¶ Introduction

Credit facilities are pre-approved loans that allow a borrower to access funds on an ongoing basis over an extended period, eliminating the need to apply for a new loan each time additional funds are required. Credit facilities are generally classified into two types: short-term and long-term. Short-term facilities are typically used to meet working capital needs, such as paying suppliers and bills, while long-term facilities are intended for capital expenditure projects and are often financed through banks or private placements.

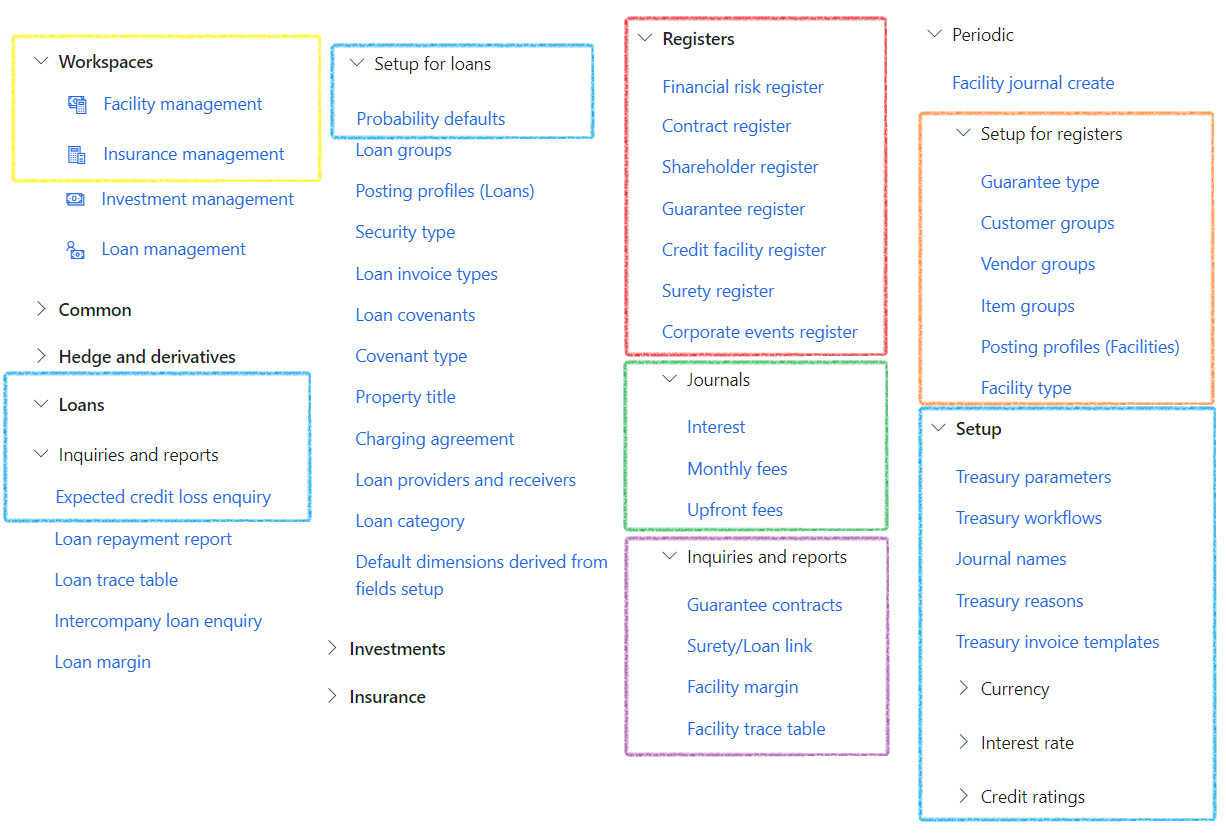

¶ Navigation

¶ Specific setup

Journal names, Posting profiles and Facility type must be setup for Credit Facilities.

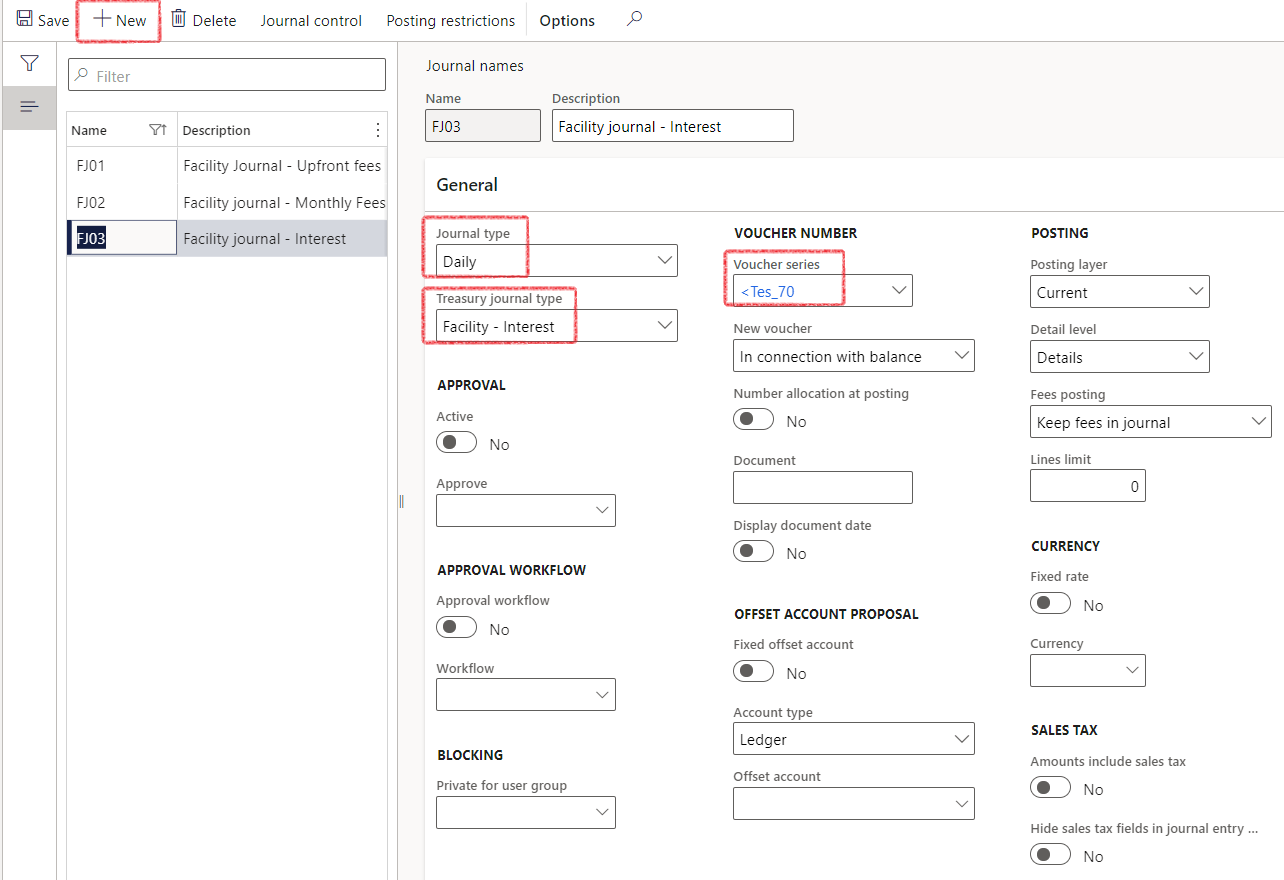

¶ Step 1: Journal names

- To set up journal names that will be used on the Posting profiles for

- Upfront fees

- Monthly fees and

- Interest

- Go to: Treasury > Setup >Journal names

- Click on New

- Type a Name and Description for the new journal name

- Select a journal type. In this example the journal type will be Daily

- Select Treasury journal type

- Choose a Voucher series

- Select Account type

- Click on Save

The Treasury journal types for Credit facilities:

- For upfront fees, select the Treasury journal type Facility - Upfront Fees

- For monthly fees, select the Treasury journal type Facility - monthly fees

- For interest, select the Treasury journal type Facility - interest

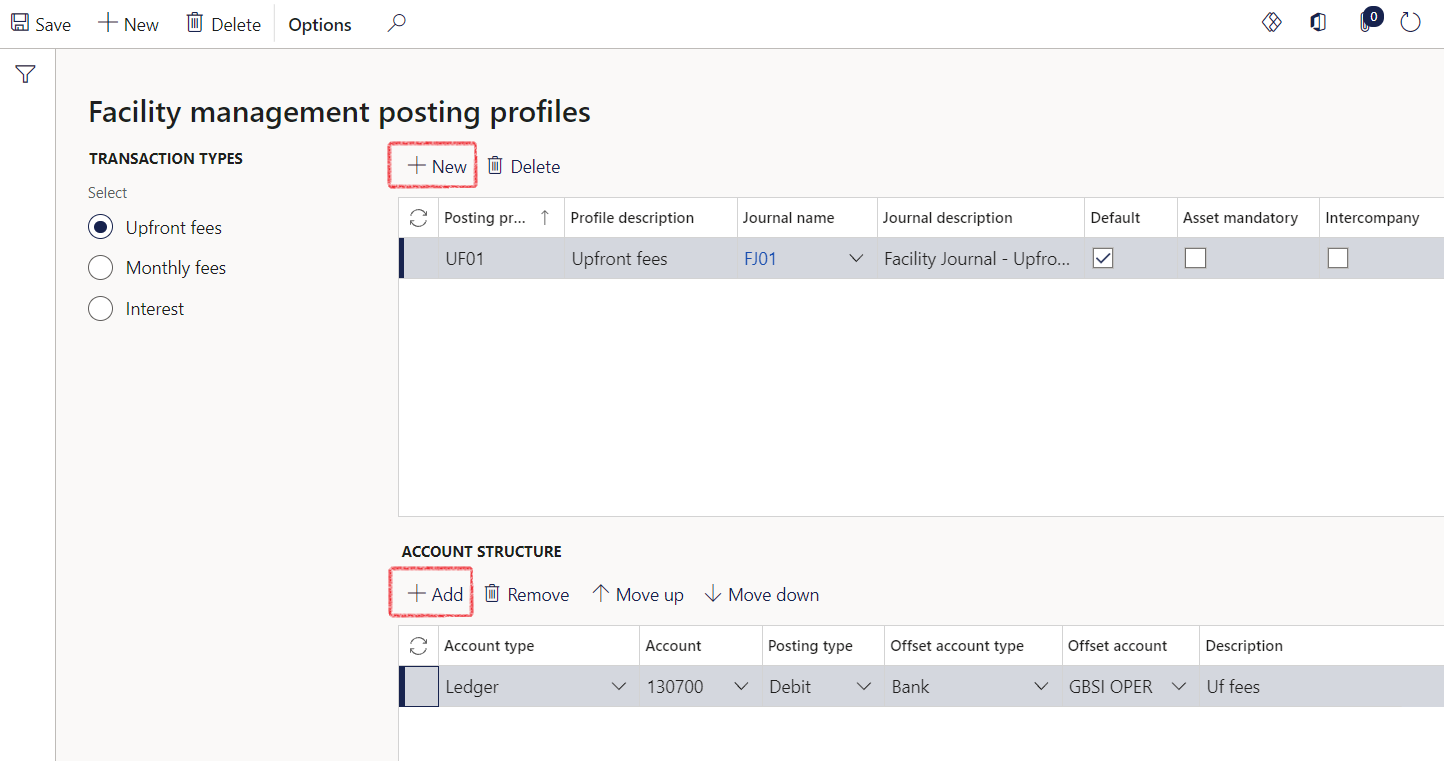

¶ Step 2: Posting profiles - Facilities

The posting profiles should be set up for

- Upfront fees

- Monthly fees and

- Interest

- Go to: Treasury > Registers> Setup for registers> Posting profiles - Facilities

- On Upfront fees, click New

- Enter posting profile and description

- Select a journal name from the drop-down list

- Indicate if this is a default posting profile

- On the Account structure of the page, click on Add

- Select Account type (choose between Ledger, Customer, Vendor, Project, Fixed assets or Bank)

- Select the relevant account

- Indicate if the posting type is a Debit or Credit

- Enter the Offset account details

- Click on Save

- Follow the same steps to setup Monthly fees and Interest posting profiles

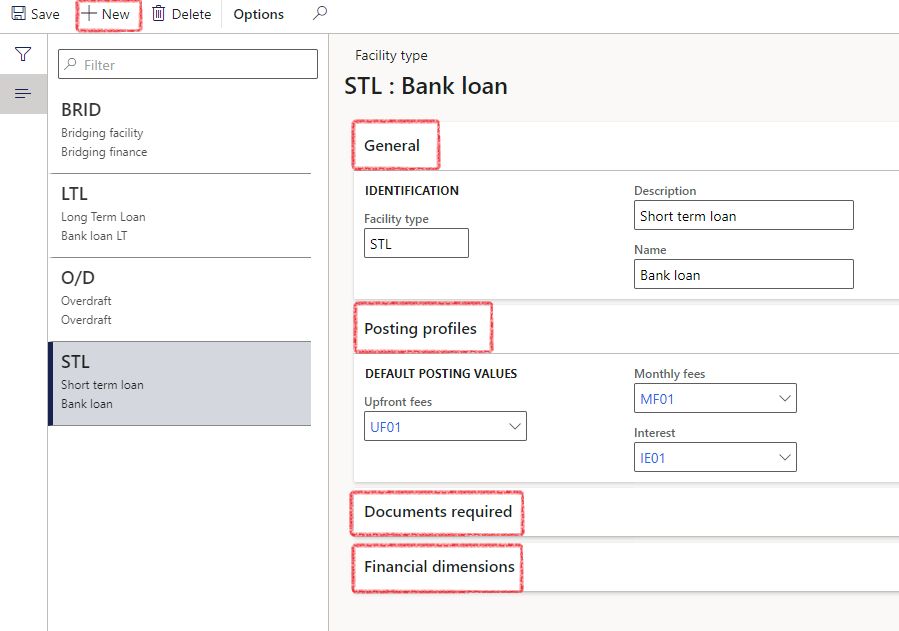

¶ Step 3: Facility type

- Go to: Treasury > Registers> Setup for registers> Facility type

- Click on New

- Expand the General FastTab

- Enter a Facility type

- Add a description

- Type in the Name

- Expand the Posting Profiles FastTab

- Select the relevant posting profiles for Upfront fees, Monthly fees, and Interest

