¶ Introduction

Corporate events (CE's) are actions initiated by public companies that affect the status of their issued securities, typically approved by the board and shareholders. Common examples include stock splits, dividends, and mergers. CE's are categorized as mandatory (affecting all shareholders), voluntary (shareholders choose to participate), or mandatory with choice (all shareholders are affected but can select from options).

Even when securities are on loan, shareholders retain rights related to corporate events and dividend entitlements, though voting rights are temporarily forfeited. Dividends on loaned securities, known as manufactured or substitute payments, may have tax implications. Platforms like Sharegain provide notifications for corporate events, allowing shareholders to recall their securities if desired.

¶ Navigation

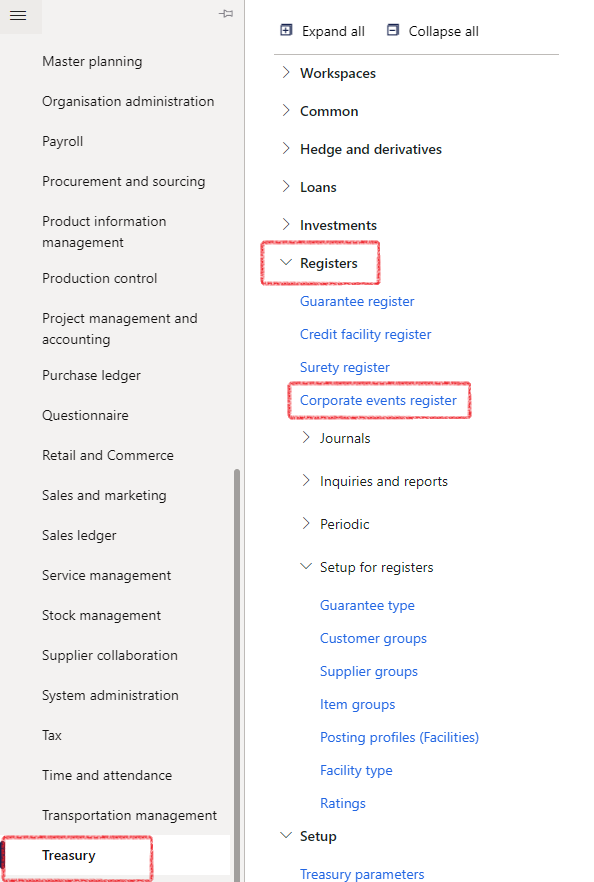

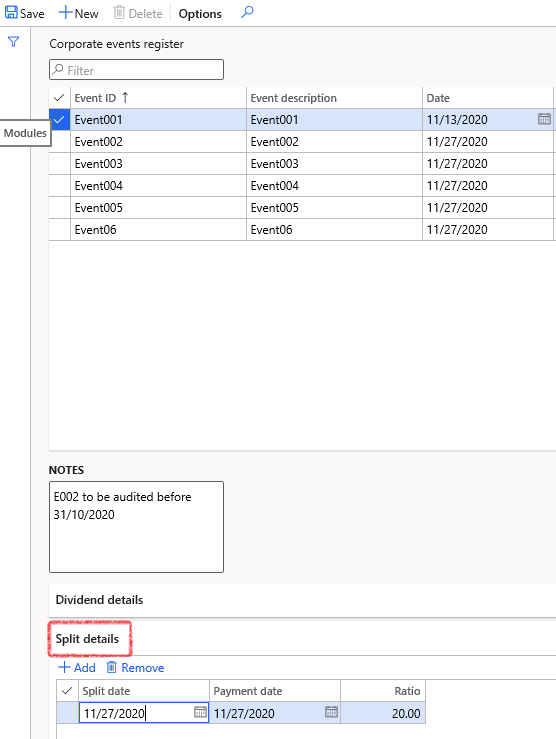

Select the Corporate events register under Registers in the Treasury module.

