¶ Introduction

Daily balances represent the amount of money in a financial account at the end of each day. This can apply to checking, savings, investment, loan, or other account types.

Daily balances are often used to calculate interest, determine minimum payments, and provide a clear snapshot of an account’s financial position on a specific date.

It’s important to note that the daily balance may differ from the current balance. The current balance reflects transactions as they occur, including those still pending, while the daily balance only includes transactions that have been fully processed and posted.

In D365FO, within the Treasury module, the daily balances function recalculates loan balances either as of today’s date or as of the specified As of date.

¶ Navigation

¶ Daily use

¶ Step 1: View daily balances

For a quick look at daily balances,

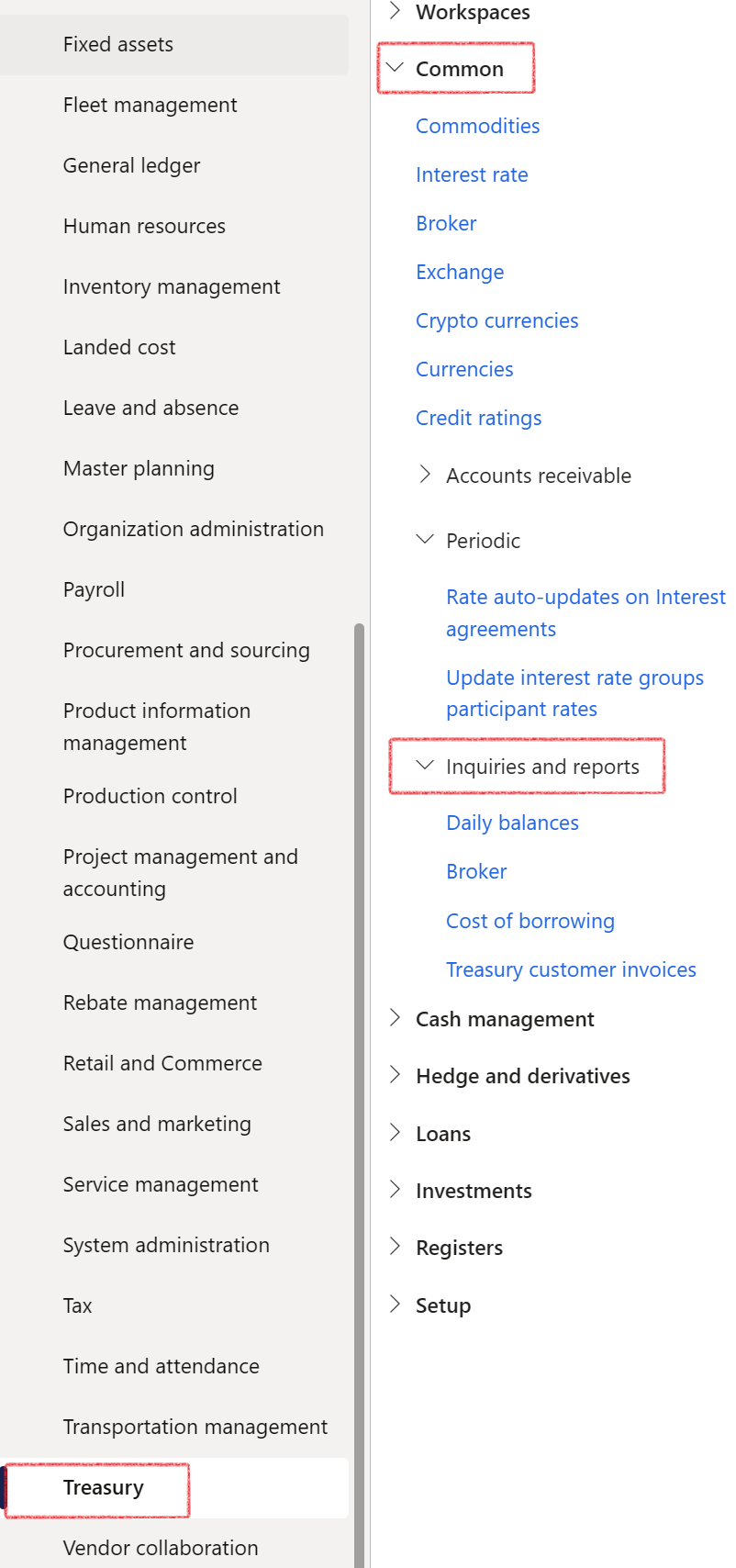

- in the navigation pane, go to: Modules > Treasury > Common > Inquiries and reports > Daily balances

