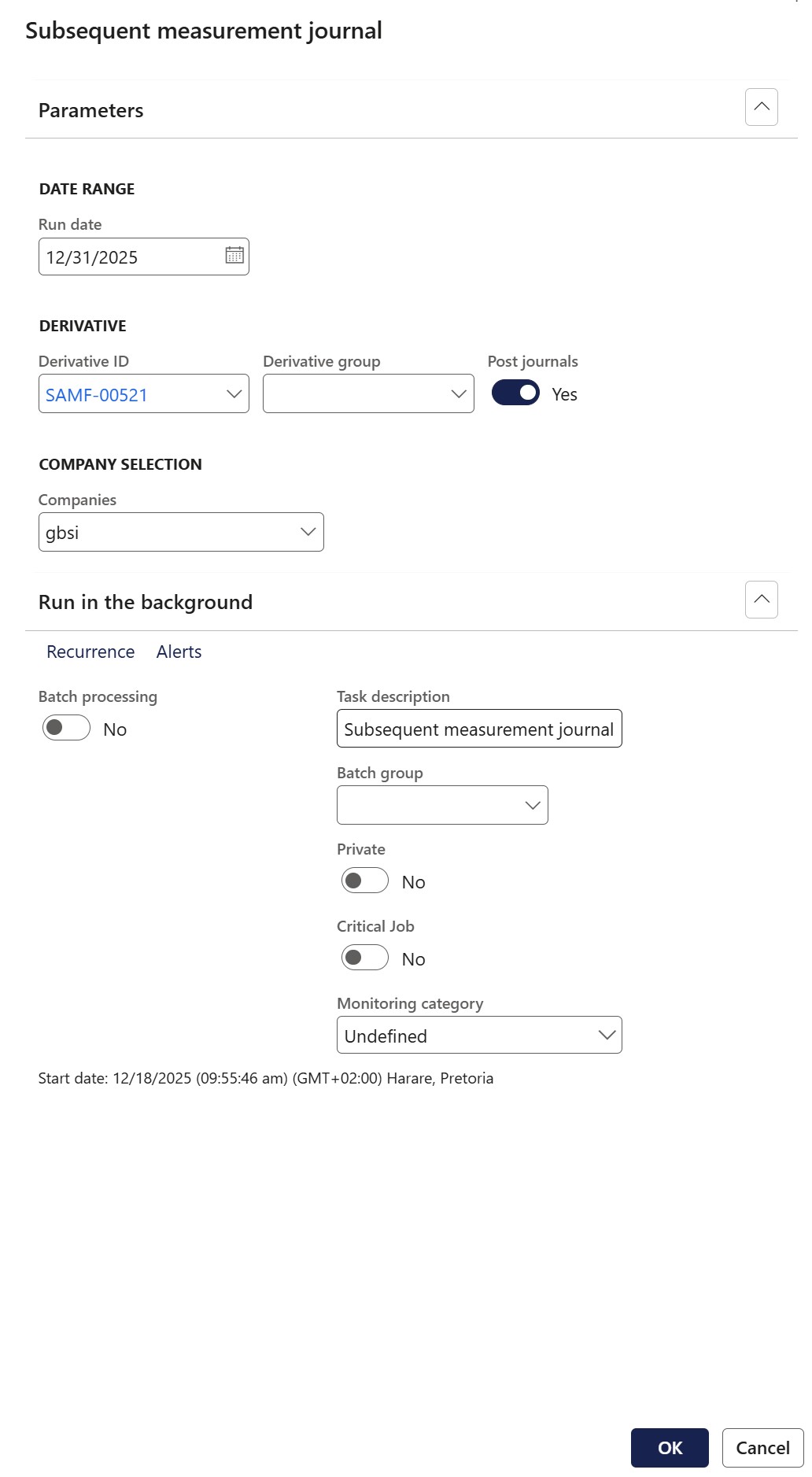

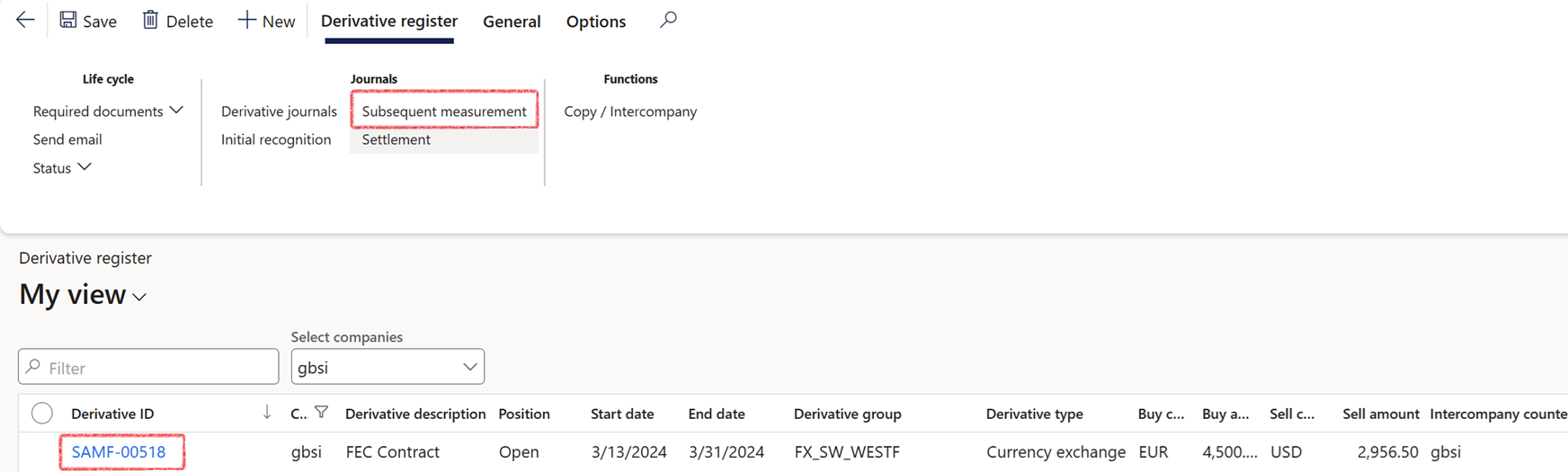

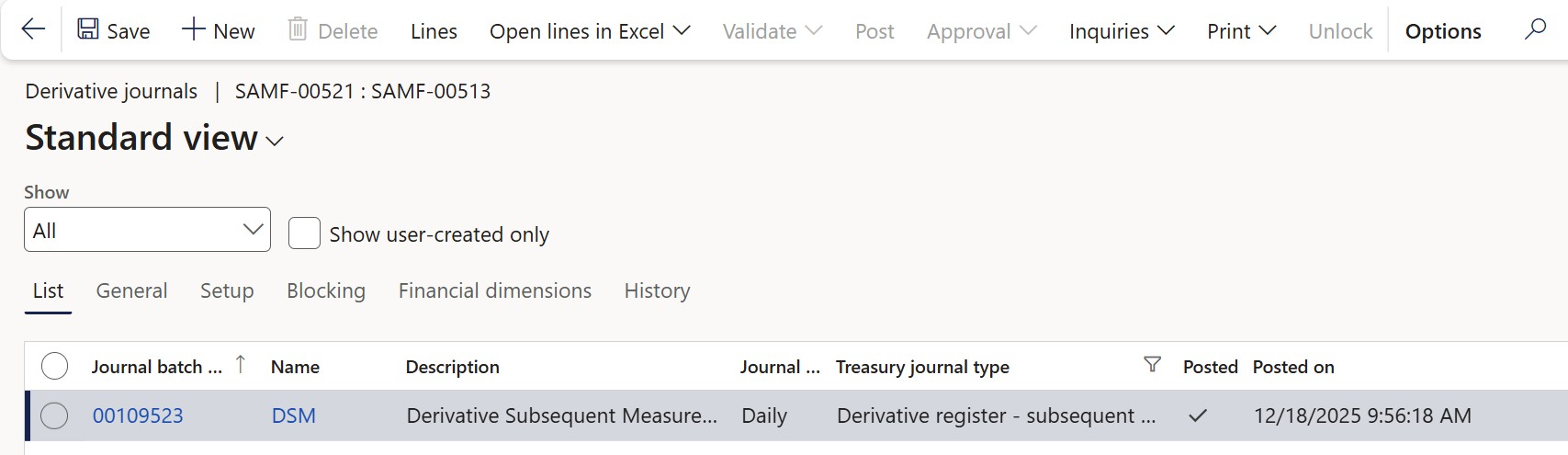

¶ Step 14.2: Subsequent Measurement Journal

If the contract period is over multiple months, the contract should be re-measured at each month end.

- Navigate to: Treasury > Hedges and Derivatives > Periodic > Subsequent Measurement journal

- Click on Subsequent Measurement Journal, complete the necessary fields and click on OK

- Enable the Post journal setting to Yes if the journal should be posted automatically

- Navigate to the Derivative Register menu on the Derivative contract, the journal has been created:

No Subsequent Measurement journal will be created after a contract expires

Closed positions will not generate a Subsequent Measurement journal.

To prevent duplicates, only one Subsequent Measurement journal can be posted in a month.

