¶ Introduction

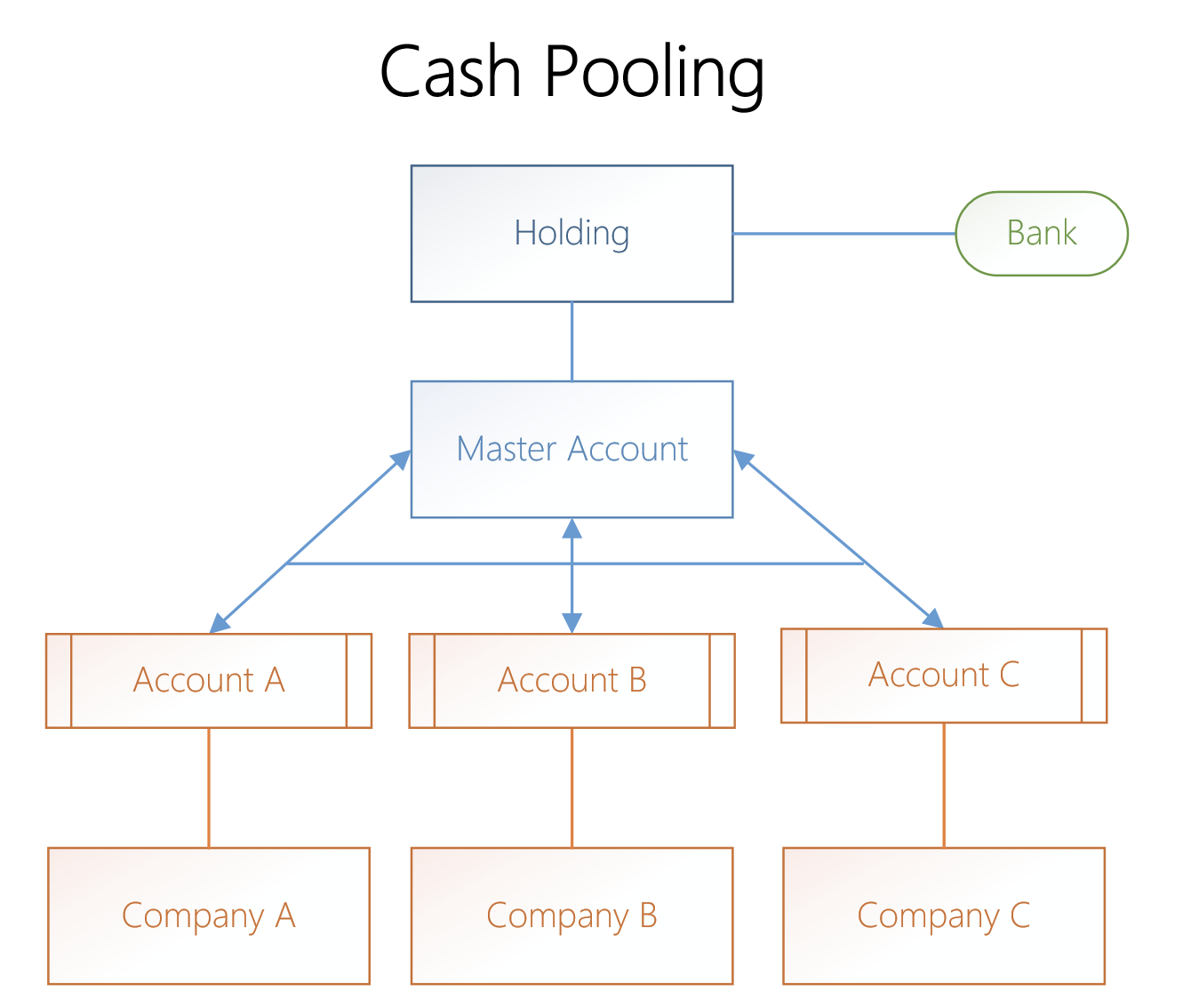

Cash pooling (sometimes also written as cash pooling) is a centralized cash management technique that is used by companies made up of multiple subsidiaries. It helps groups optimize the cash balances of all the legal entities as efficiently as possible.

The principle of cash pooling is to centralize cash flow management with the holding company and to balance the bank accounts of all the subsidiaries. Indeed, some entities of a group may be experiencing cash deficits and have to resort to rather expensive short-term cash flow financing options (high-interest loans, overdrafts that are subject to fees or bank commissions and so on), even though the group is financially healthy on the whole. At the same time, other entities within the group may have cash surpluses that just sit in their accounts and yield little.