- Expand the Documents required FastTab to add any requirements for Documents

- Expand the Financial dimensions FastTab to add Financial Dimensions for tbis specific Facility type

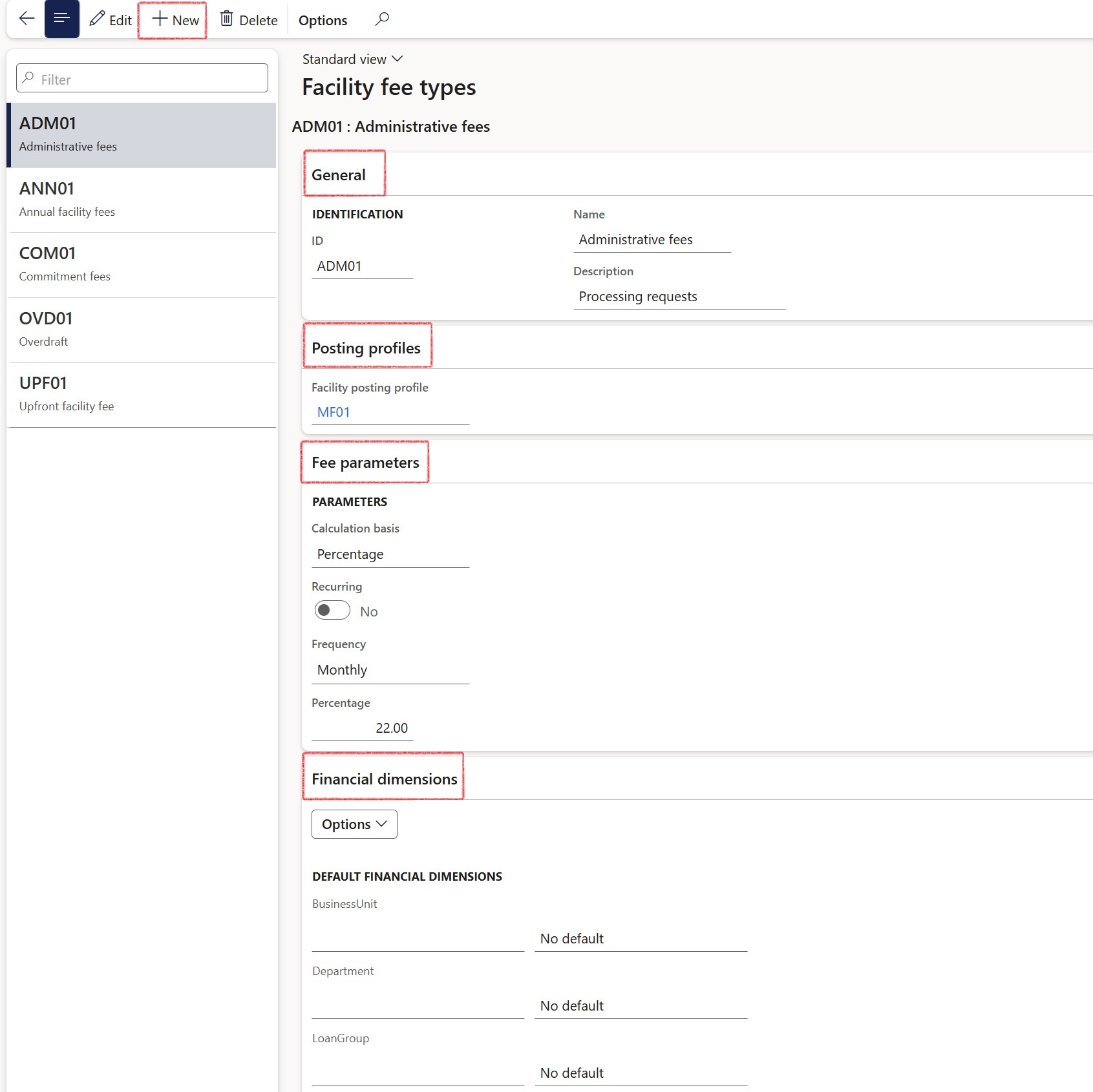

¶ Step 4: Facility fee types

- Go to: Treasury > Registers > Setup for registers > Facility fee types

- Click on New

- Expand the General FastTab

- Enter an ID

- Add a Description

- Type in the Name

- Expand the Posting Profiles FastTab

- Select a Facility posting profile

- Expand the Fee parameters FastTab

- Select a Calculation basis. Choose between Fixed or Percentage

- Set the Recurring toggle to Yes or No

- Frequency can be Monthly or Annually

- Enter a Percentage

- Expand the Financial dimensions FastTab to add Financial Dimensions for tbis specific Facility type

¶ Daily use

¶ Step 5: Credit facility register

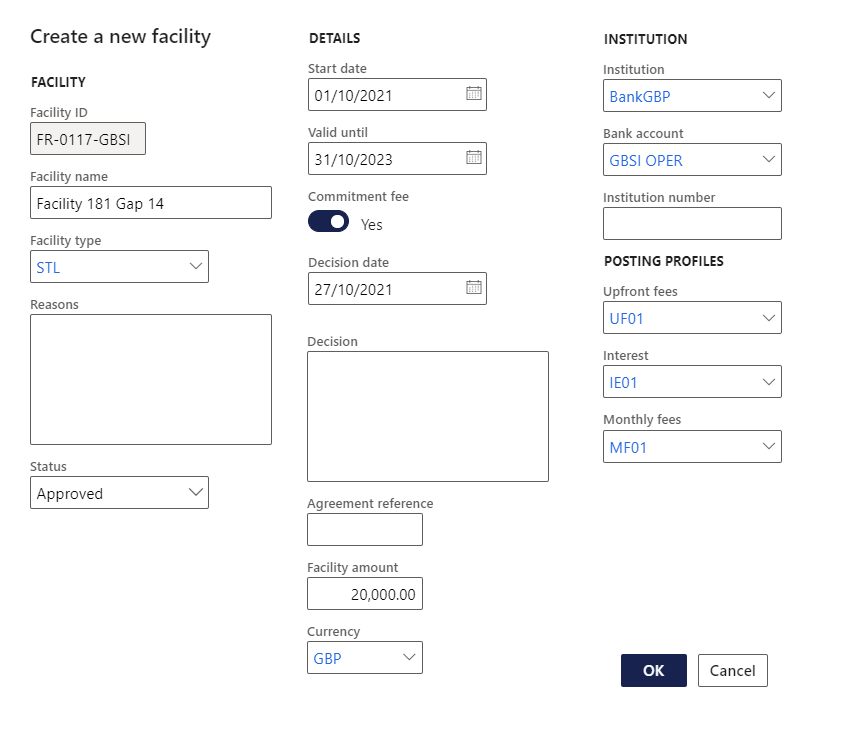

Create a new Credit facility register

- Go to: Treasury > Registers > Credit facility register

- Click on New to create a new facility, or Edit to add information to an existing facility

- Enter a facility name

- The facility ID is system generated

- Select a Facility type from the dropdown menu

- Enter a Start date

- Enter a Facility amount

- The Currency field is mandatory

- Select a Bank account

- The Status of a credit facility can be one of the following:

- Applied

- Review

- Approve

- Rejected

- Cancelled

- Posting profiles is automatically populated when the Facility type is entered.

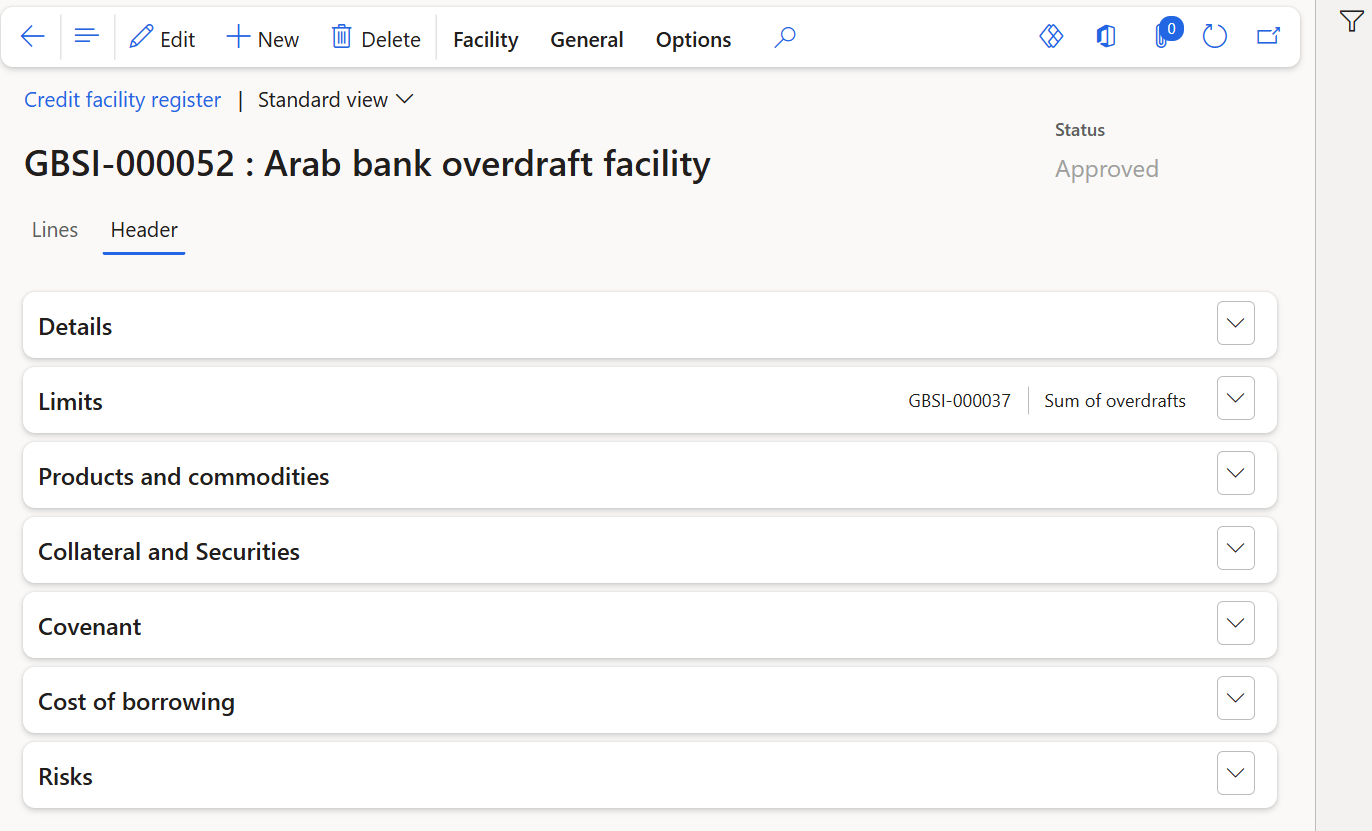

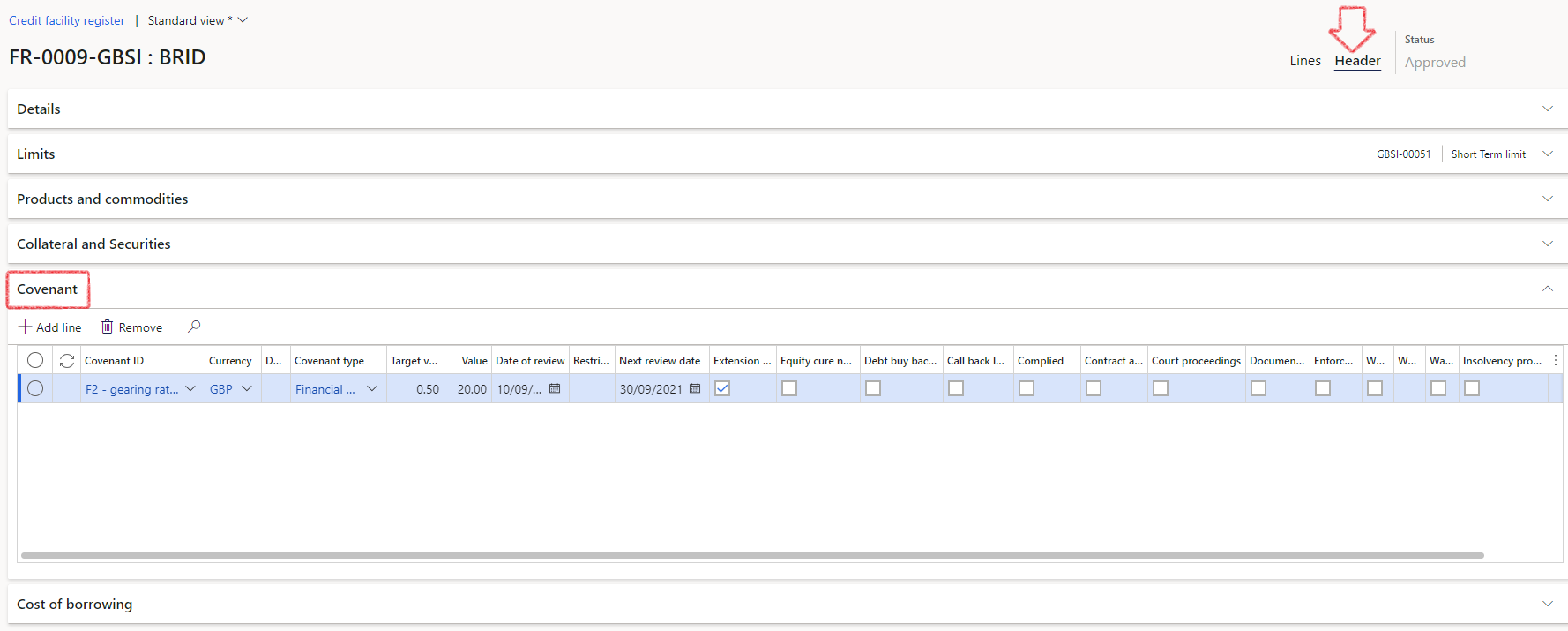

¶ Step 5.1: Header index tab on the Credit facility register

Edit an existing register or add transactions on a newly created credit facility.

