¶ Introduction

Intercompany loans are loans extended between entities within the same corporate group. In these transactions, one subsidiary or affiliate provides funds to another under the same parent company or corporate structure. The loan terms, including interest rates and repayment schedules, are typically established through internal agreements and often reflect the financial strategies and requirements of the respective entities.

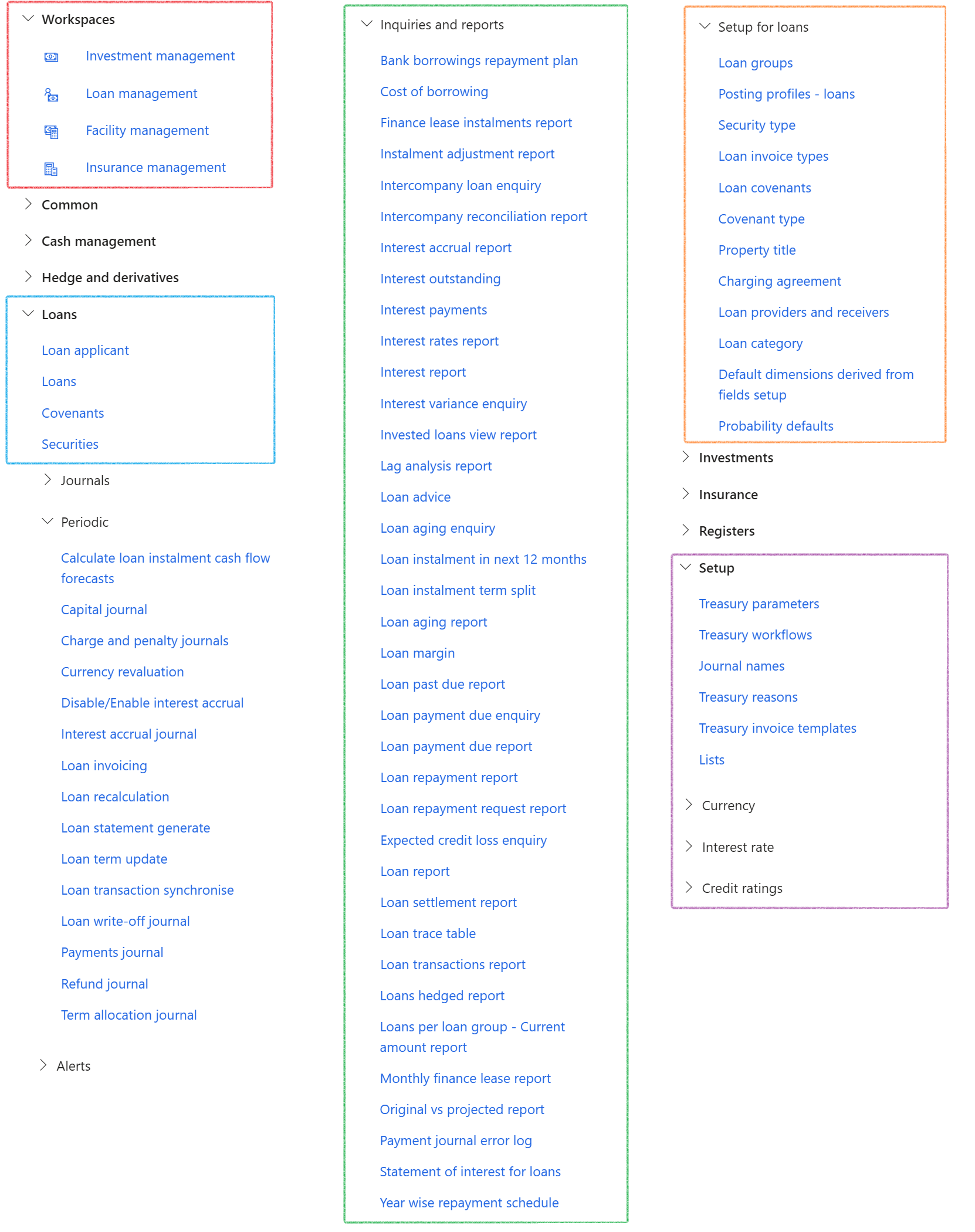

¶ Navigation

¶ Specific setup

The following is required and will be covered in detail below:

- Treasury parameters

- Loan groups

- Posting profiles

¶ Step 1: Treasury parameters

The intercompany loan group can be selected on Treasury parameters. This field serves as the default loan group when a loan is copied to a specific entity where an Intercompany loan group has been selected.

- When selecting Copy/Intercompany on the Loan list page, and opting to copy to another legal entity, the loan created in the target entity will utilize the designated loan group specified in that entity's TMS parameters.

¶

Step 2: Loan groups

Each loan type can be linked to multiple loan groups.

Different types of loans provide various options for consumers and businesses to better manage their financial situation.

The loan type drives how calculations are done.

Loan types are not manually created and will be determined by the Loan group.

- The loan group set up page consist of the following FastTabs:

- General

- Posting profiles

- Documents required

- Interest calculation

- Payments

- Financial dimensions

¶ Step 3: Posting profiles

Posting profiles are the point of integration between the sub-ledger (fixed assets, accounts payable, inventory, banks, accounts receivable, TMS Treasury, etc.) and the general ledger. It is a set of main accounts that are used to generate the automatic ledger entry in which a transaction has occurred. In this scenario, it is used to post loan transactions. You can select different ledger accounts for each type of loan journal.

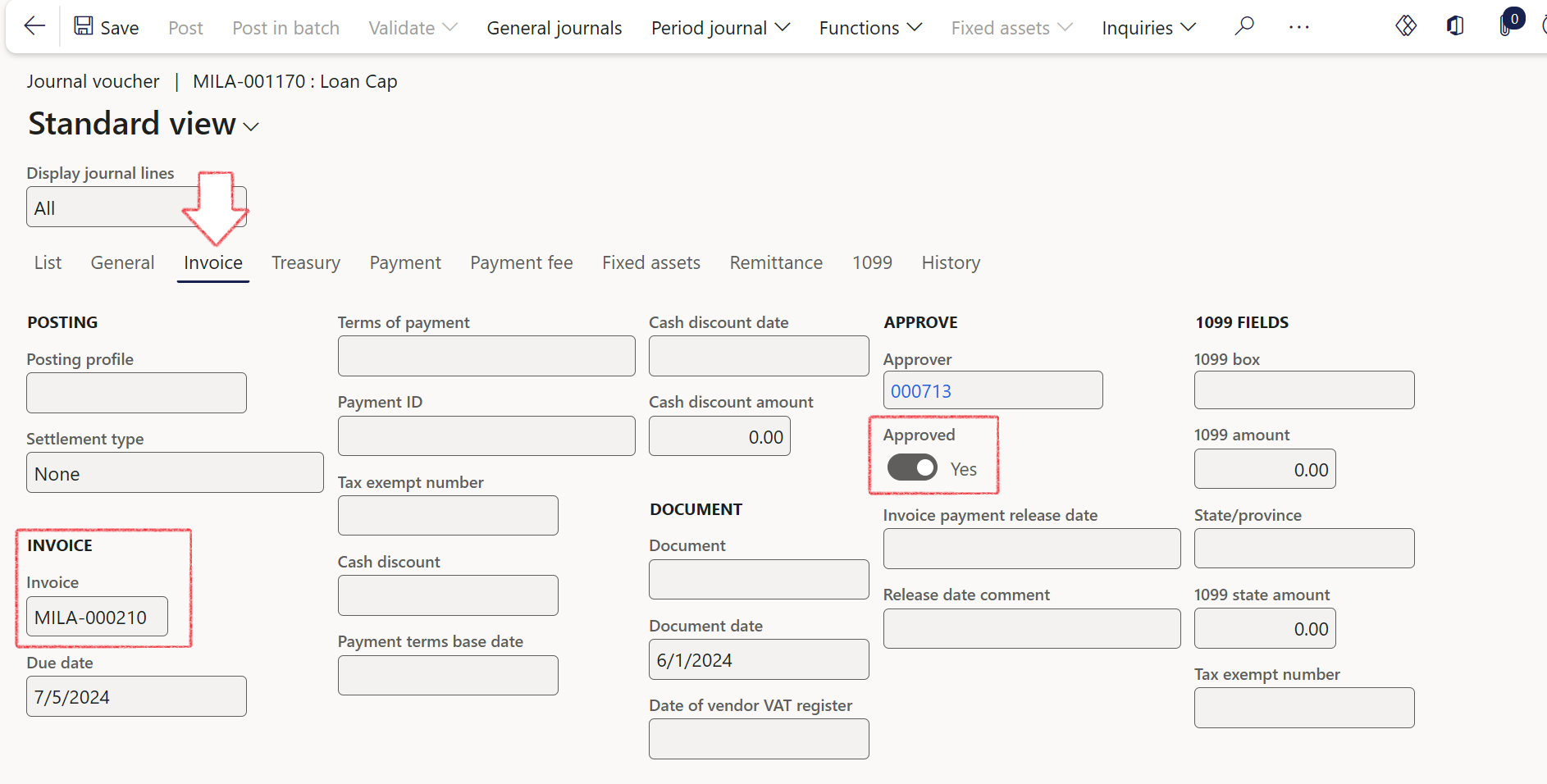

- When the Invoice tick is selected on the posting profile, and when the account or off-set account is a customer or a vendor, then an Invoice will automatically be created for the related journal. This invoice number can be viewed on the Journal lines, Invoice Tab.

- When creating loan journals (Capital journal, Interest accrual journal, Payments journal, etc.) that involve customer or vendor transactions in their accounting entries, these vouchers will automatically be approved

- Once the vouchers are approved, users can manually settle these transactions if necessary

- Invoices can also be created when no intercompany setup exists.

- You can select Invoice on the posting profile where the account or offset account is Vendor or Customer.

- On intercompany transactions, the invoice number is transferred from the vendor to the customer or from the customer to the vendor, depending on which transaction occurred first.

- The invoice number can be generated and immediately used in the corresponding entity's journal.

- On intercompany transactions, the invoice number is stored in the first legal entity and utilized in a subsequent journal creation event in the second entity.

- Additionally, a TMS vendor journal can originate the invoice number, which can later be utilized when creating a TMS customer journal.

- When creating a journal, the system looks up the invoice number used by the corresponding journal and populates it accordingly.

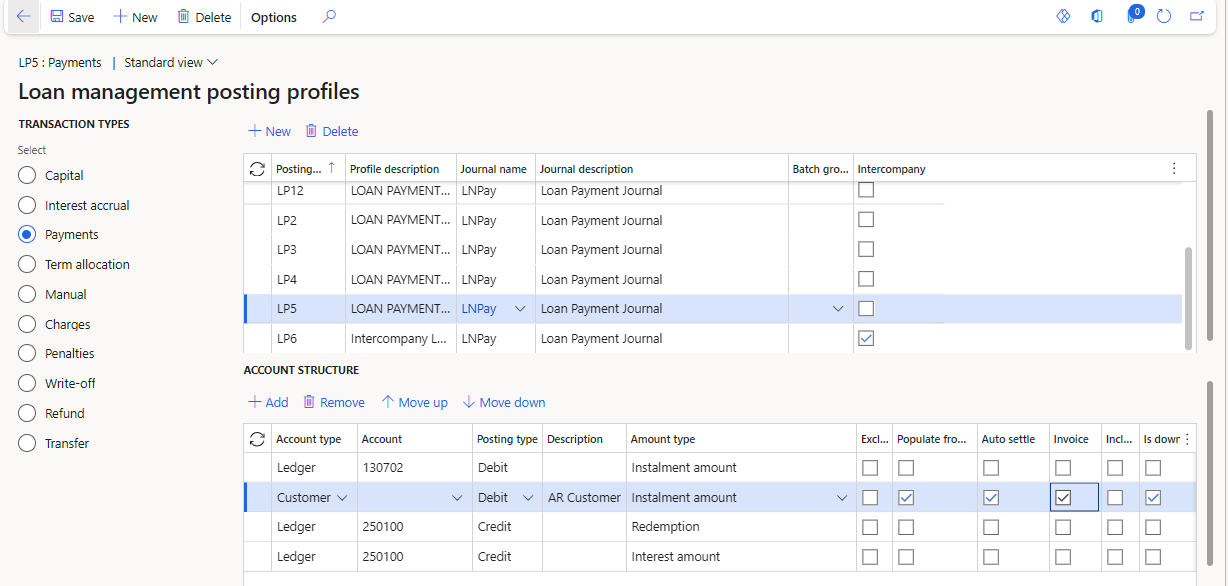

- Users can invoice loan payment journal lines and generate invoices for repayments. This means TMS can also generate an invoice number for a loan payment journal (similar to capital or interest journals)

- An invoice can be allocated even if the customer is the offset account entry. If the invoice number is generated first on the vendor side, the Accounts Payable number sequence is used and fetched when creating the customer journal.