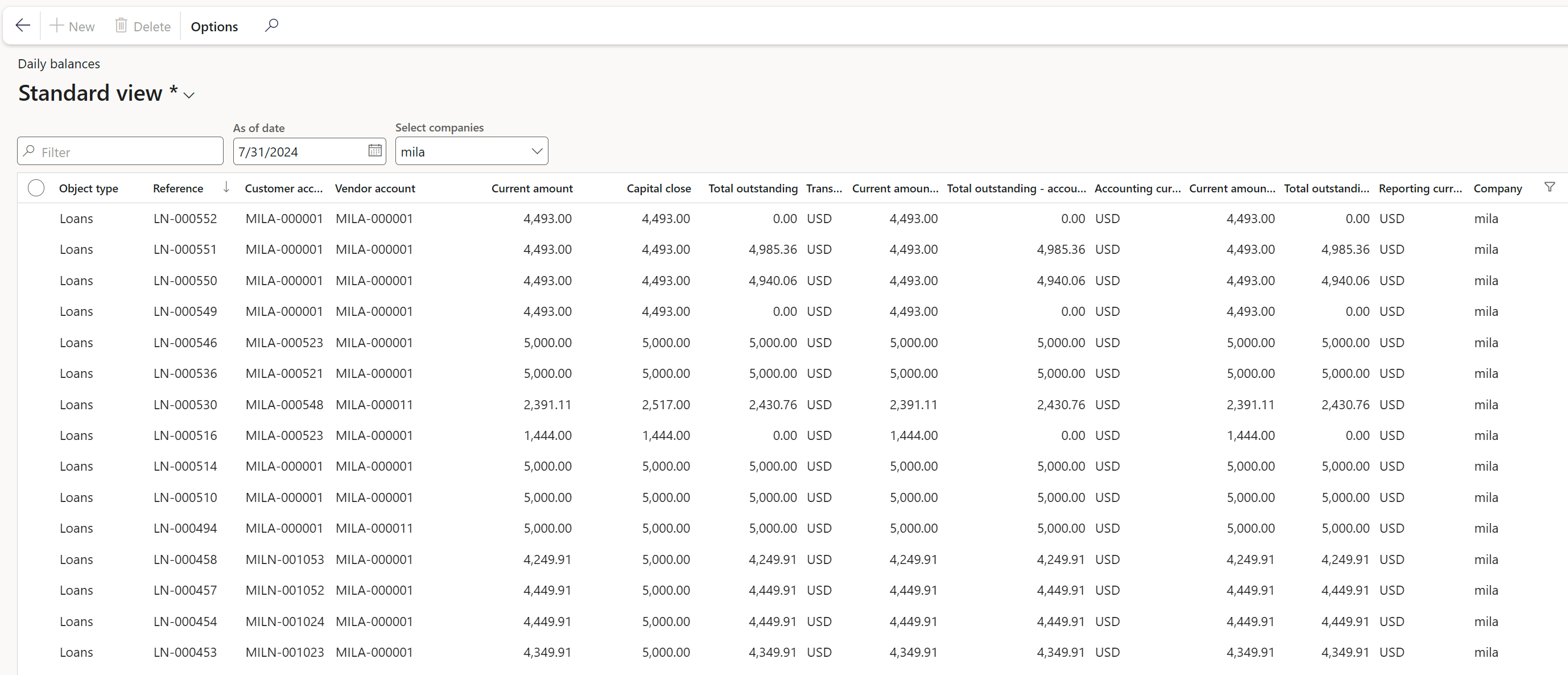

The Daily balances list page will be visible, featuring the following columns:

- Select companies

- The Select companies filter allows users to globally view all loans across entities.

- As of date

- The As of date filter indicates the day on which the Daily balance was revised

- Object type

- The Object type will specify whether the balance represents a Loan, Cash investment, or Non-Cash investment.

