¶ Introduction

Cryptocurrencies are digital currencies that rely on encryption to control the creation of new units and to verify transactions. They are decentralized, meaning they function without oversight from a central bank or government. All transactions are recorded on a public digital ledger called a blockchain, which provides both transparency and security. Cryptocurrency holdings are stored in digital wallets, and well-known examples include Bitcoin, Ethereum, and Litecoin.

Cryptocurrency gets its name from the use of encryption, which secures and verifies transactions. Advanced coding is applied to store and transmit data between digital wallets and public ledgers. The purpose of this encryption is to ensure both security and protection of the transactions.

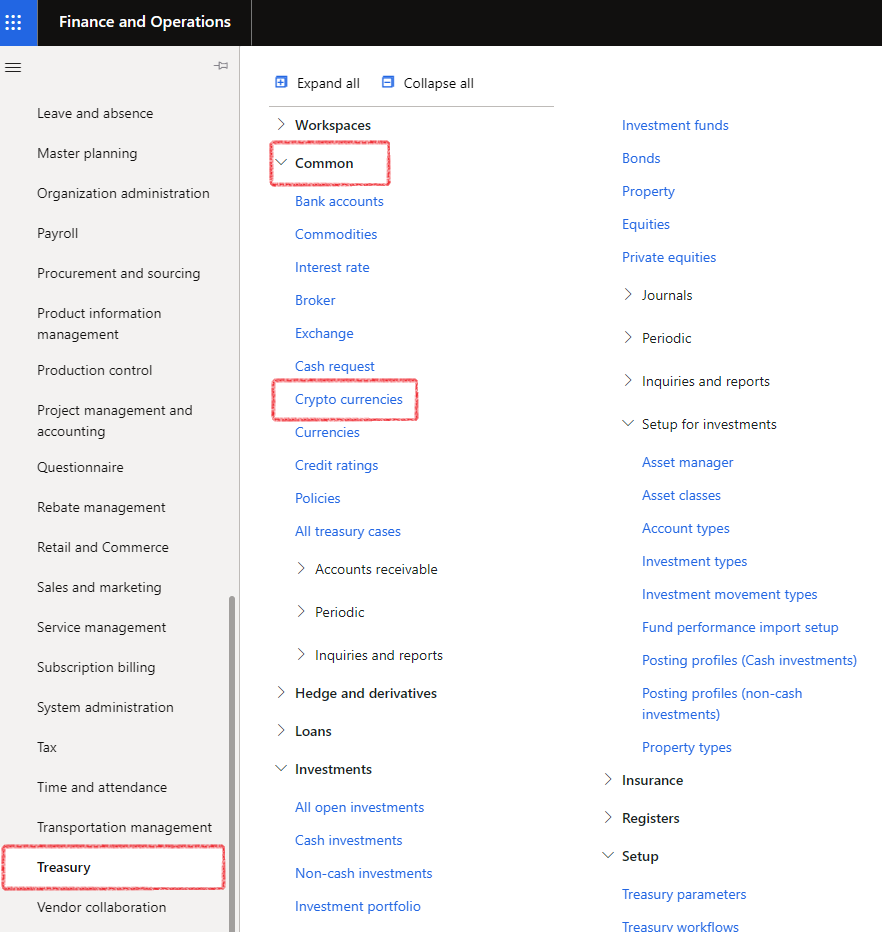

¶ Navigation

¶ Specific setup

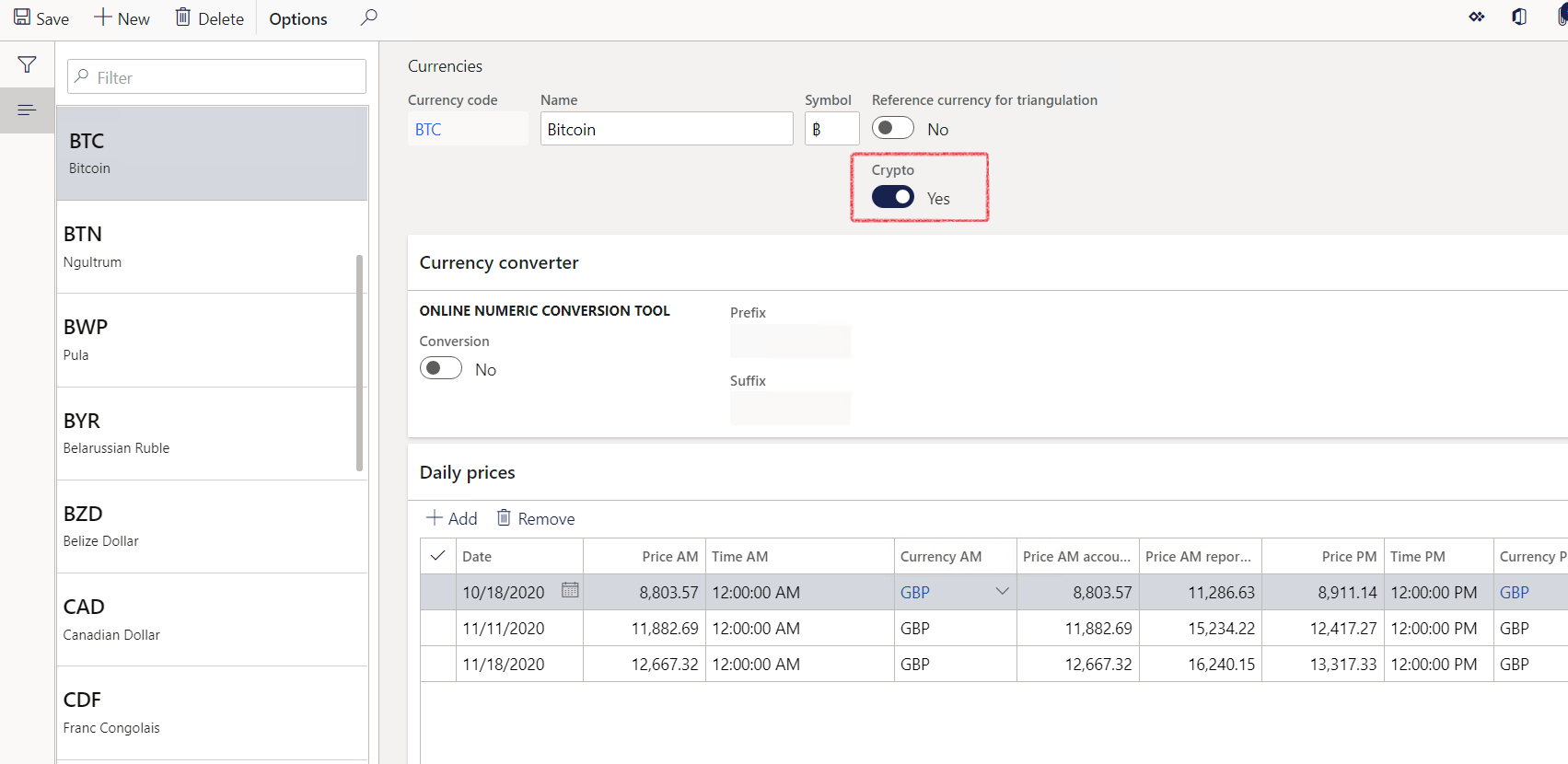

¶ Step1: Create a new Crypto Currency

In TMS, one may examine and configure crypto currencies under the Common menu

- To mark a currency as Crypto, go to Treasury > Common > Currencies

- Set the slider to Yes for Crypto

- Here, users can also view and modify cryptocurrencies.

