¶ Introduction

A cash investment involves holding cash or cash equivalents, such as bank deposits, treasury bills, certificates of deposit, or money market funds. The main goal is to preserve capital while earning a low-risk return. Cash investments are generally low in volatility and risk, offering lower potential returns compared to stocks, bonds, or real estate. They are commonly chosen by conservative investors, those seeking liquidity, or anyone needing cash reserves for short-term obligations.

Cash investments involve placing funds with a financial institution to earn interest. They are typically short-term, often less than 90 days, and provide returns in the form of interest payments. While cash investments generally offer lower returns compared to other types of investments, they carry very low risk and are often insured by a Deposit Insurance Corporation.

A cash investment also refers to an individual’s or businesses direct financial contribution to a venture, as opposed to borrowed money

The focus of this module is to manage cash, claims, interest and money as efficiently as possible.

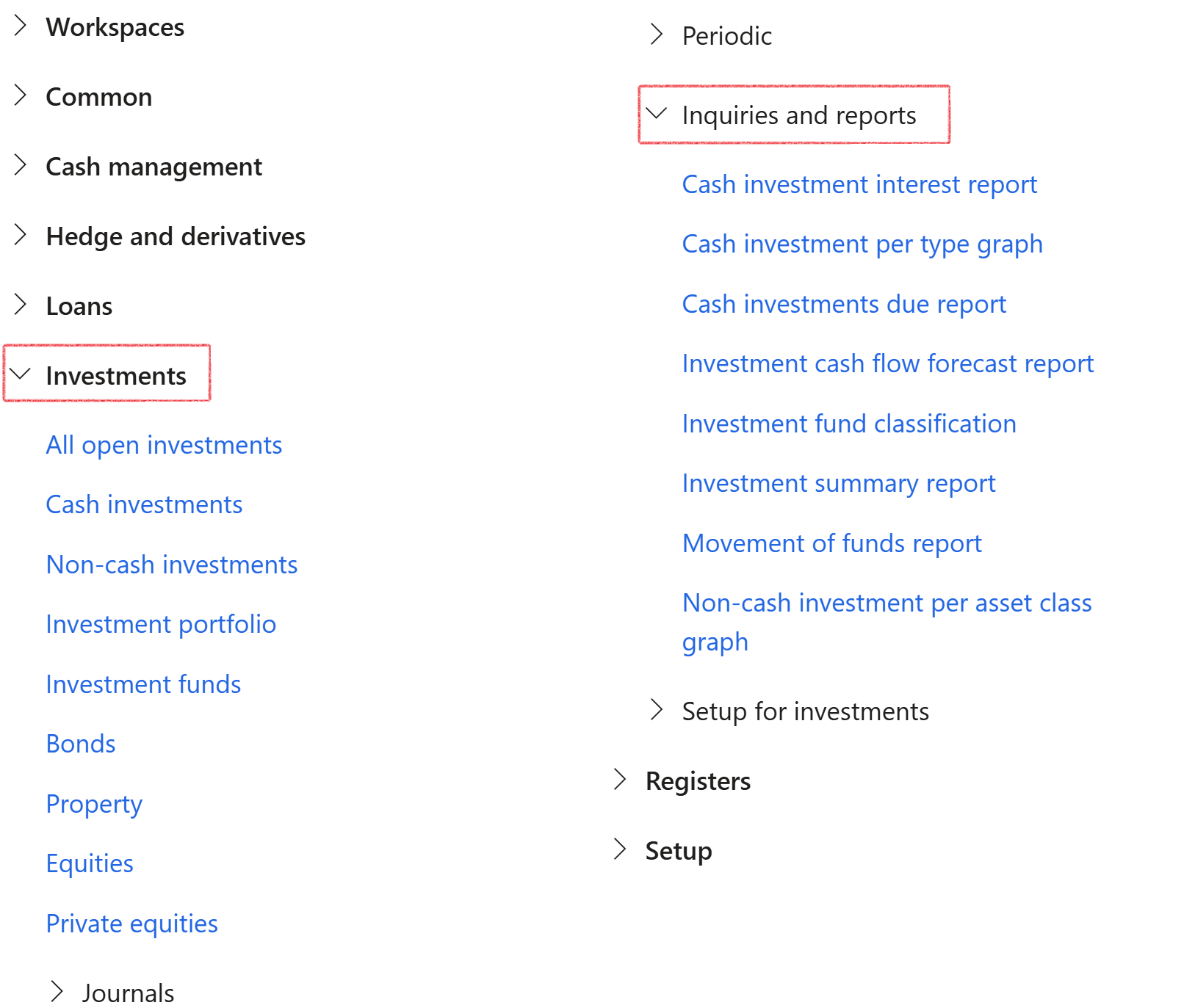

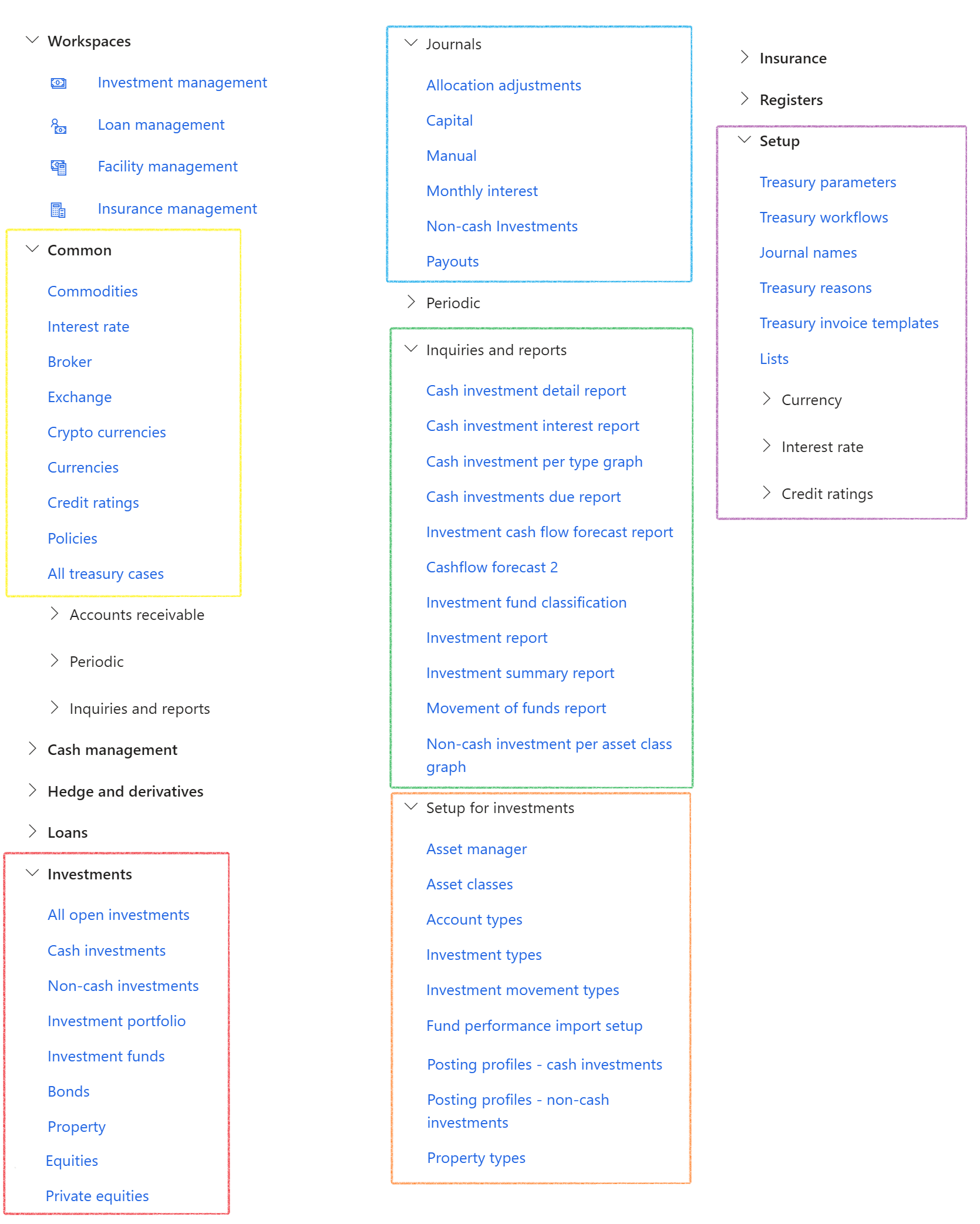

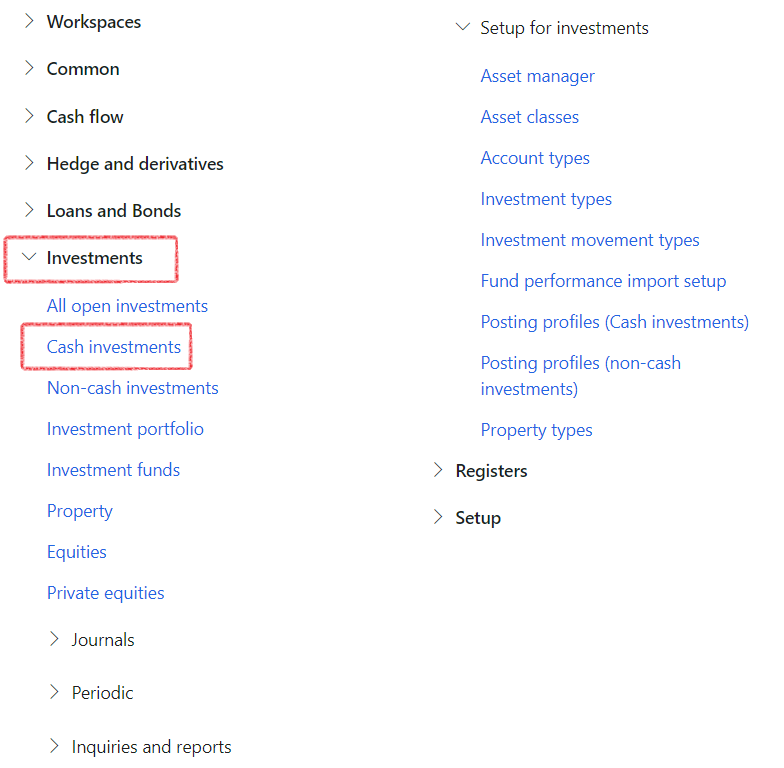

¶ Navigation

Inside Microsoft Dynamics 365, Axnosis created a storage area for Cash Investments. From the main menu, browse to Treasury

¶ Specific setup

- Budget models, codes and parameters

- Treasury parameters

- Exchange

- Journal names

- Account types

- Investment types

- Cash flow forecast run dates

- Posting profiles

- Bank accounts

¶ Step 1: Budget models, codes and parameters

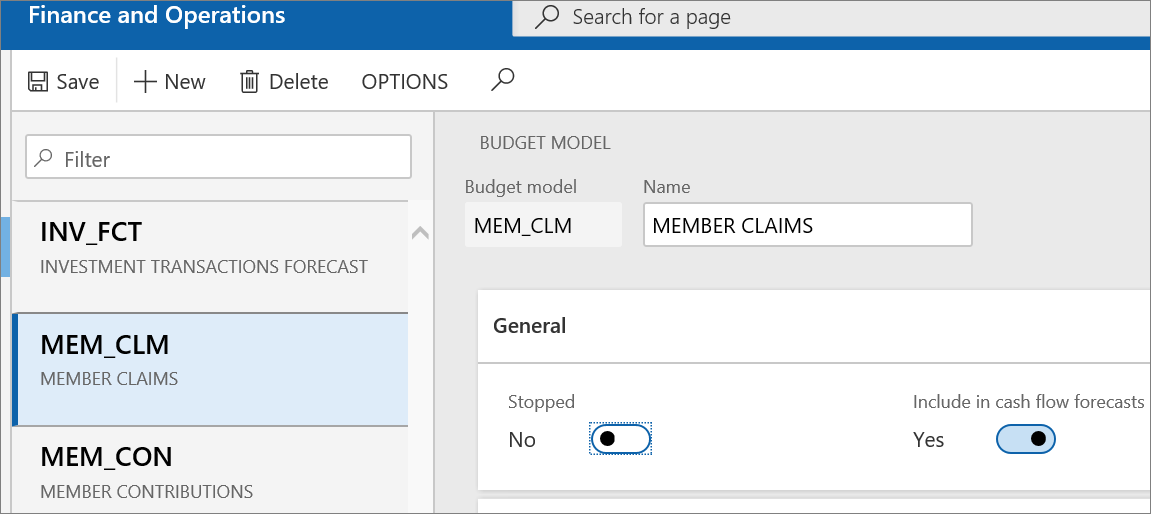

For completeness: set up Budget models

- Go to: Budgeting > Setup > Basic Budgeting > Budget models

- Create Budget Models for Member Contributions, member claims and Investment Transactions

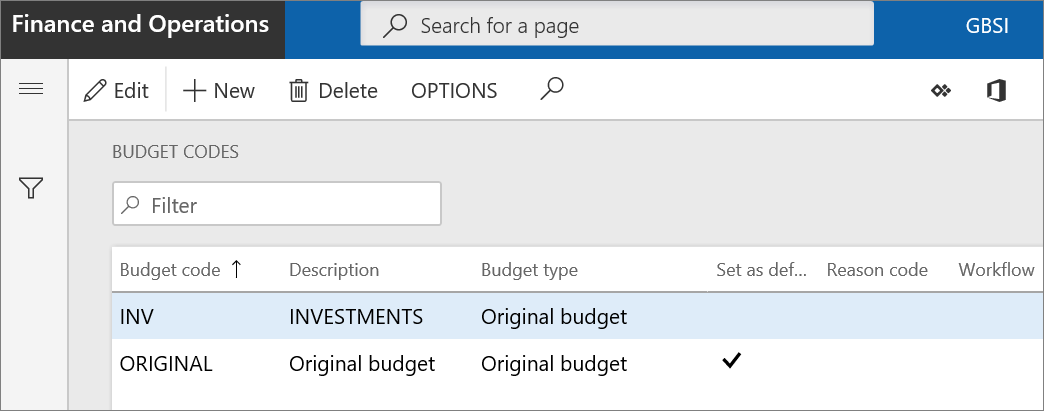

For completeness, set up Budget codes

- Go to: Budgeting > Setup > Basic Budgeting > Budget codes

- Create Budget Code for Investment Module

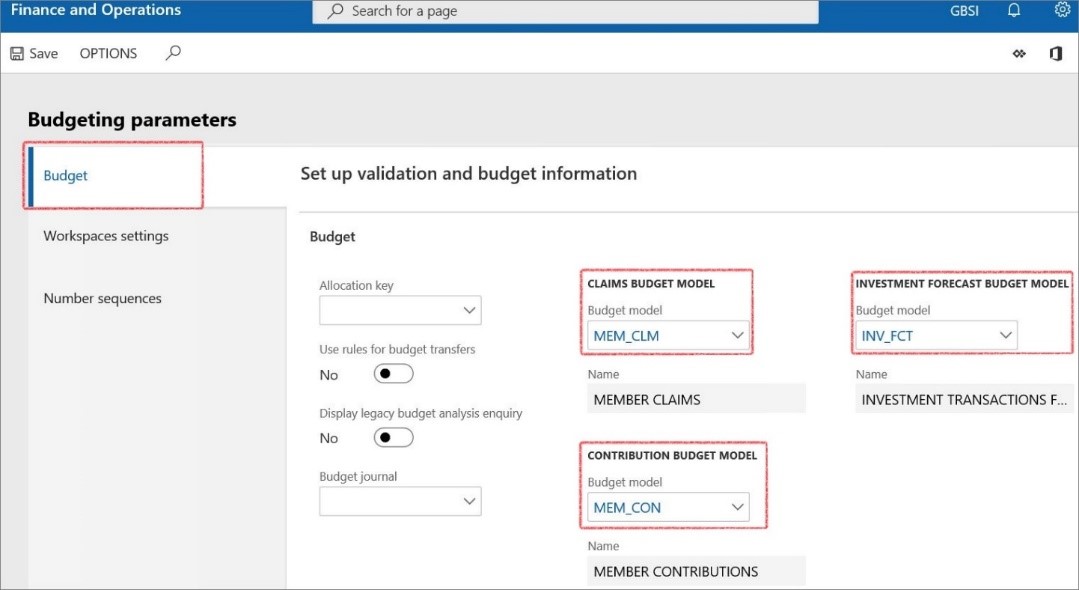

For completeness, set up Budgeting Parameters

- Go to: Budgeting > Setup > Basic Budgeting > Budgeting Parameters

- Link the newly created Budget Models to the model fields under parameters

¶ Step 2: Setup Treasury parameters

Treasury parameters is the core setups specifically for the Treasury module and will be relevant to each area in TMS.

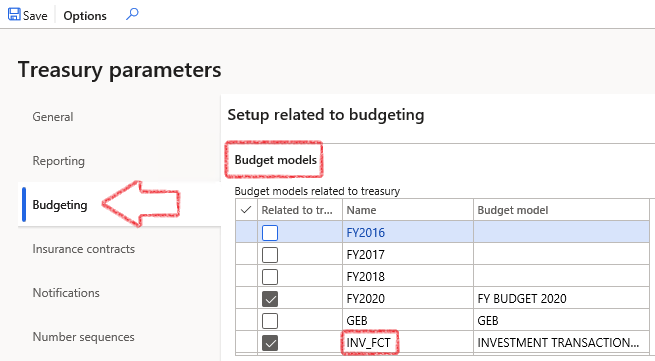

¶ Step 2.1: View Budget models

Budget models are part of the assumed setups and can be found by navigating to Budgeting > Setup > Basic budgeting > budget models.