- If the invoice is generated first on the customer side, the Free Text Invoice number sequence is used and fetched when creating the vendor journal

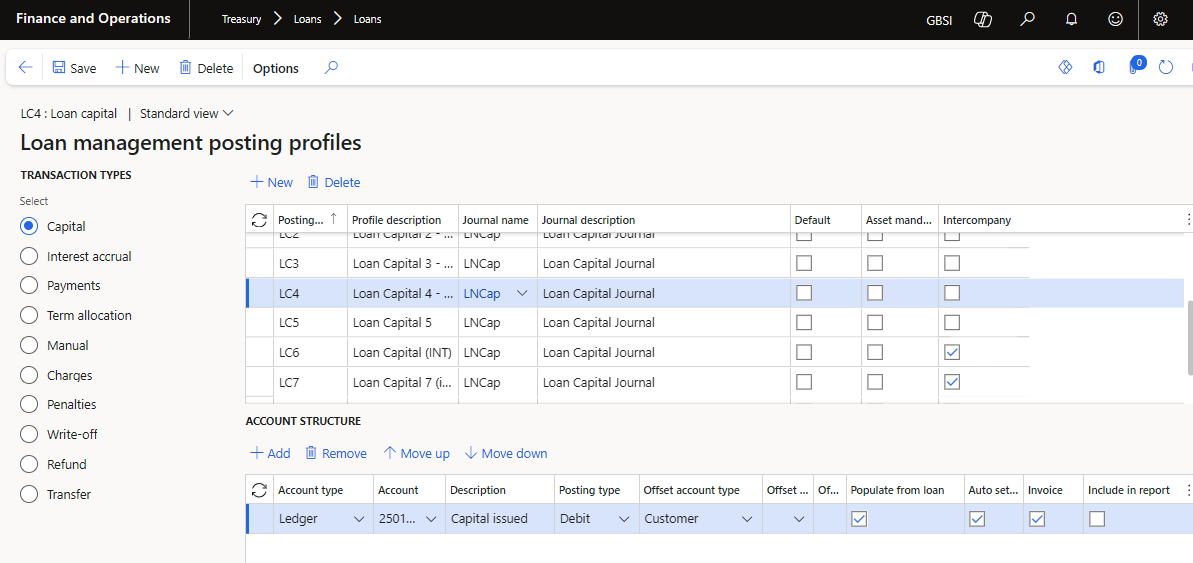

Capital posting profile

- This posting profile will be used for the capital journal or drawdown journal

Payment posting profile

¶ Step 4: Default customer and vendor account between two companies

Default customer and vendor accounts can be used when copying an intercompany loan. When creating a new loan in Company A, a customer and vendor from Company B can be selected. By clicking Copy Loan, a loan will be created in Company B with the correct customer and vendor from Company A.

For this to work, Customers and Vendors should be created in both companies:

¶ Step 4.1: In Company A, create a vendor for Company B

- navigate to Accounts payable>Vendors>All vendors

- Click on the New button

- Type a new Vendor account

- Type a Name

- Select Group from the dropdown list

- Click on Save

¶ Step 4.2: In Company B, create a vendor for Company A

- navigate to Accounts payable > Vendors > All vendors

- Click on the New button

- Type a new Vendor account

- Type a Name

- Select Group from the dropdown list

- Click on Save

¶ Step 4.3: In Company A, create a customer for Company B

- navigate to Accounts receivable > Customers > All customers

- Click on the New button

- Type a new Customer account

- Type a Name

- Select a Customer group

- Click on Save

¶ Step 4.4: In Company B, create a customer for Company A

- navigate to Accounts receivable > Customers > All customers

- Click on the New button

- Type a new Customer account

- Type a Name

- Select a Customer group

- Click on Save

¶ Step 5: Setup intercompany trading relationships for customers

To use default customers for intercompany loans, the intercompany setup for customers must be completed in both companies.

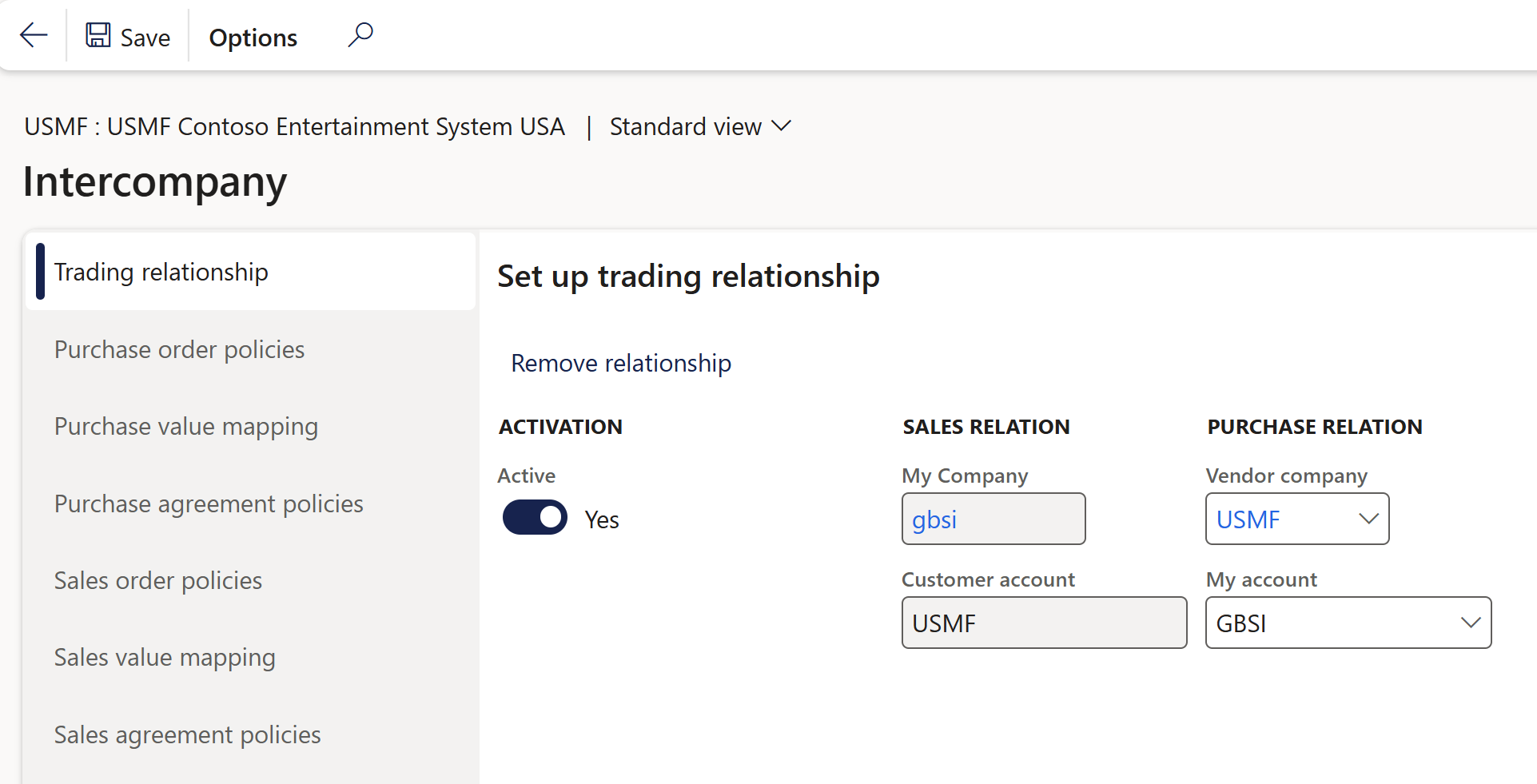

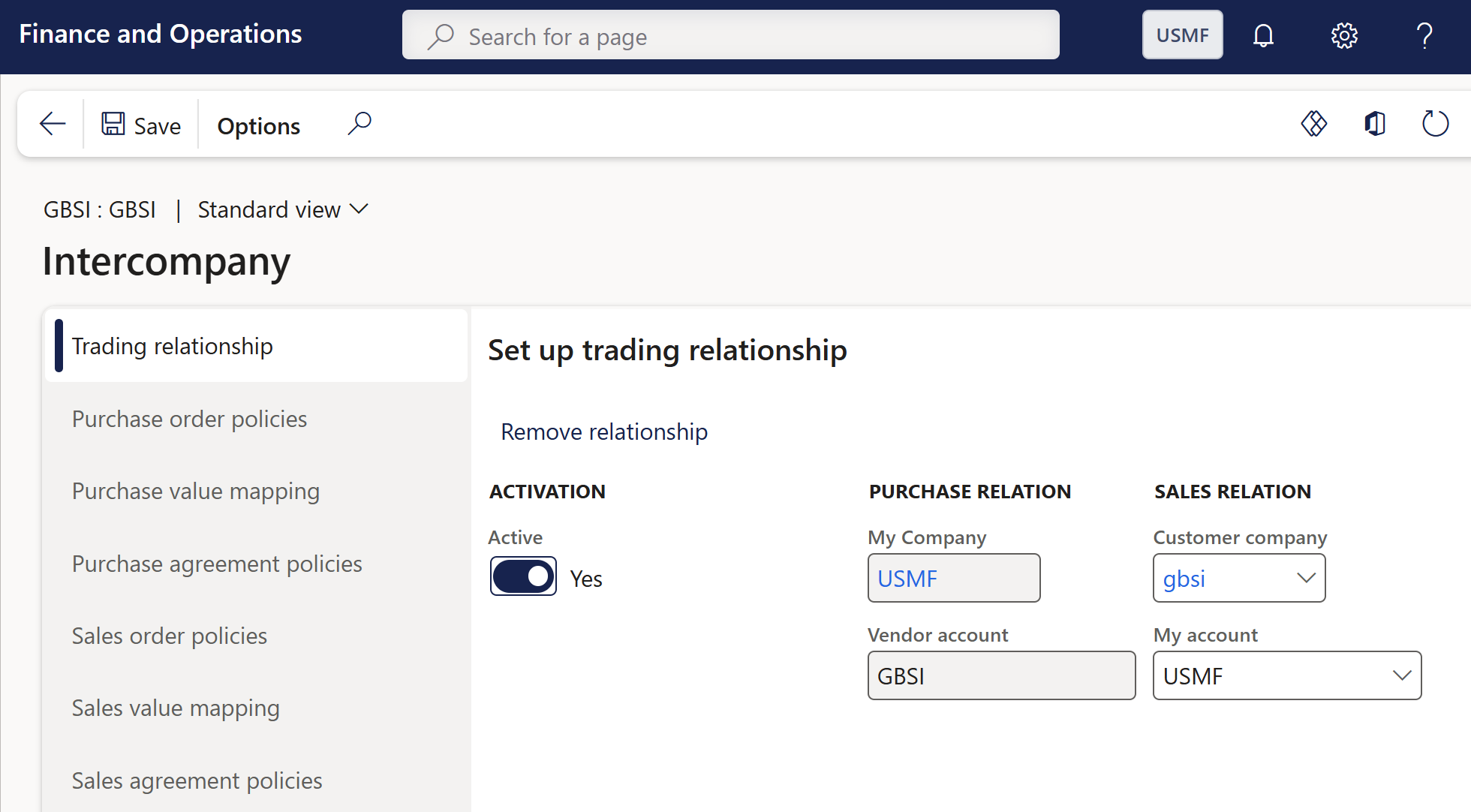

¶ Step 5.1: Intercompany trading relationship setup in company A for company B

- In Company A, go to customers, find the customer for company B, on the General tab, on the Setup section, select Intercompany