¶ Daily use

¶ Step 1: Create a Corporate event

Corporate events register can be created by navigating to:

- Treasury > Registers > Corporate events register

- Click on New

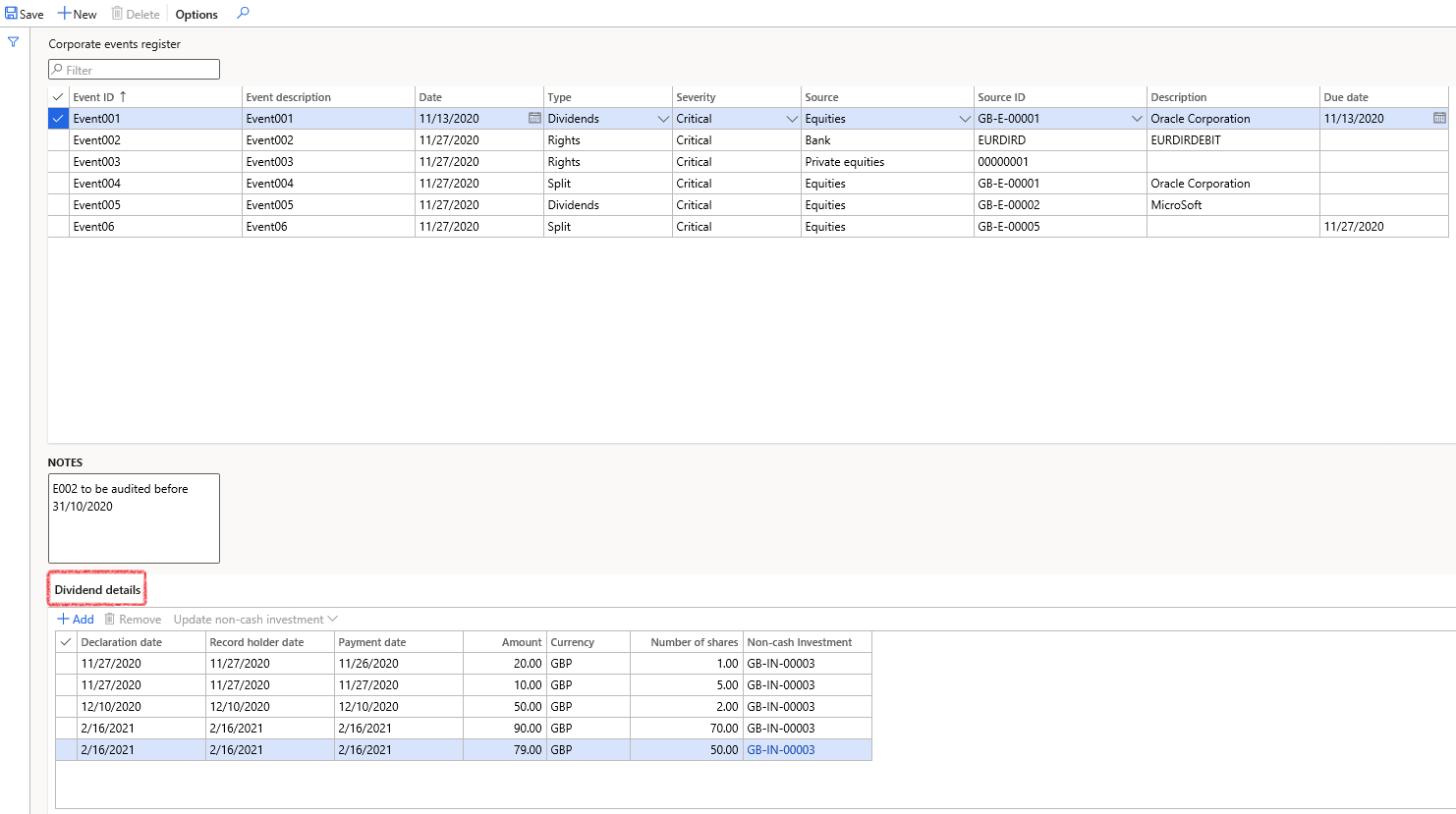

- Enter an Event ID number and Event description

- Select an event Type

- Select severity

- Choose a source and select the relevant Source ID

- Add notes

- Each corporate event has three Fast Tabs that can be opened and are filtered:

- Dividend details (declaration date, payment date, amount and number of shares)

- Split details (Split date, Payment date and Ratio)

- Rights details (Issue date, Exercise date and Ratio)

- Enter more information on Dividend details Fast Tab, such as

- Declaration date

- Record holder date

- Payment date

- Amount

- Currency

- Number of shares and

- Non-cash investment number

¶ Step 2: Link a Non-Cash Investment

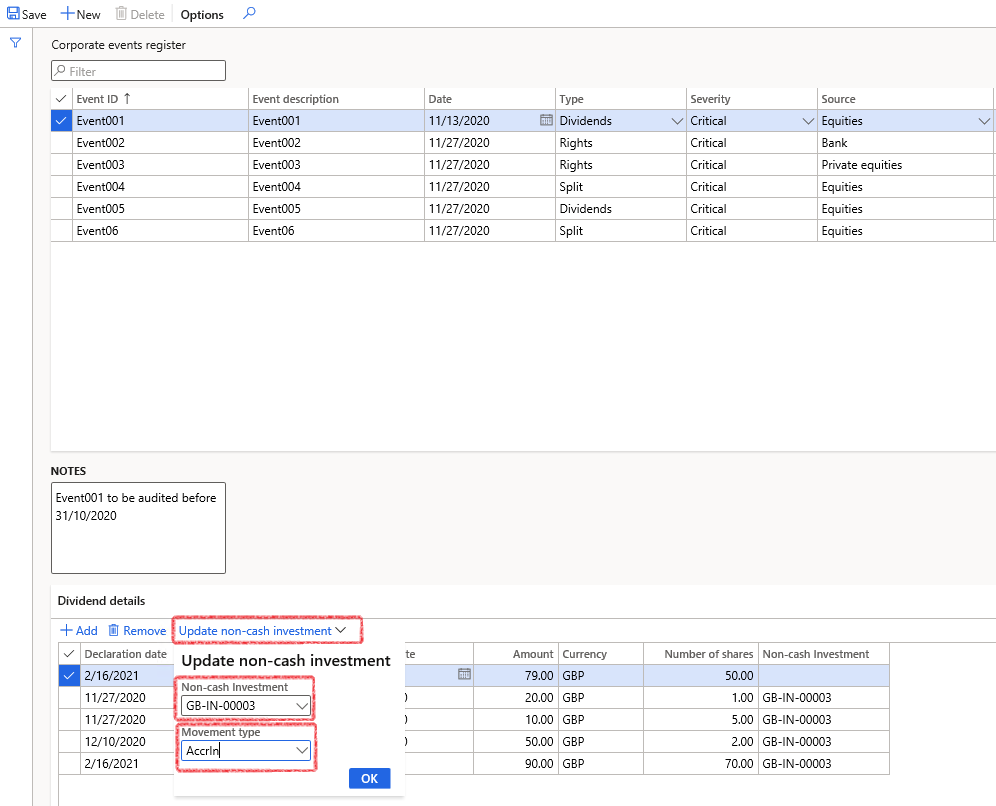

- After creating a new dividend, you can select Update non-cash investment to bring up a drop-down box where you may choose the non-cash investment you wish to associate the dividend with.