- To view the setup for Budget models, go to: Treasury > Setup > Treasury parameters

- Open the Budgeting fast tab

- Ensure that you can view the setup for budget models related to treasury as per screenshot below:

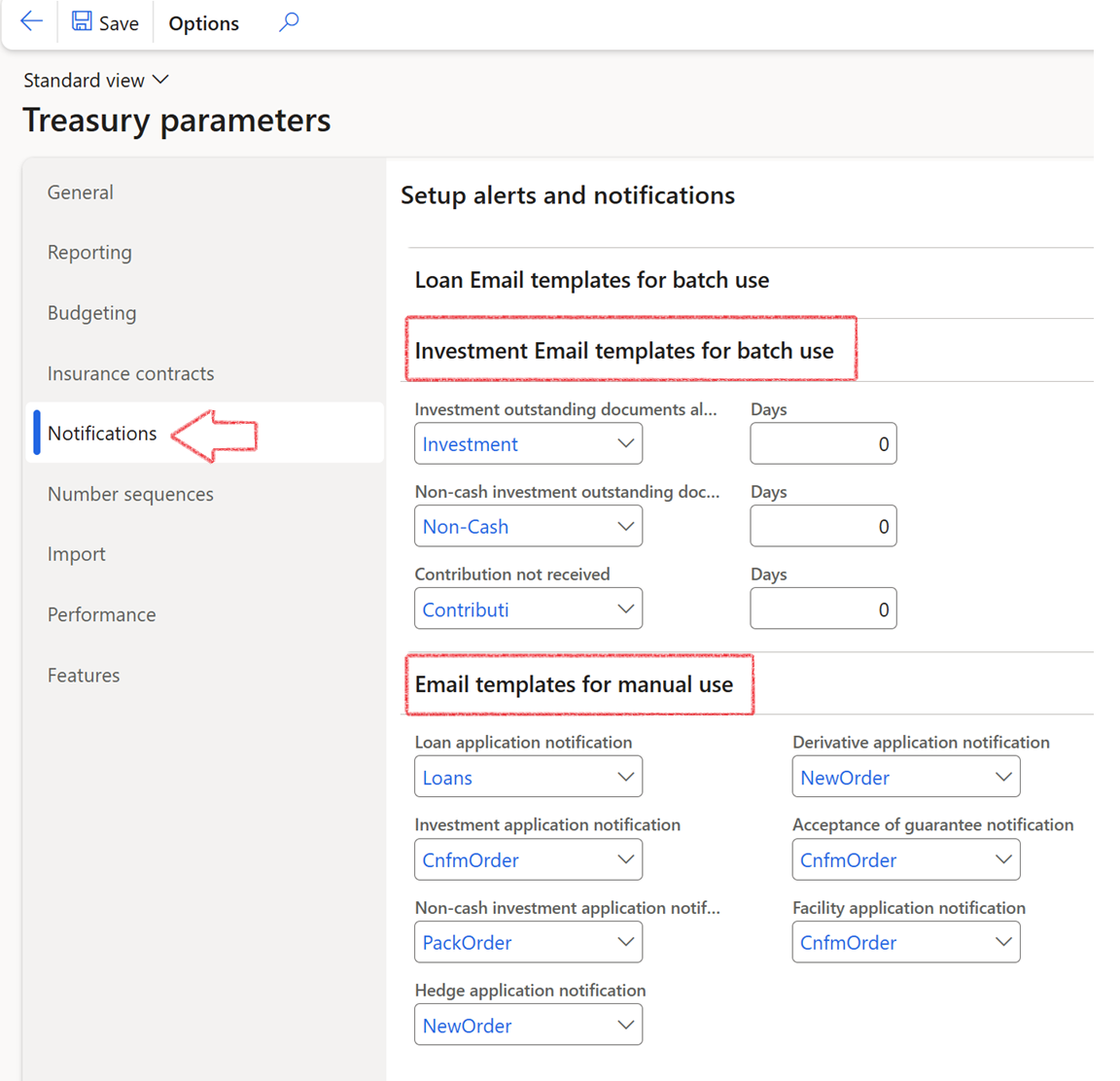

¶ Step 2.2: Set up Notifications

Email templates can be set up by navigating to Organisation administration > Setup > Organisation email templates.

- To select Investment E-mail templates for batch use, go to Treasury > Setup > Treasury parameters

- Open the Notifications fast tab

- Select the relevant e-mail templates for Investment outstanding documents from the list

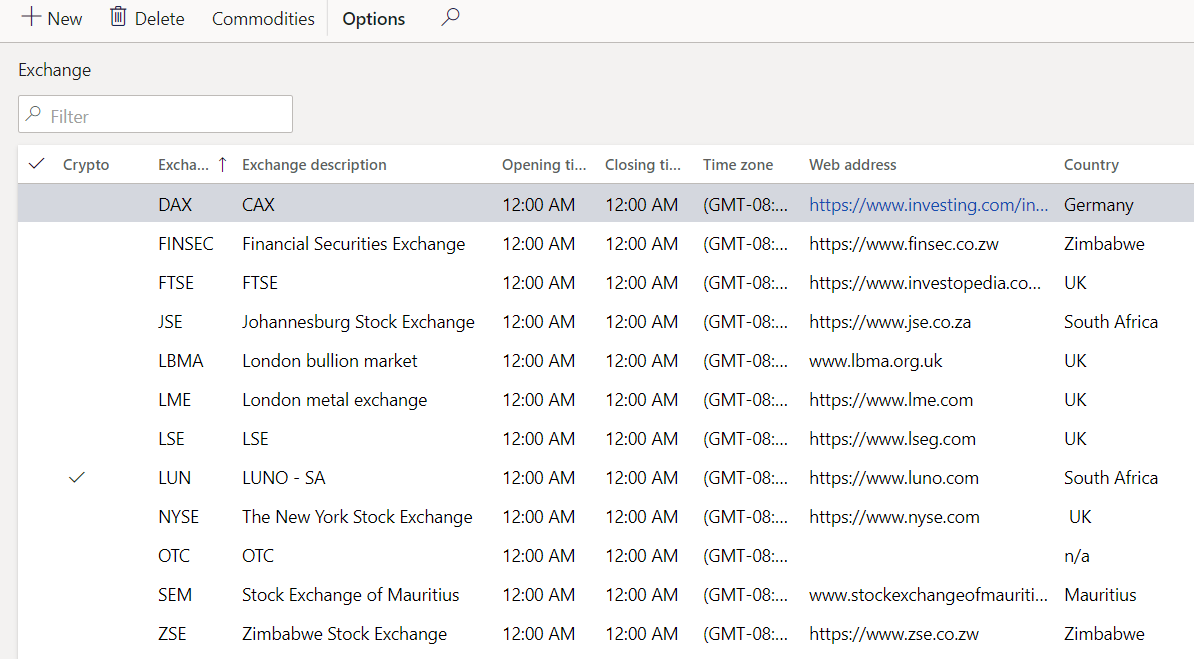

¶ Step 3: Setup Exchange

Exchange is the market for Interest rate indexes. Typical market rate indexes include London Inter-bank Offered Rate (LIBOR), Bloomberg foreign exchange, and Reuter’s foreign exchange. An index categorizes the various market rates that you track.

- Go to: Treasury > Common > Exchange

- Click the New button

- Enter the Exchange ID and Description

- Also complete the Web address

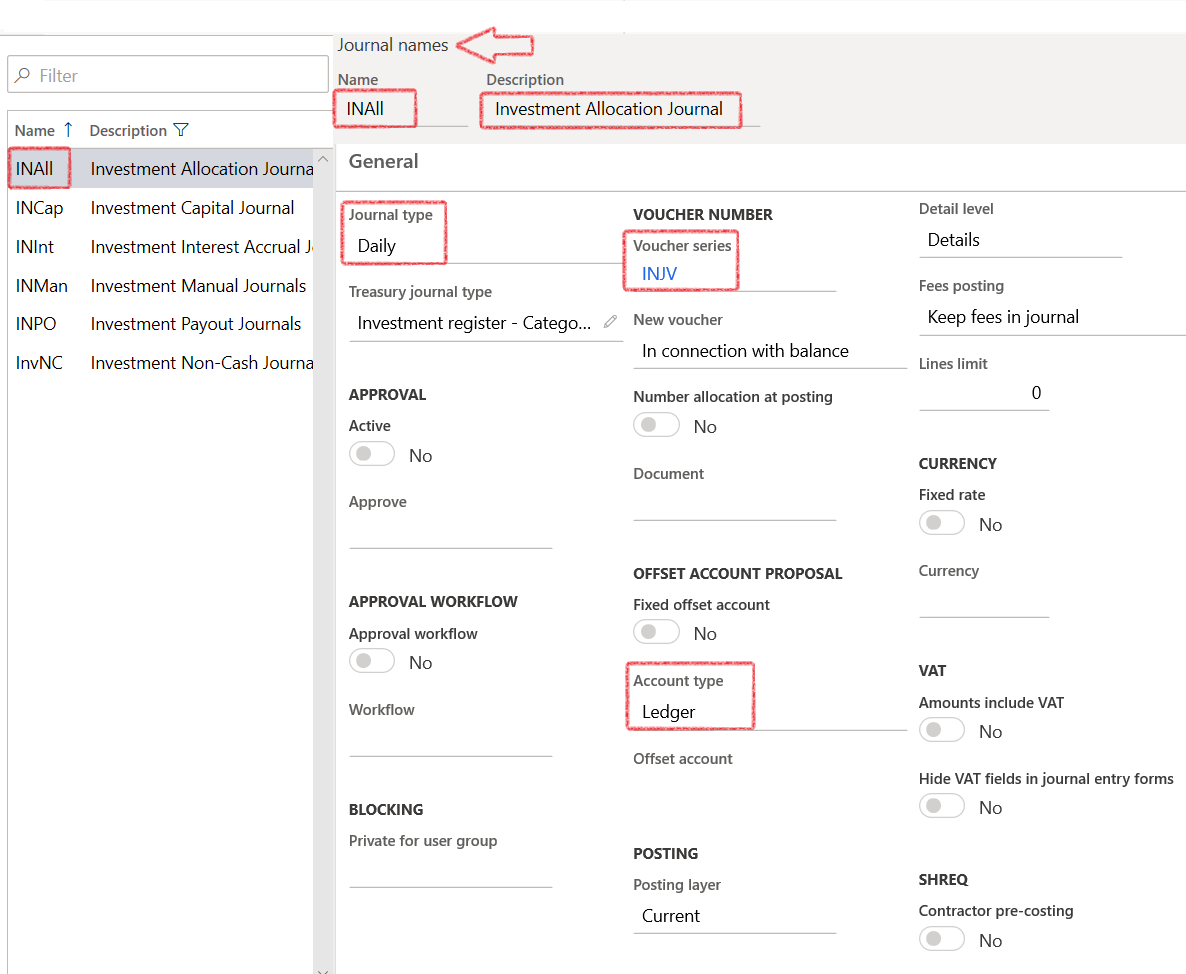

¶ Step 4: Create Journal names

For Investments, the following journal names are used most often:

|

Journal name |

Journal Description |

Linked to Journal Type |

Appear under Journal |

| INAll | Investment Allocation Jnl. | Investment register – Category adjustments | Allocation adjustments |

| INCap | Investment Capital Journal | Investment register – Investment capital | Capital |

| INInt | Investment Interest Accrual | Investment register – Monthly interest accrual | Monthly interest |

| INMan | Investment Manual Jnl. | Investment register - Transactions | Manual |

| INPO | Investment Payout Journals | Investment register – payouts | Payouts |

When creating a journal, the first selection to be done is a journal name. In Treasury, each journal name setup is done by linking the journal name to a Treasury journal type, as well as an Account type.

- Go to: Treasury > Setup > Journal names

- On the Action pane, click on the New button

- In the Name field, enter the name of the journal. This name is used to refer to this journal throughout the system

- Enter a brief Description for the journal

- Under the General Fast tab:

- Select the relevant Journal type from the dropdown list

- Select the relevant Treasury journal type from the dropdown list

- Under the Approval field group, the user can select Yes to Activate the manual journal approval system for this journal name

- In the Approve field, select the user group that can approve the journal

Only users in this group can approve the journal

- Expand the Financial dimension Fast tab

- Select the relevant Business Unit from the dropdown list

- Select the relevant Department from the dropdown list

- Select the relevant Project from the dropdown list

- Select the relevant Service Line from the dropdown list

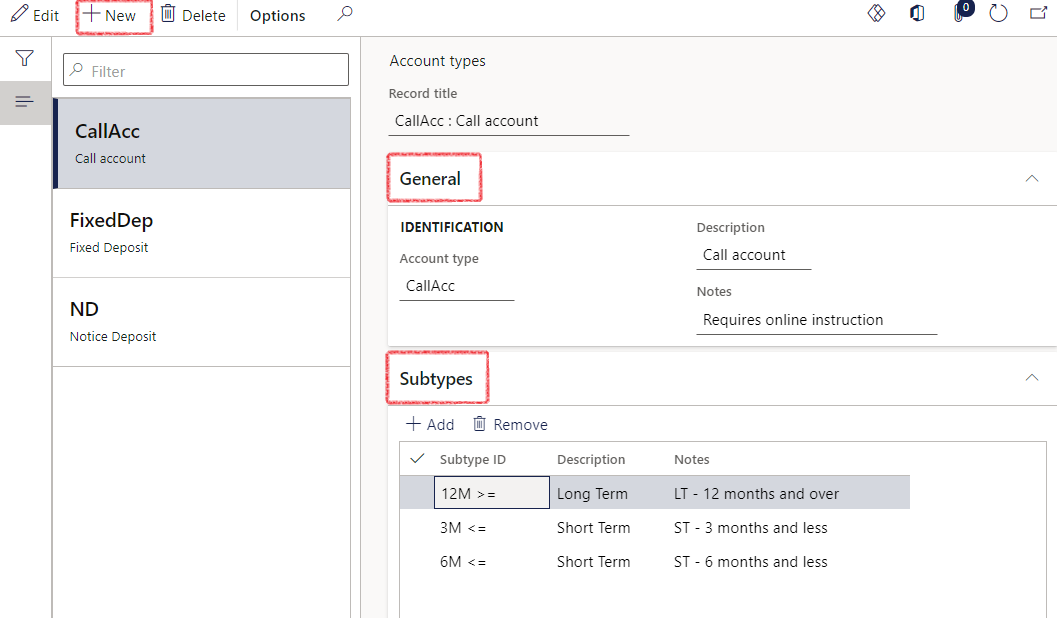

¶ Step 5: Setup Account types

A call deposit account is a bank account for investment funds that offers the advantages of both a savings and a checking account. Like a checking account, a call deposit account has no fixed deposit period, provides instant access to funds and allows unlimited withdrawals and deposits.

A fixed deposit is a type of savings/investment account that promises the investor a fixed rate of interest. In return, the investor agrees not to withdraw or access their funds for a fixed period of time. In a fixed deposit investment, interest is only paid at the very end of the investment period.

A notice account requires you to 'notify' the savings provider in advance every time you want to make a withdrawal. The idea is that, in return, you get a higher interest rate than you would on a standard easy access savings account.

- To set up Account types for Cash Investments, go to Treasury > Investments > Setup for investments > Account Types

- Create New Account types

- Add New Subtypes

- Do the same for Call account, Fixed Deposit and Notice deposit

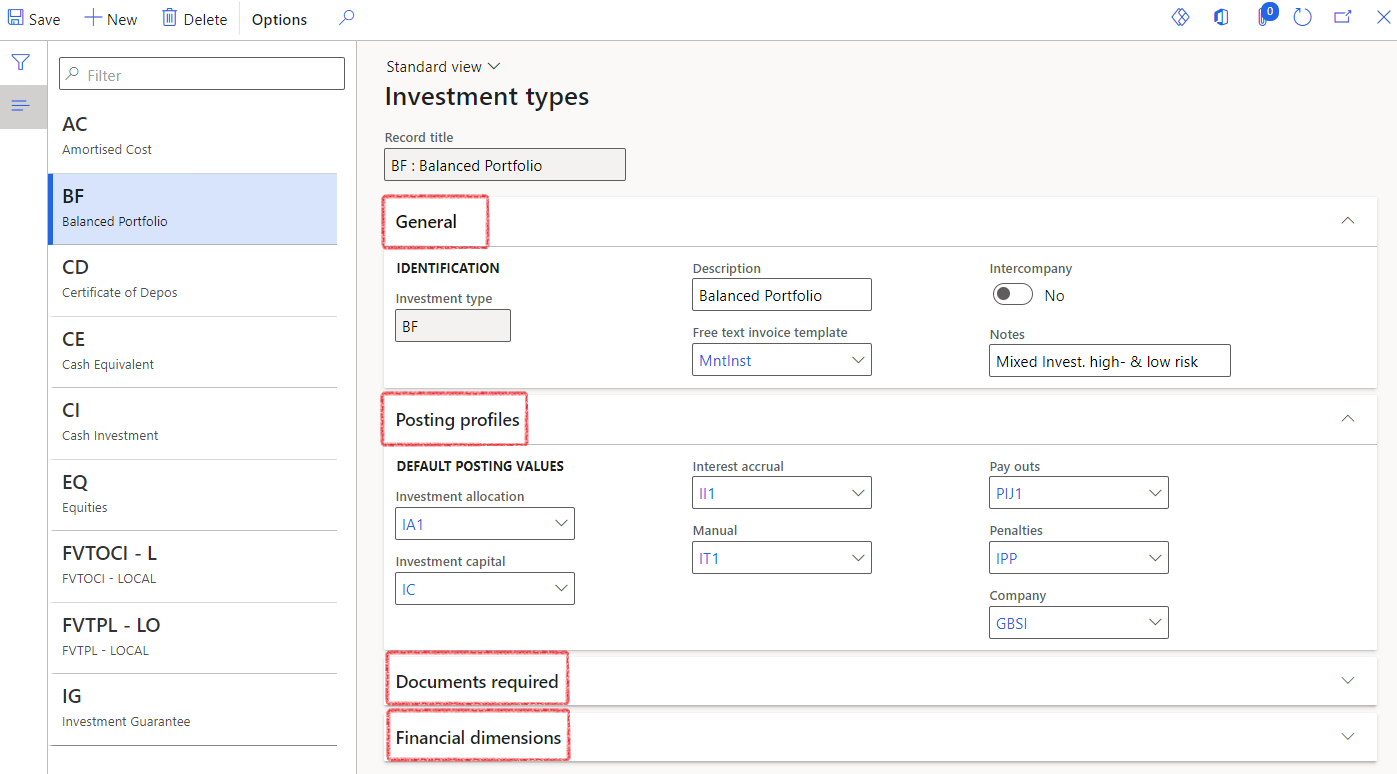

¶ Step 6: Setup Investment types

You will set up the four main investment types, namely Balanced Portfolio, Certificates of deposit, Cash equivalents and Equities.

- Go to: Treasury > Investments > Setup for investments > Investment types

- Create New Investment types

- Complete the Identification tab fields

- Investment type

- Description

- Notes

- Select default posting values for this investment type

- Add documents required for the investment

- Add default financial dimensions for each investment type. This financial dimension will default to the individual investments and can be used for journal processing.

- A specific Free text invoice template can be selected for each Investment type.

This can be done if the Treasury slider is selected on the Free Text Invoice template form.

Balanced Portfolio is a portfolio with money invested equally or almost equally in high-risk and low-risk securities. It requires less day-to-day management than an aggressive investment strategy, but more than a defensive one.

Certificates of deposit are a secure form of time deposit, where money must stay in the bank for a certain length of time to earn a promised return. A CD, also called a share certificate at credit unions, almost always earn more interest than a regular savings account.

Cash equivalents are investment securities that are meant for short-term investing; they have high credit quality and are highly liquid. Cash equivalents are one of the three main asset classes in financial investing, along with stocks and bonds.

Equities - An equity investment generally refers to the buying and holding of shares of stock on a stock market by individuals and firms in anticipation of income from dividends and capital gains. A calculation can be made to assess whether an equity is over or underpriced, compared with a long-term government bond.