- on the Trading relationship tab, Set up trading relationship:

- On the Sales relation section, under My company , company A will be filled in already

- Customer account: This is the newly created customer account for company B and will be filled in already

- On the Purchase relation section, select company B for Vendor company

- My account: select vendor account for company A

- Set the Active toggle to Yes

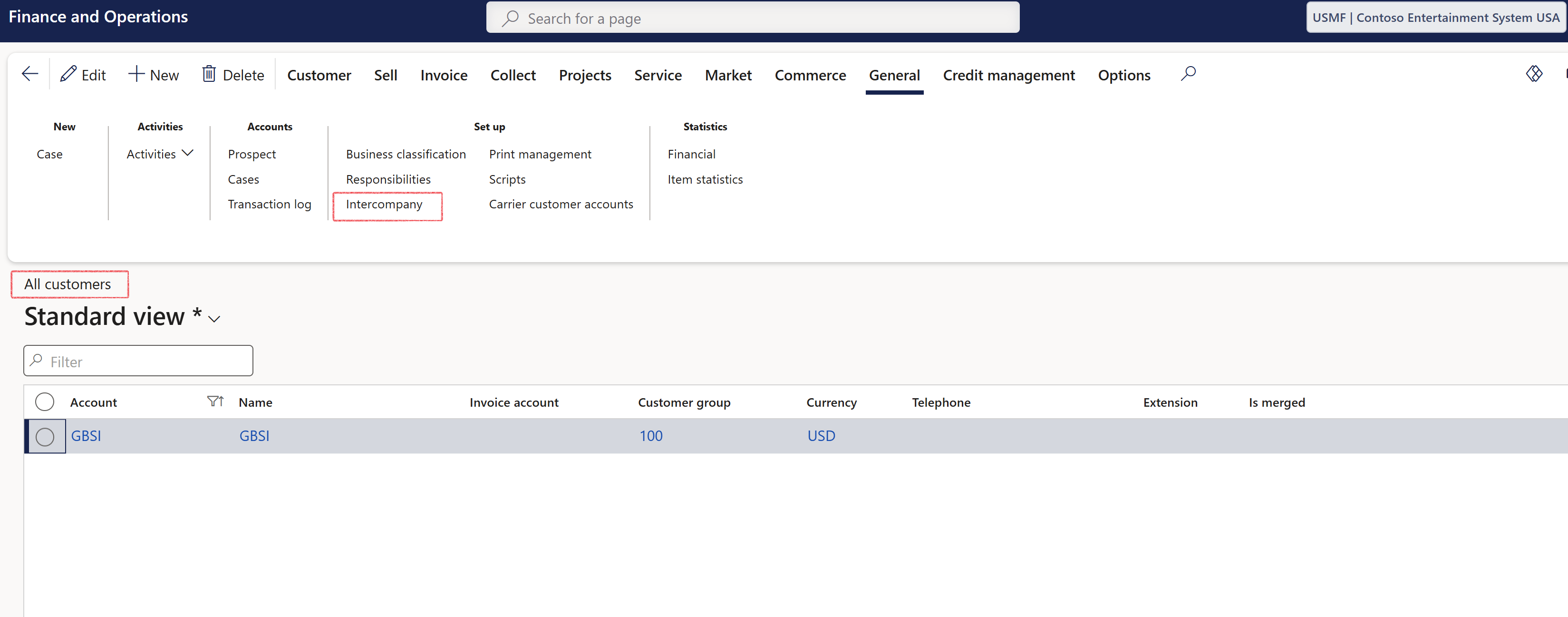

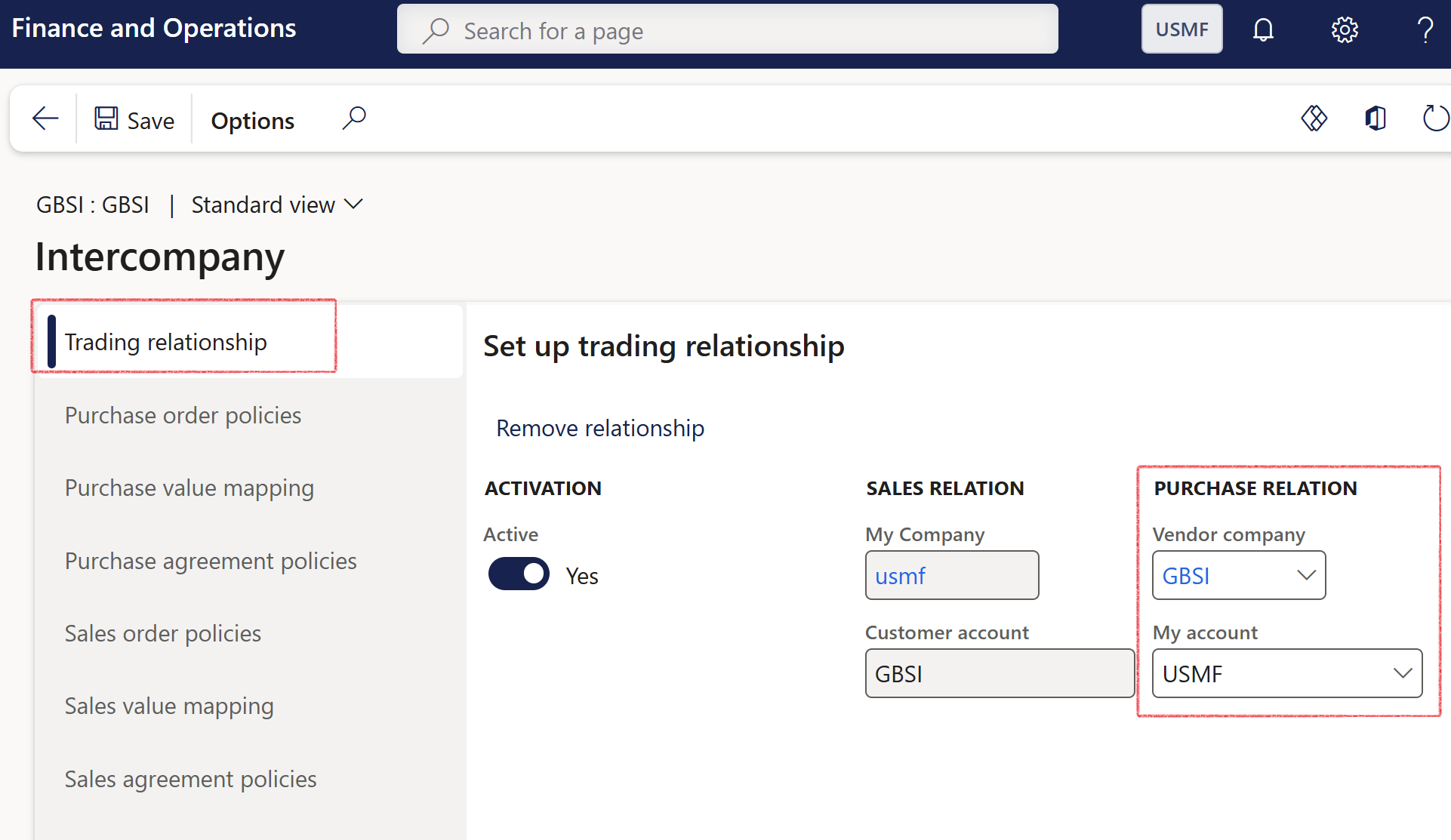

¶ Step 5.2: Intercompany trading relationship setup in company B for company A

- in Company B, go to customers, find the customer for company A, on the General tab, select Intercompany

- on the Trading relationship tab, Set up trading relationship:

- On the Sales relation section, under My company company B should display already

- Under Customer account, the newly created customer account for company A will be populated already.

- Under the Purchase relation section, under Vendor company, select company A

- Under My account, select the vendor account for company B

- Set the Active toggle to Yes

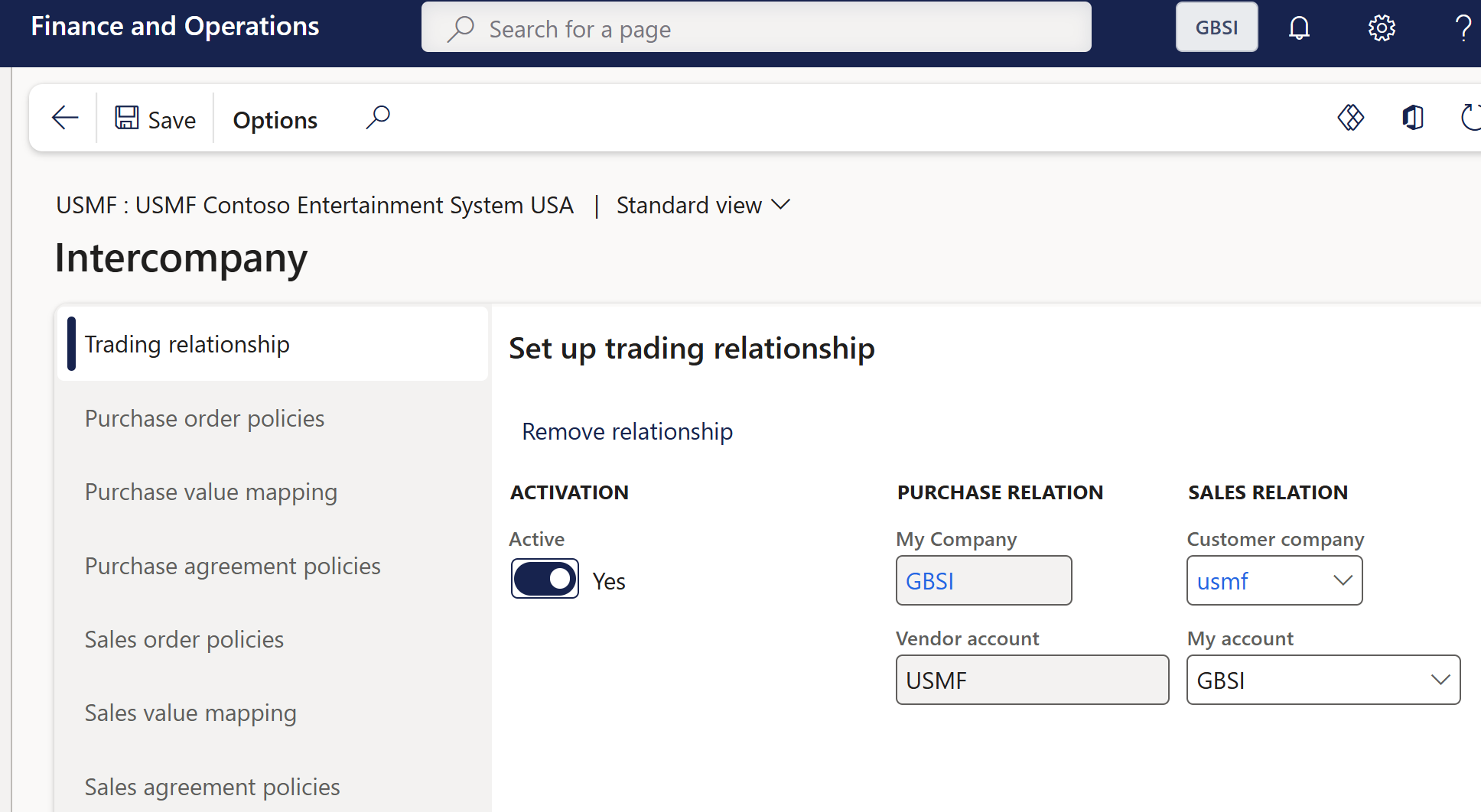

¶ Step 6: Setup intercompany trading relationships for vendors

To use default vendors for intercompany loans, the intercompany setup for vendors must be completed in both companies.