- Go to: Treasury > Registers > Credit facility register

- On the Header section, complete information on the following FastTabs

- Details

- Limits

- Products and commodities

- Collateral and Securities

- Covenant

- Cost of borrowing

- Risks (G2T)

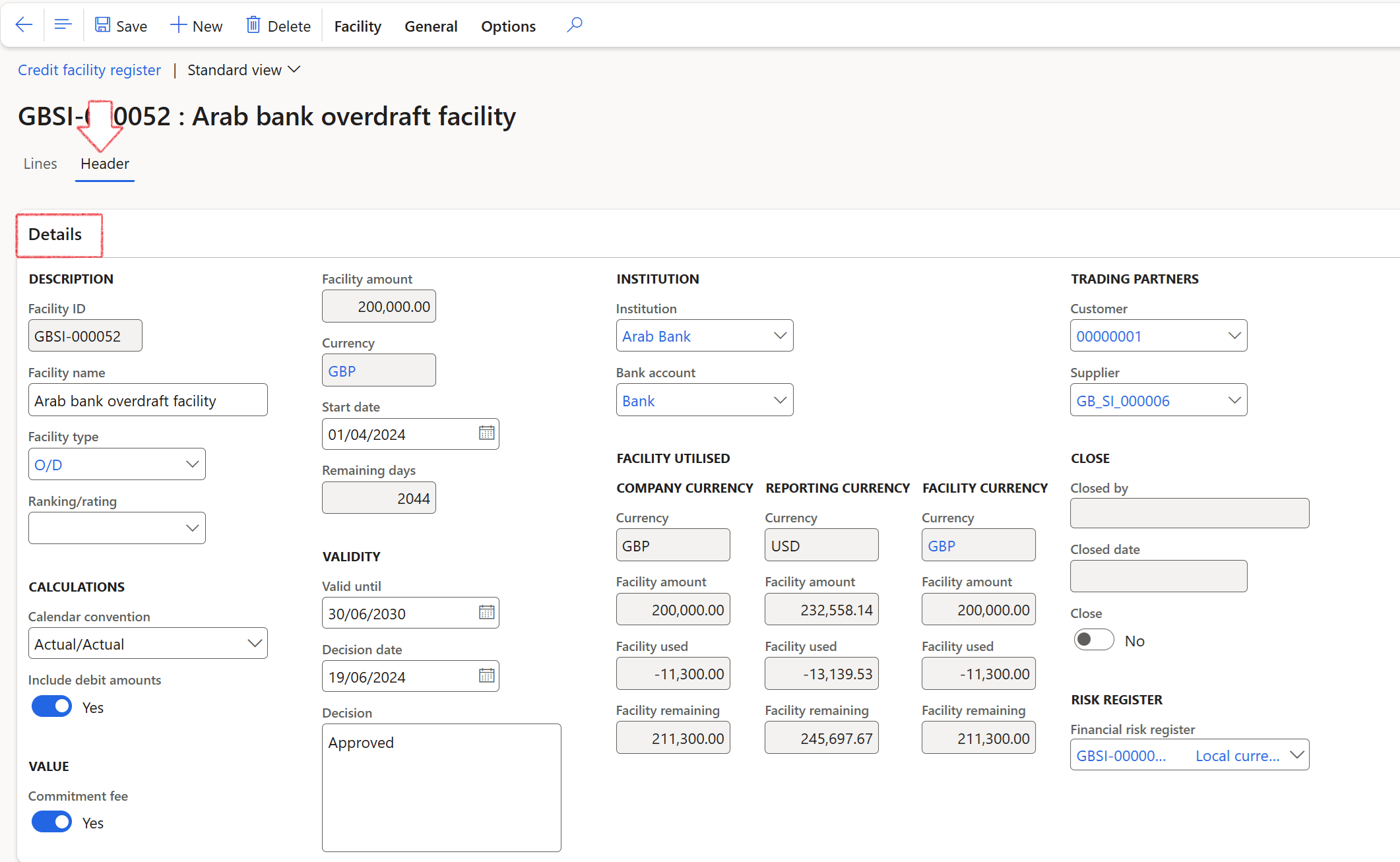

¶ Step 5.1.1: Details FastTab

On the Header section, expand the Details Fast Tab:

- Description keeps information on the Facility ID, Name and Facility type and Ranking/Rating

- Calculations will show the calendar convention. Choose between Actual/Actual, Actual/365 Fixed, Actual/360 or 30/360

- Value will indicate if a Commitment fee is used (yes/no slider), the Currency and the Facility amount, start date and Remaining days (automatically calculated as per Start date and Valid until date)

- Validity displays the Valid until date, Decision date and free text Decision field. If the Valid until date is left blank, the facility will not count as an Active facility, and will fall under Other when viewing the Facility management workspace.

- Institution (branch) and Bank account

- Facility utilized shows balances in Company currency, Reporting currency and Facility currency

- Trading partners for Customers and Vendors

- Close will show the logged in user that closed the record, and the Date it was closed

- Risk register: a financial risk register can be selected (G2T)

Additional logic in determining facility utilised are available, specifically to take into account, or ignore, inverse balances

- When the parameter Include debit amounts on the Credit facility header is set to No it means that all debit balances are ignored as though they were zero. So when the Include debit amounts option is set to No, debit amounts will be treated as zero or omitted from the calculation of facility limits (Facility Utilized)

- Conversely, when the parameter Include debit amounts is set to Yes, it means that debit balances are included in the calculation, which will offset some credit balances utilizing the Facility.

¶ Step 5.1.2: Limits FastTab

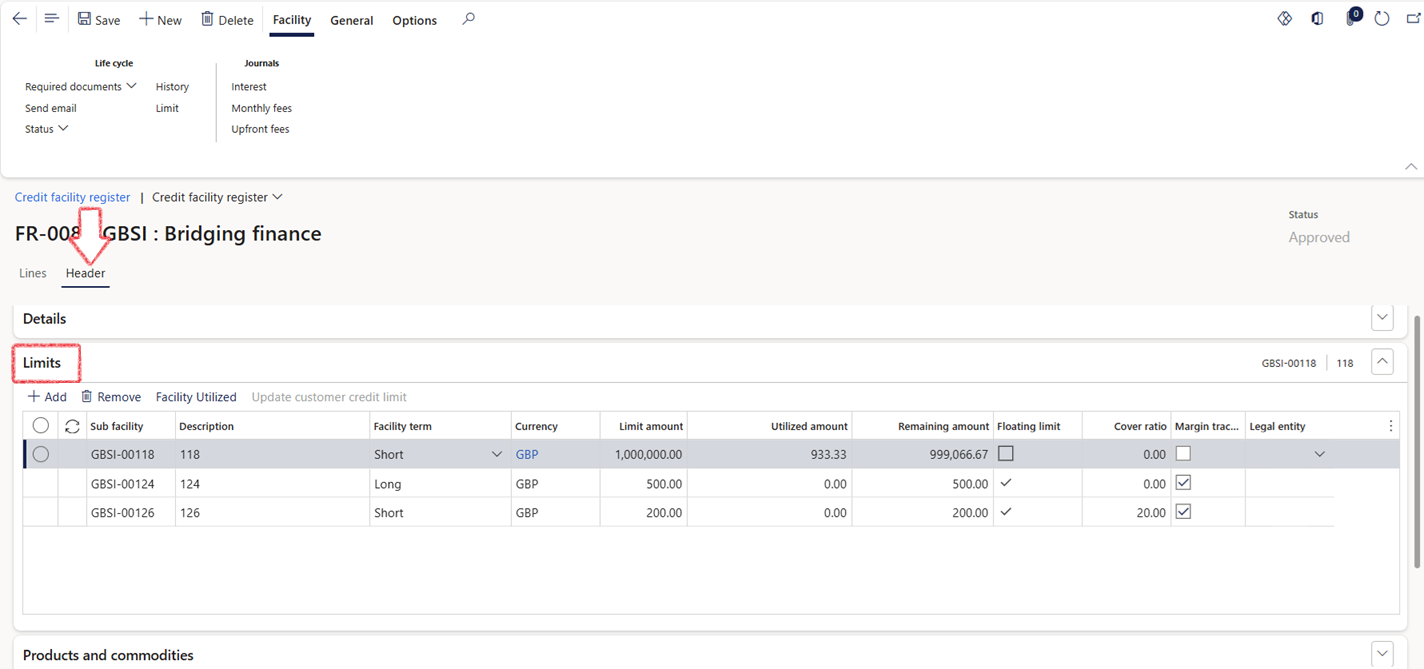

On the Header section, expand the Limits Fast Tab:

- Add a Sub facility, Description.

- Indicate if it is a long or short term

- Select currency

- Enter Limit amount

- Indicate if it will be a Floating limit

- Capture the margin that the bank requires per sub-facility

- Enter the cover ratio (numeric, 2 decimals)

- Indicate if Margin tracking is required or not

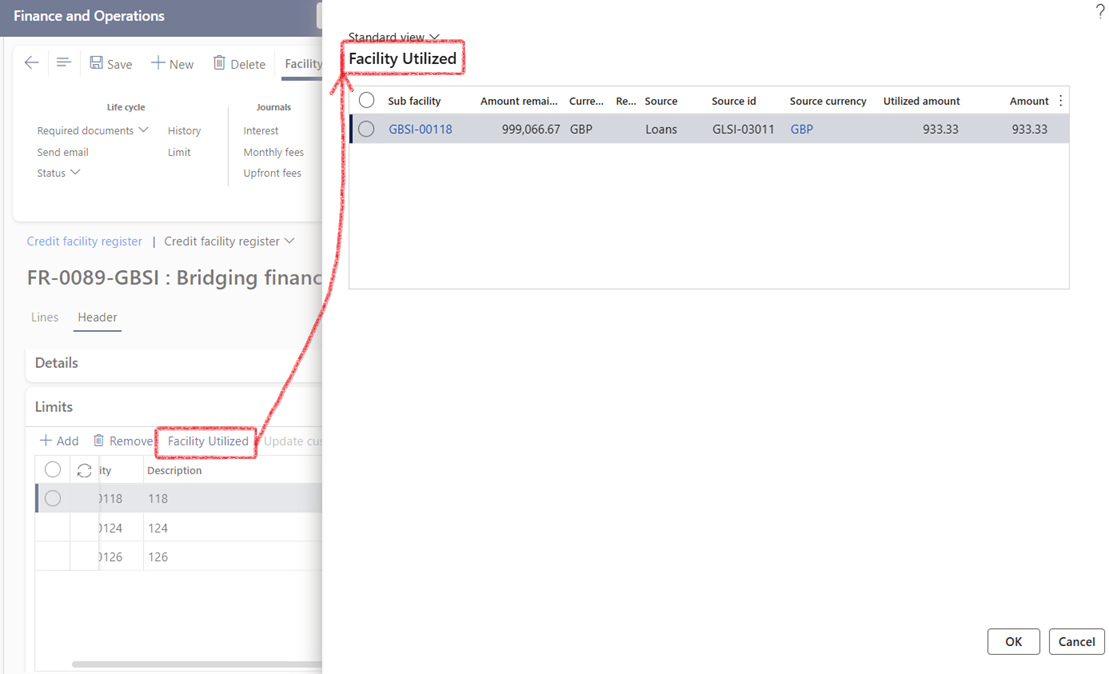

- Click on Facility Utilized to see more information on the utilized amounts

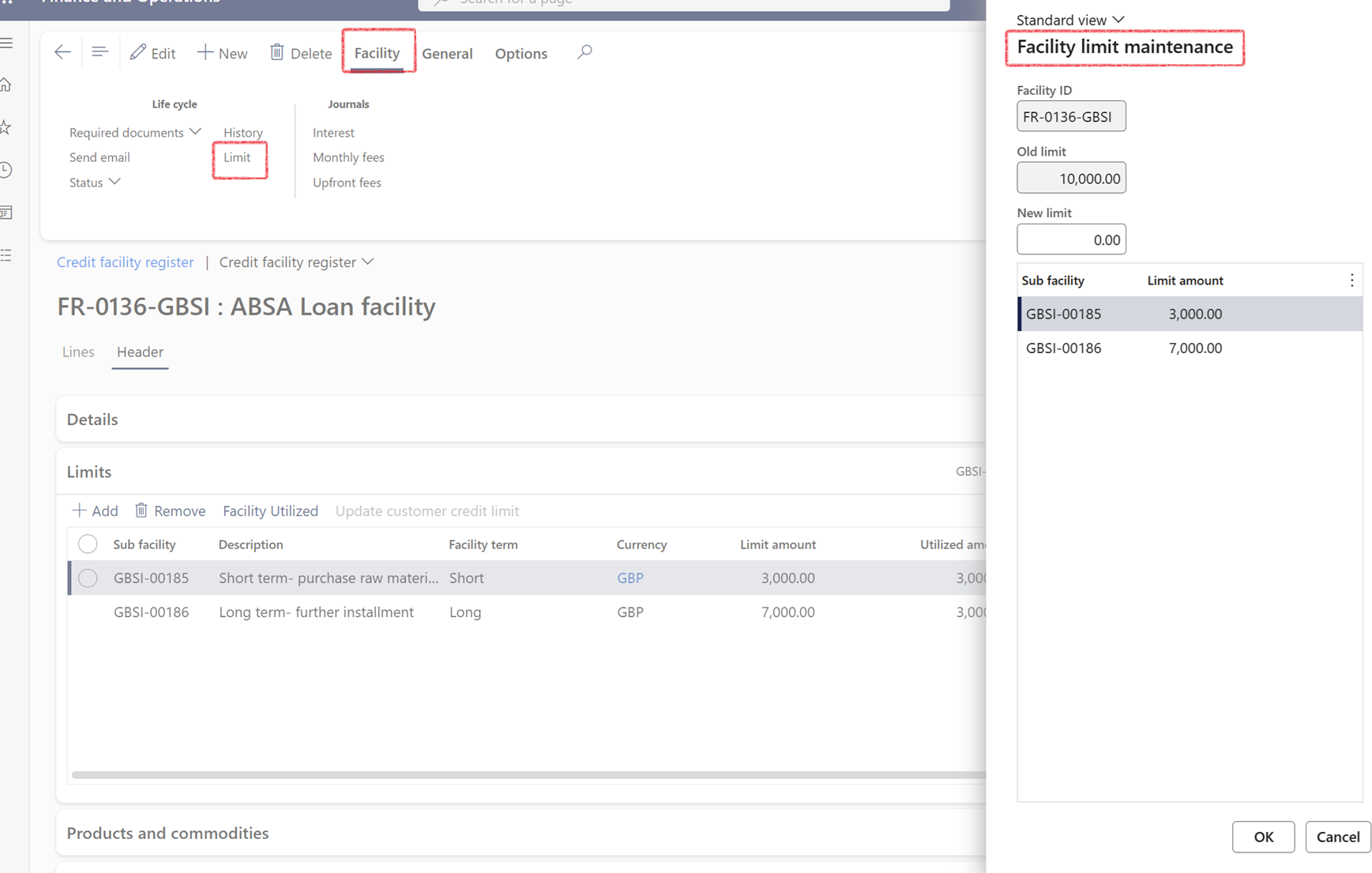

¶ Step 5.1.2.1: Facility limit maintenance

Sub-limits can be edited at the same time as the main limit, ensuring better flexibility and control over facility adjustments. Sub-limits can be edited when modifying the Facility Limit. In the action menu on the top of the screen, when clicking on the Limit button, a Facility limit maintenance dialogue will open. The fields will display as follows:

- Facility ID

- Old limit

- New limit

- Sub facility

- Limit amount: This is an editable field where the sub-limit amount can be adjusted

The sum of sub-limits should not exceed the main facility limit.