¶ Step 7: Setup Cash Flow forecast run dates

- Go to: Treasury > Cash flow > Setup for cash flow > Cash flow forecast run dates

- Create New date

Dates should be a two-week cycle and ensure the dates are always at least 12 months into the future.

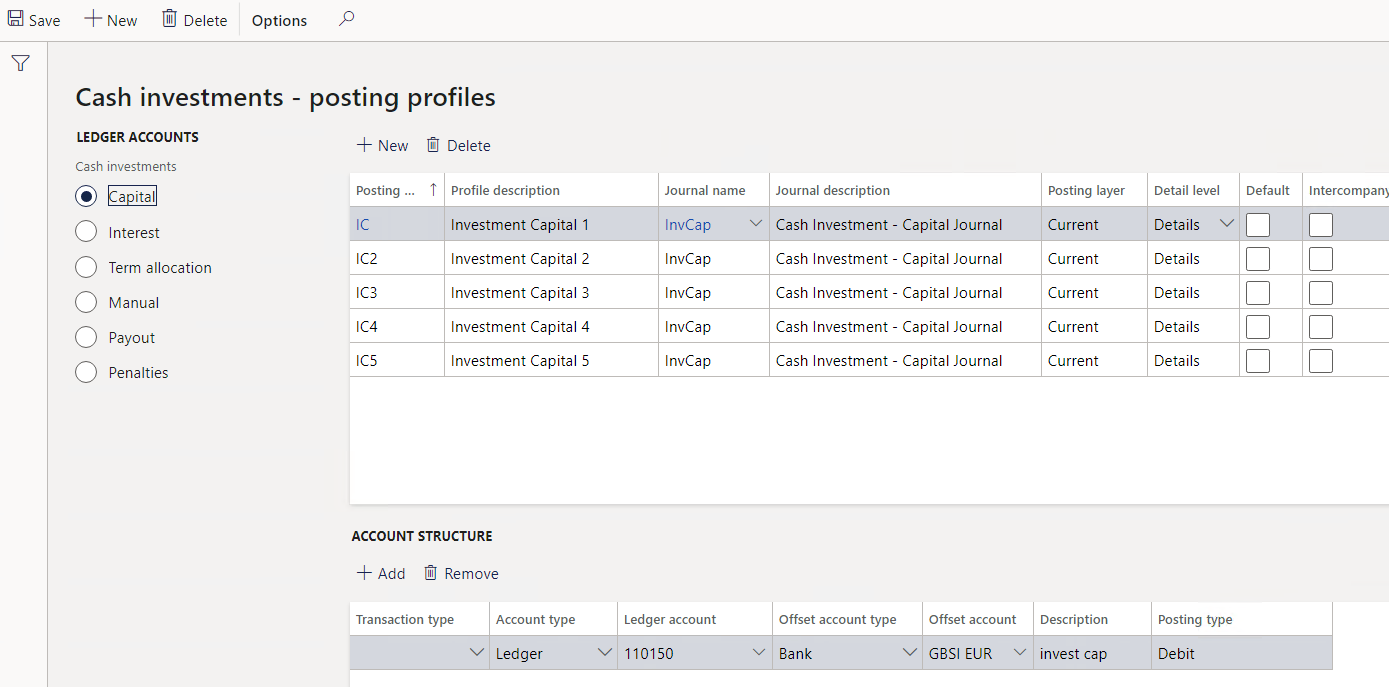

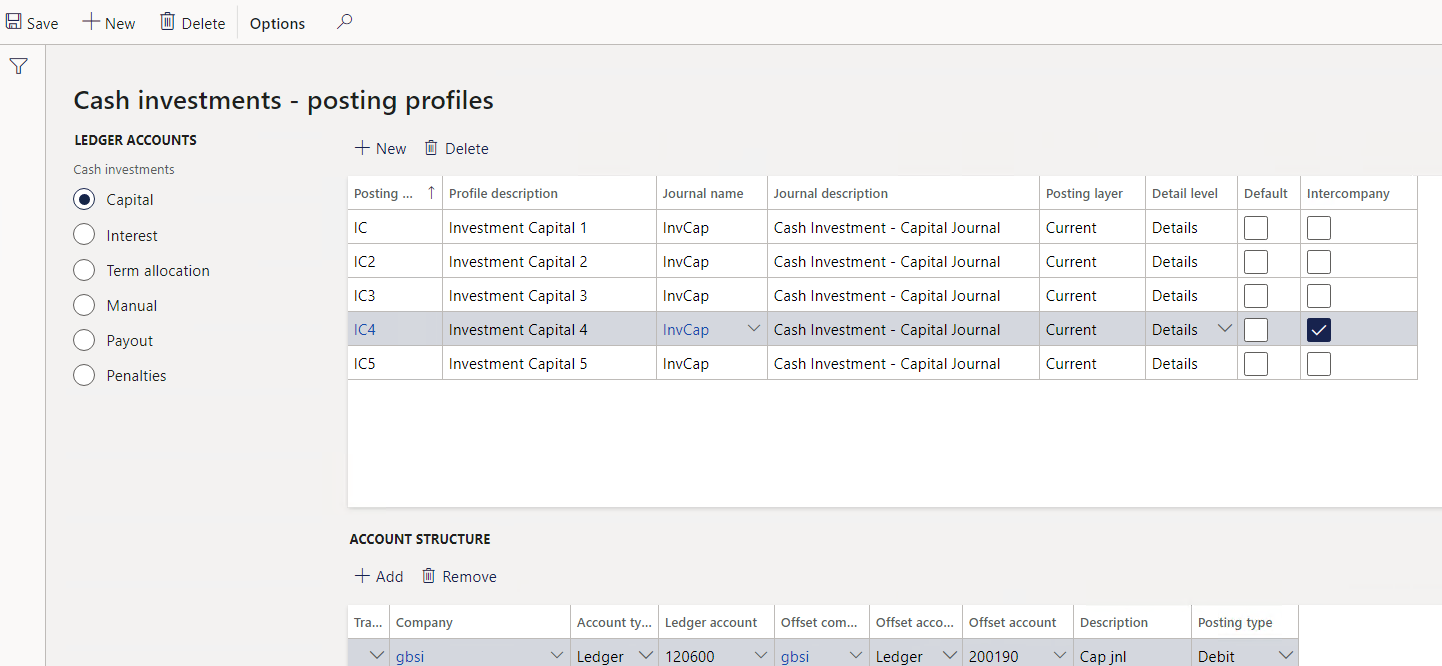

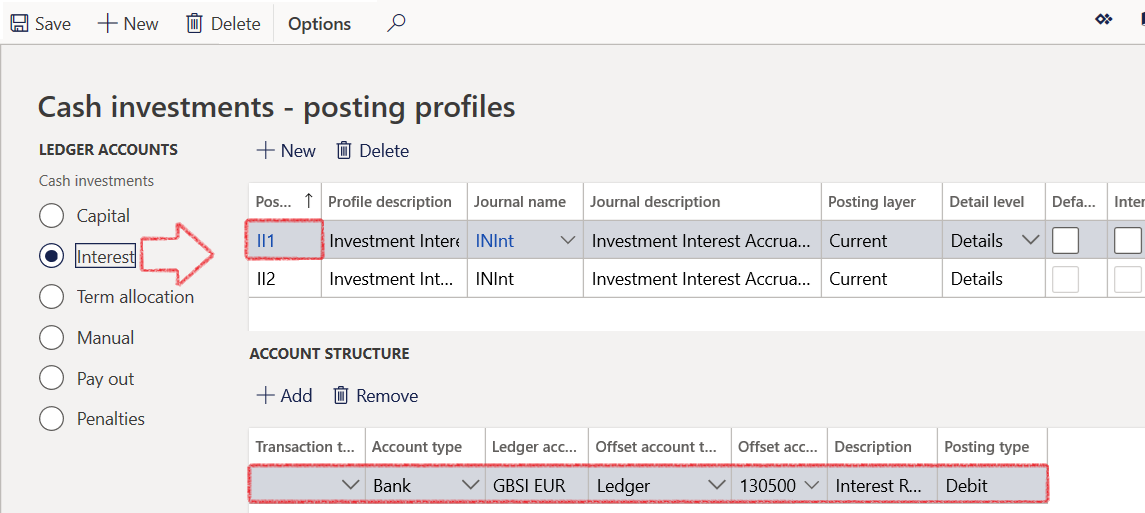

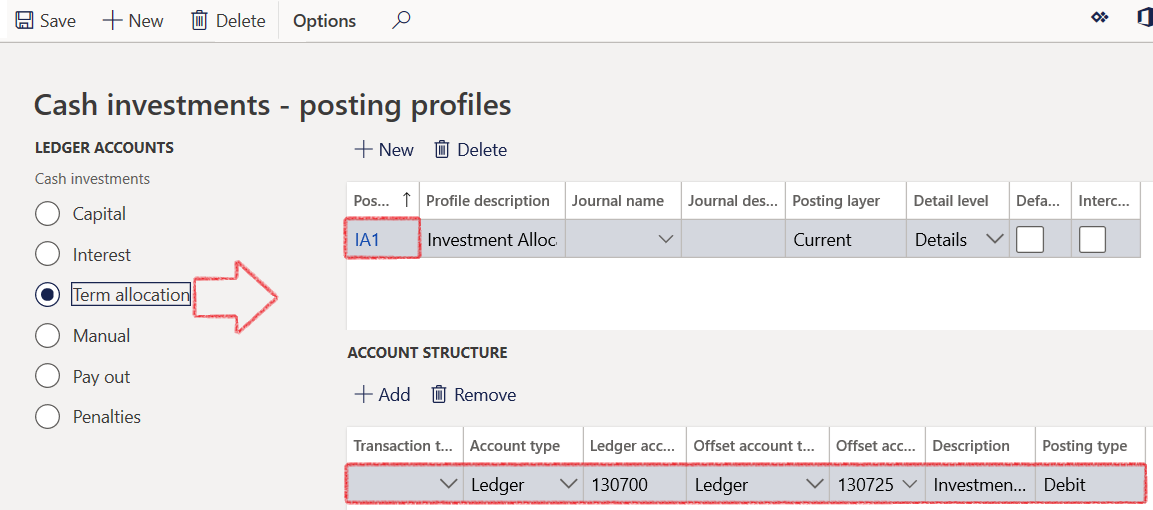

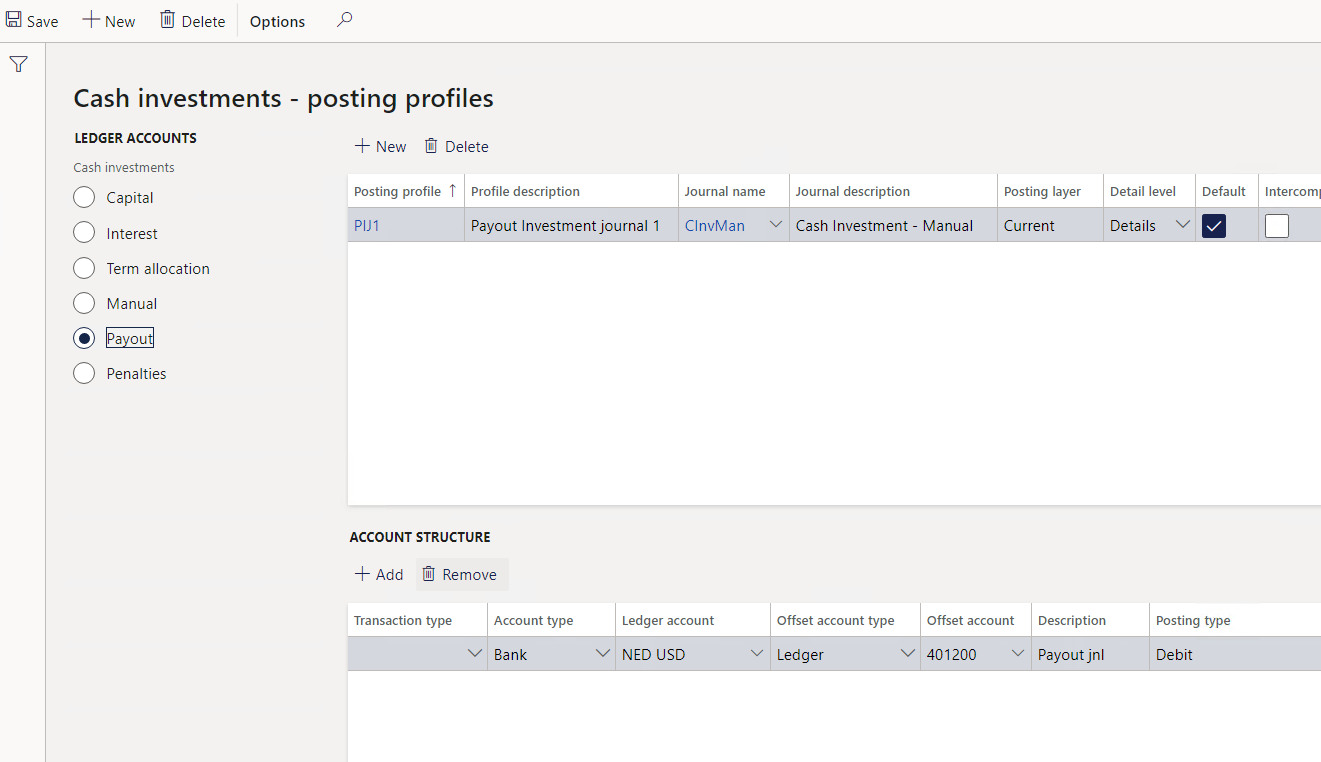

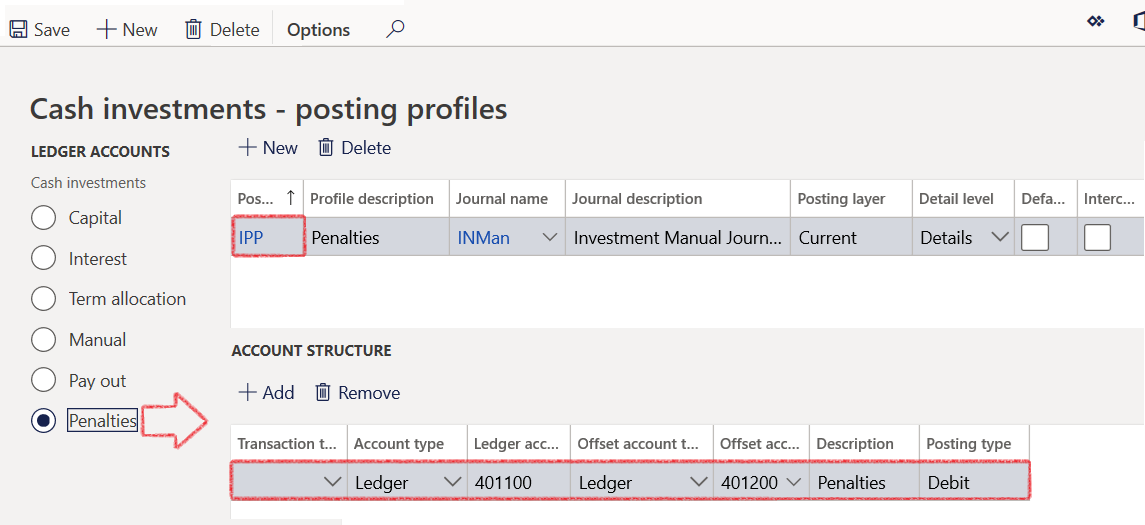

¶ Step 8: Setup posting profiles - cash investments

Capital posting profile -Investment capital are those payouts, those actual investment placements that happens - the principal amount.

Interest accrual posting profile – indicates to the system where to post the monthly interest accruals.

Payout posting profile – is used when an investment matures; the system will suggest a journal against which the payout should be set off.

Investment allocation posting profile - is a re-allocation at year end in terms of an investment capital amount that will mature over the next 12 months.

The Manual posting profile is for any other kind of transactions against this investment. This would typically be any additional top-up investments or funds that you are placing into that investment account. There is also a posting profile for Penalties. To set up these posting profiles, go to:

- Treasury > Investments > Setup for investments > Posting profiles (cash investments)

- Select Capital Cash Investment Ledger account on the left

- Create new posting profile header, journal type InCap (investment capital)

- Under Account structure, Add posting profile accounts. Ensure the Investment posting account is the Bank Account you created for the investment. Posting transactions will then lie against the related Bank account and will post through to the relevant GL accounts.

- Example of Capital investment for Inter-company transactions. Notice the tick box for Intercompany is selected

- Select Interest Cash Investment Ledger account

- Create New Posting profile header

- Journal name will be selected from a dropdown list – Investment Interest Accrual

- Under Account structure, Add Posting profile accounts

- Click Term allocation Cash investment Ledger account

- Create New Posting profile header

- Under Account structure, Add Posting profile accounts

- Click on Manual Cash investments Ledger account on the left

- Create New Posting profile header and select journal name Investment Manual journals

- Under Account structure, Add Posting profile accounts

- Select Account type as Ledger

- Offset account is Ledger as well

- Posting type will be Debit

- Select Payout Cash Investments Ledger account

- Create New Posting profile header and select Investment Payout Journals from the dropdown list

- Under Account structure, Add Posting profile accounts

- Select Account type as Bank

- Offset Account is Ledger

- For this example, posting type will be Debit

- Click Penalties on the left

- Create New Posting profile header

- Select Investment Manual journal type

- Under Account structure, Add Posting profile accounts

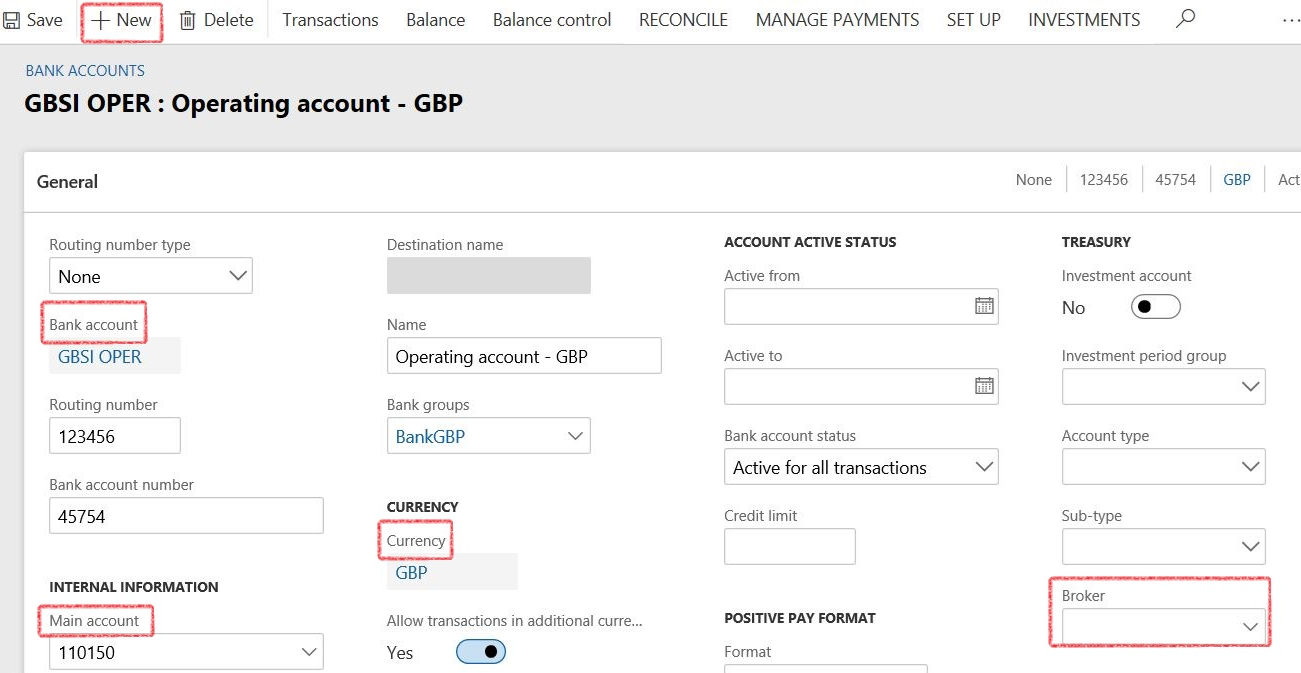

¶ Step 9: Create Bank accounts

You can use the Cash and bank management module in Dynamics 365 Finance to maintain an organization's bank accounts and the financial instruments that are associated with those bank accounts. To create a new bank account for the legal entity:

- Go to: Treasury > Common > Bank Accounts

- When creating a new bank account, the Main account should be selected

- Enter the Bank account. The Bank account is a unique ID you will use to identify the bank account on reports.