¶ Step 6.1: Intercompany vendor trading relationship setup in company A

- in Company A, go to vendors, find the vendor for company B

- on the General tab, select Intercompany

- you will find that this is setup already

- on the Purchase relation section, under My company, company A should be selected

- for Vendor account, company B should be populated

- on the Sales relation section, for Customer company, select company B

- On My account, select the newly created customer account for company A

- the toggle is set to Active: Yes

¶ Step 6.2: In company B, setup Intercompany for vendors

- in Company B, go to vendors, find the vendor for company A, on the General tab, select Intercompany

- you will find that this is setup already

- in the Purchase relation section, under My company, company B should be selected

- company A will be selected for Vendor account

- on the Sales relation section, Company A should be selected for Customer company

- on My account, the newly created customer account for company B should be selected

- the toggle is set to Active: Yes

Default customer and vendor accounts can be utilized when copying an intercompany loan. When creating a new loan in company A, select the customer and vendor from company B. Upon clicking Copy loan, a loan will be created in company B with the correct customer and vendor from company A.

¶ Daily use

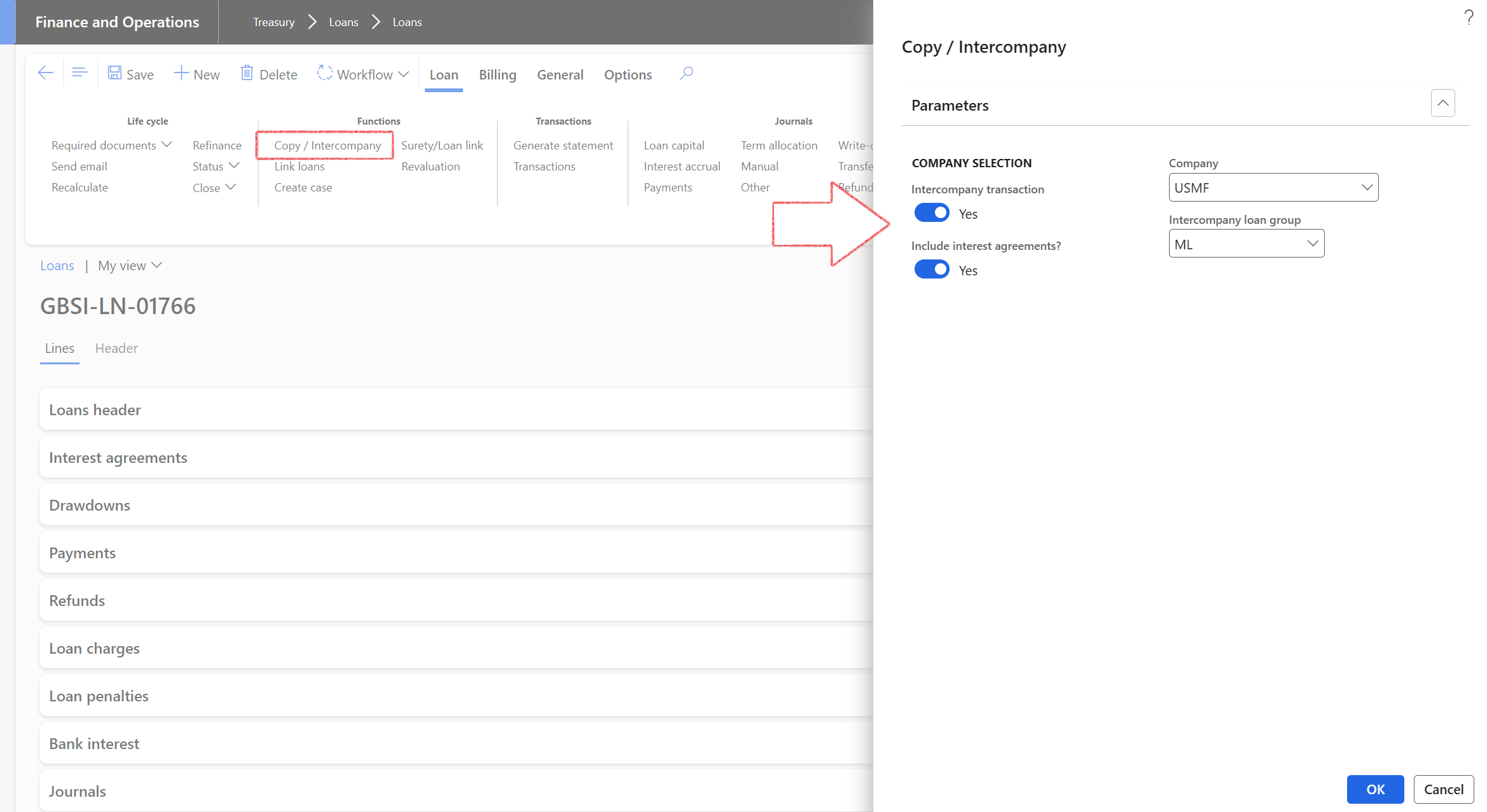

¶ Step 7: Copy an intercompany loan

- In the navigation pane, go to: Modules > Treasury > Loans > Loans

- You will be greeted by a list page

- When selecting Copy/Intercompany on the Loan list page, and opting to copy to another legal entity, the loan created in the target entity will utilize the designated loan group specified in that entity's TMS parameters.

- If Intercompany transaction is set to No, the company selection will be hidden.

- If Intercompany Transaction is set to Yes, the intercompany selection will be displayed.

- If the user selects a different company, the loan group of the selected company will default into the Loan Group field. This field remains editable, allowing users to choose from the loan groups set up in the selected company.

- Even for non-intercompany copies of loans (i.e., within the current entity), users can still choose a loan group for copying.

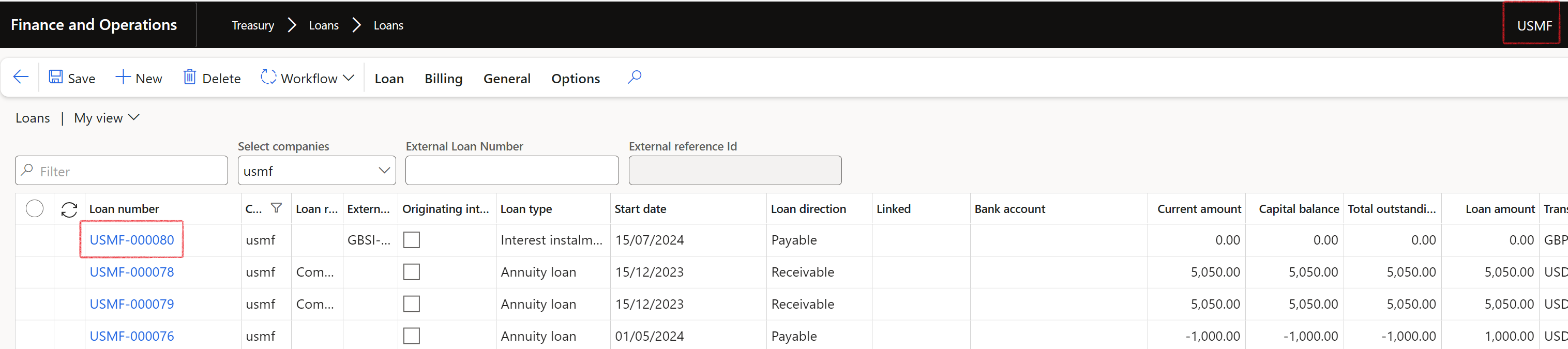

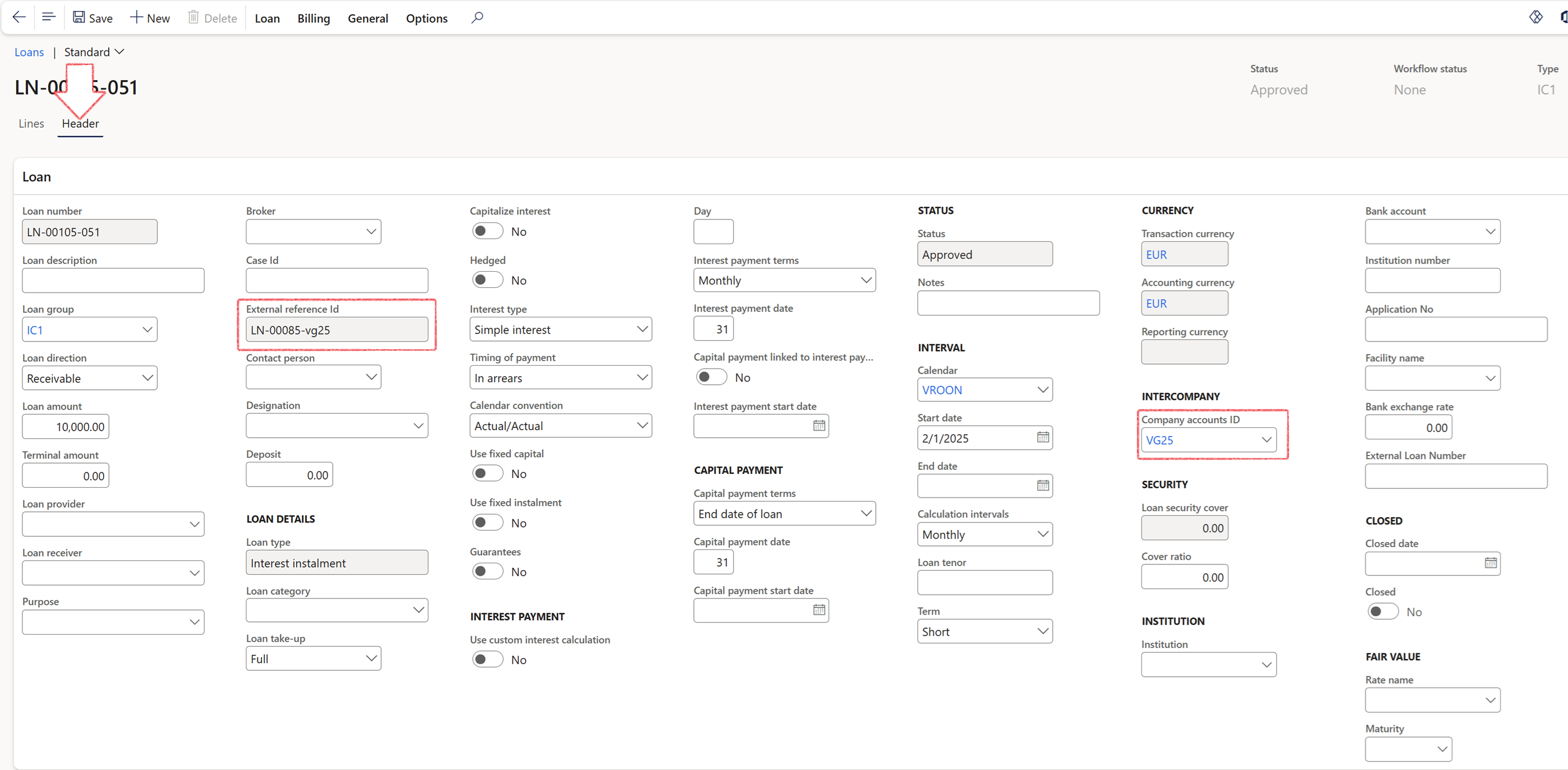

¶ Step 8: Transactions copied between legal entities

When copying a loan to a new loan (either within the same company or to an Intercompany loan), the financial dimensions from the original loan can be copied to the new loan.