What is a cash pooling structure?

Cash pooling arrangements provided by banks allow corporations to externalize the. intra-group cash management, and thus, manage their global liquidity more effectively and with. lower costs.

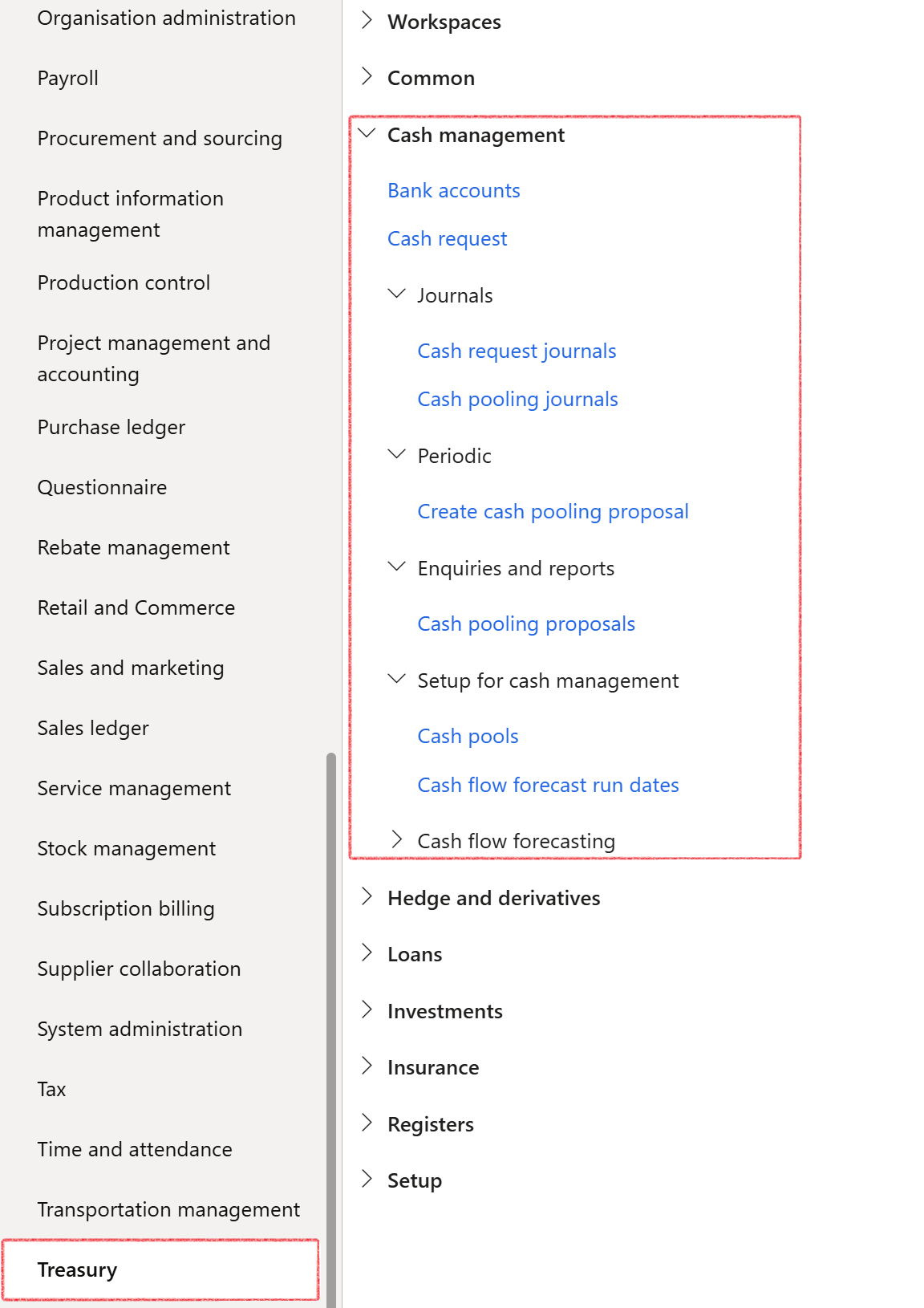

¶ Navigation

¶ Specific Setup

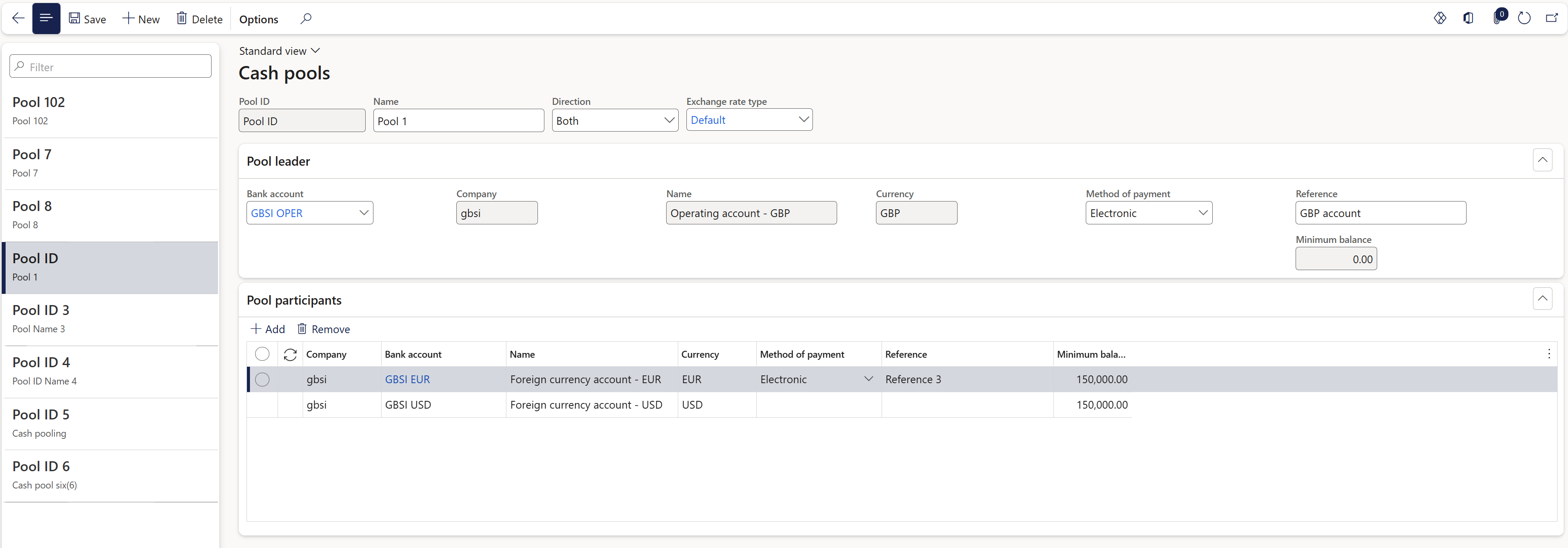

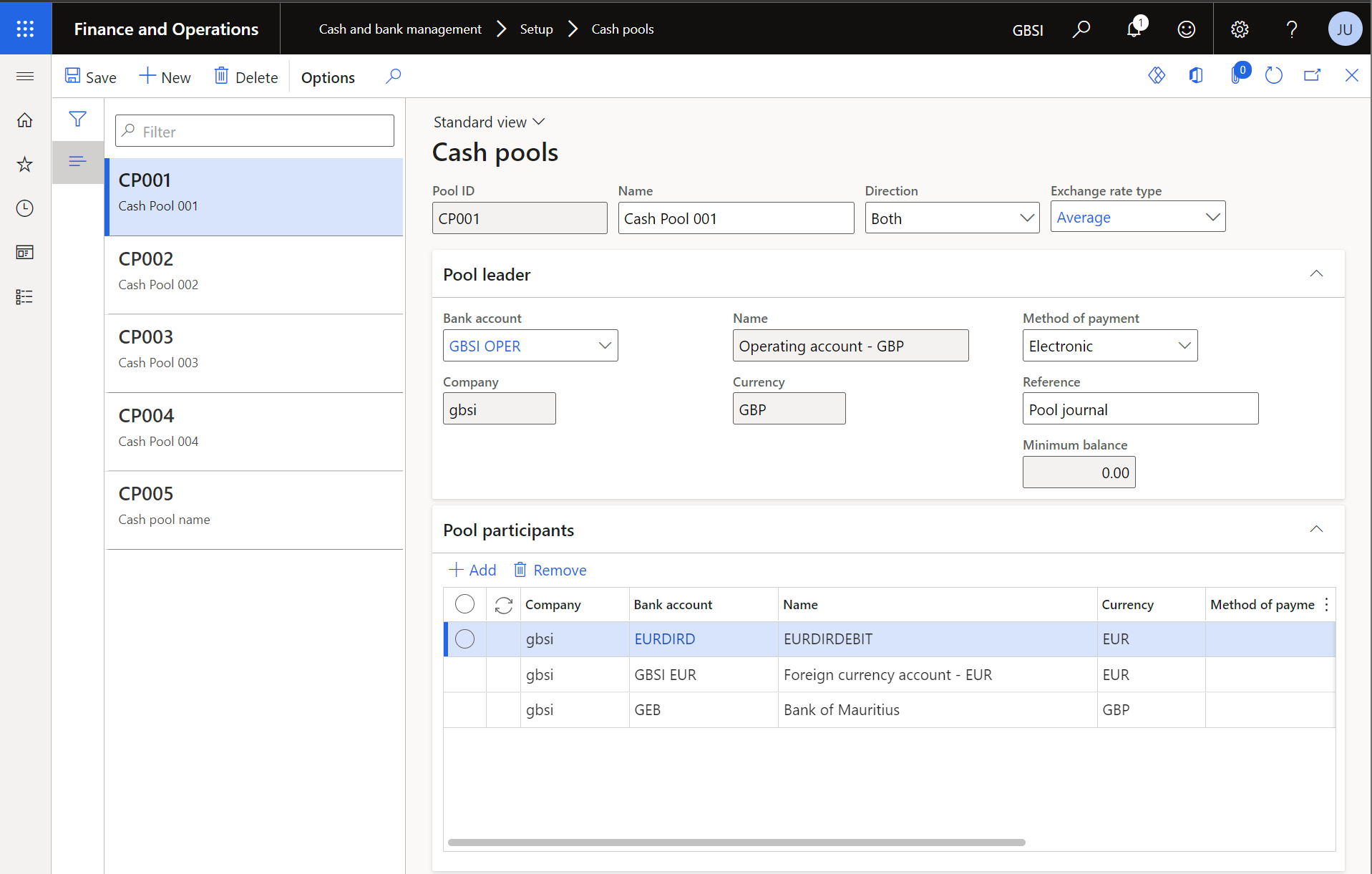

¶ Step 1: Create a Cash pool

- Go to Treasury > Cash management > Setup for cash management > Cash pools

- Alternatively, go to Cash and bank management > Setup> Cash pools