- Select a currency

- If required, select a Broker from a dropdown list.

- Under the General fast tab, a new Treasury group is visible. Here, for a selected bank account, users can mark it as a specific Investment account, indicating what account and sub- account types are used and whether the account was opened through a broker. Consequently, the account is not to be used for operational purposes.

¶ Daily use

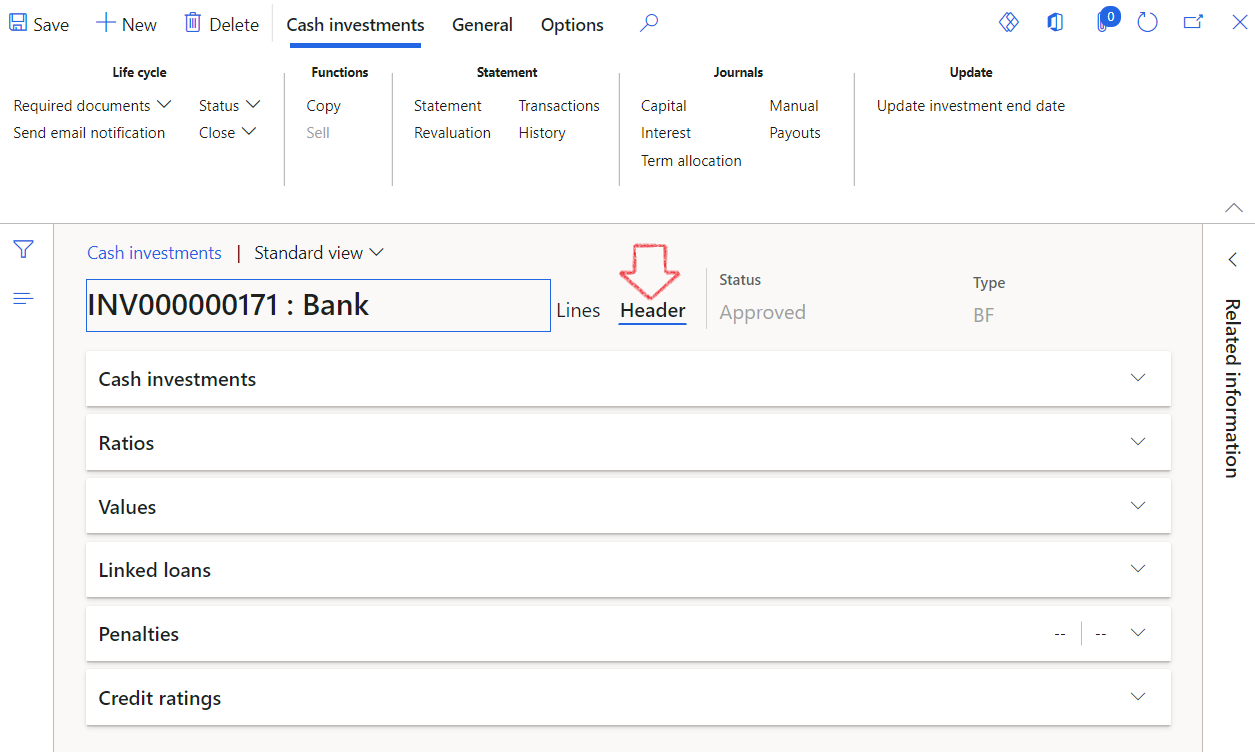

¶ Step 10: Create new Cash investments

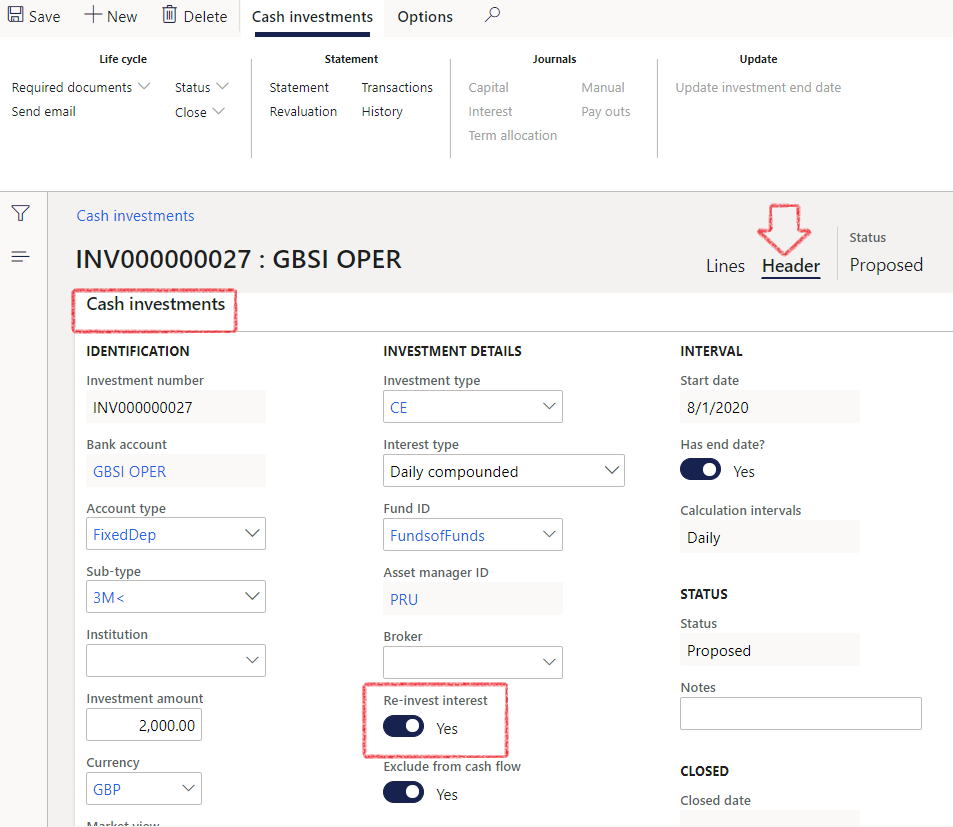

A cash investment is where the interest rate is known, and the interest return can be calculated beforehand. The system will predict the future interest and the payout or the capitalization thereof.

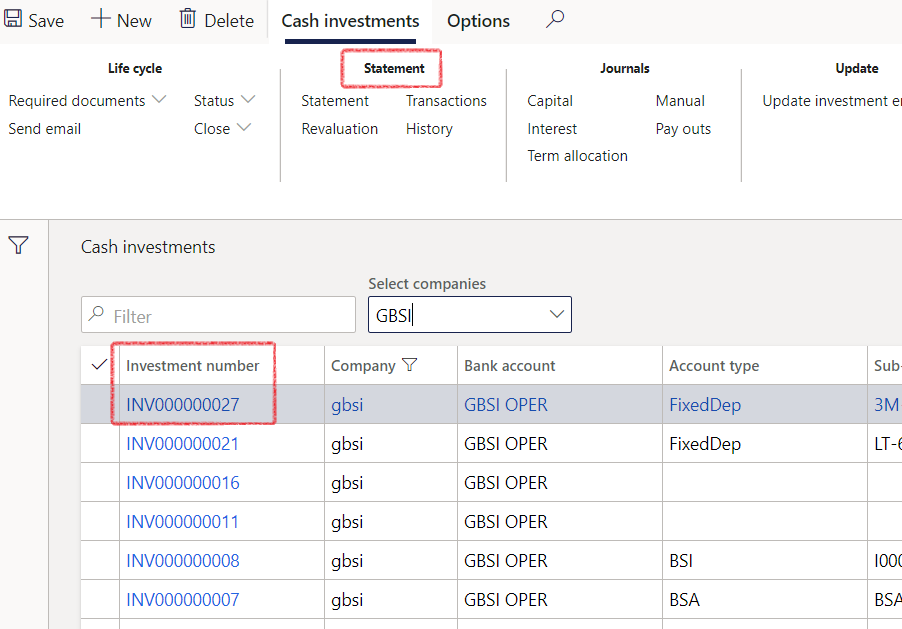

Go to: Treasury > Investments > Cash investments

- Standard for Dynamics 365 F&O, you will be greeted by a list page.

- To create a new Cash investment, select the +New button on top

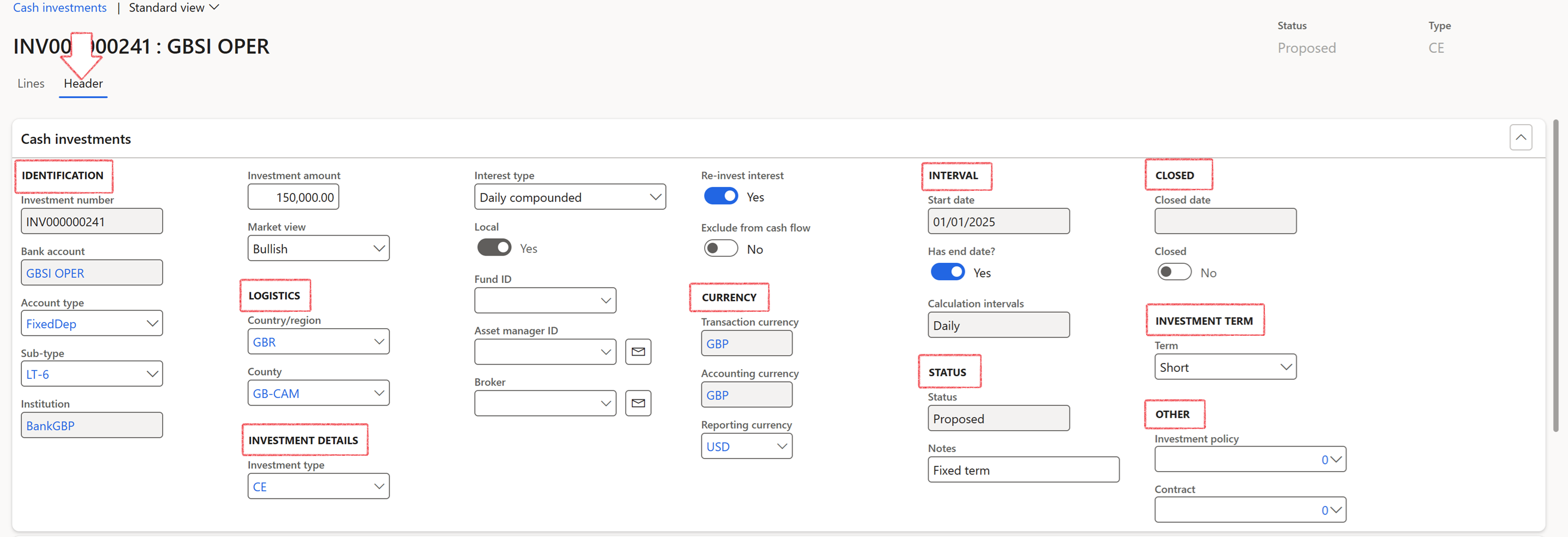

- Populate all relevant fields under the Identification, Investment details and Interval tabs

- Mandatory fields to complete are Bank account, Currency and Start date.

- The Investment number is automatically assigned via number sequence

- On the Account type, you need to select the relevant type. This is either user/client definable

- Depending on the Account type that you selected, you also need to select a sub-type

- On investment amount, capture the initial investment amount that is being placed with the banking institution where you are investing

- Select the Investment Currency

- Select the relevant market view at the time.

- Bank account is specifically the account that you are utilizing for this investment and

- Bank group or institution you are making this investment with. Institutions are the bank groups setup in the Cash and Bank module. Only the related bank accounts will be available once the specific Institution has been selected. If no institution has been selected, any Bank account will be available on the following field

- The Investment type field is a mandatory selection. This field will drive the Posting profiles that will be linked to the Investment. Typically, this will be Cash Equivalents, but you can have multiple types of Cash equivalents if need be

- Interest Type: this is to indicate how the rate was quoted from the bank. Is it a Daily Compounded (if the investment interest is capitalised daily) or a Monthly compounded rate? Typically, it would be daily

- Fund ID: If this investment is with a specific investment fund, you need to go and select that specific fund

- If you are working through an Asset manager, there is a setup for that as well and it can be selected from a drop-down menu

- Very important, what needs to happen with the interest that’s going to be earned on this investment? Must it be re-invested, meaning must the Capital balance or the investment amount grow with the interest, so month two you will earn interest on interest, or must it payout and the investment amount will stay the same and the interest itself will then be paid out to another account. Only select Re-invest interest if the interest is capitalised at month-end, otherwise leave it blank. If not selected, this can be seen as simple interest and the investment will be paid out and the system will want to generate a journal for pay out. If Yes is selected for re-invest, then interest amount is added to the capital amount

- Must it be included or excluded from a Cash flow tool or Cash Flow job that will generate budget entries?

- Start date can be any required date that the investment starts.

- Does it have an end date? If the investment has a specific maturity date you will say yes, and you’ll capture the maturity date later

- Calculation intervals defaults from the Interest type.

- Click Create Cash Investment

- Go to the newly created Cash investment by refreshing the List Page, and select the investment you created, it will default to the top of the list page

An Investment status by default is Proposed - An authorized user must change the status manually from Proposed to either Approved or Cancelled Permission for this is driven by System roles. Workflows should guide the approval process, when user clicks the Submit to workflow button in the action pane.

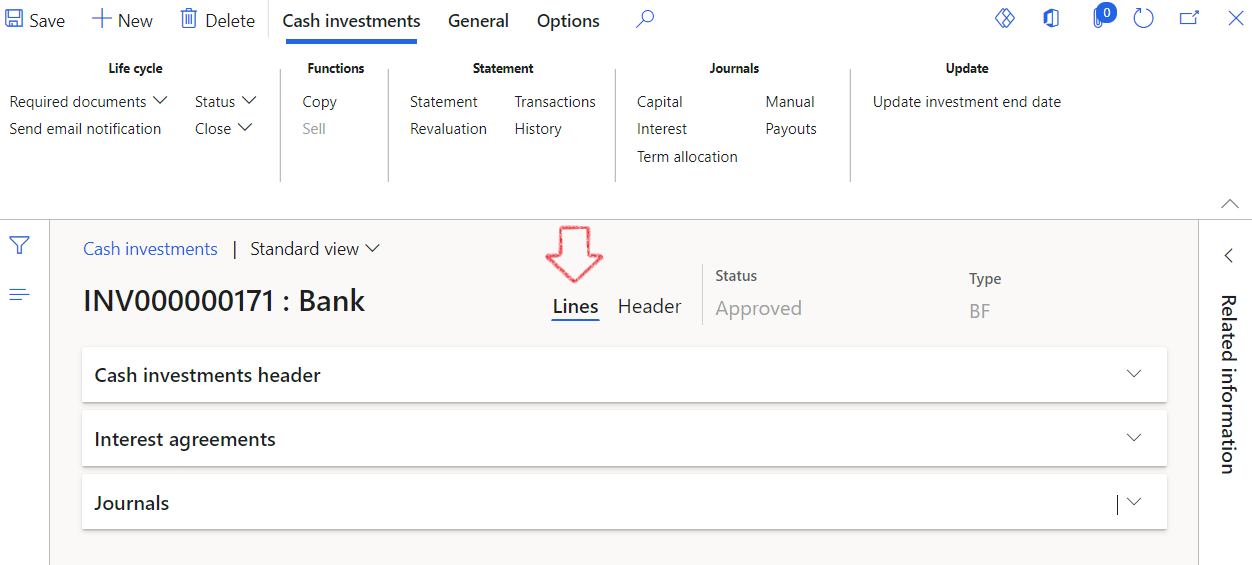

- Under the Header tab, the following Fast Tabs are available:

- Under the Lines, the following Fast Tabs are available:

- Now go back to the Header and expand the Cash Investments fast tab. All the details that you saw on the new dialogue will display here as well.