- Only dimensions that exist in the other company and have corresponding dimension values will be copied over.

- If copying certain dimensions fails, the system will not produce an error but will continue to copy the loan record as intended.

Users can duplicate the line exactly onto the associated inter-company loan. Transactions can be copied between different legal entities with the following conditions:

- A corresponding loan must exist in both entities before transactions can be copied.

External reference ID is a reference number of a counterparty (the loan number of the copied loan in the related entity)

Company accounts ID is the legal entity of the related loan

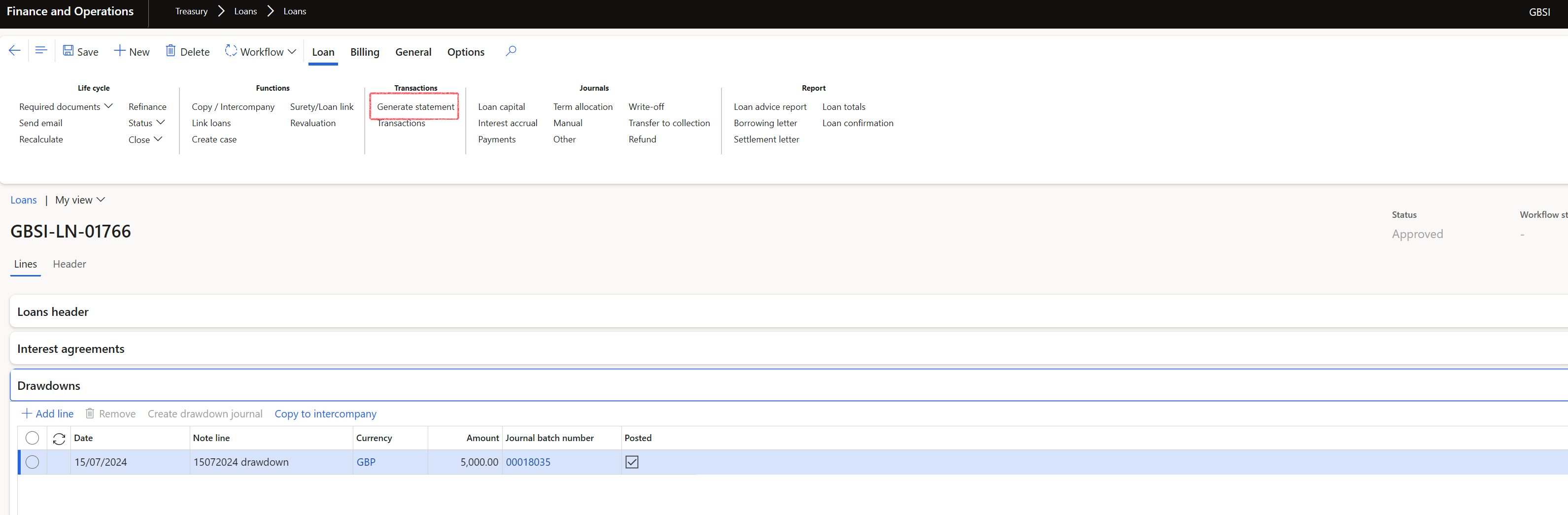

¶ Step 9: Copy drawdown journals

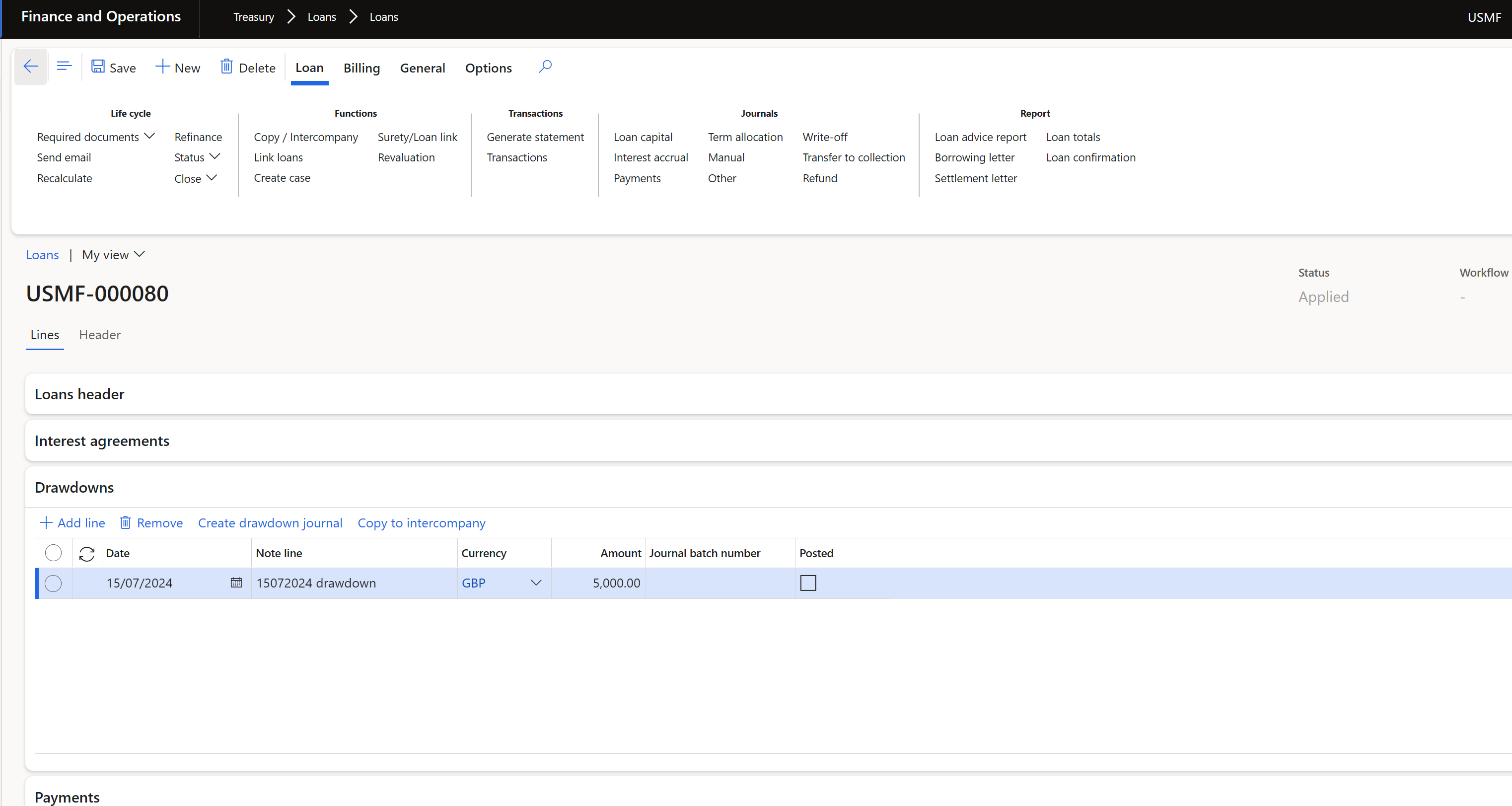

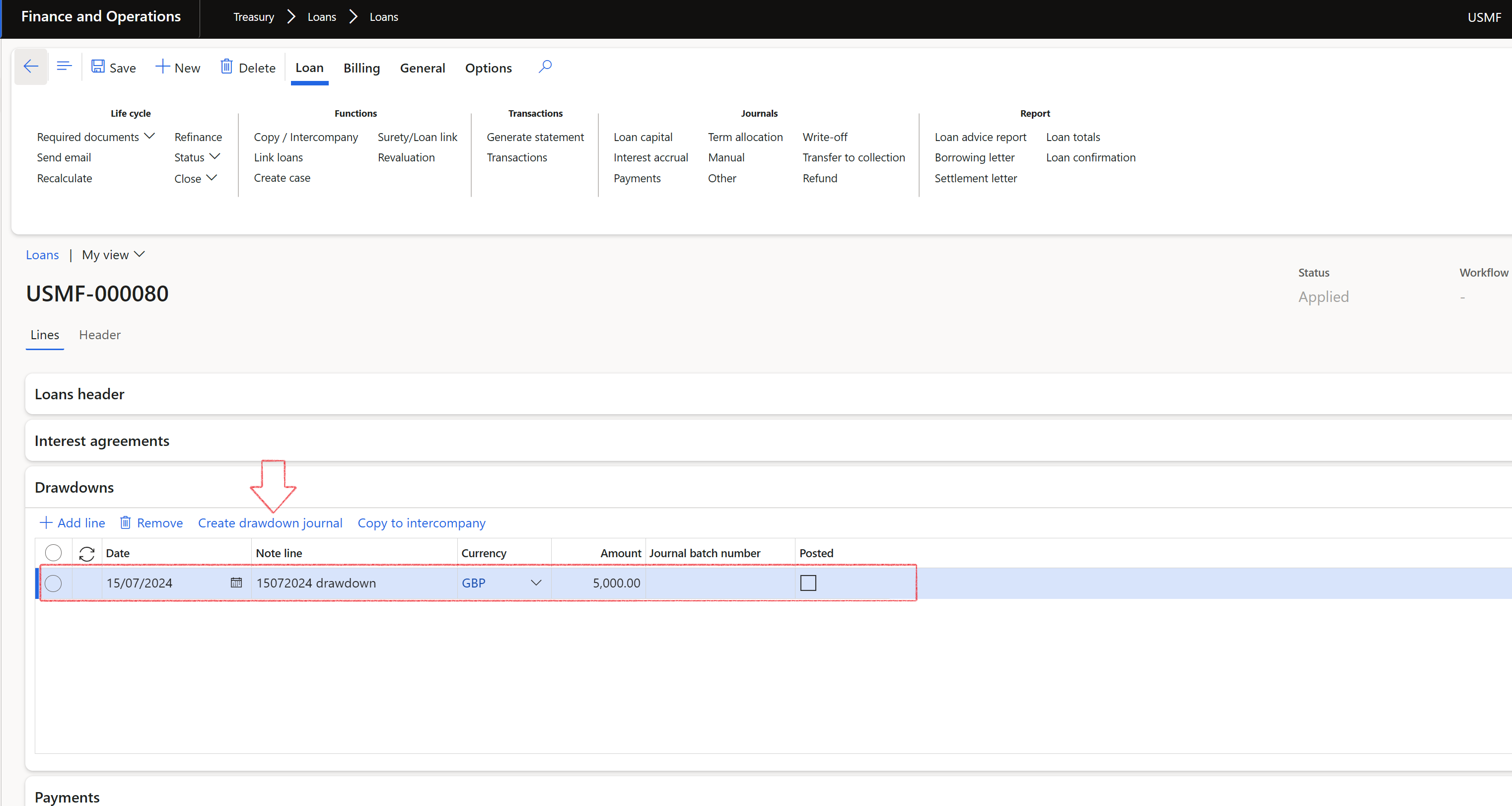

On the Drawdown Journals FastTab, the following actions are available:

- Add Line

- Remove

- Create Drawdown Journal

- Copy to Inter-Company: This action results in an identical entry on the related loan's line (without impacting the journal itself).

- The prerequisite is that the loan must already be linked to another entity's loan

- The following details are copied:

- Date

- Note line

- Currency

- Amount

- Within Drawdown Journals, individual drawdown lines can be copied directly to the corresponding intercompany loan.

- The copied entry will appear under the Drawdown FastTab of the related loan.

- Only the specific line on the Drawdown FastTab is copied, not the entire journal.