Editing the main limit is done through the Facility Register (Treasury > Registers > Credit Facility Register).

After selecting a facility, the Limit button in the Activity Pane - Life Cycle allows modifications.

Sub-limits are listed and editable directly within this dialog, alongside the main limit.

Changes to the main limit are logged as before, but sub-limit changes are not logged.

A built-in validation ensures the sum of sub-limits cannot exceed the new main limit.

¶ Step 5.1.3: Products and commodities FastTab

On the Header section, expand the Products and commodities Fast Tab:

- Select an Item number and commodity ID and enter a Description

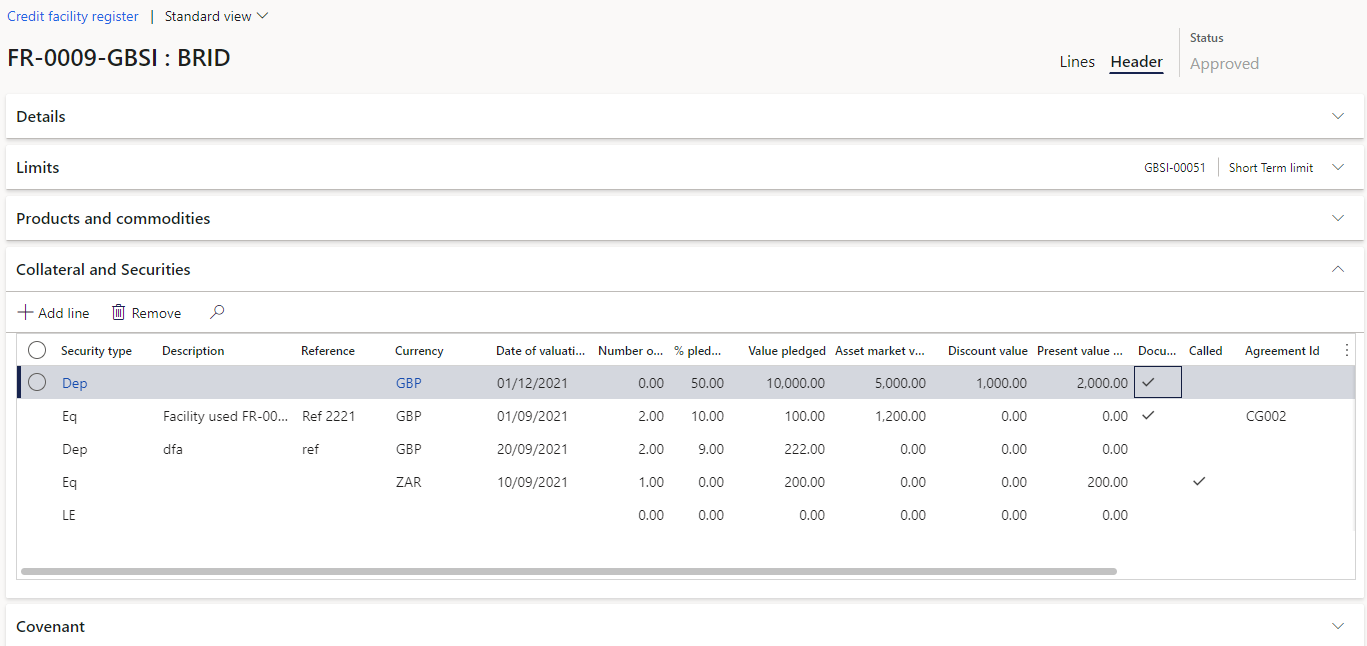

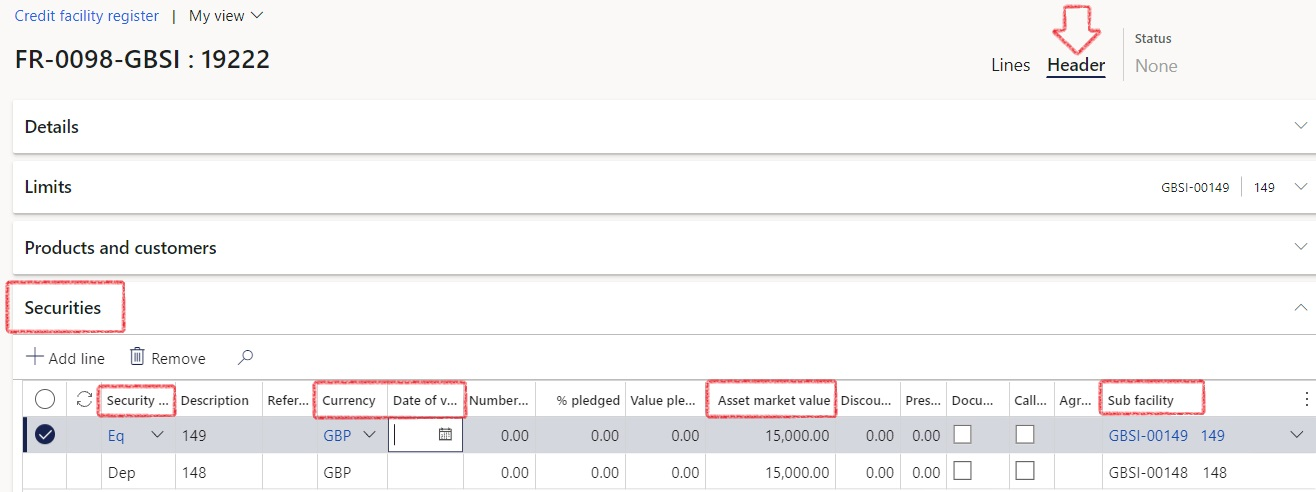

¶ Step 5.1.4: Collateral and Securities FastTab

Collateral and Securities Fast Tab:

- Select a Security type

- Enter a Description

- Reference is optional

- Select a Currency

- Date of valuation

- Number of shares

- % pledged

- Value pledged

- Asset market value

- Discount value

- Present value of Future Cash flows

- Document attached (tick box)

- Called (tick box)

- Agreement Id (select from list)

- Sub facility – select from list

If Margin tracking required is ticked on under the Limits FastTab, the amounts entered in the Asset market value field will influence the values on Facility margin (Treasury> Registers> Inquiries and reports> Facility margin)

¶ Step 5.1.5: Covenant FastTab

Covenant FastTab:

- Click Add line

- If required, the line can be Removed

- Select a Covenant ID from the drop-down list (asset/debt ratio, gearing ratio, cashflow interest, security cover, etc.)

- Select a Currency

- Add a Description

- Select a covenant type (Financial Covenant, Negative or Positive)

- Enter a Target value

- Enter Value

- Date of review

- Next review date

- Restrictions

Tick boxes for the following:

- Extension required

- Equity cure needed

- Debt buy back needed

- Call back loan

- Complied

- Contract addendum needed

- Court proceedings

- Document attached

- Enforce collateral

- Insolvency process

- Waiver offered

- Warning notes

- Warning issues

- Action required: free text field

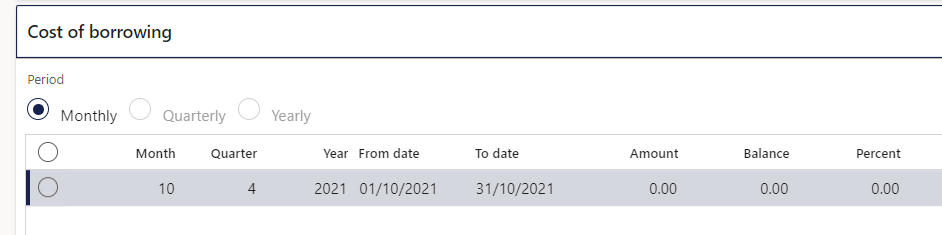

¶ Step 5.1.6: Cost of borrowing FastTab

On the Header section, expand the Cost of borrowing FastTab. Cost of borrowing can be viewed for different periods:

- Monthly

- Quarterly and

- Yearly

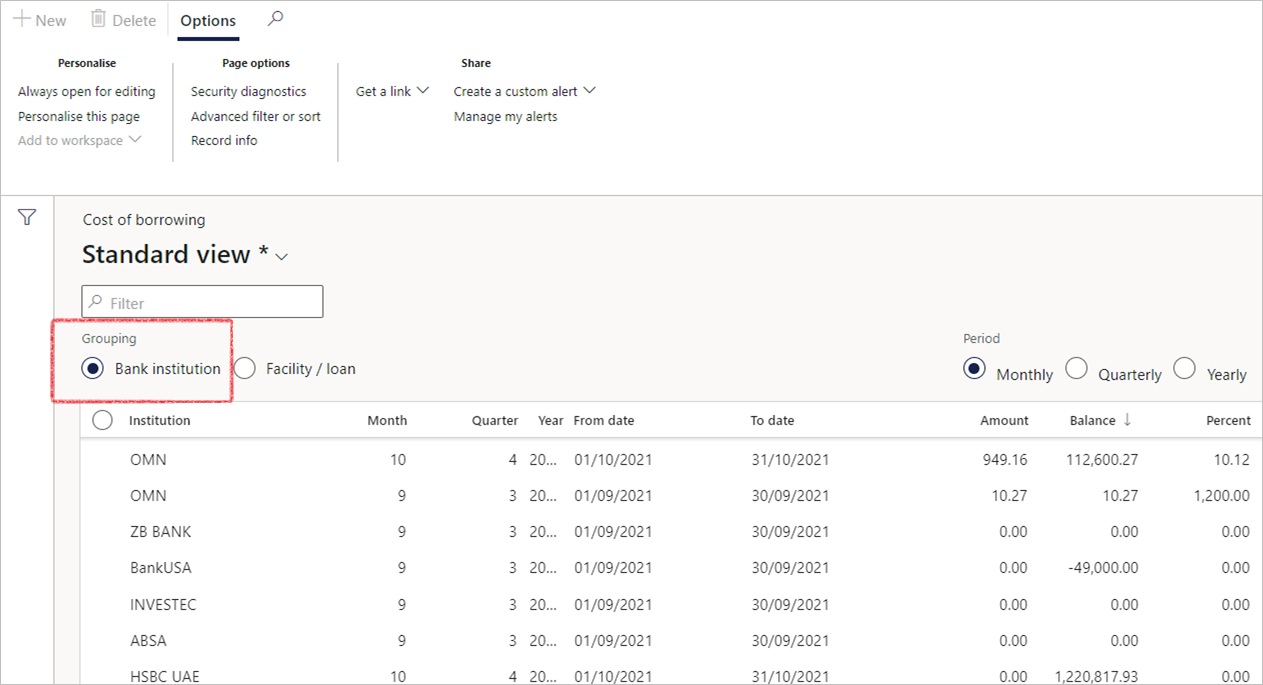

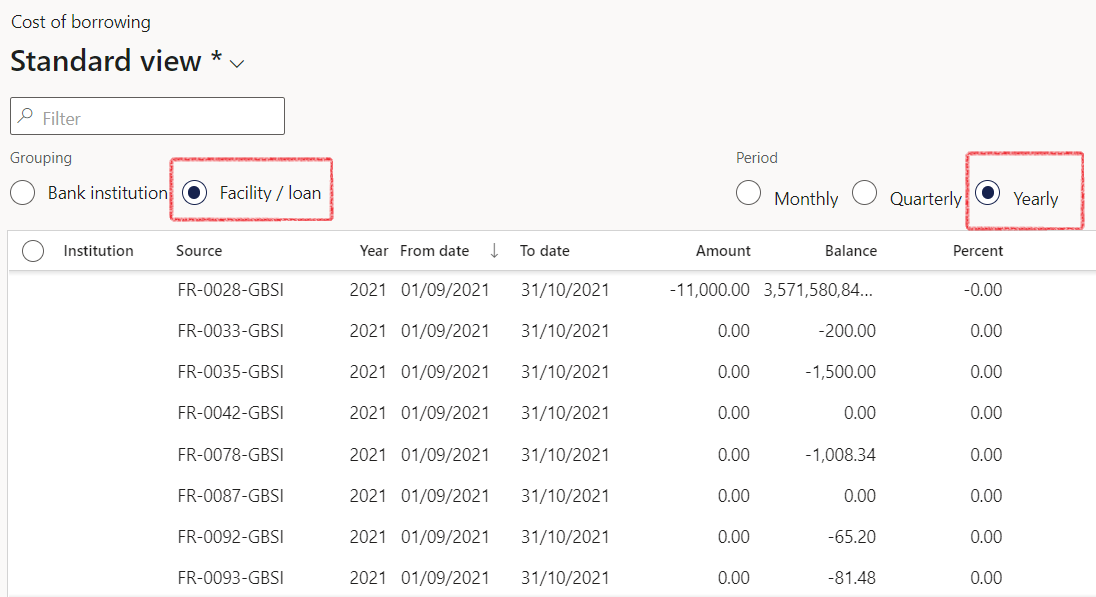

- An enquiry screen for Cost of borrowing can be viewed by navigating to Treasury> Common> Inquiries and reports> Cost of borrowing