- You will find sections for the following:

- Identification

- Logistics

- Investment details

- Currency

- Interval

- Status

- Closed

- Investment term

- Other

- Other (part of G2T)

- Investment policy

- Contract

When users add a Contract to the Cash investment form, a record will be created in the Reference table with the new related value and populate the following:

- Investment ID in the description field

- Initial amount

- Currency

- To view the register, go to: Treasury > Registers > Contracts

The following rules apply to the Contracts lookup field

- PCR type should be Contract

- Status can be Draft, Submit, Approve or Revise

- Not baseline

- Not insurance

- If the investment is closed, you can go and mark it as Closed and it will prevent further transactions. This will also prevent the user to select the Investment number on any journal, going forward

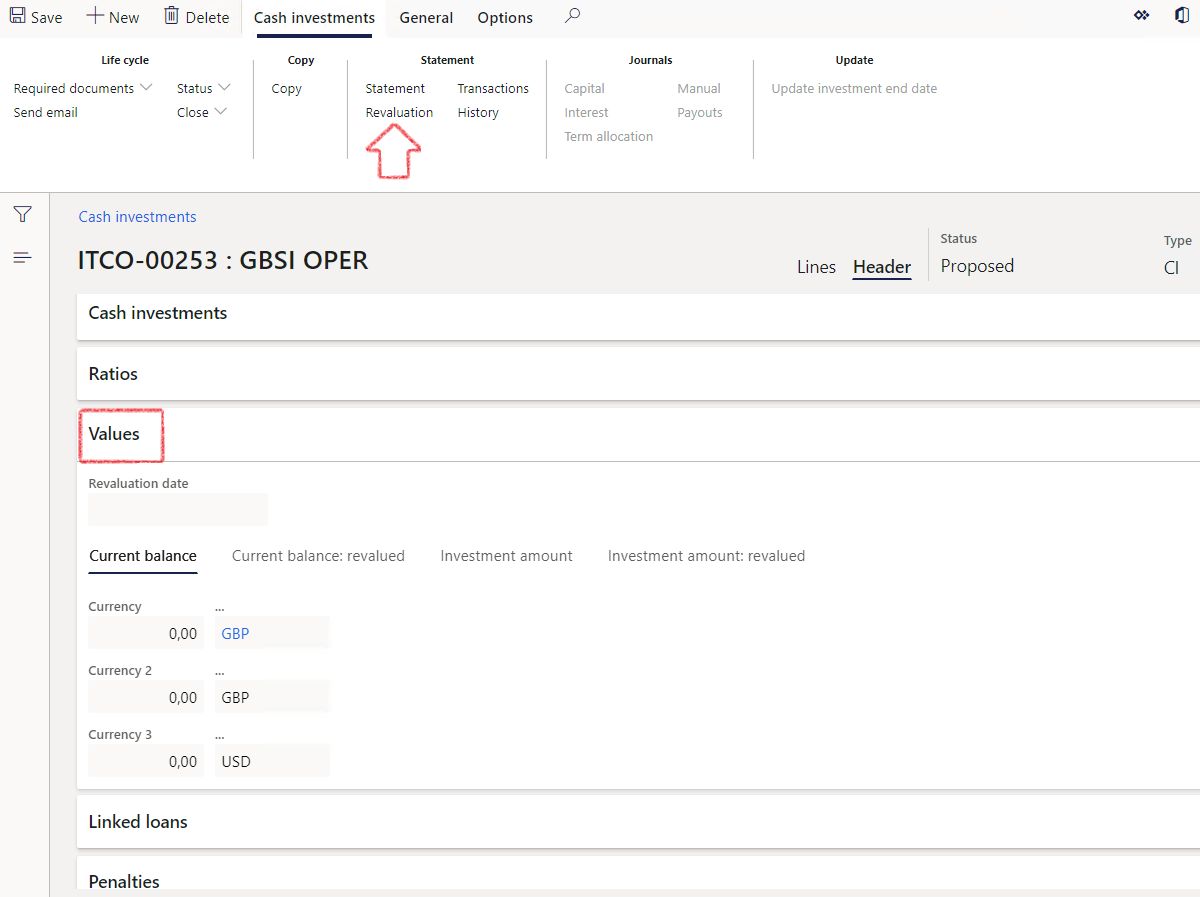

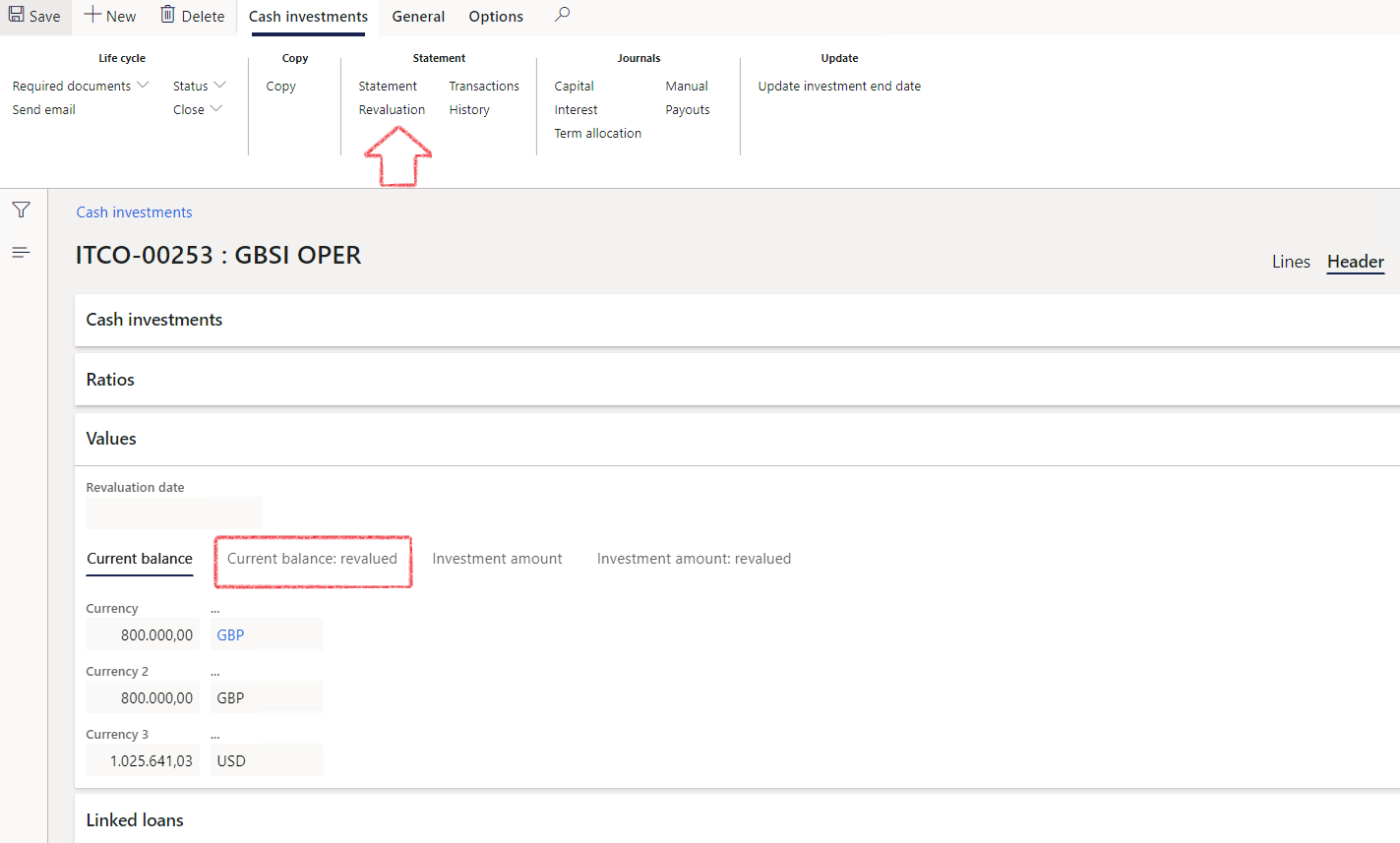

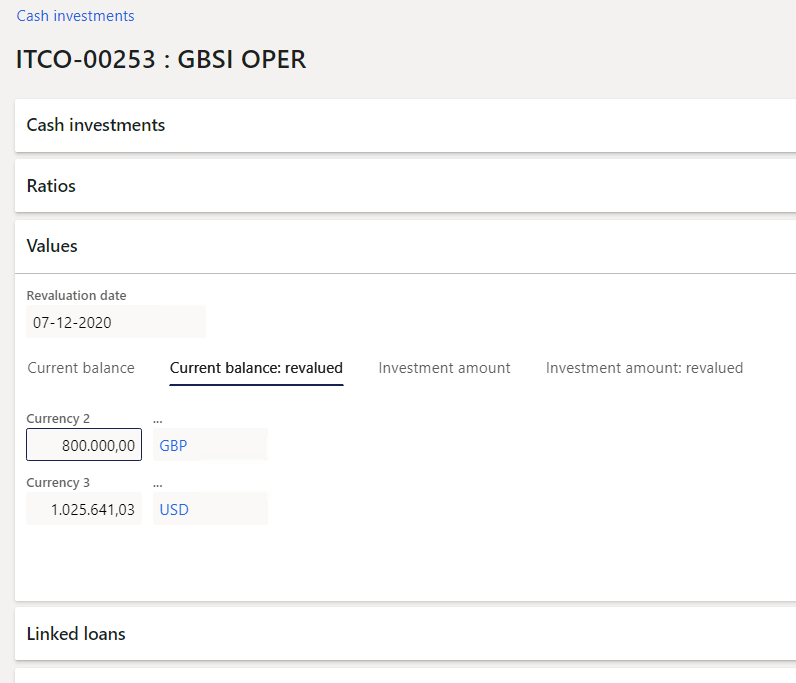

- There are some additional fast tabs, for example Values, so if transactions have been posted against this investment, they will appear here – in the form of the Current balance, the Company currency and Reporting currency; but you can go and revalue those amounts based on today’s exchange rates, with the revaluation button at the top

The Current balance and the Current balance: revalued will reflect already posted journals, and the Investment amount is the initial investment that has been placed.

- If the investment is linked to a specific loan, it can be linked under the Linked loans fast tab.

An example of a linked loan would be where you are managing the same pool of funds. A client borrows funds from a loan provider. You re-invest those funds (hopefully at a higher exchange and interest rate). You can then link the borrowed funds (Loan) on the ‘Linked loans’ fast tab (to see where the funding/ money is coming from) to the specific investment.

- If there are specific penalties charged by a banking institution, those details can be captured under the Penalties fast tab - the penalty amount, the specific currency, Percentage amount, etc. Notes can also be added if needed, and whether it’s been posted or not. Note that there is a specific posting profile for penalties as well

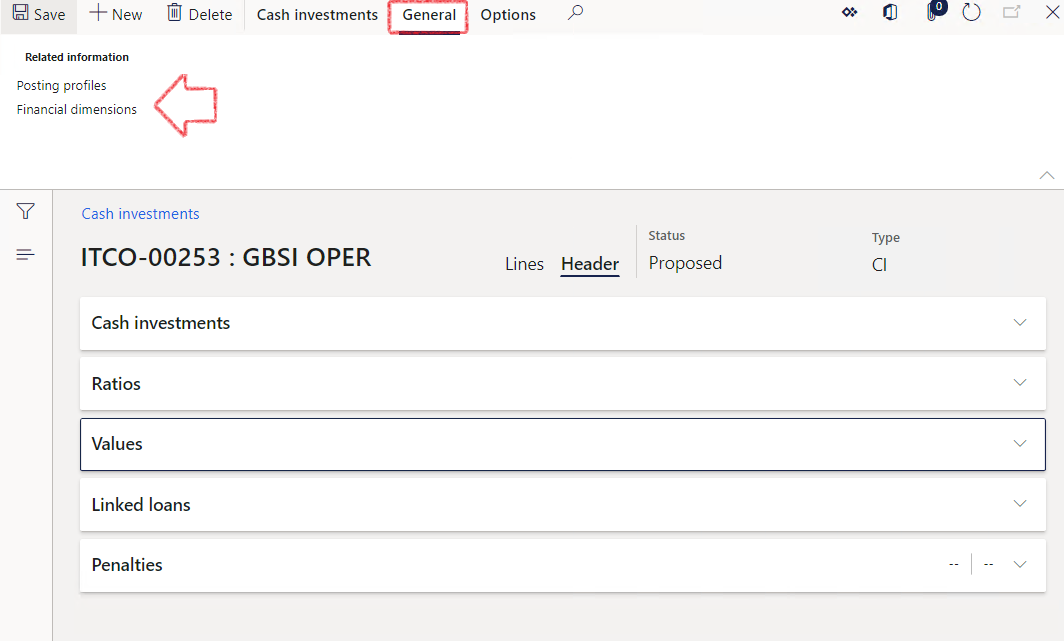

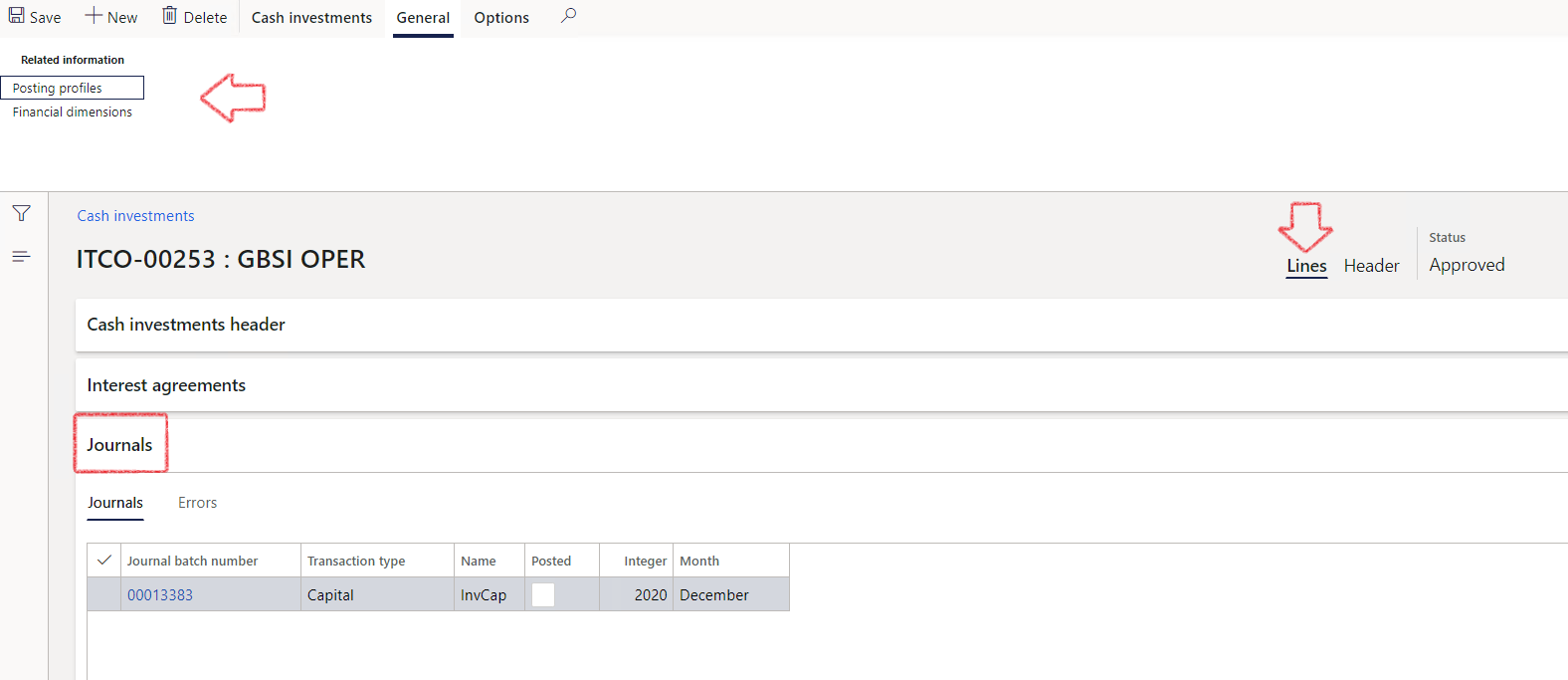

- Default Financial Dimensions and Posting profiles for this specific Cash Investment can be viewed, set up or edited under Related information in the Action pane> ribbon bar on top

¶ Step 11: Processing Interest agreement

The interest agreement is the rate earned on the investment and can be linked to an interest rate table should you wish to do so, or else the rate can be updated manually.

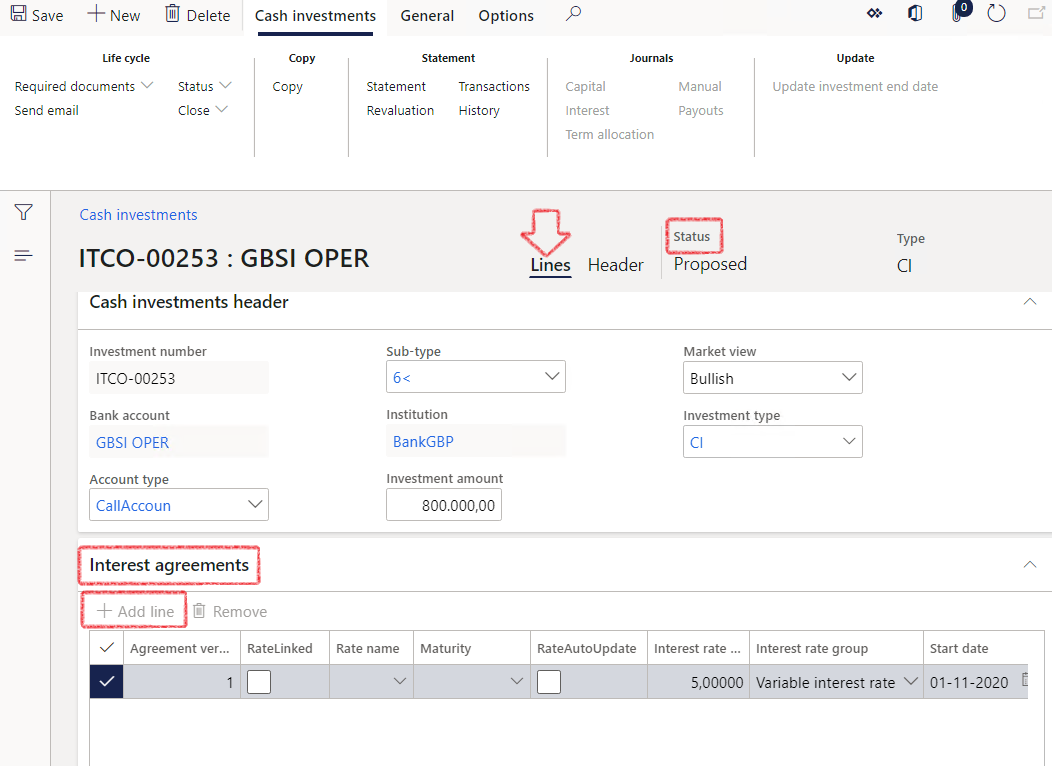

- Go to Treasury > Investments > Cash investments

- Open the existing cash investment details form. Move along from the Header to the Lines tab on the top right. Expand the Interest agreements fast tab.

- Expand the interest agreement fast tab

- Click Add Line to capture the interest details.

- Every time you add a line, a new version will be created

- If this interest rate is linked to a specific Market rate, Exchange rate or Exchange market, you can go and link that

- On Rate name, you can specify the Market it is linked to - LIBOR is a very common one

- Maturity period for this interest rate can be selected. It could be overnight, 1 week etc.