- The information copied to the intercompany loan includes:

- Date

- Note

- Currency

- Amount

- Click on Create drawdown journal

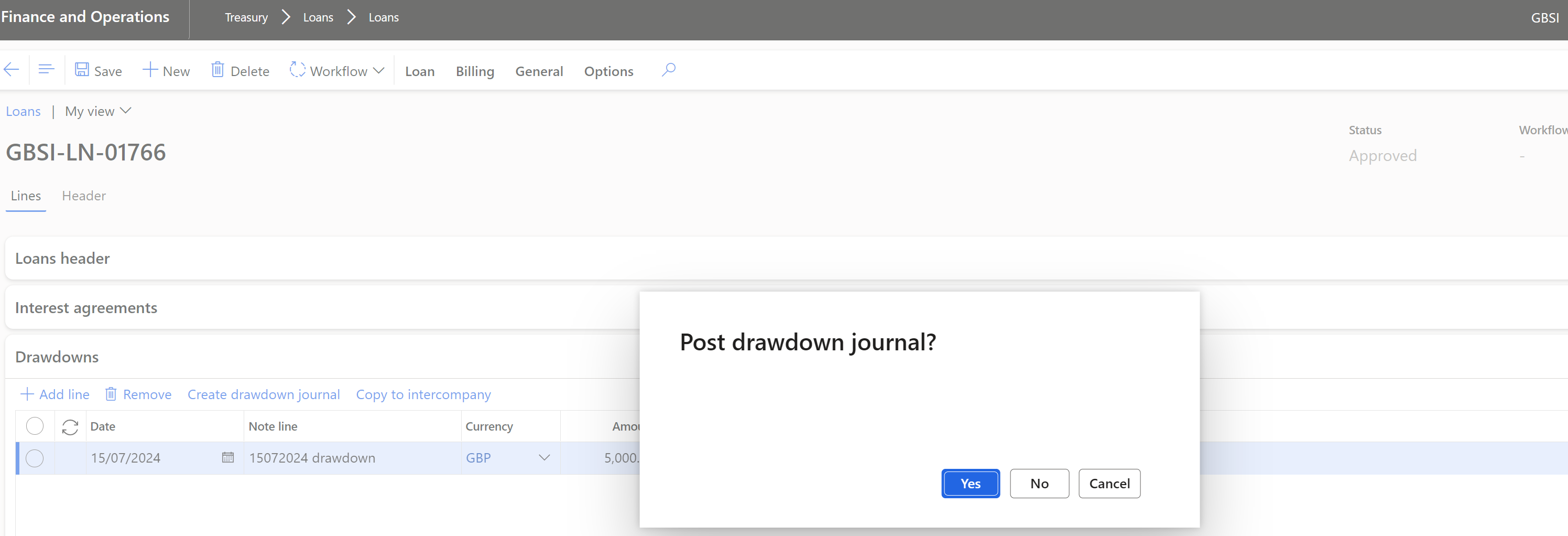

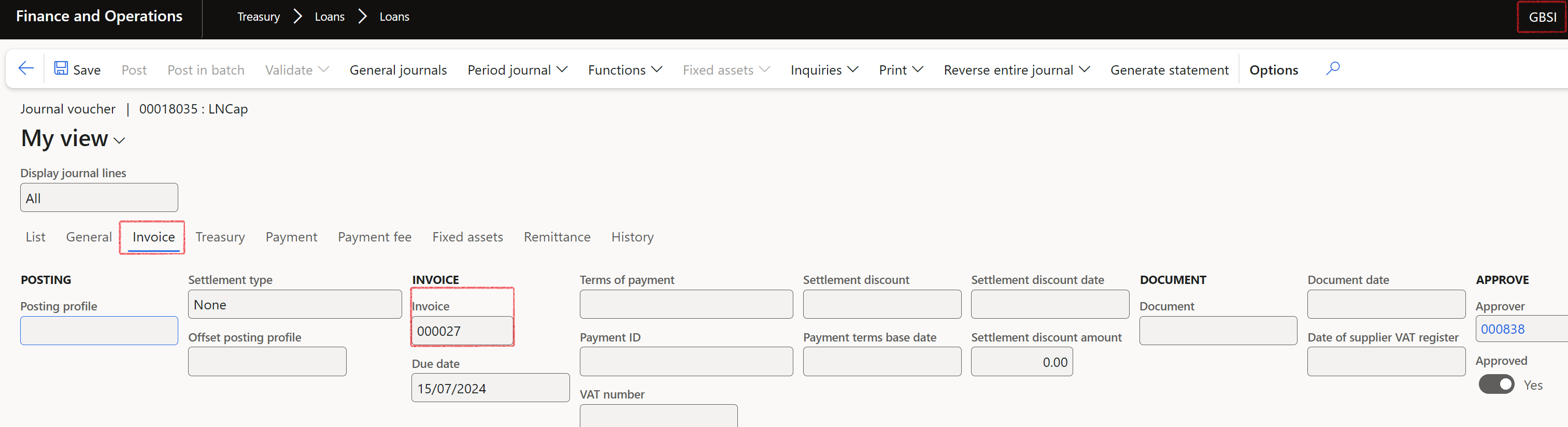

- Click Yes to Post the journal

- Note that the journal batch number is filled in, and the Posted tick is on.

- Do the same in the corresponding entity:

- To view the posted drawdown journals, click on the Loan capital button in the action menu

- Click on Lines to view the posted journal lines

- Click on the Invoice tab and see that the invoice number has been automatically allocated, and the voucher is approved

- This will be as per the posting profile setup. If the Invoice tick was not selected on the Capital posting profile, no invoice number would be allocated. This is only applicable to customer or vendor transactions, and normal Ledger tansactions will not have the option to have an invoice number allocated to the transaction.

- in the copied legal entity, the invoice number will be the same:

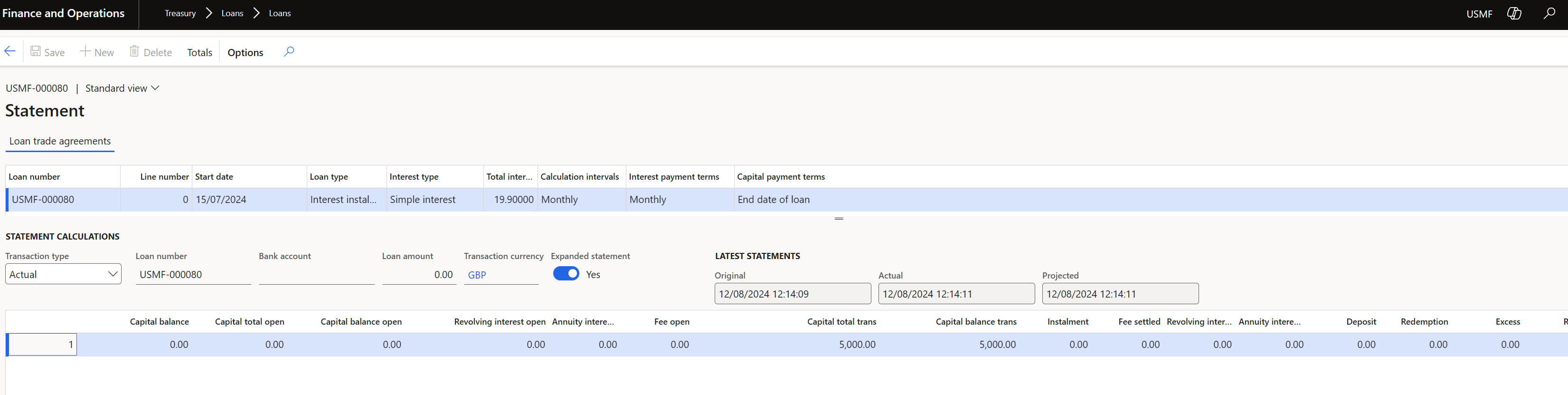

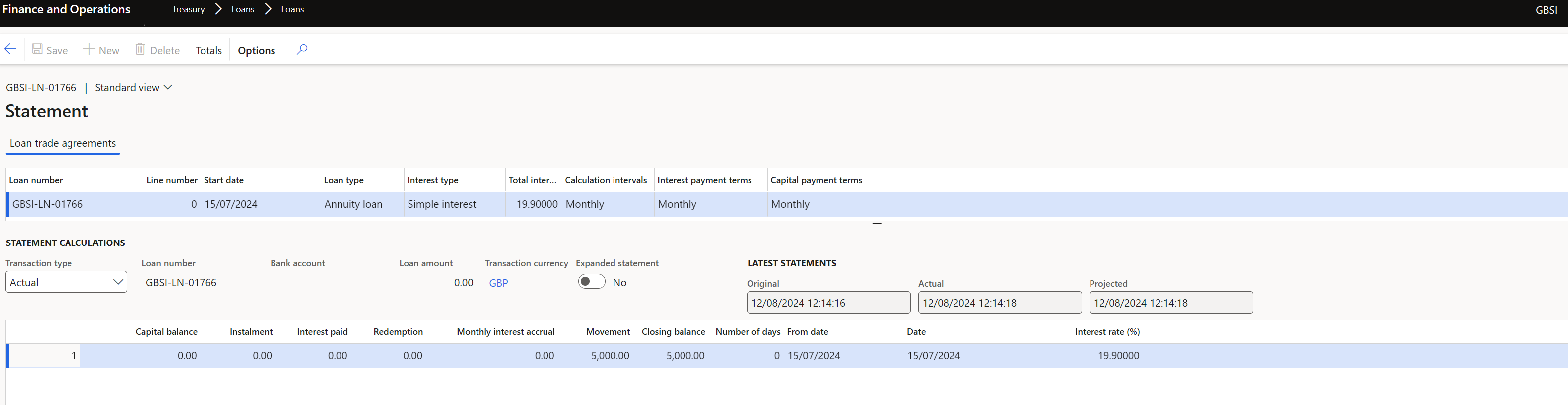

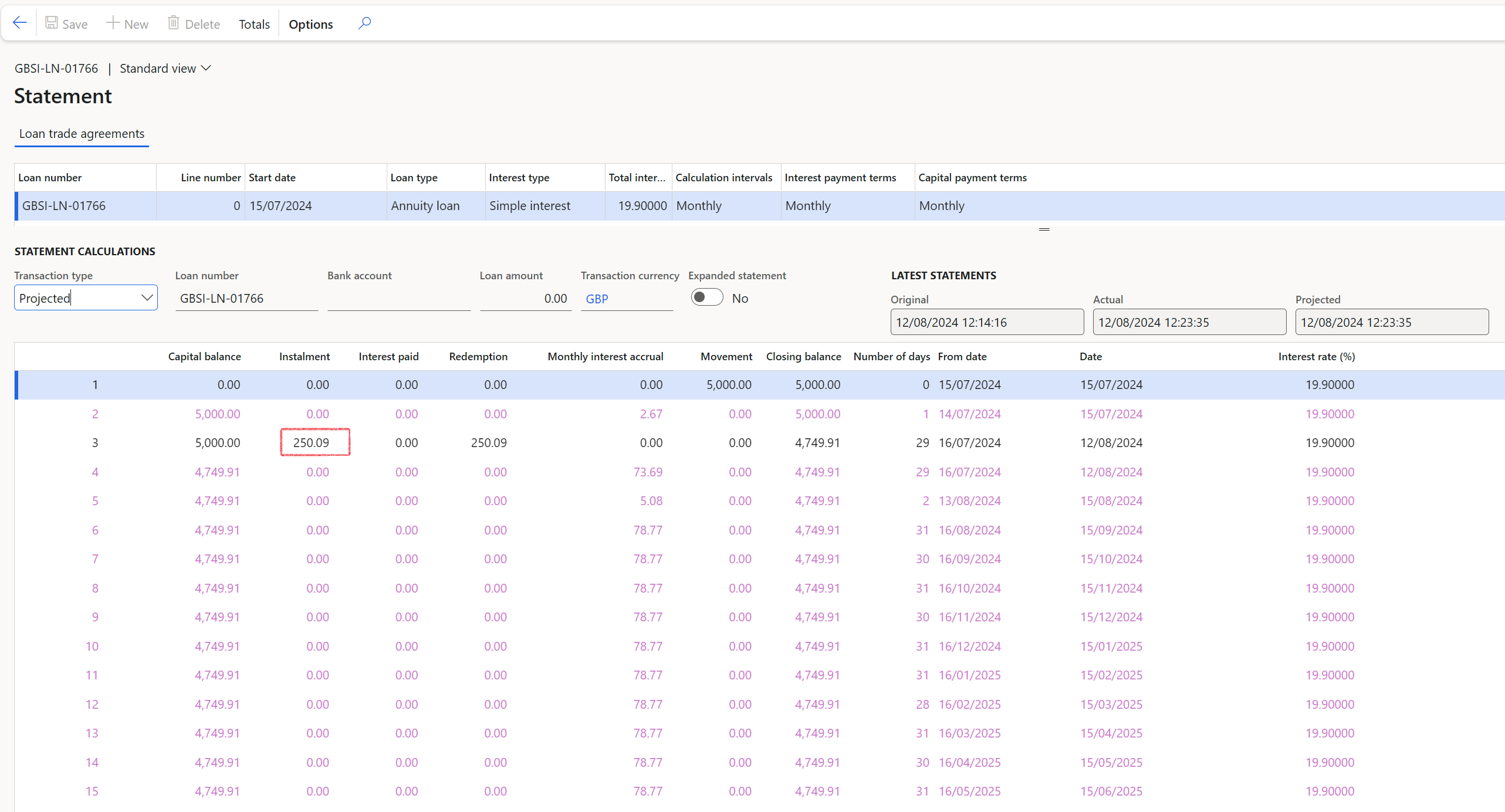

- Click on Generate statement to view the posted drawdown journal on the Actual loan statement. Do this in both entities.

View the Actual statement:

¶

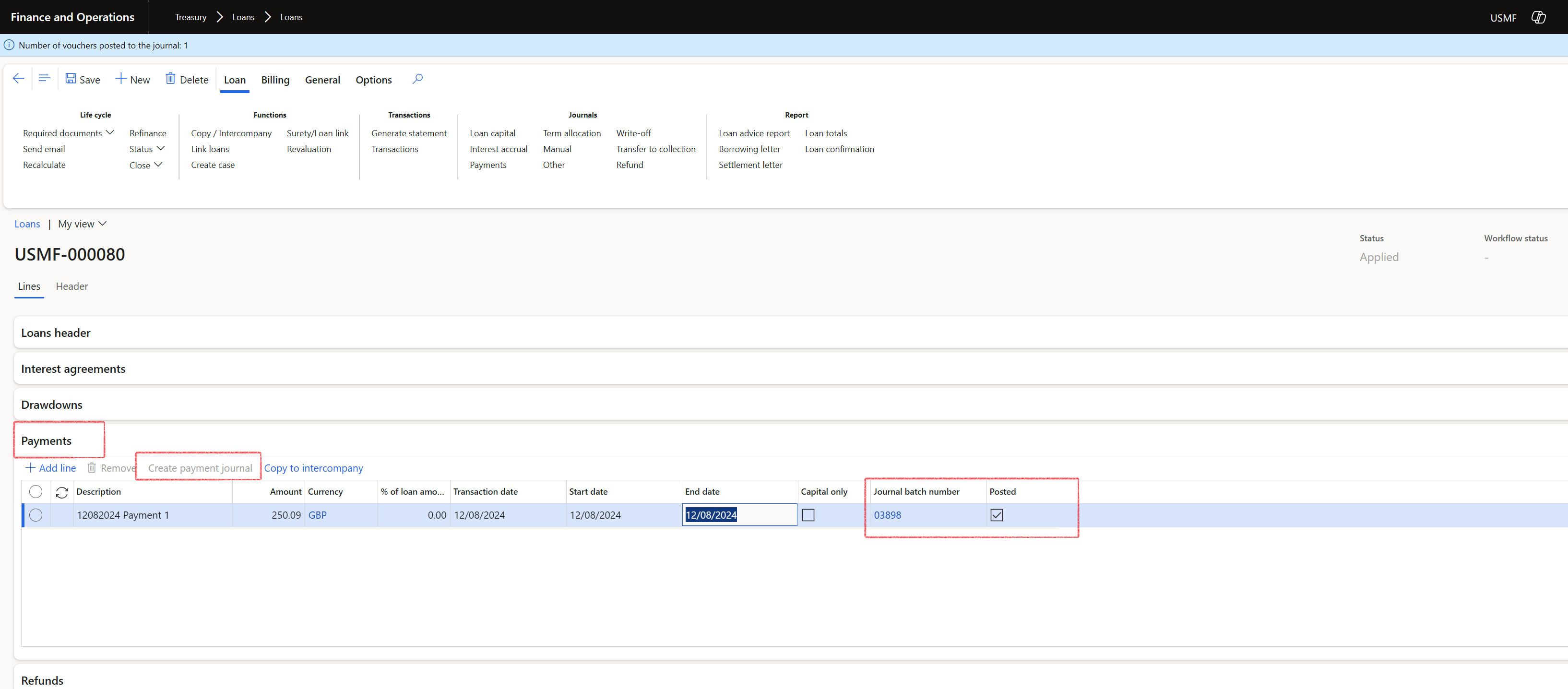

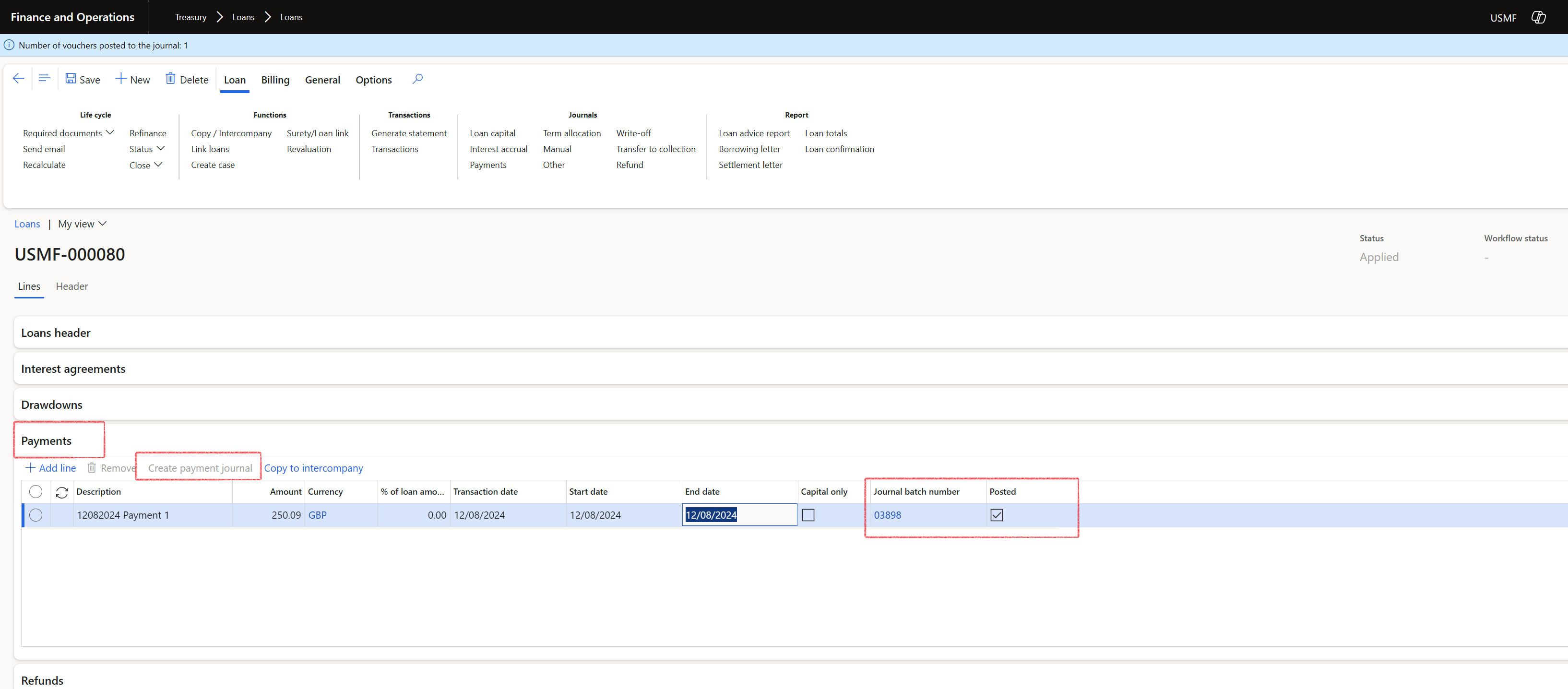

Step 10: Create Payment journals

On the Payments FastTab, the following buttons are available:

- Add Line

- Remove

- Click on Add line

- Type a Description

- When this description field is completed, it will be appended to the journal Description field in the Payment journal lines.

- Enter an Amount

- Select a Currency

- Enter a Transaction date

- When the Capital only option is chosen, it applies the full amount to loan capital.

- If the Capital only option is not selected, the process mirrors creating a payment journal from customer payments, where it first allocates against open interest (e.g., annuity, interest installment, revolving, etc.).

- When capturing a line, users can effortlessly generate a Payment journal with the option to post it simultaneously

- Users will be prompted to decide whether to Post the journal immediately. If not posted, they can preview it before finalizing.

- The batch number of the journal will be visible under the Payments FastTab.

- A Posted indicator will show whether the journal has been posted.