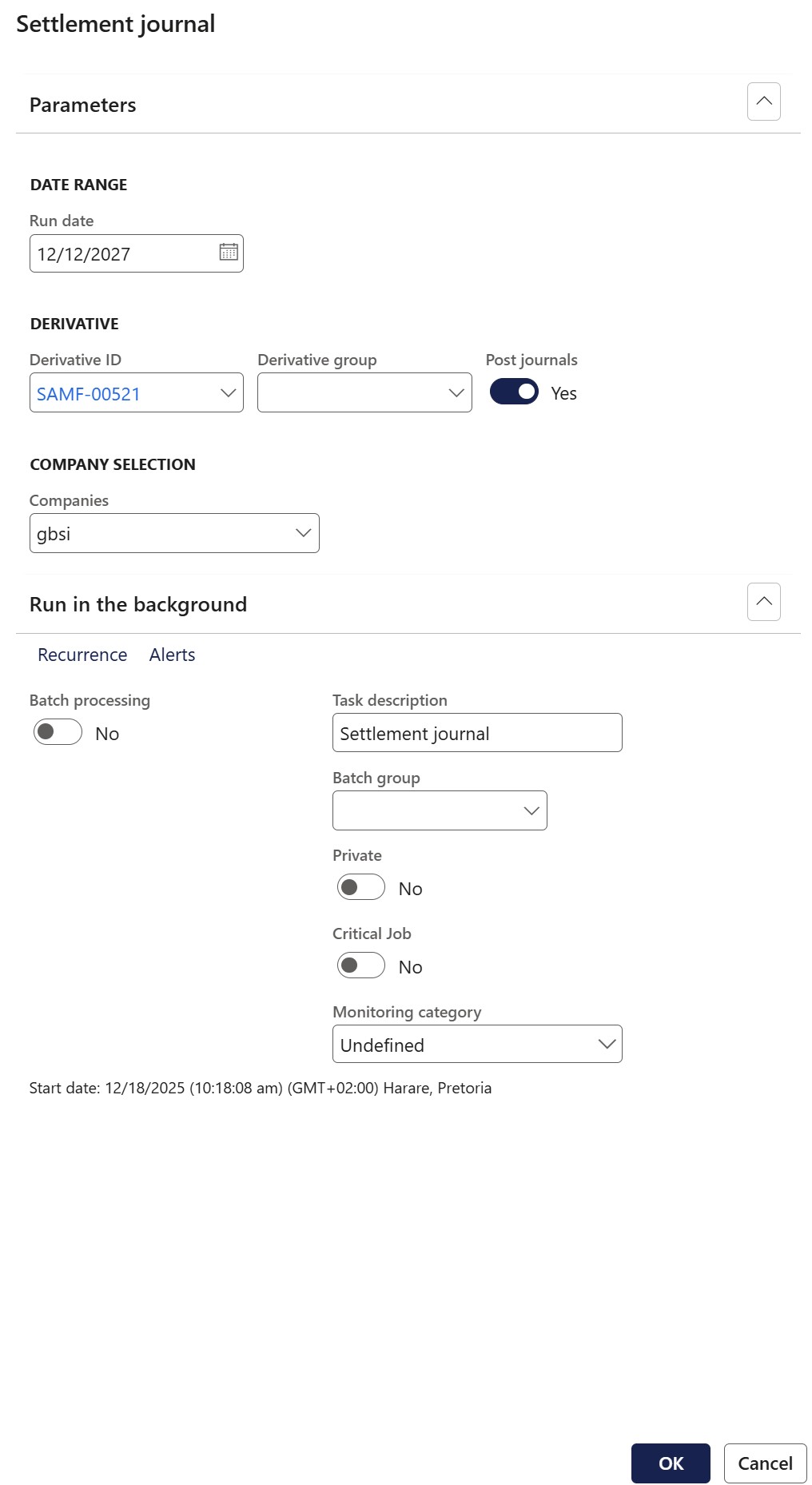

¶ Step 14.3: Settlement Journal

When the contract terminates the settlement journal should be created and posted to settle the contract

- Navigate to: Treasury > Hedges and Derivatives > Periodic > Settlement journal

- Click on Settlement Journal, complete the necessary fields and click on OK

- Enable the Post journal setting to Yes if the journal should be posted automatically.

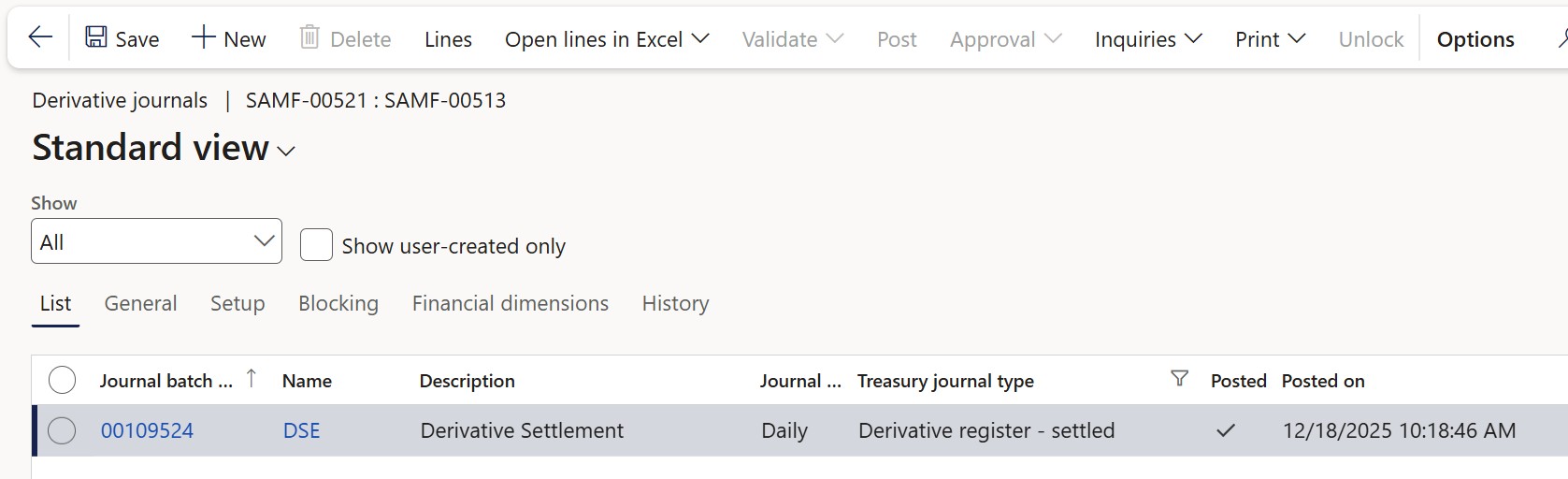

- Navigate to the Derivative Register menu on the Derivative contract, the journal has been created:

If a derivative has any posted or unposted journals, it will be non-deletable. When attempting to delete a derivative with an Intercompany counterparty that has existing journals (posted or unposted), the following warning will be displayed:

Note: Journals already exist for the intercompany counterparty. Are you sure you want to delete?with options for Yes or No.

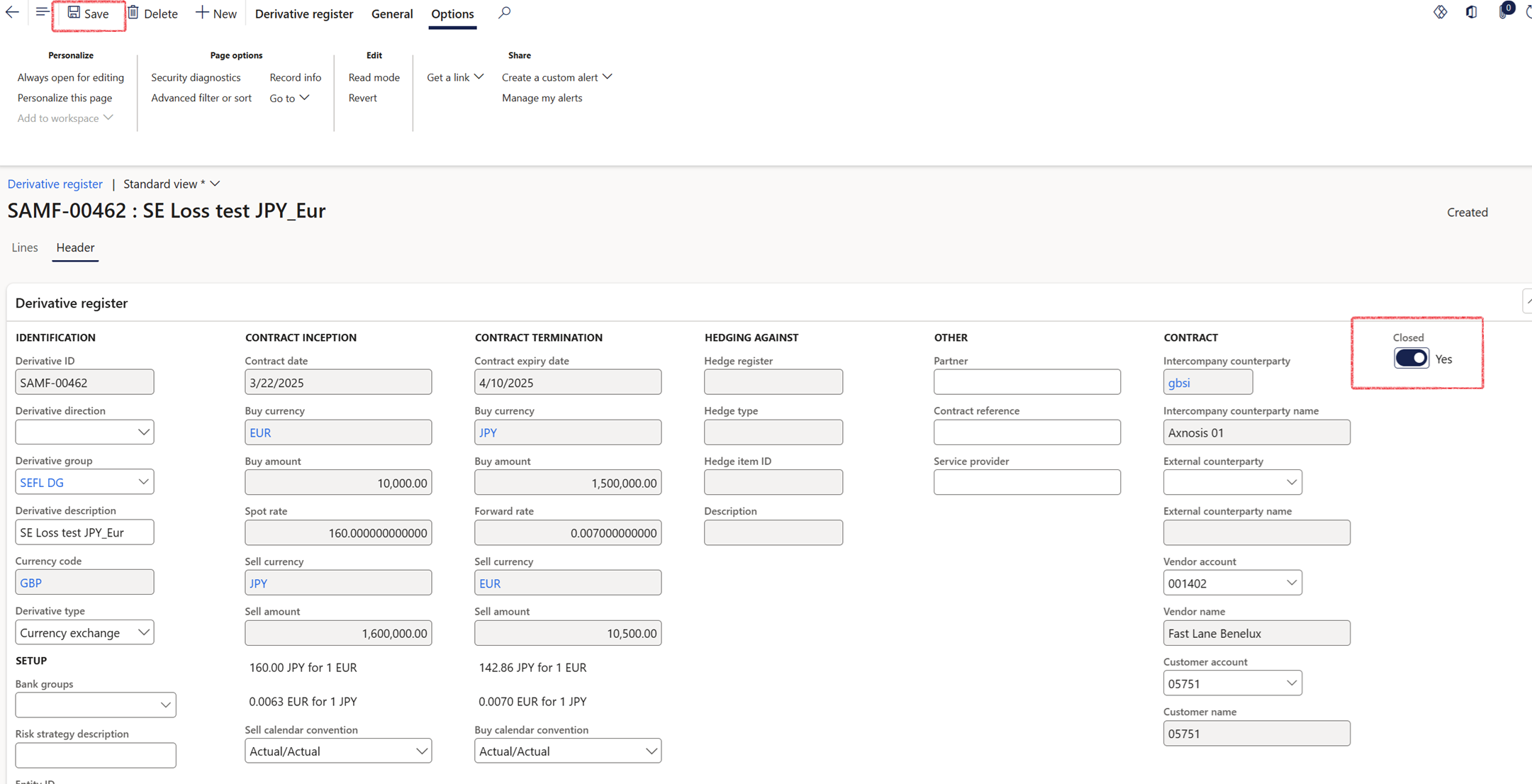

The Position field on each Swap header automatically updates from Open to Closed when a Settlement journal is successfully posted. By default, the 'Position' is set to Open upon swap creation.

When settling a derivative dual interest swap, the system now uses the GL exchange rate for the settlement journal. Previously, the settlement process sourced the exchange rate from the derivative contract itself. This has been updated to ensure consistency with the logic used during initial recognition and subsequent measurement journals. All stages of processing a derivative dual interest swap now consistently use GL exchange rates, not the exchange rate from the derivative header.