- Rate Auto Update selection will indicate if the rate must auto update

- Enter the interest rate

- Indicate if it is a fixed or variable interest rate group - variable will allow you to add multiple interest rates, whereas fixed will assume the rate will stay static throughout

- Enter a start date and the end date. The start date is populated from the header. The end date is when this investment you expect to come to an end, effectively the maturity date. If the investment is open ended, the end date should be left blank

- The system will automatically calculate the number of statement lines,

- The Interest payment terms are typically Monthly, Quarterly, half-yearly and Yearly

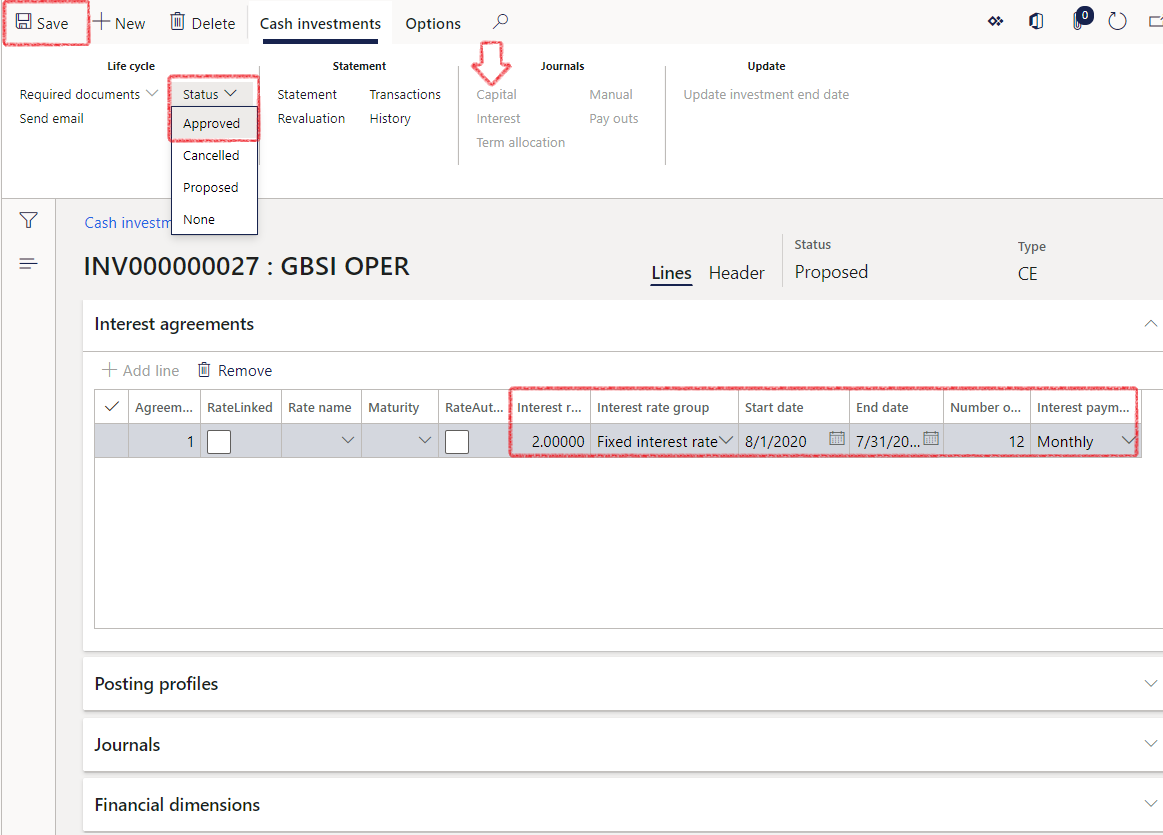

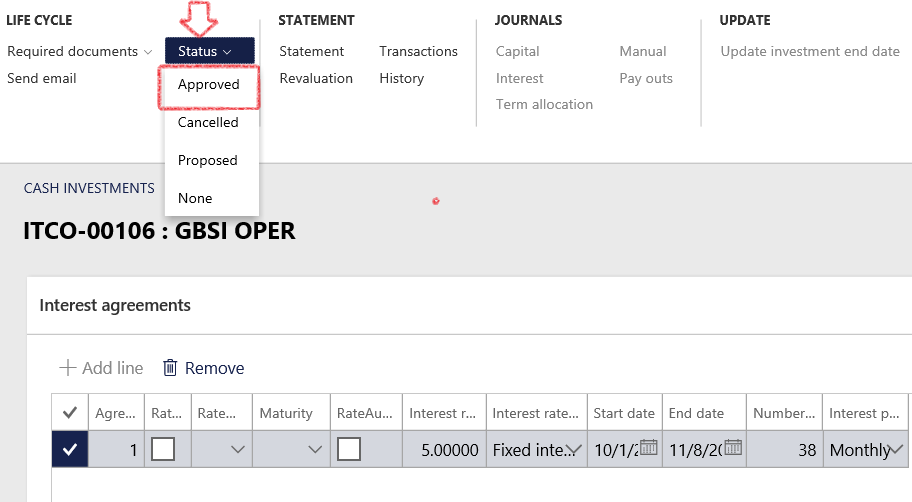

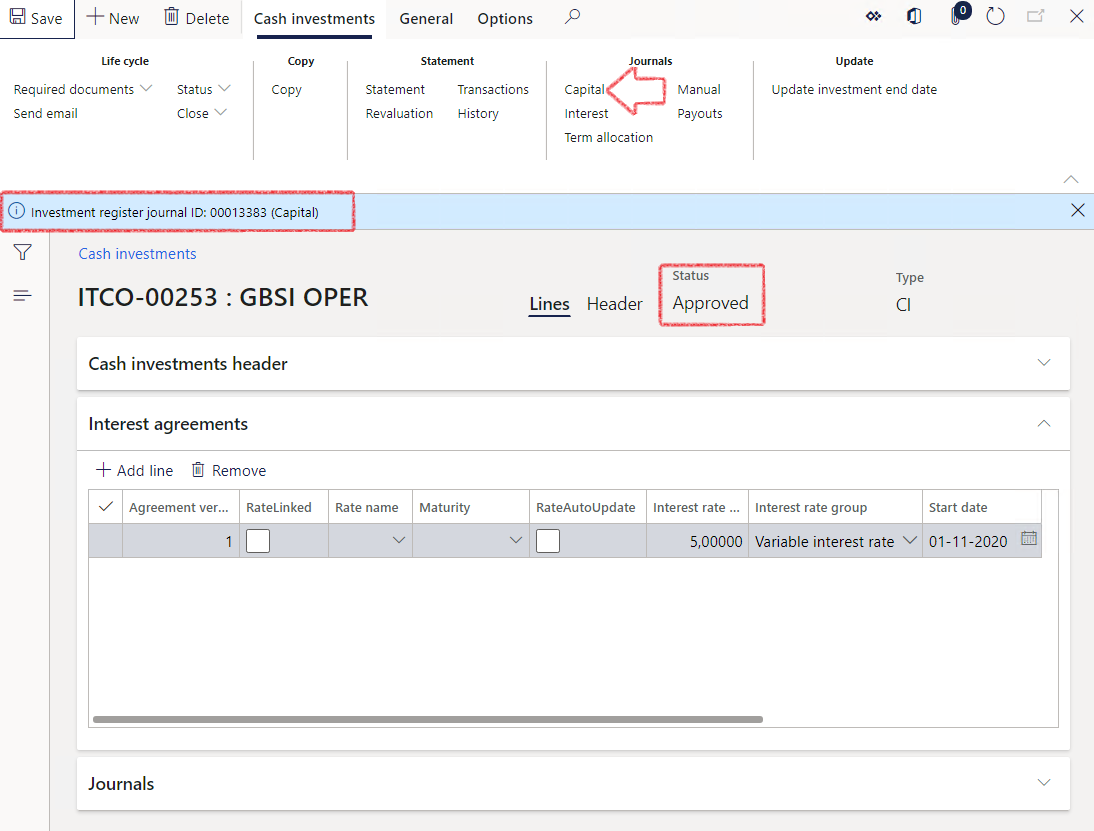

- For the Capital journal to be automatically created, this interest agreement must have a status of Approved

- When the status is approved, save the interest agreement lines.

This screenshot above will change, as the user will not manually select the status, but rather click the Submit to workflow button on the ribbon bar.

- Once the Investment is approved, you will get a message to indicate that an Investment register journal has been created for the initial capital investment amount. Else, an investment must be cancelled. Investment capital are those pay-outs, those actual investment placements that happens - the principal amount

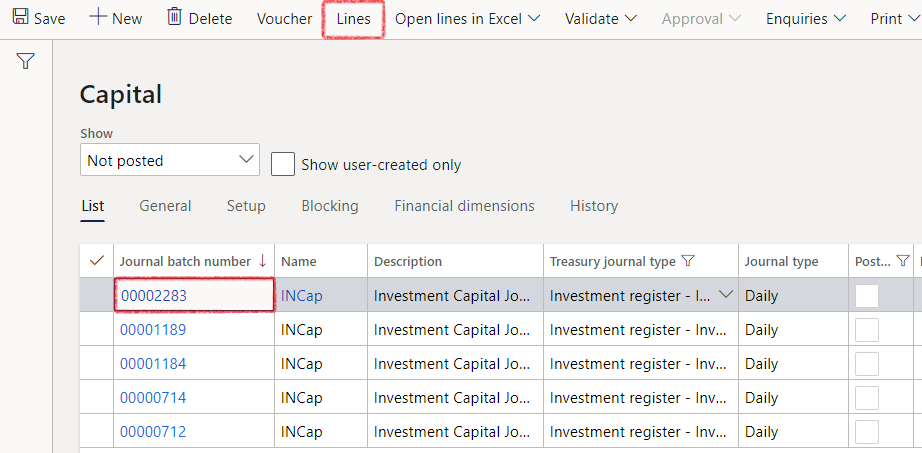

- To view and post the journal, click on the Journals section on top, and click on Capital. This will open all open capital journals

- Open the new Capital journal by clicking on the journal batch number, alternatively, click on Lines to open the journal

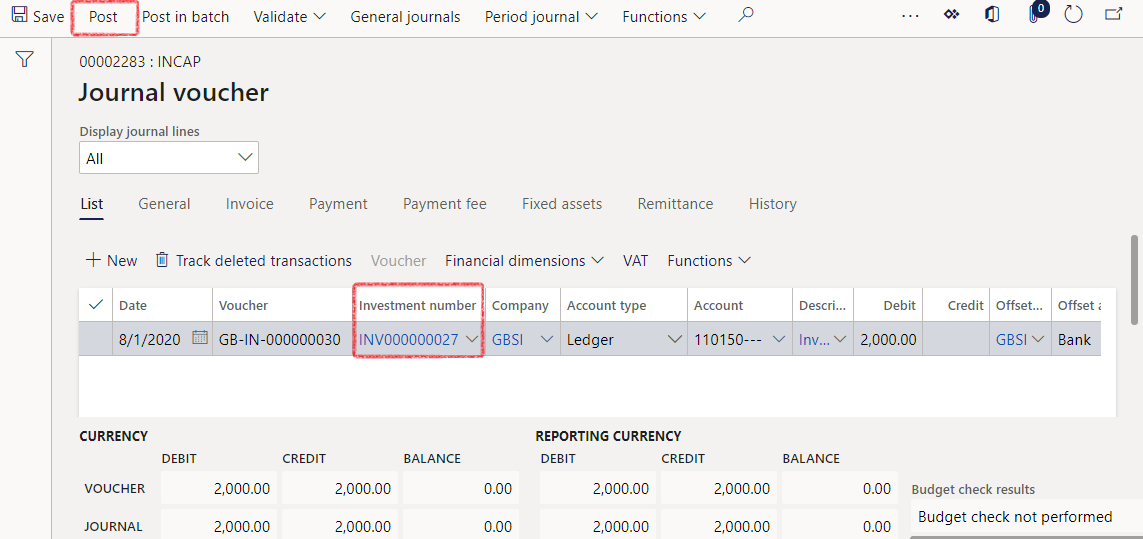

- The newly created journal can now be viewed, validated and posted, by standing on the journal, and clicking on Lines

- The voucher number has automatically been assigned

- The investment number will also be populated

- The company is the local company,

- Account type and account is from the posting profile setup, as well as the Description

- Currency will be populated from the investment table

- Proceed to Post the journal and close the screen

- Close the journal forms

- Go to the Journals fast tab on the Lines inside the Cash Investment

- Journals will show any journals that have already been created against this investment

- When clicking on the Journal batch number, the user will be directed to that specific journal header, and more details can be seen under lines

- Financial dimensions are standard Dynamics, so whichever dimensions are required, can be selected and linked to all the transactions for this investment.

Note the posting profiles on the related information in the General action pane has been pre-populated – that comes from the Investment Type that was captured earlier.

It assumes that all the postings that’s necessary for this specific investment has already been set up under those default posting profiles. If need be, you can go and set up unique posting profiles for this investment, so it doesn’t have to default, but it tells you which accounts it will post to.