- Click New

- In the Pool ID field, type a value

- In the Name field, type a value

- In the Exchange rate type field, select a value

¶ Step 1.1: Pool leader Fast Tab

- In the Bank account field, select a value

- In the Method of payment field, select a value

- In the Reference field, type a value

The Reference field is not compulsory

¶ Step 1.2: Pool participants Fast Tab

Before moving to the next step, within the Exchange rate type selected, make sure a currency pair exists between the Pool leader currency and Pool participant currency. Otherwise, the system will provide an error.

- Click Add

- In the Bank account field, select a value

- In the Minimum balance field, enter a value

Minimum balance is a compulsory field

Unlimited Pool participants can be added

- Click Save

¶ Daily Use

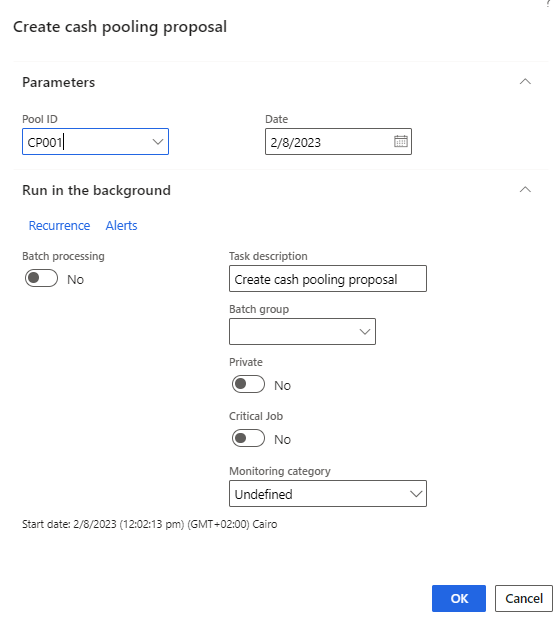

¶ Step 2: Cash pooling proposals

- To view a list of all the Cash pooling proposals, go to Treasury > Cash management > Inquiries and reports > Cash pooling proposals