- Can filter between Bank institution and Facility/loan

- Can view the overall percentage

- Can select to view Monthly, Quarterly or Yearly summary per institution

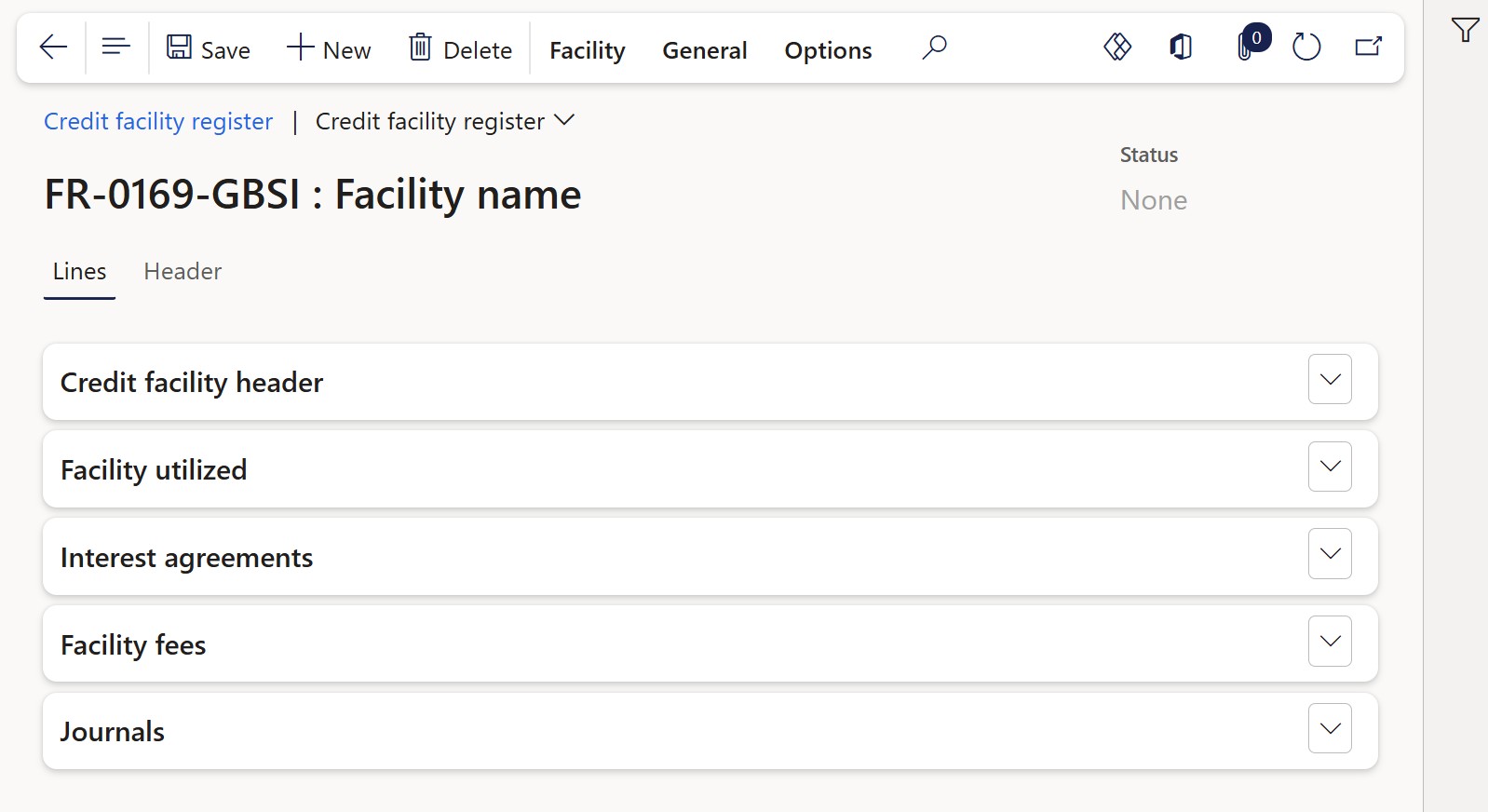

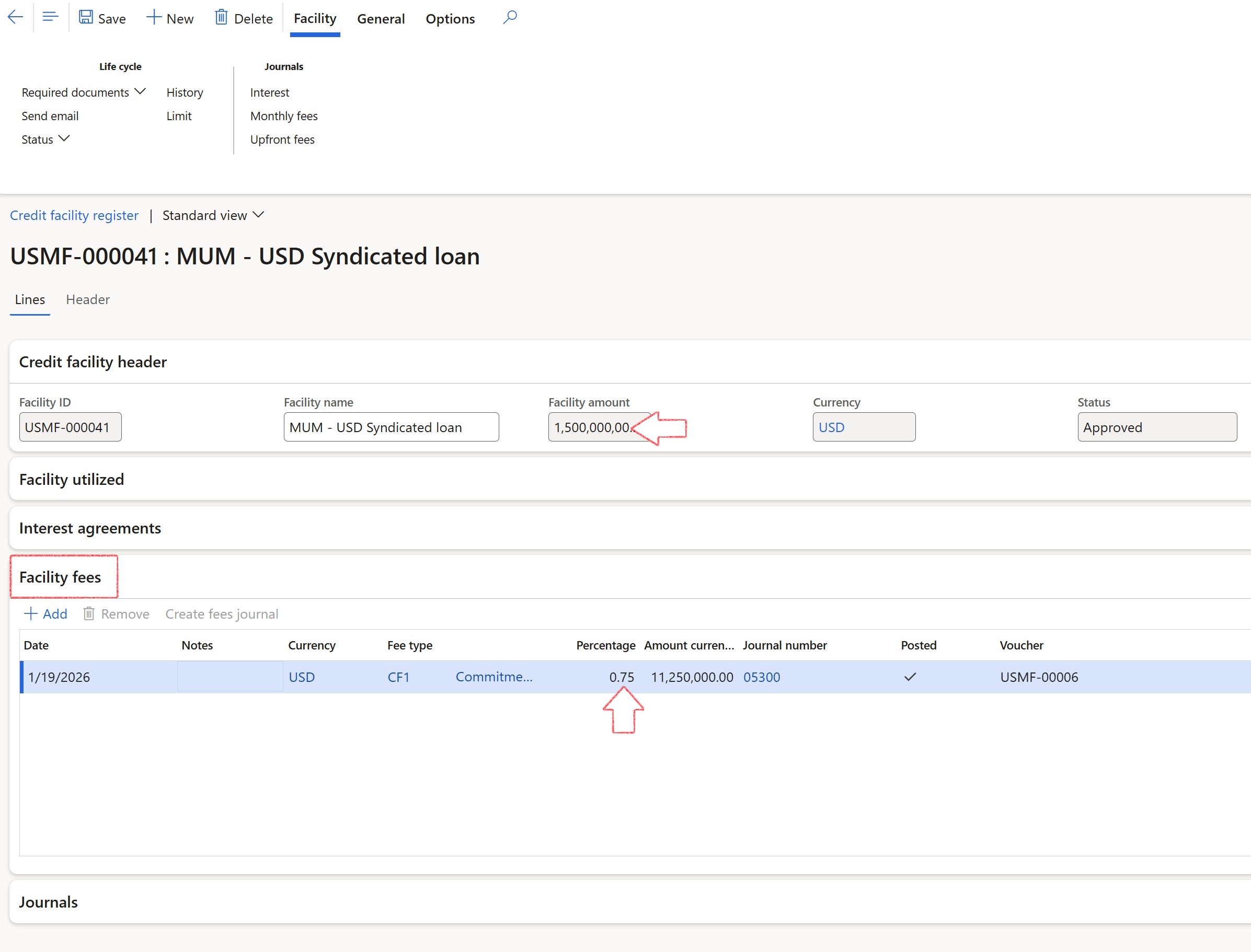

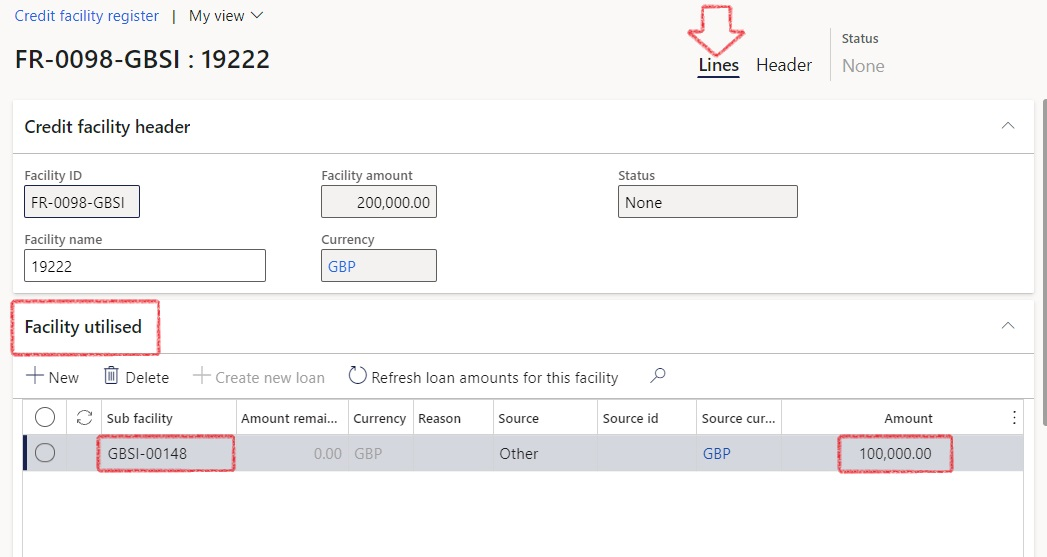

¶ Step 5.2: Lines index tab on the Credit facility register

- On the Lines section, complete information on the following Fast Tabs

- Credit facility header

- Facility utilised

- Interest agreements

- Facility fees

- Journals

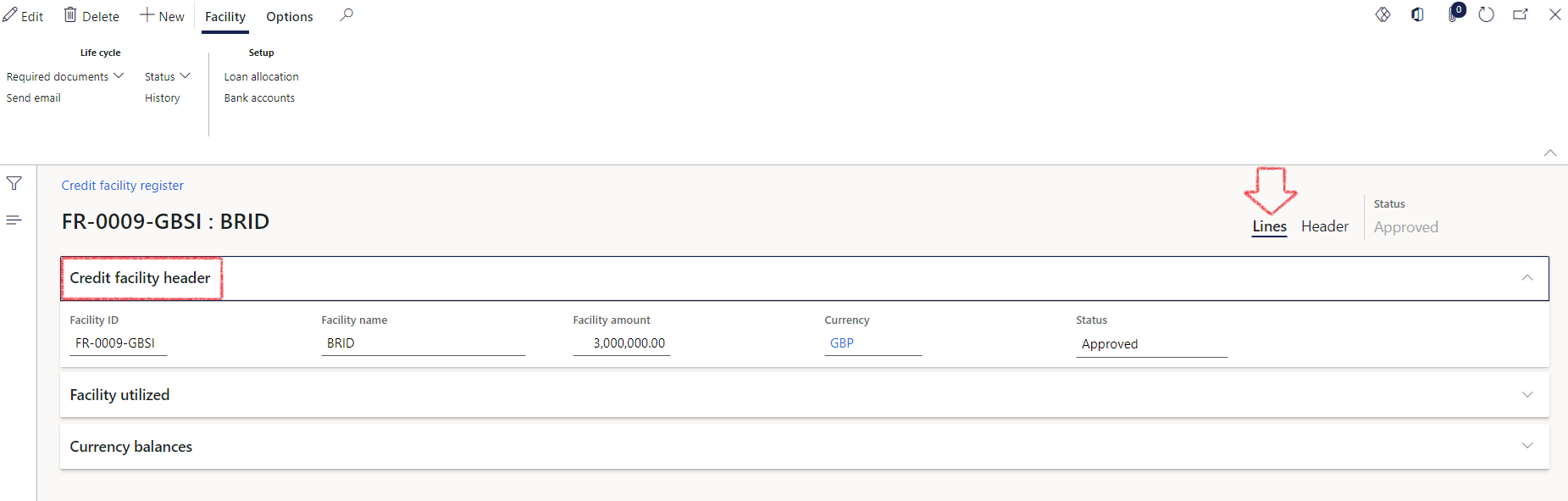

¶ Step 5.2.1: Credit facility header FastTab

On the Lines section, expand the Credit facility header FastTab to view the following:

- Facility ID

- Facility name

- Facility amount

- Currency

- Status

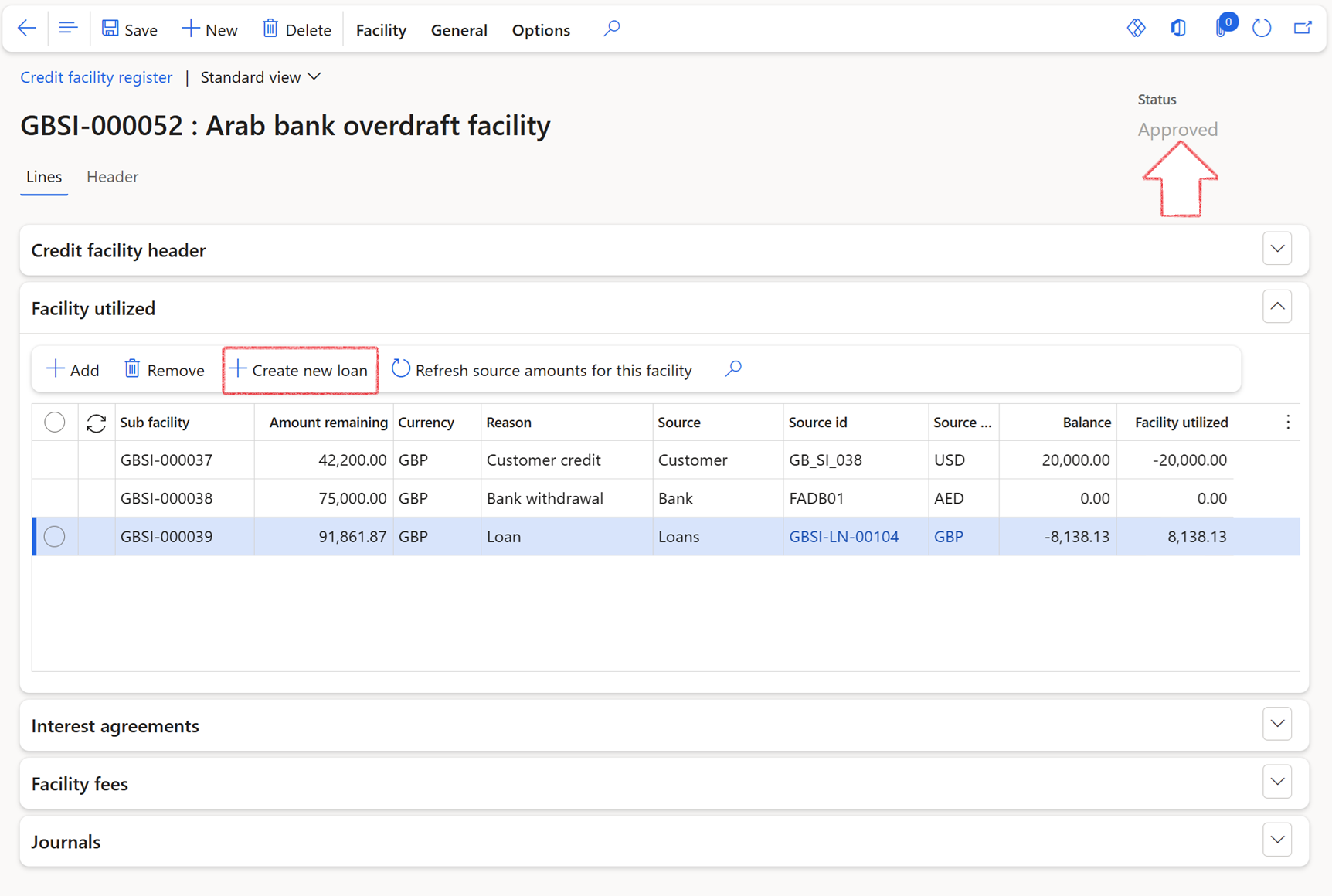

¶ Step 5.2.2: Facility utilized FastTab

- On the Lines section, expand the Facility utilized Fast Tab

- Select a Sub facility from the drop-down list

- Select a Source. Choose between

- Loans

- Bank

- Customer

- Vendor

- Other

- Ledger

- Select a Source id (if source was loans, the source ID will be a loan number. If source was Bank, the source ID will be a bank account, if the source was customer, the source ID will be a customer account ID, and so on).

By clicking on the Update customer credit limit button, the selected customer’s credit limit can be adjusted.

- Select a Source currency

- Enter an amount

- A new Loan can be created from here, provided the facility status is Approved

- On the Facility utilised FastTab, there is a button called Refresh source amounts for this facility. This will update the Amount on the loan facility

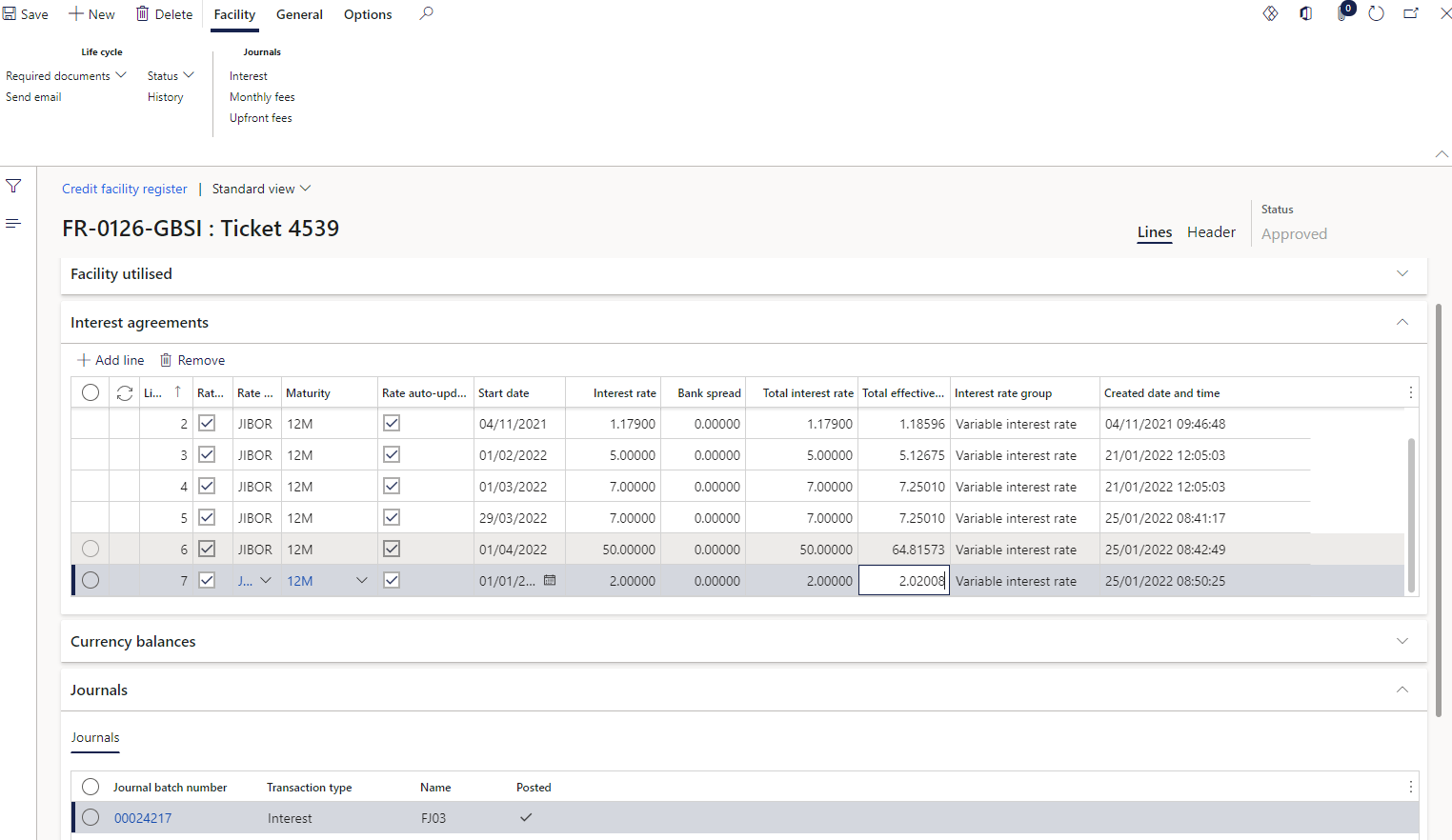

¶ Step 5.2.3: Journals FastTab

On the Lines section, expand the Journals Fast Tab

- The journals FastTab will display the journal batch number, transaction type, name of journal and show if it is posted or not

- To generate an interest journal, there must be an interest agreement linked to the facility

¶ Step 5.2.4: Administration fees FastTab

- On the Lines section, expand the Facility fees FastTab

- Click on Add to add a new line for the journal

- Click on Remove to remove an existing line. This can only be done if the journal was not posted yet.

- The Facility fees FastTab consist of the following columns:

- Date

- Notes - a free text field

- Currency - can select from a drop-down menu

- Fee type - can select from a drop-down menu

- Percentage - Entering a percentage in this field will automatically calculate the fee as a percentage of the Amount currency field for credit facilities

- Amount currency – type in the amount for this journal line

- Journal batch number – this is a display field only

- Posted is also a display field and will indicate if this journal line is posted or not

- Voucher is the voucher number for the journal line and is a display field

- Click on Create fees journal for the system to automatically create a journal.

- The journal will be created and can be found under Monthly Fees in the ribbon bar. Alternatively, click on the journal batch number link in the lines, to be directed to the journal record.

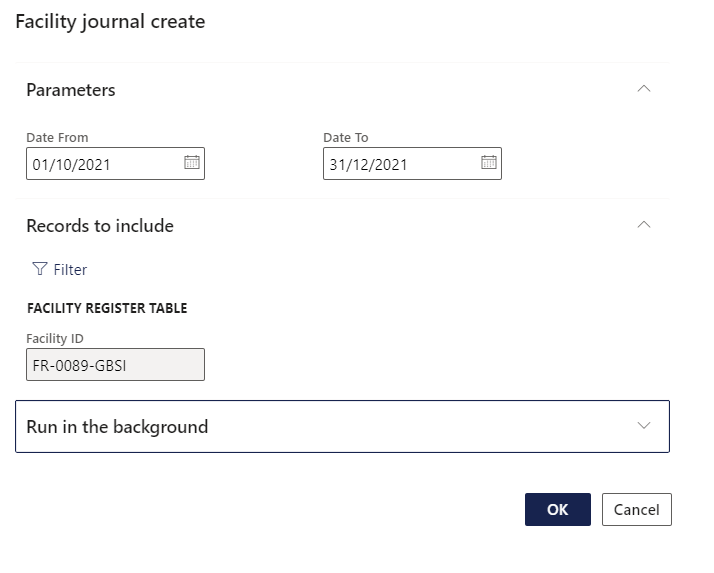

¶ Step 6: Facility journal create

A periodic function to create a Credit facility journal

- Go to: Treasury > Registers > Periodic> Facility journal create

- Can select a date from and date to

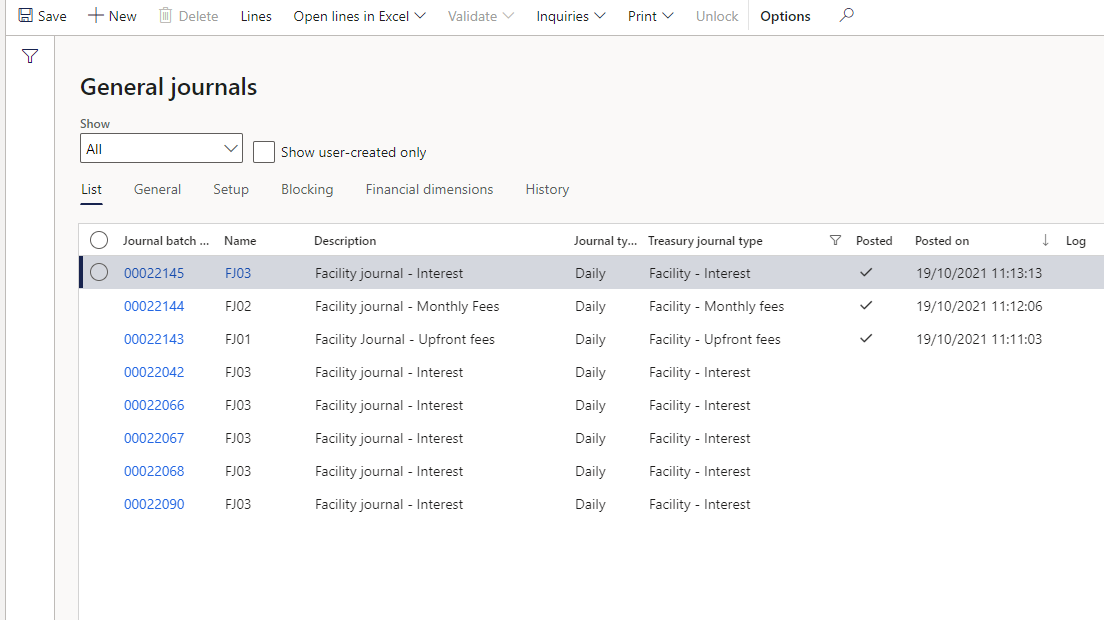

¶ Step 7: Journals

View three types of Journals for credit facilities

- Go to: Treasury > Registers > Journals>

- Interest journals, Monthly fees and Upfront fees journals can be viewed from here.