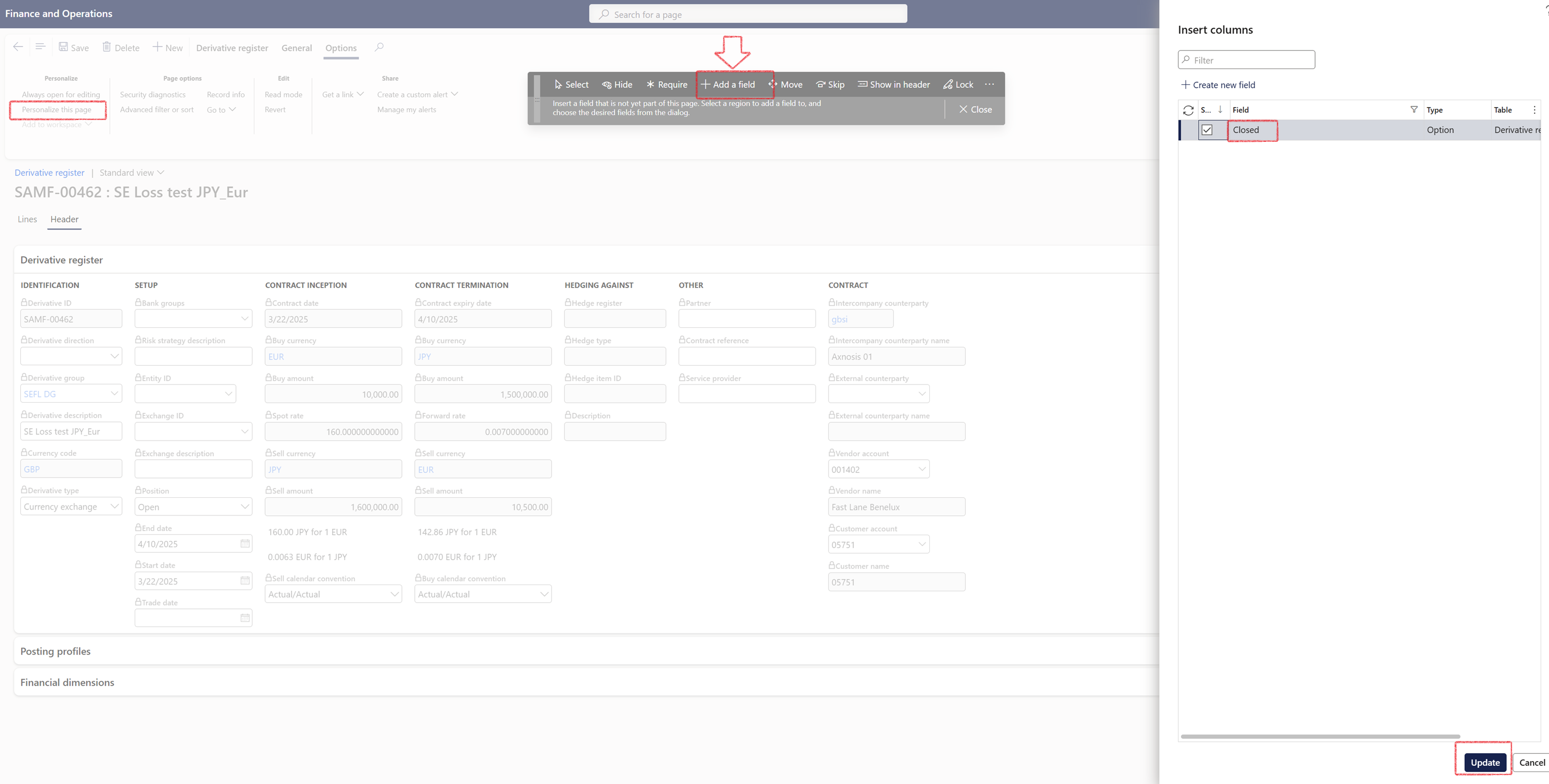

¶ Step 14.3.1: Re-open Position

Once a Settlement journal has been posted, the Position status is updated to Closed, preventing any further transactions on the derivative. However, in rare cases, it may be necessary to record additional transactions on a closed derivative. To enable this, the position can be re-opened by following these steps:

- Navigate to: Treasury > Hedges and Derivatives > Derivative register

- Select the relevant Derivative record

- In the action menu, under Options, click Personalize this page

- Click on Add field

- Search for the field labeled Closed

- Click the Update button

- Set the toggle to No

- Click Save

¶ Reporting

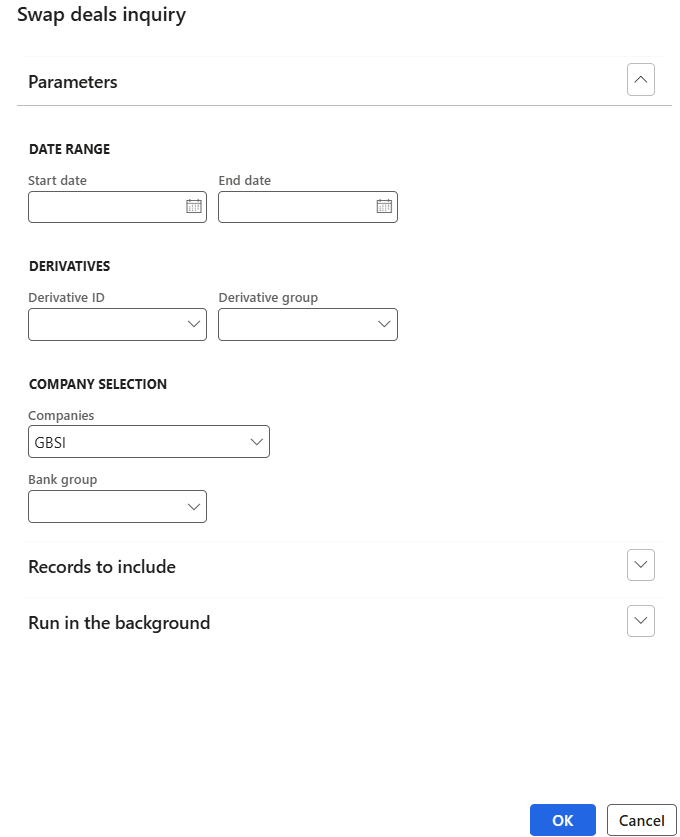

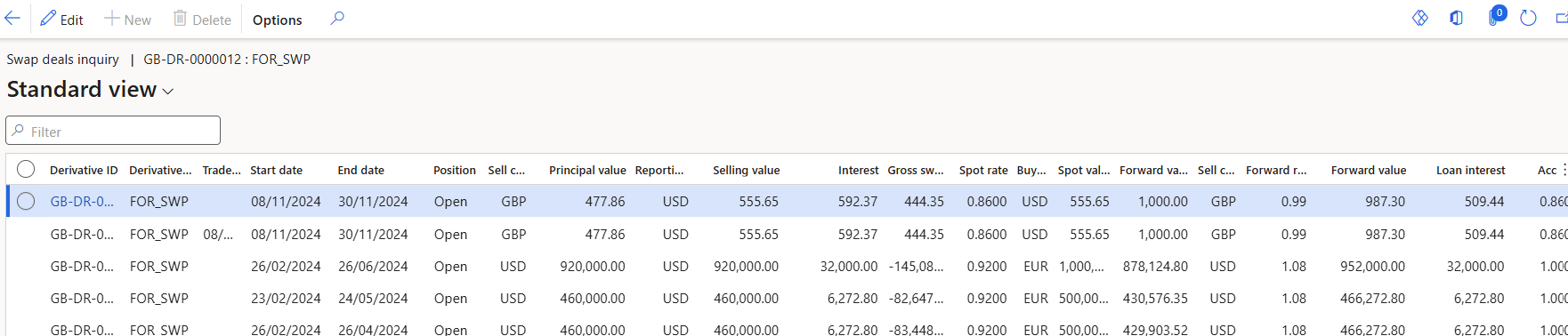

¶ Step 15: Swap deals inquiry

Once an FX Swap contract is terminated, a revaluation will occur to calculate the Gain/Loss on the contract. This revaluation is based on the commitment at the contract termination against the exchange rate value captured in the system, and not the forward rate fixed on the deal.

This report will only calculate and populate after the settlement journal has been completed.

To run the Swap deals inquiry report, go to:

- Treasury > Hedge and derivatives > Enquiries and reports > Swap deals inquiry

- The Start date and End date fields are not mandatory

- This report will calculate and populate after the settlement journal has been posted.

Some of the columns on the Swap deals inquiry include:

- Trade date - linked to document date

- Bank - this is the bank providing the swap

- Spot rate - conversion rate from Currency 1 to Currency 2

- Spot value - nominal value of deal in Currency 2 on start date

- Forward rate - conversion rate from Currency 2 to Currency 1

- Accounting rate - conversion rate between currencies as on contract End date

- Linked loan - loan number display as a hyperlink. This is the loan that is linked to the swap deal on the Derivative register