¶

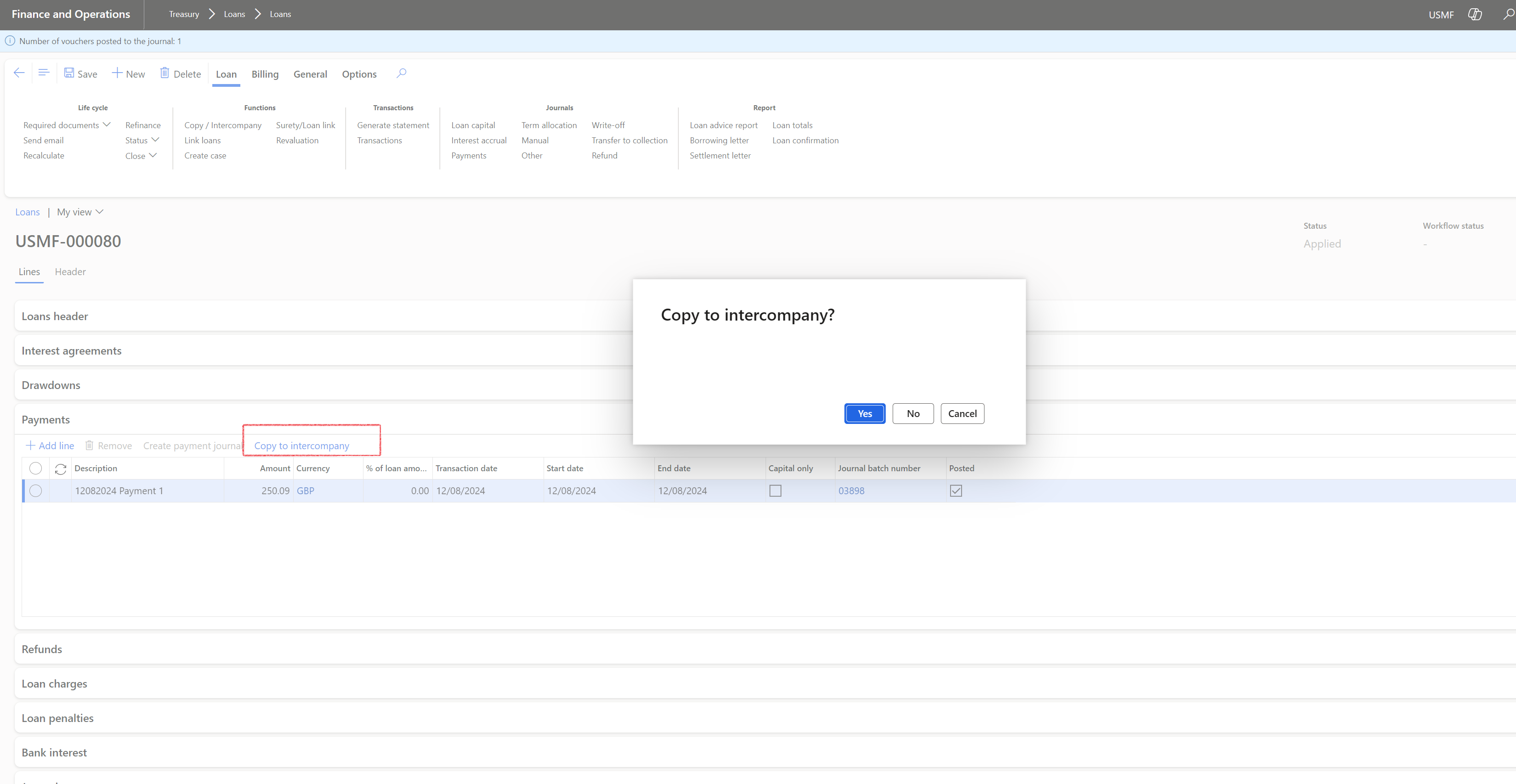

Step 11: Copy Payment journals

- Copy to Inter-Company

- Users can copy payment lines exactly as they are to the corresponding intercompany loan.

- When this description field is populated, it will be appended to the journal Description field in the Payment journal lines.

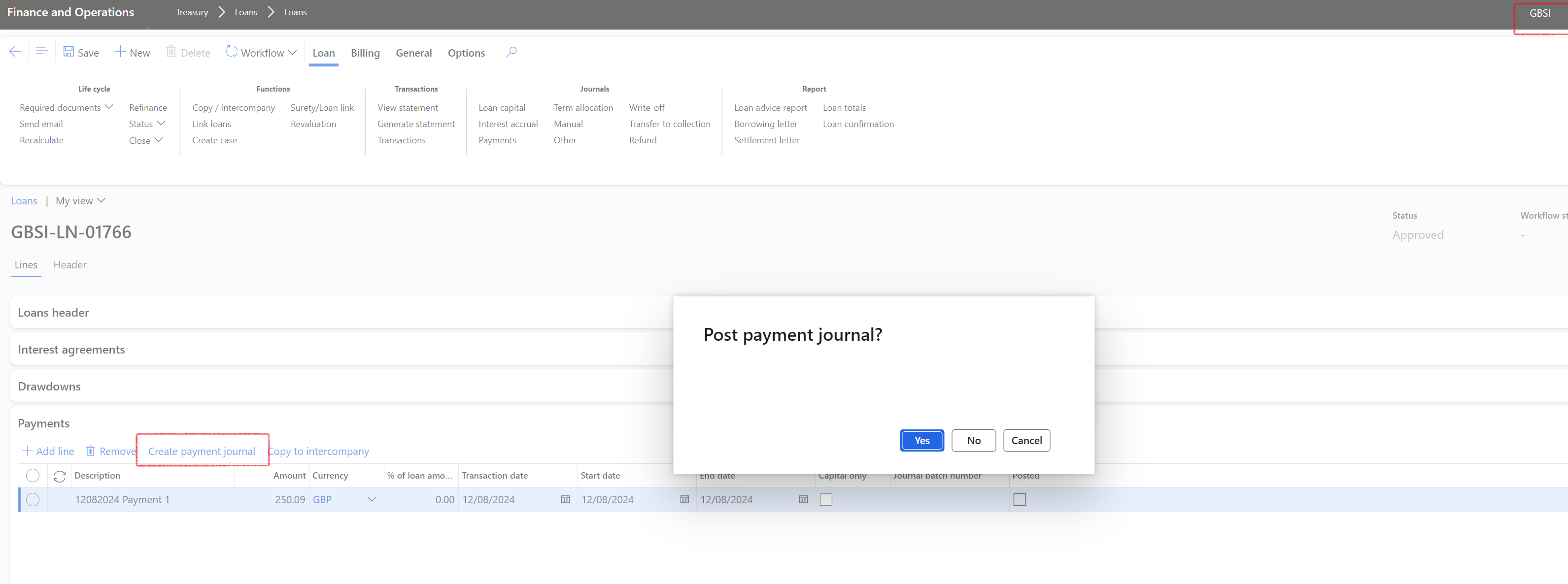

Note for this example, the Payment journal has been created and posted in the copied legal entity first.

- The copied record will appear as a line under the Payments FastTab. After creating this line, users must click the Create payment journal button to generate the Payments journal.

- The information copied includes:

- Description

- Amount

- Currency

- Transaction Date

- Start Date

- End Date

- Capital Only (flag)

- Users will receive a notification confirming whether the copy operation was successful.

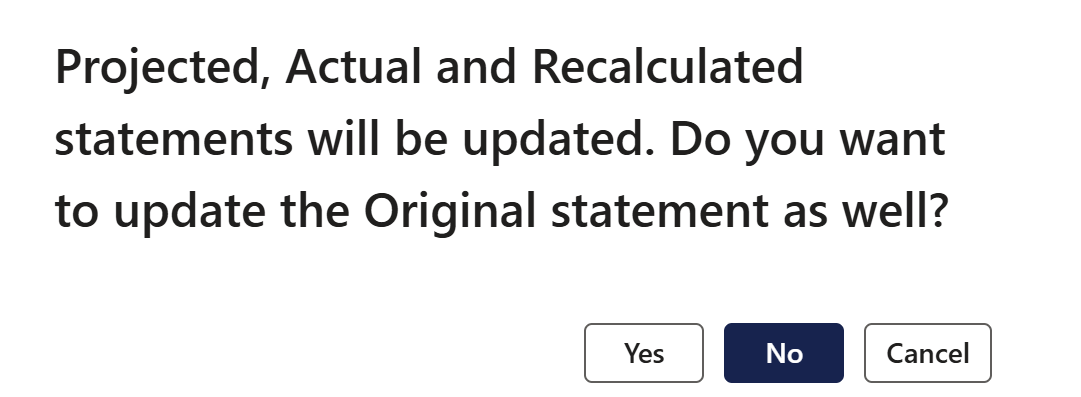

- After any journal has been posted, always click on Generate statement.

When you click on Generate statement, you'll see the following notification: Projected, Actual and Recalculated statements will be updated. Do you want to update the Original statement as well?

- Both drawdown and payment lines can be copied even if the journal has not yet been created.

- Transactions can be copied bi-directionally between entities.

- Copying to intercompany is not allowed if there is no related intercompany entity for the loan.

- When copying a loan to a new loan (either within the same company or to an Intercompany loan), the financial dimensions from the original loan can be copied to the new loan.

- Only dimensions that exist in the other company and have corresponding dimension values will be copied over.

- If copying certain dimensions fails, the system will not produce an error but will continue to copy the loan record as intended.

¶ Reporting

¶ Step 12: Reports

On the parameters dialogue for loan reports where multiple loans are included, there is an option to Exclude inter-company loans (when the loan group is setup for intercompany)

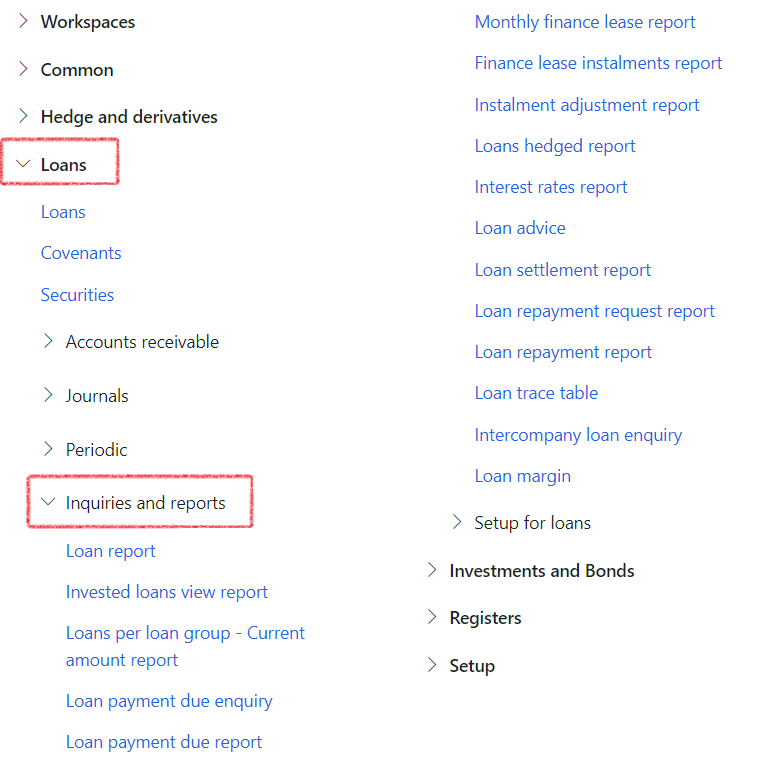

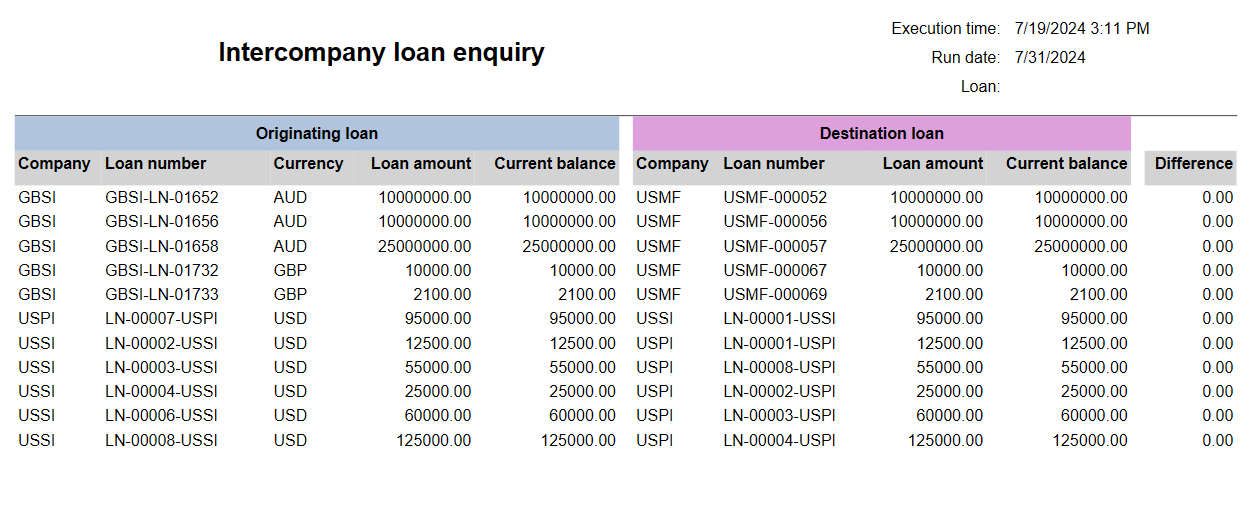

¶ Intercompany loan enquiry

- Treasury > Loans > Inquiries and reports > Intercompany loan enquiry

¶ Intercompany reconciliation report

- Treasury > Loans > Inquiries and reports > Intercompany reconciliation report