¶ Daily use

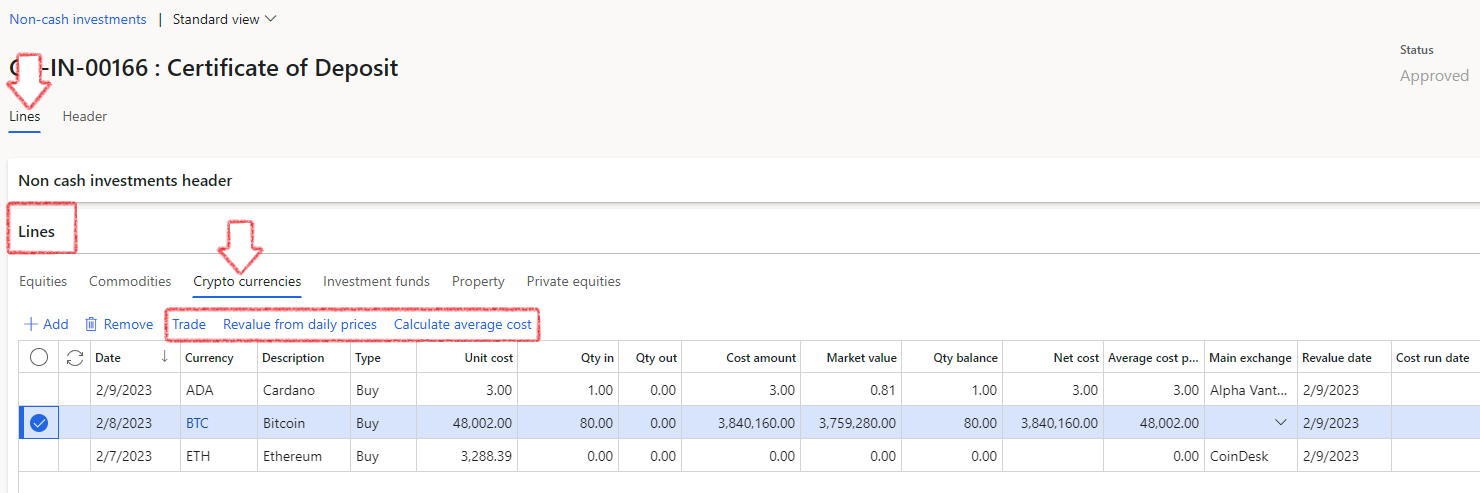

¶ Step 2: Crytocurrencies and Non-Cash Investments

- Navigate to Treasury > Investments > Non-Cash Investments

- Open an existing record

- Expand the Lines FastTab on a Non-cash investment

- Complete the Index tabs for the following asset:

- Crypto currencies

Users can perform the following tasks on a Crypto investment:

- Trade

- Revalue from daily prices

- Calculate average cost

By performing these tasks within the system, users can get a complete picture of their cryptocurrency investments, including the trade history, market value, and cost basis. This information can be used to make informed investment decisions and manage the portfolio effectively

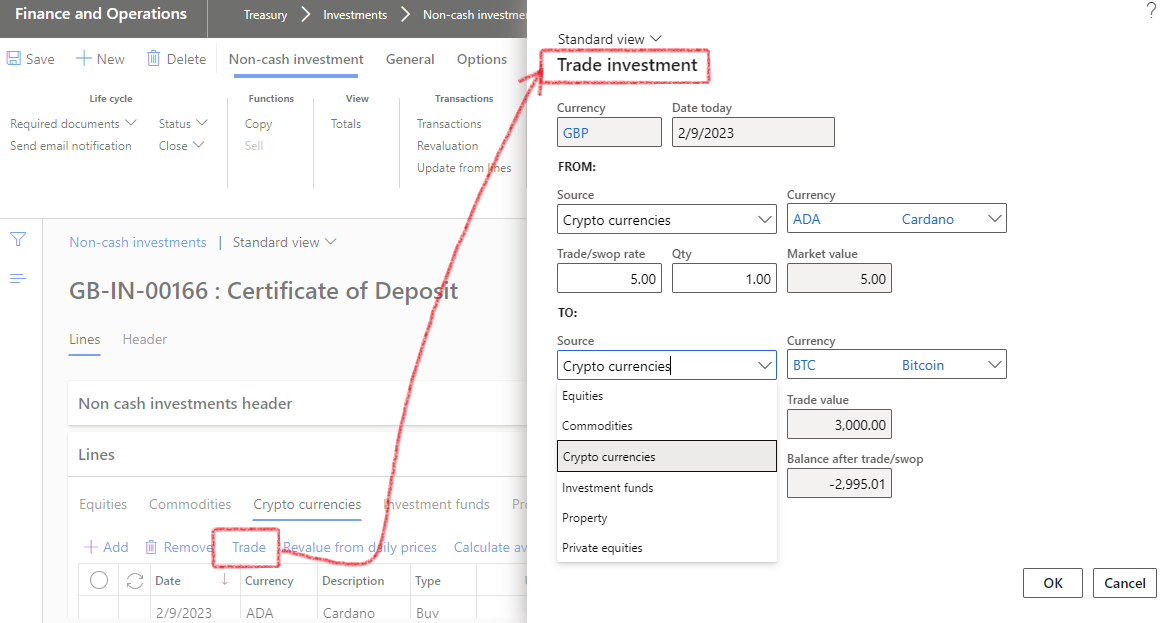

¶ Step 2.1: Trading Crypto currencies

When clicking on the Trade button, a Trade investment dialogue will open.

- in the FROM section of the dialogue, choose the Crypto currencies as the source option.

- Select the Currency if you selected Cryptocurrencies as the source.

- Select the specific Equity if you selected Equities as the source

- If you selected Investment funds, choose the Fund

- If you selected Property, choose the precise Property

- If you selected Private equities, choose the precise Private equity

- Choose the specific Commodity if you choose Commodities as the source

- Enter a Trade/swop rate

- Enter the Quantity

- Do the same in the TO section of the dialogue

When the following fields are filled out, the Trade value field and Balance after trade/swop fields will update automatically:

- Quantity

- Cost price

- Fee & commision

- Trade/swop rate

- Click the OK button when done

The balance after the Trade/swop whould be zero