- Select the Non-cash investment you want to link it to

- Select the Movement type

- Click OK

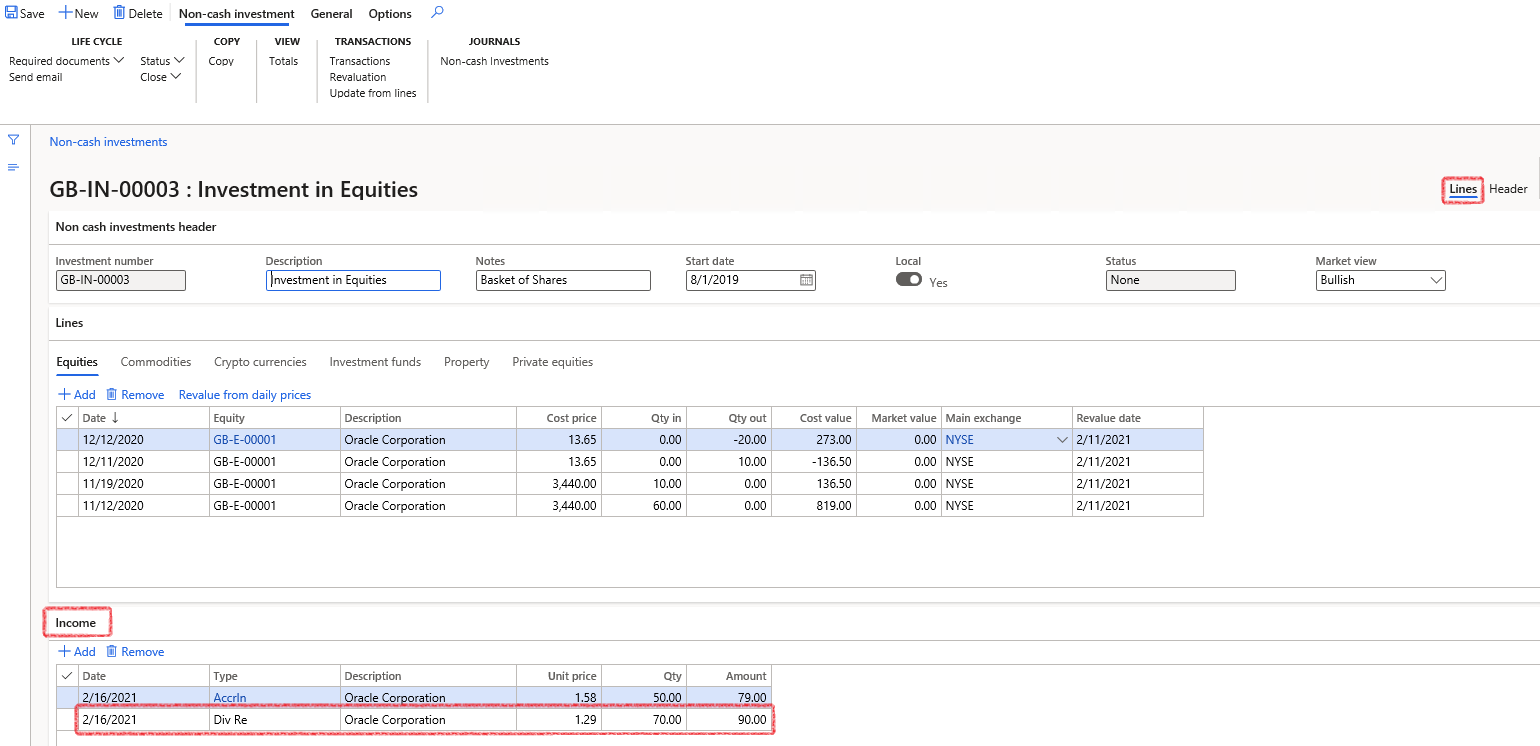

After clicking OK, the Dividend line will the automatically be updated in the Income FastTab under Lines of the record that the non-cash investment was linked to

¶ Step 2.1: Adding more information

¶ Step 2.1.1: Split details Fast Tab

- Enter more information on Split details Fast Tab, such as

- Select a Split date and a Payment date

- Insert the desired Ratio

¶ Step 2.1.2: Rights details Fast Tab

- Enter more information on Rights details Fast Tab

- Select an Issue date and an Exercise date

- Insert the desired Ratio