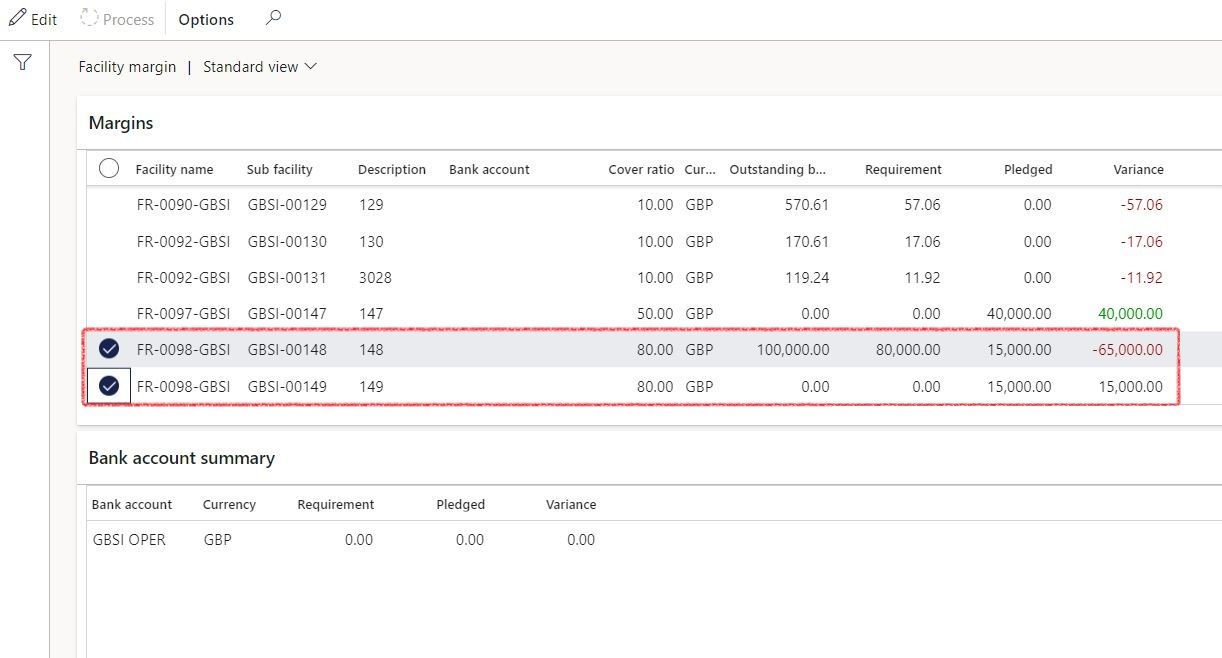

¶ Step 8: Pledge position

To calculate and display margins and excess or shortfalls, the following areas needs to be completed inside the Credit facility register.

Enter limits on the Sub facility

- Go to: Treasury > Registers > Credit facility register

- On the header section, expand the Limits FastTab

- Enter the following:

- Limit amount

- Cover ratio percentage (the margin that the bank requires per sub-facility)

- Select the Margin tracking required tick box

On the Lines section, expand the Facility utilized Fast Tab

- Select a sub facility

- Select a source (if applicable), and a Currency and

- Enter an Amount

Enter Securities information on the header section

- Expand the Securities FastTab

- Select a Security type from the list

- Enter a description

- Select a Currency

- Enter the Asset market value

- Select a Sub facility

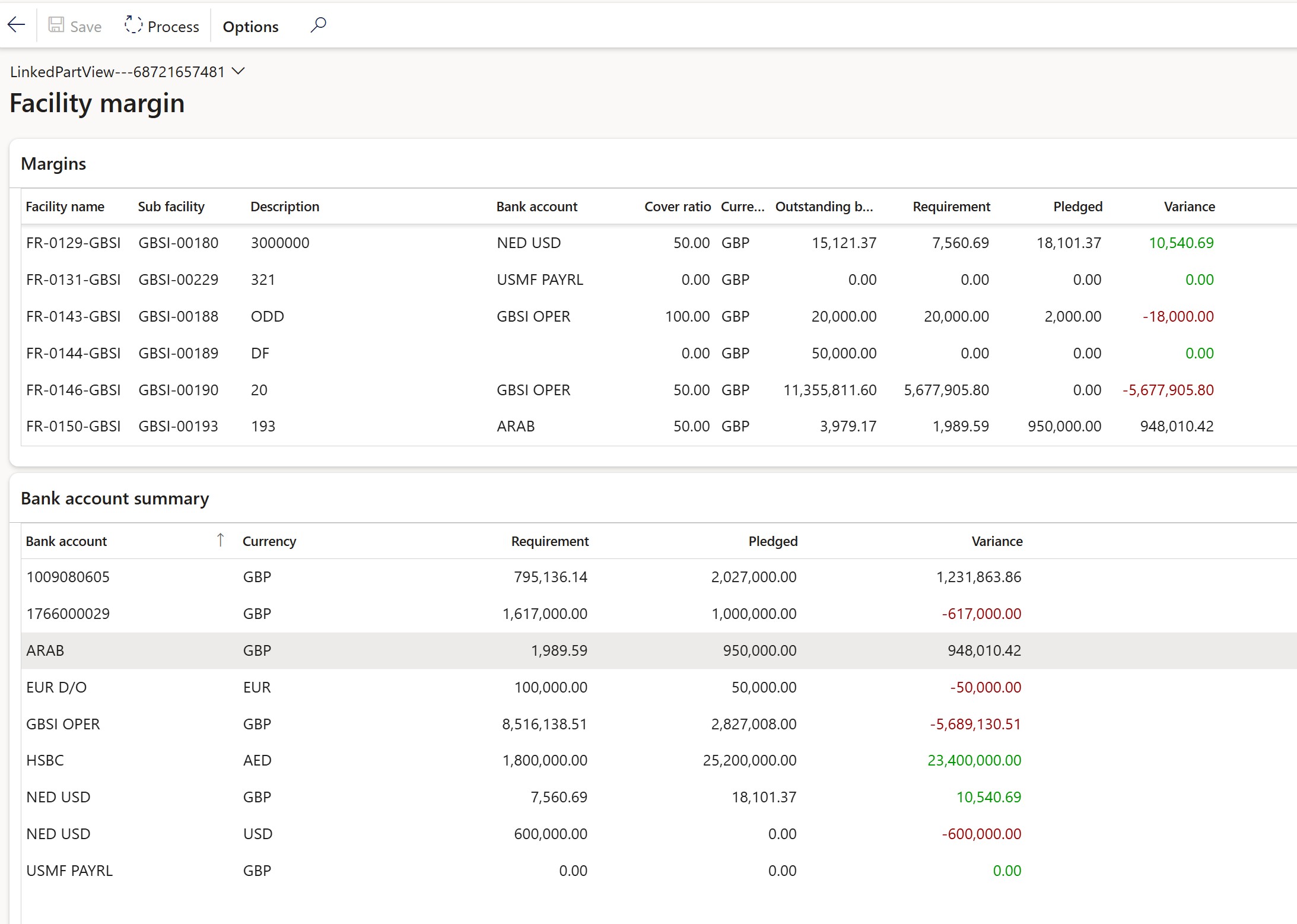

To view facility margin – excess or shortfalls, navigate to:

- Treasury> Registers> Inquiries and reports and click on Facility margin

- Move to the Facility name and click on Process

- The following information will be displayed:

- Facility name and Sub facility

- Cover ratio

- Currency

- Outstanding balance

- Requirement

- Pledged

- Variance

¶ Workspaces & Reports

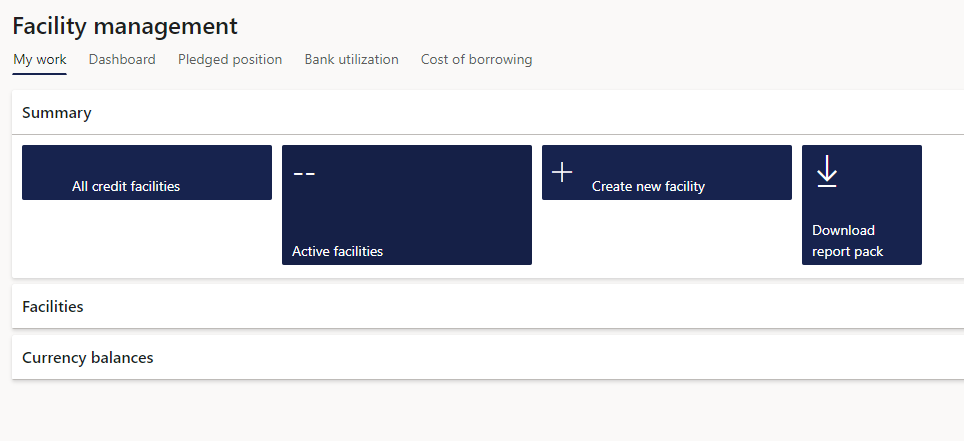

¶ Step 9: Facility management workspace

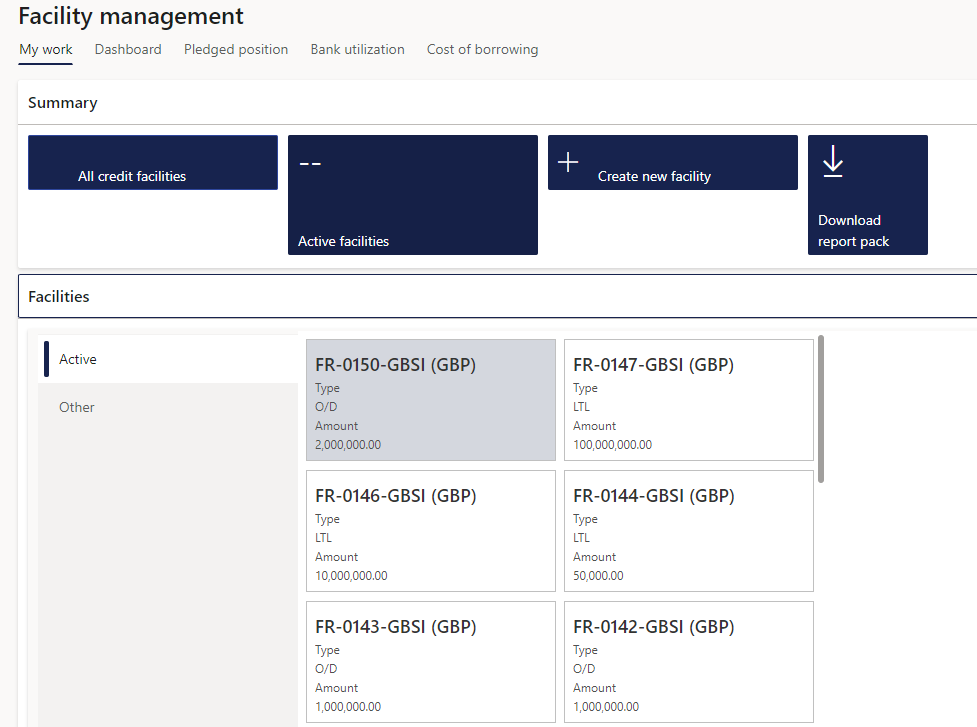

The facility management workspaces can be accessed by navigating to:

- Go to Treasury > Workspaces > Facility management

- The workspace consists of the following areas:

- My work

- Dashboard

- Pledged position

- Bank utilization

- Cost of borrowing

¶ Step 9.1: My work tab

¶ Step 9.1.1: Summary FastTab

- Contains a summary FastTab, which displays the count of Credit facilities. The user can also create a new facility from this section.

¶ Step 9.1.2: Facilities FastTab

- The second FastTab is called Facilities. This contains tiles of Active and Other facilities, sorted by number. Active facilities will have a Start date and Valid until date.

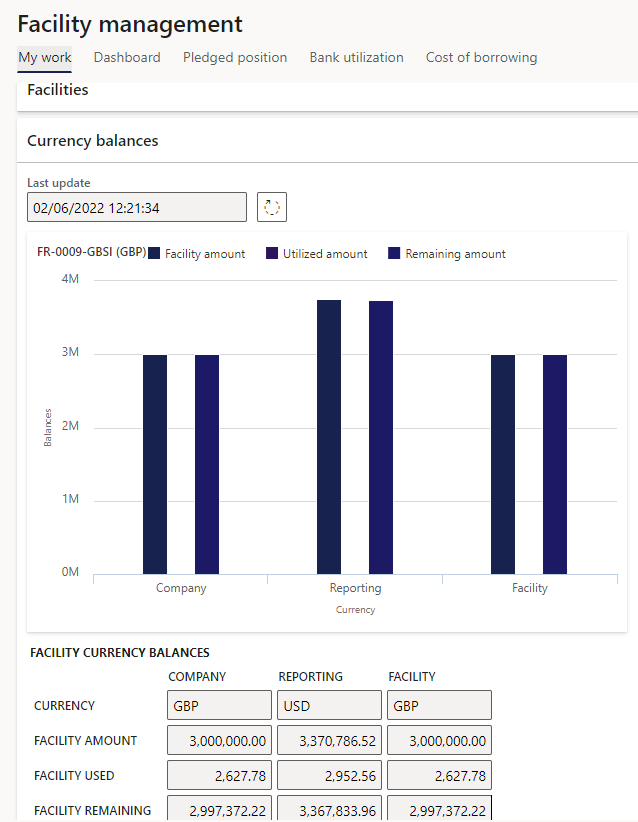

¶ Step 9.1.3: Currency balances FastTab

- The third FastTab displays graph for the Currency balances for the facility that is selected on the tile in the middle of the workspace. The graph shows the Facility amount, Utilized amount and Remaining amounts