- Interest percentage - loan interest as setup on loan

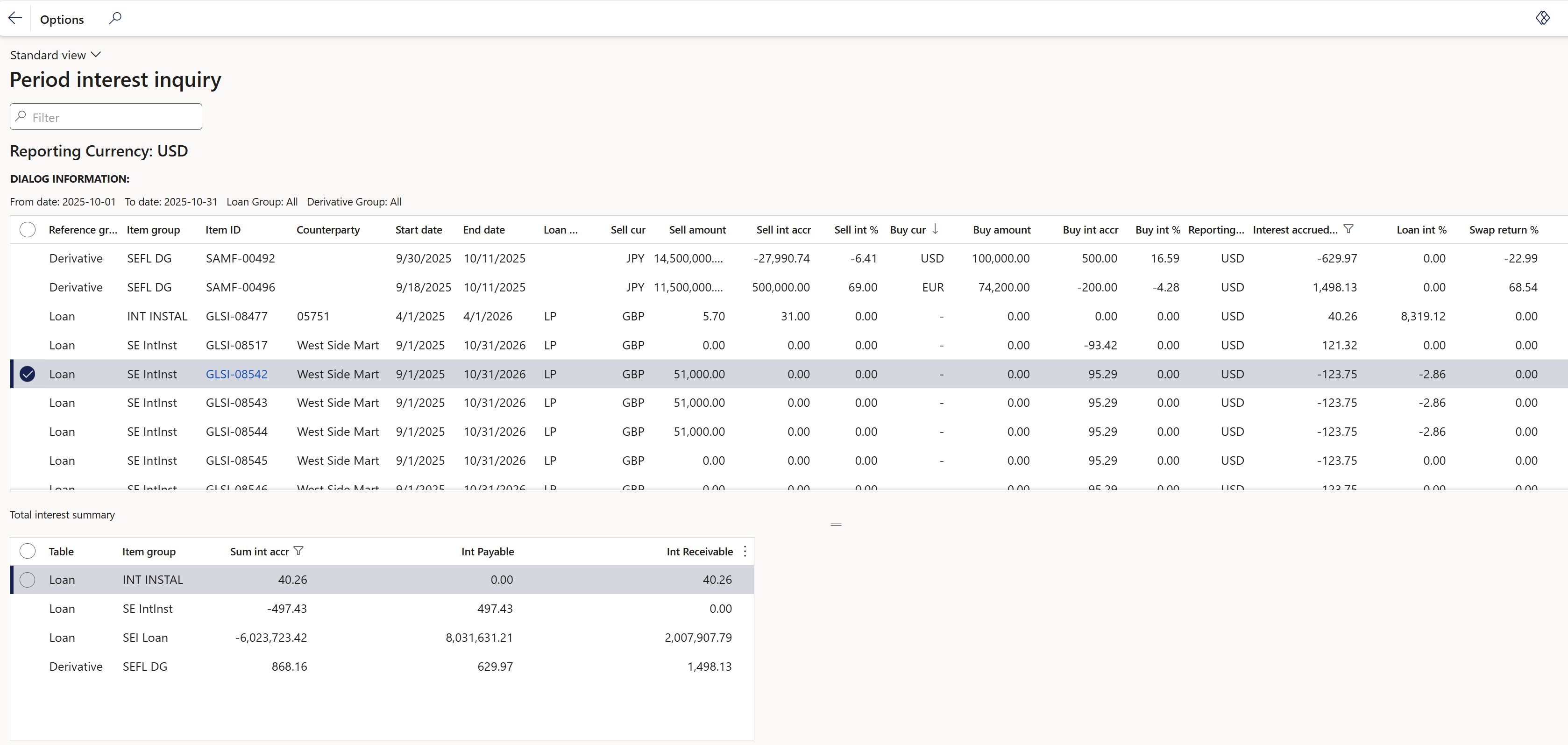

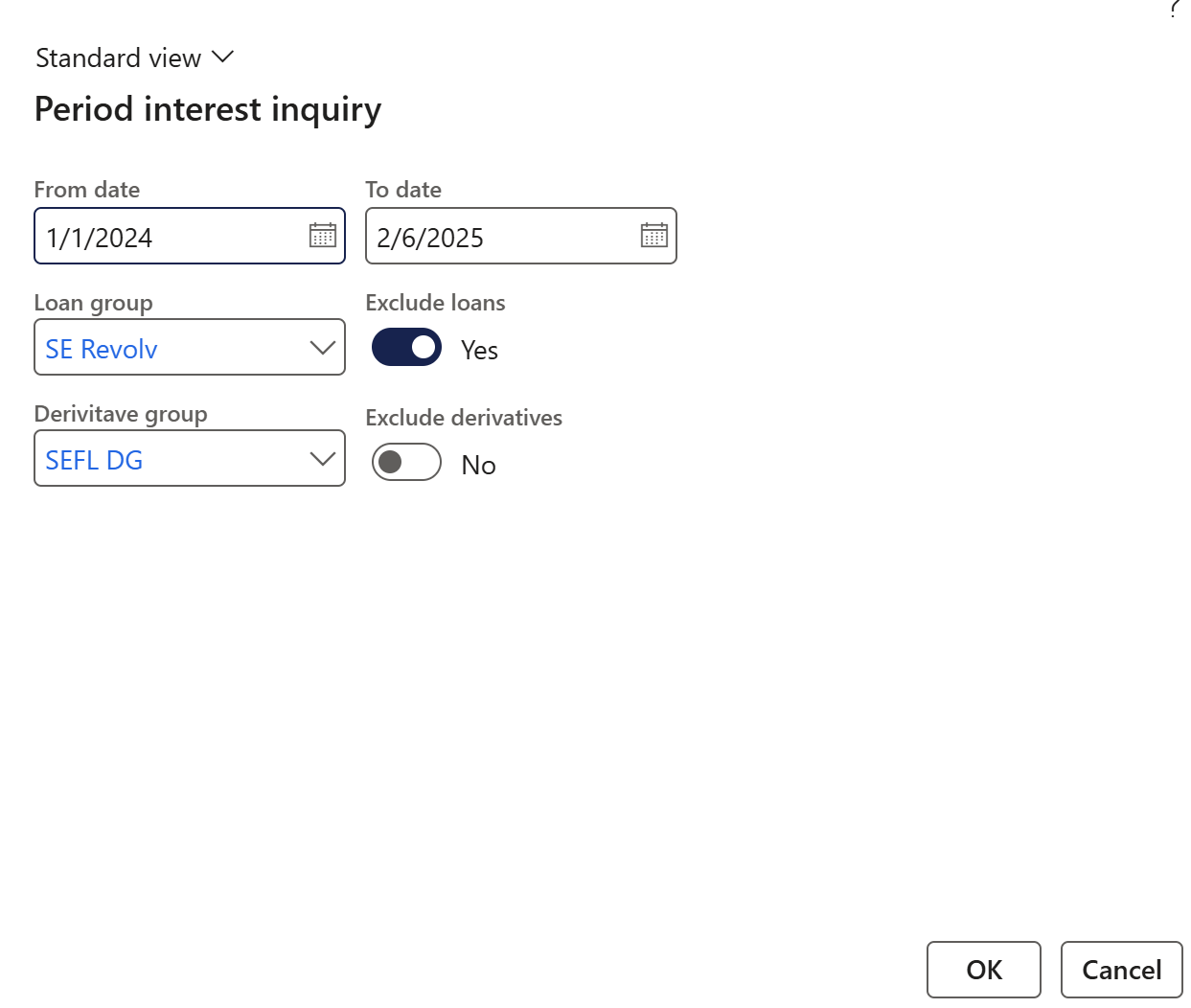

¶ Step 16: Period interest inquiry

To run the Period interest inquiry report, go to:

- Treasury > Hedge and derivatives > Enquiries and reports > Period interest inquiry

- Select a From date

- Select a To date

All posted interest accruals falling within the specified From and To dates will be included in the report.

An initial recognition journal must be posted first for a derivative in order to qualify for the Period Interest Inquiry.

- Choose a Loan group from the drop-down menu

- Select a Derivative group

- Set the toggle to Yes if you want to Exclude loans from the report

- Set the toggle to Yes if you want to Exclude derivatives from the report, and No to include derivative records

- Click the OK button

The report differentiates between Interest Receivable and Interest Payable when both items are present on a single loan. The loan group reports these items separately.

The inquiry page is divided into two sections:

- Period interest inquiry

- Total interest summary

The Period interest inquiry has the following columns:

- Reference group

- Item group

- Item ID

- Counterparty

- Start date

- End date

- Calendar convention

- The basis on which interest is being calculated

- Calc basis

- Sell cur

- Sell amount

- The average loan amount for all loans for the reporting period for both loans receivable and loans payable loan types.

For derivatives this is the Spot selling amount.

- The average loan amount for all loans for the reporting period for both loans receivable and loans payable loan types.

- Sell interest accrued

- The the receivable interest accrued values for the report period for both loans and derivatives.

No negative values will be shown in the column itself. So: - If it is a loan payable, then the sum of the Debit amount falls under Sell interest accrued. This means for payable loans, the sum of negative accrued values for the requested period.

- If it is a loan receivable, then the sum of the Credit amount falls under Sell interest accrued.

- The the receivable interest accrued values for the report period for both loans and derivatives.

- Sell int %

- The Sell int % column and Buy int % column are able to display negative values for returns on derivative transactions

- Buy cur

- Buy amount

- This is the Spot buying amount for derivatives

- This can also display the average loan amount for a loan direction loans payable for the reporting period.