- Reference

- The Loan number ID is visible within the Reference field

- Start date

- Date from when the loan is effective

- Customer

- Vendor

- Last transaction date

- Current amount

- This amount shows if any capital is outstanding and decreases to zero when the loan is fully repaid. Loan current balance (after payments). Loan current outstanding capital balance

- The Current amount column on Daily balances is the same as Principal balance column on Customer loan balances data entity

- The Current amount column on Daily balances is the same as Closing balance on the Loan statement

- Capital close

- Total Capital journals posted.

- This is the total capital issued on a loan and does not decrease over time.

- Net debit is positive for receivable loans; net credit is positive for payable loans.

- The Capital close on the Daily balances page is the same as the Capital balance close column on the Loan statement

- Total outstanding

- The amount displayed in the Total outstanding column matches the Total outstanding amount stated on the expanded loan statement.

- It is the sum of outstanding capital and outstanding interest on the expanded loan statement.

- The Total outstanding amount is displayed in the loan currency, sourced from the Loans list page.

- The Total outstanding column on the Daily balances page is the same as the Loan balance column for Customer loan balance data entities

- Outstanding Interest

- The Outstanding Interest amount is the sum of the Annuity Interest Close and Revolving Interest Close columns in the Actual Loan Statement

- The interest balance is unpaid interest, which reaches zero when the loan is fully repaid.

- Outstanding interest column on Daily balances is the same as Interest balance on the Customer loan balances data entity.

- Transaction currency

- Daily balance amounts will be displayed in both Transaction currency and Accounting currency

- Current amount - accounting currency

- Calculated as the Capital balance outstanding adjusted by the latest exchange rate for the accounting currency.

- Total outstanding - accounting currency

- It is derived from the Total outstanding amount and the latest exchange rate.

- It is calculated by multiplying the outstanding amount in loan currency by the latest exchange rate

- Accounting currency

- Current amount - reporting currency

- Total outstanding - reporting currency

- Reporting currency

- Company

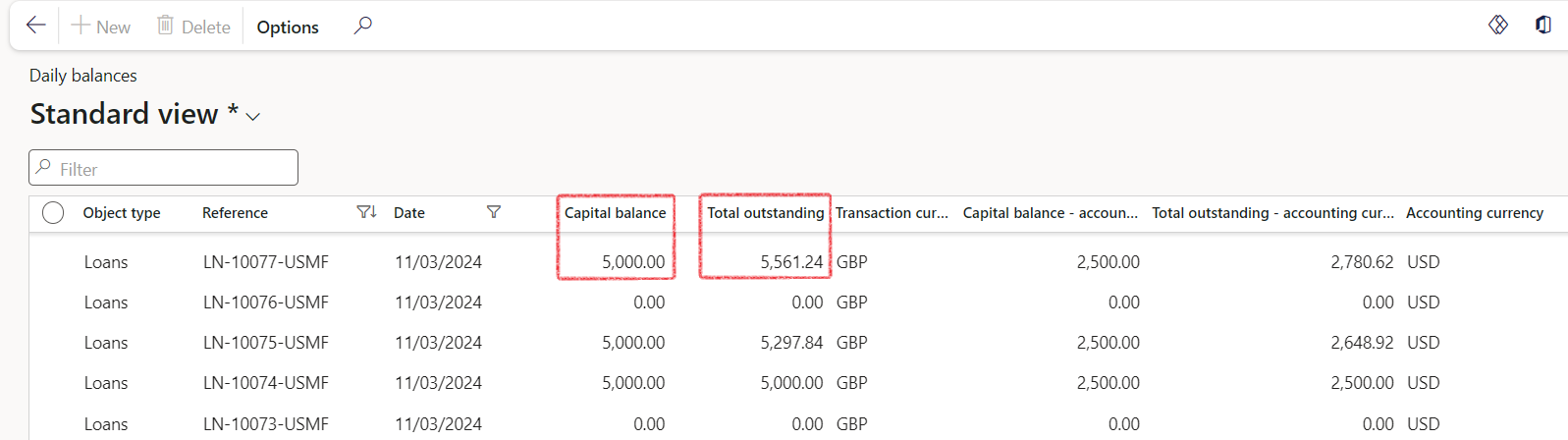

- Capital balance

- The amount in the Capital balance column displayed on the Daily Balances inquiry corresponds to the Capital balance close amount indicated on the loan statement.

- Capital balance - accounting currency

- Capital balance - accounting currencyis calculated as the Capital balance adjusted by the latest exchange rate for the accounting currency.