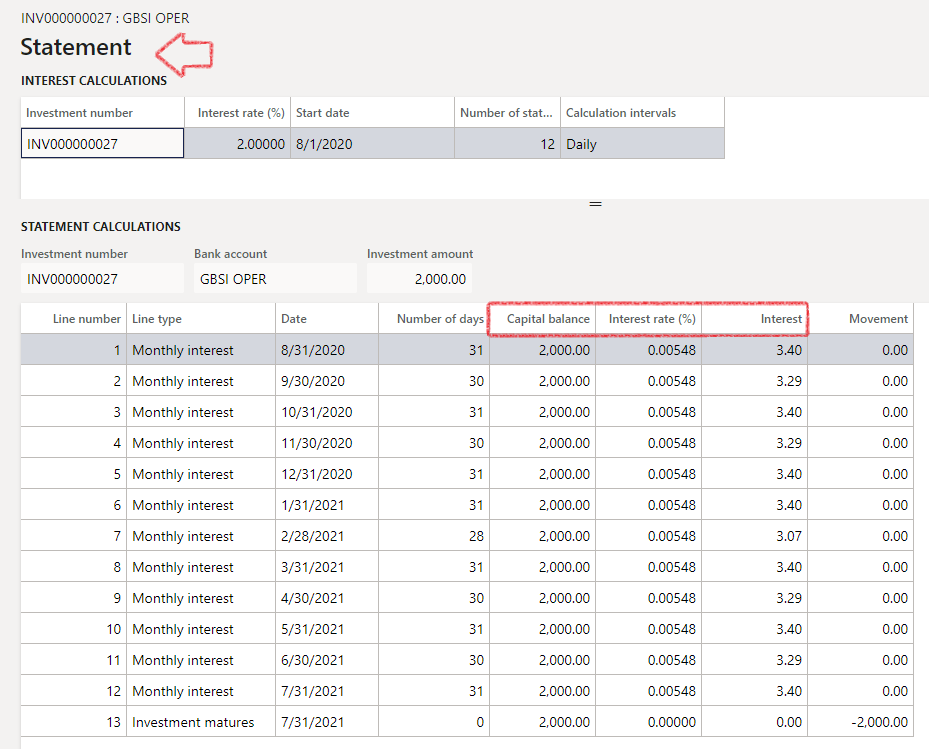

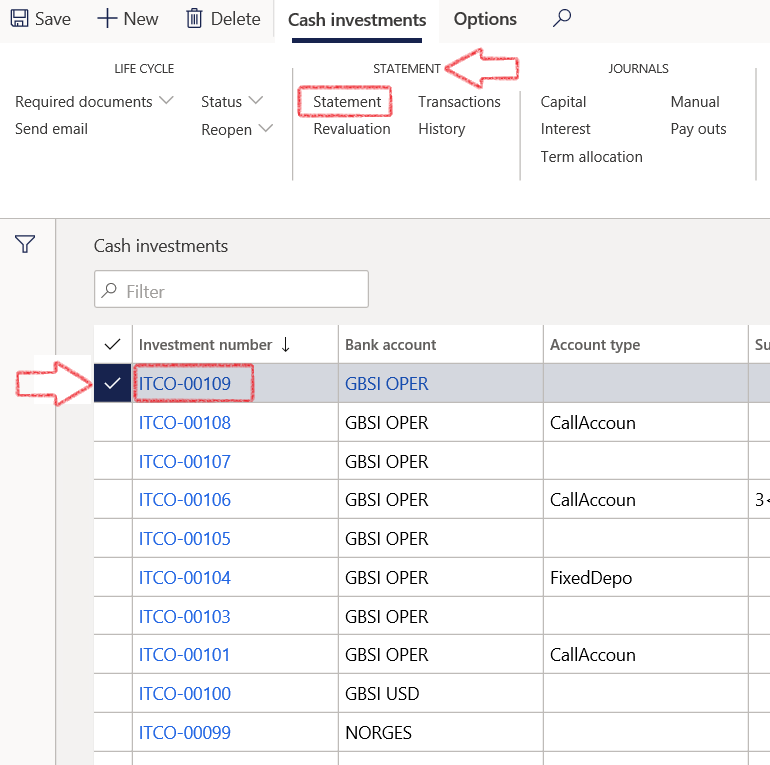

¶ Step 12: View Statement

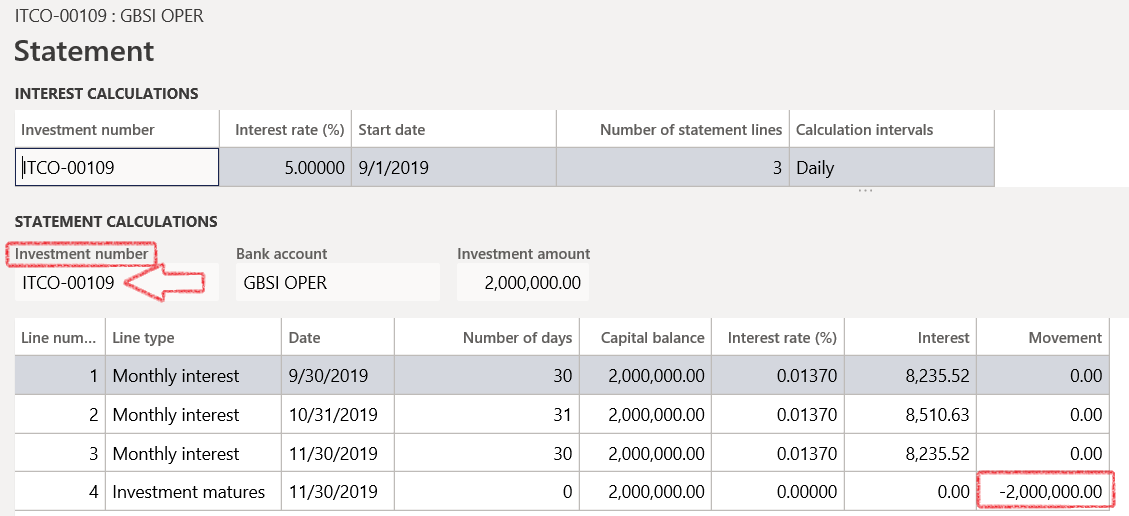

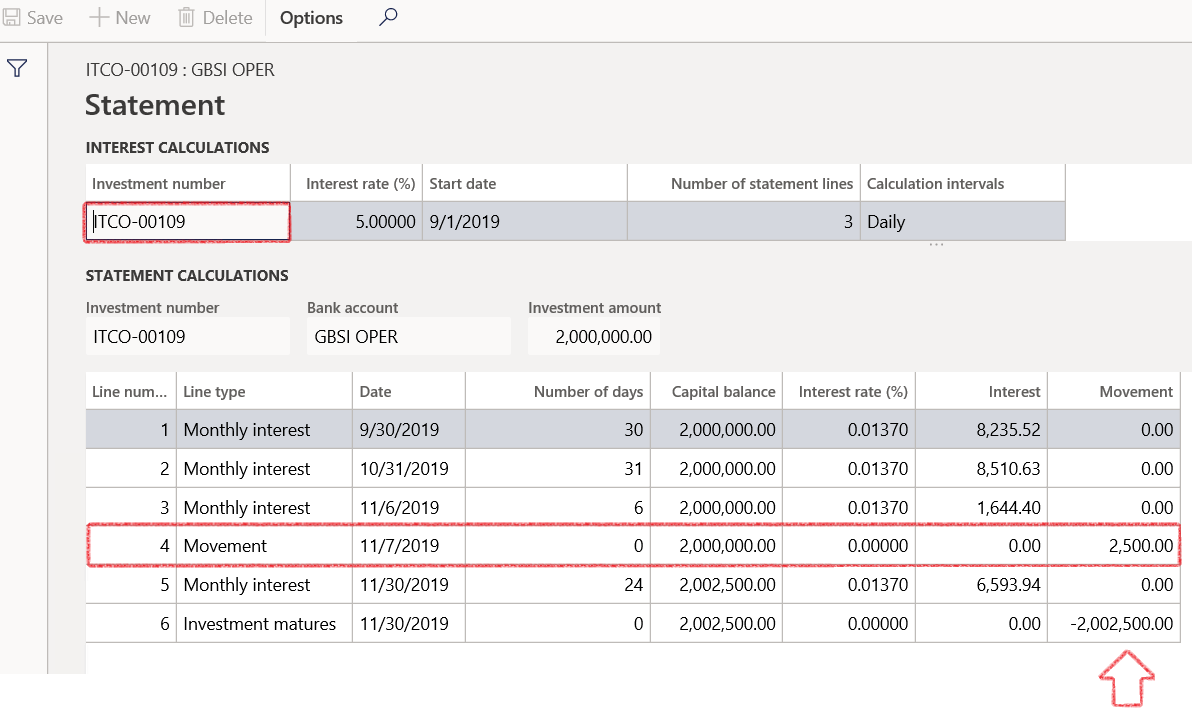

The statement indicates the interest that is expected to be earned on the investment and how the investment will grow and whether the interest will be paid out or not. Accordingly, you’ll see the full amount that you’ve captured as well as the daily interest rate, as it is based on number of days per month, and it will calculate the Interest accordingly

In this example, the Interest is not set to Capitalize, so the investment amount or the capital balance will stay the same throughout

- Go to: Treasury > Investments > Cash investments

- Ensure you first select the specific investment for which you want to view a statement – Select Statement on the ribbon bar

- A screen like this will open, giving a detailed display of your Statement

- If the Re-invest box is ticked, see difference where the Capital balance grows every month

- To select the re-invest option, go to the Header, expand the Cash investments fast tab and under investment details there is an option to re-invest yes/no slide

¶ Step 13: Revaluations

The system allows you to view current balances as well as investment amounts at posted amounts or at the current exchange rate values. Subsequently, if you have an investment in a foreign currency and the Exchange rate has changed, you can go and post the necessary gains and losses for that as well.

- Go to: Treasury > Investments > Cash investments

- Open the specific investment that should be revalued

- On the Header section, expand the Values fast tab

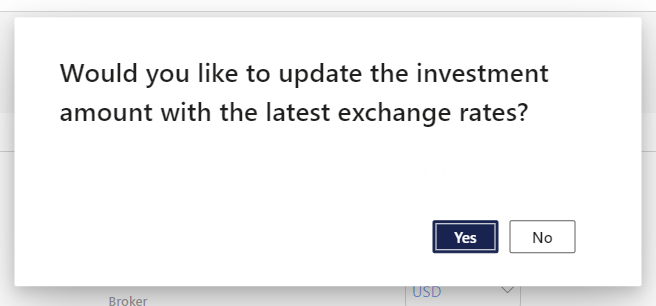

- Select Revaluation on the ribbon bar

- A message will pop up, asking if you want to update the investment amount with the latest exchange rates. Select Yes and refresh the page

- After the page has been refreshed, you will see the amounts has been updated with revalued amounts

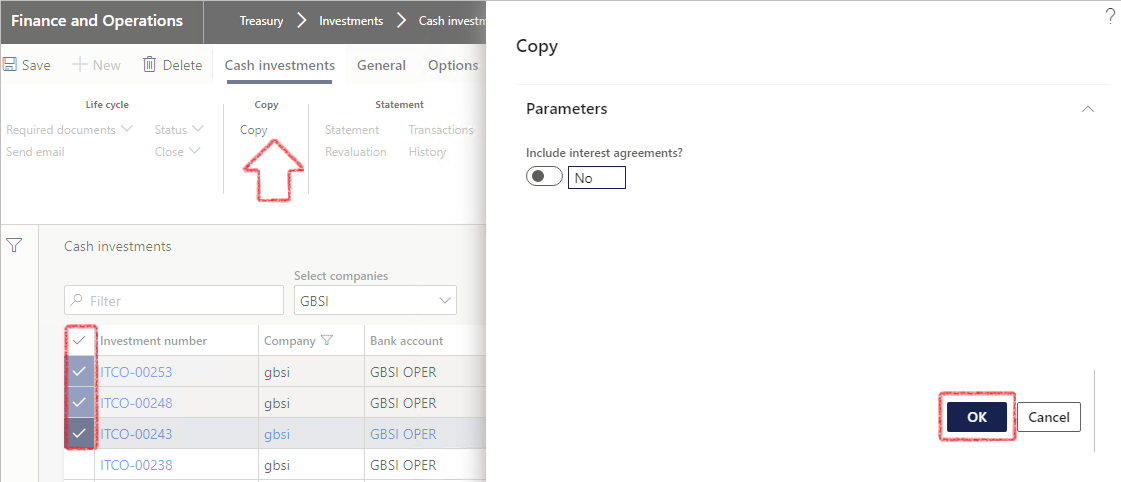

¶ Step 14: Copy Cash Investment

Users have the option to copy an already created Cash Investment.

- Go to: Treasury > Investments > Cash investments

- Select one or multiple investments to be copied

- Indicate yes/no to Include interest agreements for the selected investments

- Click OK

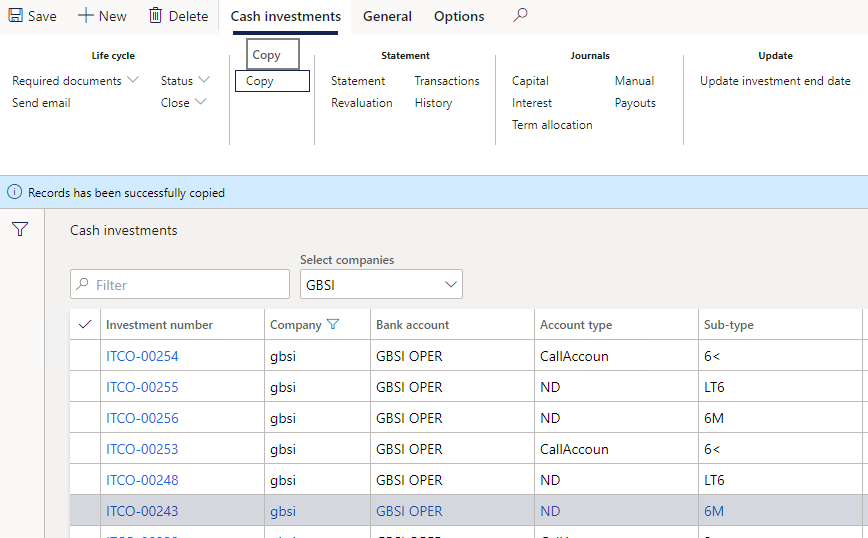

- When done, a notification will appear that the Records have been successfully copied.

- The new investments will appear on the list page with investment numbers as per the number sequence setup.

¶ Step 15: Create Monthly interest journals

This process will create monthly interest journals for investments. Interest accrual is telling the system where to post the monthly interest accruals to.

- Go to: Treasury > Investments > Periodic > Monthly interest journal

- Click OK

- Currently, this looks at the calendar month that you are in, and it will create a journal based on the Posting profile and if there is an interest amount for the current month

- Note that the default dimensions setup for each investment will default to each journal line

- To view the journal, go to Treasury > Investments > Journals > Monthly interest

- Select the correct journal number and click Lines in the ribbon bar to open the journal and review it.

- View the journal lines for correctness. Changes can be made. Once done Select Post > Post

¶ Step 16: Create Payouts journals

The process will create investment Payouts journals for investments that mature during the current financial period when running the Payout journal.

This journal will be used to post the investment payouts, e.g., due to investment maturity

- Go to: Treasury > Investments > Periodic > Payout journal

- Click OK

- View the journal under Investments > Journals > Payouts

- Select correct journal number and click Lines

- View the journal lines for correctness. Changes can be made. Once done select Post > Post

- This journal creates Payouts journals for all your investments maturing in the current calendar month you are in

- Go to: Cash Investments > Statement and ensure the posted movement is reflected on the statement

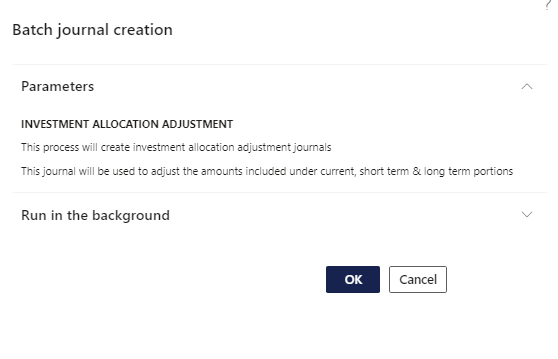

¶ Step 17: Create Allocation adjustments journal

Investment allocation is the re-allocation at year end in terms of investment capital amount that matures over the next 12 months. This journal moves all investment balances that will mature in the next 12 months, from Non-current assets to the Current assets section of the balance sheet, as set up in the posting profile. This is only a reallocation on the GL, and typically you would also go and set it up to automatically reverse the next day, or the first day of the next financial year and then you can re-run that again next year.

This process will create investment category adjustment journals. The journal will be used to adjust the amounts included under current, short term and long-term portions.

- Go to: Treasury > Investments > Periodic > Allocation adjustments journal

- Click OK

- When done, you can view and post the journal. Go to: Treasury > Investments > Journals > Allocation adjustments

- Select the newly created allocation journal and click on Lines to open the journal.

- Review and update

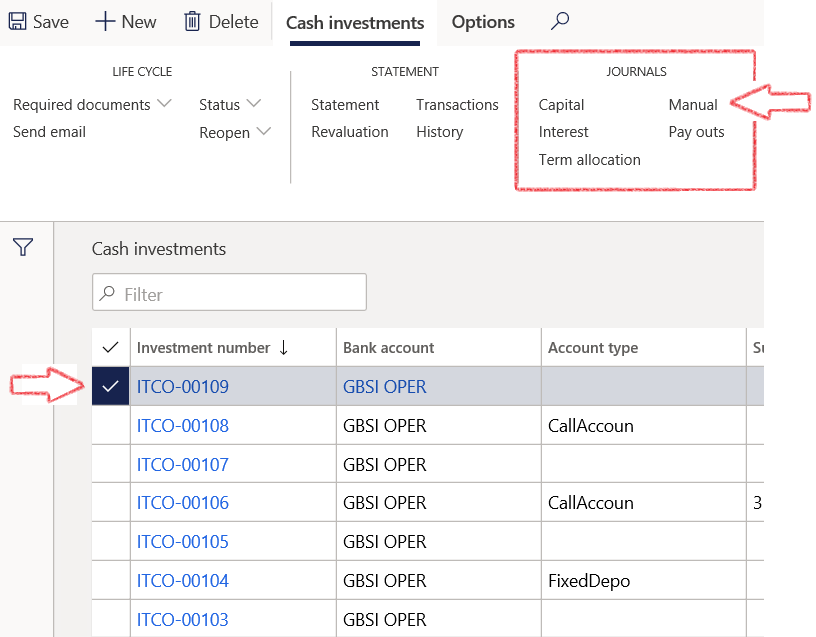

¶ Step 18: Create a Manual journal

When creating a manual journal, it will change the amounts in the statement.

For the purpose of this example, an existing statement will be displayed on a specific cash investment, then we will create and post a manual journal, and then review the statement again to see how it changed.

- Go to: Treasury > Investments > Cash investments

- Select your cash investment from the list page, and then click on the STATEMENT section and the ribbon bar and select Statement

- The statement currently displays the following information:

- Go to: Treasury > Investments > Cash investments

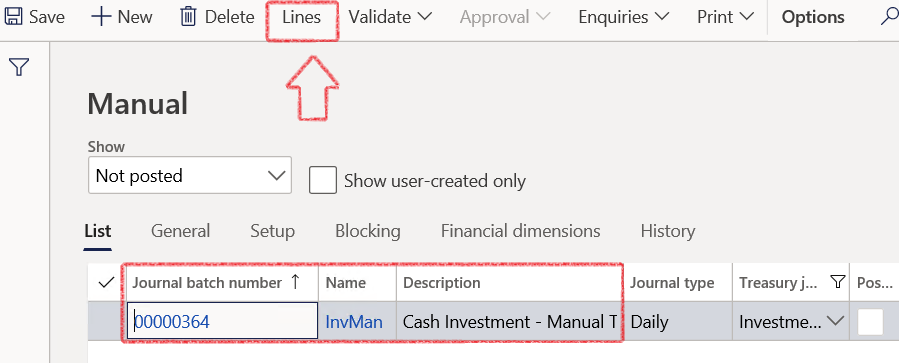

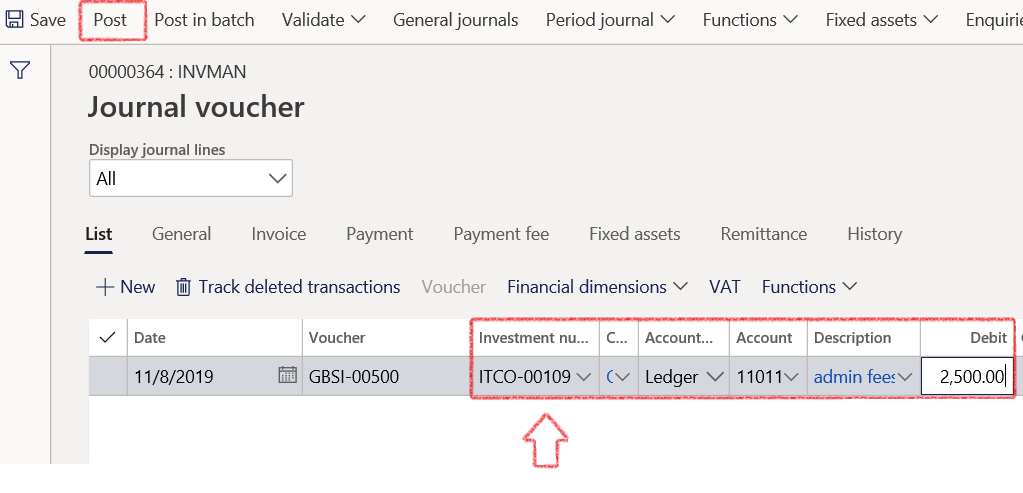

- Select your cash investment from the list page, and then click on the Journals section of the action pane and select Manual

- A screen will open, with the journal header already completed.

- Click on lines to open and complete the journal details

- Select the Investment number from the dropdown collection

- Enter a transaction, such as admin fees and post the journal

- This transaction should appear separately on the statement after the journal is posted

- Close the screen

- Go back to the investment and view the statement. The movement balance has changed with the amount of the manual journal transaction.