- Buy interest accrued

- This column displays the payable Interest accrued values during reporting period for loans and derivatives.

No negative values will be displayed in the column itself. - For Derivatives, the Buy int accr column will display per derivative group the summaries of all the calculated accrued interest values of swaps for the period

- For loans: if it is a loan payable, then the sum of Credit amount falls under Buy interest accrued. This means for loan directions loans Payable the sum of positive accrued values for the requested period of report.

- If it is a loan receivable, then the sum of Debit amount falls under Buy interest accrued. This means for loan directions loans Receivable the sum of negative accrued values for the period of the report.

- This column displays the payable Interest accrued values during reporting period for loans and derivatives.

- Buy int %

- The Sell int % column and Buy int % column are able to display negative values for returns on derivative transactions.

- Reporting currency

- Interest accrued in reporting cur

- This is the nett interest values, i.e. Interest Receivable (Sell interest) minus Interest Payable (Buy Interest). In other words, the Sell interest in reporting currency minus Buy interest in reporting currency.

- Int %

- Swap return %

The exchange rate used to convert the Interest Accrued in Reporting Currency field is determined by the From Date selected in the report dialog. For example, if the report is run with a From Date of 1 January 2020, the exchange rate effective on that date will be applied.

Total interest summary columns:

- Table

- Item group

- Sum of interest accrued%

- Int Receivable minus Int Payable will nett to Sum of Interest accrued

- Int Payable

- The Int Payable column displays, per loan and derivative group, the summaries of all the calculated accrued interest values in the Buy Int Accr column for the reporting period and in the reporting currency.

- For Payable loans, all positive interest accruals within the report period on the statement, as displayed on the Buy Int accr column

For Receivable loans, all negative interest accruals during report period on statement, as displayed in the column Buy int acc column

- Int Receivable

- The Int Receivable column displays, per loan and derivative group, the summaries of all the calculated accrued interest values in the Sell Int Accr column for the reporting period.

- These columns will display in Reporting currency