- Total outstanding - accounting currency

- Total outstanding - accounting currency. This represents the converted loan currency, determined by the latest exchange rate. Thus, it is derived from the Total outstanding amount and the latest exchange rate. It is calculated by multiplying the outstanding amount in loan currency by the latest exchange rate.

Transactions in a financial system are typically recorded in a transaction currency, which is the currency in which the transaction took place.

The reporting currency is the currency in which financial reports are prepared and presented, and the accounting currency is the currency in which a company's financial statements are kept and recorded.

Having the ability to view the daily balance amounts in all three currencies allows for a comprehensive view of the financial information and helps in effective financial management and analysis.

The transaction currency provides a clear picture of the financial activity in the currency it took place, while the reporting and accounting currencies help in presenting the financial information in a manner that is easily understood and comparable across different periods and with other companies

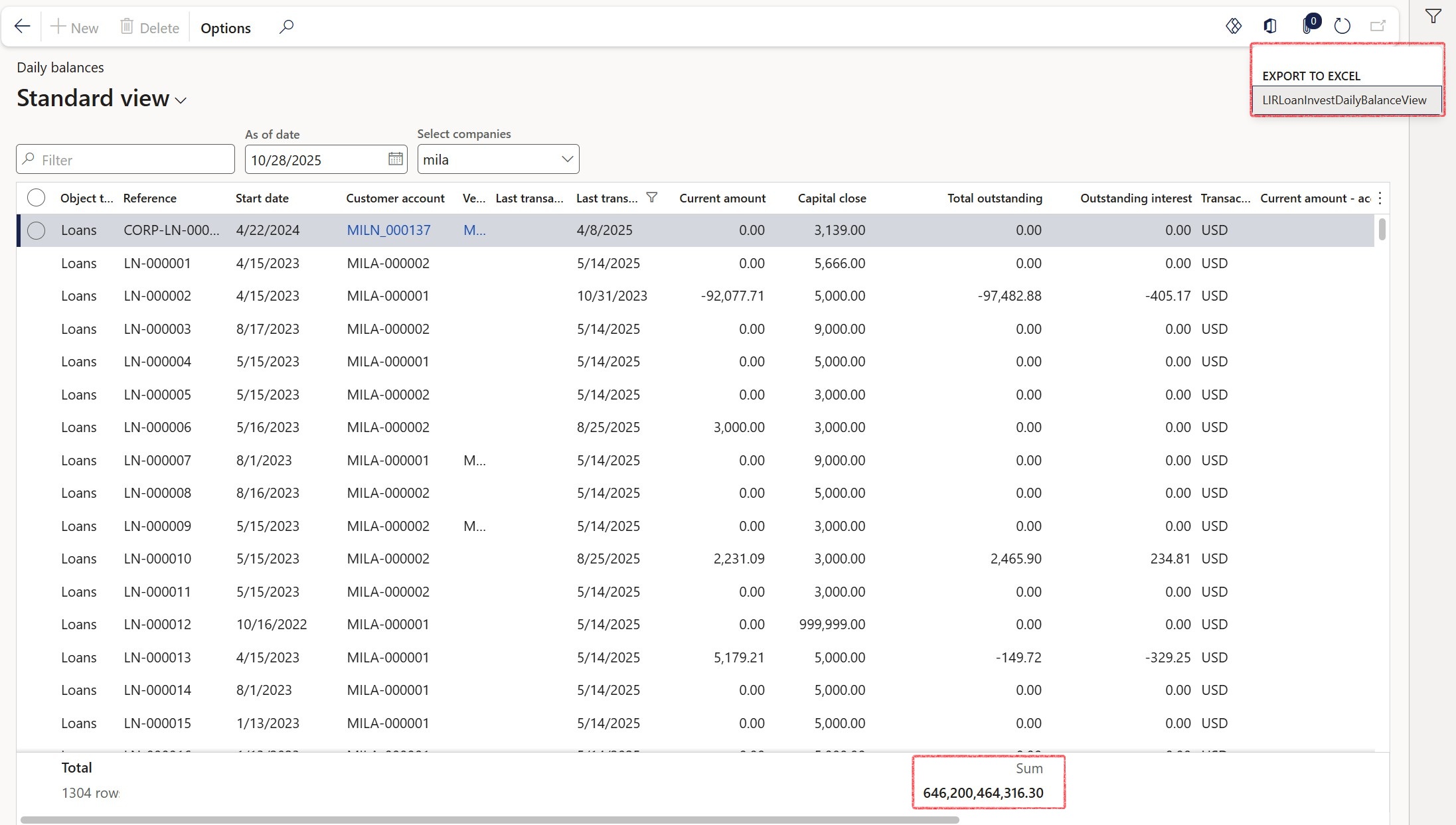

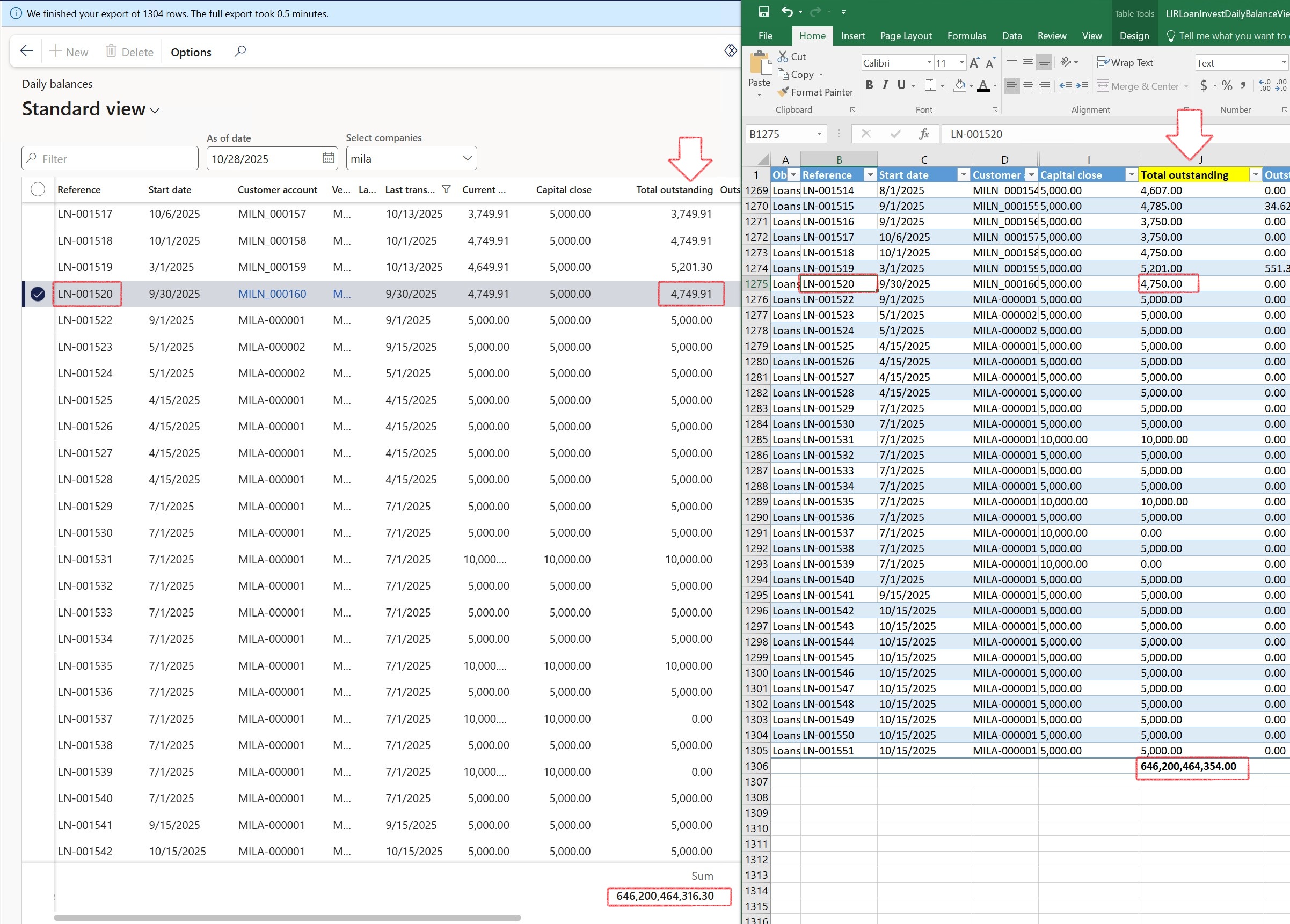

¶ Step 1.1: Export to Excel

The Daily balances list page can be Exported to Excel.