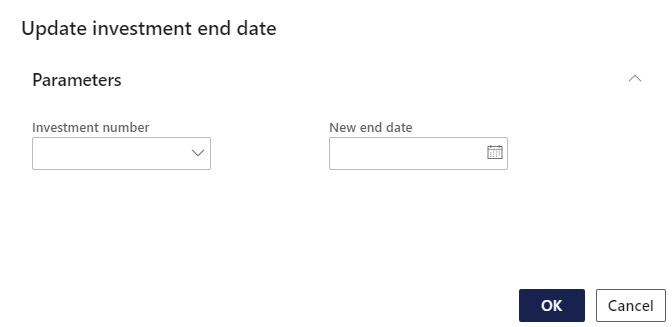

¶ Step 19: Updating investment end date

- Go to: Treasury > Investments > Periodic > Update investment end date

- Select Investment number and new end date if required

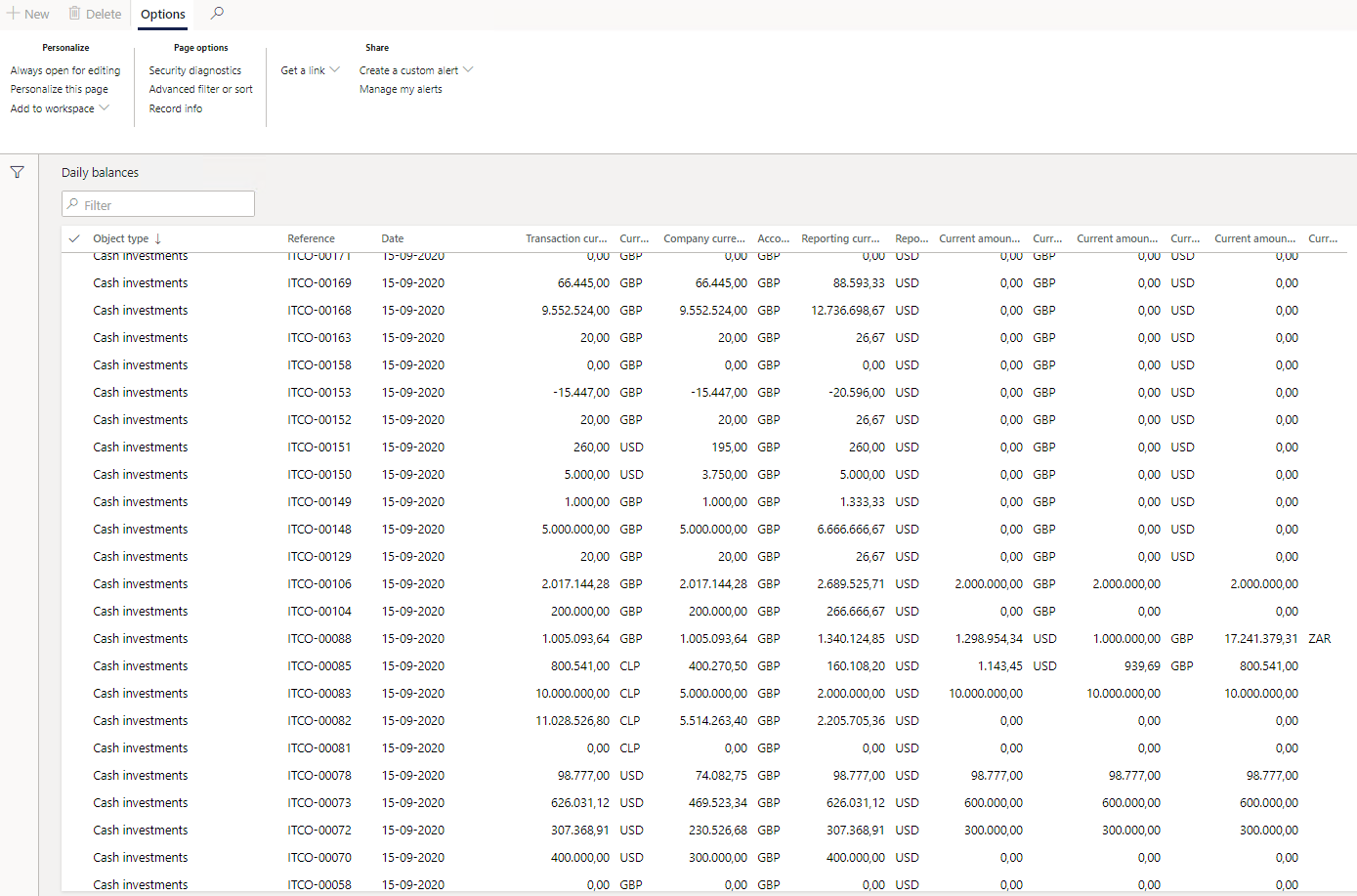

¶ Step 20: Daily balances

- Go to: Treasury > Common > Periodic > Calculate Daily balances

- To view the created daily balances, go to: Treasury > Common > Enquiries and reports > Daily balances

- A list page with the updated daily balances will display

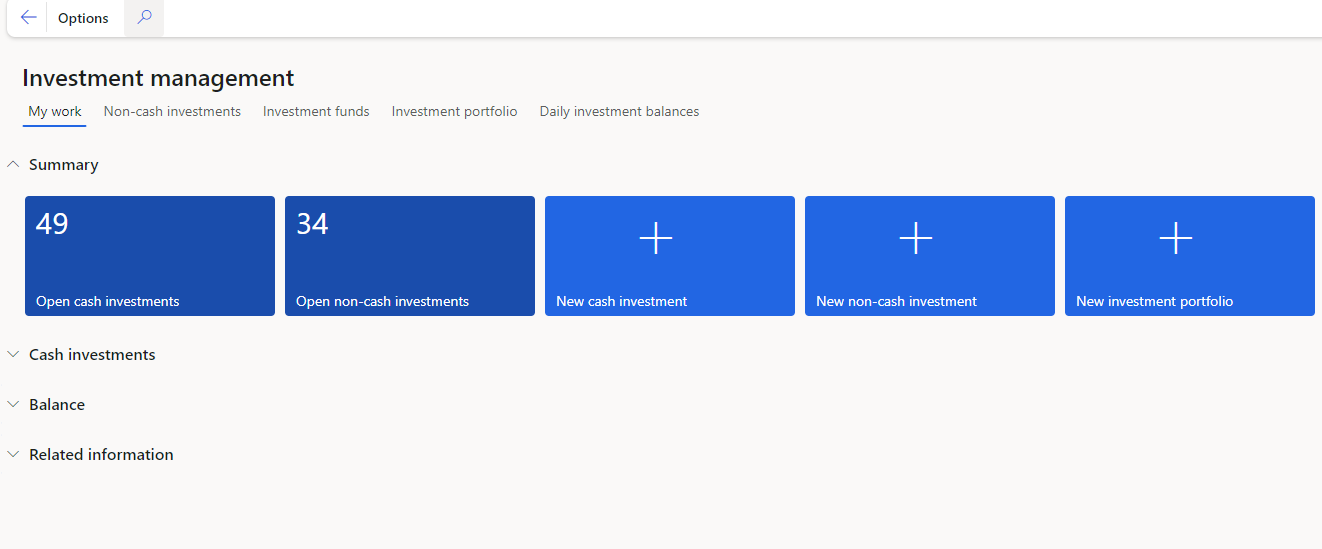

¶ Step 21: Workspaces

Go to: Treasury > Workspaces > Investment management

The following tabs can be used:

- My work

- Non-cash investments

- Set up Posting profiles for loans

- Investment funds

- Investment portfolio

- Daily investment balances

¶ Step 21.1 My work tab

The following FastTabs can be expanded to display more information:

- Summary

- Cash investments

- Balance

- Related information

The Summary FastTab consists of Open cash investments, Open non-cash investments, Create New Cash investment, New Non-cash investment, and New investment portfolio.

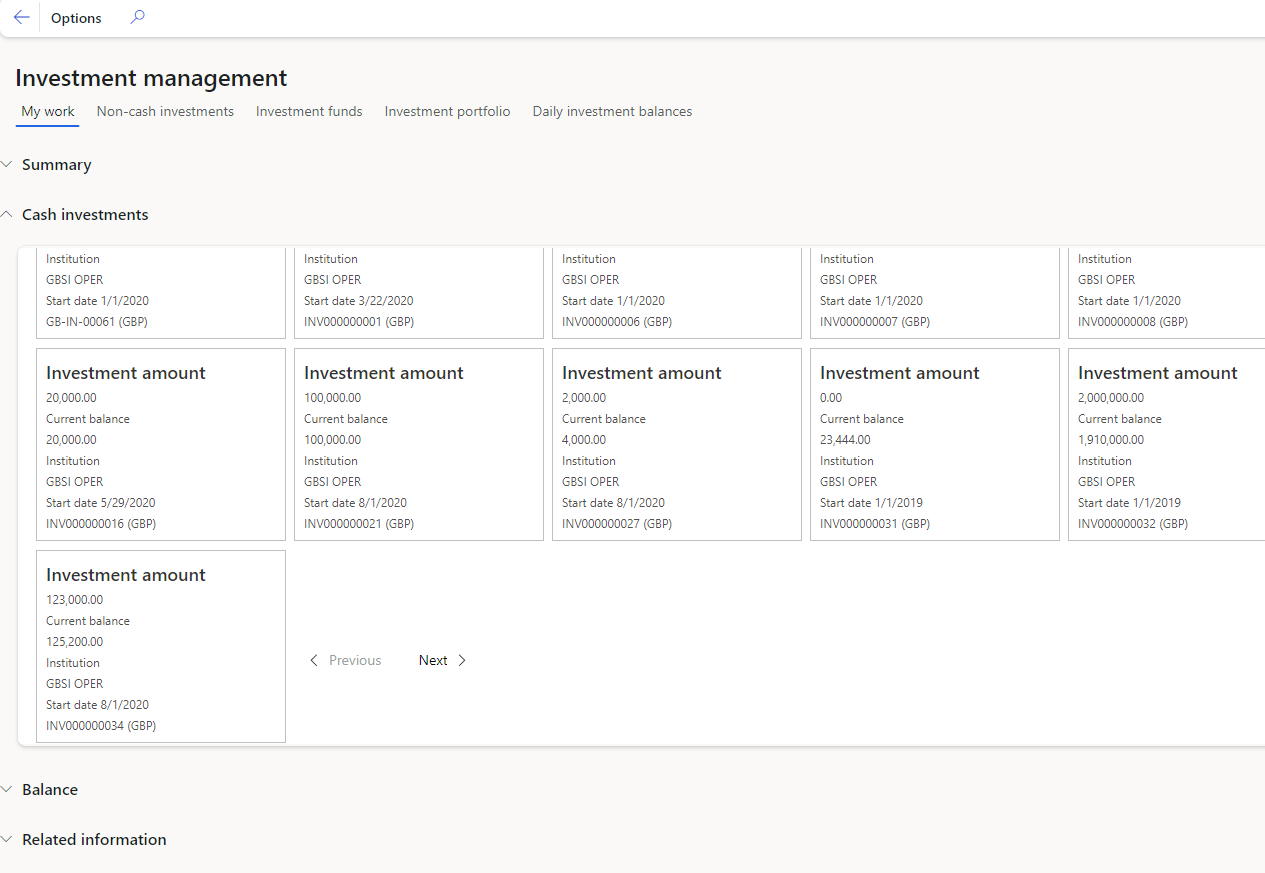

The Cash investments FastTab will display multiple investment tiles, with the following information: Investment amount, Current balance, Institution, Start date and Currency.

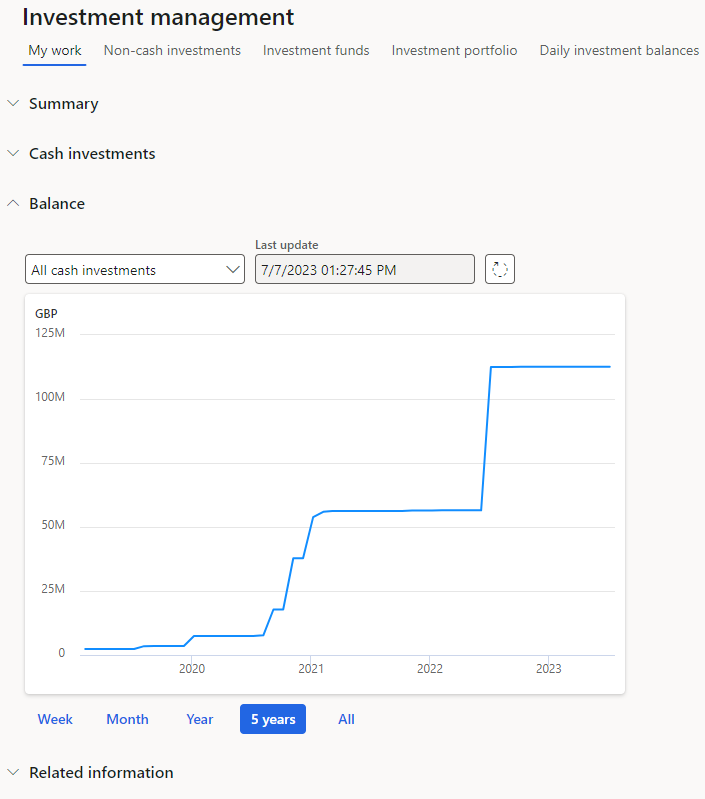

By expanding the Balance FastTab, the balance for a specific cash investment, or all investments can be displayed in a graph for Week, Month, Year, 5 years or all.

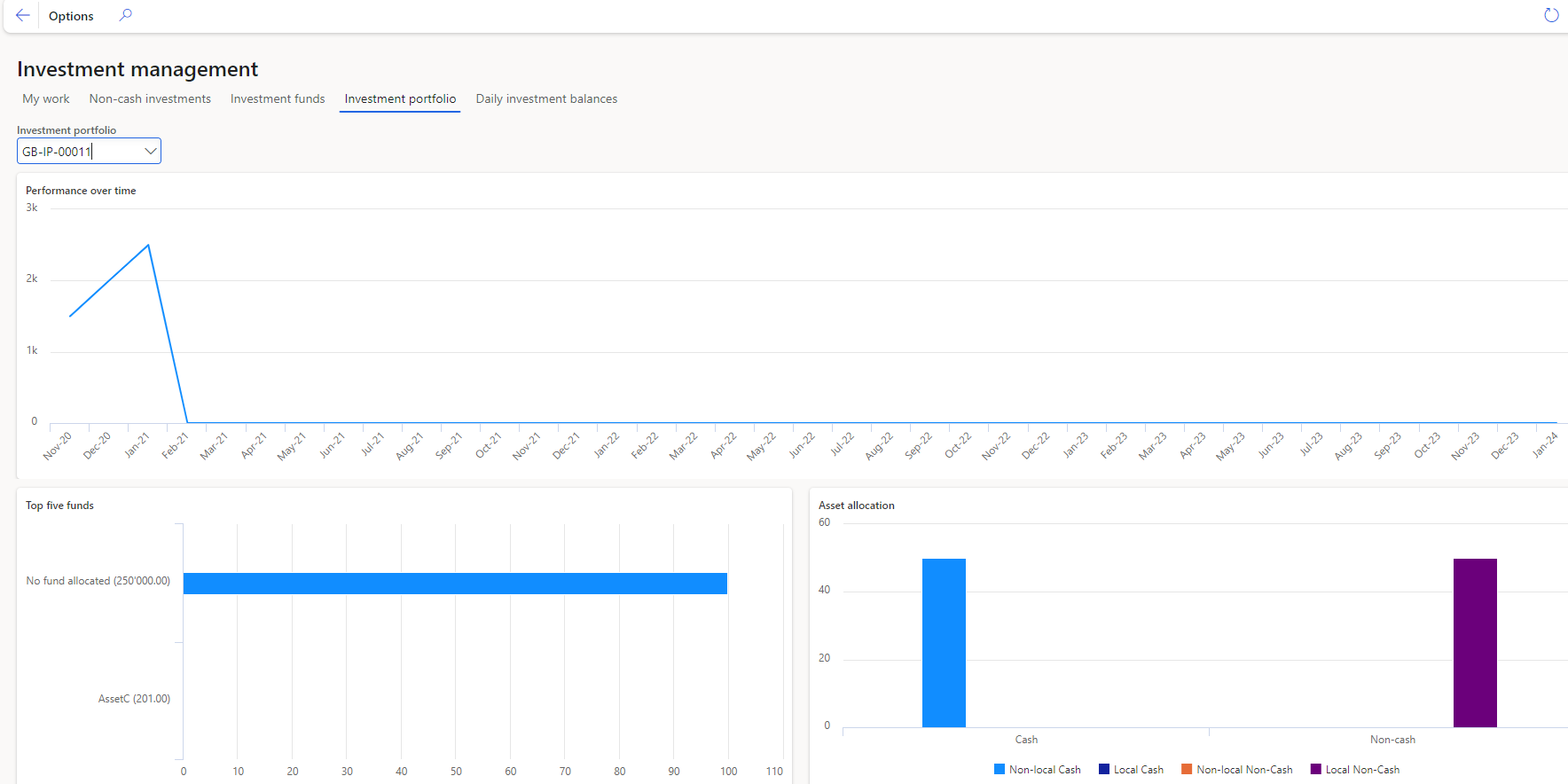

¶ Step 21.2 Investment Portfolio

A graph for a selected Investment will display

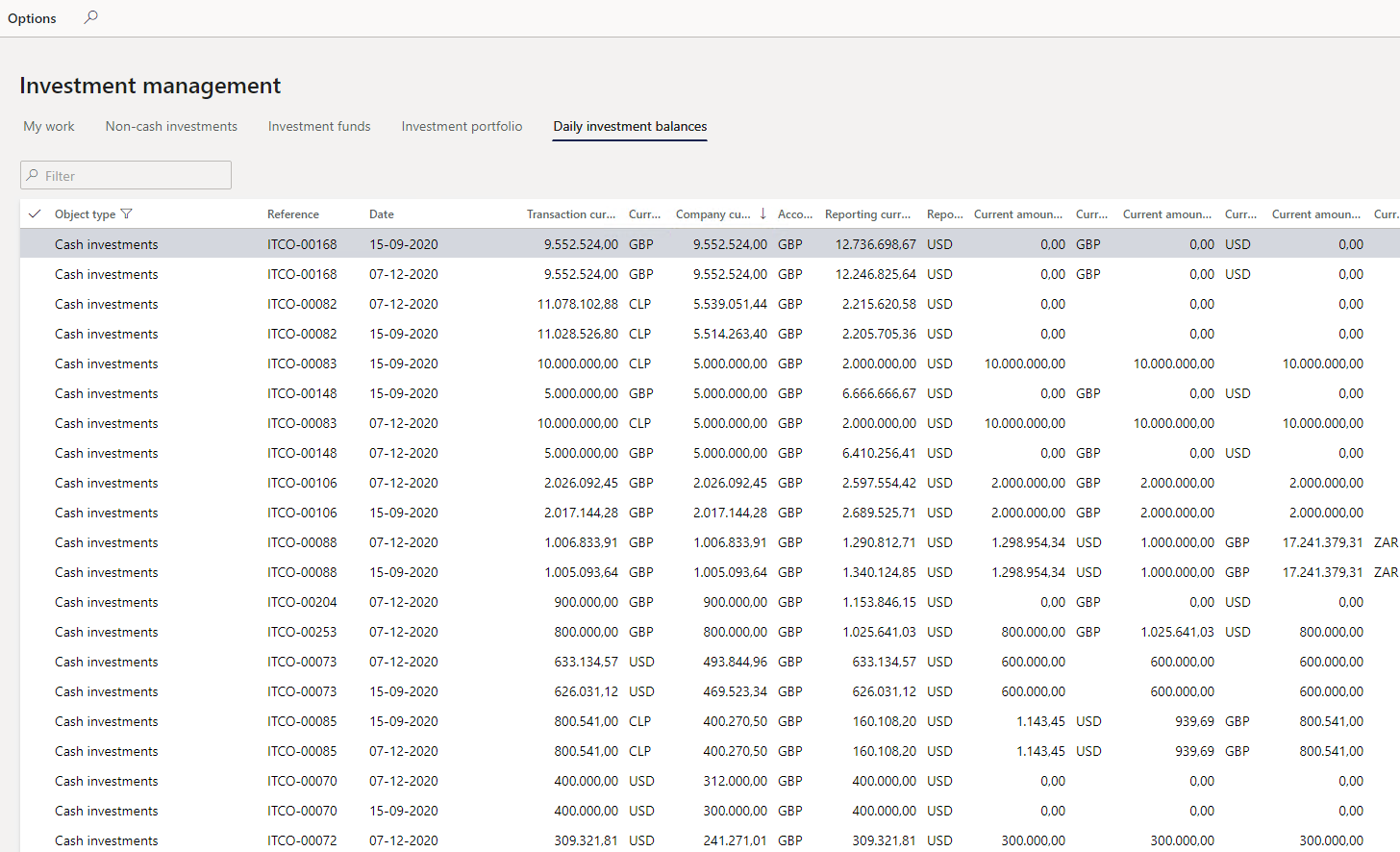

¶ Step 21.3 Daily investment balances

Daily investment balances will display a list page of all the daily balances for Cash investments

¶ Reporting

¶ Step 22: Cash Investment reports

- Go to: Treasury > Investments > Enquiries and reports

- Cash investment interest report

- Cash investment per type graph

- Cash investments due report

- Investment cash flow forecast report

- Investment summary report

- Daily investment balances: enquiries