- To create a new Cash pooling proposal, go to Treasury > Cash management > Periodic > Create cash pooling proposal

- Alternatively, go to Cash and Bank management> Periodic tasks > Create cash pooling proposal

- Click New

- In the Pool ID field, enter or select a value

- In the Date field, enter or select a value

The date field in the previous step will be the journal date

- If required, set up batch processing in the Run in the background Fast Tab

- Click OK

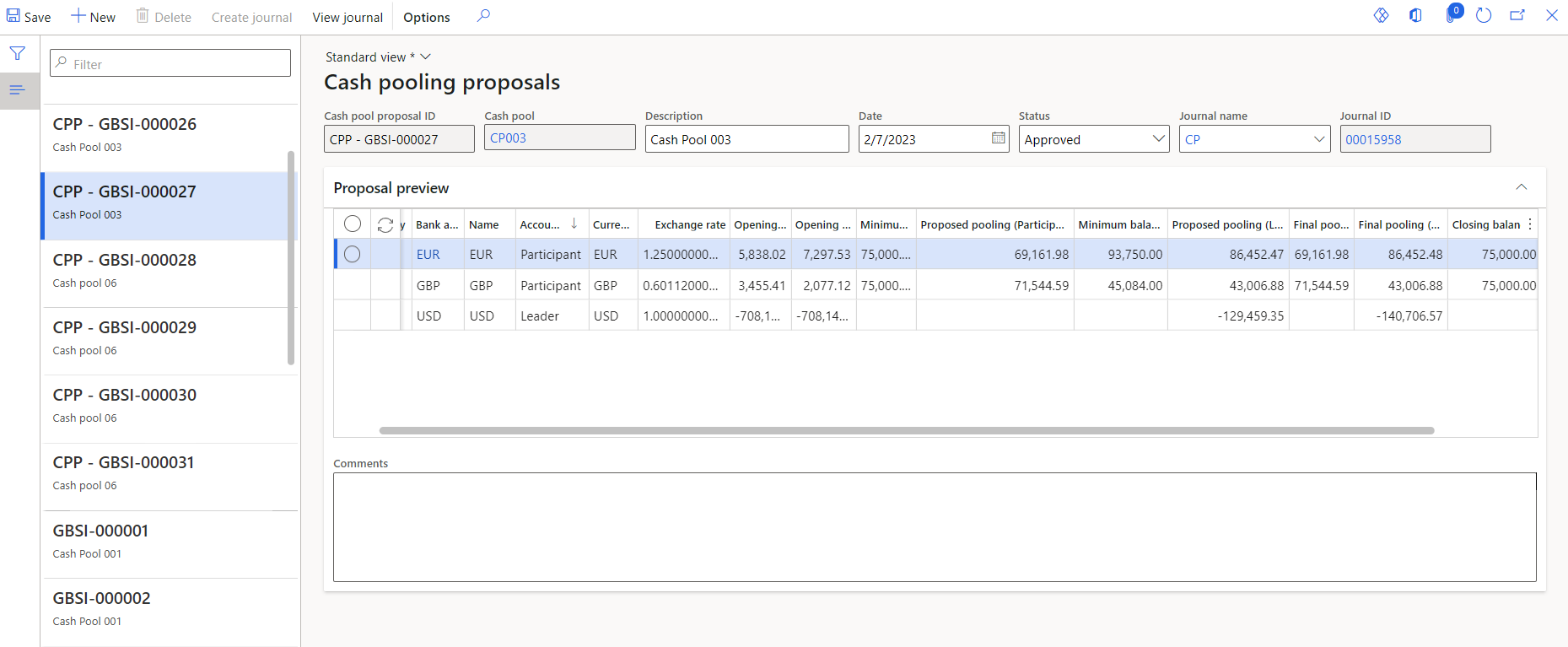

¶ Step 2.1: Cash pooling proposal

A Cash pooling proposals page will open

- In the Description field, enter a value

- In the Journal name field, select a value

¶ Step 2.2: Proposal preview Fast Tab

- In the Final pooling (Participant currency) lines, change the value if required

The system bases its calculation of the Final pooling (Participant currency) on the Minimum balance specified for the Pool participant in the Cash pool.