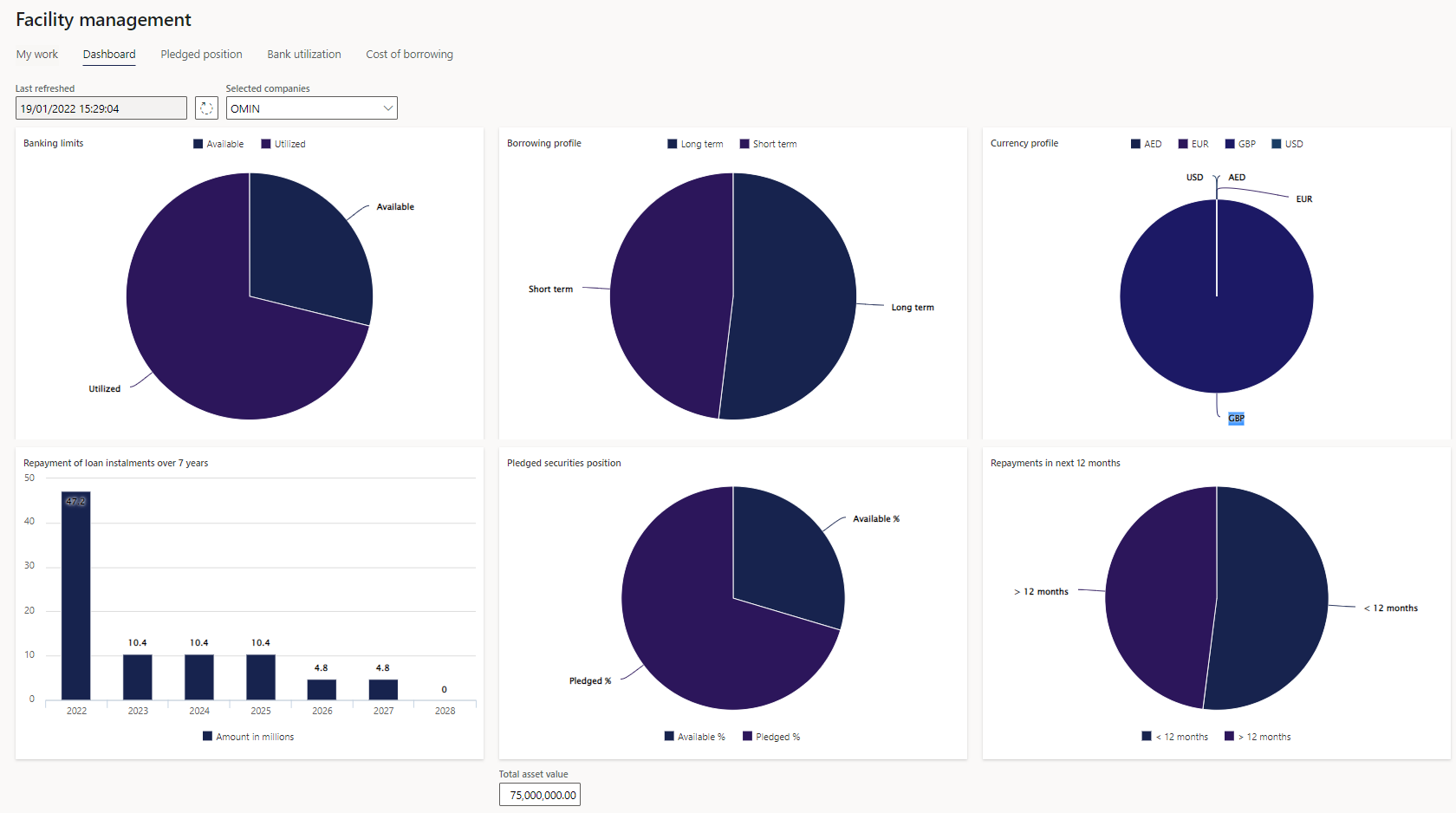

¶ Step 9.2: Dashboard tab

Dashboard of the following:

- Banking limits:

- total of utilized facilities

- total of available (not used) facilities

- displayed as a percentage of total facilities

- Borrowing profile

- total of short-term facilities utilized

- total of long-term facilities utilised

- both displayed as a percentage of total facilities utilized

- Currency profile

- total of facilities utilized, per currency

- expressed as a percentage of total facilities

- adjusted for currency exchange rates

- Repayment of loan instalments over 7 years

- Amounts expressed in millions

- Source is Redemption amounts as per projected loan statements

- X-axis is years

- Y-axis is Total of repayment amounts in company currency

- Pledged securities position

- amount of assets pledged against total assets

- pledged percentage is Total of market value of all securities pledged against facilities, as a percentage of total assets

- available percentage is Total of assets less total of market value of pledged securities, as a percentage of total assets

- Repayments in next 12 months

- Based on loans, but filter out inter-company loans (only bank loans)

- Repayment totals for 12 months

- As a percentage of total payments, on all loans

- Total asset value

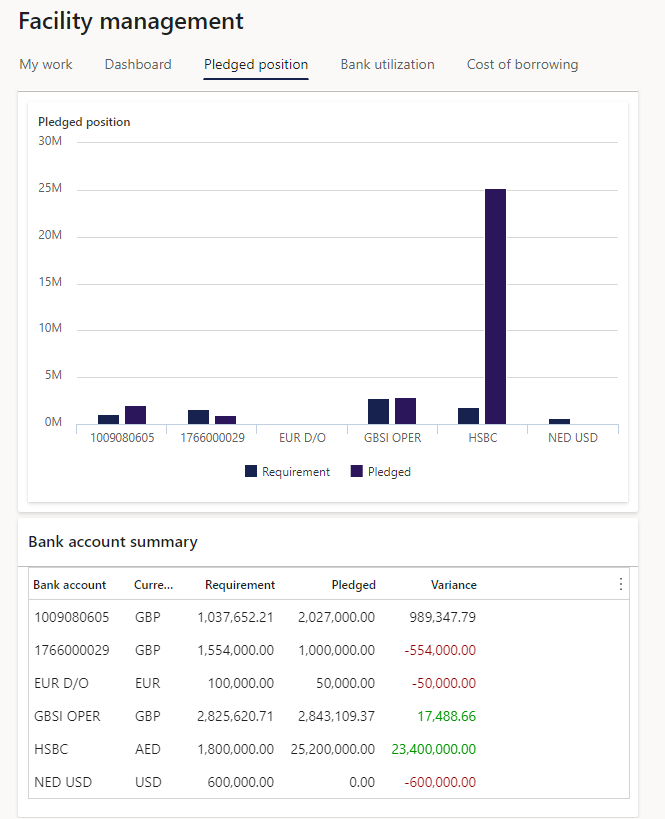

¶ Step 9.3: Pledged position tab

- Pledged position graph

- Bank account summary

- Bank account summary

- Bank account

- Currency

- Requirement

- Pledged amount

- Variance

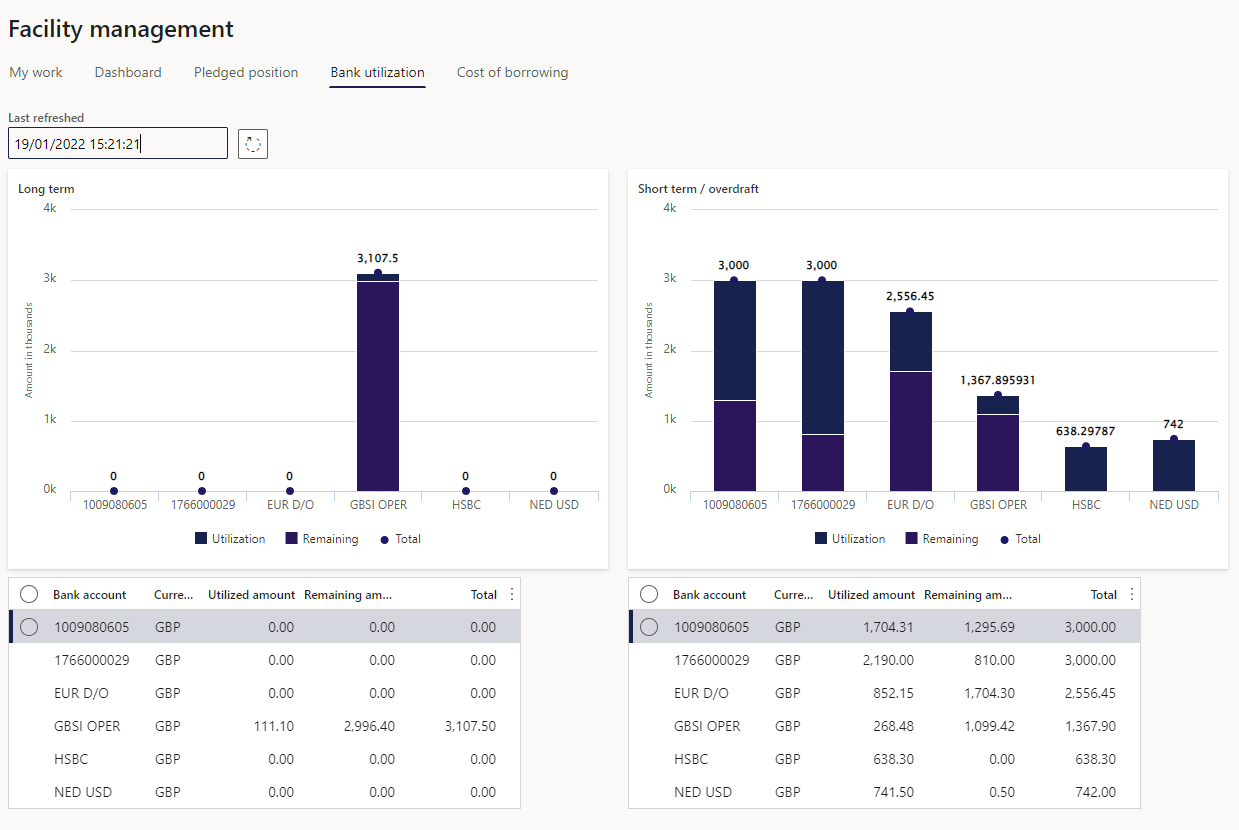

¶ Step 9.4: Bank utilization tab

- Long term graph:

- Display balances linked to long term facilities

- Amounts rounded to thousands

- Totals per bank

- Per bank, broken into facilities available / utilised

- Total facilities per bank

- Total for facilities still available

- All balances linked to facilities (loans, bank, other)

- Keeping into account that limit may be fixed or floating

- Short term / overdraft graph:

- Same as long term, but only display facilities marked as short-term

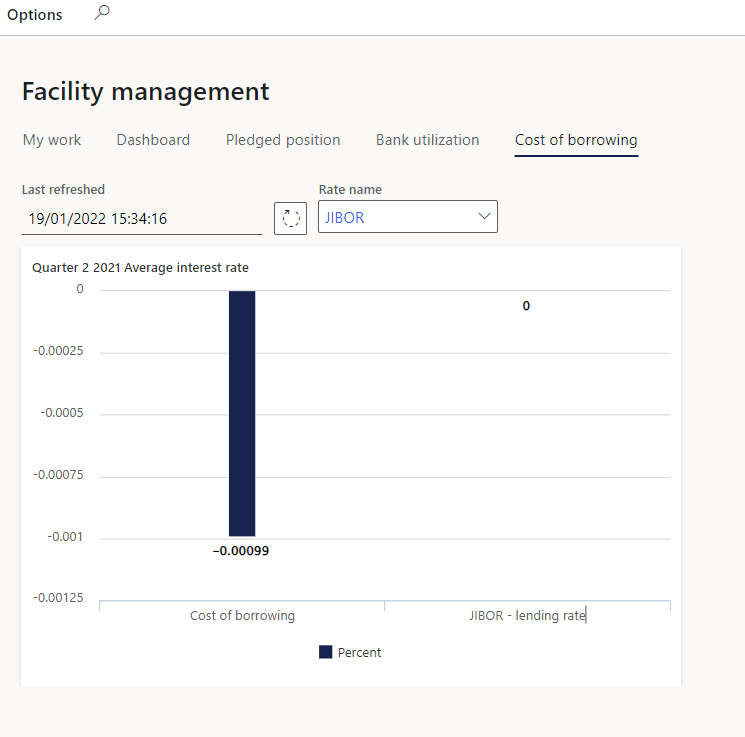

¶ Step 9.5: Cost of borrowing tab

- Dashboard indicating total % of cost of funding

- Show calculation for most recent quarter

- Bank rate to be captured in interest rate table, with selection to choose relevant rate.

¶ Step 10: Facility margin

- Go to: Treasury > Registers > Inquiries and reports > Facility margin

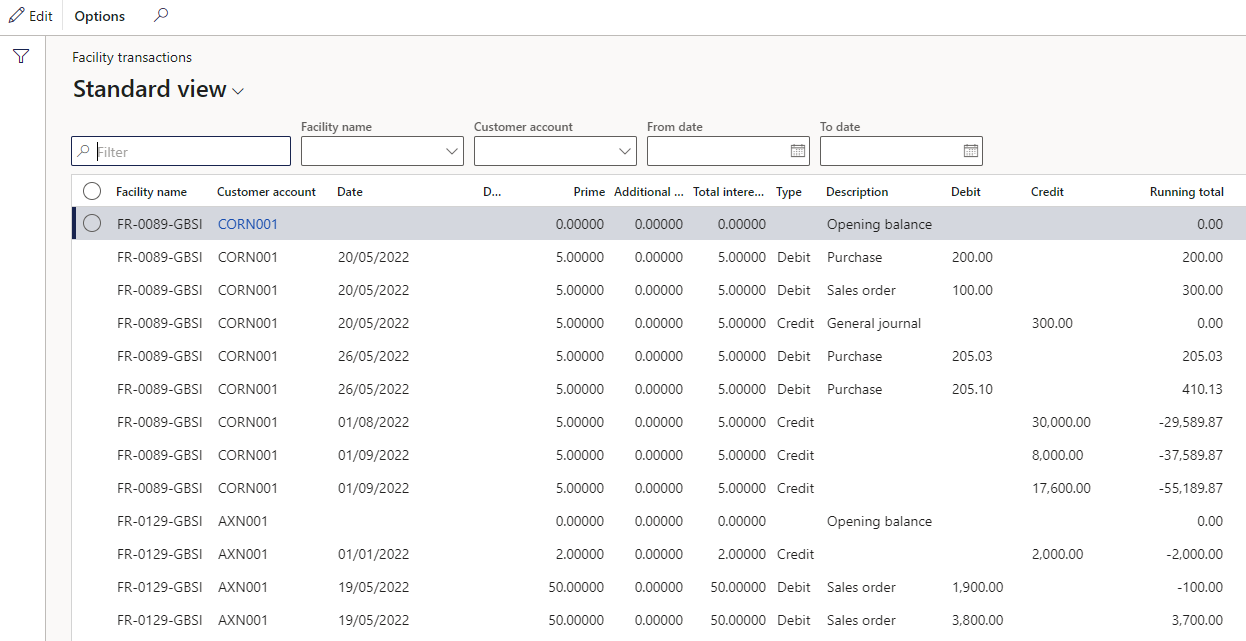

¶ Step 11: Facility transactions

The Facility transactions report will indicate the movement against a facility. The report list all the transactions, with additional information regarding the interest rate. Date range, Facility number and Customer account can be filtered.

- Go to: Treasury > Registers > Inquiries and reports > Facility transactions

The following filters are available:

- Date range: From and To date

- Facility number: can specify a facility

- Customer: specify a customer

Report columns:

- Facility name

- Customer account

- Date

- Document

- Prime

- Additional interet

- Total interest %

- Type

- Description

- Debit

- Credit

- Running total