Note, when exporting the Daily Balances report to Excel, the values in the Total Outstanding column are rounded, and the cents are not fully displayed. As a result, the total outstanding balance shown on the list page may be higher than the total outstanding balance in the exported Excel file.

¶ Step 1.2: Treasury columns explained

| CUSTOMER LOAN BALANCE DATA ENTITY | LOAN STATEMENT | DAILY BALANCES | LOANS LIST PAGE | DESCRIPTION |

|---|---|---|---|---|

| PAID CAPITAL | Sum of all paid capital on loan actual statement | |||

| PAID INTEREST | Sum of all paid interest amounts on loan actual statement | |||

| TOTAL LOAN AMOUNT | The sum of all payments, accounting for scenarios that deviate from the projected statement. The calculation involves adding the Actual instalments for the loan to the Projected instalments for the loan. This includes both the history of payments and future planned instalments. |

|||

| LOAN AMOUNT | Loan limit granted | |||

| LOAN BALANCE | TOTAL OUTSTANDING | TOTAL OUTSTANDING | TOTAL OUTSTANDING | Total outstanding is the sum of outstanding capital and outstanding interest on the expanded loan statement |

| CURRENT AMOUNT – ACCOUNTING CURRENCY | Calculated as the Capital balance outstanding adjusted by the latest exchange rate for the accounting currency. | |||

| TOTAL OUTSTANDING – ACCOUNTING CURRENCY | It is derived from the Total outstanding amount and the latest exchange rate. It is calculated by multiplying the outstanding amount in loan currency by the latest exchange rate |

|||

| INTEREST BALANCE | ANNUITY INTEREST CLOSE + REVOLVING INTEREST CLOSE | OUTSTANDING INTEREST | OUTSTANDING INTEREST | The interest balance is unpaid interest, which reaches zero when the loan is fully repaid. It equals the sum of Annuity interest close and Revolving interest close on the Actual statement. |

| CAPITAL BALANCE CLOSE | CAPITAL CLOSE | CAPITAL CLOSE | Total Capital journals posted. This is the total capital issued on a loan and does not decrease over time. Net debit is positive for receivable loans; net credit is positive for payable loans. |

|

| PRINCIPAL BALANCE | CLOSING BALANCE | CURRENT AMOUNT | CURRENT AMOUNT | This amount shows if any capital is outstanding and decreases to zero when the loan is fully repaid. Loan current balance (after payments). Loan current outstanding capital balance |

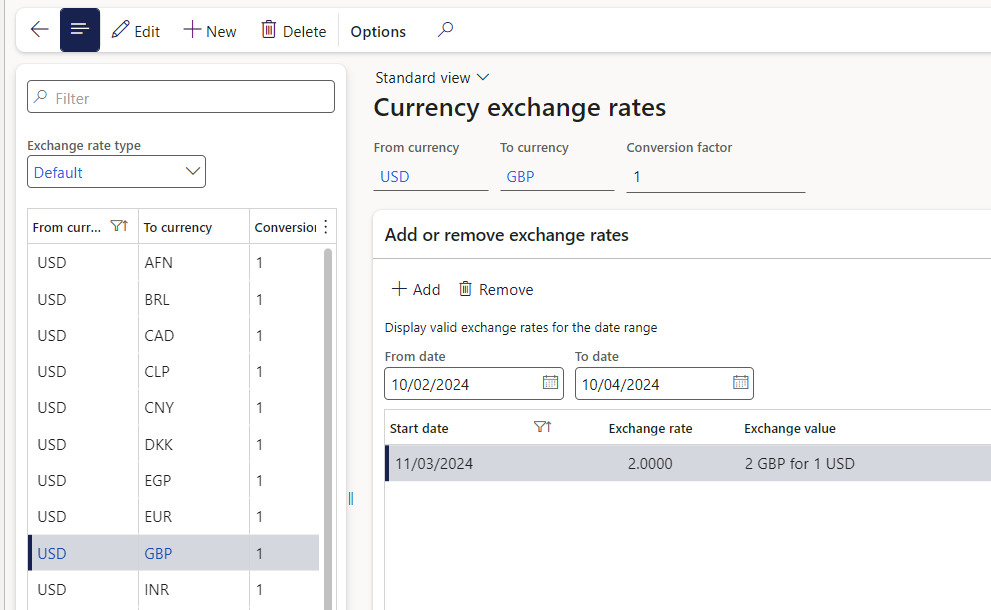

¶ Step 2: View the currency exchange rate

For this example, the focus will be on the currency exchange rate between USD and GBP.