- In the Status field, change the value to Approved

- Click the Save button

- Click the Create journal button

- To view a list of all Cash pooling proposals, navigate to Cash and Bank management > Enquiries and reports > Cash pooling > Cash pooling proposals

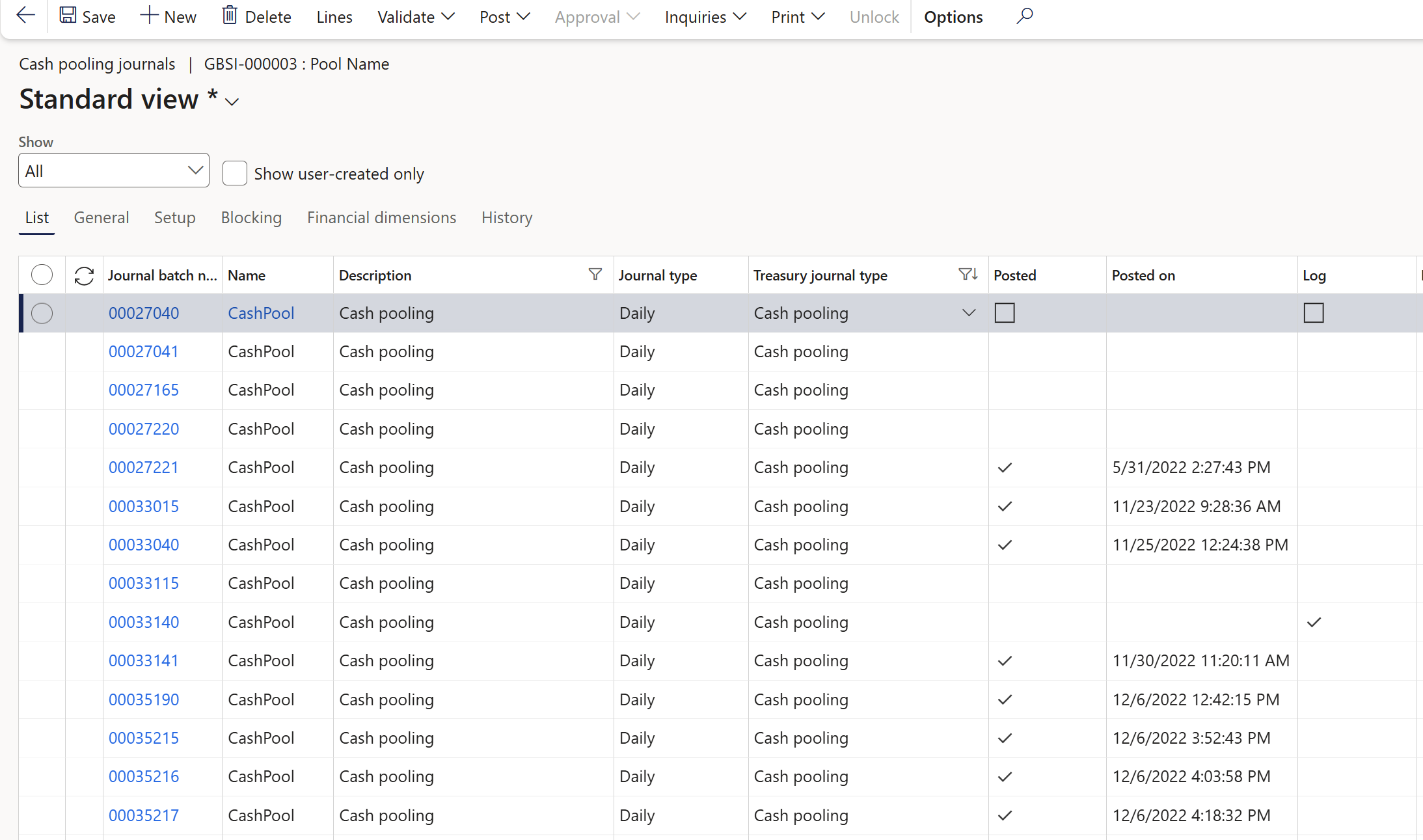

¶ Step 3: Post a Cash pooling journal

- After the Cash Pooling journal has been created, go to Treasury > Cash management > Journals > Cash pooling journals

- The same menu item is also available on the Cash and Bank management module. To access it, go to Cash and bank management > Enquiries and reports > Cash pooling > Cash pooling journals

- Click on the Post button