- Navigate to: Treasury>Setup>Currency>Currency exchange rates

- In the From currency column, filter on USD

- In the To currency column, find GBP

- Examine the most recent exchange rate between USD and GBP

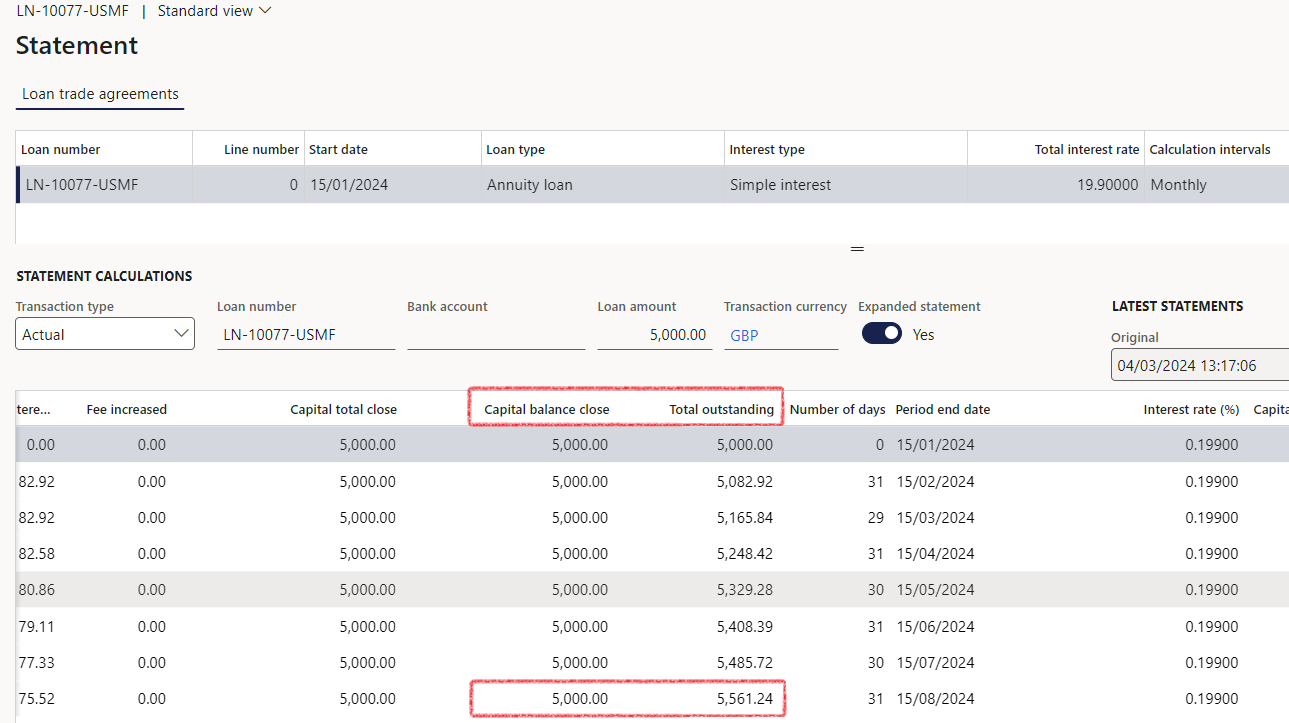

¶ Step 3: Daily balances on a loan

To illustrate a practical example of a loan with a transaction currency of GBP and an accounting currency of USD:

- Navigate to Treasury > Loans > Loans

- Filter on a specific loan

- In the Action menu, on the Loan tab, under the heading Transactions, click on Generate statement

- For Transaction type, select Actual

- The Expanded statement toggle should be set to Yes

- Find the columns called Capital balance close and Total outstanding

- For the Capital balance close and Total outstanding columns, review the figures on the last line of the Actual loan statement, and compare them with the totals provided in the Daily Balances inquiry

- Compare these amounts with the amounts on the Daily balances enquiry screen